Wind Farm Financial Model

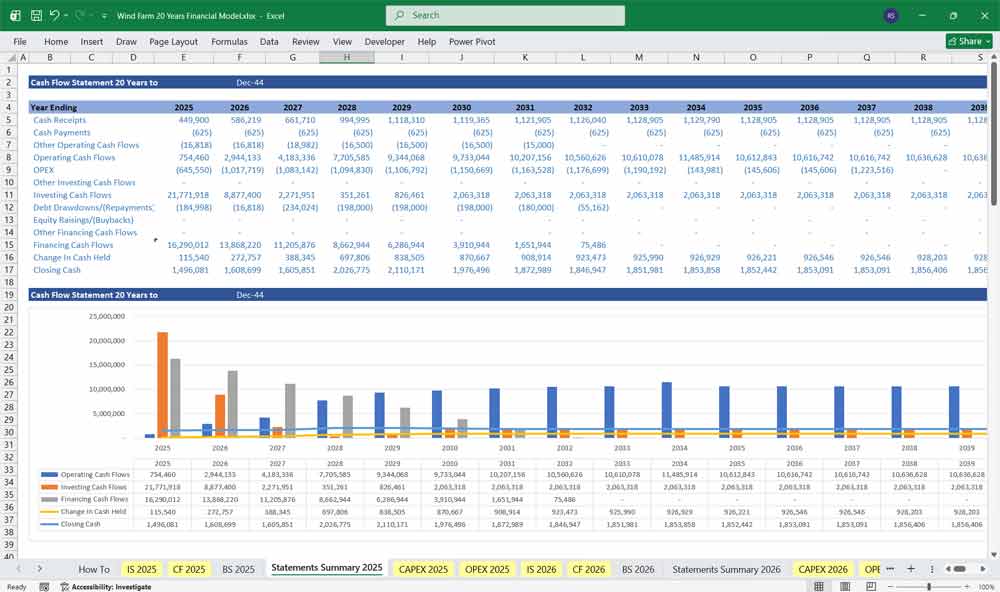

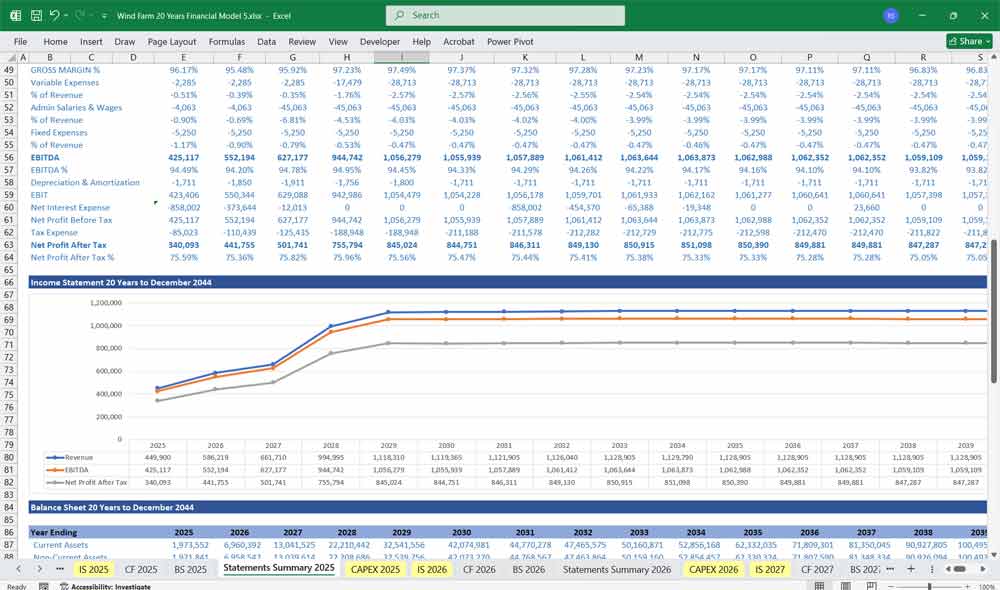

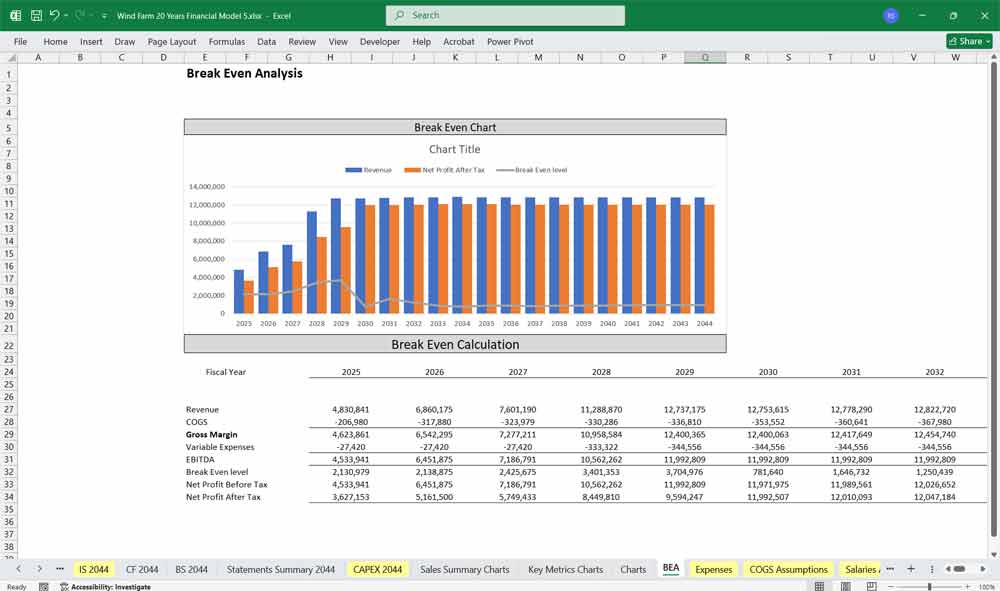

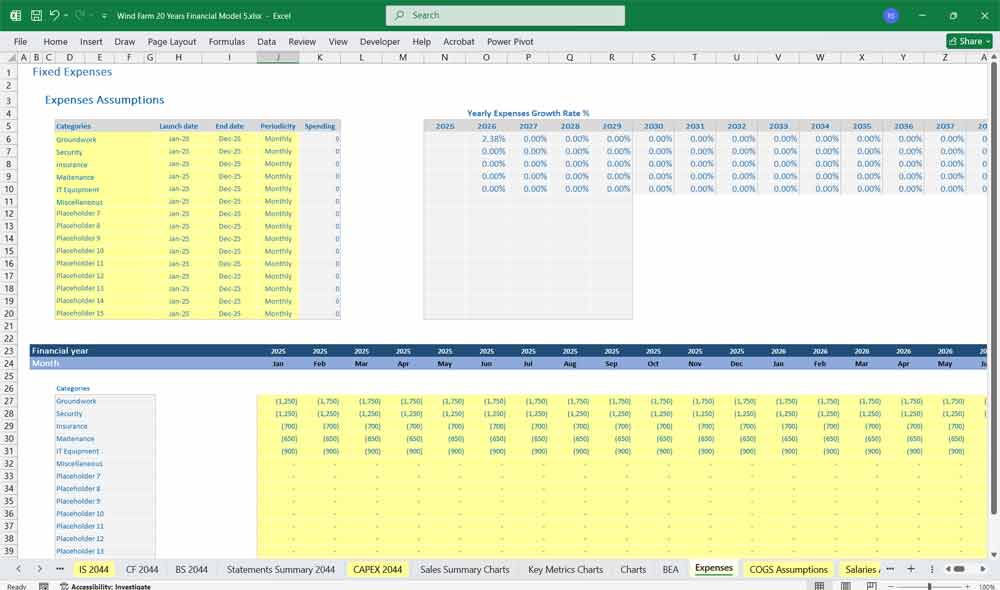

20 Year 3 Statement Wind Farm Financial Model in Excel provides a structured framework to analyze the financial health of your Wind Energy Farm’s profitability and expenditure.

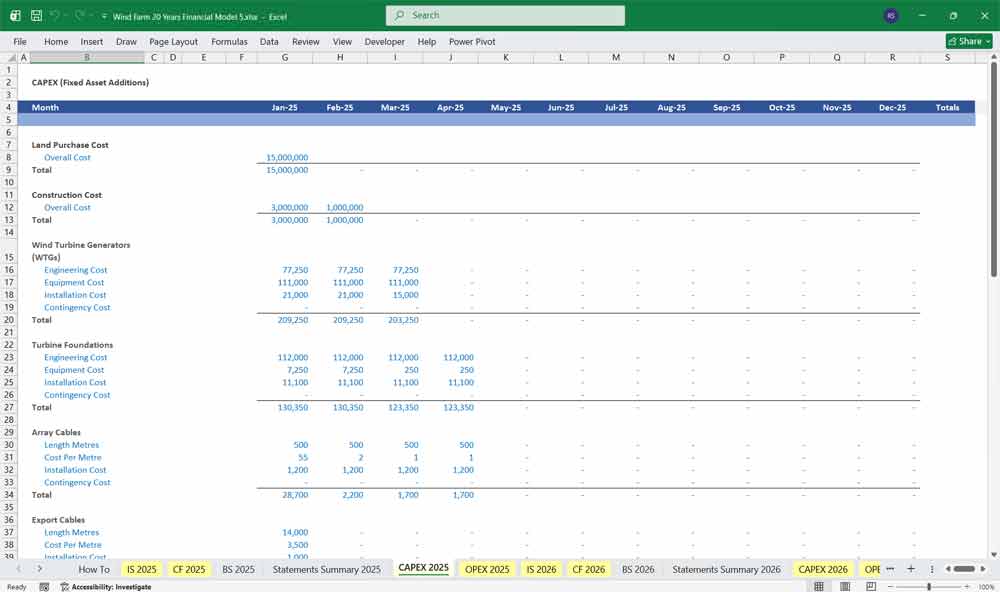

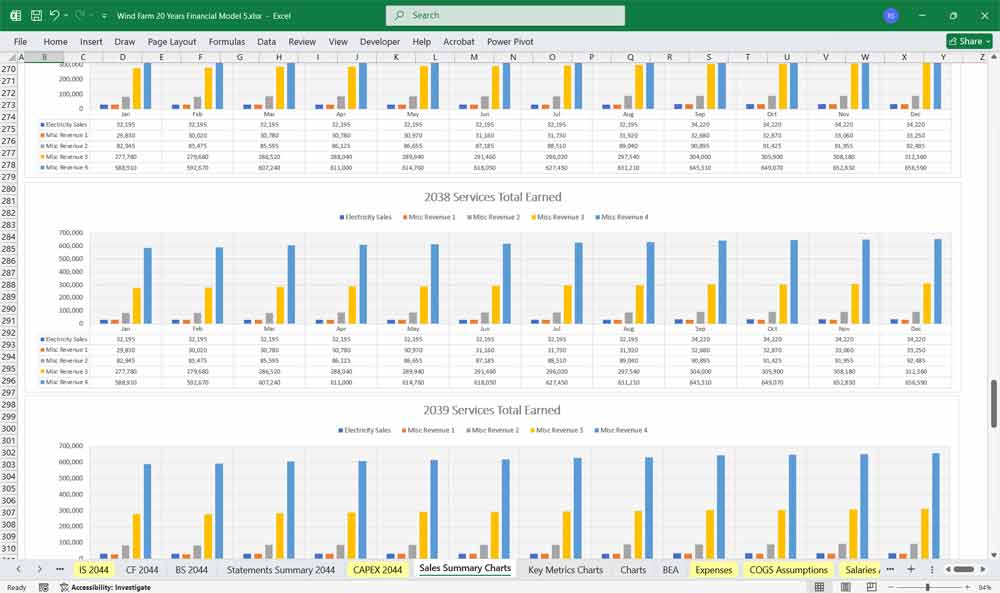

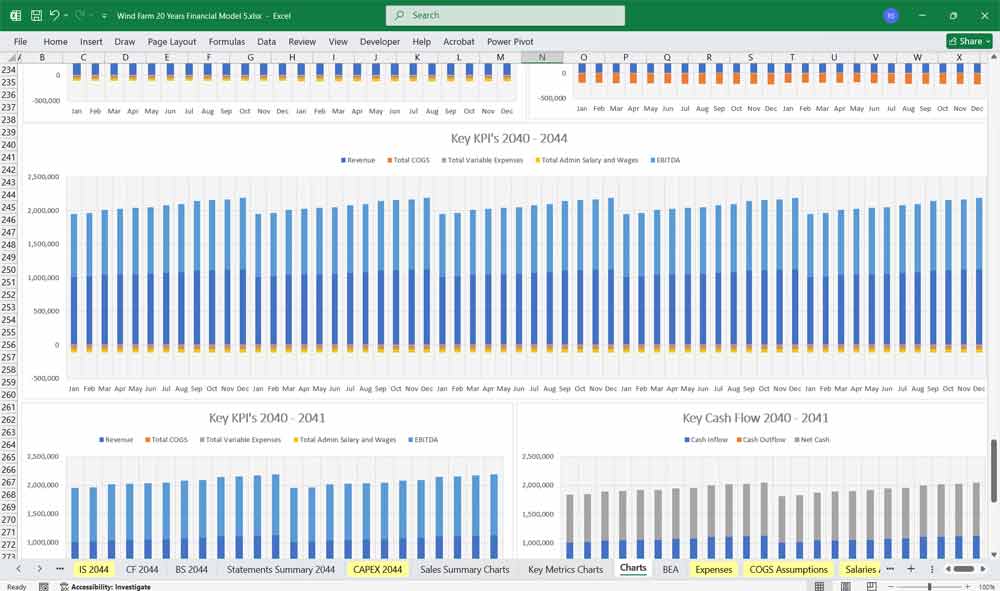

20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the specified revenue streams, BEA charts, sales summary charts, and expenses sheets. Over 130 Tabs of financial data to monitor for unmatched Wind Farm Financial Modeling.

Financial Model For A Wind farm

This 20-Year 3 Statement Wind Farm Financial Model is a robust financial model designed to evaluate the profitability and viability of a wind farm project. The model incorporates three integrated financial statements—Income Statement, Cash Flow Statement, and Balance Sheet—spanning 20 years of project operations. The outputs include detailed metrics for analyzing investor returns and financial performance

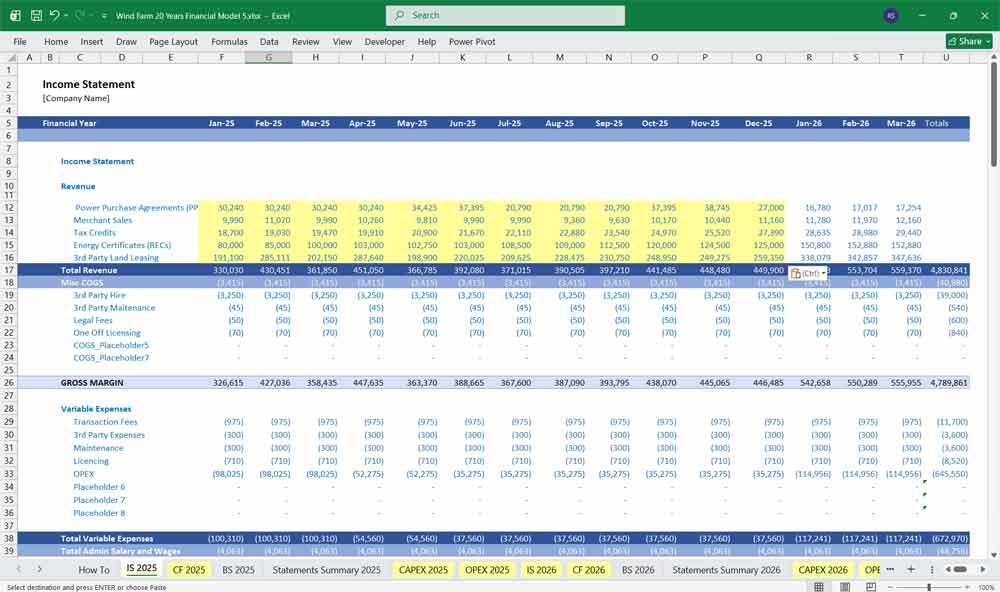

Income Statement

The Income Statement calculates the project’s profitability over each year of the 20-year lifecycle.

Key Components:

Revenue:

- Wind Energy Sales: Income from selling electricity generated by wind turbines to utilities or directly to consumers.

- Wind Energy Tax Credits and Incentives: Government subsidies, tax credits, or grants received for producing renewable energy.

- Renewable Energy Certificates (RECs): Earnings from selling RECs, which represent the environmental benefits of generating wind energy.

- Capacity Payments: Payments received for maintaining the availability of wind energy generation capacity, ensuring grid stability.

- Other Wind Energy Income: Additional income from partnerships, research grants, or leasing land for related infrastructure.

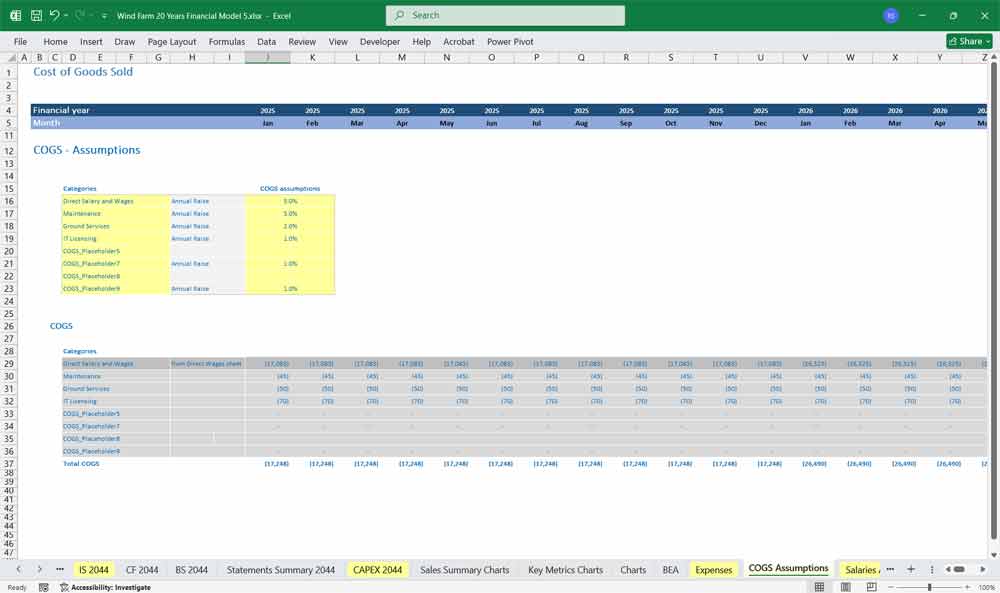

Expenses Example:

- Wind Energy Turbine Maintenance: $1,200,000

- Land Lease and Permits: $500,000

- Employee Salaries and Benefits: $700,000

- Insurance and Compliance Costs: $300,000

- Administrative and General Expenses: $400,000

Total Expenses: $3,100,000

Operating Income: $1,900,000

Other Income/Expenses:

- Interest Expense: $200,000

- Miscellaneous Income: $50,000

Net Other Expenses: $150,000

Net Income Before Taxes: $1,750,000

Income Tax Expense: $350,000

Net Income: $1,400,000

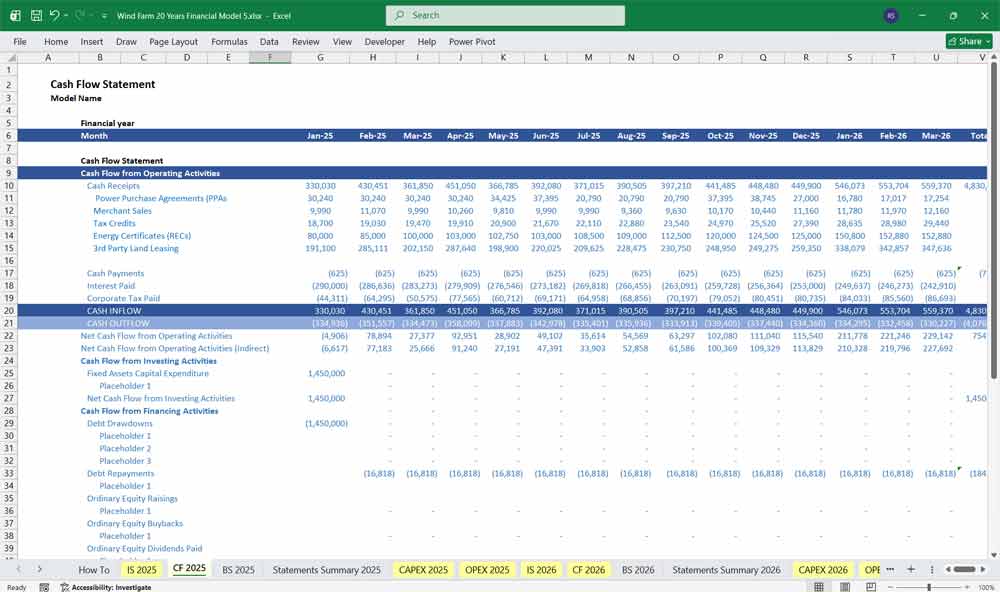

Wind Farm Cash Flow Statement

The Cash Flow Statement tracks cash movements to ensure the project maintains sufficient liquidity.

Key Components:

Cash Flows from Operating Activities:

- Revenue Receipts from Wind Energy Sales: $4,500,000

- Receipts from Wind Energy Tax Credits and Subsidies: $300,000

- Cash Payments for Wind Energy Turbine Maintenance: $(1,200,000)

- Outgoing Payments for Employee Salaries and Benefits: $(70,000)

- Cash Payments for General Operations: $(900,000)

Net Cash Flows from Operating Activities: $2,000,000

Cash Flows from Investing Activities:

- Purchase of New Wind Energy Turbines: $(2,500,000)

- Proceeds from Sale of Old Wind Energy Equipment: $500,000

Net Cash Flows from Investing Activities: $(2,000,000)

Cash Flows from Financing Activities:

- Proceeds from Wind Energy Project Financing: $1,800,000

- Repayment of Loans: $(500,000)

- Dividend Payments: $(200,000)

Net Cash Flows from Financing Activities: $1,100,000

Net Increase in Cash and Cash Equivalents: $1,100,000

Cash and Cash Equivalents at Beginning of Year: $600,000

Cash and Cash Equivalents at End of Year: $1,700,000

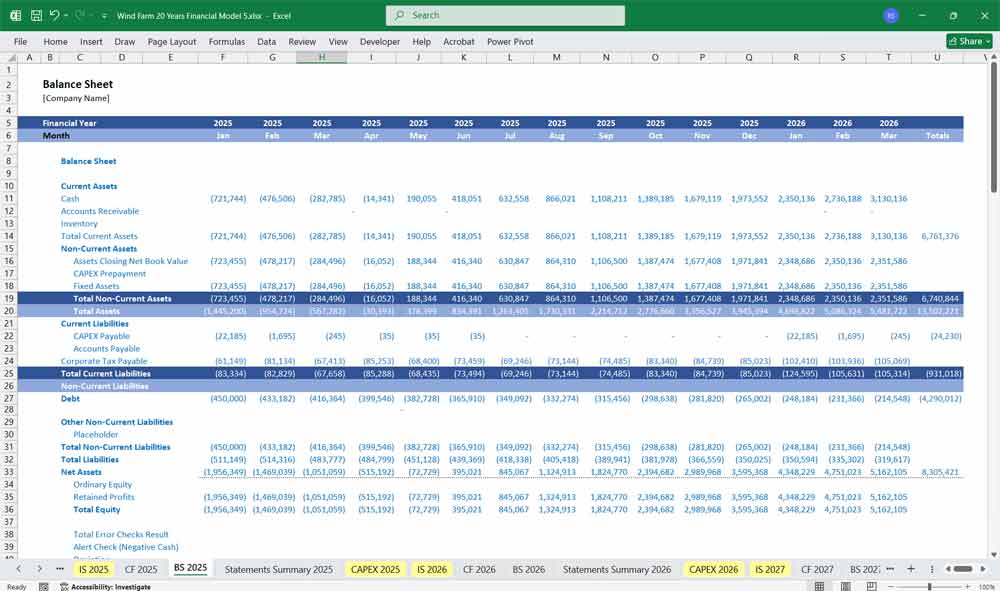

Wind Farm Balance Sheet

The Balance Sheet represents the project’s financial health at year-end, showing assets, liabilities, and equity.

Key Components:

Assets:

Current Assets:

- Cash and Cash Equivalents: $1,700,000

- Accounts Receivable – Wind Energy Sales: $500,000

- Prepaid Expenses (including insurance and maintenance contracts): $150,000

- Total Current Assets: $2,350,000

Non-Current Assets:

- Wind Energy Turbines (Net of Depreciation): $15,000,000

- Wind Energy Land and Infrastructure: $2,000,000

- Wind Energy Equipment (including transformers, batteries): $800,000

- Total Non-Current Assets: $17,800,000

Total Assets: $20,150,000

Liabilities:

Current Liabilities:

- Accounts Payable – Wind Energy Expenses: $400,000

- Short-Term Debt: $600,000

- Total Current Liabilities: $1,000,000

Non-Current Liabilities:

- Long-Term Debt – Wind Energy Financing: $8,000,000

- Total Non-Current Liabilities: $8,000,000

Total Liabilities: $9,000,000

Equity:

- Common Stock: $7,000,000

- Retained Earnings (from Wind Energy Operations): $4,150,000

Total Equity: $11,150,000

Total Liabilities and Equity: $20,150,000

Key Notes:

Wind Energy Infrastructure (e.g., turbines, towers) is the largest asset category, reflecting the capital-intensive nature of wind farms.

Long-term debt is often used to finance Wind Energy projects, making it a significant liability.

Wind Energy Development Costs are capitalized and amortized over the life of the project.

Depreciation of Wind Energy assets is a major factor in reducing the book value of non-current assets.

Wind Energy Reserves ensure funds are available for future maintenance and upgrades.

The balance sheet highlights the importance of long-term planning and financing in the Wind Energy sector.

Wind Farm Key Performance Indicators

This section evaluates the financial returns for equity and debt investors.

1. Wind Farm Operations

Capacity Factor:

Measures the actual energy output as a percentage of the maximum possible output.

Formula: Capacity Factor = (Actual Energy Output / (Installed Capacity × Total Hours in Period)) × 100.

Availability Factor:

The percentage of time the wind turbines are operational and available to generate power.

Formula: Availability Factor = (Operational Hours / Total Hours in Period) × 100.

Turbine Efficiency:

Measures how effectively turbines convert wind energy into electrical energy.

Formula: Turbine Efficiency = (Actual Energy Output / Theoretical Maximum Output) × 100.

Wind Speed Utilization:

Tracks the average wind speed at the site and its alignment with the turbine’s optimal operating range.

2. Wind Farm Financial Metrics

Levelized Cost of Energy (LCOE):

The average cost of generating wind energy 1 MWh of electricity over the lifetime of the wind farm.

Formula: LCOE = (Total Lifetime Costs / Total Lifetime Energy Output).

Revenue per MWh:

The wnd farm income earned per megawatt-hour of electricity sold.

Formula: Revenue per MWh = Total Revenue / Total Energy Output (MWh).

Operating Expense (OPEX) per MWh:

The average operating cost per megawatt-hour of wind energy electricity produced.

Formula: OPEX per MWh = Total Operating Costs / Total Energy Output (MWh).

Net Profit Margin:

The percentage of wind farm revenue remaining as profit after all expenses.

Formula: Net Profit Margin = (Net Income / Total Revenue) × 100.

3. Wind Energy Production Metrics

Annual Energy Production (AEP):

The total energy generated by the wind farm in a year, measured in MWh.

Capacity Utilization:

The ratio of actual energy output to the wind farm’s installed capacity.

Formula: Capacity Utilization = (Actual Energy Output / Installed Capacity) × 100.

Downtime Percentage:

The percentage of time turbines are non-operational due to maintenance or failures.

Formula: Downtime Percentage = (Downtime Hours / Total Hours in Period) × 100.

4. Wind Farm Environmental and Sustainability Metrics

Carbon Offset:

The amount of CO2 emissions avoided due to wind energy generation.

Formula: Carbon Offset = Energy Output (MWh) × Grid Emission Factor (tCO2/MWh).

Renewable Energy Certificates (RECs) Generated:

The number of RECs earned for producing clean energy, which can be sold for additional revenue.

Energy Payback Time:

The time it takes for the wind farm to generate the amount of energy used in its construction and operation.

5. Wind Farm Maintenance and Reliability Metrics

Mean Time Between Failures (MTBF):

The average time between wind turbine failures, indicating reliability.

Mean Time to Repair (MTTR):

The average time taken to repair a wind turbine after a failure.

Maintenance Cost per Turbine:

The average annual cost to maintain each wind turbine.

6. Wind Farm Financial Return Metrics

Internal Rate of Return (IRR):

The annualized return on investment over the lifetime of the wind farm.

Payback Period:

The time it takes to recover the initial investment from project revenues.

Debt Service Coverage Ratio (DSCR):

Measures the ability to cover debt payments from operating income.

Formula: DSCR = Net Operating Income / Total Debt Service.

Key Notes On Wind Farm Financials:

Capacity Factor and LCOE are critical for comparing the efficiency and cost-competitiveness of wind farms.

AEP and Revenue per MWh directly impact the financial performance of the wind farm.

Carbon Offset and RECs Generated highlight the environmental benefits of wind energy.

Regular monitoring of these metrics ensures optimal performance, cost management, and alignment with sustainability goals.

Wind Farm Miscellaneous Revenue Examples

1. Wind Farm Renewable Energy Certificates (RECs) / Carbon Credits

RECs Sales:

Selling certificates to utilities or companies needing to meet renewable portfolio standards (RPS).

Carbon Offset Markets:

Earning revenue through carbon trading schemes or voluntary offset markets.

2. Wind Farm Land Lease Revenues

Subleasing Land:

Renting unused land portions for grazing, agriculture, or telecom towers.

Access Rights:

Charging third parties (e.g., surveyors or utilities) for access or use of roads and infrastructure.

3. Grid Support Services / Wind Farm Ancillary Services

Reactive Power Compensation:

Earning revenue by helping maintain voltage levels in the grid.

Frequency Regulation:

Participating in grid balancing programs through load-following or curtailment.

4. Wind Farm Tourism and Educational Activities

Site Tours:

Charging fees for public or educational tours of the wind farm.

Partnerships with Educational Institutions:

Revenue from schools/universities for hosting research or training programs.

5. Wind Farm Energy Co-location with Alternative Energy Systems

Battery Storage Leasing:

Renting space or infrastructure to battery storage companies.

Hybrid Installations:

Revenue sharing from solar panels or hydrogen production co-located on-site.

Scenario and Sensitivity Analysis

Of The Financial Model –

This 20 Year Wind Farm Financial Model includes modules to simulate different scenarios and analyze sensitivities:

- Production Sensitivity: Impact of changes in wind speeds or turbine efficiency.

- Tariff Sensitivity: Changes in power purchase agreement (PPA) prices or escalation rates.

- Cost Sensitivity: Variations in capex, opex, or financing terms.

This comprehensive structure ensures that the financial viability and investment returns for the wind farm project are rigorously evaluated, offering valuable insights to developers, lenders, and investors.

Download Link On Next Page