Downstream Oil Gas Financial Model

Financial Model for a Downstream Oil and Gas Company

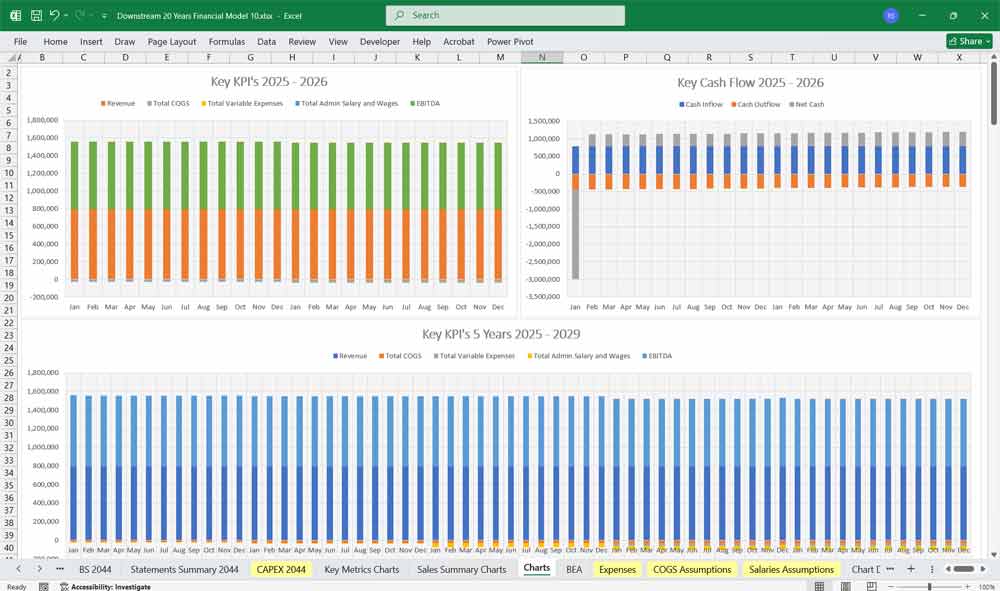

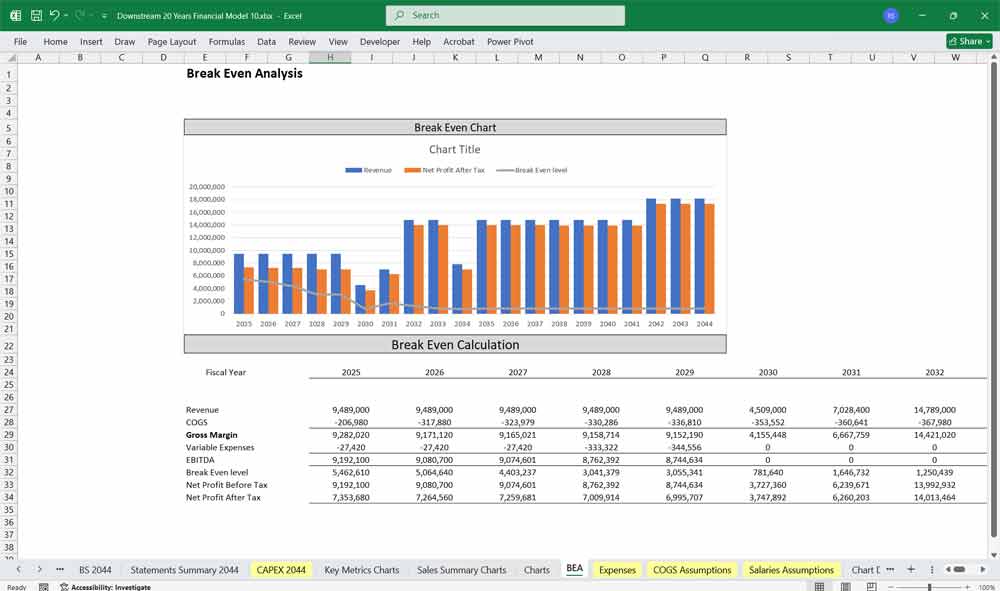

This very comprehensive 20-year Financial Model for a Downstream Oil and Gas Company serves as the ultimate tool to project the company’s financial performance by analyzing revenues, costs, and other financial aspects related to downstream activities like refining, distribution, and marketing of petroleum products. 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX Sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the specified revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets. 160 Tab oil and gas cost models. (Upstream Model, Midstream, Downstream, LNG Terminal.

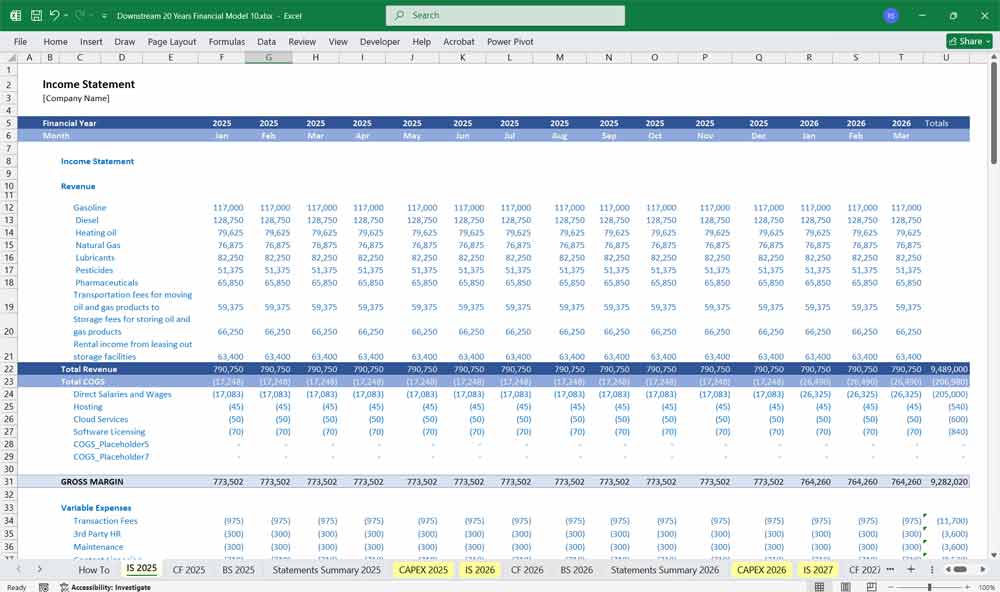

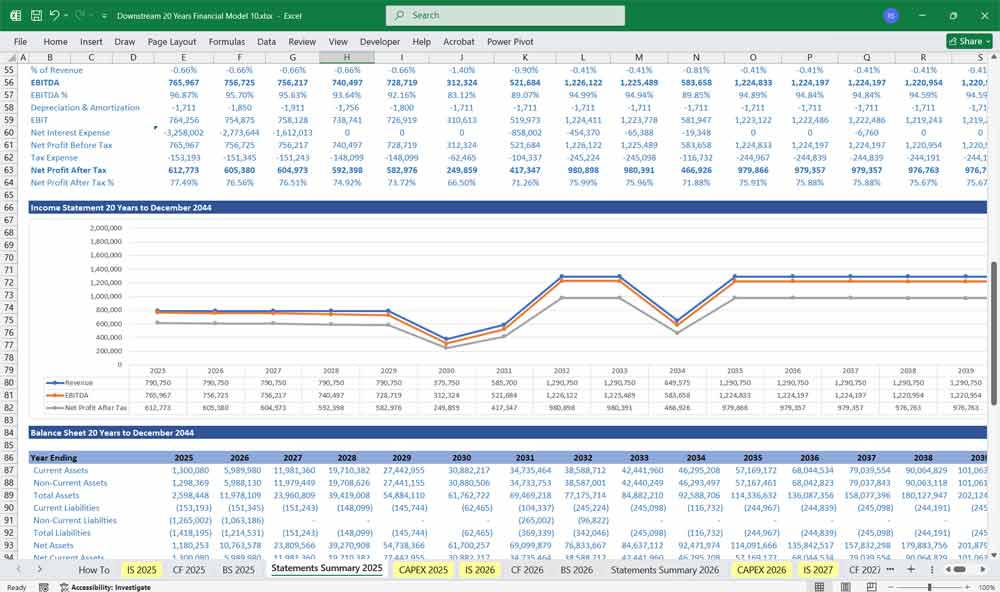

Income Statement

This section outlines the company’s profitability over a period of time.

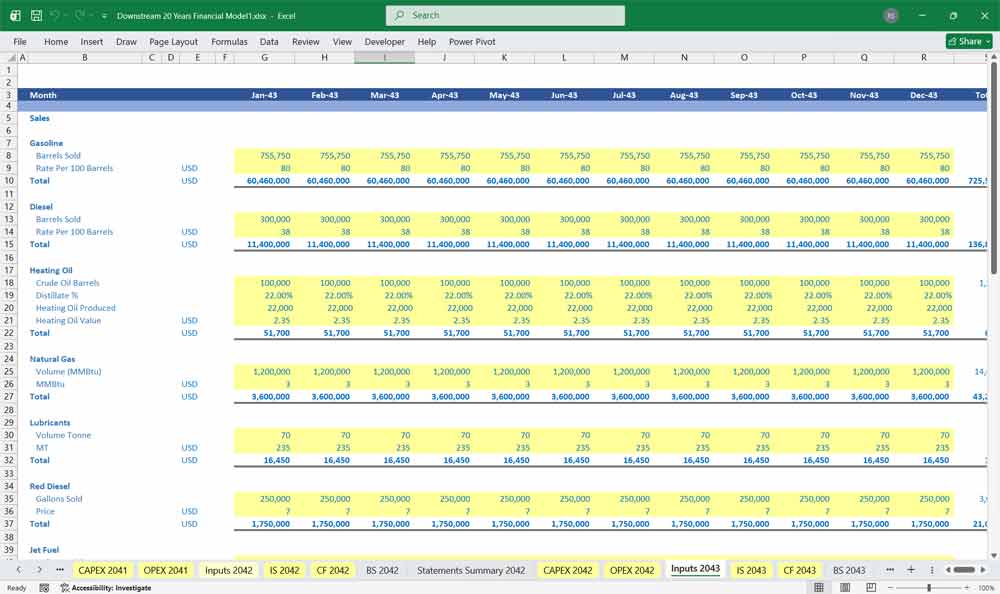

Revenues:

Downstream Gasoline Sales: Sales volume × average gasoline price.

Downstream Diesel Sales: Sales volume × average diesel price.

Heating Oil Downstream Sales: Sales volume × average heating oil price.

Natural Gas Downstream Sales: Sales volume × average natural gas price.

Downstream Lubricant Sales: Sales volume × average lubricant price.

Red Diesel Downstream Sales: Sales volume × Gallon price.

Downstream Jet Fuel Sales: Sales volume × average product price.

Other Revenues: Service fees, storage fees, or logistics revenue.

Total Revenues: Sum of all revenue streams.

Operating Expenses (OPEX):

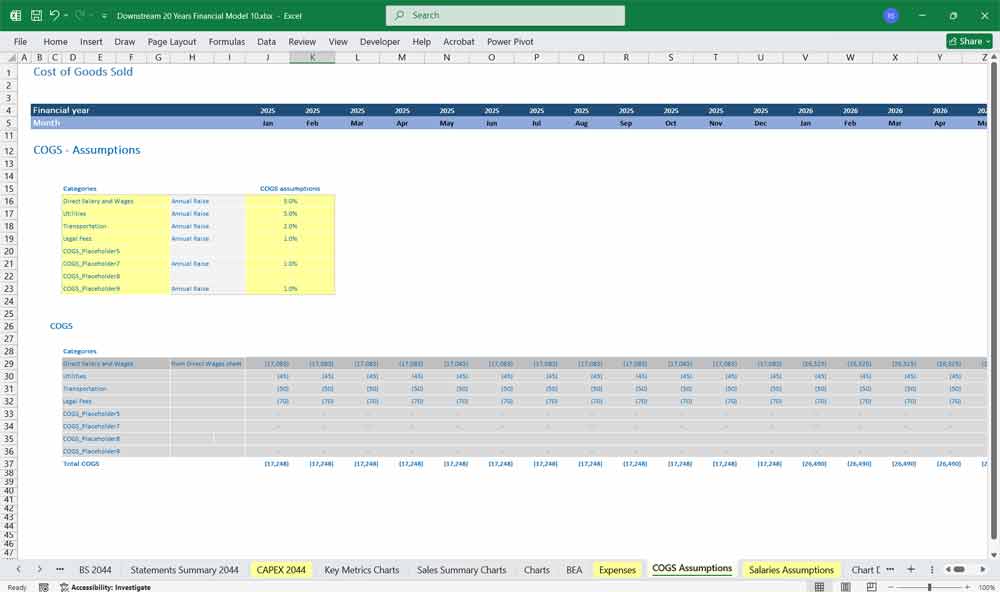

Feedstock Costs: Crude oil, natural gas, and other raw materials.

Refining Costs: Energy costs, labor, and maintenance of refining units.

Transportation and Logistics: Pipeline fees, shipping, and distribution costs.

Maintenance & Repair: Reliability levels impacting production

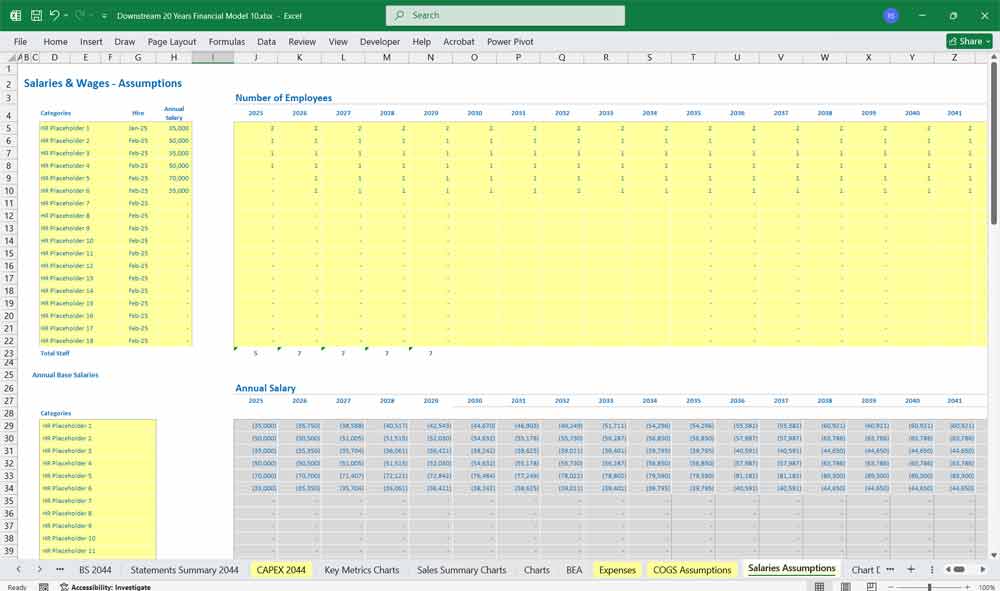

- Employee Wages: Dedicated tab covering wages and bonuses

Total OPEX: Sum of all costs related to product sales.

Gross Profit:

Gross Profit = Total Revenues – Total COGS

Operating Expenses:

Selling, General, and Administrative (SG&A): Marketing, salesforce, and corporate expenses.

Research and Development (R&D): Innovation in refining techniques and product development.

Depreciation and Amortization: Allocation of asset costs over time.

Other Operating Expenses: Compliance, safety measures, and environmental costs.

Total Operating Expenses: Sum of all expenses.

Operating Profit (EBIT):

EBIT = Gross Profit – Total Operating Expenses

Non-Operating Items:

Interest Expense: Debt service costs.

Other Income/Expenses: Non-core business activities (e.g., asset sales).

Profit Before Tax (PBT):

PBT = EBIT – Interest Expense + Other Income

Income Tax Expense:

Tax Rate × PBT

Net Income:

Net Income = PBT – Income Tax Expense

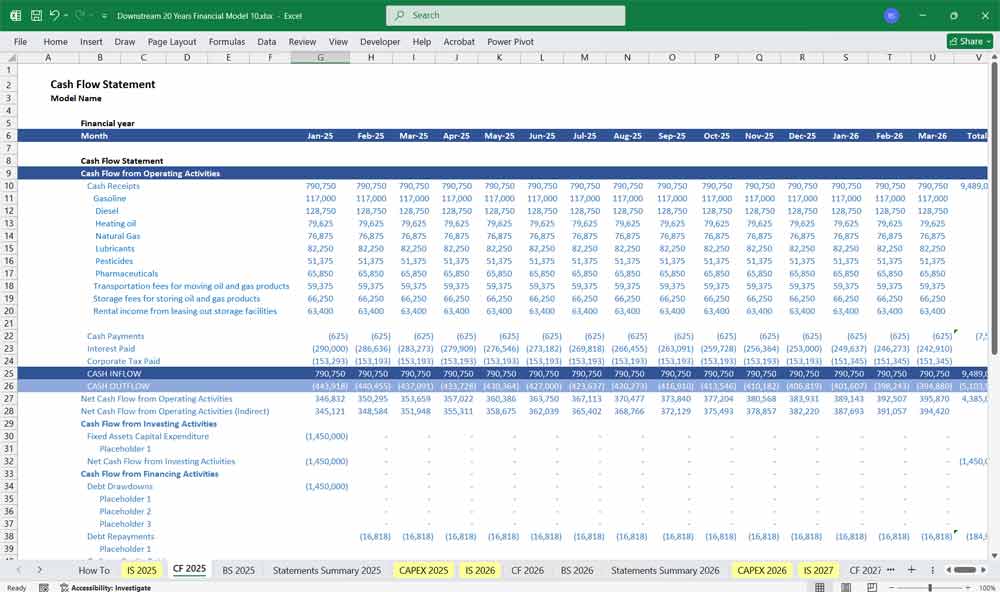

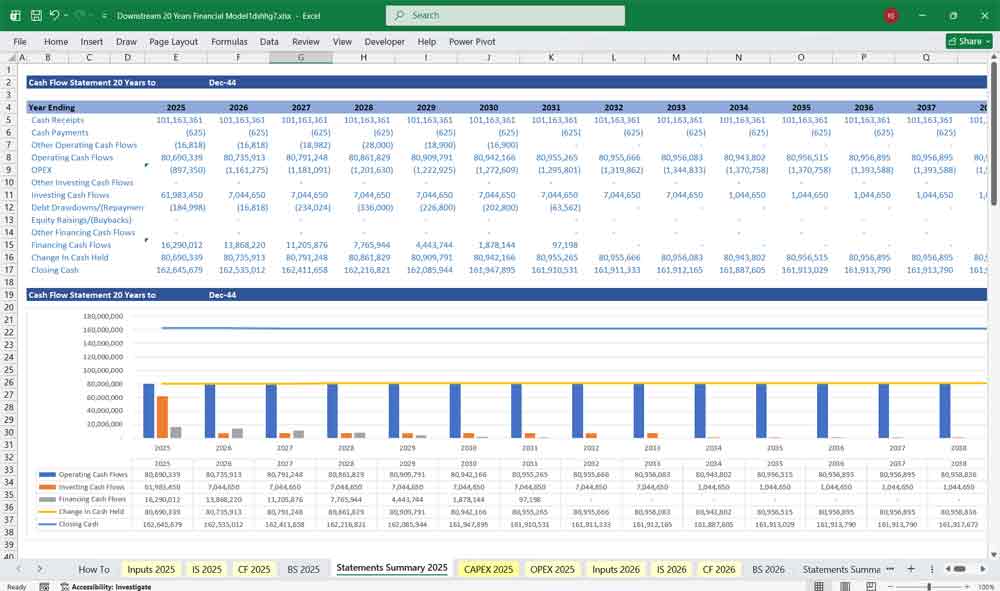

Downstream Oil and Gas Cash Flow Statement

Tracks cash inflows and outflows over a period.

Operating Activities:

Net Income: From the Income Statement.

Adjustments for Non-Cash Items: Depreciation, amortization, and non-cash expenses.

Changes in Working Capital:

Increase/Decrease in Accounts Receivable.

Increase/Decrease in Inventory.

Increase/Decrease in Accounts Payable.

Net Cash from Operating Activities: Cash generated from core operations.

Investing Activities:

Capital Expenditures (CapEx): Investments in refining units, pipelines, and storage.

Acquisition of Assets: Purchase of new equipment or technology.

Proceeds from Asset Sales: Disposal of non-core assets.

Net Cash from Investing Activities: Cash used for growth and maintenance.

Financing Activities:

Debt Issuance/Repayment: Loans or bond issuances.

Equity Issuance/Buyback: Raising equity or share repurchases.

Dividend Payments: Payments to shareholders.

Net Cash from Financing Activities: Cash movements related to financing.

Net Change in Cash:

Net Change = Operating + Investing + Financing Activities

Cash at Beginning of Period: Starting cash balance.

Cash at End of Period:

Cash at End = Cash at Beginning + Net Change in Cash

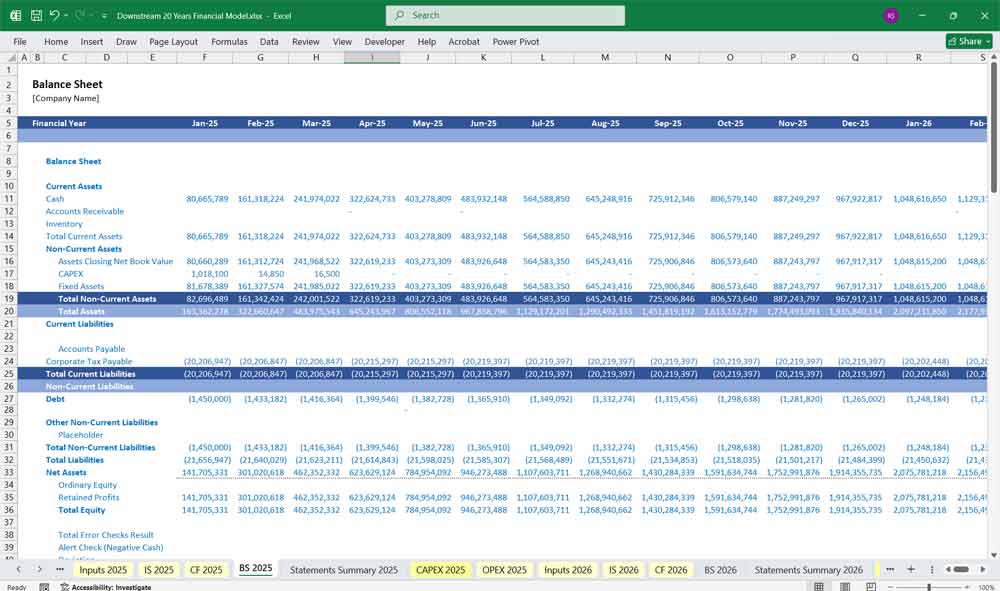

Downstream Oil and Gas Balance Sheet

A snapshot of the company’s financial position at a point in time.

Assets:

Current Assets:

Cash and Cash Equivalents.

Accounts Receivable: Customer invoices for downstream product sales.

Inventory: Petroleum products ready for sale.

Prepaid Expenses: Advance payments for services or supplies.

Non-Current Assets:

Property, Plant, and Equipment (PP&E): Refineries, pipelines, and storage.

Intangible Assets: Patents, licenses, and trademarks.

Investments: Joint ventures or partnerships.

Total Assets: Sum of current and non-current assets.

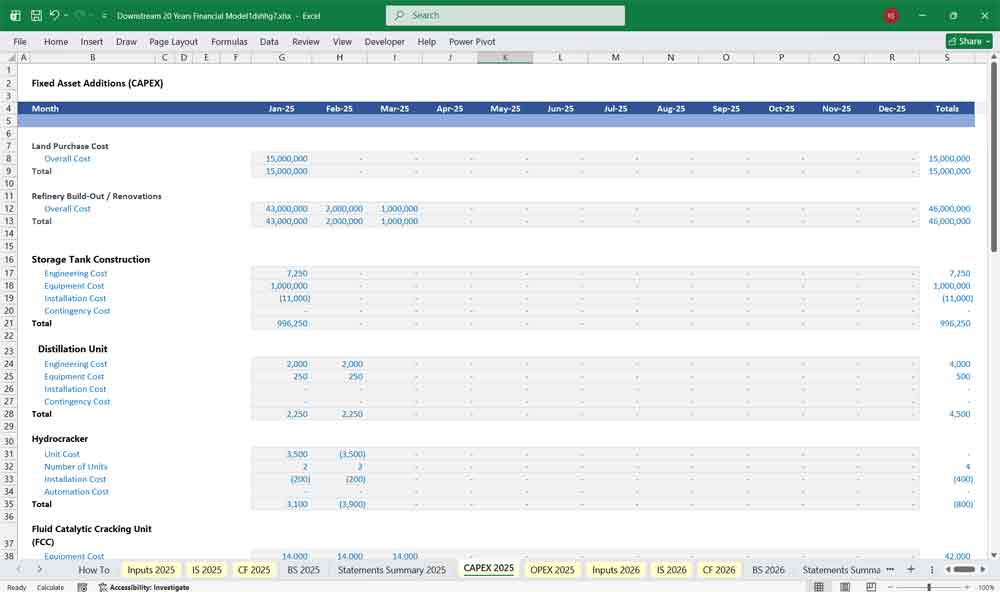

CAPEX:

Some CAPEX Inputs:

New crude distillation unit.

Hydrocracker or hydrocracking unit.

Fluid catalytic cracking (FCC) unit upgrades.

- Delayed coker unit (DCU) installation

- Hydrotreater additions

OPEX:

Some OPEX Inputs:

Personnel Costs.

Maintenance and Repair.

Transportation and Logistics.

- Digital and Technology Costs.

- Wastewater Treatment.

Liabilities:

Current Liabilities:

Accounts Payable: Supplier invoices.

Short-Term Debt: Portion of debt due within a year.

Accrued Liabilities: Employee wages, taxes, and other obligations.

Non-Current Liabilities:

Long-Term Debt: Bonds or bank loans maturing after a year.

Asset Retirement Obligations: Decommissioning costs of facilities.

Total Liabilities: Sum of current and non-current liabilities.

Equity:

Share Capital: Capital raised from shareholders.

Retained Earnings: Cumulative profits not distributed as dividends.

Other Reserves: Revaluation reserves or foreign exchange reserves.

Total Equity: Sum of share capital, retained earnings, and other reserves.

Balance Sheet Equation:

Assets = Liabilities + Equity

Additional Downstream Metrics to Track:

Gross Margin: Gross Profit ÷ Total Revenue.

EBITDA Margin: (EBIT + Depreciation + Amortization) ÷ Total Revenue.

Net Profit Margin: Net Income ÷ Total Revenue.

Return on Assets (ROA): Net Income ÷ Total Assets.

Debt-to-Equity Ratio: Total Debt ÷ Total Equity.

Current Ratio: Current Assets ÷ Current Liabilities.

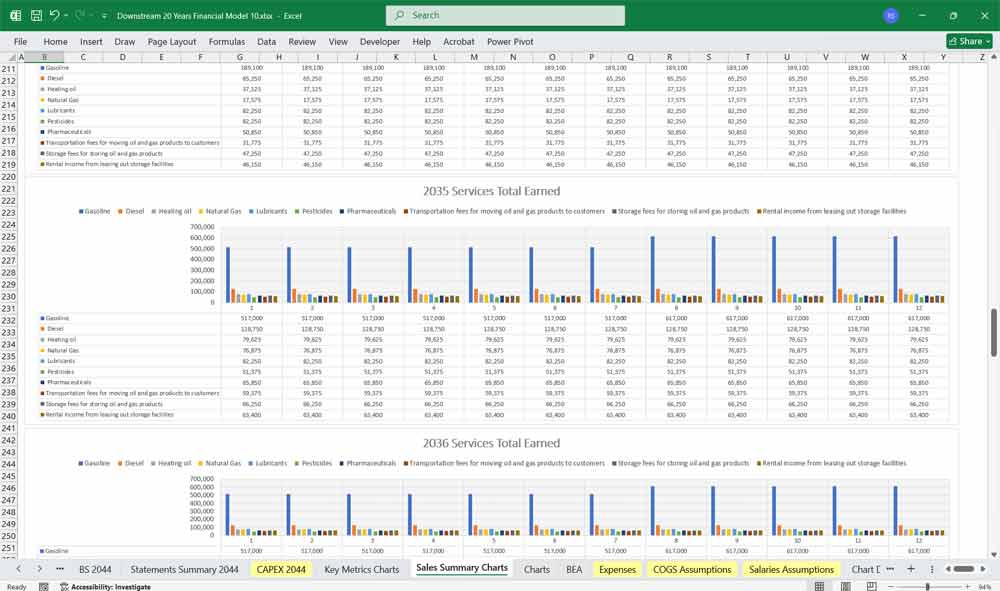

Downstream Gasoline Sales

Downstream gasoline sales represent the revenue generated from refining crude oil into gasoline and selling it to consumers through retail stations, wholesalers, or distributors. Within a financial model, gasoline sales are calculated by multiplying the volume of gasoline sold by its average selling price. Key oil and gas cost model components include crude oil procurement, refining expenses, transportation, and distribution costs. Factors like market demand, global oil prices, refining margins, and regulatory changes can impact sales performance. Tracking these metrics helps project revenues, assess profitability, and make strategic decisions in optimizing pricing and supply chain efficiency.

Downstream Diesel Sales

Downstream diesel sales represent revenue from refining crude oil into diesel and distributing it through retail networks, wholesalers, or direct sales to industries like transportation, agriculture, and construction. In a financial model, diesel sales are calculated by multiplying the volume sold by the average diesel price. Key cost factors include feedstock procurement, refining, transportation, and distribution expenses. Market dynamics such as industrial activity, seasonal demand, and global oil prices influence sales performance. Accurately modeling these factors helps project revenue, assess margins, and support strategic decisions to optimize pricing and supply chain efficiency.

Heating oil Downstream Revenue

Heating oil downstream revenue is generated from refining crude oil into heating oil and selling it to residential, commercial, and industrial customers, especially in colder regions. In a financial model, this revenue is calculated by multiplying the volume of heating oil sold by its average selling price. Key cost components include crude oil procurement, refining, transportation, and storage. Seasonal demand, weather patterns, and fluctuations in crude oil prices heavily influence sales performance. By modeling these variables, your company can predict sales, evaluate profitability, and inform strategic choices about inventory control and pricing.

Natural Gas Downstream Revenue

Natural gas downstream revenue comes from processing and distributing natural gas to residential, commercial, and industrial customers for heating, power generation, and other applications. In a financial model, this revenue is calculated by multiplying the volume of natural gas sold by its average selling price. Key cost drivers include procurement, processing, transportation, and distribution expenses. Market factors like seasonal demand, regulatory changes, and global energy prices impact revenue. Within a model, these elements help forecast cash flows, assess margins, and support strategic decisions in pricing, infrastructure investments, and supply chain management.

Downstream Lubricant Revenue

Downstream lubricant revenue is generated from refining base oils and blending them with additives to produce lubricants for automotive, industrial, and commercial applications. In a financial model, this revenue is calculated by multiplying the volume of lubricants sold by their average selling price. Key cost drivers include raw material procurement, blending processes, packaging, and distribution. Market demand is influenced by vehicle sales, industrial activity, and maintenance cycles. It is easier to predict revenue, monitor margins, and make strategic decisions about pricing, product mix, and market expansion when these aspects are accurately modeled.

Downstream Pesticide Revenue

Downstream pesticide revenue comes from refining petrochemical derivatives into pesticides and selling them to agricultural, commercial, and residential markets. In a financial model, this revenue is calculated by multiplying the volume of pesticides sold by their average selling price. Key cost drivers include raw material procurement, chemical processing, regulatory compliance, and distribution expenses. Market demand is influenced by agricultural cycles, pest outbreaks, and environmental regulations. Modeling these factors helps forecast revenue, assess profitability, and guide strategic decisions on pricing, production, and market expansion.

Downstream Pharmaceutical Revenue

Downstream pharmaceutical and chemical revenue is generated from refining petrochemical products into raw materials and specialized chemicals used in pharmaceuticals and other industries. In a financial model, this revenue is calculated by multiplying the volume of products sold by their average selling price. Key cost drivers include feedstock procurement, processing, compliance with stringent regulations, and distribution. Market demand is influenced by healthcare needs, innovation, and regulatory changes. In a Financial Model, these elements support revenue forecasting, margin analysis, and strategic choices about pricing, and production capacity.

Final Notes on the Financial Model

This 20-year Downstream Oil Gas Financial Model must focus on balancing capital expenditures with steady revenue growth from diversified sales and services. By optimizing operational costs, productivity and efficiency, and maximizing high-margin services the model ensures a great view of profitability and cash flow stability.

Download Link on Next Page