Virtual Reality Software Financial Model

This 3-Statement Excel Virtual Reality Financial Model covers revenue and expenditure streams from development, subscriptions, banner advertising, affiliates etc. With cost structures, and financial statements to forecast the financial health of your company.

Financial Model for a Virtual Reality Software Company

What Do You Get? 2 Versions In 1 Zip File

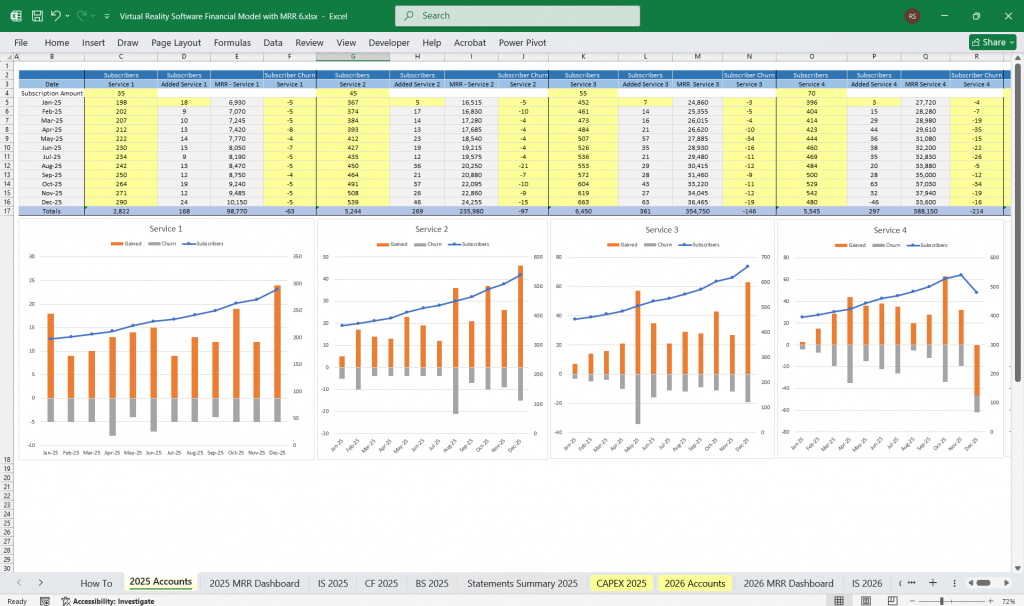

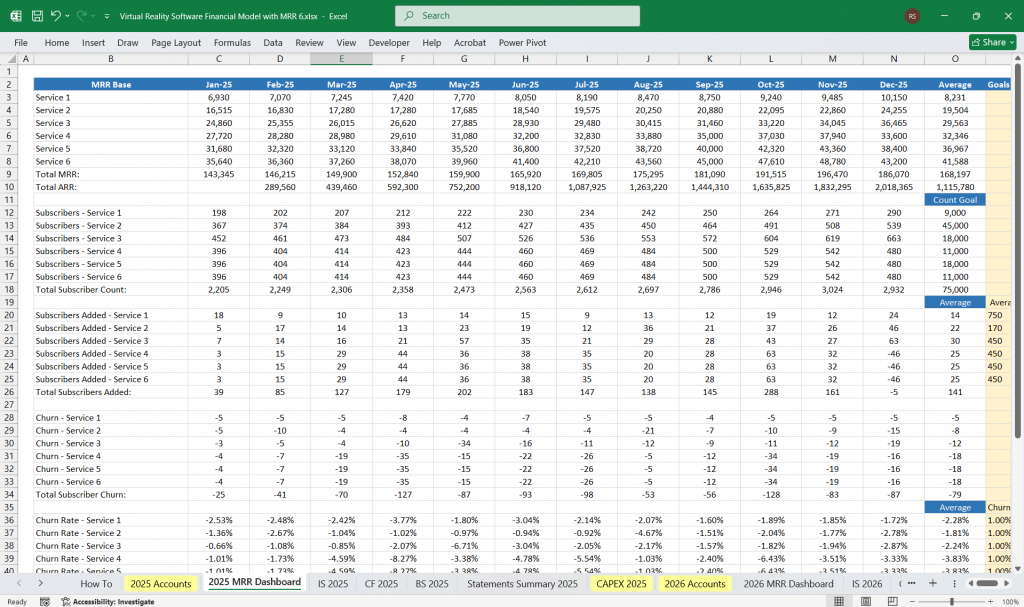

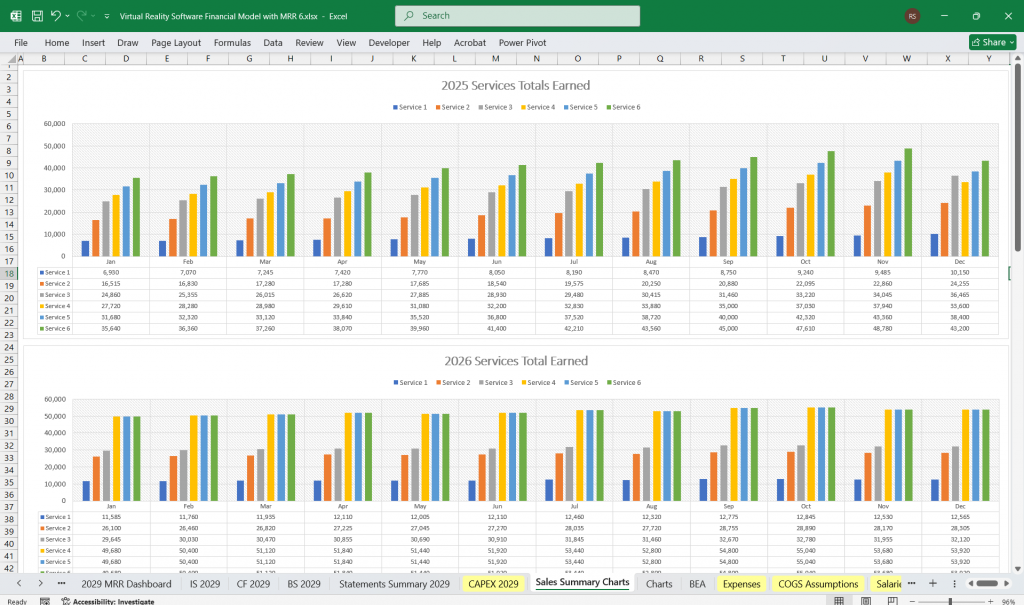

Version 1: 5-Year, 3 Statement financial model wth 5 revenue inputs for tracking and reporting of your Virtual Reality Software, or consulting fee financials.

Version 2: 5-Year, 3 Statement 5 PAYG project-based consulting revenues, plus 6 Tier Subscription Tracking for software sales. ‘Managed Service Agreements’. Build Your MSA book as quickly as possible.

You would typically sell your services at tiered 12-month agreements that increase in price as SLAs (Service Level Agreements) and monthly consulting hours scale upwards.

Software Development: Software Development as a Service (SDaaS)

Benefits of MRR Subscription service in software development and distribution:

Flexibility: Teams in different regions can work around the clock, leveraging the expertise of team members during their peak hours

Scalability: The flexibility in scaling resources aligns with non-traditional workflows

Cost-effectiveness: Customers only pay for the result, without the need to assemble a team, pick technologies, or pay for idle time or overtime.

Here’s a six-tier subscription model for a Virtual Reality Software Company (focused on content creation, immersive experiences, and media production):

1. Free / Trial Virtual Reality Tier (Entry-Level)

- Limited access to sample VR experiences

- Basic VR content player (ad-supported)

- Access to community forums

- Watermarked VR previews

- Monthly newsletter with industry insights

2. Enthusiast Virtual Reality Tier ($10-$25/month)

- Full access to a library of VR experiences

- Offline playback for select content

- Early access to new experiences

- No ads

- Basic customer support

3. Creator Virtual Reality Tier ($50-$100/month)

- Access to VR creation tools (limited export options)

- Use of pre-made assets & templates

- Licensing for non-commercial projects

- Cloud storage for VR content

- Standard customer support

4. Professional Virtual Reality Tier ($250-$500/month)

- Advanced VR production tools & software

- Commercial licensing for VR content

- High-quality export options (4K/8K support)

- Collaboration tools for teams

- Priority customer support

5. Enterprise Virtual Rality Tier ($1,000+/month)

- All Professional features

- Custom VR content production services

- Dedicated cloud hosting for VR projects

- API integrations for business applications

- Dedicated account manager

6. Partner / Studio Virtual Reality Tier (Custom Pricing)

- Co-production & funding for VR projects

- Exclusive distribution & marketing support

- Revenue-sharing on VR content sales

- Custom-built VR solutions for specific industries

- Personalized 24/7 support

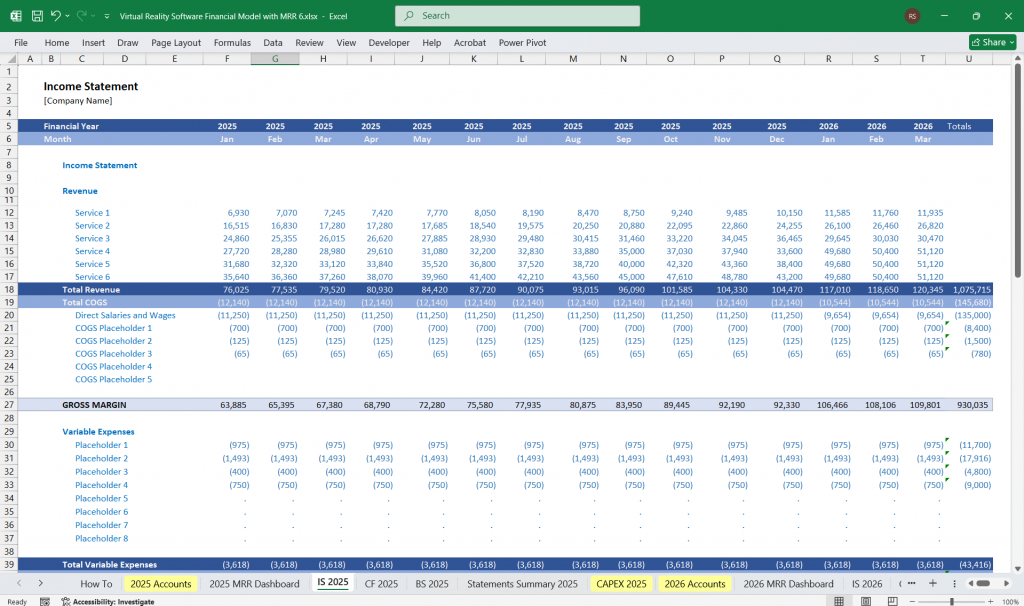

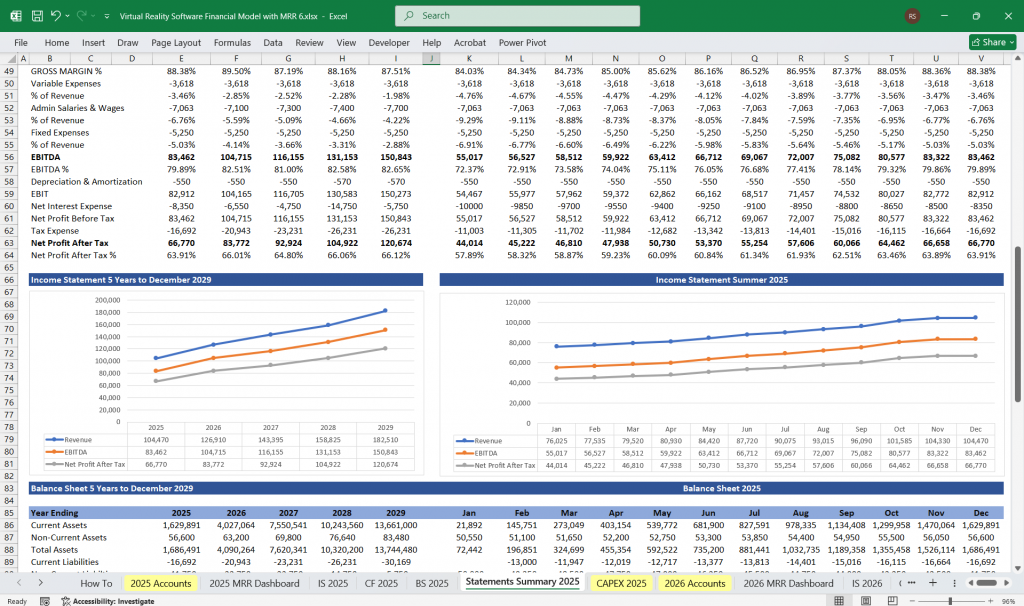

Virtual Reality Financial Model Income Statement (Profit & Loss Statement)

The Income Statement shows the company’s profitability over a specific period, including revenue sources, operating expenses, and net income.

Revenue Streams

- Direct Software Sales – Sales of VR games and applications via platforms (SteamVR, Oculus Store, PlayStation VR, etc.).

- Subscription Revenue – Recurring revenue from different subscription tiers (Gamer, Developer, Studio, Enterprise, etc.).

- VR Content Licensing – Licensing VR experiences to third parties (businesses, educational institutions, healthcare, etc.).

- Esports & Competitive Gaming Revenue – Sponsorships, tournament fees, advertising, and revenue share from competitions.

- Custom VR Development – Revenue from businesses commissioning custom VR experiences.

- Advertising & Partnerships – In-game advertisements, brand sponsorships, and affiliate marketing.

- Asset & Marketplace Sales – Selling VR assets, environments, or modding tools to developers.

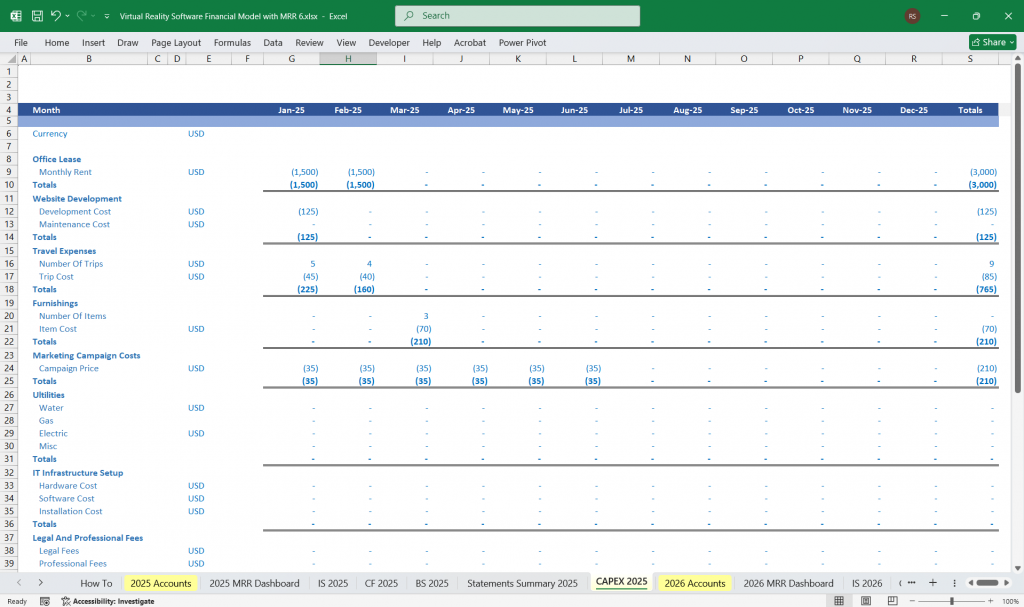

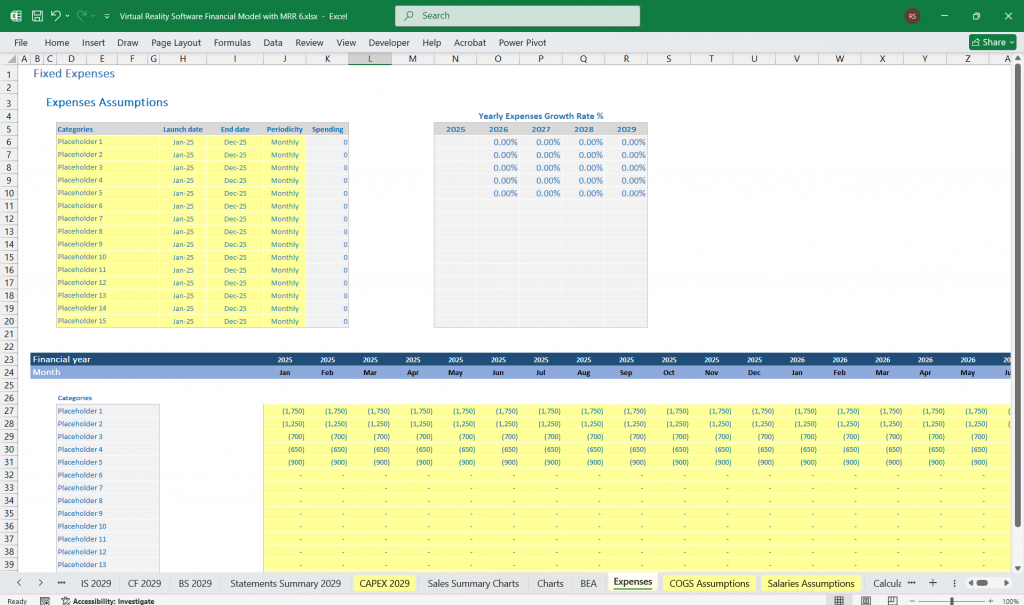

Expenses (Costs & Operating Costs)

Cost of Goods Sold (COGS)

- Server hosting costs for online VR content & multiplayer games

- Revenue share with distribution platforms (Steam, Meta, etc.)

- Licensing fees for third-party engines (Unity, Unreal Engine)

- VR asset creation & acquisition costs

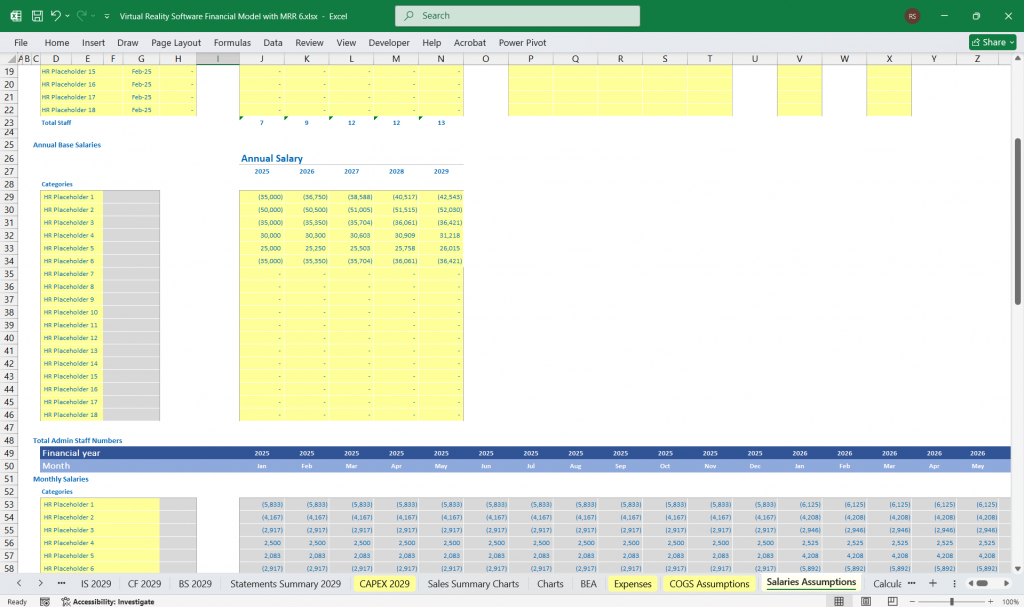

Operating Expenses (OPEX)

- Development Costs – Salaries for developers, designers, and engineers

- Marketing & Advertising – Promotions, influencer partnerships, esports sponsorships

- General & Administrative (G&A) Expenses – Office expenses, software tools, legal, HR

- Customer Support & Community Management – Salaries for support staff and forum moderators

- Research & Development (R&D) – Investment in new VR technology and innovation

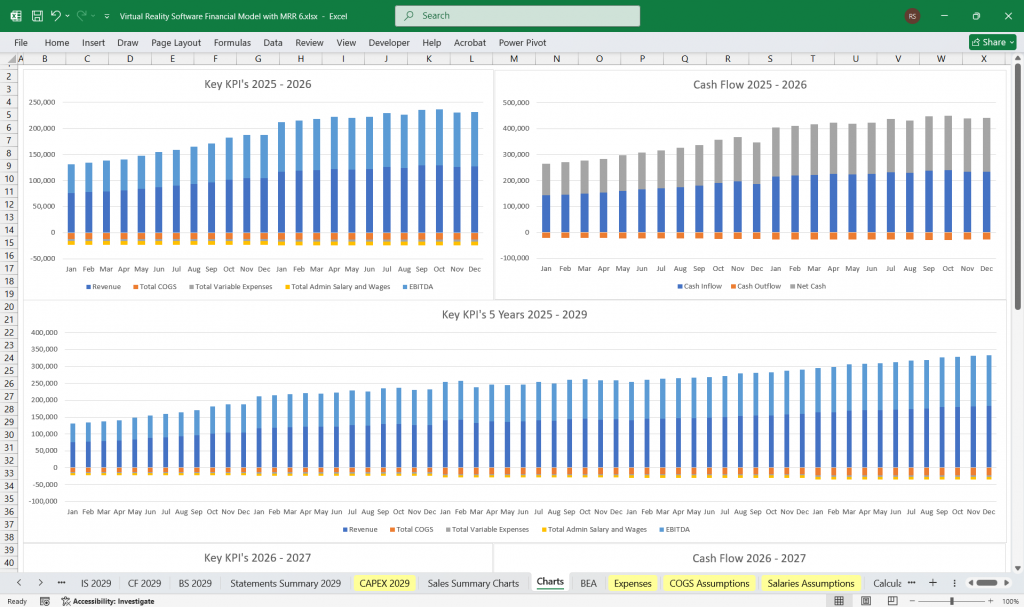

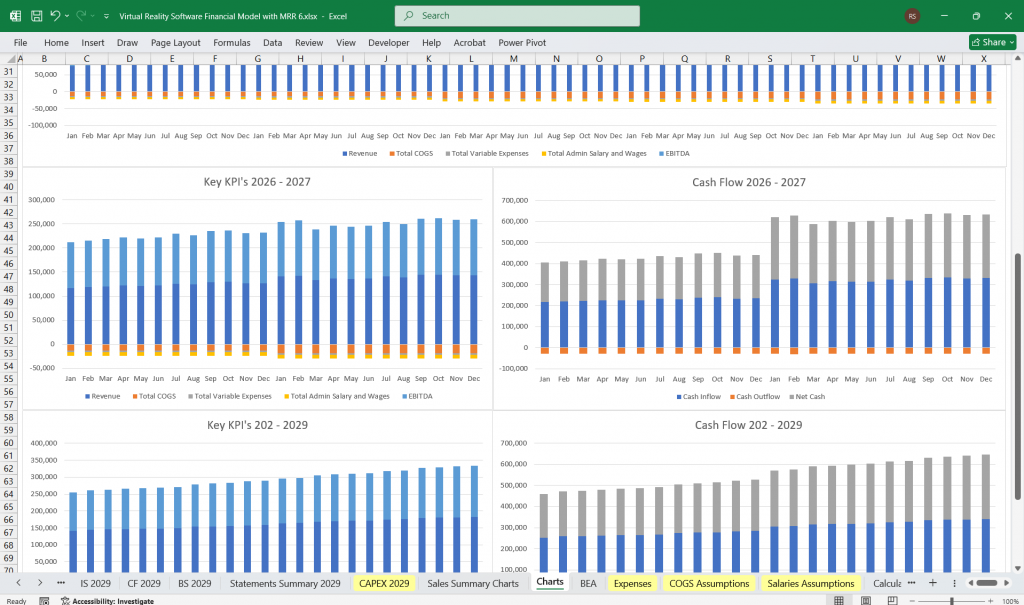

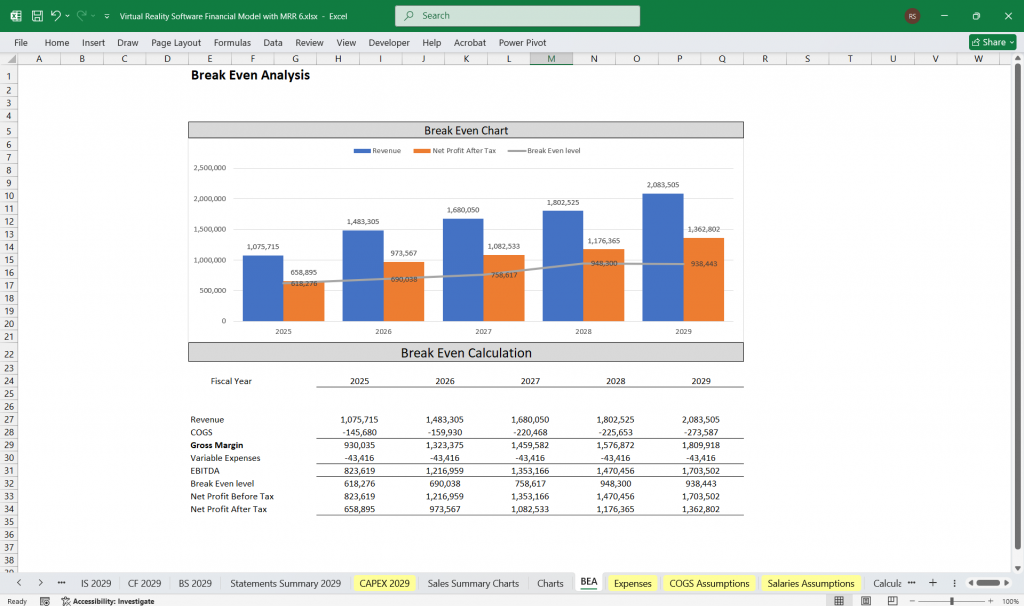

Profitability Metrics

- Gross Profit = Revenue – COGS

- Operating Profit = Gross Profit – Operating Expenses

- Net Profit = Operating Profit – Taxes & Interest Expenses

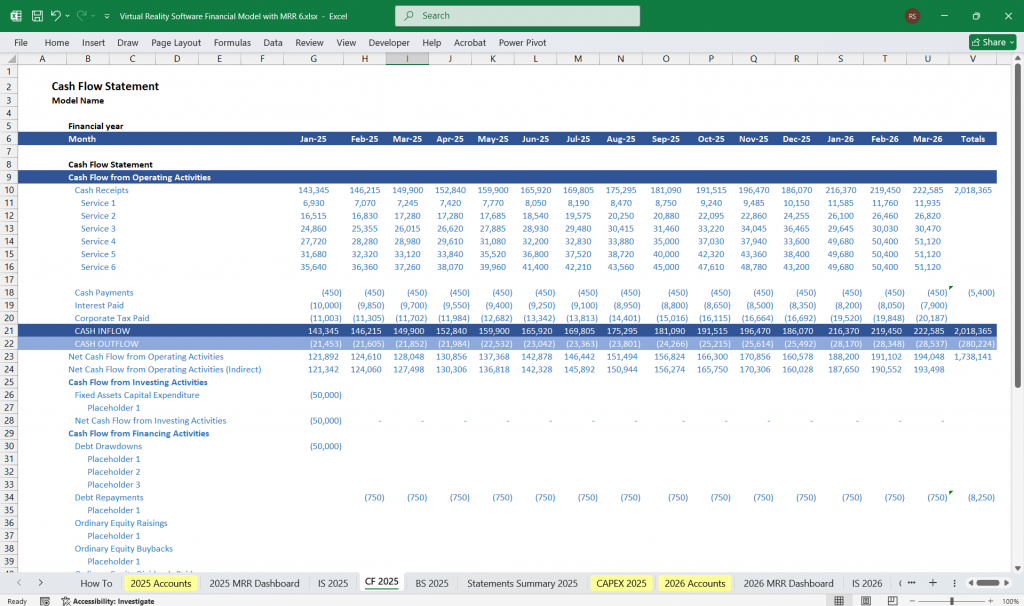

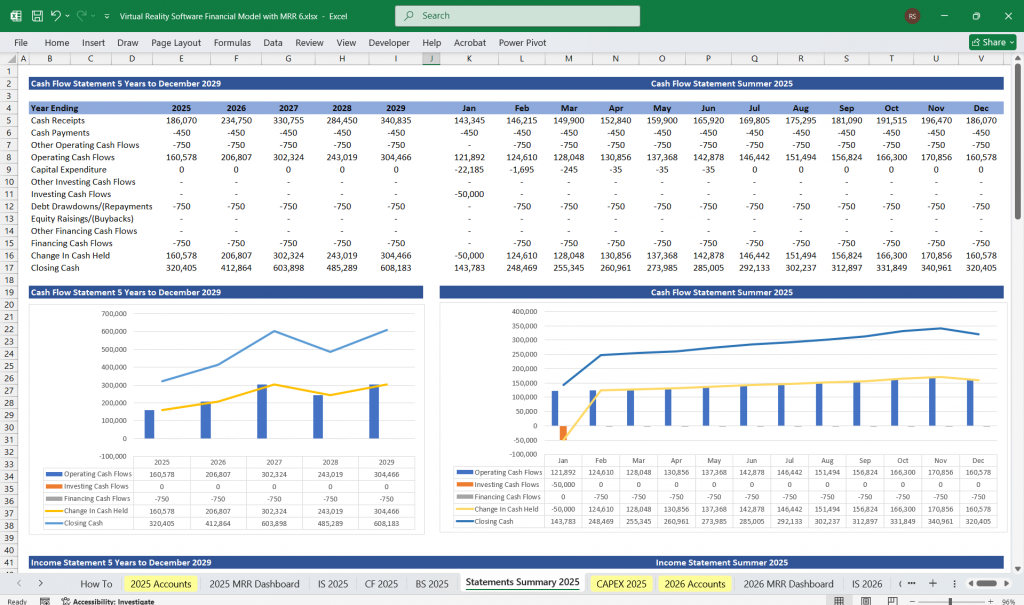

Virtual Reality Financial Model Cash Flow Statement

The Cash Flow Statement tracks cash movements in and out of the company and ensures financial sustainability.

Operating Cash Flow (Cash Inflows & Outflows from Core Business)

Cash Inflows

- Revenue from VR software & subscriptions

- Payments from licensing deals

- Revenue from esports sponsorships and ticket sales

- Upfront payments from enterprise clients

Cash Outflows

- Salaries for employees and contractors

- Server and hosting costs

- Marketing expenses

- R&D and content production costs

Investing Cash Flow (Asset Purchases & Investments)

Cash Inflows

- Sale of old equipment or intellectual property

- Investment income from acquired companies

Cash Outflows

- Purchase of new VR equipment & motion capture tech

- Development of proprietary VR engines or tools

Financing Cash Flow (Funding & Debt Management)

Cash Inflows

- Venture capital investments

- Loans or government grants for VR innovation

- Crowdfunding campaigns

Cash Outflows

- Loan repayments

- Dividends paid to investors

- Buyback of company shares

Key Cash Flow Metrics

- Free Cash Flow (FCF) = Operating Cash Flow – Capital Expenditures

- Cash Burn Rate = Monthly Operating Expenses – Revenue

- Runway = Cash Reserves / Monthly Cash Burn Rate

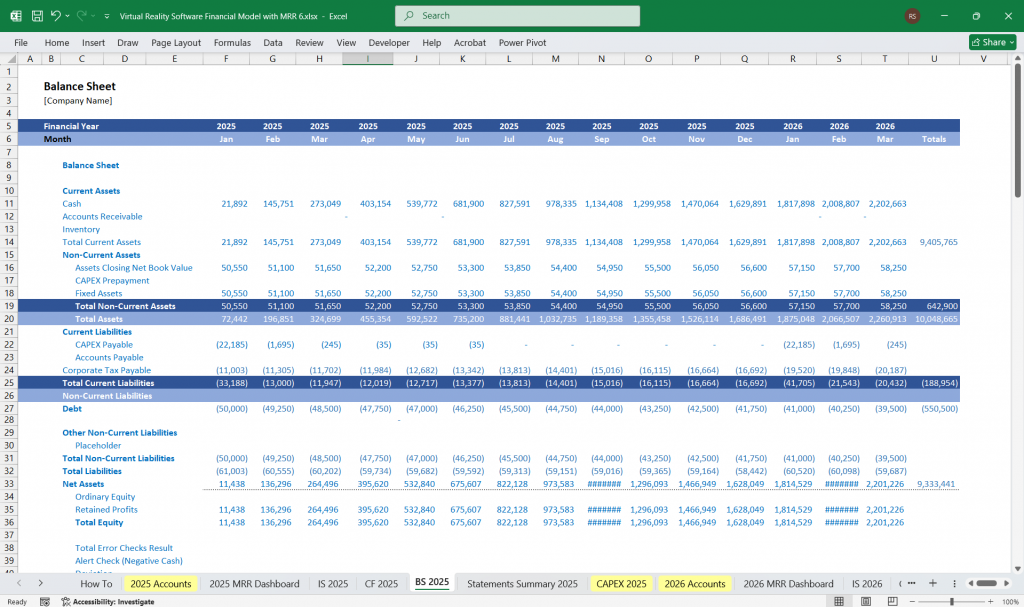

Virtual Reality Financial Model Balance Sheet

The Balance Sheet provides a snapshot of the company’s financial position at a given time.

Assets (What the Company Owns)

Current Assets

- Cash & Cash Equivalents (cash in bank accounts)

- Accounts Receivable (payments due from customers & platforms)

- Inventory (VR assets, game licenses, digital products)

Non-Current Assets

- Intellectual Property (VR game licenses, proprietary engines)

- VR Equipment & Hardware (motion capture tools, VR headsets)

- Software Development Costs (capitalized software expenses)

Liabilities (What the Company Owes)

Current Liabilities

- Accounts Payable (outstanding payments to suppliers)

- Short-Term Loans (bank loans due within a year)

- Deferred Revenue (prepaid subscriptions, esports entry fees)

Non-Current Liabilities

- Long-Term Debt (venture capital loans, corporate bonds)

- Lease Obligations (office & studio space leases)

Equity (Owner’s Share of the Business)

Shareholder’s Equity

- Paid-in Capital (funds raised from investors)

- Retained Earnings (profits reinvested into the company)

Key Balance Sheet Metrics

- Current Ratio = Current Assets / Current Liabilities (Liquidity Check)

- Debt-to-Equity Ratio = Total Liabilities / Shareholder’s Equity (Financial Leverage)

- Return on Assets (ROA) = Net Income / Total Assets (Profitability Efficiency)

Financial Model Summary & Key Considerations

Revenue Growth Strategy

- Expanding Virtual Reality Software subscription models

- Creating premium esports experiences

- Licensing VR content to corporate clients

Cost Management Strategy

- Optimizing server hosting costs

- Managing content production budgets

- Leveraging automation for customer support

Investment & Financing Strategy

- Securing venture capital for growth

- Diversifying revenue streams to mitigate risk

Download Link On Next Page