Textile Manufacturer Financial Model

Here’s an Excel Textile Manufacturer Financial Model, with an Income Statement, Cash Flow Statement, and Balance Sheet. With revenues from 80 product lines and a Subscription Add-On. Cost structures and financial statements to forecast the financial health of your Textile Manufacturing.

Financial Model for a Textile Manufacturer

This 20 Year financial model helps analyze the profitability, cash flow, and financial position for a textile manufacturing business. It considers assumptions, revenue projections, cost structures, and financial statements.

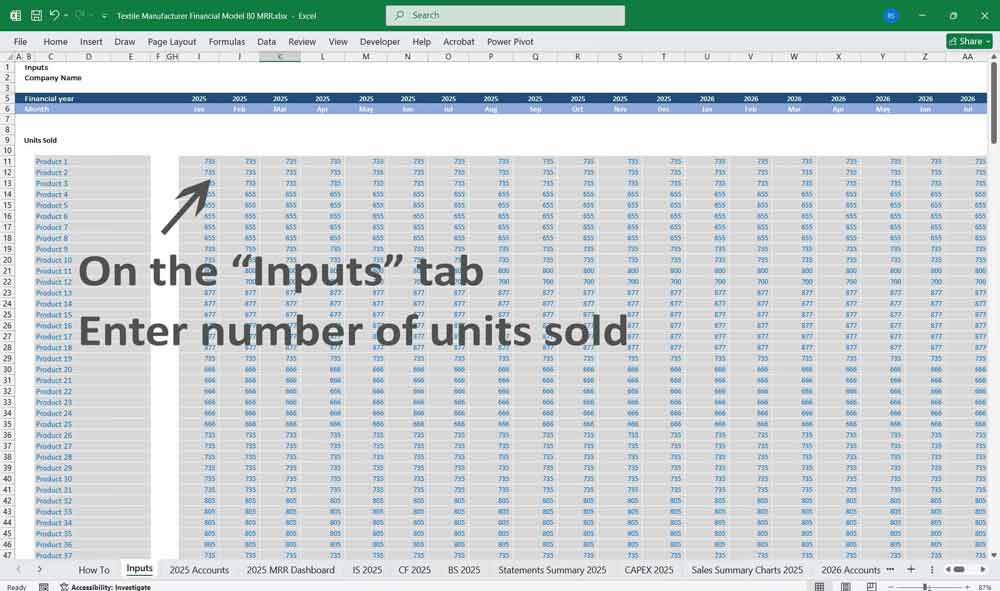

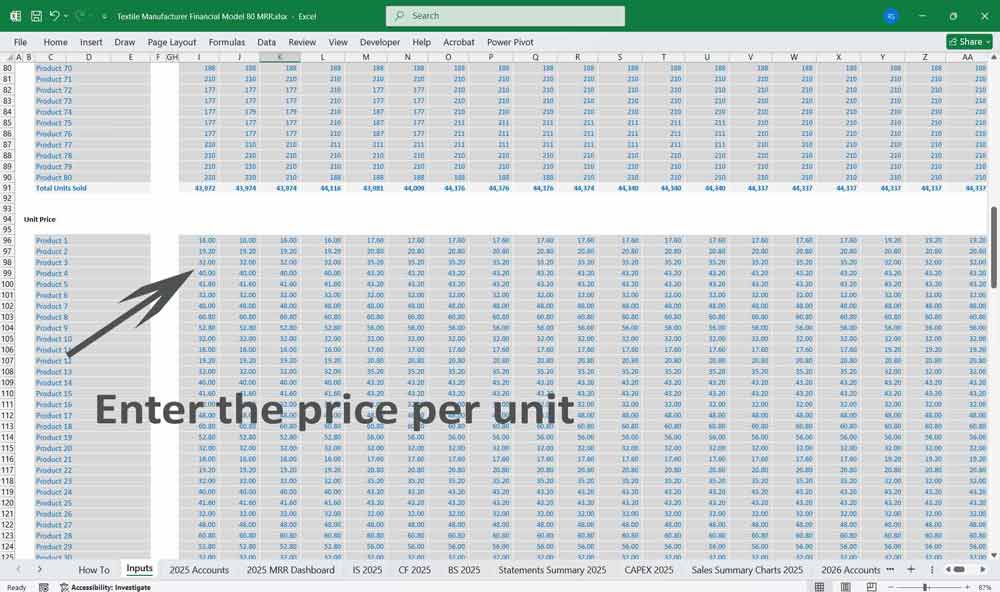

Assumptions & Key Inputs

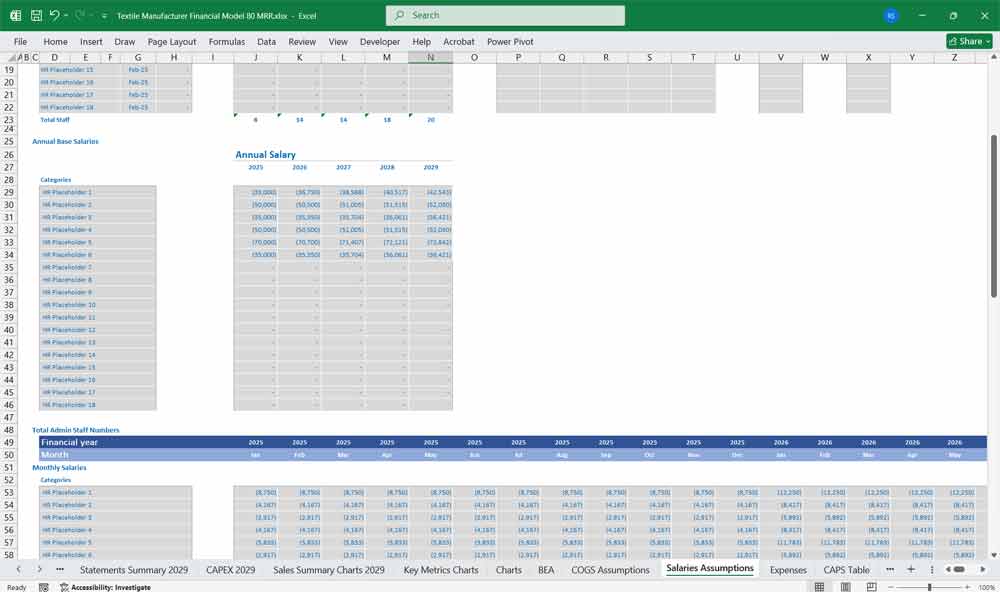

A textile manufacturer’s financial performance depends on production capacity, sales volume, pricing strategy, and cost structures.

General Assumptions

- Production Capacity depends on factory size and efficiency.

- Sales Growth is assumed to increase annually for both scenarios.

- Pricing Strategy is based on market demand and product positioning.

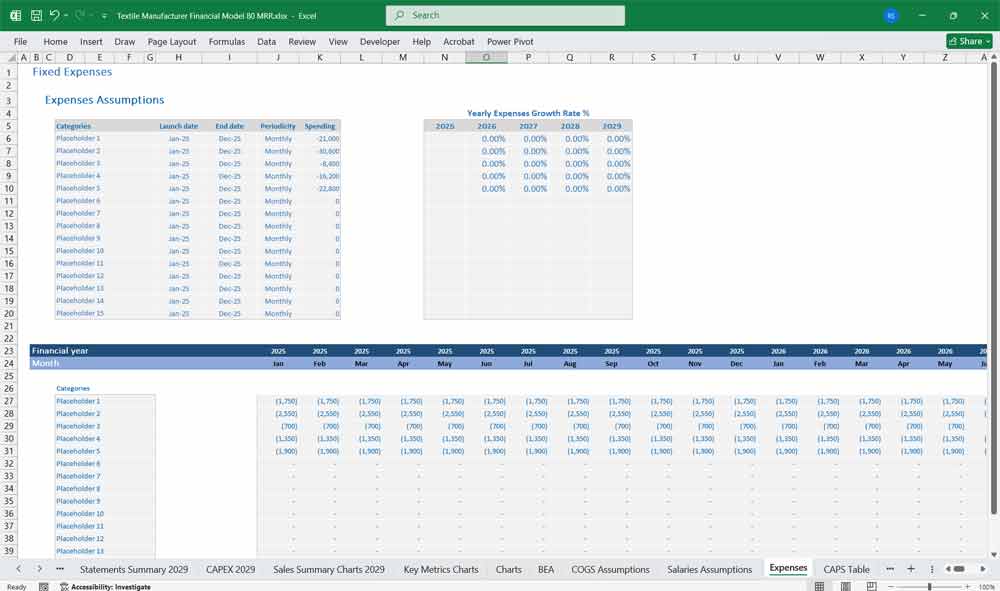

- Raw Material Costs include fabric, dyes, thread, labor, and energy.

- Operating Expenses cover salaries, marketing, rent, utilities, maintenance, and logistics.

Scenario Breakdown

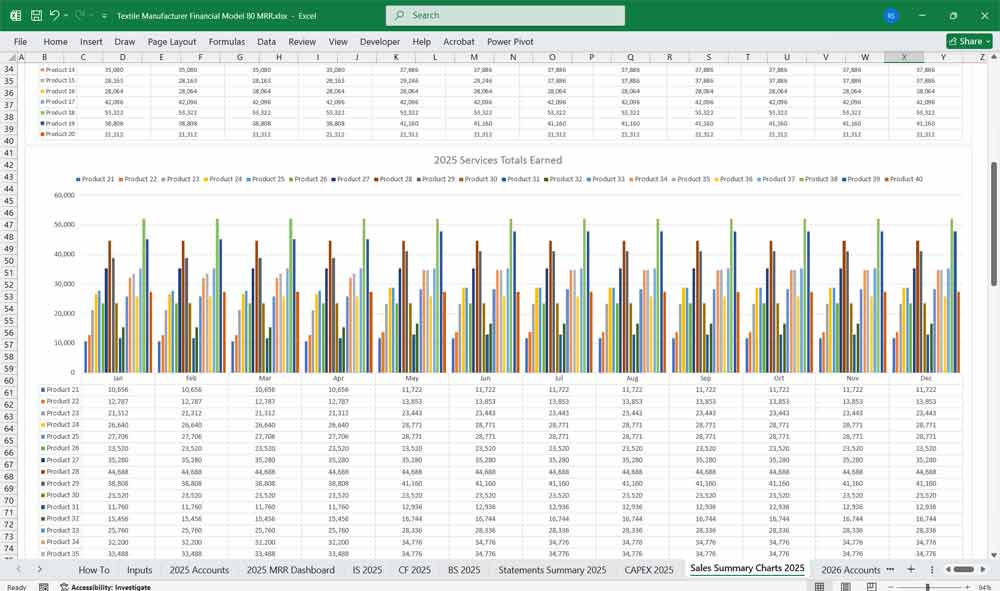

An 80-product line manufacturer deals with a more complex supply chain, higher raw material procurement costs, and increased warehousing, logistics, and workforce requirements. However, it also benefits from a broader market reach and revenue potential.

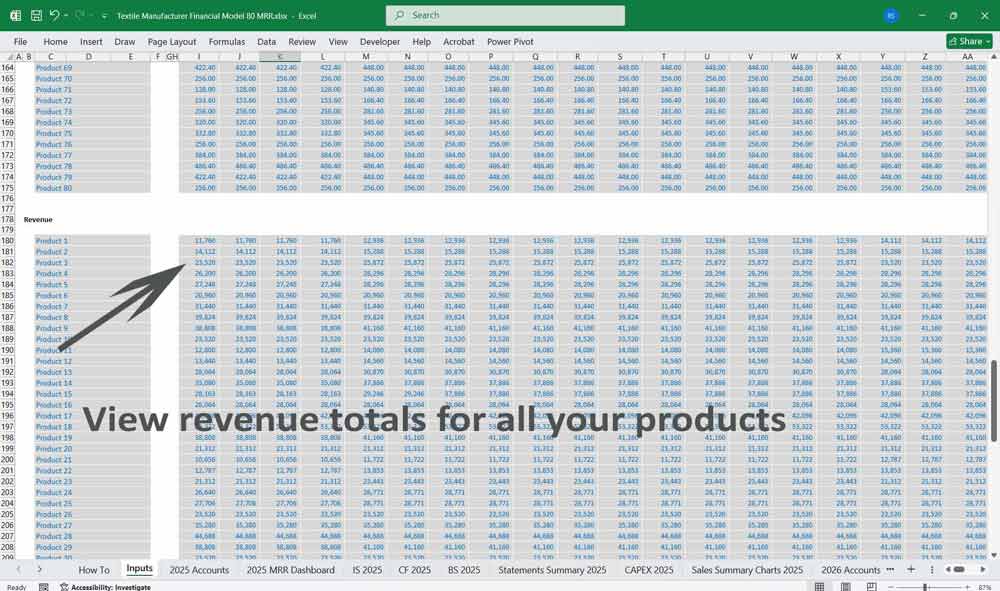

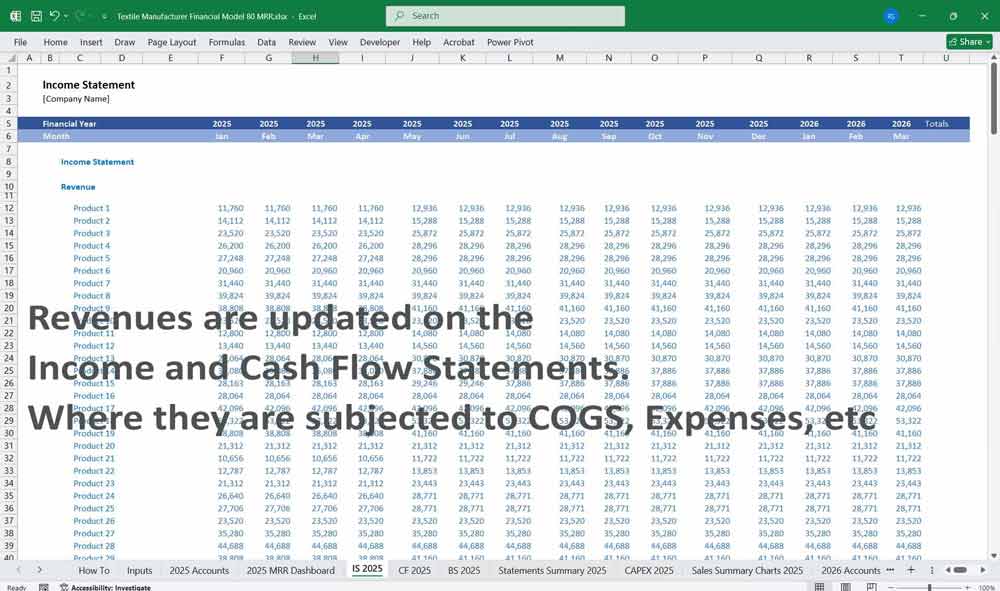

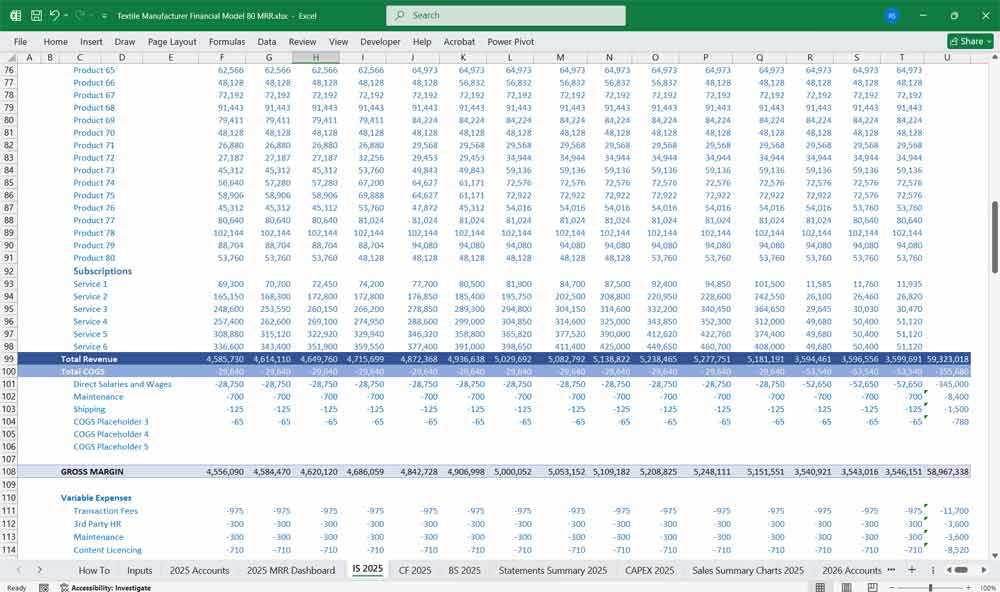

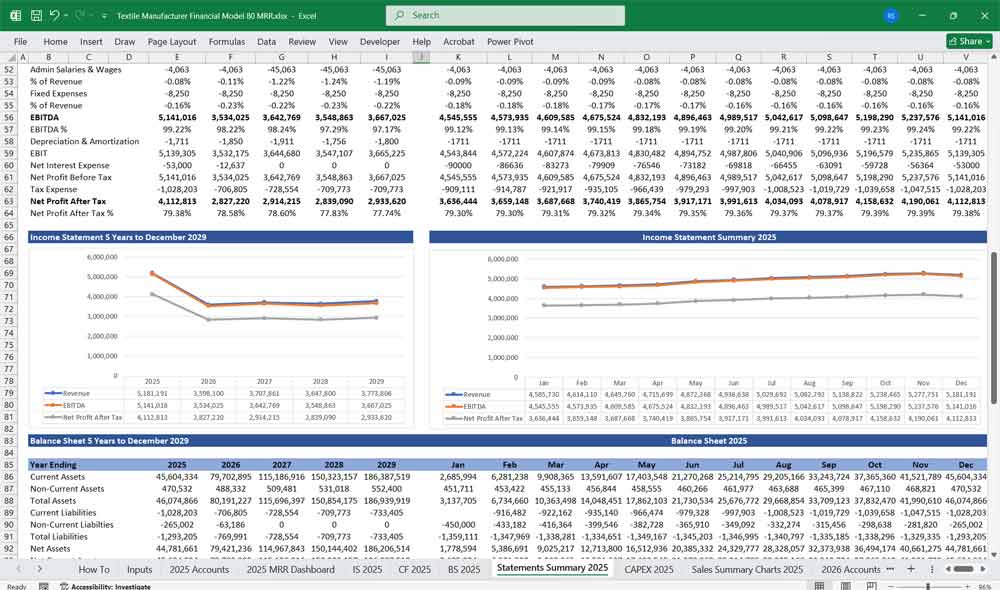

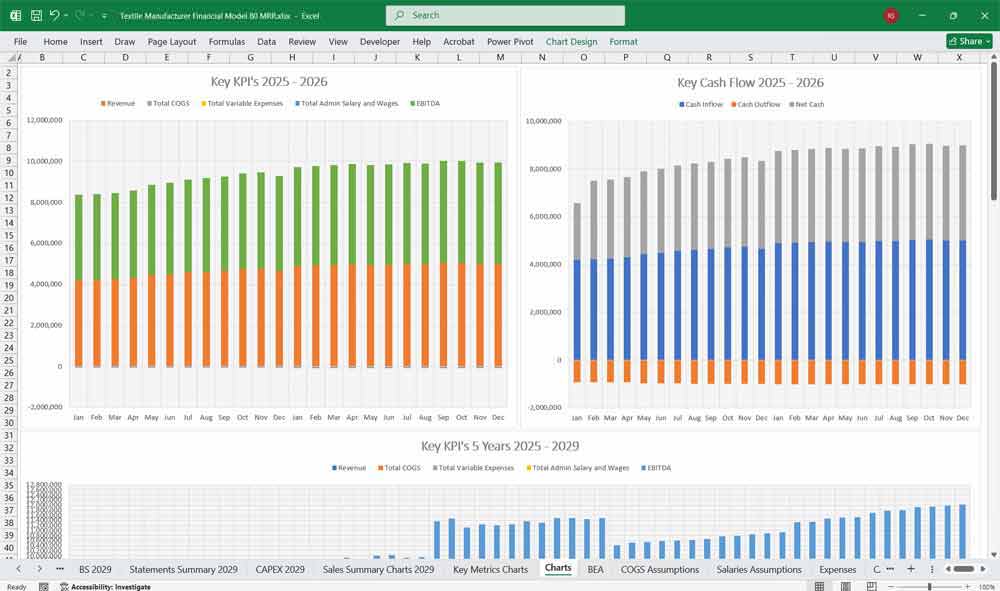

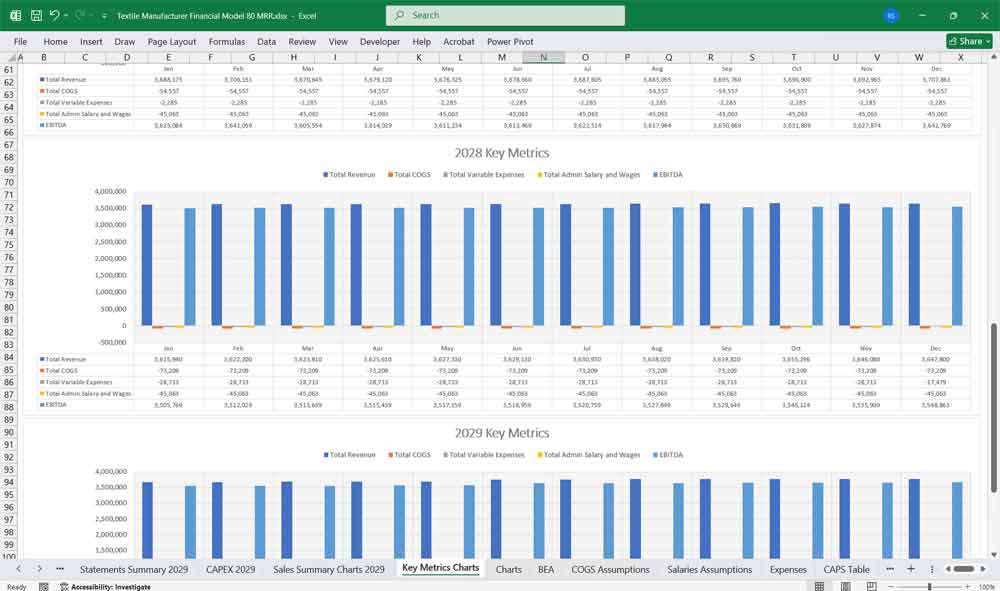

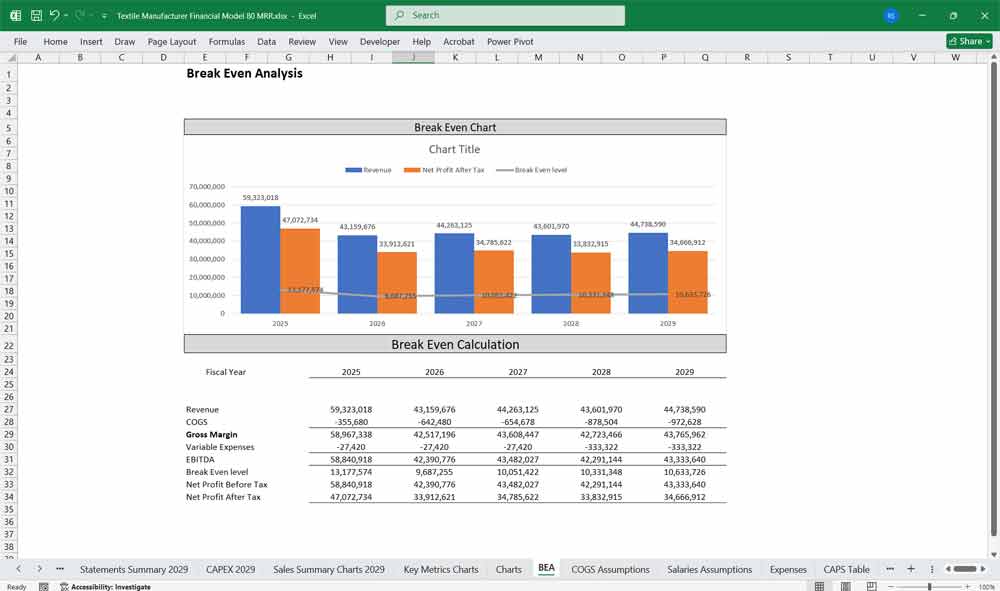

Income Statement (Profit & Loss Statement)

The Income Statement tracks revenues, expenses, and profitability.

With up to 80 product lines, revenue potential is high due to increased product variety. However, COGS rises due to complex production needs and larger procurement volumes. Operating expenses are also higher, with increased spending on marketing, staffing, and logistics.

Gross profit is calculated as Revenue minus COGS, and after deducting operating expenses, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is determined.

Depreciation is lower for the 40-product-line scenario due to fewer machines, while an 80-product-line setup incurs higher depreciation from additional equipment. Interest expenses also increase in the larger scenario due to greater capital requirements.

Net profit before tax is derived after deducting interest, and corporate taxes are applied accordingly. The final net profit is the remaining revenue after accounting for all expenses.

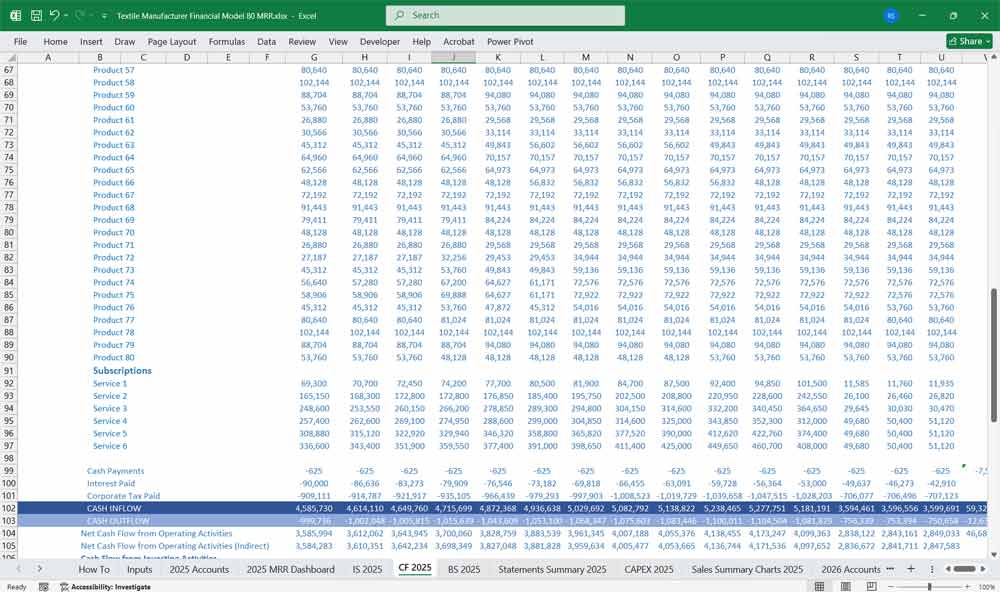

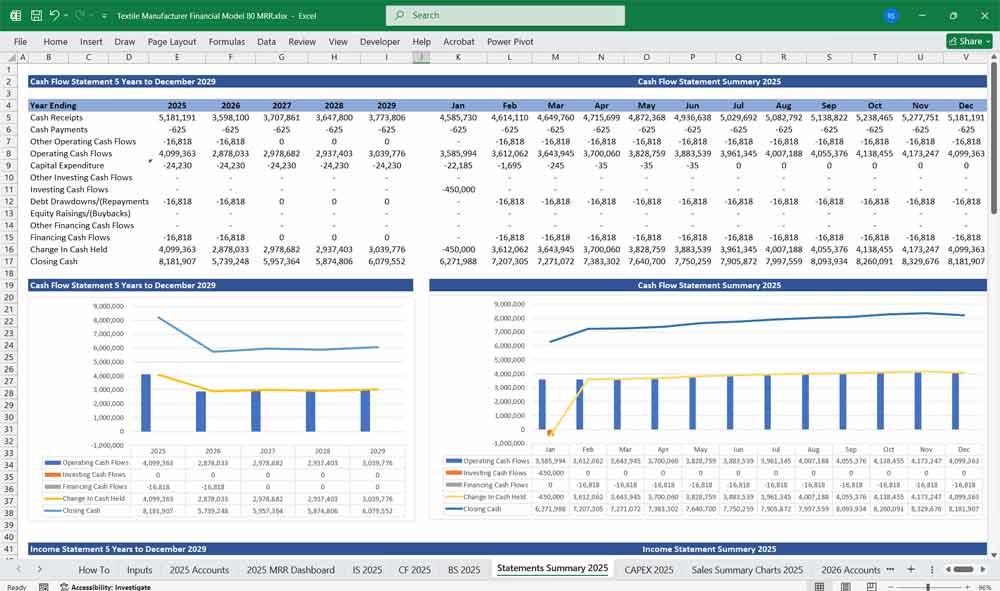

Textile Manufacturer Cash Flow Statement

The Cash Flow Statement tracks liquidity and operational cash movement.

For 80 product lines, operating cash flow is higher due to increased sales, but there are greater cash requirements for raw materials and inventory management.

Investing cash flow considers machinery and facility expansions. A smaller setup requires moderate capital investments, while a larger operation demands higher spending on new machines, warehouses, and technology upgrades.

Financing cash flow accounts for loans and equity financing. A 40-product-line manufacturer requires moderate financing, while an 80-product-line manufacturer relies on more substantial funding to support operations and growth.

The net cash flow position is positive if operational efficiency is maintained, but the larger setup faces greater capital intensity.

Operating Activities

Cash from Sales: Revenue collected from customers.

Cash Spent on COGS: Payments for raw materials, labor, and overheads.

Operating Expenses: Cash outflows for R&D, marketing, and G&A.

40 vs. 80 Product Lines: Higher cash inflows from increased sales, but higher outflows for production and operating costs.

Investing Activities

Capital Expenditures (CapEx): Investments in machinery, equipment, and factory expansion.

40 vs. 80 Product Lines: Higher CapEx may be required to support additional production lines.

Financing Activities

Debt Repayment: Principal repayments on loans.

Equity Financing: Cash inflows from investors.

Dividends: Cash outflows to shareholders.

Net Cash Flow

Net Cash Flow = Cash from Operating Activities + Investing Activities + Financing Activities.

Indicates the company’s liquidity position.

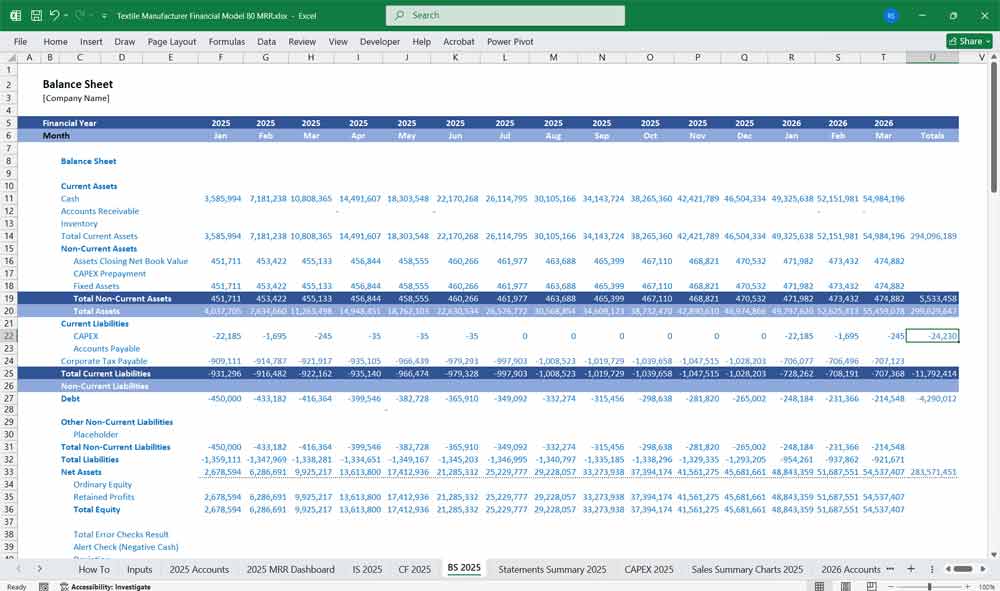

Textile Manufacturer Balance Sheet

The Balance Sheet provides an overview of assets, liabilities, and equity.

For a lower product-line business, assets include moderate cash reserves, accounts receivable from customers, and inventory with lower stock levels. Property, plant, and equipment investments are minimal, reflecting fewer machines and lower capital expenditure.

In an 80-product-line setup, assets increase significantly, with higher cash balances due to increased sales. Accounts receivable grow due to a broader customer base, while inventory expands to accommodate the diverse product range. Property and equipment investments are also higher due to additional machinery and infrastructure.

Liabilities include accounts payable for supplier payments, which remain lower in the smaller setup but increase in the larger one due to higher procurement needs. Loans and borrowings are moderate in the 40-product-line scenario but escalate in the 80-product-line scenario due to expansion financing.

Equity consists of retained earnings from accumulated profits and shareholder investments. The larger operation benefits from stronger equity due to increased revenue and profitability.

Assets

Current Assets:

Cash: Cash balance from the Cash Flow Statement.

Accounts Receivable: Revenue not yet collected from customers.

Inventory: Raw materials, work-in-progress, and finished goods.

Non-Current Assets:

Property, Plant, and Equipment (PP&E): Factory, machinery, and equipment (net of depreciation).

Intangible Assets: Patents, trademarks, and R&D investments.

40 vs. 80 Product Lines: Higher inventory and PP&E to support additional production.

Liabilities

Current Liabilities:

Accounts Payable: Unpaid bills to suppliers.

Short-Term Debt: Loans due within a year.

Non-Current Liabilities:

Long-Term Debt: Loans due after a year.

40 vs. 80 Product Lines: Higher liabilities may be required to finance expansion.

Equity

Shareholder Equity: Common stock, retained earnings, and additional paid-in capital.

40 vs. 80 Product Lines: Equity may increase if the company raises funds from investors.

Balance Sheet Equation

Assets = Liabilities + Equity.

Key Financial Metrics for a Textile Manufacturer

Production Capacity: Maximum output for 40 and 80 product lines.

Sales Growth: Projected growth rates for each product line.

Pricing Strategy: Average selling prices and discounts.

Cost Structure: Variable and fixed costs for production and operations.

Working Capital: Inventory turnover, accounts receivable, and accounts payable cycles.

Capital Expenditures: Investments in machinery and factory expansion.

Scenario Analysis

40 Product Lines:

Lower revenue but simpler operations.

Lower COGS and operating expenses.

Reduced need for CapEx and working capital.

80 Product Lines:

Higher revenue potential but increased complexity.

Higher COGS and operating expenses.

Greater need for CapEx and working capital.

Financial Ratios

Profitability Ratios: Gross margin, operating margin, net margin.

Liquidity Ratios: Current ratio, quick ratio.

Leverage Ratios: Debt-to-equity, interest coverage.

Efficiency Ratios: Inventory turnover, asset turnover.

Sensitivity Analysis

Test the impact of changes in key assumptions (e.g., raw material costs, sales volume, pricing) on the financial model.

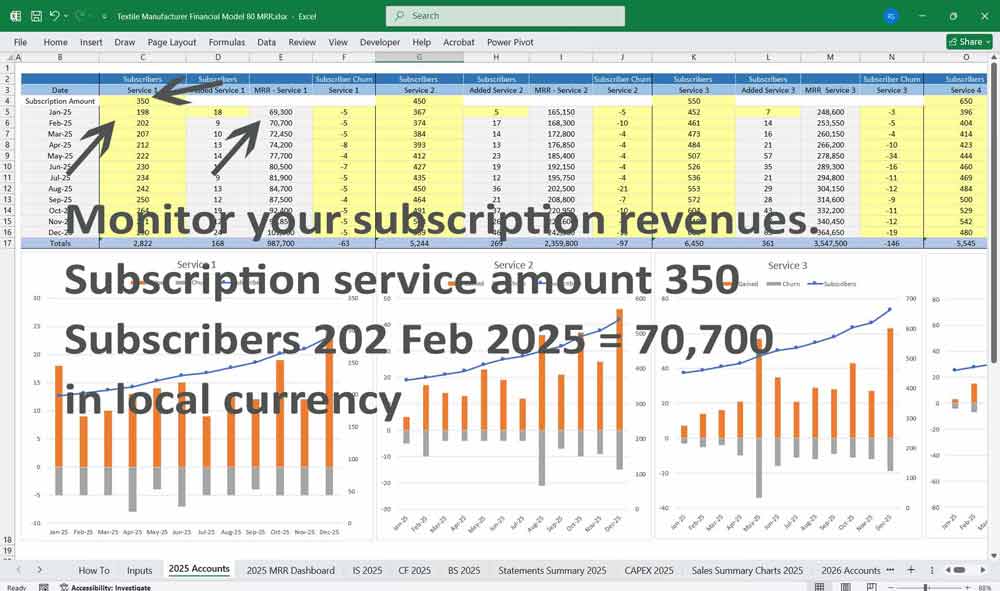

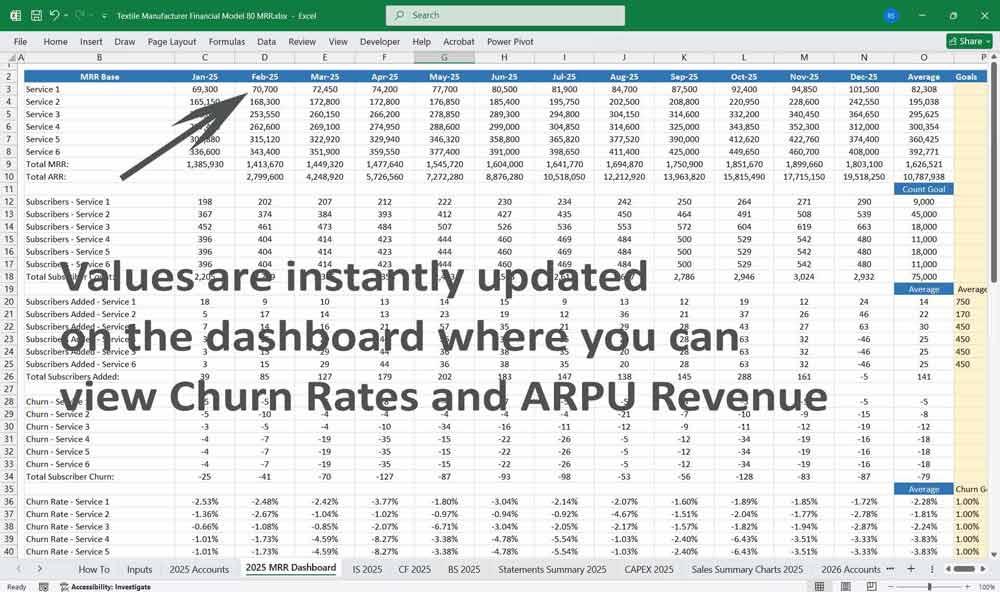

6-Tier Subscription Model for a Textile Manufacturer

This tiered subscription model is designed for wholesale buyers, fashion brands, retailers, and designers who need regular textile supplies with varying levels of customization, pricing, and service.

Each tier offers progressively better pricing, order flexibility, customization, and exclusive services.

Tier Structure & Overview

1. Basic Tier – “Starter” (For Small Businesses & Textile Startups)

- Target Audience: Small textile brands, boutique designers, and startups testing new collections.

- Subscription Fee: $49/month or $499/year.

- Minimum Order Quantity (MOQ): 50 meters per order.

- Discount on Fabrics: 5% off standard pricing.

- Customization: Limited to stock colors and fabrics.

- Delivery Time: Standard processing (15–20 days).

- Support: Email support only.

- Additional Benefits:

- Access to a basic textile fabric catalog.

- First-time consultation on fabric selection.

2. Growth Tier – “Professional” (For Expanding Brands & Small Textile Retailers)

- Target Audience: Mid-sized brands & retailers scaling up.

- Subscription Fee: $99/month or $999/year.

- Minimum Order Quantity (MOQ): 100 meters per order.

- Discount on Fabrics: 10% off standard pricing.

- Customization: Access to custom dyeing and printing on select fabrics.

- Delivery Time: 12–15 days.

- Support: Priority email support & limited phone support.

- Additional Benefits:

- Quarterly trend report on textile fabrics.

- Free swatches for 5 fabric types per quarter.

3. Business Tier – “Premium” (For Retail Textile Chains & Growing Designers)

- Target Audience: Established fashion textile brands & regional retailers.

- Subscription Fee: $249/month or $2,499/year.

- Minimum Order Quantity (MOQ): 200 meters per order.

- Discount on Fabrics: 15% off standard pricing.

- Customization: Full access to dyeing, printing, and texture finishing.

- Delivery Time: 10–12 days.

- Support: Dedicated account manager, email & phone support.

- Additional Benefits:

- Early access to new textile fabric collections.

- Free swatches for 10 textile fabric types per quarter.

- Exclusive access to limited edition fabrics.

- Factory visit invitations (1 per year).

4. Enterprise Tier – “Elite” (For Large Retailers & International Textile Brands)

- Target Audience: Large-scale fashion textile brands & distributors.

- Subscription Fee: $499/month or $4,999/year.

- Minimum Order Quantity (MOQ): 500 meters per order.

- Discount on Fabrics: 20% off standard pricing.

- Customization: Full access + priority production slot.

- Delivery Time: 8–10 days.

- Support: Dedicated account manager & express support.

- Additional Benefits:

- Complimentary sustainability consulting.

- Free shipping on bulk textile orders.

- Private label branding options.

- Exclusive pricing for custom textile weaves.

- Joint marketing opportunities.

5. Industrial Tier – “Corporate” (For Textile Distributors & Exporters)

- Target Audience: Textile wholesalers, and supply chain businesses.

- Subscription Fee: $999/month or $9,999/year.

- Minimum Order Quantity (MOQ): 1,000 meters per order.

- Discount on Fabrics: 25% off standard pricing.

- Customization: Exclusive textile fabric designs & private production runs.

- Delivery Time: 6–8 days.

- Support: 24/7 dedicated support team.

- Additional Benefits:

- Supply chain financing options.

- Custom packaging & branding.

- Factory audit reports & compliance documents.

- Exclusive networking events with textile manufacturers.

6. Ultimate Tier – “Bespoke” (For Luxury & High-End Textile Clients)

- Target Audience: High-end fashion houses & custom textile brands.

- Subscription Fee: Custom Pricing (Based on contract).

- Minimum Order Quantity (MOQ): Flexible, with made-to-order options.

- Discount on Fabrics: 30% off standard pricing.

- Customization: Fully personalized textiles, patterns, and production process.

- Delivery Time: 5–7 days, with priority scheduling.

- Support: VIP concierge service with direct factory access.

- Additional Benefits:

- Exclusive textile fabric development.

- Direct collaboration with textile designers.

- R&D partnership for new materials.

- Invitation to textile industry trade fairs & exclusive events.

- Personalized sustainability & supply chain strategy consulting.

Key Benefits of The Subscription Model Add-on

- Loyalty & Retention – Encourages long-term partnerships with textile buyers.

- Predictable Revenue Stream – Generates stable monthly or annual revenue.

- Customization & Scalability – Offers businesses flexibility based on their needs.

- Value-Added Services – Provides exclusive benefits like custom branding and R&D collaborations.

- Efficiency & Priority Service – Helps large-scale buyers secure priority manufacturing slots.

Key Takeaways for the Financial Model

This Textile Manufacturer financial model provides a comprehensive framework for analyzing the financial performance of the manufacturing process with 40 and 80 product lines. These templates are built using Excel and should be updated regularly to reflect actual performance and changing market conditions.

Download Link On Next Page