Data Center Finance Model

5 Year 3 Statement Excel Data Center Finance Model provides a structured framework to analyze the financial health and project profitability of your Data Center. Modeling User Guide.

Financial model for a data center

This involves projecting the financial performance of the center over a 5-year period (For a 20 year model click here). The model includes three core financial statements: the Income Statement, Cash Flow Statement, and Balance Sheet. Below is a detailed description of each component, tailored to a data center business.

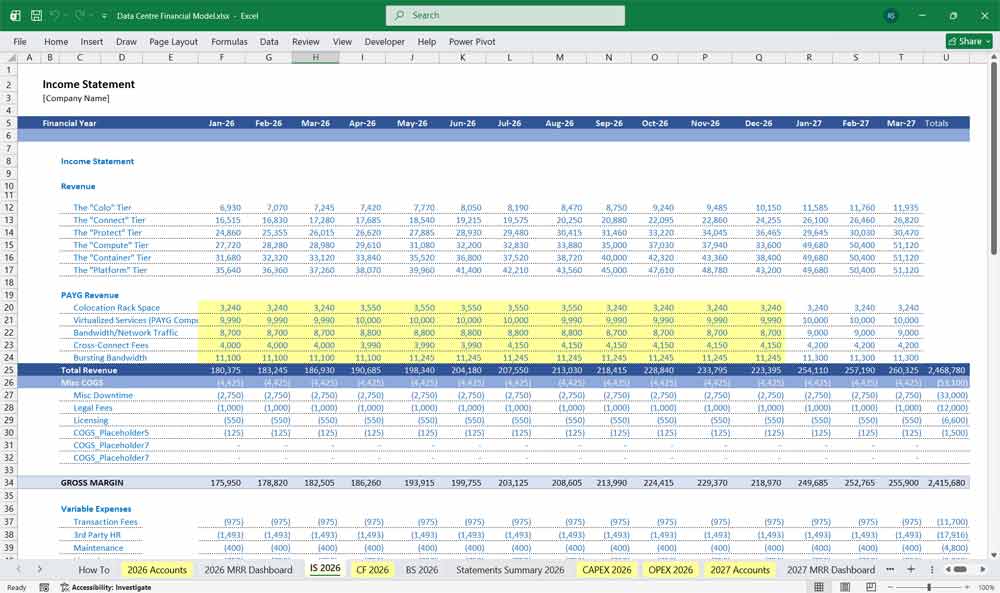

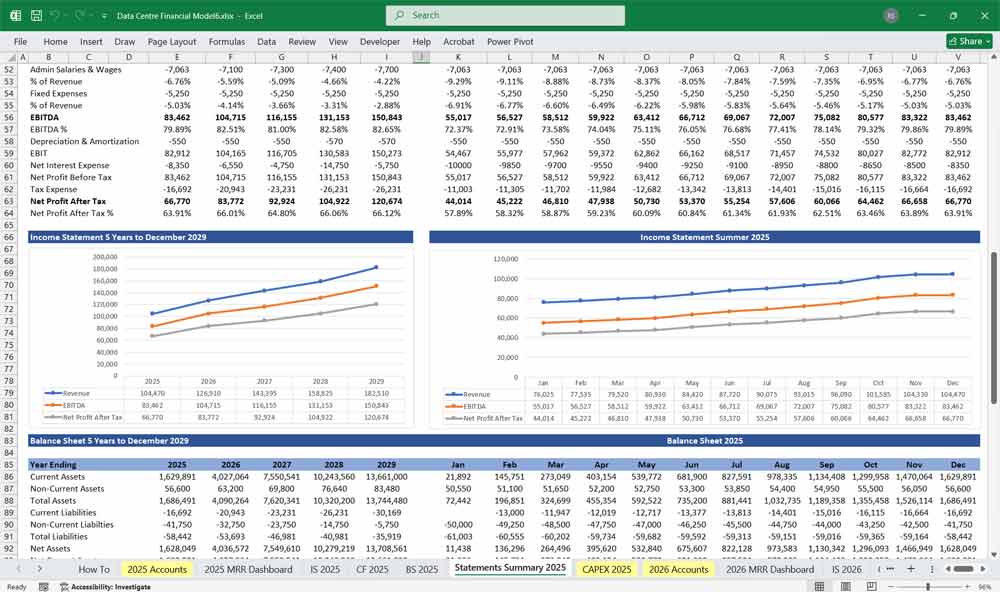

Income Statement (Profit & Loss Statement)

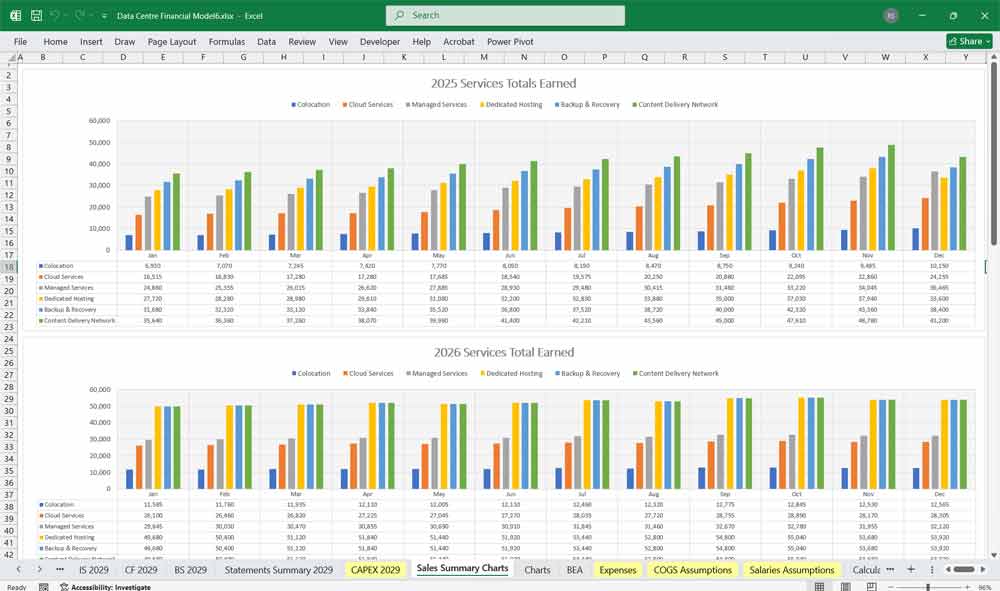

The Income Statement reflects the revenue, costs, and profitability of the data center over a specific period.

Revenue Streams (Completely Editable)

Colocation Services: Revenue from renting out rack space, cabinets, or private suites to clients.

Cloud Services: Revenue from providing cloud infrastructure, such as virtual machines, storage, and networking.

Managed Services: Revenue from offering additional services like monitoring, security, and maintenance.

Dedicated Hosting: Revenue from selling internet bandwidth to clients.

Backup & Recovery: Revenue from consulting, disaster recovery, or backup services.

- Content Delivery Network: Distribution servers delivering CDN (Website images, videos) etc.

Cost of Goods Sold (COGS)

Power Costs: Electricity consumption is a significant expense for data centers.

Cooling Costs: HVAC systems to maintain optimal temperatures.

Bandwidth Costs: Purchasing internet bandwidth from upstream providers.

Hardware Maintenance: Costs associated with maintaining servers, storage, and networking equipment.

Licensing and Software: Costs for software licenses and management tools.

Operating Expenses (OPEX)

Staffing Costs: Salaries for IT staff, security personnel, and management.

Facility Maintenance: Costs for maintaining the physical infrastructure (e.g., generators, UPS systems).

Sales and Marketing: Expenses for acquiring new clients and promoting services.

General and Administrative (G&A): Office expenses, insurance, legal fees, and other overheads.

Depreciation and Amortization

Depreciation of physical assets like servers, cooling systems, and building infrastructure.

Amortization of intangible assets like software licenses.

EBITDA and Net Profit

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): A measure of operating profitability.

Net Profit: Revenue minus all expenses, including taxes and interest.

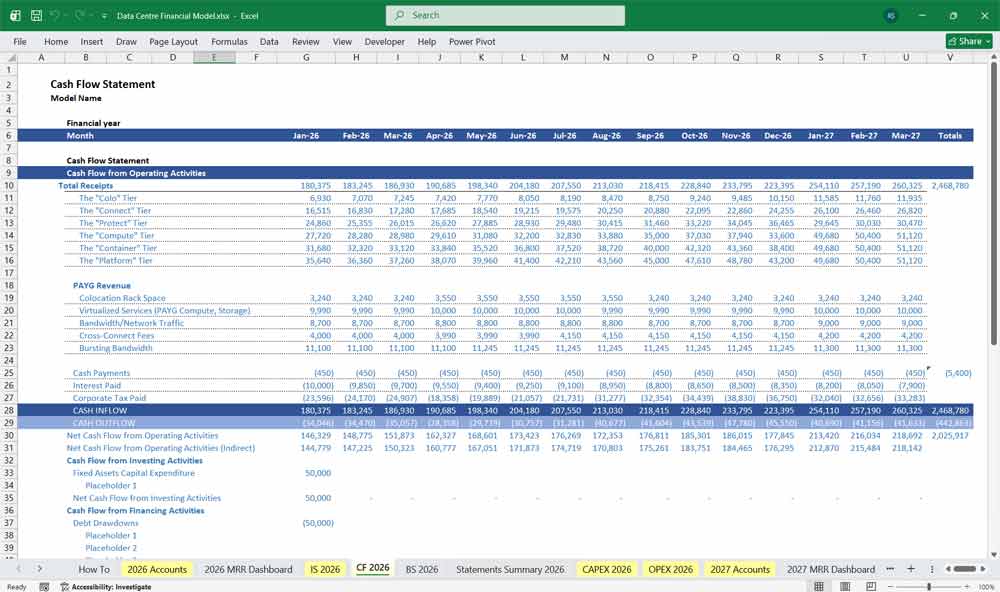

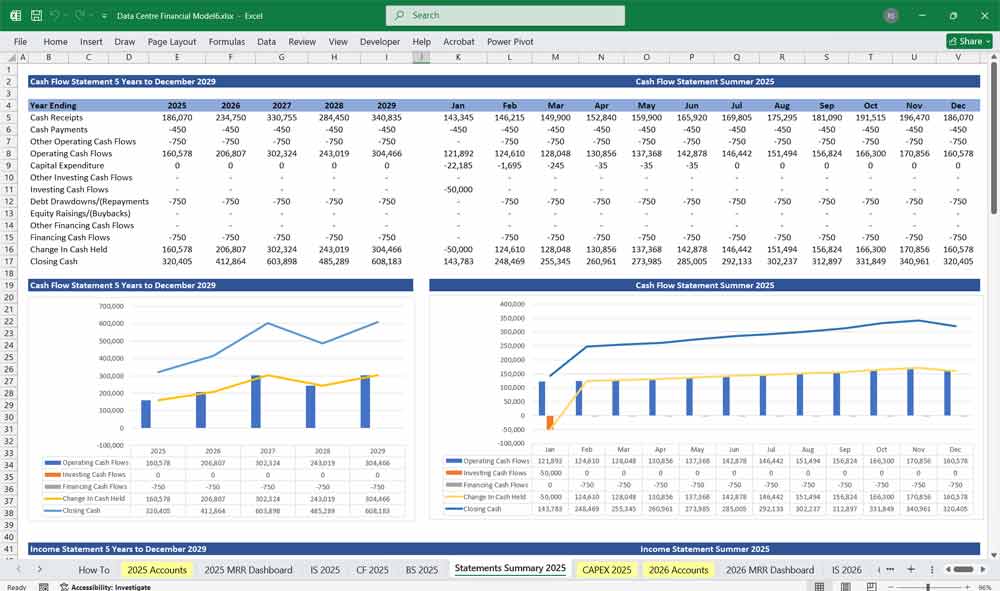

Data Center Cash Flow Statement

The Cash Flow Statement tracks the inflows and outflows of cash, divided into three sections: Operating Activities, Investing Activities, and Financing Activities.

Operating Activities

Cash Inflows:

Revenue from colocation, cloud services, and other offerings.

Receipts from clients for services rendered.

Cash Outflows:

Payments for power, cooling, and bandwidth.

Salaries and wages.

Payments to vendors for hardware and software.

Investing Activities

Capital Expenditures (CapEx):

Purchase of servers, storage, and networking equipment.

Construction or expansion of data center facilities.

Upgrades to cooling systems and power infrastructure.

Other Investments:

Investments in software or technology platforms.

Financing Activities

Debt Financing:

Proceeds from loans or bonds issued to fund CapEx.

Repayment of principal and interest on debt.

Equity Financing:

Issuance of shares to raise capital.

Dividend payments to shareholders.

Net Change in Cash

The sum of cash flows from operating, investing, and financing activities.

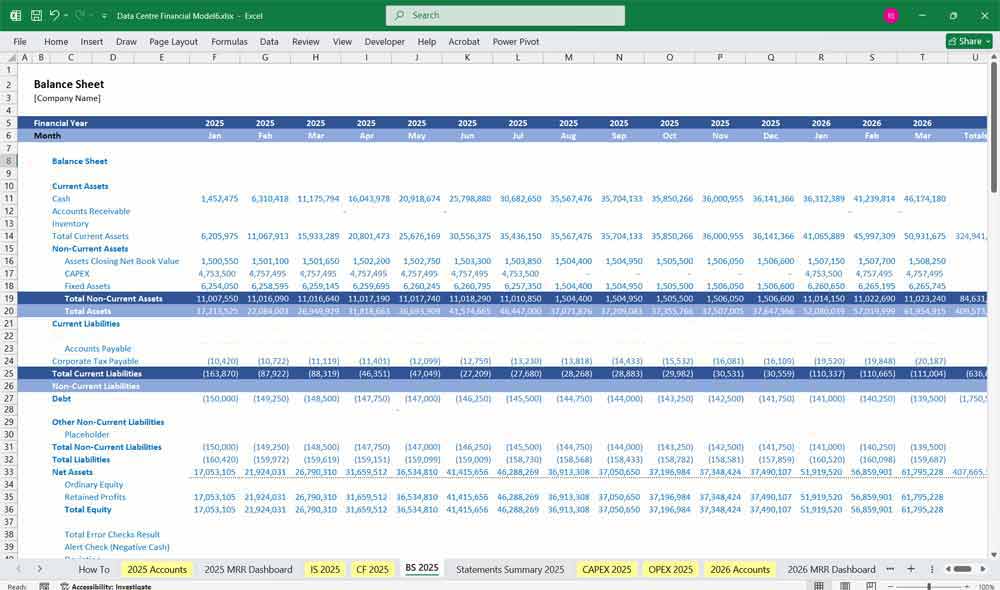

Data Center Balance Sheet

The Balance Sheet provides a snapshot of the data center’s financial position at a specific point in time, showing assets, liabilities, and equity.

Assets

Current Assets:

Cash and cash equivalents.

Accounts receivable (outstanding payments from clients).

Prepaid expenses (e.g., prepaid power or bandwidth contracts).

Non-Current Assets:

Property, Plant, and Equipment (PPE): Data center buildings, servers, cooling systems, and other infrastructure.

Intangible Assets: Software licenses, patents, or trademarks.

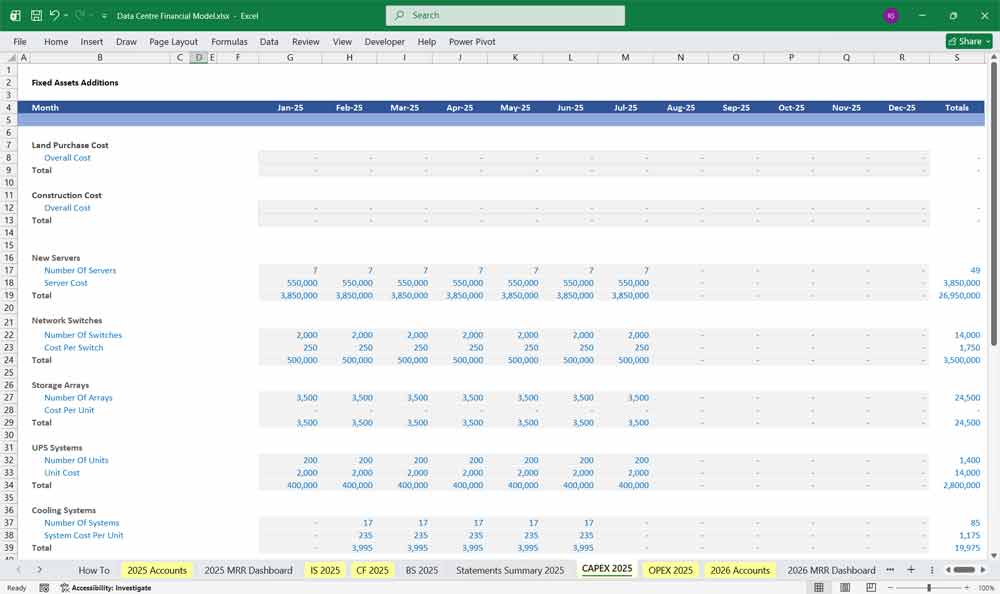

CAPEX: 10 Fully Editable

New Servers.

Network Switches.

- Storage Arrays

- UPS Systems

- Cooling Systems

Liabilities

Current Liabilities:

Accounts payable (e.g., unpaid invoices to vendors).

Short-term debt (e.g., revolving credit facilities).

Accrued expenses (e.g., wages, taxes).

Non-Current Liabilities:

Long-term debt (e.g., loans for facility construction).

Deferred revenue (e.g., payments received in advance for services).

OPEX: 10 Fully Editable

Personnel Costs.

Maintenance & Repair.

- Transportation

- Supplies & Materials

Equity

Shareholder Equity:

Common stock and additional paid-in capital.

Retained earnings (cumulative net profit minus dividends).

Key Metrics and Assumptions

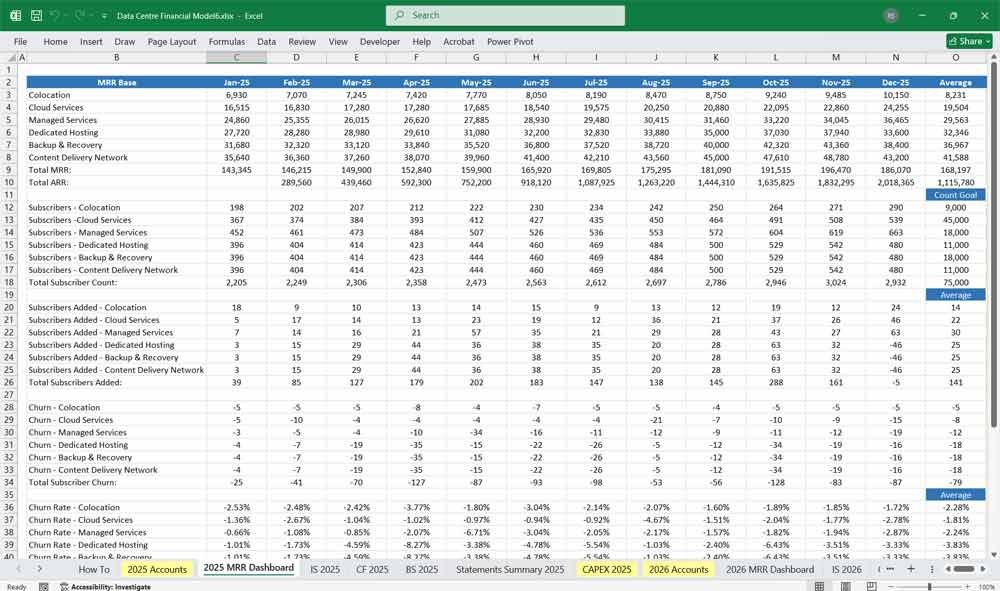

Utilization Rate: Percentage of data center capacity being used.

Power Usage Effectiveness (PUE): Measure of energy efficiency (total energy used divided by energy used for IT equipment).

Customer Acquisition Cost (CAC): Cost to acquire a new client.

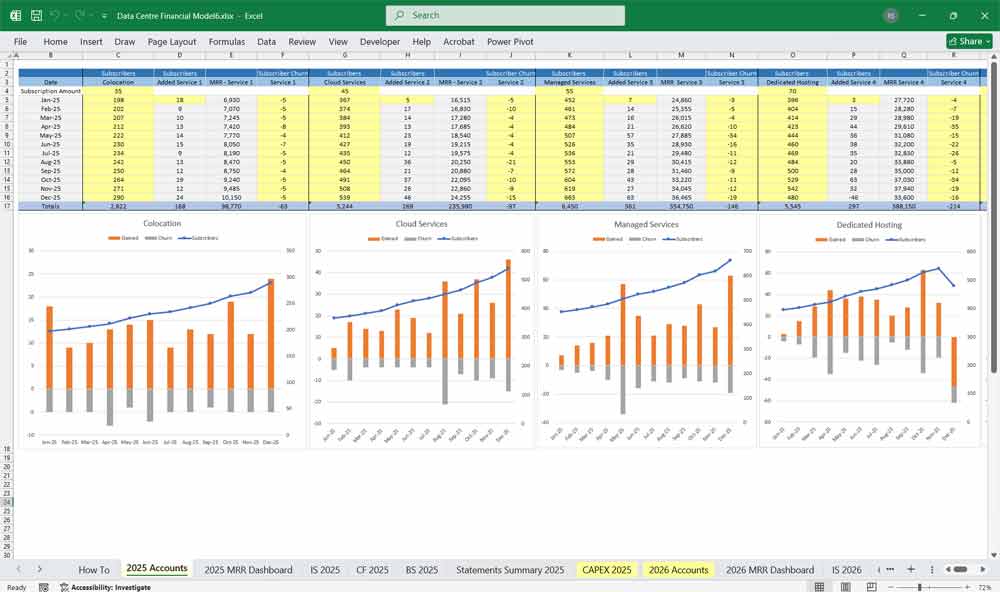

Churn Rate: Percentage of clients who stop using services annually.

Average Revenue Per User (ARPU): Average revenue generated per client.

Key Financial Metrics for a Data Center

Revenue Metrics (Fully Editable)

Monthly Recurring Revenue (MRR): Predictable income from ongoing services like colocation, cloud hosting, or managed services.

Annual Recurring Revenue (ARR): Yearly equivalent of MRR, providing a long-term revenue outlook.

Revenue per Rack: Average income generated per server rack, indicating space utilization efficiency.

Revenue per Square Foot: Income generated per unit of physical space, reflecting facility efficiency.

Cost Metrics

Capital Expenditure (CapEx): Initial investment in infrastructure, hardware, and construction.

Operational Expenditure (OpEx): Ongoing costs for maintenance, utilities, staffing, and software.

Cost per Rack: Total cost of operating a single server rack, including power, cooling, and maintenance.

Power Usage Effectiveness (PUE): Ratio of total energy used to energy delivered to IT equipment (lower PUE = better efficiency).

Benefits of Using a Data Center Financial Model

Data Center: Cost Optimization

- Identifies areas to reduce operational expenses

- Forecasts CAPEX and OPEX for better budgeting

- Optimizes resource allocation for maximum ROI

Data Center Revenue Forecasting

- Projects future income based on market trends

- Assesses profitability of different pricing models

- Helps in setting competitive service rates

Data Center Investment Planning

- Provides clear ROI projections for stakeholders

- Identifies break-even points for capital investments

- Supports funding decisions and financial backing

Data Center Risk Management

- Analyzes potential financial risks and mitigations

- Models impact of market fluctuations on revenue

- Prepares contingency plans for economic downturns

Data Center Scalability Planning

- Projects when and how to expand infrastructure

- Balances demand growth with financial feasibility

- Ensures sustainable long-term investment

Data Center Pricing Strategy Development

- Helps set competitive pricing for services

- Identifies optimal profit margins

- Adapts pricing to different customer segments

Data Center Capital Expenditure Planning

- Determines necessary investments in hardware and facilities

- Allocates budget efficiently for expansion projects

- Evaluates lease vs. purchase options for infrastructure

Data Center Operational Expense Management

- Tracks recurring costs like power and cooling

- Identifies cost-saving opportunities in maintenance

- Benchmarks expenses against industry standards

Data Center Profitability Analysis

- Measures financial performance against industry peers

- Breaks down profit drivers and cost leakages

- Evaluates long-term sustainability of operations

Data Center Financial Compliance & Reporting

- Ensures adherence to accounting and tax regulations

- Generates reports for auditors and stakeholders

- Helps maintain transparency in financial operations

Data Center ROI Calculation for Clients

- Demonstrates cost savings for potential customers

- Justifies pricing based on value-added services

- Helps clients make informed purchasing decisions

Data Center Funding & Loan Justification

- Provides financial projections for lenders and investors

- Strengthens business cases for loan approvals

- Supports negotiations for better interest rates

Data Center Planning & Sensitivity Analysis

- Models best and worst-case financial situations

- Helps assess the impact of economic downturns

- Improves strategic decision-making for resilience

Data Center Energy Cost Forecasting

- Estimates power consumption and related expenses

- Identifies efficiency improvements to lower costs

- Helps negotiate better utility contracts

Data Center Capacity Planning

- Forecasts infrastructure requirements based on demand

- Balances workload distribution for optimal efficiency

- Prevents over-investment or under-utilization of assets

Data Center Benchmarking

- Compares financial performance with industry leaders

- Identifies cost advantages and efficiency gaps

- Helps refine business strategies for market leadership

Data Center Contract & SLA Profitability Analysis

- Evaluates revenue impact of service-level agreements

- Assesses profitability of long-term contracts

- Helps negotiate favorable terms with clients

Data Center Hybrid Cloud Cost Comparison

- Assesses cost differences between cloud and on-prem solutions

- Determines when to shift workloads for financial benefit

- Optimizes cloud spending for better cost efficiency

Data Center Mergers & Acquisitions Valuation

- Helps determine fair market value for acquisitions

- Assesses financial synergies in potential mergers

- Supports due diligence and investment decisions

Data Center Investor Confidence & Stakeholder Engagement

- Provides clear financial insights for investor trust

- Strengthens business credibility with data-backed projections

- Enhances decision-making for board members and executives

6-tier subscription model For A Data Center (Named Tiers Are Completely Editable).

A data center can cater to a wide range of customers, from small businesses to large enterprises, by offering varying levels of service, resources, and support. Each tier should provide incremental value, with higher tiers offering more advanced features, greater flexibility, and enhanced support. Below is a detailed breakdown of a 6-tier subscription model:

1. Basic Data Center Tier (Entry-Level)

Target Audience: Small businesses, startups, or individuals with minimal IT needs.

Features:

Colocation Space: 1 rack unit (1U) or a small cabinet.

Power: Limited power allocation (e.g., 1 kW).

Bandwidth: Shared bandwidth with basic speed (e.g., 100 Mbps).

Support: Email support with limited SLAs (Service Level Agreements).

Security: Basic physical security (e.g., CCTV, access control).

Uptime: 99.5% uptime guarantee.

Backup: Self-managed backups (customer responsible).

Pricing: Low-cost, pay-as-you-go or monthly subscription.

2. Standard Data Center Tier (SMB Tier)

Target Audience: Small to medium-sized businesses (SMBs) with moderate IT requirements.

Features:

Colocation Space: Half or full cabinet.

Power: Higher power allocation (e.g., 3-5 kW).

Bandwidth: Dedicated bandwidth with moderate speed (e.g., 1 Gbps).

Support: 24/7 phone and email support with improved SLAs.

Security: Enhanced physical security (e.g., biometric access).

Uptime: 99.9% uptime guarantee.

Backup: Optional managed backup services.

Monitoring: Basic server and network monitoring.

Pricing: Moderate monthly subscription.

3. Professional Data Center Tier (Mid-Market Tier)

Target Audience: Growing businesses with more complex IT needs.

Features:

Colocation Space: Multiple cabinets or a private cage.

Power: Higher power density (e.g., 10 kW per cabinet).

Bandwidth: Dedicated high-speed bandwidth (e.g., 10 Gbps).

Support: 24/7 technical support with faster response times.

Security: Advanced physical and cybersecurity measures.

Uptime: 99.95% uptime guarantee.

Backup: Managed backup and disaster recovery services.

Monitoring: Advanced server, network, and application monitoring.

Compliance: Assistance with basic compliance requirements (e.g., GDPR, HIPAA).

Pricing: Higher monthly subscription with volume discounts.

4. Enterprise Data Center Tier (Corporate Tier)

Target Audience: Large enterprises with mission-critical IT infrastructure.

Features:

Colocation Space: Private suite or custom-built space.

Power: High power density with redundancy (e.g., 20 kW per cabinet).

Bandwidth: Ultra-high-speed bandwidth with redundancy (e.g., 40 Gbps).

Support: Dedicated account manager and 24/7 premium support.

Security: State-of-the-art physical and cybersecurity, including DDoS protection.

Uptime: 99.99% uptime guarantee.

Backup: Comprehensive backup and disaster recovery solutions.

Monitoring: Real-time monitoring and analytics.

Compliance: Full compliance support for industry standards.

Customization: Tailored solutions for specific business needs.

Pricing: Custom pricing based on requirements.

5. Premium Data Center Tier (High-Performance Tier)

Target Audience: Enterprises with high-performance computing (HPC) or hyperscale needs.

Features:

Colocation Space: Large private suites or entire data hall.

Power: Ultra-high power density with full redundancy (e.g., 50 kW per cabinet).

Bandwidth: Multi-terabit bandwidth with multiple carriers.

Support: 24/7 on-site engineering support and dedicated SLAs.

Security: Military-grade physical and cybersecurity.

Uptime: 99.999% uptime guarantee.

Backup: Enterprise-grade backup and disaster recovery.

Monitoring: AI-driven predictive monitoring and data analytics.

Compliance: Full compliance with global standards.

Customization: Fully customized infrastructure and services.

Pricing: Premium pricing with long-term contracts.

6. Elite Data Center Tier (Bespoke Tier)

Target Audience: Hyperscale companies, governments, or organizations with unique requirements.

Features:

Colocation Space: Entire data center or custom-built facility.

Power: Unlimited power with full redundancy and green energy options.

Bandwidth: Global network with direct peering and cloud connectivity.

Support: 24/7 dedicated team with guaranteed response times.

Security: Top-tier physical and cybersecurity, including zero-trust architecture.

Uptime: 100% uptime guarantee (with financial penalties for downtime).

Backup: Fully redundant, geographically distributed backup and DR.

Monitoring: AI-driven, real-time monitoring with predictive maintenance.

Compliance: Full compliance with the most stringent global standards.

Customization: Fully bespoke solutions, including custom hardware and software.

Pricing: Negotiated pricing with long-term commitments.

Key Differentiators Across Tiers

Scalability: Higher tiers offer greater scalability to meet growing demands.

Support: More advanced support options, including dedicated teams and faster response times.

Security: Enhanced security measures, from basic to military-grade.

Uptime: Higher uptime guarantees with financial penalties for downtime in elite tiers.

Customization: Greater flexibility and customization options for higher tiers.

Compliance: Full compliance support for industries with strict regulatory requirements.

Pricing Strategy

Volume Discounts: Discounts for higher usage or long-term commitments.

Add-Ons: Optional add-ons like additional bandwidth, storage, or managed services.

Tier Upgrades: Allow customers to upgrade tiers as their needs grow.

This 6-tier subscription model ensures that the data center can serve a diverse customer base while maximizing revenue opportunities and providing tailored solutions for each segment.

Final Notes on the Financial Model

This financial model for a Data Center provides a comprehensive view of the data center’s financial performance, helping stakeholders make informed decisions about investments, operations, and growth strategies.

Download Link On Next Page