Midstream Facility Financial Model

This 20-Year, 3-Statement MS Excel Midstream Facility Financial Model includes revenue streams from Crude Oil and LNG Storage to Throughput fees and Blending Services. These oil and gas cost models offer a great insight into the profitability of your Midstream Oil and Gas facility.

Financial Model for a Midstream Oil and Gas Facility

A Midstream Oil and Gas Terminal primarily operates in the transportation, storage, and distribution of crude oil, refined petroleum products, and natural gas. This financial model for such a terminal is designed to assess profitability, cash flows, and balance sheet strength over time. It is a very comprehensive (140 tab Excel Workbook) 20-year 3 Statement Financial Model and serves as a tool to project the company’s financial performance by analyzing revenues, costs, and other financial aspects related to downstream activities like refining, distribution, and marketing of petroleum products. (Upstream Model, Downstream, LNG Terminal.

Income Statement

This section outlines the company’s profitability over a period of time.

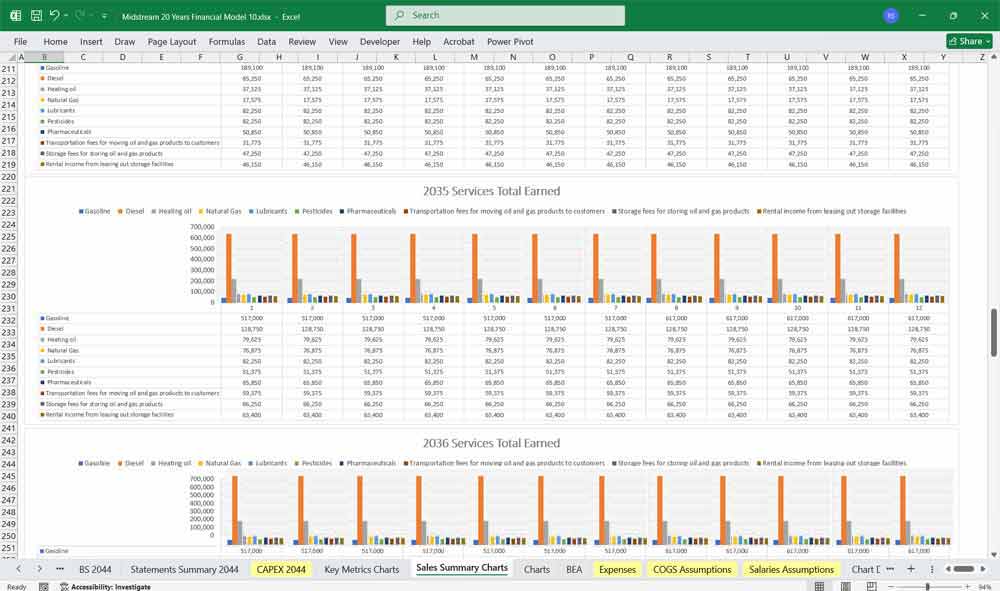

Revenue Streams

Storage Revenue – Fees charged to customers for storing oil, gas, or refined products.

Throughput Revenue – Fees based on the volume of oil and gas transported through the terminal.

Blending and Processing Fees – Revenue from blending different grades of oil or refining by-products.

Ancillary Services – Fees from heating, cooling, testing, and other related services.

Pipeline and Docking Fees – Revenue from pipeline interconnections and vessel docking services.

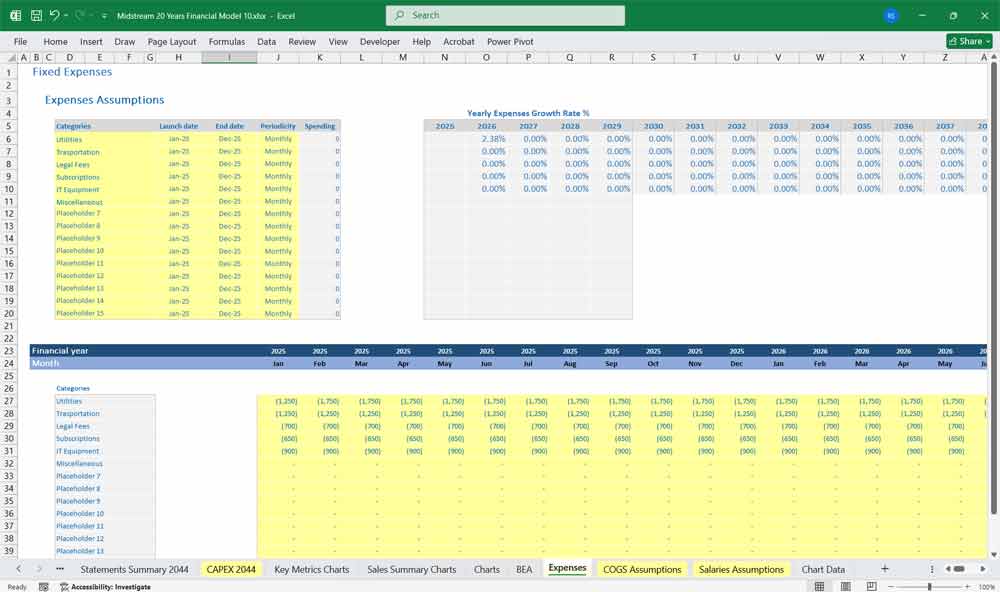

Cost of Goods Sold (COGS)

Direct Operating Expenses – Includes costs for equipment, pipelines, and storage tank maintenance.

Energy and Utilities – Power costs for heating, cooling, and pumping.

Third-Party Transportation Costs – If outsourcing certain logistics or pipeline usage.

Regulatory and Compliance Costs – Costs associated with environmental regulations and permits.

Operating Expenses (OPEX)

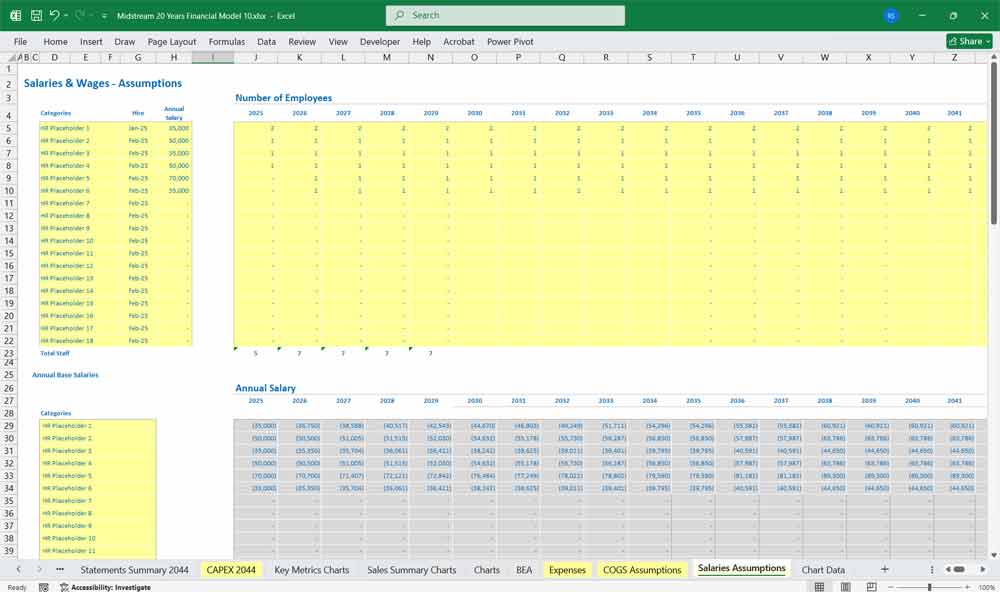

Salaries and Wages – Compensation for terminal operators and management.

Maintenance and Repairs – Regular upkeep of storage tanks, pipelines, and docks.

Insurance – Liability insurance, property coverage, and risk mitigation policies.

Administrative Expenses – Office overhead, legal, and consulting fees.

Depreciation and Amortization

Depreciation of Fixed Assets – Storage tanks, pipelines, and terminal infrastructure.

Amortization of Intangibles – Right-of-way agreements, licenses, and leases.

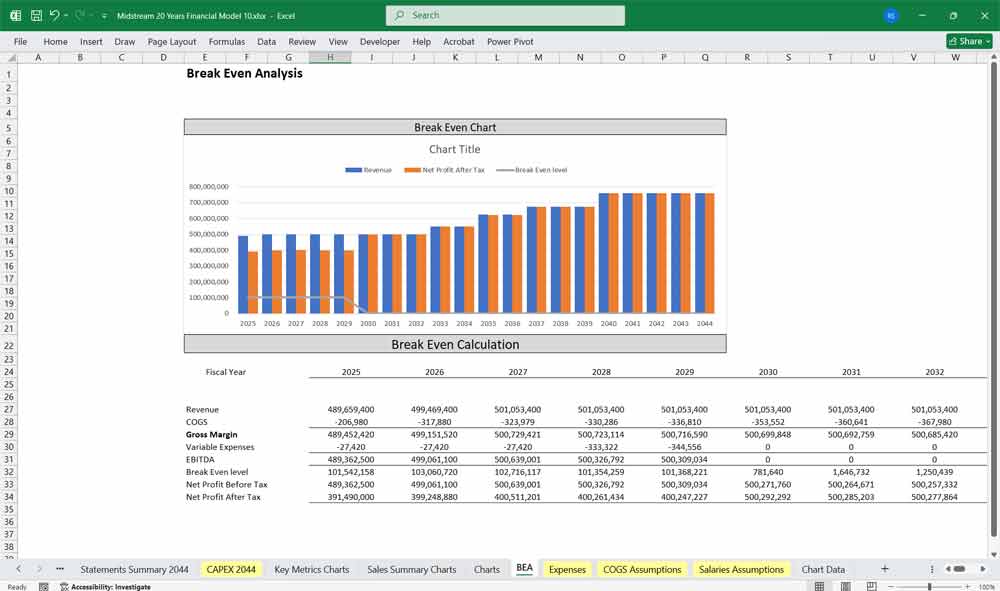

Operating Profit (EBIT)

Earnings Before Interest and Taxes (EBIT) = Total Revenue – (COGS + OPEX + Depreciation/Amortization).

Interest Expense & Taxes

Interest on Debt – Financing costs for loans or bonds.

Income Taxes – Based on taxable income after interest deductions.

Net Income

Net Income = EBIT – Interest Expense – Taxes.

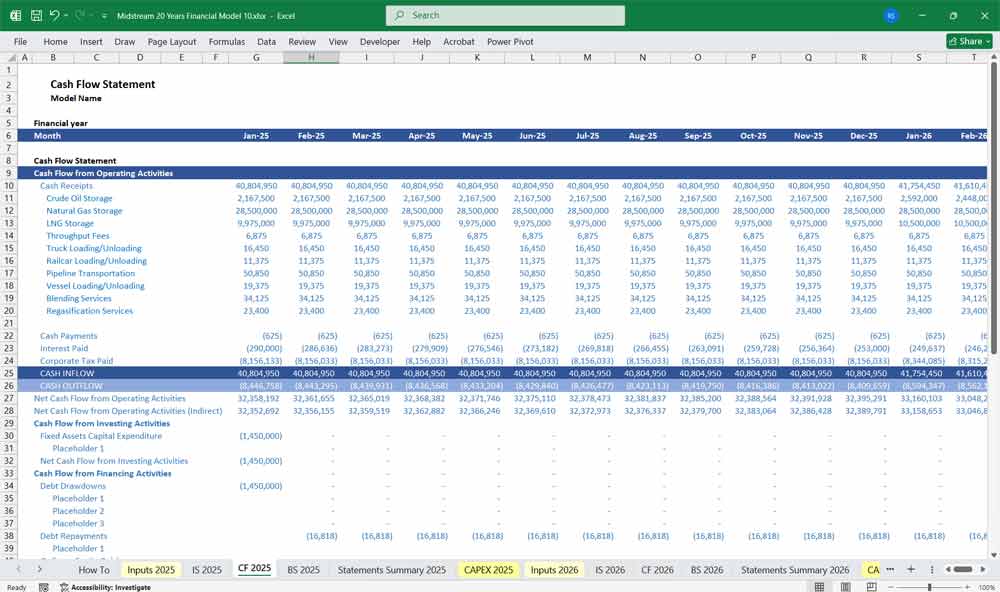

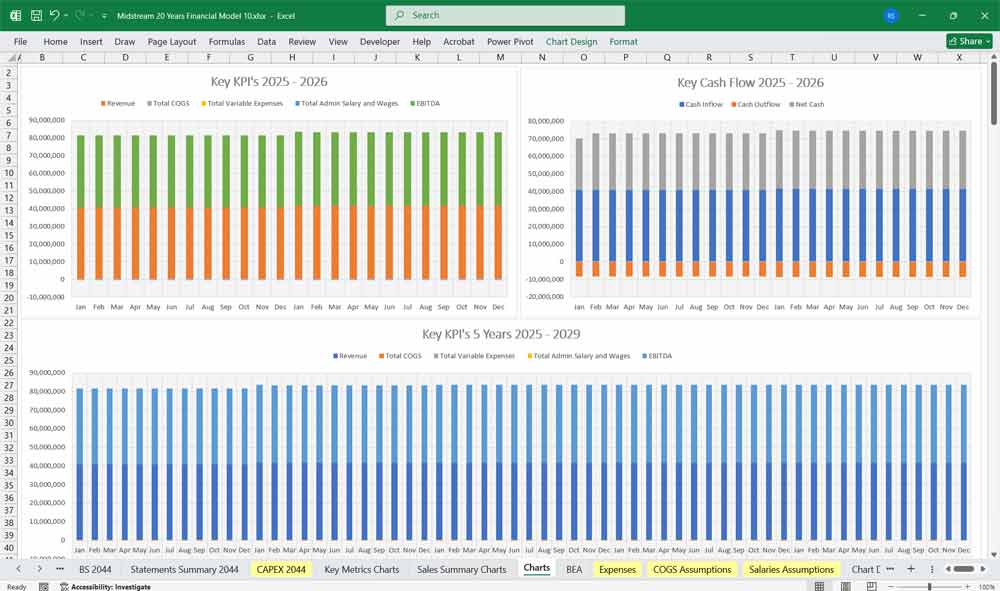

Midstream Oil and Gas Cash Flow Statement

The cash flow statement tracks the movement of cash in and out of the business.

Operating Cash Flow

Net Income (from Income Statement)

Adjustments for Non-Cash Items:

Depreciation and amortization

Changes in working capital (inventory, receivables, payables)

Operating Cash Flow Before Working Capital Changes

Changes in Working Capital:

Increase/(Decrease) in Accounts Receivable

Increase/(Decrease) in Accounts Payable

Increase/(Decrease) in Inventory

Total Operating Cash Flow

Investing Cash Flow

Capital Expenditures (CapEx) – Investments in new tanks, pipelines, or terminal expansion.

Proceeds from Asset Sales – Selling of aging infrastructure or excess storage capacity.

Other Investments – Joint ventures, acquisitions, or investments in new technology.

Financing Cash Flow

Debt Issuance – Raising capital through loans or bonds.

Debt Repayment – Paying off principal on outstanding loans.

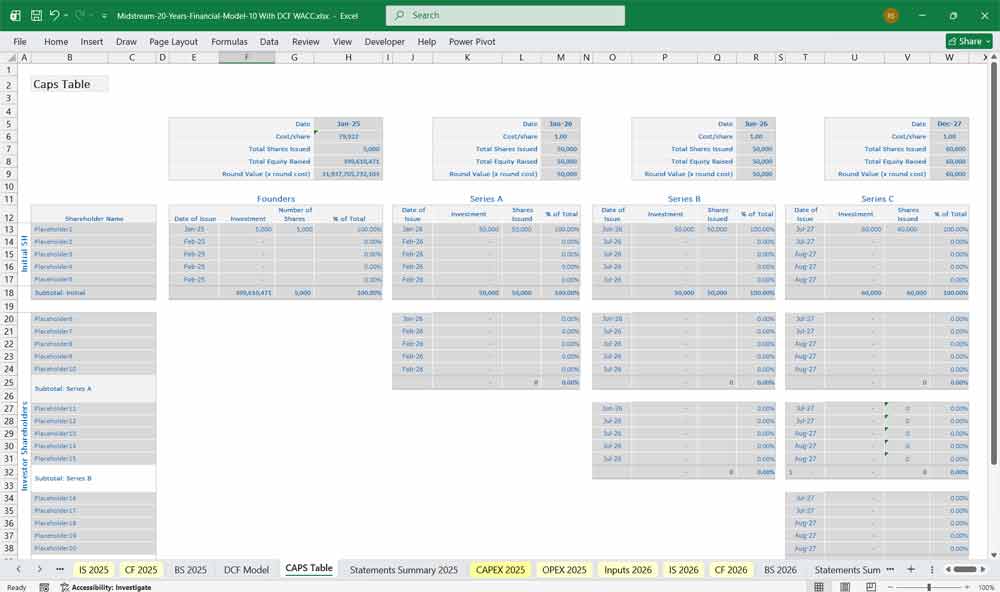

Equity Issuance – Raising money via new stock issuance.

Dividend Payments – Distributions to shareholders.

Total Financing Cash Flow

Net Cash Flow & Closing Balance

Net Increase (Decrease) in Cash = Operating Cash Flow + Investing Cash Flow + Financing Cash Flow

Beginning Cash Balance + Net Cash Flow = Ending Cash Balance

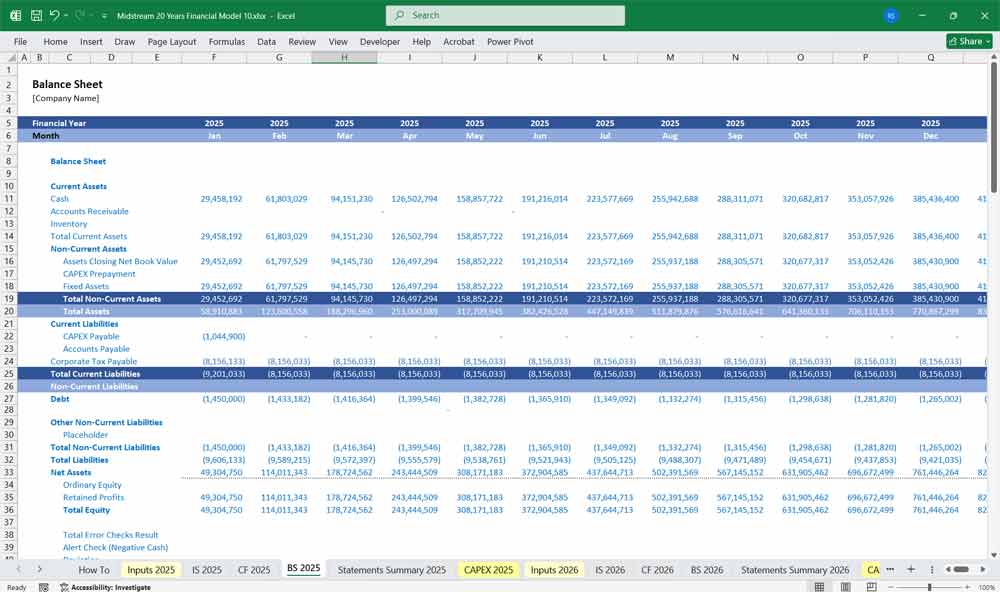

Midstream Oil and Gas Balance Sheet

The balance sheet shows the company’s financial position at a given time.

Assets

Current Assets:

Cash & Equivalents – Cash on hand and liquid investments.

Accounts Receivable – Outstanding payments from customers.

Inventory – Stored crude oil, refined products, or chemicals.

Prepaid Expenses – Prepaid maintenance or insurance costs.

Non-Current Assets:

Property, Plant & Equipment (PP&E) – Terminals, pipelines, storage tanks, loading/unloading facilities.

Intangible Assets – Permits, licenses, and operational rights.

Goodwill – Value from acquisitions.

Liabilities

Current Liabilities:

Accounts Payable – Unpaid vendor and supplier invoices.

Short-Term Debt – Maturing debt obligations within one year.

Accrued Expenses – Wages, interest, and taxes payable.

Non-Current Liabilities:

Long-Term Debt – Loans and bonds with maturity beyond one year.

Deferred Tax Liabilities – Tax obligations deferred to future periods.

Equity

Common Stock & Retained Earnings – Shareholder investments and retained profits.

Additional Paid-in Capital – Extra capital raised beyond stock par value.

Total Equity = Assets – Liabilities

Key Financial Midstream Ratios & Metrics

These ratios help evaluate the financial health of the midstream terminal.

Profitability Ratios

EBITDA Margin = (EBITDA / Revenue) × 100

Net Profit Margin = (Net Income / Revenue) × 100

Return on Assets (ROA) = (Net Income / Total Assets) × 100

Return on Equity (ROE) = (Net Income / Shareholder Equity) × 100

Liquidity Ratios

Current Ratio = Current Assets / Current Liabilities

Quick Ratio = (Cash + Receivables) / Current Liabilities

Leverage Ratios

Debt-to-Equity Ratio = Total Debt / Shareholder Equity

Interest Coverage Ratio = EBIT / Interest Expense

Operational Metrics

Utilization Rate = (Storage Volume Used / Total Storage Capacity) × 100

Throughput Volume Growth = (Current Year Volume – Previous Year Volume) / Previous Year Volume × 100

Crude Oil Storage at a Midstream Terminal

This storage at a midstream terminal plays a critical role in managing supply and demand imbalances, serving as a buffer for producers, refiners, and traders. Revenue from storage is typically generated through fixed lease contracts or variable fees based on storage duration and volume. However, fluctuations in oil prices can significantly impact storage demand and, consequently, terminal revenues. During periods of oversupply or contango (when future oil prices are higher than spot prices), storage demand increases as traders hold crude to sell at a later date, driving up utilization rates and revenues. Conversely, in a backwardation market (when spot prices exceed future prices), storage demand declines, reducing terminal earnings. Within a financial model, these fluctuations affect revenue projections, operating cash flow, and asset utilization rates, which, in turn, impact key financial ratios such as EBITDA margin and return on assets. Additionally, uncertain storage demand may lead to variable capital expenditures for tank expansions or maintenance, influencing long-term investment decisions.

LNG Storage at a Midstream Terminal: Revenue Impact of Capacity Price Fluctuations in a Financial Model

LNG storage at a midstream terminal generates revenue primarily through capacity reservation fees (fixed payments for reserved storage space) and variable usage fees (charges per unit of LNG injected or withdrawn). Unlike crude oil, LNG storage is highly sensitive to seasonal demand shifts (winter heating vs. summer cooling demand) and global LNG price arbitrage, which drive fluctuations in storage utilization and capacity pricing. When LNG prices spike (e.g., due to supply disruptions or cold weather), demand for storage surges, allowing terminals to charge premium rates. Conversely, oversupply or weak demand reduces capacity prices, pressuring revenues. In a financial model, these fluctuations directly impact EBITDA and cash flow, requiring scenario-based assumptions on:

Contract structures (long-term take-or-pay vs. spot market exposure),

Utilization rates (linked to regional gas demand and export economics),

Price-linked fee adjustments (e.g., fees indexed to Henry Hub or TTF gas prices).

Since LNG storage has high fixed costs (cryogenic maintenance, boil-off gas management), revenue volatility can significantly affect operating leverage and break-even utilization rates. The financial model should incorporate stress tests for low-price environments and sensitivity analysis on capacity pricing to assess downside risks and investment returns.

Natural Gas Storage at a Midstream Terminal: Revenue Drivers and Financial Model Impact

Natural gas storage terminals generate revenue through injection fees (paid when gas is stored), withdrawal fees (charged when gas is delivered), and capacity reservation fees (fixed payments to secure storage space). Revenue stability depends on three key factors:

Gas Price Volatility – Storage becomes more valuable when price spreads between seasons (winter premiums) or market dislocations create arbitrage opportunities. High volatility incentivizes traders to store gas, boosting utilization and allowing terminals to charge higher fees. Conversely, low volatility reduces demand for storage, pressuring revenues.

Seasonal Demand – Gas demand peaks in winter (heating) and summer (power generation for cooling), driving cyclical storage patterns. Terminals must balance injection season (low demand, high storage) with withdrawal season (high demand, rapid turnover), impacting fee structures and cash flow timing.

Storage Utilization Rates – Contracts may be firm (guaranteed revenue) or interruptible (subject to market conditions). Low utilization in oversupplied markets erodes revenue, while high utilization during shortages allows for premium pricing.

In a financial model, these dynamics affect EBITDA margins, working capital cycles, and capital allocation. Key considerations include:

Sensitivity to Henry Hub/TTF price spreads,

Break-even storage spreads (injection vs. withdrawal economics),

Contract mix (long-term take-or-pay vs. spot exposure),

Operational constraints (e.g., cycling limits, cushion gas requirements).

Stress-testing scenarios (e.g., mild winters, LNG export disruptions) is critical to assess downside risks and debt serviceability.

Blending Services at a Midstream Terminal: Revenue Drivers and Financial Model Implications

Blending services at a midstream terminal generate revenue by customizing hydrocarbon products (e.g., adjusting octane levels in gasoline, diluting heavy crude, or meeting ethanol mandates), typically through per-barrel processing fees or value-based pricing tied to product quality improvements. Revenue is influenced by three key factors:

Commodity Price Volatility – Wide crude or gasoline price differentials (e.g., Brent vs. WTI, RBOB vs. conventional gasoline) incentivize traders to optimize blends for arbitrage, increasing demand for blending services. Conversely, narrow spreads reduce economic incentives, lowering utilization.

Seasonal Demand Shifts – Gasoline blending peaks ahead of summer driving season (requiring higher-RVP blends), while winter diesel demand affects ultra-low-sulfur diesel (ULSD) blending. Regulatory changes (e.g., biofuel mandates) can also drive sudden demand spikes.

Terminal Utilization & Storage Dynamics – Blending requires available storage and throughput capacity. High storage utilization may limit blending flexibility, while underutilized terminals can offer blending as a value-added service to attract customers.

In a financial model, blending revenue introduces variable margin risk, as fees often depend on feedstock costs and output pricing. Key considerations include:

Margin Compression Risks (e.g., rising input costs not fully passed through to customers),

Regulatory Sensitivity (changing biofuel or sulfur rules requiring blend adjustments),

Throughput Linkage (blending often complements core storage/throughput revenue).

Scenario analysis projections within the financial model should take into account test price spread shocks, regulation-driven demand shifts, and competing terminal strategies to assess revenue resilience.

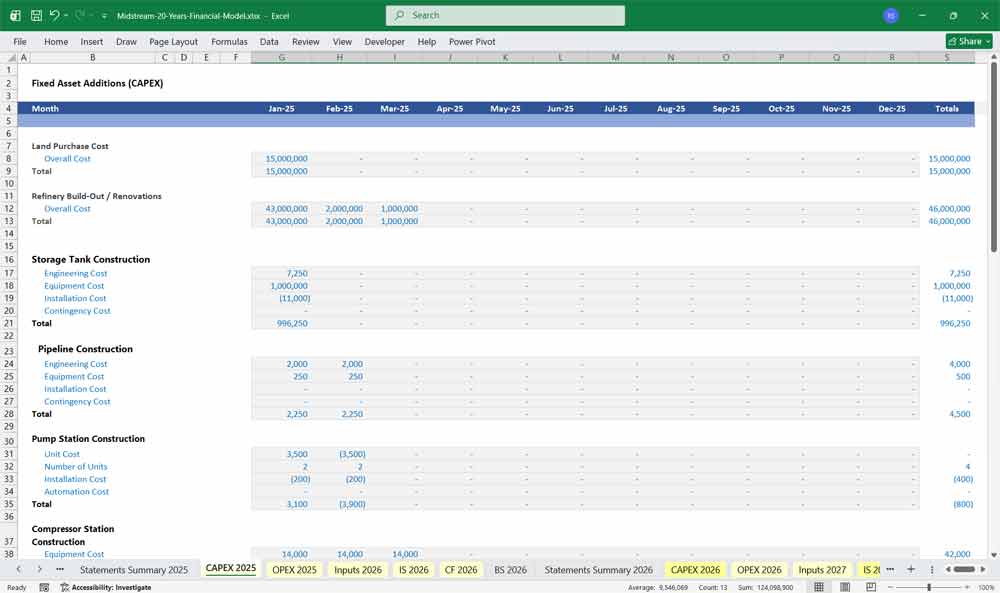

New Storage Tank Construction at a Midstream Terminal: Cost Dynamics & Financial Model Impact

The construction of new storage tanks at a midstream terminal involves four major cost components: engineering (design, permits, studies), equipment (tanks, pumps, valves, safety systems), installation (civil works, welding, electrical), and contingency (typically 10-15% for overruns). Fluctuations in material prices (e.g., steel), labor shortages, or regulatory delays can escalate costs, directly impacting project capex and ROI. In a financial model, these variables influence:

Upfront Capital Outlay: Higher-than-budgeted engineering or equipment costs may require additional debt/equity financing, increasing interest expense and diluting returns.

Depreciation & EBITDA Impact: Larger capex raises long-term depreciation, reducing EBIT but shielding taxable income.

Cash Flow Timing: Construction delays defer revenue generation, extending the payback period.

Profitability hinges on post-construction utilization rates and storage fee pricing. If demand weakens (e.g., due to falling crude inventories or competing terminals), the project may struggle to meet break-even utilization, pressuring IRR. Sensitivity analysis should test:

Steel price volatility (+/- 20% on tank costs),

Permitting delays (6-12 month revenue postponement),

Interest rate hikes (if construction is debt-financed).

A well-structured model will incorporate phased cost disbursements and scenario-based utilization assumptions to assess viability under stress conditions.

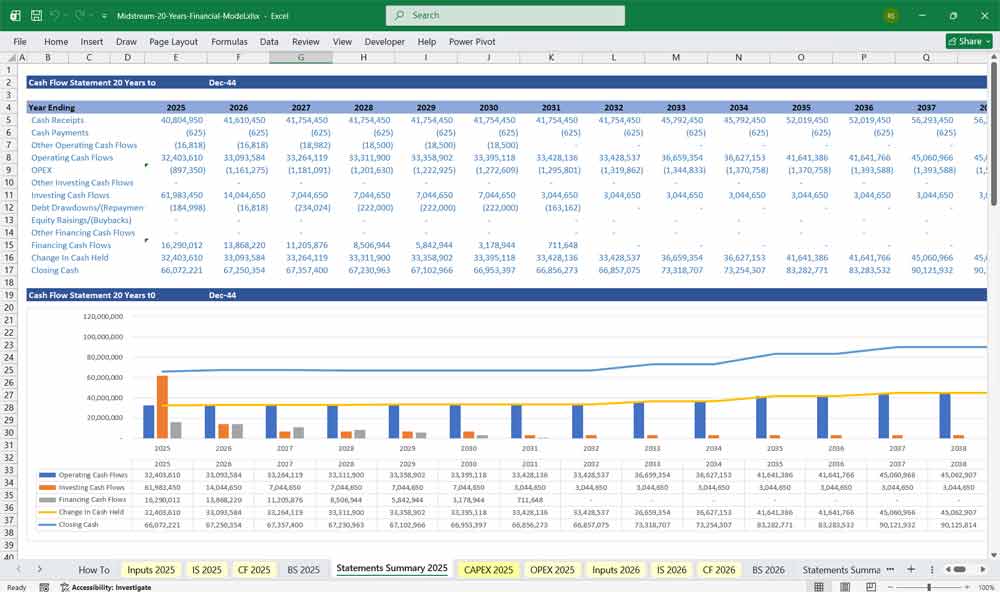

Benefits of a 20-year financial model on midstream oil & gas cost models

This offers significant long-term benefits for strategic planning and decision-making. These models allow companies to project revenues, expenses, and cash flows over an extended period, which is crucial for a capital-intensive industry with long project lifecycles. By analyzing various scenarios—such as fluctuating commodity prices, changes in regulation, or shifts in market demand—a company can better understand potential risks and opportunities. This foresight enables management to make informed decisions about major investments like pipeline expansions, new processing facilities, or acquisitions.

20 Year Oil & Gas Cost Models evaluate long-term midstream project viability.

A 20-year model can accurately forecast the profitability of projects like a new pipeline that may take many years to build and even longer to recoup its initial investment. It helps in assessing the project’s internal rate of return (IRR) and net present value (NPV) by considering the entire lifecycle, including construction, operation, and eventual decommissioning costs. This detailed analysis ensures that a project is not only profitable in the short term but also sustainable and valuable over its full operational life.

Oil & Gas Cost Models and securing Midstream financial investors.

Lenders and investors need to see a clear, comprehensive plan that demonstrates the project’s long-term financial health and ability to generate consistent returns. A well-structured 20-year model provides the necessary data to support loan applications or equity raises, showing that the company has a solid understanding of its market, operational costs, and revenue streams. This transparency and a robust financial outlook can significantly increase confidence and lower the cost of capital.

Long term risk management and stress testing with Midstream Oil & Gas Cost Models

The midstream sector is vulnerable to various external factors, including commodity price volatility, regulatory changes, and environmental policies. A 20-year model allows companies to run stress tests by modeling extreme but plausible scenarios. For example, a company can simulate the impact of a sustained period of low oil prices on its cash flow or model the cost implications of new environmental regulations. This proactive approach helps identify vulnerabilities and develop mitigation strategies before they become a crisis.

A 20-year financial model supports optimizing asset utilization and strategic growth within Midstream Oil & Gas Cost Models.

By forecasting future capacity needs and operational costs, a company can make better decisions about when to expand infrastructure or when to divest underperforming assets. It helps in identifying synergies from potential mergers and acquisitions and provides a framework for integrating new assets into the existing portfolio. This long-term perspective ensures that all strategic decisions contribute to the company’s overall growth and profitability goals, rather than just short-term gains.

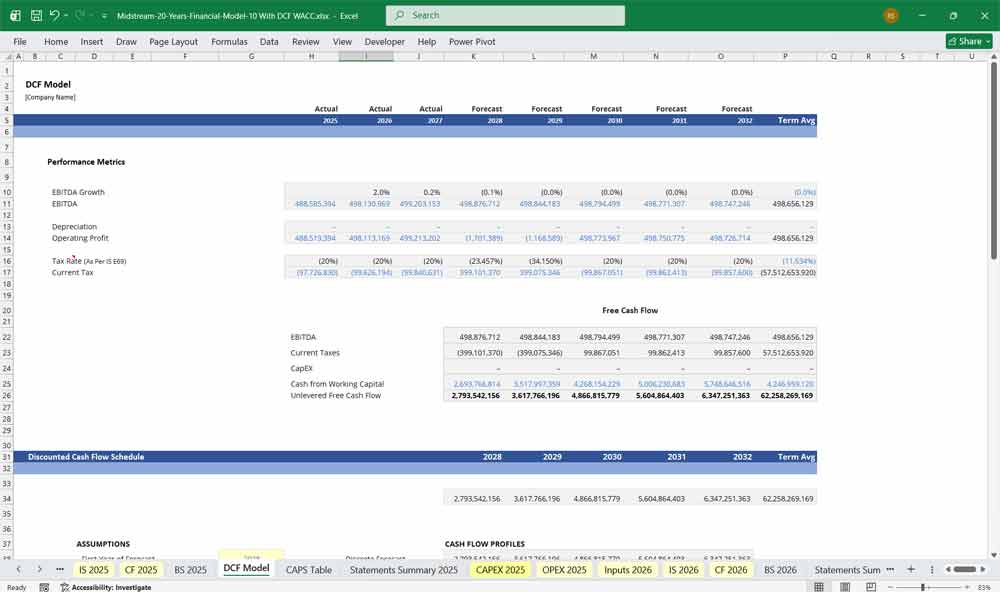

Midstream Oil and Gas Discounted Cash Flow (DCF) with Terminal Value, Sensitivity Analysis, and WACC Model add-on

DCF: Valuing Long-Term Infrastructure

In the midstream sector, a Discounted Cash Flow (DCF) analysis is the gold standard for valuing terminals, as these assets are defined by steady, predictable cash flows backed by long-term “take-or-pay” contracts. Unlike volatile upstream plays, a terminal’s value is derived from its throughput capacity and storage fees over a 20-year horizon. The DCF captures the initial heavy capital expenditure of tank farm construction and offsets it against years of stable EBITDA, ultimately discounting those future payouts to determine if the project meets its internal rate of return (IRR) hurdles.

WACC: Balancing Project Risk and Leverage

The Weighted Average Cost of Capital (WACC) for a midstream terminal typically reflects the asset’s “utility-like” risk profile, often allowing for higher debt-to-equity ratios compared to other energy segments. Because terminals are capital-intensive, the WACC is heavily influenced by prevailing interest rates and the company’s credit spread. A precisely calculated WACC ensures that the discount rate accounts for the specific risks of the commodity being handled—such as the difference in regulatory or environmental risk between a crude oil hub and a refined products terminal.

Sensitivity Analysis: Testing Throughput and Macro Shifts

Given the 20-year lifespan of a terminal, Sensitivity Analysis is vital to account for shifts in the energy landscape, such as the energy transition or changes in regional production. By “stretching” variables like utilization rates (e.g., 70% vs. 95% capacity) and tariff escalators, analysts can identify the “break-even” point where the project remains viable. This analysis is particularly crucial for identifying how sensitive the terminal’s valuation is to its Terminal Value, as a slight change in the exit multiple or long-term growth rate can significantly alter the investment case.

Final Notes on the Financial Model

This 20-year Midstream Facility Financial Model incorporates revenue forecasting, operating expenses, investment activities, financing decisions, and profitability analysis. Oil and gas cost models help you maintain healthy financial ratios, manage cash flows efficiently, and optimise asset utilization. The terminal can maximize profitability and shareholder value.

Download Link On Next Page

Download Link On Next Page