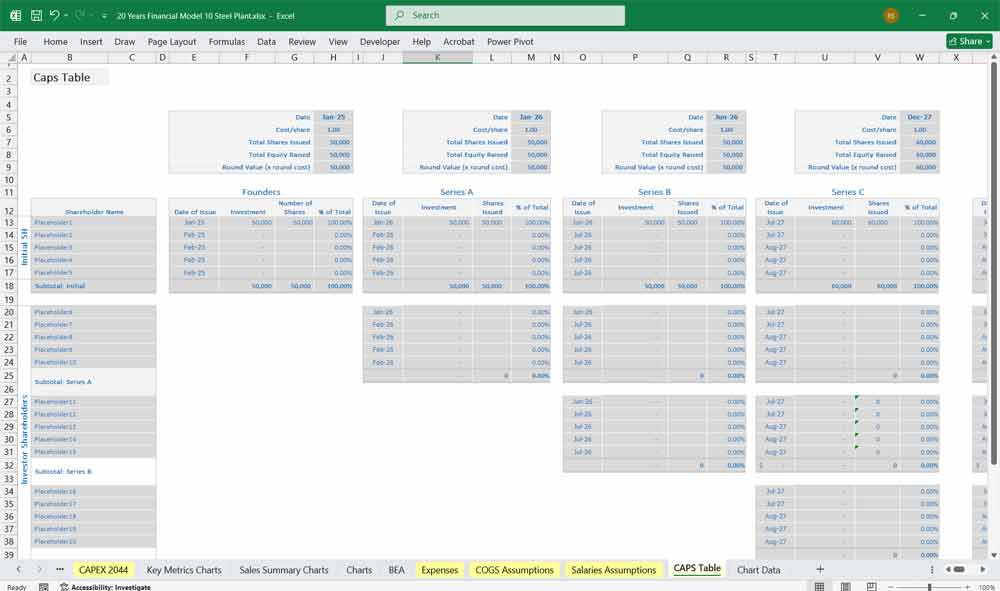

Steel Plant Financial Model

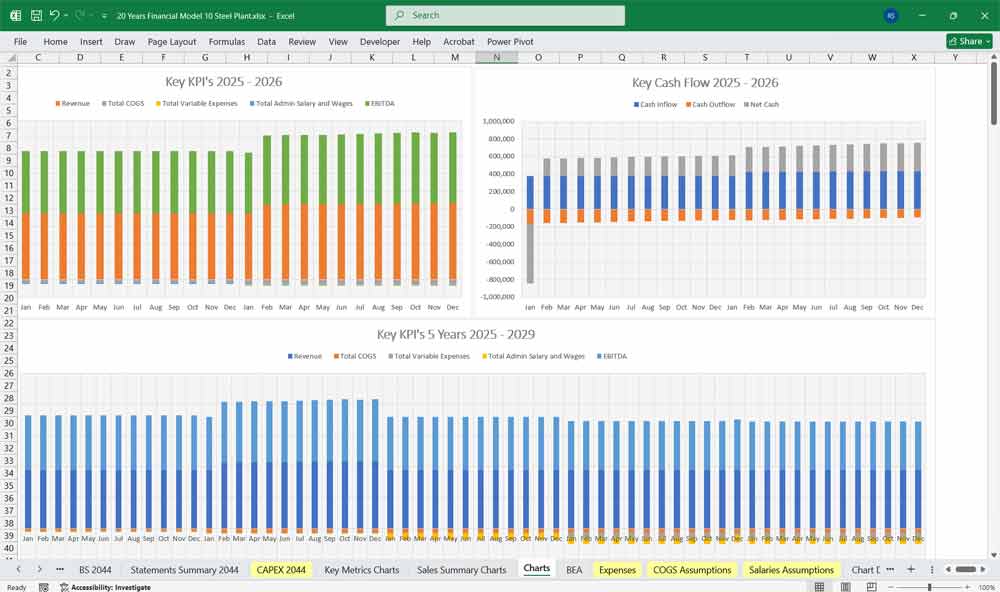

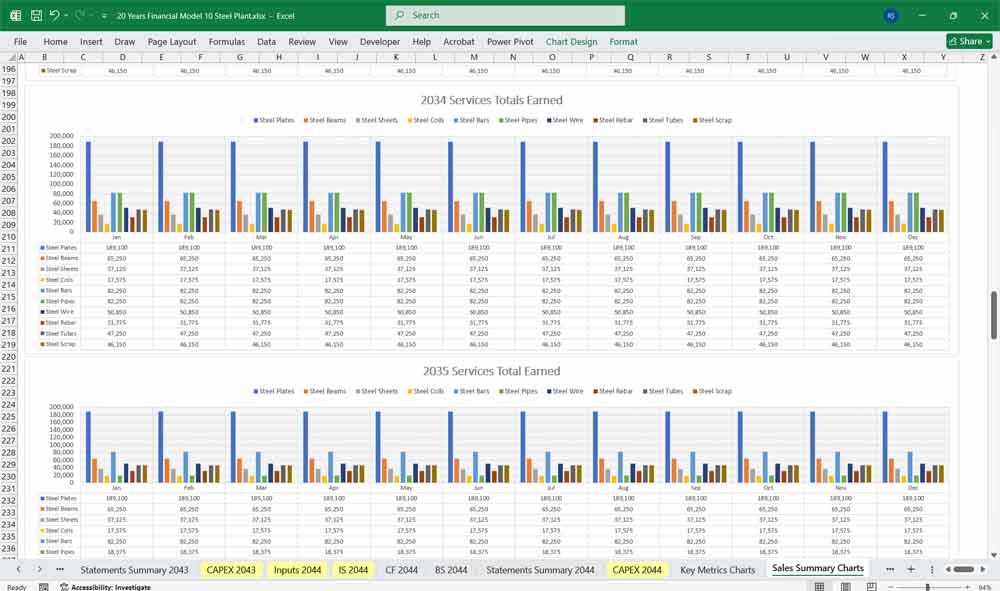

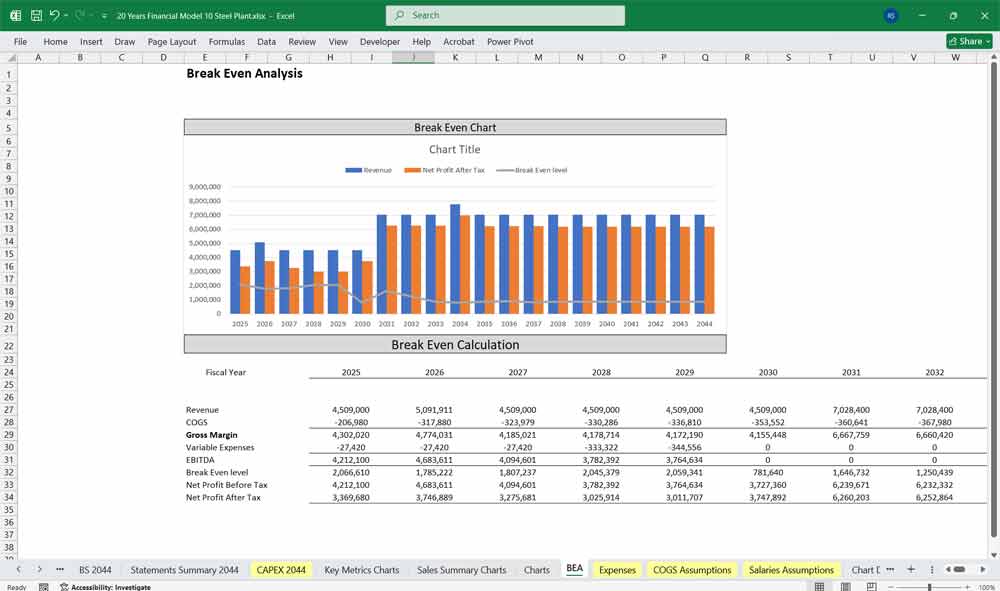

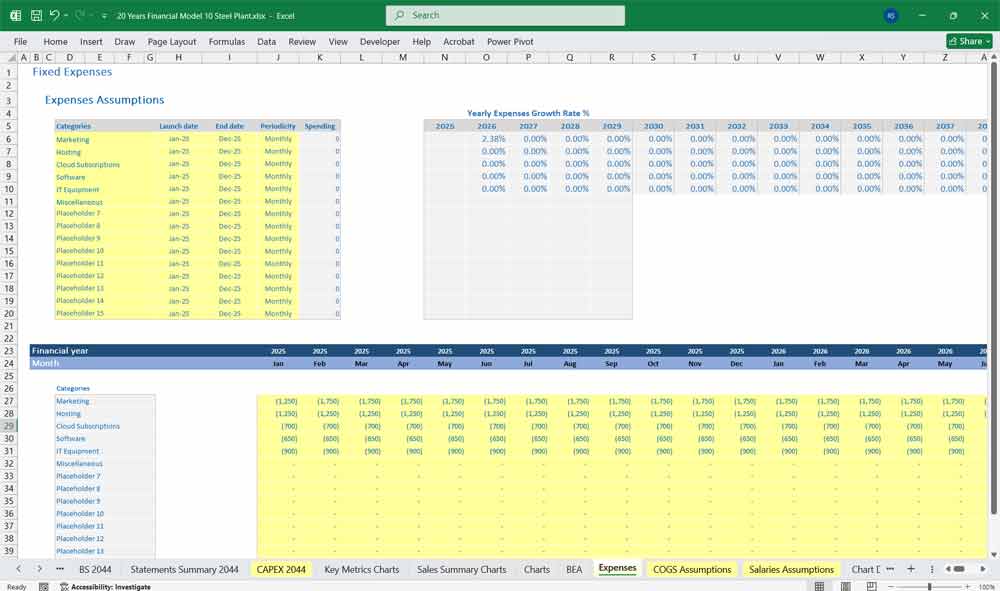

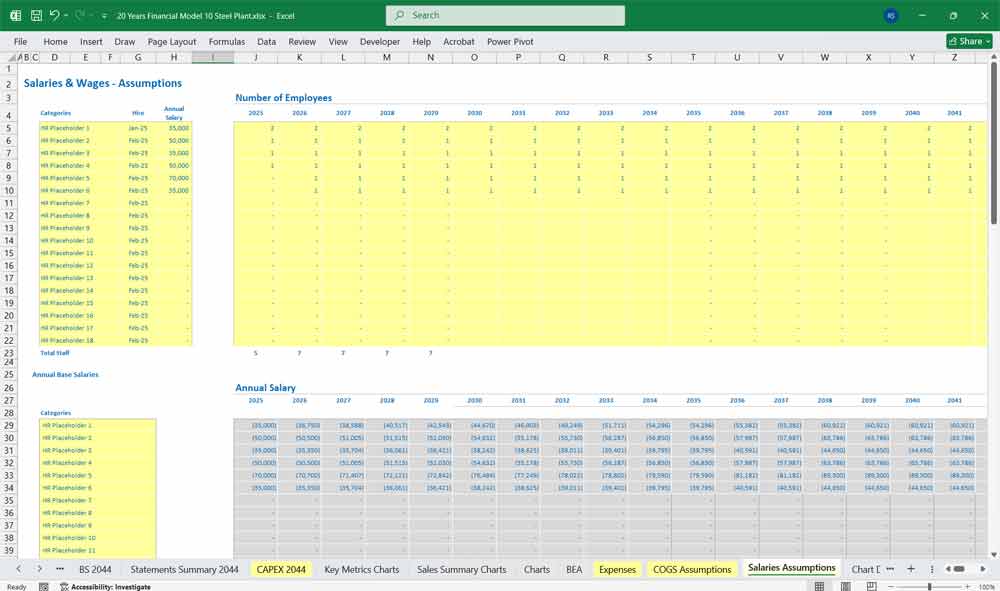

A very comprehensive 20-year 3 statement Excel Steel Plant Financial Model, includes the Income Statement, Cash Flow Statement, and Balance Sheet. Cost structures and financial statements to forecast the financial health of your Steel Plant. 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX Sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the specified revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets.

Financial Model for a Steel Plant

Covering key components such as the Income Statement, Cash Flow Statement, and Balance Sheet.

Revenue Projections

Production Capacity: Estimated annual steel production in tons.

Utilization Rate: Expected percentage of capacity utilization.

Sales Price per Ton: Pricing based on market trends.

Total Revenue:

Revenue=Production Output×Sales Price per Ton\text{Revenue} = \text{Production Output} \times \text{Sales Price per Ton}Revenue=Production Output×Sales Price per TonAdditional Revenue Streams:

By-products (slag, gases, etc.)

Scrap metal sales

Export incentives, subsidies (if applicable)

Cost Structure

A. Direct Costs (Cost of Goods Sold – COGS)

Raw Material Costs

Iron Ore

Coal/Coke

Scrap Metal

Fluxes (Limestone, Dolomite)

Ferroalloys

Energy Costs

Electricity

Gas & Fuel

Labor Costs

Plant Operations Workforce

Maintenance Crew

Manufacturing Overheads

Depreciation of plant & machinery

Repairs & Maintenance

Consumables (electrodes, refractories)

B. Operating Expenses (SG&A)

Administration Costs

Salaries of management & office staff

Legal & professional fees

Selling & Distribution Expenses

Freight & logistics

Marketing costs

Export duties & customs charges

Other Operational Costs

R&D for process improvements

ESG compliance & environmental penalties

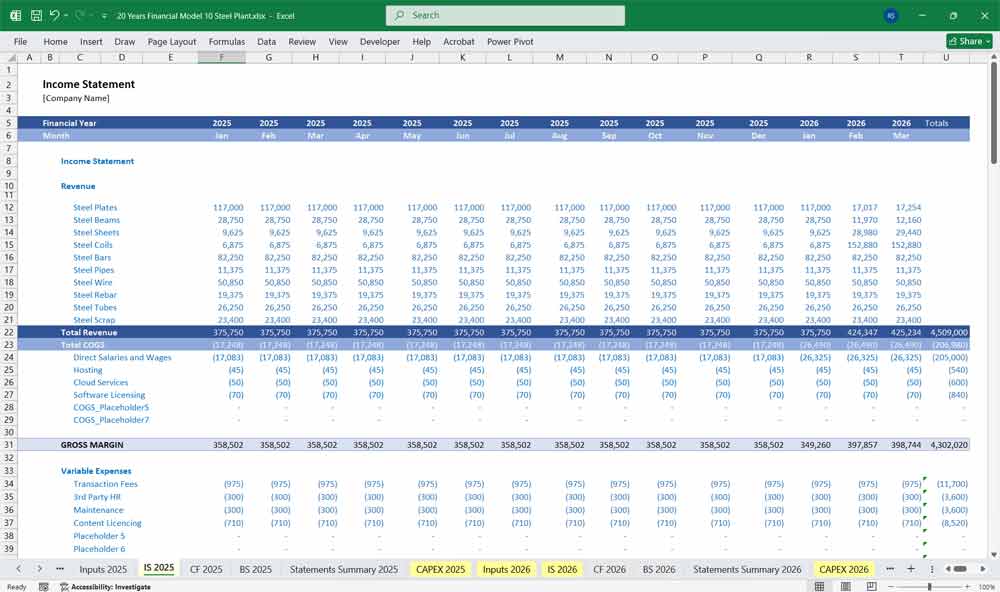

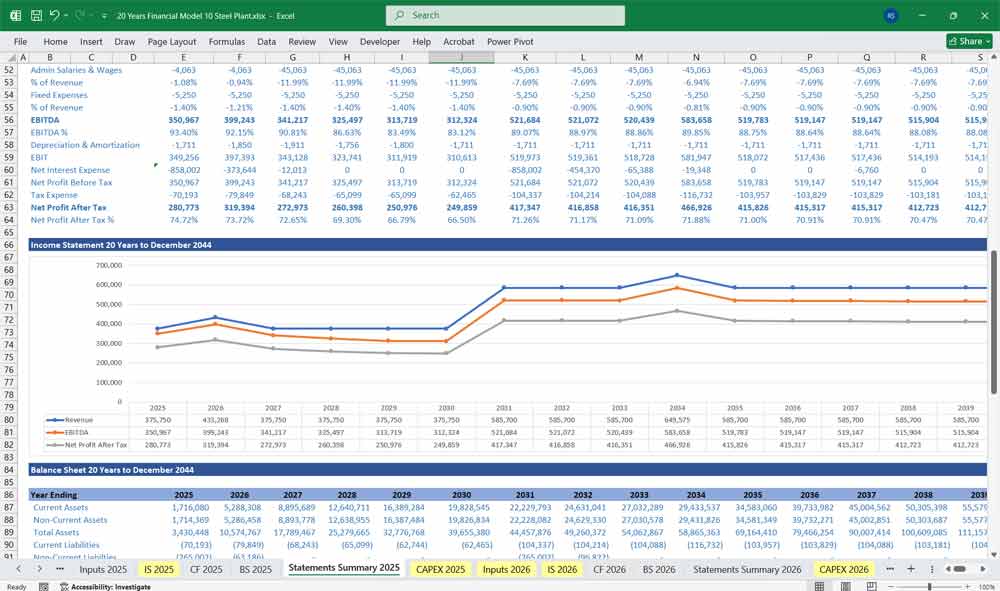

Income Statement (Profit & Loss Statement)

The Income Statement summarizes revenues, costs, and profitability over a given period (monthly/quarterly/annually).

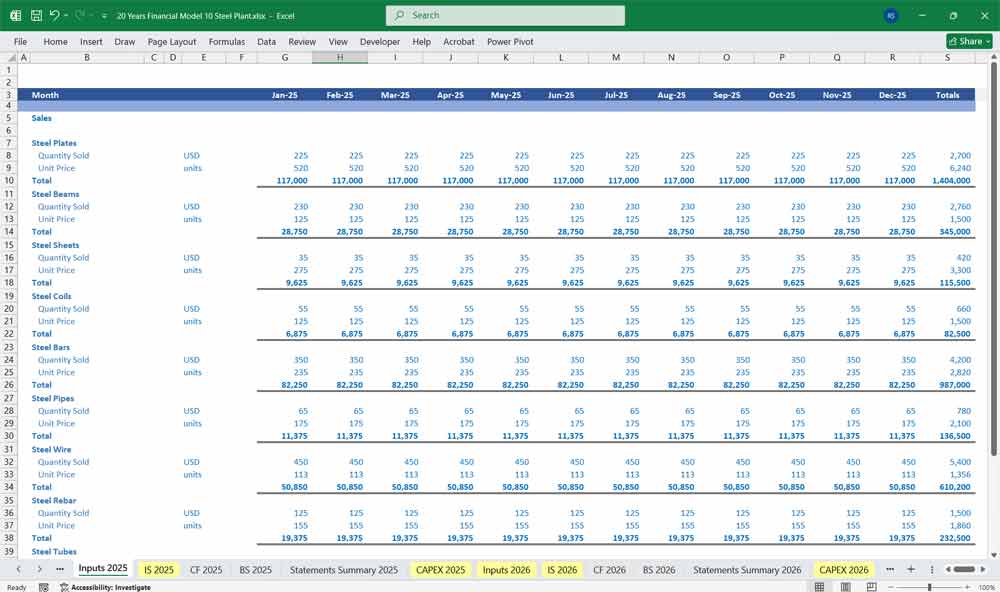

Revenue

Sales Volume (Tons) – Projected production and sales of steel products (e.g., HRC, CRC, rebars, wire rods).

Average Selling Price (ASP) per Ton – Based on market benchmarks (e.g., $/ton).

Total Revenue = Sales Volume × ASP

Cost of Goods Sold (COGS)

Raw Materials Cost (Iron ore, coking coal, scrap, ferroalloys) – Linked to commodity prices.

Energy & Utilities (Electricity, natural gas, water) – Variable cost per ton.

Labor Costs – Wages for plant workers, engineers, and maintenance staff.

Maintenance & Repairs – Scheduled and unscheduled maintenance expenses.

Depreciation – Straight-line or accelerated depreciation on plant & machinery.

Other Variable Costs (Refractories, chemicals, consumables).

Gross Profit = Revenue – COGS

Operating Expenses (OPEX)

Selling, General & Administrative (SG&A) – Salaries, marketing, office expenses.

Logistics & Freight – Transportation costs for raw materials and finished goods.

R&D & Quality Control – Product development and testing.

Regulatory & Compliance Costs – Environmental and safety compliance.

EBITDA = Gross Profit – OPEX

EBIT = EBITDA – Depreciation & Amortization

Interest & Taxes

Interest Expense – Cost of debt (loans, bonds).

Taxes – Corporate income tax (e.g., 25-30% depending on jurisdiction).

Net Income = EBIT – Interest – Taxes

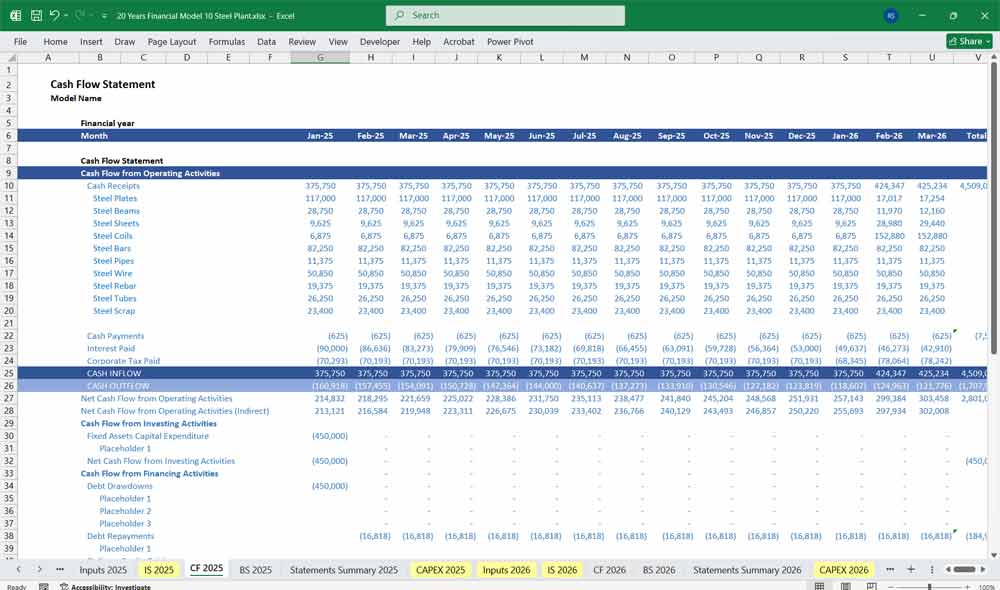

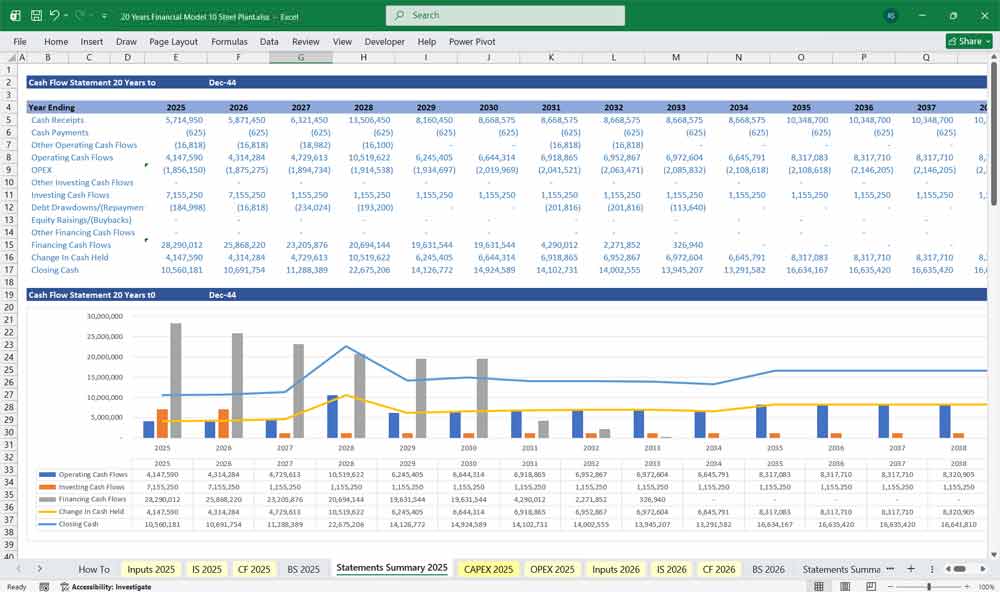

Steel Plant Cash Flow Statement

Tracks cash inflows and outflows from operations, investments, and financing.

Cash Flow from Operations (CFO)

Net Income (from Income Statement)

Adjustments for Non-Cash Items:

Depreciation & Amortization (added back)

Changes in Working Capital (inventory, receivables, payables)

Increase in Inventory = Cash Outflow

Increase in Receivables = Cash Outflow

Increase in Payables = Cash Inflow

CFO = Net Income + Depreciation – ΔWorking Capital

Cash Flow from Investing (CFI)

Capital Expenditures (CapEx)

New machinery, plant expansions, technology upgrades.

Maintenance CapEx vs. Growth CapEx.

Asset Sales (if any).

CFI = – CapEx + Asset Sale Proceeds

Cash Flow from Financing (CFF)

Debt Issuance / Repayment

Equity Issuance / Dividends Paid

Lease Payments

CFF = Debt Raised – Debt Repaid + Equity Issued – Dividends Paid

Net Cash Flow = CFO + CFI + CFF

Ending Cash Balance = Beginning Cash + Net Cash Flow

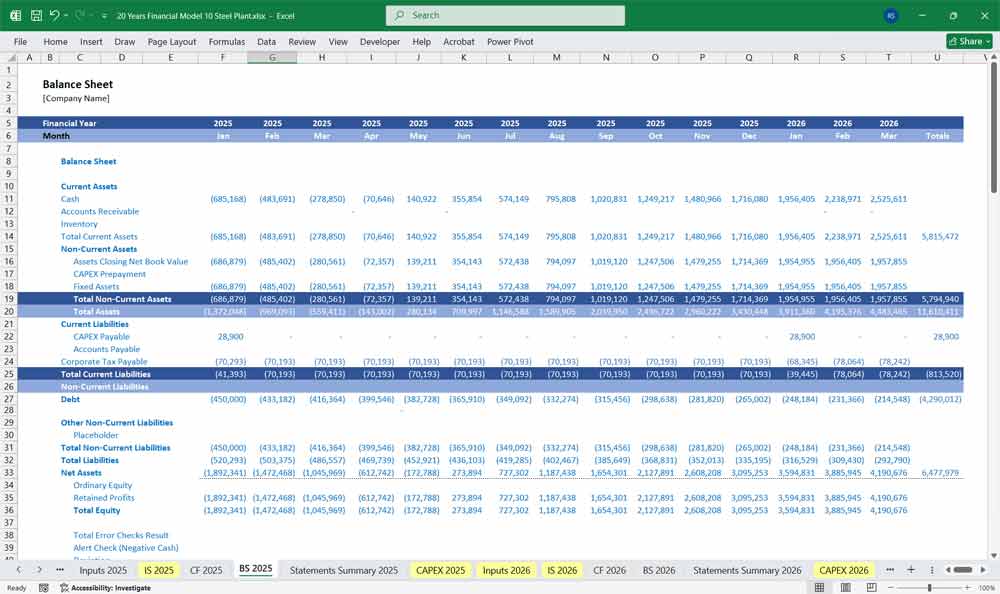

Steel Plant Balance Sheet

A snapshot of the company’s financial position at a given date.

Assets

Current Assets

Cash & Equivalents

Accounts Receivable (steel sales on credit)

Inventory (raw materials, WIP, finished goods)

Non-Current Assets

Property, Plant & Equipment (PP&E) – Net of depreciation

Intangible Assets (patents, licenses)

Liabilities

Current Liabilities

Accounts Payable (suppliers, contractors)

Short-Term Debt (working capital loans)

Accrued Expenses (wages, taxes payable)

Non-Current Liabilities

Long-Term Debt (bank loans, bonds)

Deferred Tax Liabilities

Shareholders’ Equity

Common Stock

Retained Earnings (accumulated profits)

Total Assets = Total Liabilities + Shareholders’ Equity

Key Assumptions & Drivers For a Steel Plant Financial Model

Production Capacity (tons/year) and utilization rate.

Commodity Price Fluctuations (iron ore, coal, steel prices).

Energy Costs (electricity, natural gas).

Debt Structure (interest rates, repayment schedule).

Working Capital Cycle (days inventory outstanding, days payable outstanding).

Sensitivity & Scenario Analysis

Base Case: Expected market conditions.

Bull Case: Higher steel prices, lower input costs.

Bear Case: Lower demand, rising energy/raw material costs.

Steel Plate Production Revenues in a Steel Plant Financial Model

Steel plate production revenues are a critical driver in the financial model of a steel plant, directly impacting profitability and cash flow. Revenue is calculated by multiplying the sales volume (in metric tons) by the average selling price (ASP) per ton, which fluctuates based on market demand, global steel prices, and product mix (e.g., thick plates for shipbuilding vs. thinner plates for construction). Key factors influencing revenue include capacity utilization rates (how much of the plant’s maximum output is being sold), contract vs. spot pricing (long-term agreements vs. volatile market sales), and input cost pass-through mechanisms (whether price adjustments reflect rising raw material costs). In the financial model, higher plate revenues improve gross margins and EBITDA, but must be weighed against variable costs (raw materials, energy) and fixed costs (labor, maintenance). Additionally, revenue growth may require working capital adjustments (higher receivables if sales are on credit) and potential CapEx for capacity expansion, affecting both the cash flow statement and balance sheet. Sensitivity analysis should test scenarios where plate prices drop or demand softens, assessing impacts on net income, debt coverage ratios, and overall valuation.

Steel Coil Production Revenues within a Steel Plant Financial Model

Steel coil production revenues play a pivotal role in the financial model of a steel plant, shaping profitability and cash flow dynamics. Revenue is derived from sales volume (in metric tons) multiplied by the average selling price (ASP) per ton, which varies by product type (hot-rolled coils, cold-rolled coils, galvanized coils) and market conditions (e.g., automotive demand, construction activity, export markets). Key revenue drivers include mill utilization rates (operating near full capacity boosts economies of scale), pricing mechanisms (contract-based vs. spot market sales), and value-added premiums (e.g., higher margins for specialty coated coils). In the financial model, rising coil revenues enhance gross profit and EBITDA, but must be balanced against volatile input costs (iron ore, scrap, energy) and fixed operational expenses (labor, maintenance, logistics). Since coil production often involves bulk sales, shifts in revenue can significantly impact working capital requirements (inventory turnover, receivables collection cycles) and cash conversion efficiency.

Steel Beam Production Revenues in a Financial Model

Steel beam production revenues are a key component of a steel plant’s financial model, directly influencing profitability and investment returns. Revenue is generated from sales volume (tons of beams) multiplied by the average selling price per ton, which depends on product specifications (e.g., I-beams, H-beams), market demand (construction, infrastructure projects), and regional pricing trends. Since beams are often sold through long-term contracts, revenues may be more stable than commodity steel products, but margins are sensitive to raw material costs (scrap, iron ore) and production efficiency (rolling mill yields, energy consumption). In the financial model, higher beam sales improve gross profit, but fixed costs (labor, equipment maintenance) and working capital needs (inventory buildup, project-based payment terms) must be carefully managed. Scenario analysis should assess the impact of construction market cycles and input cost inflation on cash flow and debt coverage ratios, particularly if the plant relies on debt financing for heavy mill equipment.

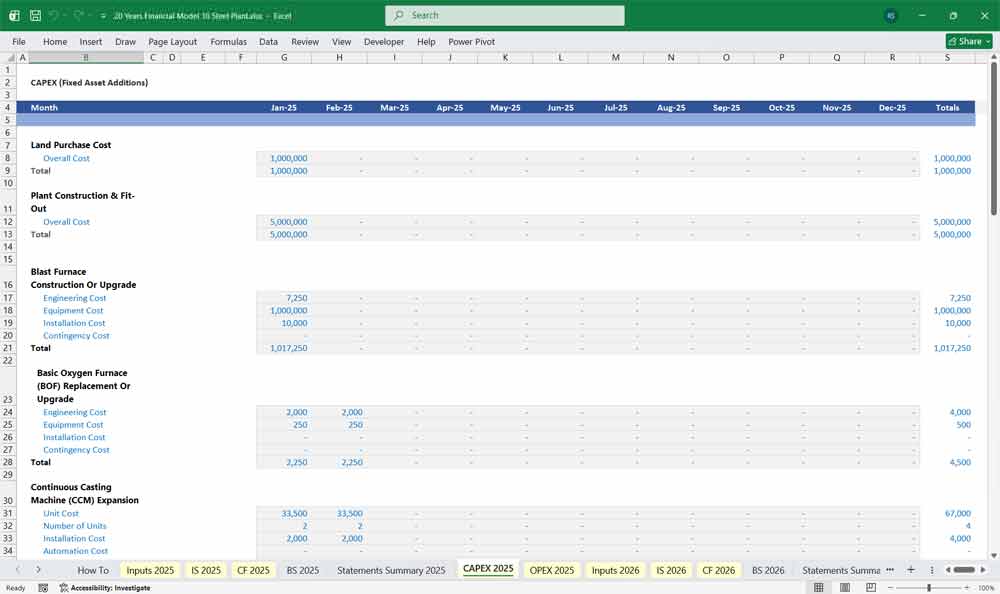

Blast Furnace Construction/Upgrade CAPEX in a Steel Plant Financial Model

The construction or upgrade of a steel plant blast furnace represents a major capital expenditure (CAPEX) in a steel plant’s financial model, significantly impacting cash flow, financing needs, and long-term profitability. A new blast furnace may cost 1–1–2 billion depending on capacity (e.g., 3–5 million tons/year) and technology (e.g., hydrogen-ready furnaces), while upgrades (relining, emissions controls) may range from $200–500 million. This CAPEX is typically amortized over 15–25 years, affecting depreciation and EBITDA margins. In the financial model, the investment is reflected in the balance sheet (PP&E increase) and cash flow statement (large upfront outlay), often requiring debt financing or equity raises. Post-construction, benefits include higher production efficiency, lower operating costs per ton, and compliance with environmental regulations, but the project must be stress-tested for construction delays, cost overruns, and fluctuating iron ore/coking coal prices to ensure ROI meets hurdle rates.

Continuous Casting Machine (CCM) Expansion CAPEX in a Steel Plant Financial Model

The expansion or modernization of a Continuous Casting Machine (CCM) represents a strategic capital expenditure (CAPEX) in a steel plant’s financial model, enhancing production efficiency, yield, and product quality. A new CCM line or upgrade typically requires $50–200 million, depending on capacity (e.g., 1–3 million tons/year) and technology (e.g., thin-slab casting, dynamic soft reduction). This CAPEX is capitalized on the balance sheet (PP&E increase) and depreciated over 10–20 years, while the cash flow statement reflects the upfront investment, often financed through debt or internal cash reserves. Post-expansion benefits include higher throughput, reduced energy costs (vs. traditional ingot casting), and improved slab/billet quality, boosting steel plant margins. However, the financial model should account for ramp-up delays, maintenance costs, and potential downtime during installation, ensuring the projected IRR meets the plant’s investment criteria. Sensitivity analysis should assess impacts from demand fluctuations and scrap/raw material price volatility on payback periods.

Final Notes on the Financial Model

20 Year Financial Model for a Steel Plant

- Scenario Analysis: Create best-case, base-case, and worst-case projections.

- Break-even Analysis: Determine sales volume required to cover fixed & variable costs.

- Sensitivity Analysis: Assess how changes in raw material costs, pricing, or demand impact profitability.

This structured model, along with other financial templates, helps a 3D manufacturing service address a broad market spectrum, offering the right balance between cost, production capacity, support, and customization at each subscription level.

Download Link On Next Page