LNG Terminal Financial Model

20-Year 3-Statement Financial Model For An LNG Terminal

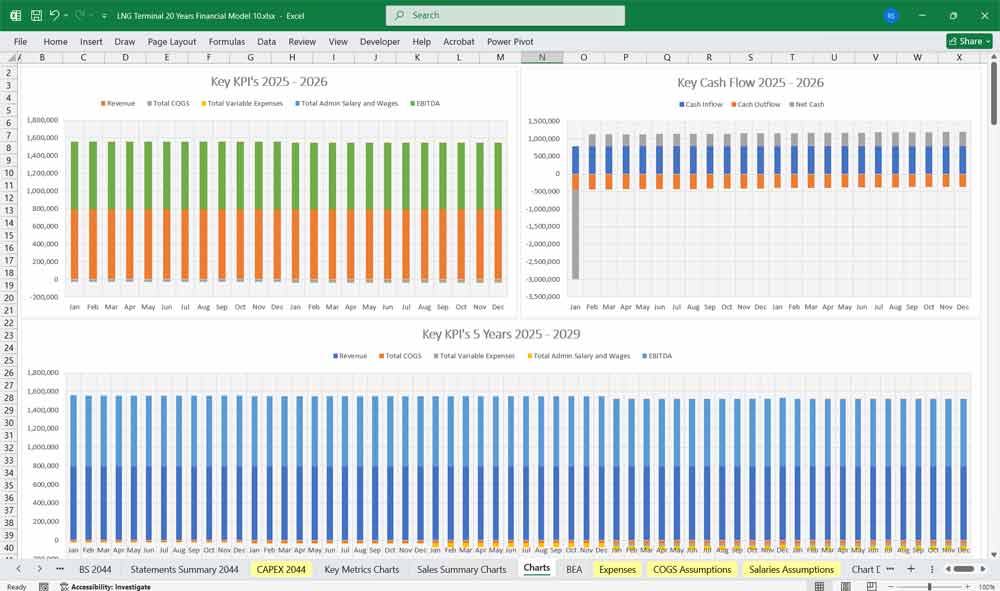

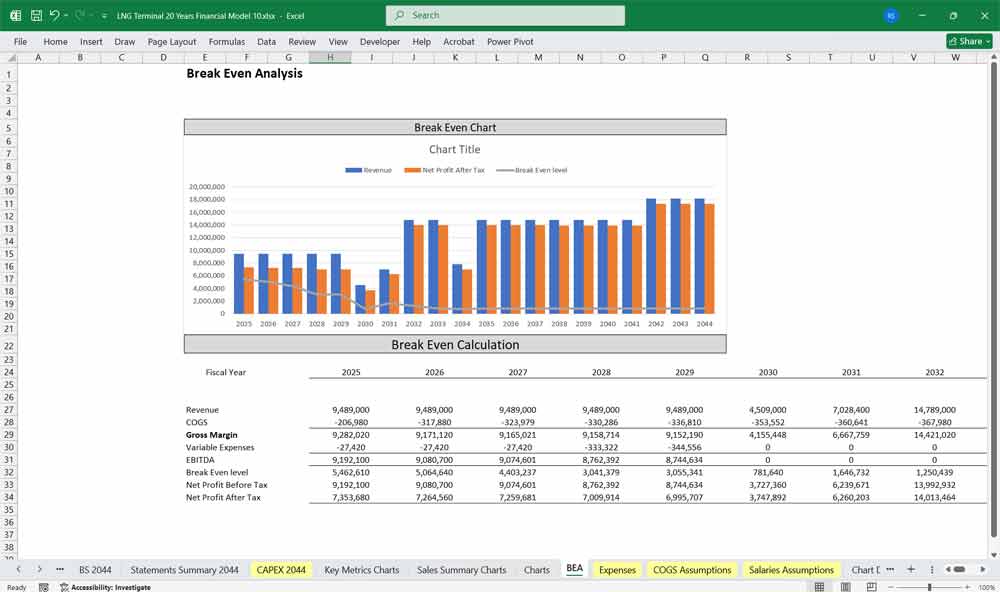

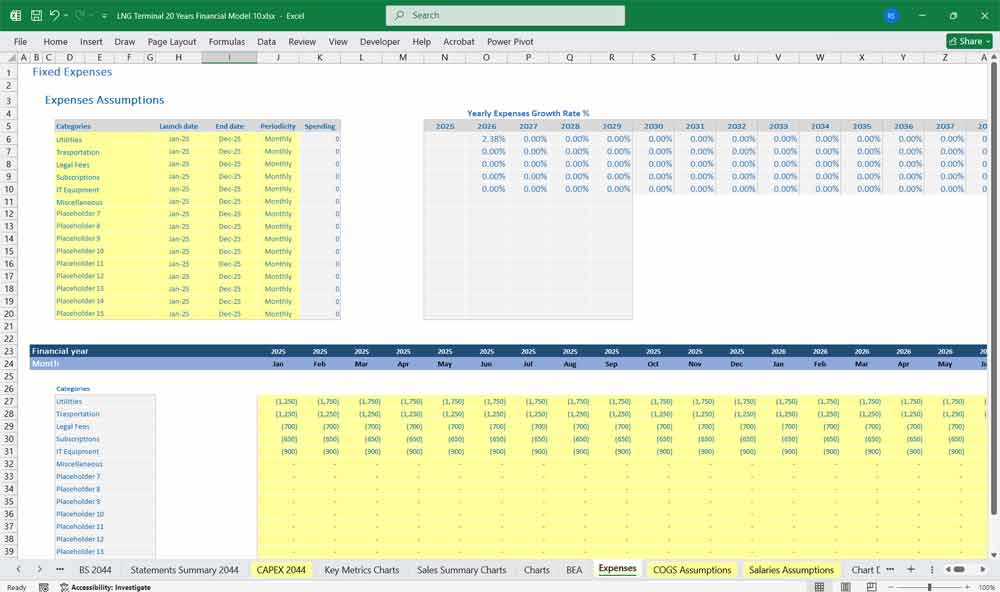

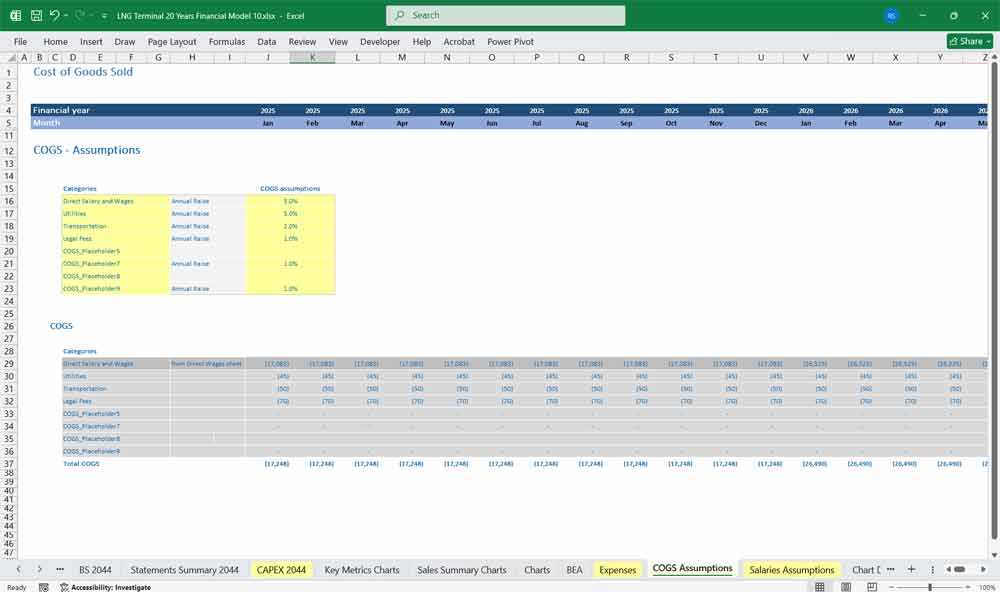

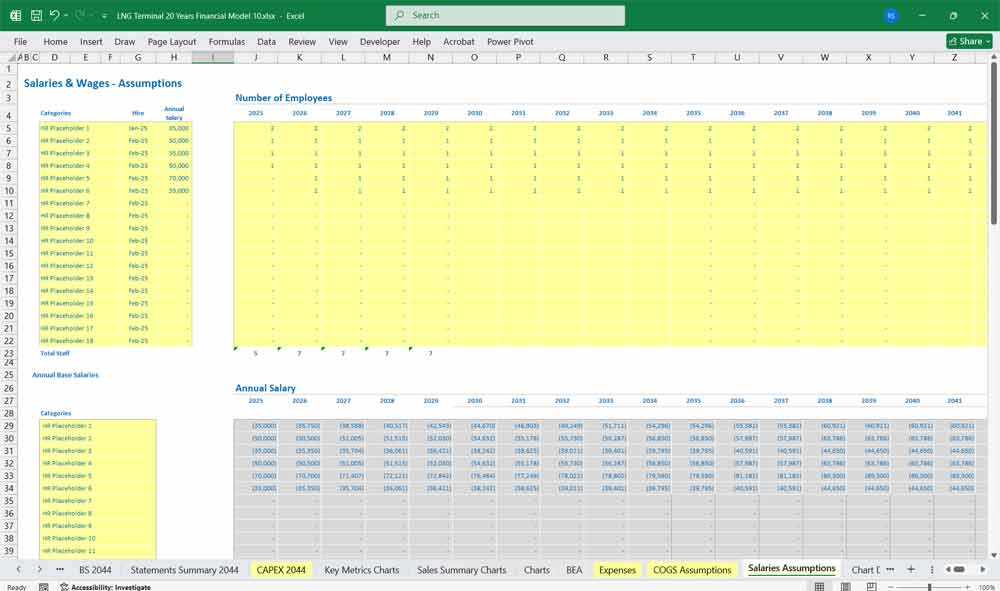

A very detailed Financial Model for an LNG Terminal (150 Excel Tab Workbook) used to assess the financial viability, performance, and risks associated with an LNG (Liquefied Natural Gas) terminal project. It integrates various financial, operational, and market assumptions into structured financial statements: the Income Statement, Cash Flow Statement, and Balance Sheets. 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX Sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the specified revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets.

Downstream Refinery Model, Midstream Storage, Upstream.

Assumptions and Inputs

- Market Assumptions:

- LNG prices (Henry Hub, JKM, Brent-linked, etc.)

- Exchange rates, inflation rates, and discount rates.

- Operational Assumptions:

- Terminal capacity (e.g., MMTPA – Million Metric Tons Per Annum)

- Utilization rates and boil-off rates.

- Start date, ramp-up period, and lifespan.

- Revenue Assumptions:

- Long-term contracts (take-or-pay clauses).

- Spot market sales volume and price.

- Cost Assumptions:

- Operating & Maintenance (O&M) expenses.

- Shipping and regasification costs.

- Financing Assumptions:

- Debt-to-equity ratio.

- Interest rates, loan tenure, and repayment structure.

- Tax and Depreciation Assumptions:

- Corporate tax rate.

- Depreciation method (straight-line, declining balance, etc.).

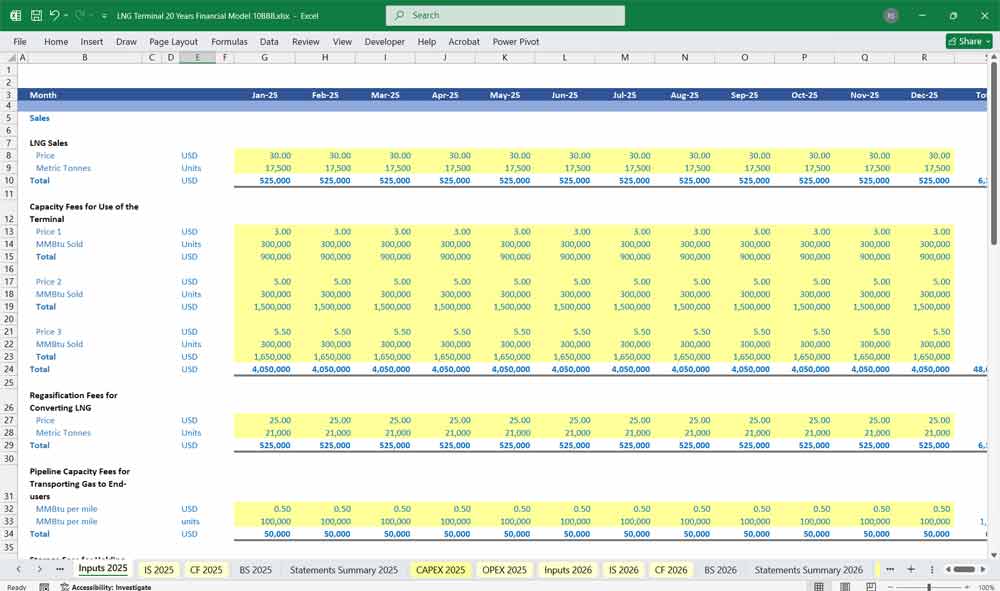

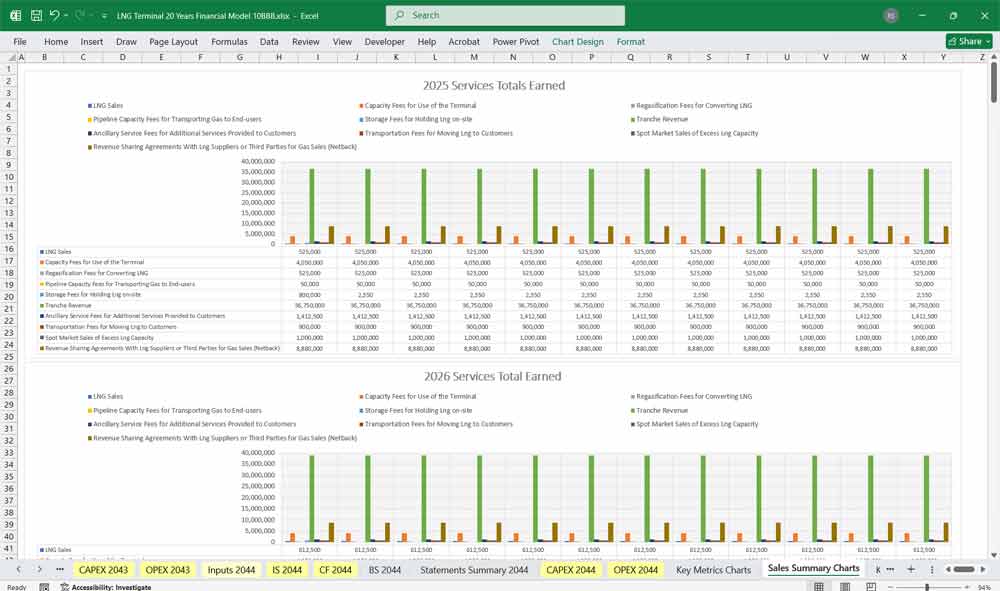

Some Inputs Used In The Model

- LNG Sales

- Capacity Fees for Use of the Terminal

- Regasification Fees for Converting LNG

- Pipeline Capacity Fees for Transporting Gas to End-users

- Storage Fees for Holding LNG on-site

- Tranche Revenue

- Ancillary Service Fees for Additional Services Provided to Customers

- Gas Quality Adjustment (Custom Blending)

- High-Priority Berthing

- Custom Send-Out Scheduling

- Truck/Loading Bay Services

- Helium or NGL Extraction

- Transportation Fees for Moving LNG to Customers

- Spot Market Sales of Excess LNG Capacity

- Revenue Sharing Agreements With LNG Suppliers or Third Parties for Gas Sales (Netback)

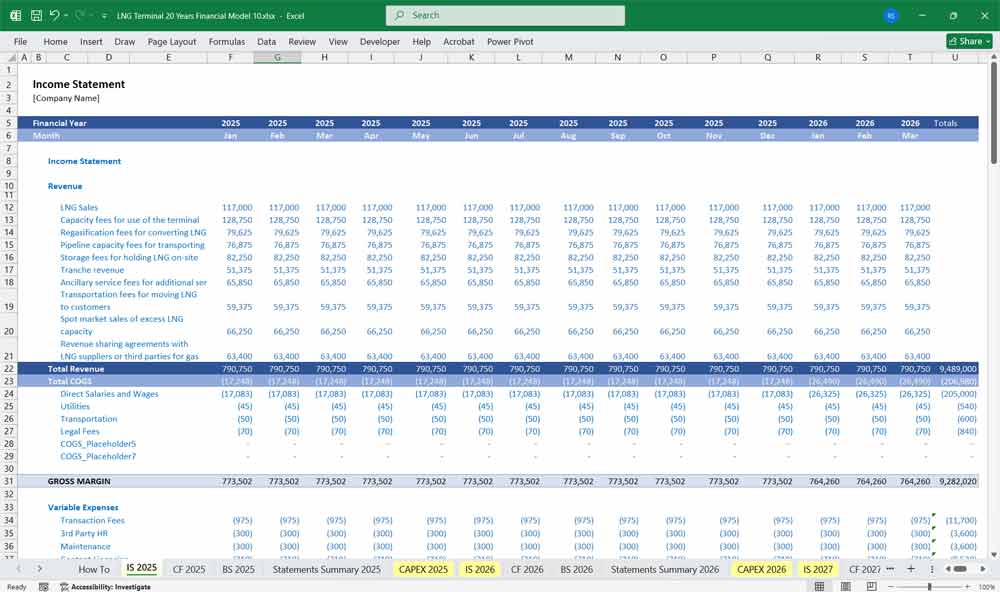

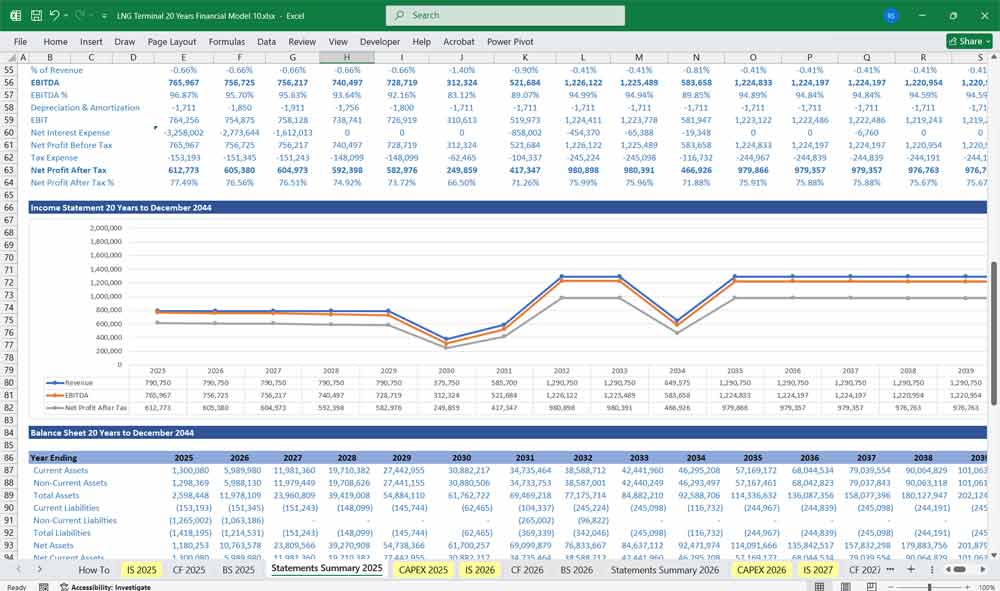

Income Statement (Profit and Loss Statement)

Revenues:

- Regasification Fees: Revenue from long-term contracts with off-takers.

- Throughput Charges: Fees based on volume processed through the terminal.

- Spot Sales: Revenue from excess capacity sold on the spot market.

- Other Income: Ancillary services, such as storage and bunkering fees.

Cost of Sales:

- LNG Procurement Cost: If applicable, for terminals that procure LNG.

- Shipping Costs: Freight charges for LNG carriers.

- Handling Costs: Costs related to unloading, storing, and regasifying LNG.

Gross Profit = Revenue – Cost of Sales

Operating Expenses:

- Operations and Maintenance (O&M) Costs: Labor, spare parts, and inspections.

- Administrative Expenses: Salaries, office expenses, and IT systems.

- Insurance Premiums: Coverage for facilities, ships, and environmental risks.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) = Gross Profit – Operating Expenses

Depreciation and Amortization:

- Depreciation of plant, pipelines, and storage tanks.

EBIT (Earnings Before Interest and Taxes) = EBITDA – Depreciation and Amortization

Interest Expense:

- Interest payments on loans and bonds.

Profit Before Tax (PBT) = EBIT – Interest Expense

Taxes:

- Corporate income tax and deferred taxes.

Net Profit = PBT – Taxes

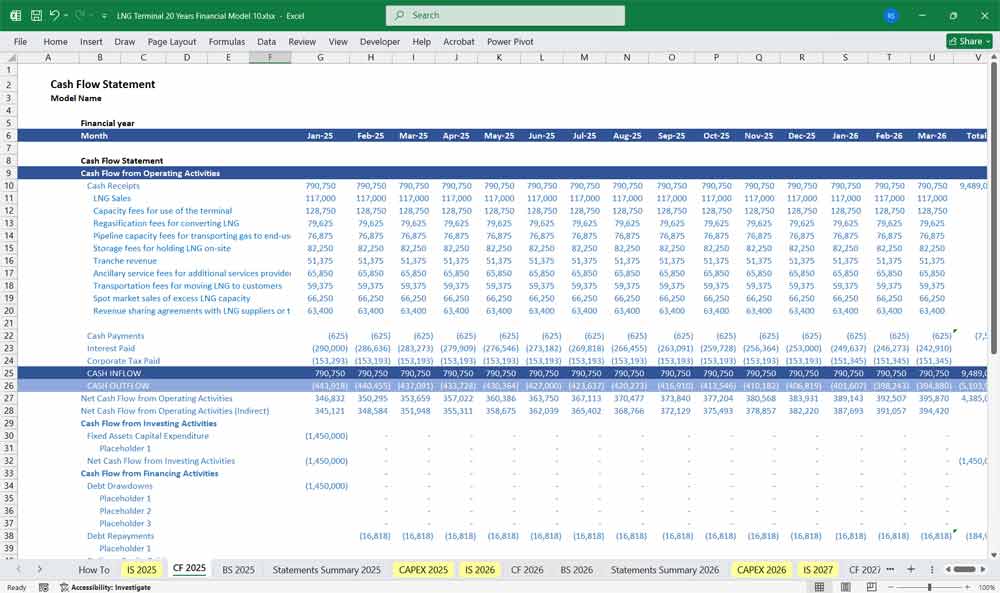

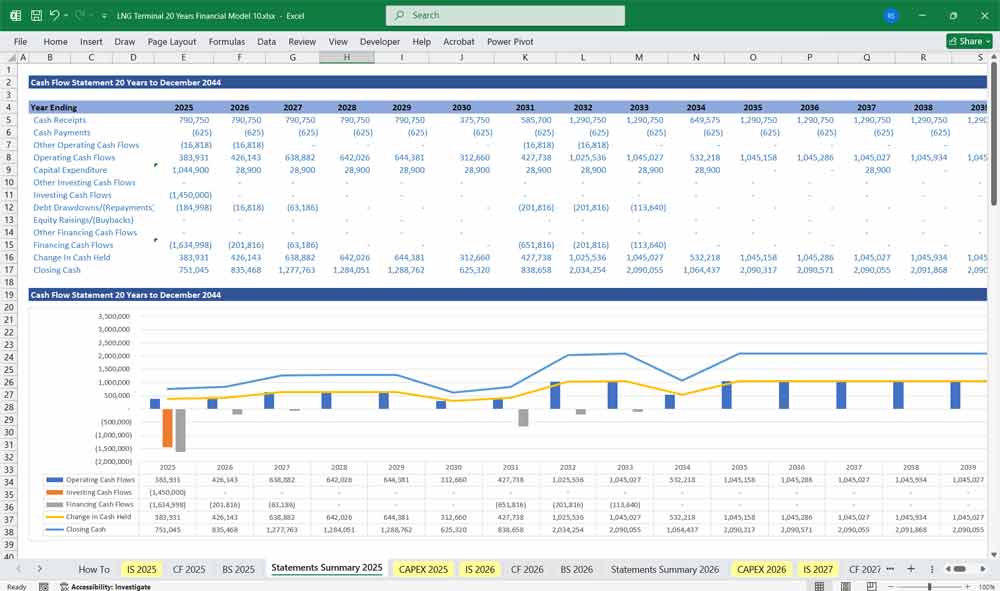

LNG Terminal Cash Flow Statement

Operating Cash Flow:

- Cash Inflows:

- Receipts from long-term contracts and spot sales.

- Cash Outflows:

- Payments for LNG purchases.

- O&M costs and administrative expenses.

- Taxes paid.

Net Operating Cash Flow = Inflows – Outflows

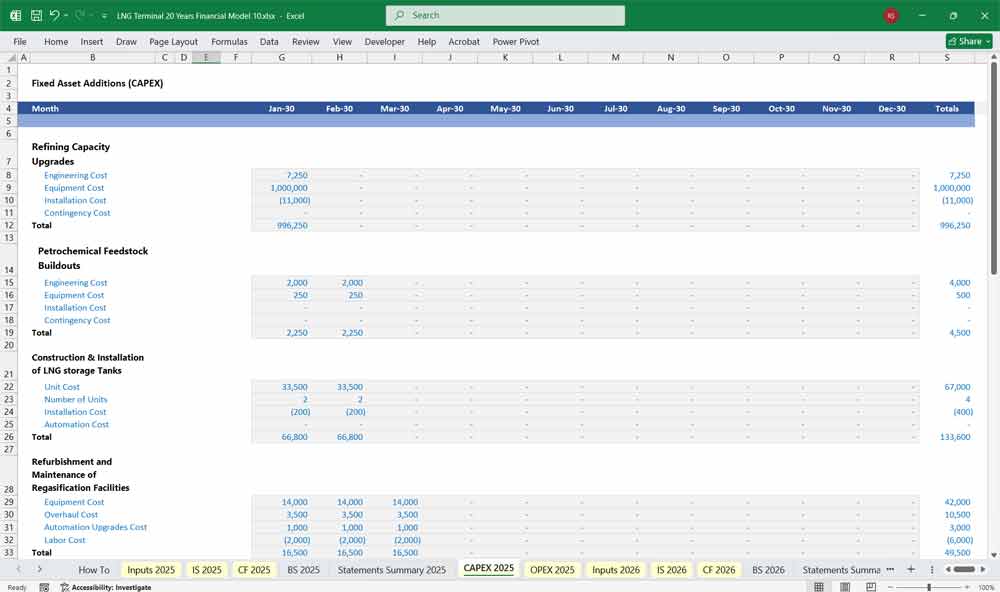

Investing Cash Flow:

- Capital Expenditures (CapEx):

- Initial construction of the terminal and pipelines.

- Expansion projects and upgrades.

- Asset Sales:

- Proceeds from selling old equipment.

Net Investing Cash Flow = CapEx – Asset Sales

Financing Cash Flow:

- Cash Inflows:

- Proceeds from debt issuance and equity contributions.

- Cash Outflows:

- Debt repayments and dividend payments.

- Interest payments.

Net Financing Cash Flow = Inflows – Outflows

Net Cash Flow = Operating Cash Flow + Investing Cash Flow + Financing Cash Flow

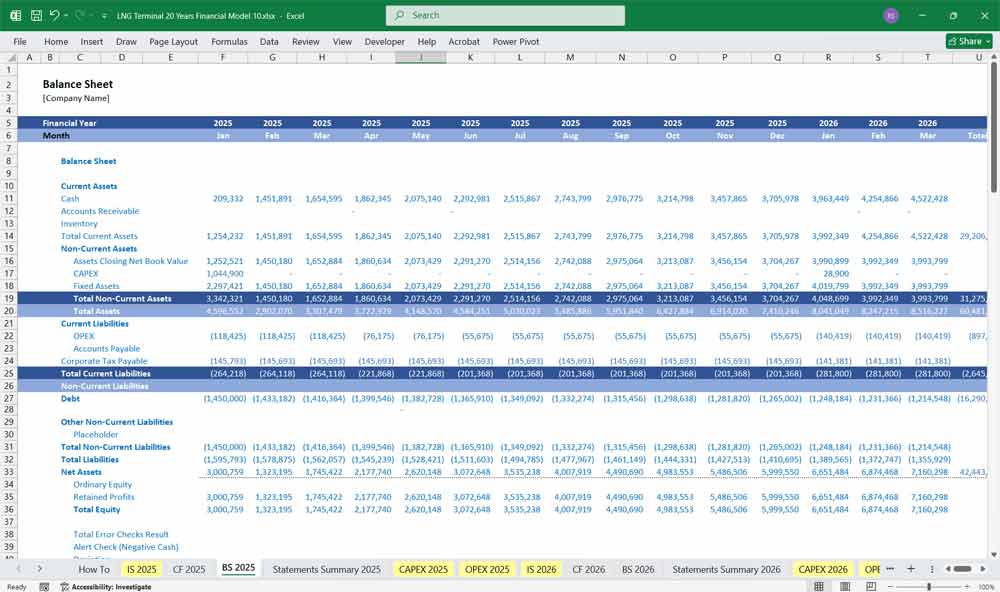

LNG Terminal Balance Sheet

Assets:

Current Assets:

- Cash and Cash Equivalents.

- Accounts Receivable (from off-takers).

- LNG Inventory.

Non-Current Assets:

- Property, Plant, and Equipment (PP&E): Storage tanks, pipelines, jetties.

- Intangible Assets: Licenses, permits, and development costs.

- Deferred Tax Assets.

Liabilities:

Current Liabilities:

- Accounts Payable (for LNG suppliers, contractors).

- Short-term Debt and Interest Payable.

Non-Current Liabilities:

- Long-term Debt (bonds, loans).

- Deferred Tax Liabilities.

Equity:

- Contributed Capital: Initial equity injections.

- Retained Earnings: Accumulated profits.

- Reserves: Contingency and maintenance reserves.

Balance Sheet Equation:

Assets = Liabilities + Equity

Key Financial Metrics For An LNG Terminal

- Net Present Value (NPV): Evaluates project profitability.

- Internal Rate of Return (IRR): Measures project return.

- Debt Service Coverage Ratio (DSCR): Assesses debt repayment capacity.

- Payback Period: Time to recover initial investment.

Benefits Of A 20-Year Model for an LNG Terminal

It provides a comprehensive, long-term perspective essential for a capital-intensive project. It’s not just about short-term viability; it’s about projecting returns over the entire operational life of the asset. This extended time horizon is crucial for capturing the terminal’s full revenue potential, which typically comes from long-term, take-or-pay contracts. It allows investors and lenders to confidently assess the project’s ability to service debt, provide a return on equity, and manage risks over several economic cycles.

LNG Terminal Debt Structuring and Financing.

Given the immense upfront capital expenditure (CapEx) to build an LNG terminal, projects are almost always financed with a high proportion of debt. Lenders require a detailed 20-year financial forecast to stress-test the project’s cash flows against various market scenarios, including fluctuations in gas prices and operational uptime. The model’s ability to demonstrate a healthy Debt Service Coverage Ratio (DSCR) over the entire loan term is a key factor in securing project financing at favourable terms. It provides the necessary transparency and confidence for financial institutions to commit billions of pounds.

Long-Term LNG Terminal Profitability And Valuation Analysis

LNG terminals are assets with lifespans of 25 to 40 years. A shorter model would fail to capture the terminal’s full earnings potential, especially in later years when debt is reduced and cash flows become stronger. By projecting revenues and costs over two decades, the model can accurately calculate key valuation metrics like Net Present Value (NPV) and Internal Rate of Return (IRR). This allows for informed investment decisions, helping investors determine if the project’s risk-adjusted return is attractive enough.

Better LNG Terminal Risk Management

The extended forecast horizon also enables robust risk management and sensitivity analysis. A 20-year model allows for the detailed examination of how various long-term risks—such as changing gas market dynamics, regulatory shifts, and major maintenance cycles—will impact the terminal’s financials. Modellers can run scenarios to see the effects of a lower gas price environment, a change in liquefaction tolls, or an unscheduled outage in year 15. This forward-looking risk assessment is invaluable for developing mitigation strategies and ensuring the project’s resilience.

20 Years of Strategic Planning for Your LNG Terminal

A 20-Year model provides management with a clear roadmap for the terminal’s future. It can be used to plan for major maintenance CapEx, such as a full plant overhaul, or to model potential expansion projects in the future. By forecasting the company’s financial position, it helps management make informed decisions on dividend policy, capital allocation, and long-term operational strategies. It transforms a complex, multi-decade project into a manageable and transparent financial plan.

Financial Planning and Investment

Financial planning and investment are crucial for the successful development and operation of an LNG terminal, ensuring long-term profitability and sustainability. This process involves creating detailed capital expenditure (CAPEX) budgets to cover infrastructure, equipment, and construction costs, alongside forecasting operational expenses (OPEX) for ongoing maintenance and staffing. Various financing models, such as public-private partnerships (PPP), bonds, or equity financing, are explored to secure the necessary funds. Comprehensive risk assessments are conducted to identify potential financial pitfalls, including market volatility and regulatory changes, allowing for the implementation of appropriate insurance and hedging strategies. Additionally, revenue forecasting and cost-benefit analyses help in evaluating the project’s economic viability, while continuous financial monitoring ensures alignment with the terminal’s commercial strategy and market demands. Effective financial planning is fundamental to attracting investors, maintaining cash flow, and ensuring the terminal’s competitiveness in a dynamic global energy market.

Final Notes on the Financial Model

- Interdependencies: Cash flow projections directly influence the income statement and balance sheet through interest income, reserves, and tranche payments.

- Scenario Analysis: Embedded functionality to test various market assumptions like property value depreciation, default rates, and interest rate spikes.

- Investor Reporting: Schedules for interest/principal payouts and performance updates tailored to tranche type

This structure helps the LNG Terminal Financial Model address a broad market spectrum, offering the right balance between cost, production capacity, support, and customization at each subscription level.

Download Link On Next Page