20 year Data Centre Financial Model

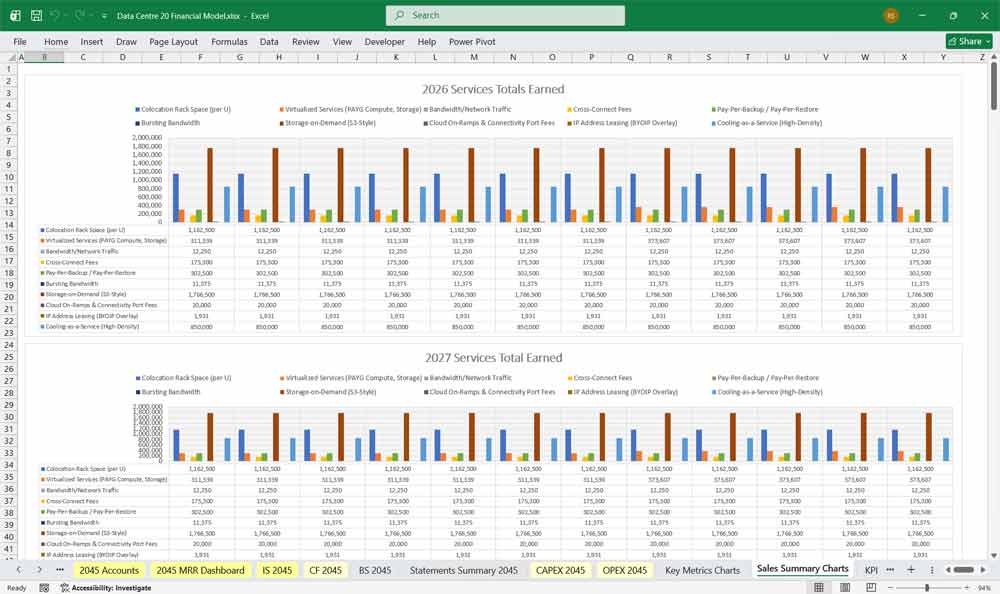

This 20-Year, 3-Statement Excel Data Centre Financial Model includes revenue streams from Colocation to Managed Services, cost structures, and financial statements to forecast the financial health of your Data Centre. User Guide.

Financial Model for a 20 Year Data Centre

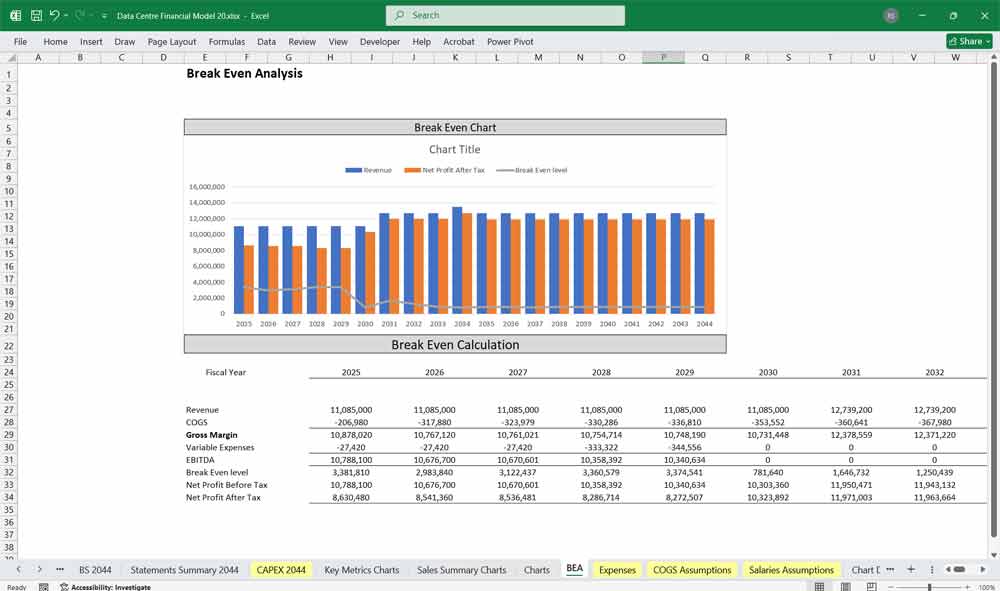

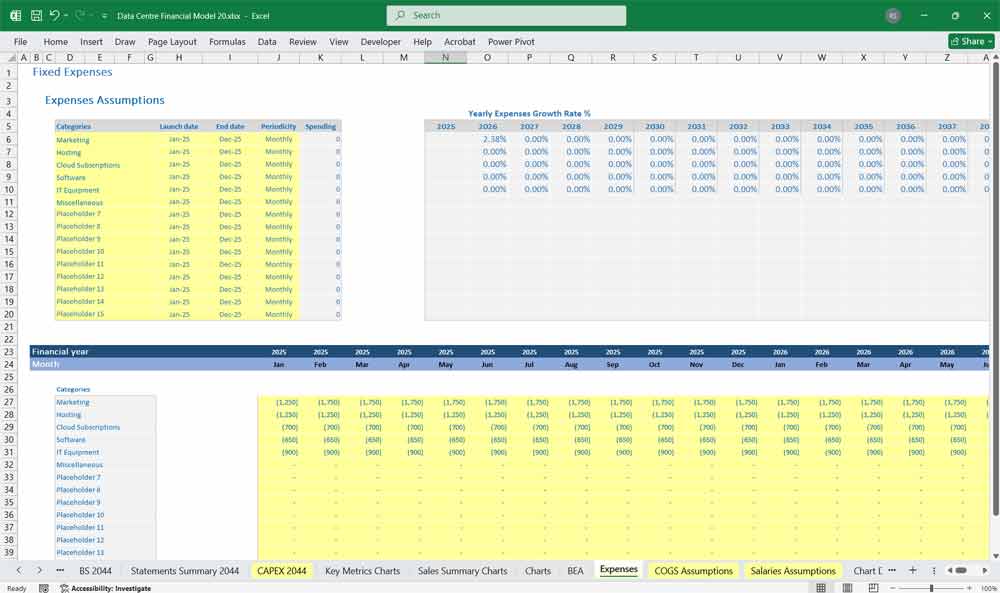

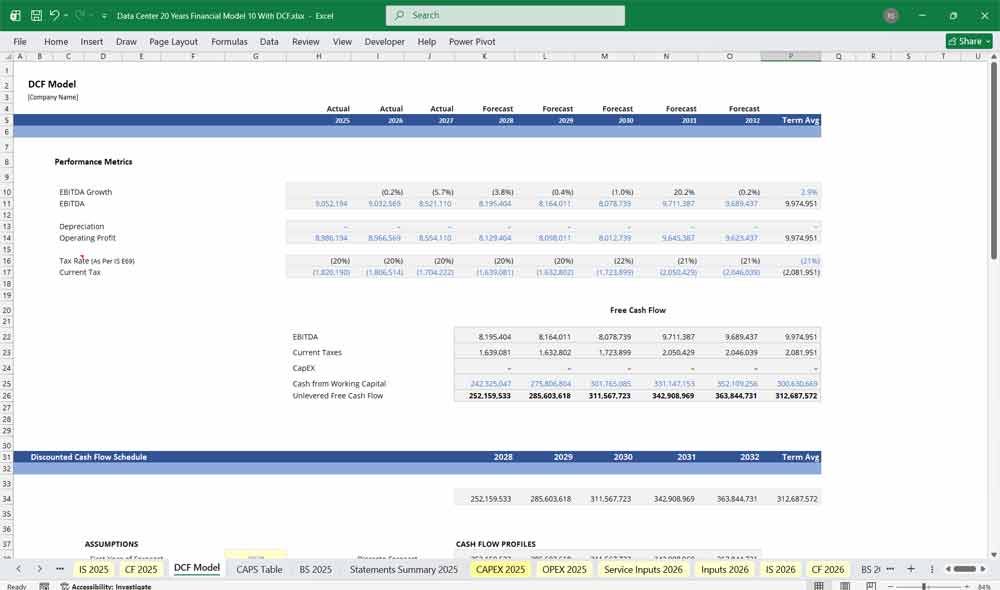

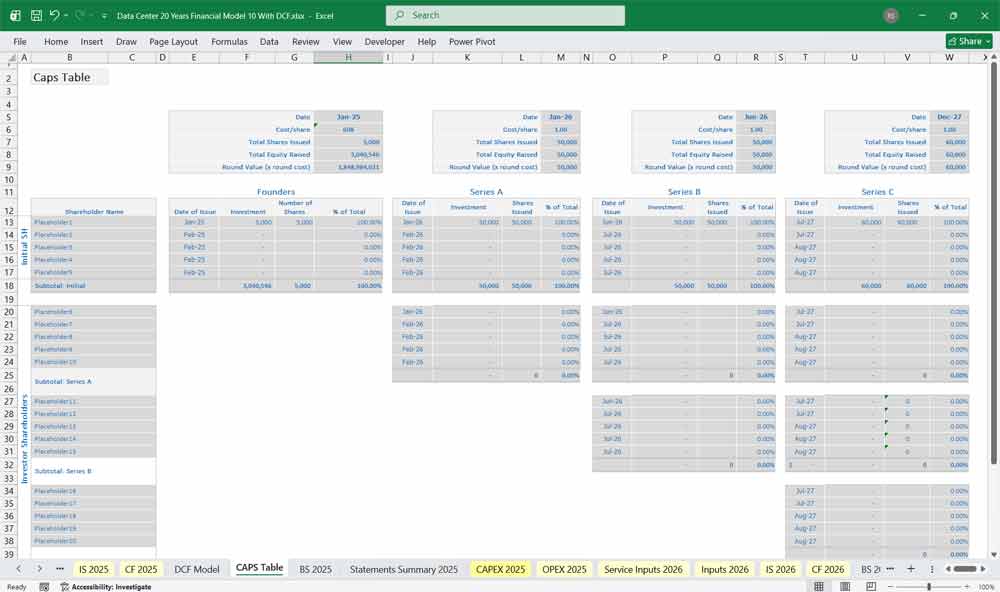

This very extensive 20 Year Data Centre Model involves detailed revenue projections, cost structures, capital expenditures, and financing needs. (5 Year Model) This model provides a thorough understanding of the financial viability, profitability, and cash flow position of the centre. Including: 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the specified revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets. DCF (Discounted Cash Flow) (5-year for explicit forecast period for high-growth, detailed projections)

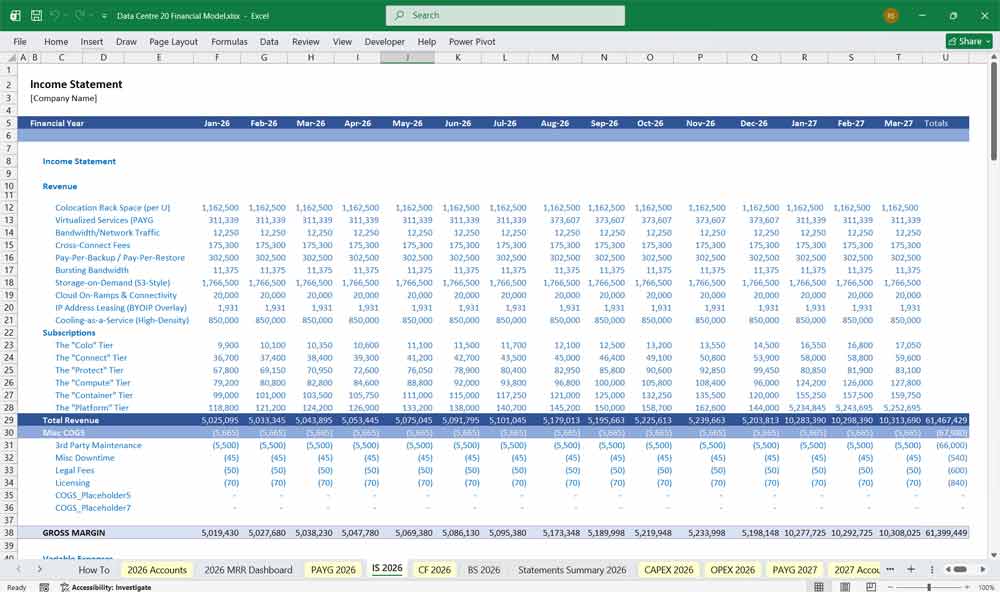

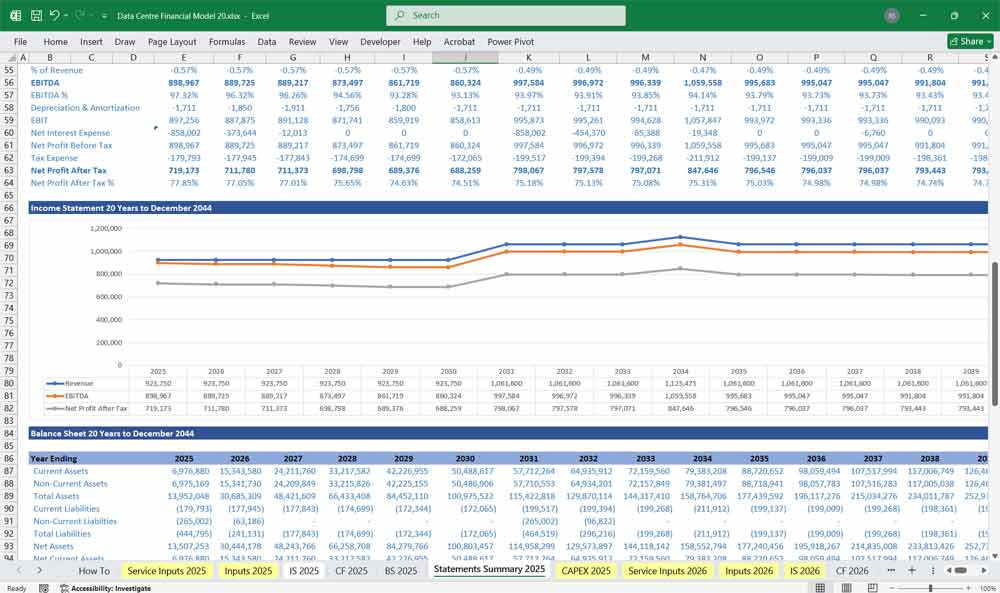

Income Statement (Profit & Loss Statement)

The Income Statement outlines the revenues, costs, and profitability of the data centre.

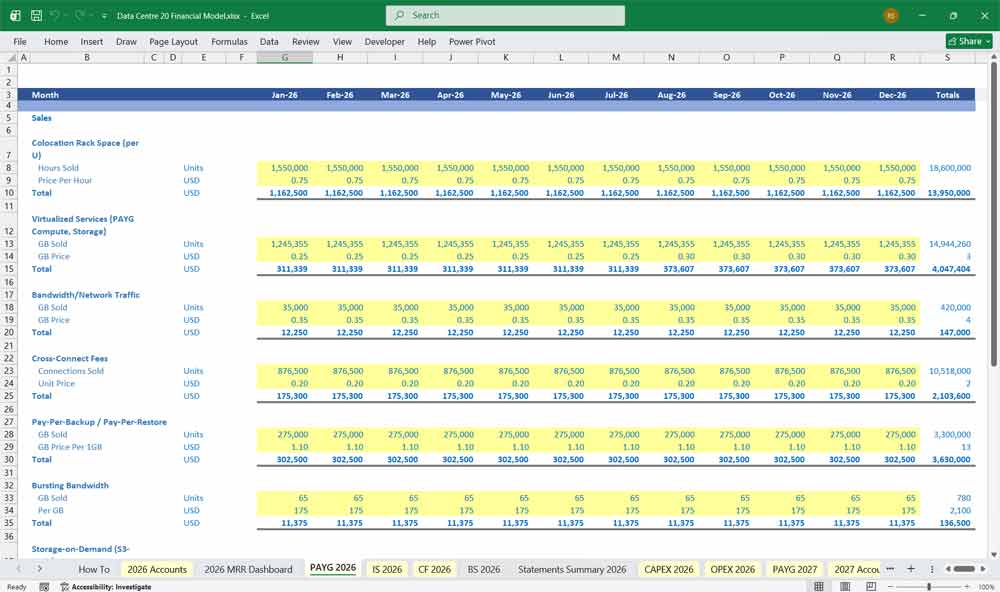

Revenue Streams:

Revenue is derived from multiple sources, categorized into the PAYG Revenues

Colocation Rack Space (per U)

- Rack space rental (per rack, per square foot)

- Power consumption charges

- Network bandwidth fees

- Cross-connect charges

- SLA-based premium support

Virtualized Services (PAYG Compute, Storage)

- Public, private, and hybrid cloud offerings

- Compute resources (CPU, RAM)

- Storage (block, object, file)

- Network traffic and security services

Managed Services

- IT infrastructure management

- Monitoring, security, patching, and compliance

- Remote hands and on-site support

Bandwidth/Network Traffic

- Billing per GB or TB of data transferred in/out of the facility

- Custom configurations for managed usage

Backup & Recovery

- Data backup services

- Disaster recovery as a service (DRaaS)

Cooling-as-a-Service (High-Density)

- (HPC) or liquid-cooled racks

- Charge customers for extra cooling required beyond base allocation (based on heat output)

Cloud On-Ramps & Connectivity Port Fees

- Customers pay per session/port usage to connect to cloud providers (AWS, Azure, etc.).

Operating Expenses (OPEX):

- Power & Cooling Costs (Energy expenses are a significant cost)

- Network & Connectivity Costs (Internet, peering, transit)

- Maintenance & Repairs (Data centre equipment servicing)

- Salaries & Wages (Technical, sales, and support staff)

- Software & Licensing Fees (Virtualization, cloud management)

- Marketing & Sales Expenses (Customer acquisition, lead generation)

- Security & Compliance Costs (Cybersecurity, certifications)

- Depreciation & Amortization (IT assets, buildings, and infrastructure)

Profitability Metrics:

- Gross Profit = Revenue – Direct Costs (Power, Connectivity, Maintenance)

- EBITDA = Gross Profit – Operating Expenses

- Net Profit = EBITDA – Depreciation – Interest – Taxes

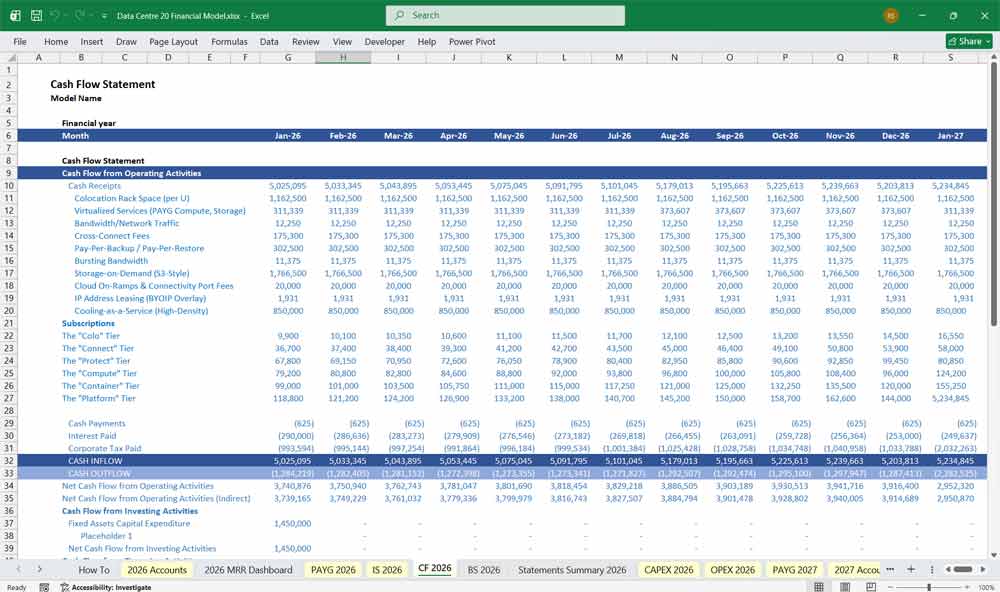

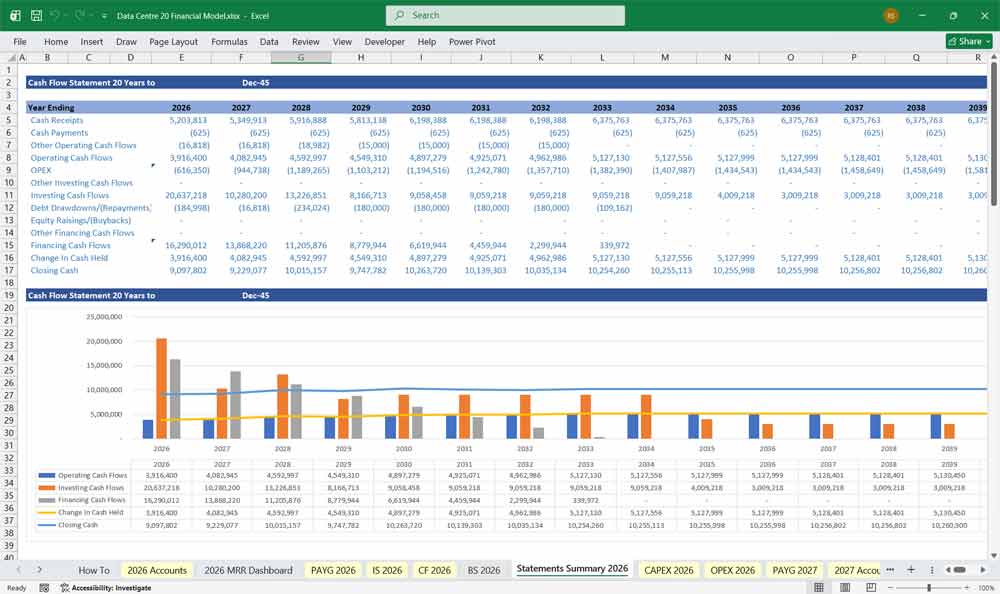

Data Centre Cash Flow Statement

A Cash Flow Statement tracks cash inflows and outflows across three sections:

Operating Cash Flow:

- Cash receipts from customers (subscription revenues)

- Payment of operating expenses (power, rent, salaries)

- Net working capital changes (receivables, payables)

Investing Cash Flow:

- Purchase of new servers, storage, network equipment

- Expansion or upgrade of data centre facilities

- Investments in software, automation, security systems

Financing Cash Flow:

- Debt financing (loans for infrastructure expansion)

- Equity funding (new investments from stakeholders)

- Interest and loan repayments

- Dividend payments (if applicable)

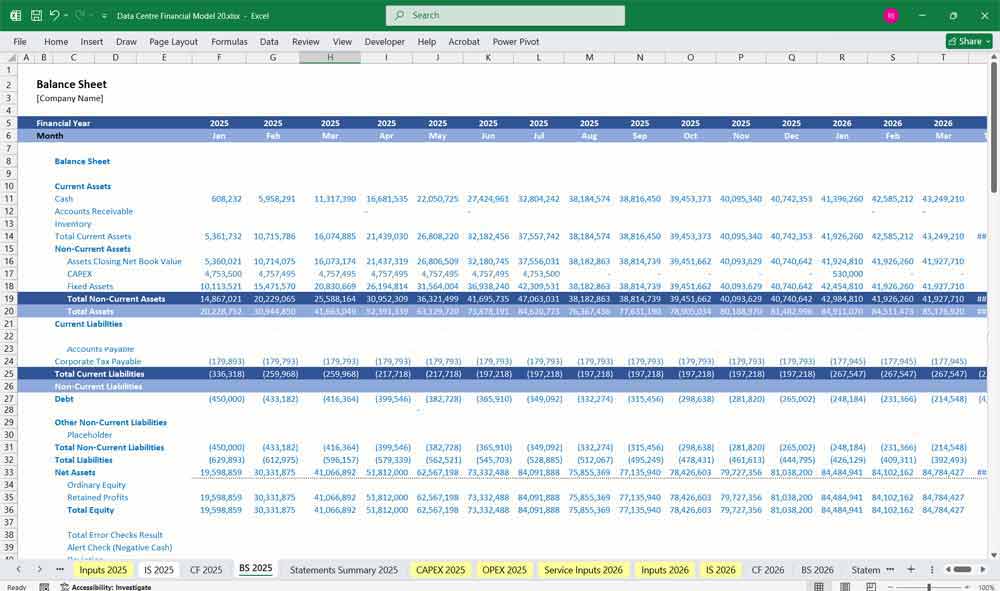

Data Centre Balance Sheet

The Balance Sheet for a 20 Year Data Centre Financial Model

provides a snapshot of the data centre’s financial position.

Assets:

Current Assets

- Cash and cash equivalents

- Accounts receivable (outstanding customer payments)

- Inventory (spare parts, hardware stock)

Fixed Assets

- Data centre infrastructure (racks, cooling, power backup)

- IT equipment (servers, storage, networking)

- Real estate and leasehold improvements

Intangible Assets

- Software, licenses, and cloud management tools

Liabilities:

Current Liabilities

- Accounts payable (supplier payments due)

- Short-term loans

- Deferred revenue (prepaid subscriptions)

Long-Term Liabilities

- Bank loans and bonds

- Lease obligations

Equity:

- Retained earnings (accumulated profits)

- Shareholder capital (investor equity)

6-Tier Subscription For A Data Centre

Tier 1: The “Colo” Tier (Physical Presence)

Target Audience: Enterprises requiring physical asset control, telcos, or compliance-driven clients (Finance, Government).

Value Proposition: A secure, physical home for your hardware with guaranteed power and cooling.

Billing Model: Recurring (Monthly/Annual) + Usage.

Sections:

Rack Space Allocation: Includes a specific number of racks (or half-racks) in a specific cage or suite. Includes locked cabinets and physical segregation from other clients.

Metered Power: Base subscription includes a minimum power draw (e.g., 3kW). Additional power is billed based on actual consumption (PAYG) or peak usage.

Hands & Eyes: Includes a set number of “free” remote hands requests per month (e.g., 2 hours of technician time for reboots or hardware swaps). Additional time is billed hourly.

Physical Security: Biometric access, CCTV monitoring, and mantraps included.

Tier 2: The “Connect” Tier (Networking & Transit)

Target Audience: Content providers, ISPs, gaming companies, and any Tier 1 client needing high-speed interconnectivity.

Value Proposition: Seamless, high-speed interconnection to the global internet and private partners.

Billing Model: Recurring (Port Fee) + Usage (Bandwidth).

Sections:

Cross-connects: Includes one or two free virtual or physical cross-connects to other tenants within the building. Additional cross-connects are billed monthly.

Internet Bandwidth: Moves from a “burstable” model to a Committed Data Rate (CDR) . The client pays a base fee for a guaranteed level of throughput, plus a surcharge for any traffic bursts above that threshold (95th percentile billing).

IP Addressing: Includes a block of public IPv4/IPv6 addresses. Usage-based billing for any additional temporary IPs needed for short-term projects.

Peering Access: Unmetered access to the data center’s Internet Exchange (IX) fabric.

Tier 3: The “Protect” Tier (Security & Resilience)

Target Audience: E-commerce platforms, SaaS companies, and clients storing sensitive user data.

Value Proposition: Enterprise-grade protection for your digital assets, both physical and virtual.

Billing Model: Flat Fee (Base) + Tiered (Scope).

Sections:

DDoS Mitigation: Always-on threat detection. Billing is triggered by attack mitigation (e.g., $/hour under active attack) or included up to a certain Gbps threshold.

Firewall as a Service: Virtual firewall instances (virtualized Palo Alto, Fortinet, or open-source alternatives). Billed based on the throughput (e.g., 100Mbps vs 1Gbps firewall license).

Backup Storage: Allocated backup repository space (e.g., 5TB included). Additional backup storage is billed per GB/month, with a premium for “air-gapped” or immutable backups.

Compliance Scanning: Automated vulnerability scanning of the client’s asset list. Billed based on the number of IPs or VMs scanned weekly.

Tier 4: The “Compute” Tier (Hardware as a Service)

Target Audience: AI startups, batch processing jobs, dev/test teams, and seasonal businesses.

Value Proposition: Instant access to raw hardware performance without the CapEx or lead time.

Billing Model: Pure Usage (Hourly/Minutely).

Sections:

Bare Metal Servers: Access to a pool of pre-configured, on-demand physical servers (e.g., Storage-Optimized, CPU-Optimized). Billed by the hour or minute, and deleted/deprovisioned when the session ends.

GPU Instances: Specialized high-end GPU nodes (e.g., NVIDIA H100/L40S) for AI training or rendering. Billed at a premium, per-minute rate due to hardware scarcity.

Snapshot/Image Storage: Storage costs for saved server “images” or snapshots. Lower cost than active compute, but billed per GB/month.

Orchestration API: Access to the API that spins these servers up/down. Metered based on the number of API calls made to the orchestration engine.

Tier 5: The “Container” Tier (Orchestration & Elasticity)

Target Audience: Modern DevOps teams, microservices architectures, and agile developers.

Value Proposition: A managed container playground where you only pay for the resources your code consumes.

Billing Model: Resource-Based (vCPU/RAM Hours).

Sections:

Managed Kubernetes (K8s): The data center manages the master nodes (control plane) for the client. The client pays only for the worker nodes (the VMs or bare metal running the containers).

Container Registry: A private Docker/OCI registry hosted inside the data center. Billed per GB of image storage, plus egress fees when images are pulled at high velocity.

Fargate/Lambda-style Functions: For specific workloads, offer a serverless function environment. Billing is incredibly granular: per 100ms of execution time and per million invocations.

Internal Load Balancing: Metered based on the amount of data processed by the load balancer or the number of load balancer hours.

Tier 6: The “Platform” Tier (Managed Application Services)

Target Audience: Developers who just want to code, not manage databases or operating systems.

Value Proposition: A fully managed cloud experience where the infrastructure is invisible.

Billing Model: Complex Usage (Provisioned vs. Serverless).

Sections:

Database as a Service (DBaaS): Managed SQL (Postgres/MySQL) or NoSQL (MongoDB/Redis) clusters. Billing is hybrid:

Provisioned: Pay for a fixed amount of RAM/CPU even when idle.

Serverless: Pay only for the storage and the I/O operations per second (IOPS) actually used.

Cache as a Service: Managed Redis or Memcached instances. Billed by memory size (GB/hour) and snapshot storage.

Object Storage (S3-compatible): Deep storage for files and assets. Billed by:

Storage: $/GB/month (Tiered: Hot, Cold, Archive).

Operations: $/PUT/GET request.

Egress: $/GB downloaded.

AI/ML Inference API: The highest tier. Pre-built models served via API. Billed per inference (e.g., $0.002 per image analyzed, or $0.0001 per text generation token).

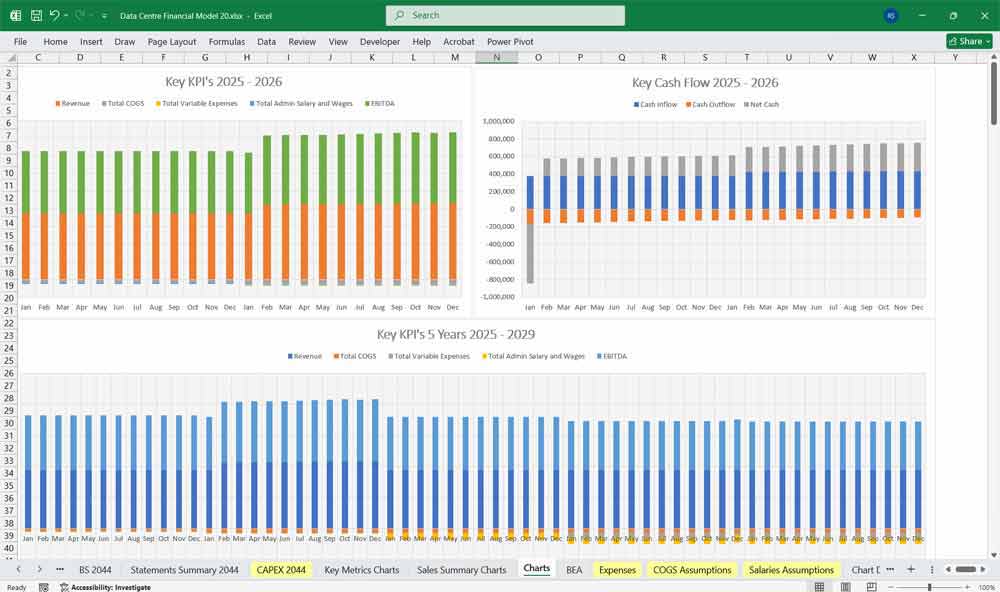

Key Financial Metrics for a Data Centre

Revenue Metrics

Monthly Recurring Revenue (MRR): Predictable income from ongoing services like colocation, cloud hosting, or managed services.

Annual Recurring Revenue (ARR): Yearly equivalent of MRR, providing a long-term revenue outlook.

Revenue per Rack: Average income generated per server rack, indicating space utilization efficiency.

Revenue per Square Foot: Income generated per unit of physical space, reflecting facility efficiency.

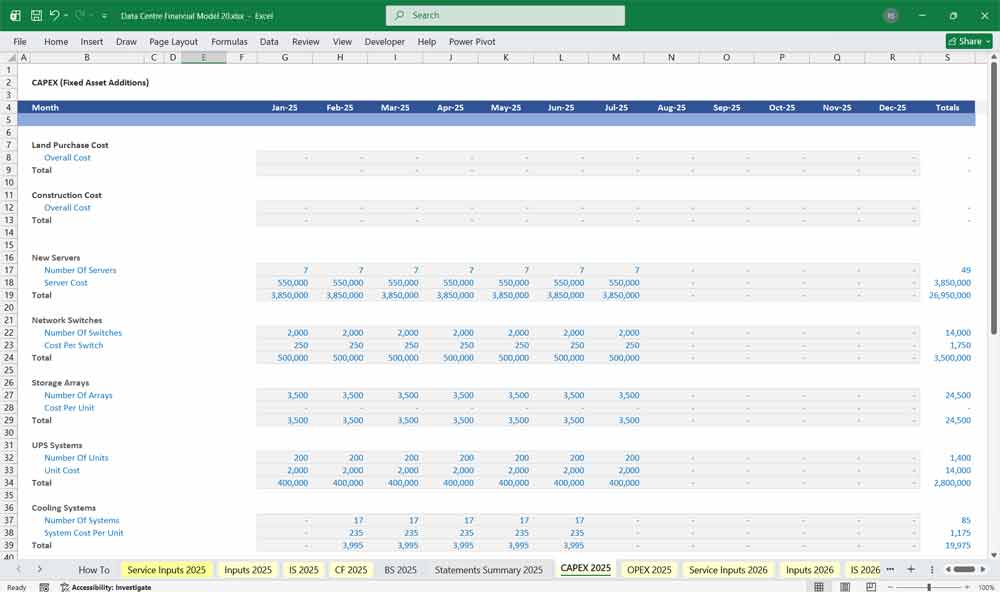

Cost Metrics

Capital Expenditure (CapEx): Initial investment in infrastructure, hardware, and construction.

Operational Expenditure (OpEx): Ongoing costs for maintenance, utilities, staffing, and software.

Cost per Rack: Total cost of operating a single server rack, including power, cooling, and maintenance.

Power Usage Effectiveness (PUE): Ratio of total energy used to energy delivered to IT equipment (lower PUE = better efficiency).

Benefits of Using a Data Centre Financial Model

Data Centre: Cost Optimization

- Identifies areas to reduce operational expenses

- Forecasts CAPEX and OPEX for better budgeting

- Optimizes resource allocation for maximum ROI

Data Centre: Revenue Forecasting

- Projects future income based on market trends

- Assesses profitability of different pricing models

- Helps in setting competitive service rates

Data Centre: Investment Planning

- Provides clear ROI projections for stakeholders

- Identifies break-even points for capital investments

- Supports funding decisions and financial backing

Data Centre: Risk Management

- Analyzes potential financial risks and mitigations

- Models impact of market fluctuations on revenue

- Prepares contingency plans for economic downturns

Data Centre: Scalability Planning

- Projects when and how to expand infrastructure

- Balances demand growth with financial feasibility

- Ensures sustainable long-term investment

Data Centre: Pricing Strategy Development

- Helps set competitive pricing for services

- Identifies optimal profit margins

- Adapts pricing to different customer segments

Data Centre: Capital Expenditure Planning

- Determines necessary investments in hardware and facilities

- Allocates budget efficiently for expansion projects

- Evaluates lease vs. purchase options for infrastructure

Data Centre: Operational Expense Management

- Tracks recurring costs like power and cooling

- Identifies cost-saving opportunities in maintenance

- Benchmarks expenses against industry standards

Data Centre: Profitability Analysis

- Measures financial performance against industry peers

- Breaks down profit drivers and cost leakages

- Evaluates long-term sustainability of operations

Data Centre: Financial Compliance & Reporting

- Ensures adherence to accounting and tax regulations

- Generates reports for auditors and stakeholders

- Helps maintain transparency in financial operations

Data Centre: ROI Calculation for Clients

- Demonstrates cost savings for potential customers

- Justifies pricing based on value-added services

- Helps clients make informed purchasing decisions

Data Centre: Funding & Loan Justification

- Provides financial projections for lenders and investors

- Strengthens business cases for loan approvals

- Supports negotiations for better interest rates

Data Centre: Scenario Planning & Sensitivity Analysis

- Models best and worst-case financial situations

- Helps assess impact of economic downturns

- Improves strategic decision-making for resilience

Data Centre: Energy Cost Forecasting

- Estimates power consumption and related expenses

- Identifies efficiency improvements to lower costs

- Helps negotiate better utility contracts

Data Centre: Capacity Planning

- Forecasts infrastructure requirements based on demand

- Balances workload distribution for optimal efficiency

- Prevents over-investment or under-utilization of assets

Data Centre: Competitive Benchmarking

- Compares financial performance with industry leaders

- Identifies cost advantages and efficiency gaps

- Helps refine business strategies for market leadership

Data Centre: Contract & SLA Profitability Analysis

- Evaluates revenue impact of service-level agreements

- Assesses profitability of long-term contracts

- Helps negotiate favorable terms with clients

Data Centre: Hybrid Cloud Cost Comparison

- Assesses cost differences between cloud and on-prem solutions

- Determines when to shift workloads for financial benefit

- Optimizes cloud spending for better cost efficiency

Data Centre: Mergers & Acquisitions Valuation

- Helps determine fair market value for acquisitions

- Assesses financial synergies in potential mergers

- Supports due diligence and investment decisions

Data Centre: Investor Confidence & Stakeholder Engagement

- Provides clear financial insights for investor trust

- Strengthens business credibility with data-backed projections

- Enhances decision-making for board members and executives

Pricing Strategy

Volume Discounts: Discounts for higher usage or long-term commitments.

Add-Ons: Optional add-ons like additional bandwidth, storage, or managed services.

Tier Upgrades: Allow customers to upgrade tiers as their needs grow.

This 6-tier subscription model ensures that the data center can serve a diverse customer base while maximizing revenue opportunities and providing tailored solutions for each segment.

Data Centre DCF (Discounted Cash Flow) (5-year for explicit forecast period for high-growth, detailed projections)

Discounted Cash Flow (DCF)

In the data centre industry, a Discounted Cash Flow (DCF) analysis is the primary method used to value the asset based on its ability to generate future cash flows. The model projects revenue streams from the six-tier subscription model—including recurring colocation fees, metered power usage, and cross-connect charges—and subtracts the significant operating expenses (OpEx) such as power consumption (often a pass-through but a key margin driver), cooling costs, and on-site security personnel. Crucially, the DCF must account for the high capital expenditures (CapEx) required for facility build-outs and server hardware refreshes, ultimately discounting the resulting Free Cash Flows to the present to determine the enterprise value.

Weighted Average Cost of Capital (WACC)

The WACC represents the critical “hurdle rate” used to discount the future cash flows in a data centre DCF, essentially reflecting the overall cost of financing the facility. It blends the cost of debt (such as loans for construction and interest on bonds) with the cost of equity (the return expected by investors). For a data centre, the WACC is heavily influenced by the perceived risk of the Power Usage Effectiveness (PUE); if the facility is inefficient (high PUE), operating margins are squeezed, raising the risk profile and thus increasing the WACC, which subsequently lowers the valuation.

Sensitivity Analysis

Given the capital-intensive nature and long-term horizons of data centre projects, Sensitivity Analysis is vital to stress-test the valuation against key variables. This involves adjusting core assumptions—such as the stabilized rental rate per kilowatt, the WACC, or the long-term vacancy rate—to see how the Net Present Value (NPV) fluctuates. For example, an investor might model scenarios where power costs increase by 15% or where customer churn doubles; a robust data centre investment should maintain a positive NPV even under these stressed conditions to account for market volatility and technological obsolescence.

Final Notes on the Financial Model

This 20 Year Data Centre Financial Model must focus on balancing capital expenditures with steady revenue growth from diversified subscription-based services. By optimizing operational costs, and power efficiency, and maximizing high-margin services like cloud and managed offerings, the model ensures sustainable profitability and cash flow stability.

Download Link On Next Page

Download Link On Next Page