Upstream Oil Gas Financial Model

Financial Model for an Upstream Oil & Gas Company

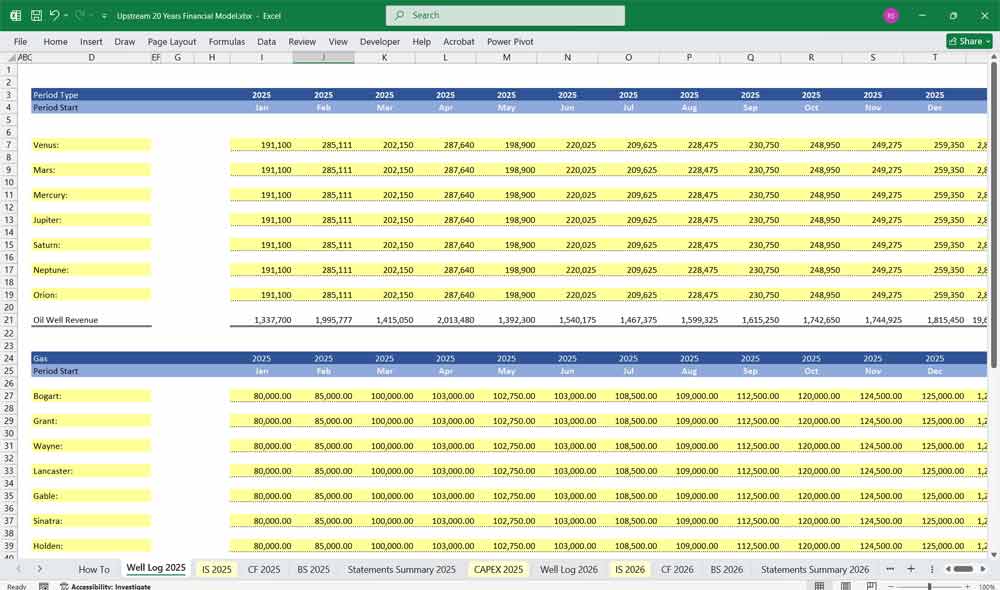

20-year oil and gas cost models with key components of 20x detailed revenue tabs, Income Statement, Cash Flow Statement, and Balance Sheet, CAPEX, OPEX,. (Downstream Model, Midstream, LNG Terminal, Petrochemical Engineering.

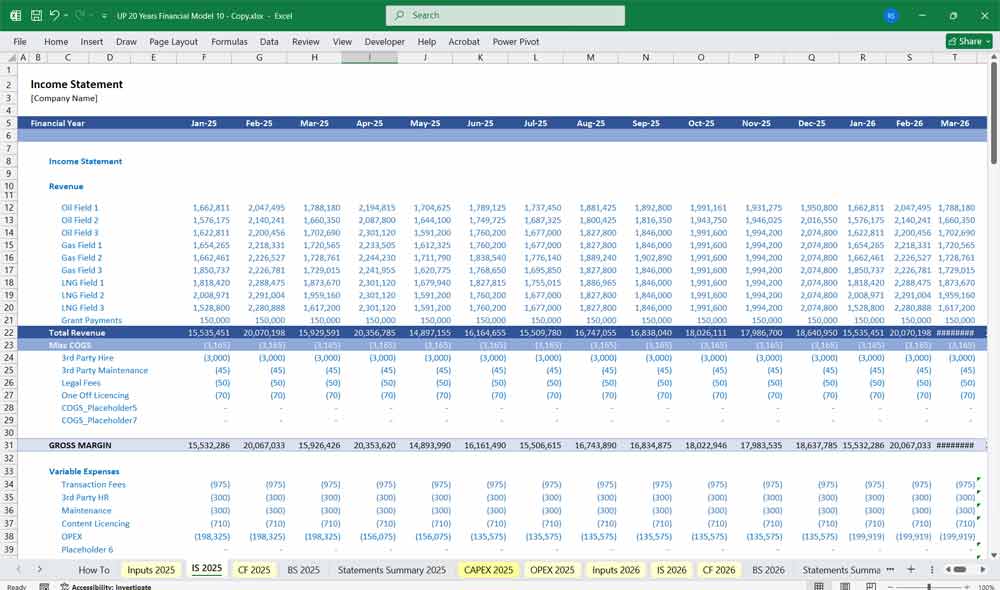

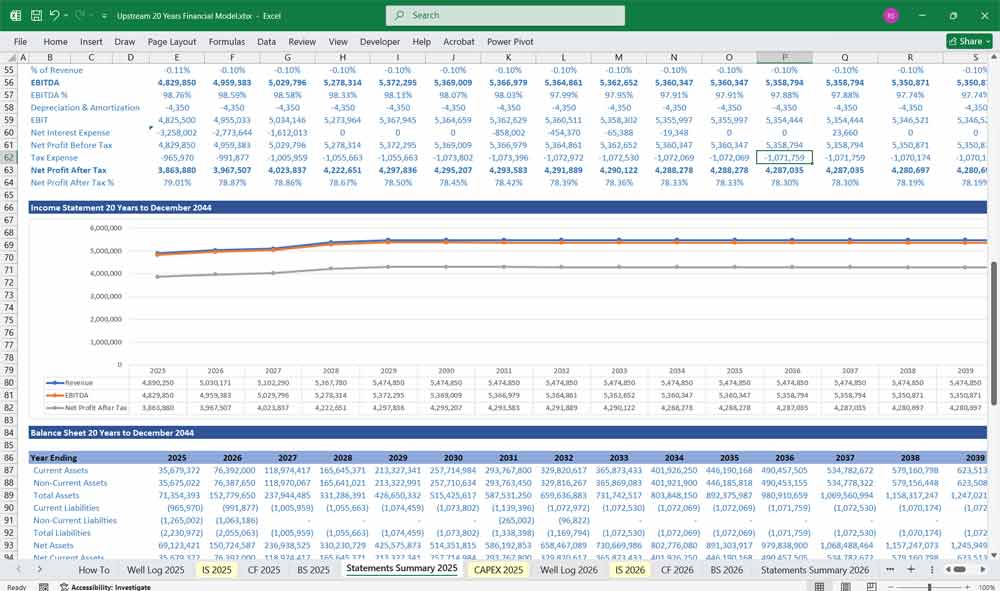

Income Statement

The income statement showcases the company’s financial performance over a specific period, reflecting revenue generation, costs, and profitability.

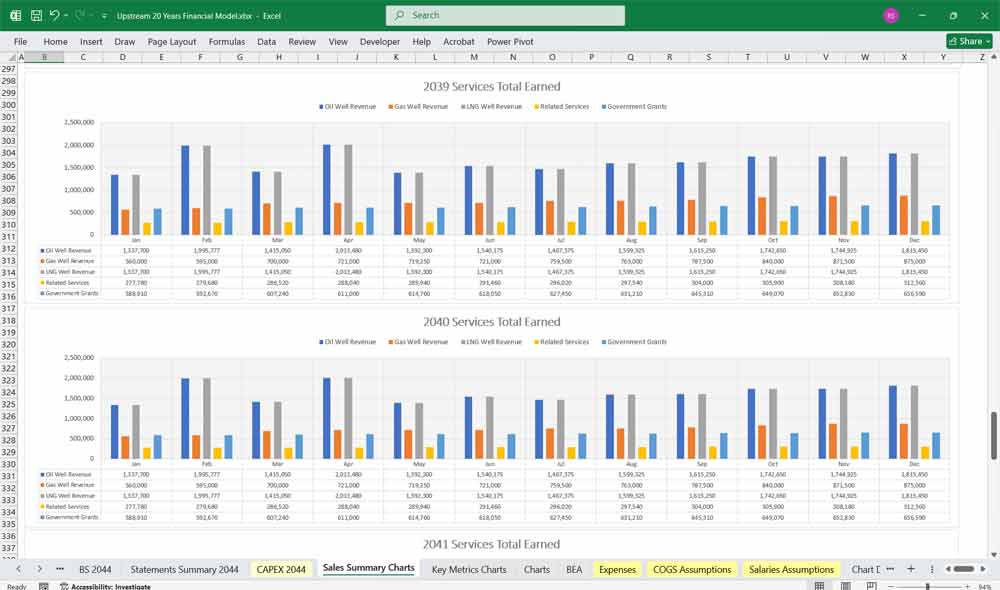

Revenue Streams

- Oil Sales Revenue: Derived from the sale of crude oil to refineries or markets.

- Gas Sales Revenue: Income from selling extracted natural gas.

- LNG Sales Revenue: Revenue generated from the liquefaction and sale of LNG, often through long-term contracts or spot markets.

- Other Revenue: Includes income from joint ventures, sale of by-products (e.g., condensates, sulfur), and service fees (e.g., transportation, storage).

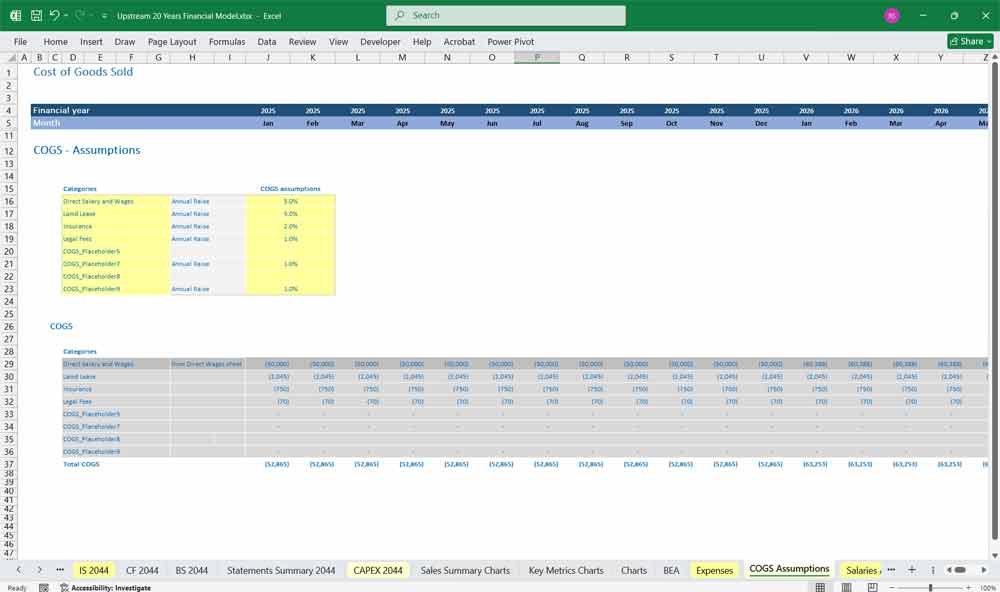

Cost of Sales / Production Costs

- Lifting Costs: Expenses for extracting hydrocarbons (labor, maintenance, energy, consumables).

- Transportation and Processing Costs: Pipeline tariffs, shipping fees, and processing costs for gas/LNG.

- Depreciation, Depletion, and Amortization (DD&A): Allocation of costs related to asset depletion and infrastructure depreciation.

Well Performance:

- Initial Production (IP) Rates: The peak production immediately after a well is brought online.

- Decline Curves: Use the model to predict production drop over time.

Gross Profit:

- Revenue minus cost of sales.

Exploration Costs:

- Expenses for seismic surveys, exploratory drilling, and unsuccessful exploration efforts (dry wells).

General & Administrative (G&A) Expenses:

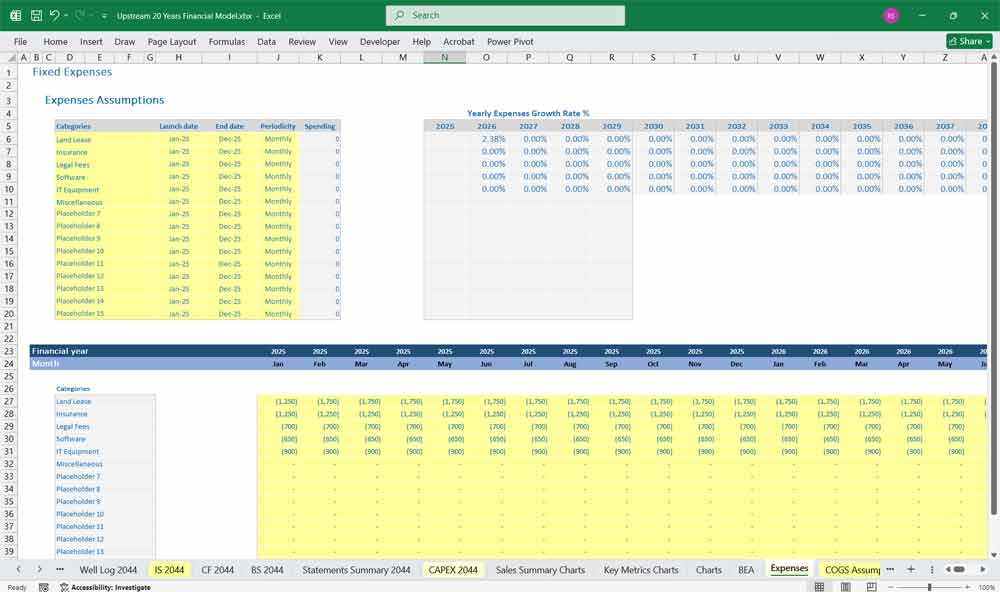

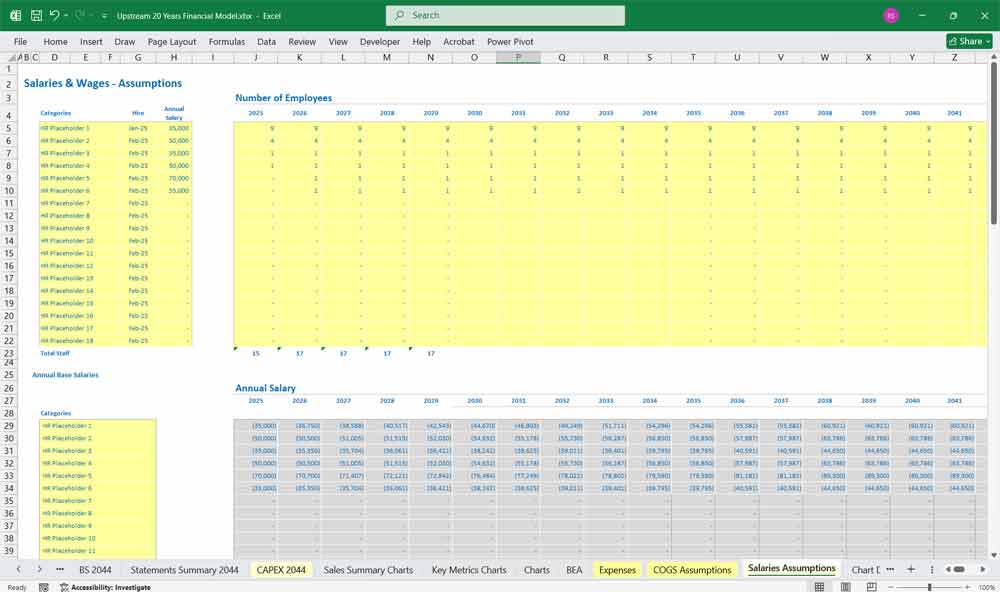

- Salaries, office expenses, legal fees, and corporate overhead.

Other Operating Expenses:

- Environmental and remediation costs, asset impairment charges, and write-offs.

Operating Profit (EBIT):

- Gross profit minus exploration, G&A, and other operating costs.

Finance Costs:

- Interest expenses on debt, lease liabilities, and hedging instruments.

Tax Expense:

- Income taxes, royalties, and other government levies.

Net Income:

- Final profit after taxes and all expenses.

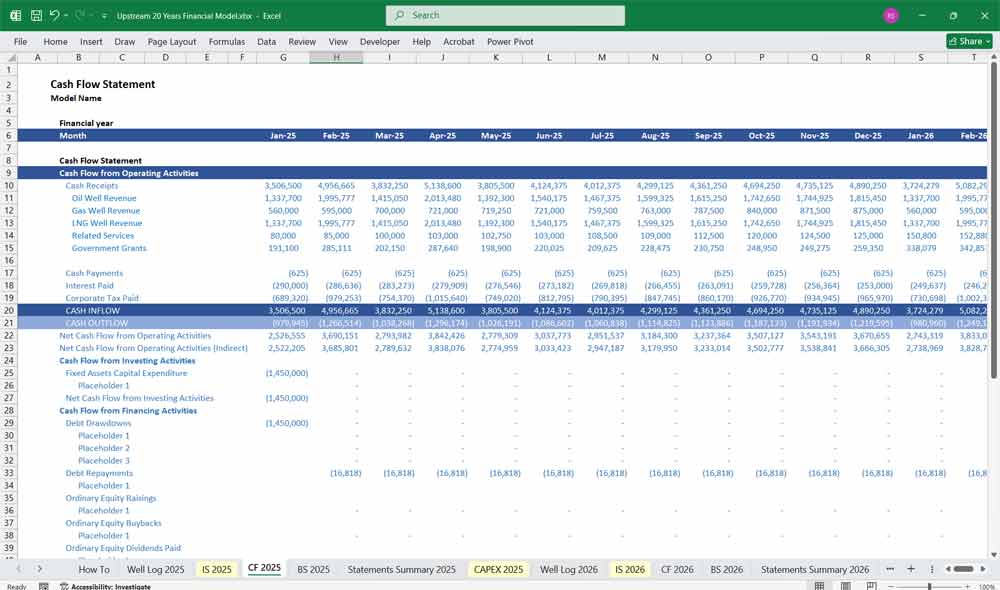

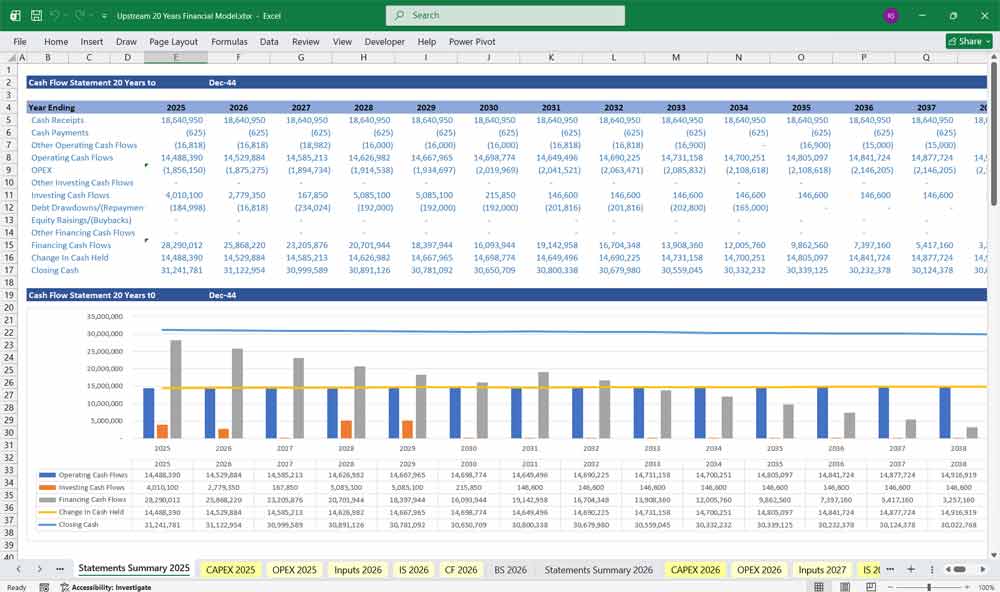

Upstream Oil and Gas Finance Model Cash Flow Statement

This statement details the company’s cash movements, highlighting operational, investing, and financing activities.

Operating Cash Flow:

- Cash Receipts from Sales: Oil, gas, and LNG sales revenue.

- Royalties and Production Taxes: Payments to governments or landowners.

- Operating Expenses: Cash spent on production, maintenance, and staff.

- Changes in Working Capital: Inventory, receivables, and payables adjustments.

Investing Cash Flow:

- Capital Expenditures (CapEx): Investments in drilling, infrastructure, pipelines, and LNG facilities.

- Exploration Expenditures: Costs of seismic studies, exploratory drilling, and data acquisition.

- Asset Acquisitions/Disposals: Buying/selling oil fields, joint venture interests, and infrastructure.

Financing Cash Flow:

- Debt Issuance/Repayment: Loans taken for development and repayments of existing debt.

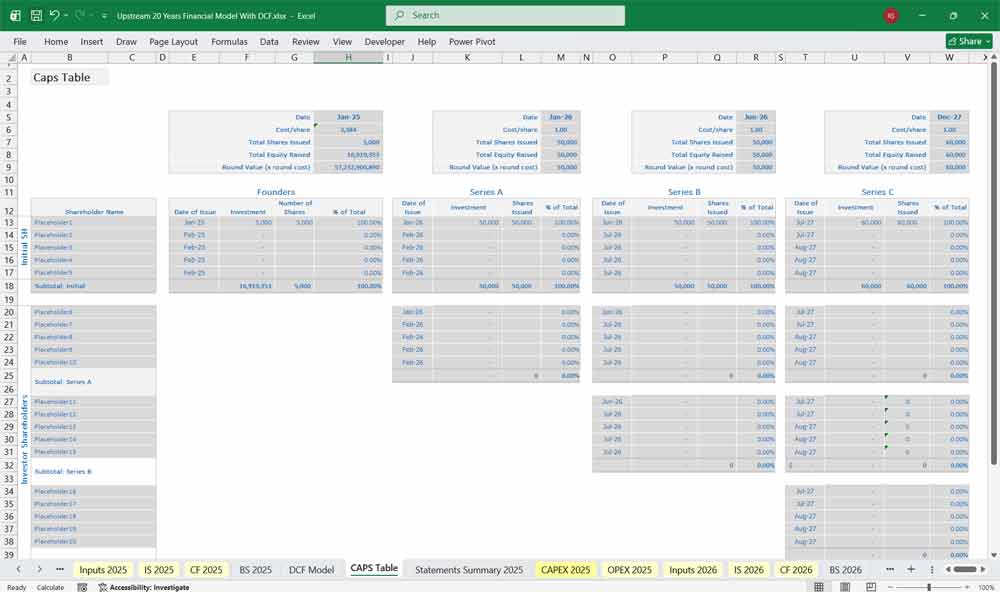

- Equity Issuance/Repurchase: Capital raised through issuing shares or share buybacks.

- Dividends and Interest Payments: Cash outflows for dividends and interest on borrowings.

Net Change in Cash:

- Sum of operating, investing, and financing activities.

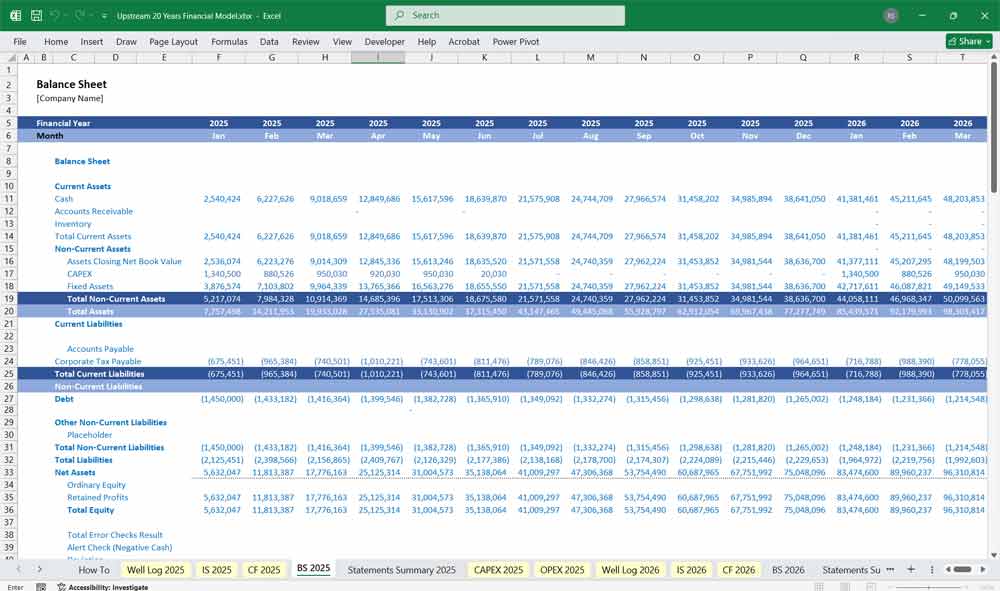

Upstream Oil and Gas Finance Model Balance Sheet

The balance sheet for these oil and gas cost models provides a snapshot of the company’s financial position at a given date.

Assets:

- Current Assets:

- Cash and Cash Equivalents

- Accounts Receivable (from oil, gas, and LNG sales)

- Inventory (crude oil, natural gas, spare parts)

- Non-Current Assets:

- Property, Plant, and Equipment (PP&E): Includes drilling rigs, pipelines, processing plants, and LNG liquefaction facilities.

- Exploration and Evaluation Assets: Capitalized exploration costs.

- Proven and Probable Reserves: Economic value of estimated recoverable reserves.

- Current Assets:

Liabilities:

- Current Liabilities:

- Accounts Payable

- Short-Term Debt

- Accrued Liabilities (taxes, royalties)

- Non-Current Liabilities:

- Long-Term Debt (project financing, bonds)

- Asset Retirement Obligations (decommissioning costs)

- Current Liabilities:

- Share Capital: Raised through equity issuance.

- Retained Earnings: Cumulative profits reinvested into the business.

Equity:

- Non-Controlling Interests: If the company has joint ventures with other parties.

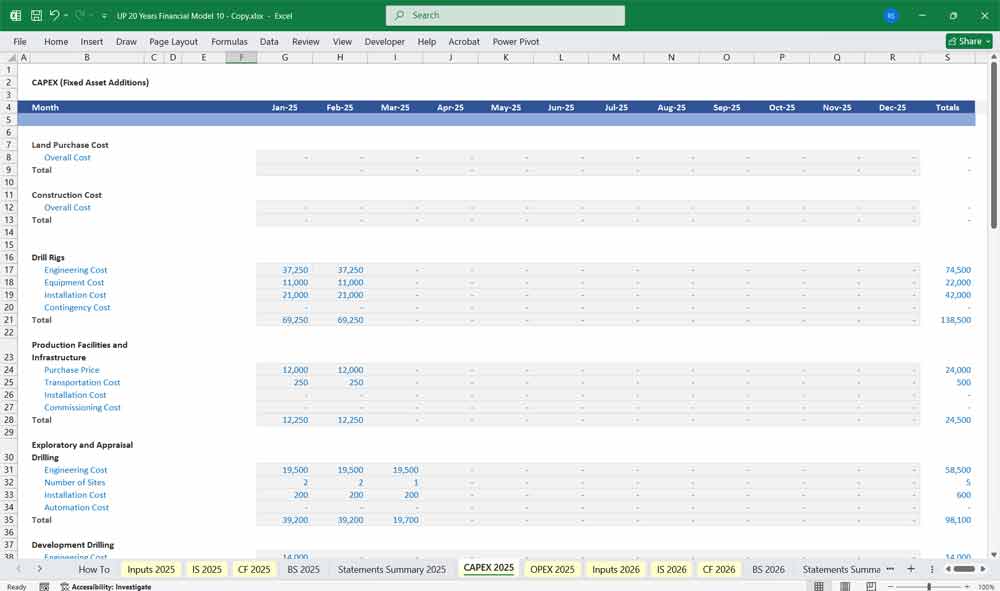

Capital Expenditure (CapEx)

CapEx covers spending on exploration, drilling, production infrastructure, and reserve replacement. It’s crucial for sustaining and growing output.

Types of CapEx:

- Exploration CapEx:

- Costs for seismic surveys, exploratory wells, and geological studies.

- Development CapEx:

- Spending to drill new wells, install pipelines, and build processing facilities.

- Maintenance CapEx:

- Ensures existing wells and infrastructure continue producing efficiently.

- Decommissioning CapEx:

- Funds set aside to retire wells and restore the environment once production ends.

CapEx Profile Over a Project’s Lifecycle:

- Exploration Phase: High upfront CapEx with no immediate revenue.

- Development Phase: Continued spending as new wells and infrastructure are built.

- Plateau Phase: Production stabilizes, and CapEx drops to maintenance levels.

- Decline Phase: Focus shifts to well intervention and eventual decommissioning.

Reserve Reporting For Oil And Gas

Reserves represent the estimated quantities of hydrocarbons that an upstream company expects to extract in the future. Reserve reporting is critical because it influences valuation, project financing, and regulatory compliance.

Types of Reserves:

Proven (1P) Reserves:

- High certainty (>90% probability) of being recoverable under existing economic and operational conditions.

- Subcategories:

- Proven Developed Producing (PDP): Currently producing wells.

- Proven Developed Non-Producing (PDNP): Drilled but not yet producing.

- Proven Undeveloped (PUD): Requires further development (e.g., drilling new wells).

Probable (2P) Reserves:

- Medium certainty (>50% probability) of being recovered.

- Reflects areas near proven reserves or wells requiring enhanced recovery techniques.

Possible (3P) Reserves:

- Lower certainty (>10% probability) of recovery.

- Contingent on exploratory success, technological advances, or market changes.

Reserve Reporting Process:

- Seismic Surveys and Well Data: Geologists and engineers analyze seismic data, drill results, and formation tests.

- Reserve Audits: Independent third parties (e.g., Ryder Scott, DeGolyer & MacNaughton) audit reserve estimates.

- Reserve Replacement Ratio (RRR): Measures the company’s ability to replace produced reserves with new discoveries or acquisitions.

Oil And Gas Hedging Strategies

Oil and gas prices are notoriously volatile, so upstream companies use hedging to reduce price risk and stabilize cash flows.

Hedging Instruments:

Futures Contracts:

- Agreement to sell oil or gas at a predetermined price on a future date.

- Reduces exposure to price drops but prevents upside gains.

Swaps:

- Exchange floating prices for fixed prices.

- Example: Swap Brent Crude’s market price for a fixed $80/barrel price.

Options (Puts and Calls):

- Put Options: Provide the right (but not the obligation) to sell at a specified price, protecting against price drops.

- Call Options: Provide the right to buy at a specified price, capping costs if prices rise.

Collars:

- Combines puts and calls to create a price floor and ceiling, limiting both downside and upside.

Costless Collars:

- Offset option costs by using premium income from selling call options.

Hedging Metrics:

- Hedge Ratio: Percentage of production covered by hedges.

- Mark-to-Market (MTM): Periodic revaluation of hedging contracts based on current market prices.

Example:

If a company expects to produce 1 million barrels next year, it might hedge 70% of that at $75/barrel, ensuring a baseline revenue of $52.5M while leaving 30% exposed to market fluctuations.

Impact on Financial Oil And gas Valuation:

Stabilized Cash Flows:

- Hedged production reduces earnings volatility, leading to:

- Lower Discount Rates (lower risk perception).

- Higher Valuations for predictable cash flows.

- Hedged production reduces earnings volatility, leading to:

Downside Protection vs. Upside Limitation:

- Downside Protection: Provides a floor during price crashes, preserving cash flows.

- Upside Limitation: Caps earnings during price surges, potentially underperforming peers in bull markets.

Mark-to-Market (MTM) Adjustments:

- Hedging gains/losses impact income statements, introducing non-cash volatility.

- Positive MTM boosts short-term valuation, but analysts often strip out these effects for long-term forecasts.

Hedge Effectiveness:

- Effective hedging strategies align with production forecasts.

- Over-hedging locks in prices too low, missing out on potential market upside.

Example:

If Brent Crude rises from $75 to $90 per barrel and a company hedged 70% at $75, its revenue growth lags unhedged peers. Investors may apply a discount to valuation due to missed upside.

Decommissioning Obligations For Oil And Gas

When oil and gas fields reach the end of their productive life, upstream companies are responsible for safely dismantling infrastructure and restoring the environment — this is known as Decommissioning.

Decommissioning Process:

- Plugging and Abandonment (P&A):

- Cementing wells to prevent hydrocarbon leakage.

- Facility Dismantling:

- Removing offshore platforms, pipelines, and subsea structures.

- Site Remediation:

- Cleaning up contamination and restoring natural ecosystems.

- Monitoring:

- Ongoing environmental monitoring to ensure long-term stability.

Financial Implications:

- Asset Retirement Obligation (ARO):

- Recognized as a liability on the balance sheet, representing the present value of future decommissioning costs.

- Adjusted annually for inflation, changes in estimates, and discount rates.

- Funding Mechanisms:

- Trust Funds: Set aside funds gradually during the asset’s productive life.

- Bonds and Guarantees: Required by regulators to ensure funds are available when needed.

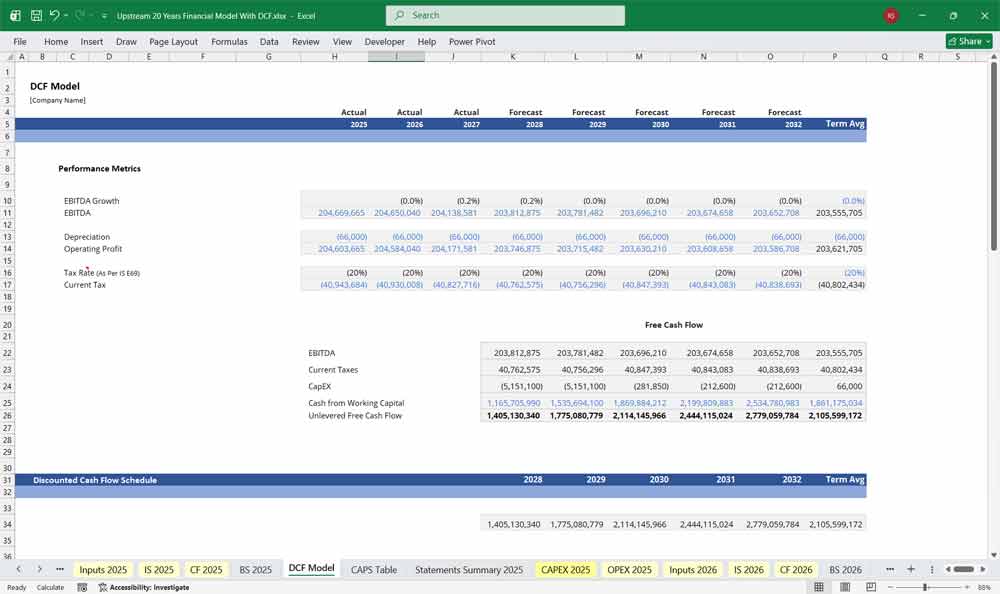

Upstream Oil and Gas Discounted Cash Flow (DCF) with Terminal Value, Sensitivity Analysis, and WACC Model add-on

This Discounted Cash Flow (DCF) analysis for your upstream oil and gas terminal estimates the asset’s value based on projected future cash flows generated from production, processing, and transportation activities. These cash flows are driven by key factors such as production volumes, commodity prices (oil and gas), operating costs, capital expenditures, and reserve life. The projected free cash flows over a defined forecast period are discounted back to present value, along with a terminal value that reflects remaining reserves or long-term operations, to determine the terminal’s intrinsic value.

Weighted Average Cost of Capital (WACC) is used as the discount rate in valuing your upstream oil and gas terminal because it reflects the blended cost of equity and debt financing for the project. Given the sector’s exposure to commodity price volatility, regulatory risk, and operational uncertainties, the cost of capital may be relatively high compared to less cyclical industries. The WACC incorporates the required return of investors and lenders, adjusted for the capital structure and tax benefits of debt, and represents the minimum return required to justify investment in the asset.

Sensitivity analysis is particularly important in valuing your upstream oil and gas terminal due to the volatility of oil and gas prices and uncertainty in reserve estimates. By testing changes in key assumptions—such as operating costs, capital expenditures, and WACC—analysts can evaluate how sensitive the valuation is to market and operational risks. This process helps identify the most critical value drivers and provides a range of potential outcomes, supporting more informed investment and risk management decisions.

Final Notes on the Financial Model

Financial Model for an Oil and Gas Company

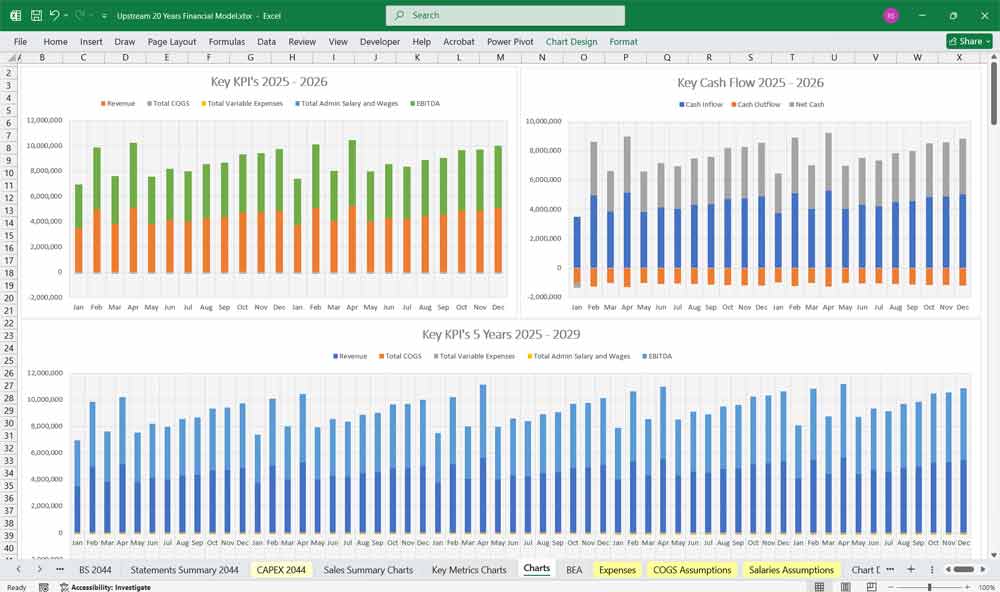

- Scenario Analysis: Create best-case, base-case, and worst-case projections.

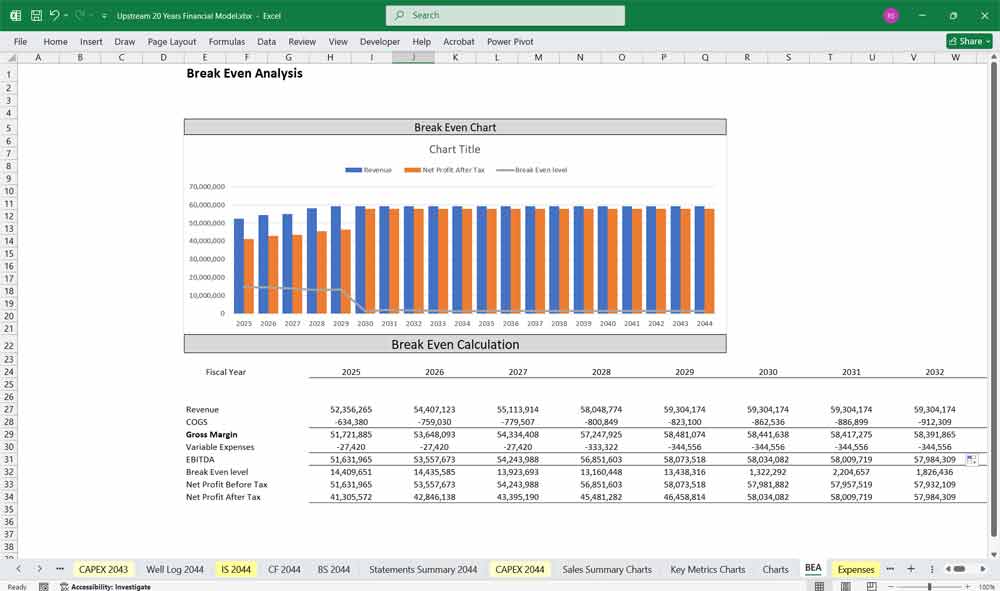

- Break-even Analysis: Determine sales volume required to cover fixed & variable costs.

- Sensitivity Analysis: Assess how changes in raw material costs, pricing, or demand impact profitability.

This structured 20 year model helps any Upstream Oil and Gas Company address a broad market spectrum, offering the right balance between cost, production capacity, support, and customization at each level.

Download Link On Next Page

Download Link On Next Page