Sports Nutrition Financial Model

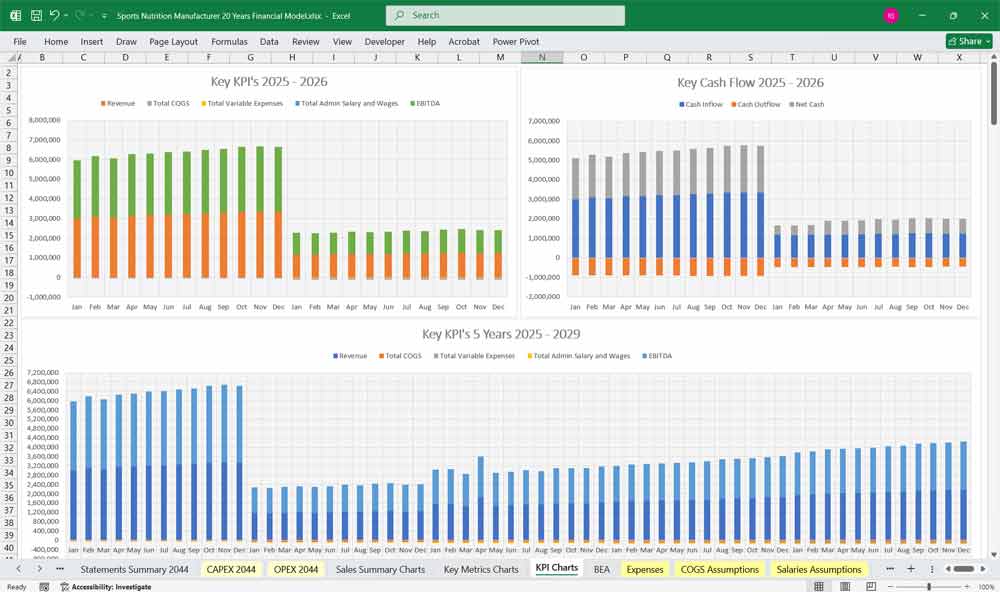

This 20-Year, 3-Statement Excel Sports Nutrition Manufacturer Financial Model includes revenue streams from 80 product lines and order subscriptions, with cost structures, and financial statements to forecast the financial health of your sports nutrition company.

20-Year Financial Model for a Sport Nutrition Manufacturer

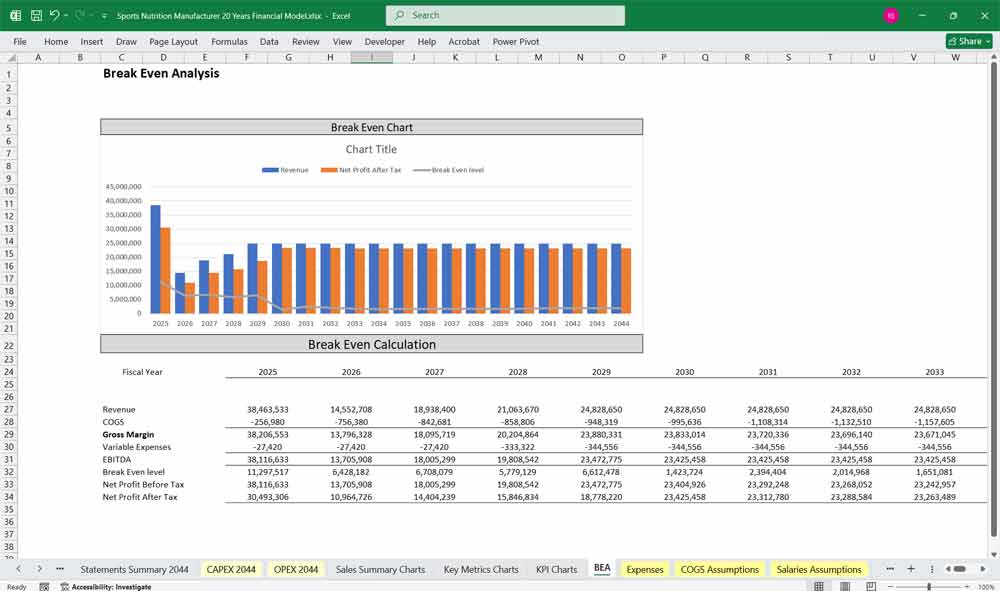

This very extensive 20 Year Nutrition Model involves detailed revenue projections, cost structures, capital expenditures, and financing needs. This model provides a thorough understanding of the financial viability, profitability, and cash flow position of your business.

Includes: 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the specified revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets. Over 130 Excel Spreadsheets of financial data to monitor.

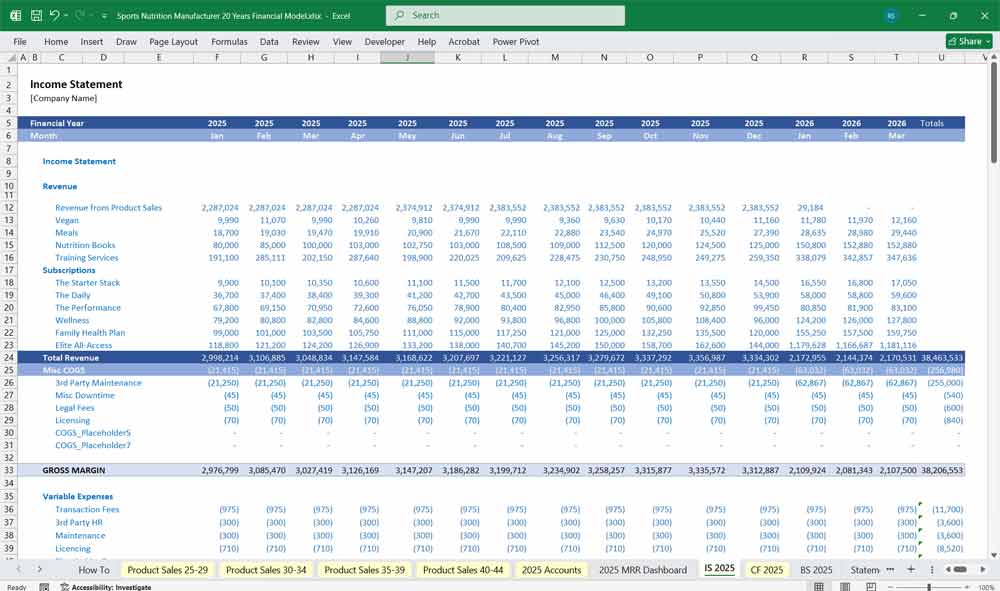

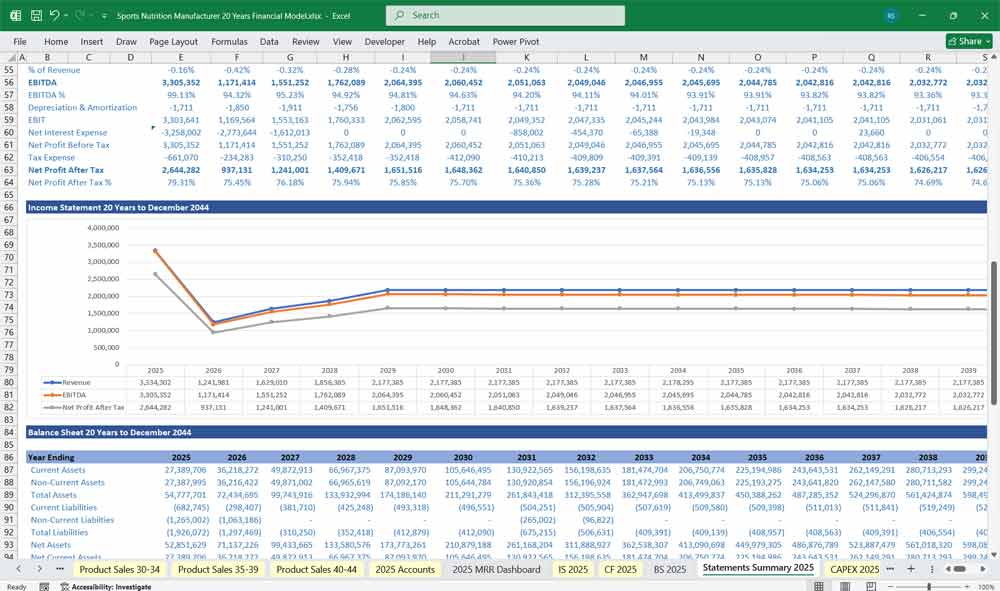

Income Statement (P&L)

The income statement projects revenues, costs, and profits over a specific period (monthly and annually).

A. Revenues

Product Sales by Category

Protein Powders

Energy Drinks & Shots

Performance Snacks & Bars

Vitamins & Supplements

Sales Channels

Direct-to-Consumer (e-commerce, brand website, subscriptions)

Retail (sports stores, supermarkets, gyms)

Wholesale/Distributors

International Sales

B. Cost of Goods Sold (COGS)

Raw Materials (whey protein, plant-based protein, amino acids, sweeteners, flavorings, packaging materials)

Manufacturing Costs (contract manufacturing or in-house plant operations, utilities, depreciation of equipment)

Logistics & Freight-in (cost to bring raw materials into the factory)

Quality Assurance & Compliance

➡ Gross Profit = Revenues – COGS

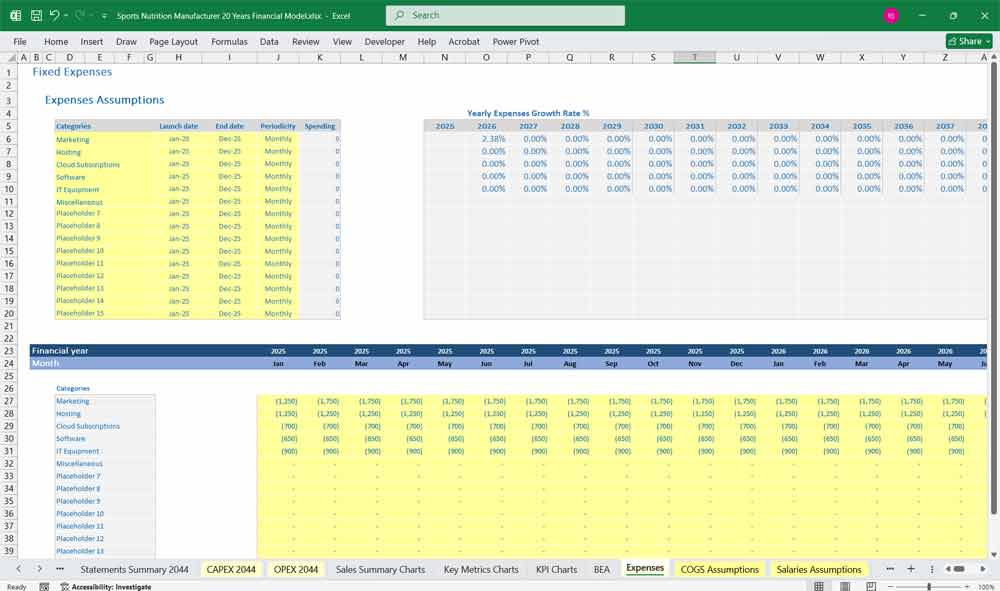

C. Operating Expenses (OPEX)

Selling & Marketing

Athlete Sponsorships & Influencer Deals

Digital Advertising (Google, Facebook, Instagram, TikTok)

Sampling Programs, Events, and Expos

Distribution & Logistics (freight-out, warehousing, fulfillment fees)

General & Administrative (G&A)

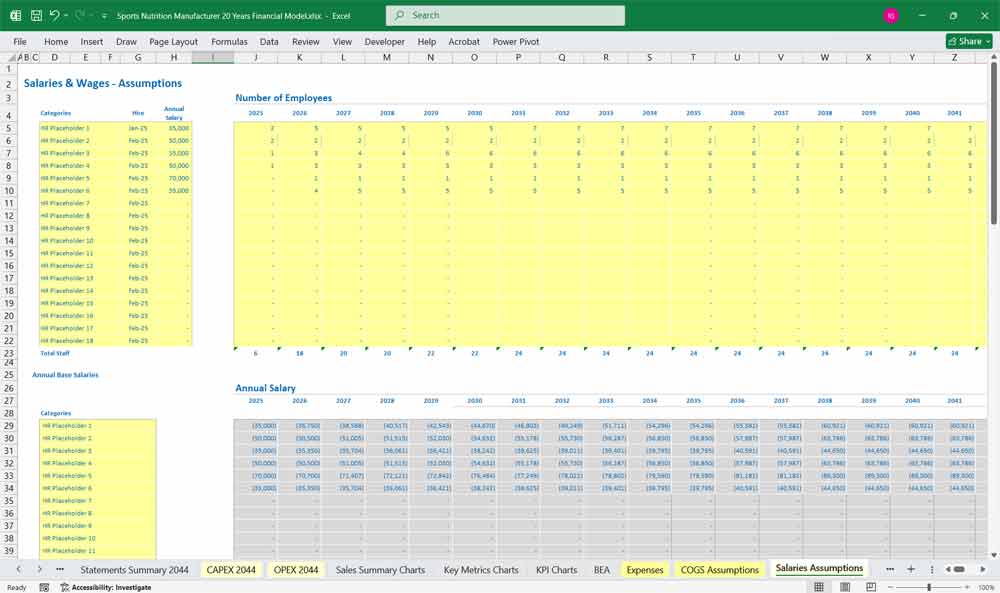

Salaries & Wages (management, R&D, admin staff)

Rent, Insurance, Office Expenses

IT Systems, ERP/CRM, Software Licenses

Research & Development (R&D)

New product formulation

Testing, certifications (e.g., NSF, Informed Sport)

EBITDA = Gross Profit – OPEX

D. Other Expenses

Depreciation & Amortization (manufacturing equipment, product formulation costs)

Interest Expense (on loans, working capital lines of credit)

Taxes

Net Income = EBITDA – D&A – Interest – Taxes

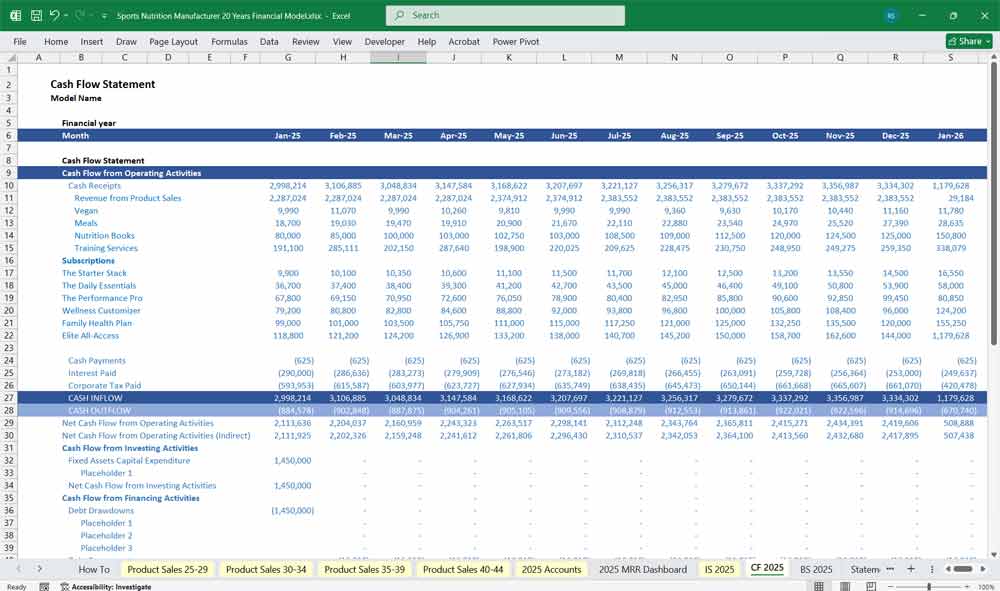

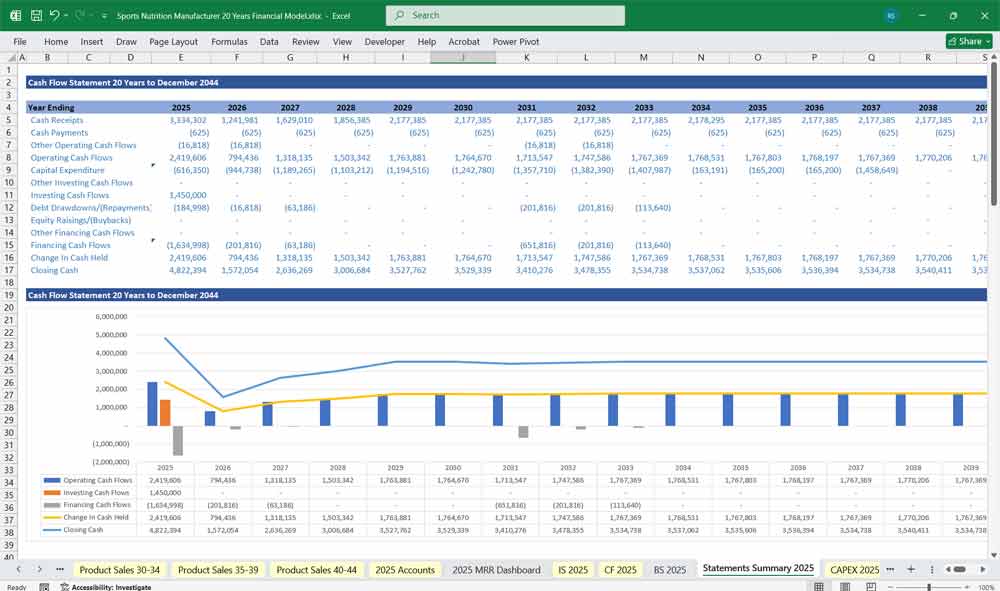

Sports Nutrition Manufacturer Cash Flow Statement

The cash flow statement translates profits into actual liquidity, showing how cash moves through operations, investments, and financing.

A. Cash Flow from Operations

Net Income (from income statement)

Non-Cash Adjustments

Depreciation & Amortization

Changes in Inventory Valuation

Changes in Working Capital

Accounts Receivable (customer payments timing, wholesale contracts)

Inventory (raw materials & finished goods buildup)

Accounts Payable (supplier credit terms)

Accrued Expenses (marketing campaigns, wages payable)

Operating Cash Flow = Net Income + Non-Cash Adjustments ± Working Capital Changes

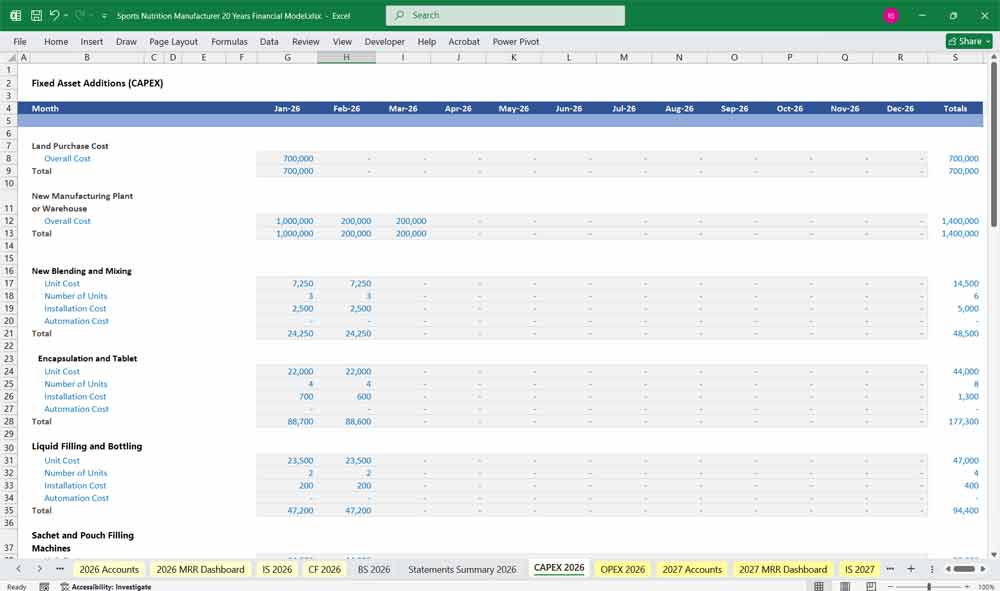

B. Cash Flow from Investing

Capital Expenditures (CapEx)

New manufacturing equipment

R&D lab setup

Warehouse expansion

Intangible Investments

Trademark/Brand Development

New product formulations

Acquisitions/Investments (if expanding via buying smaller nutrition brands)

Investing Cash Flow = Cash Outflows (CapEx, acquisitions) – Cash Inflows (asset sales, if any)

C. Cash Flow from Financing

Debt Issuance or Repayment (bank loans, working capital lines, bonds)

Equity Financing (venture capital, IPO proceeds, private placement)

Dividend Payments or Share Buybacks (if mature stage)

Financing Cash Flow = New Financing – Repayments – Dividends

D. Net Change in Cash

Total Cash Flow = Operating CF + Investing CF + Financing CF

Closing cash balance rolled into the Balance Sheet.

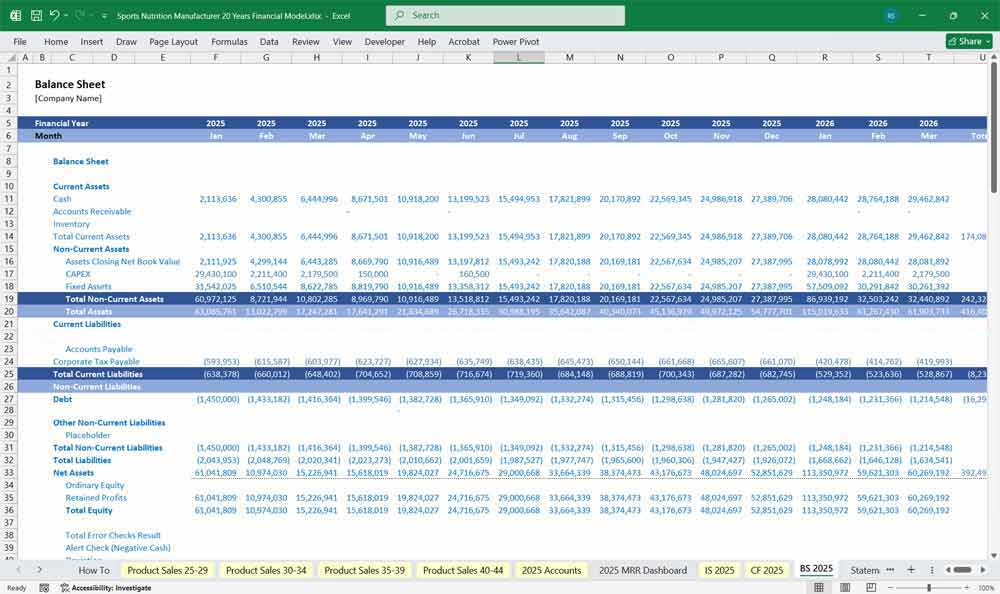

Sports Nutrition Manufacturer Balance Sheet

The balance sheet represents the company’s financial position at a point in time.

A. Assets

Current Assets

Cash & Cash Equivalents

Accounts Receivable (from retail partners, distributors, and online payment processors)

Inventory

Raw Materials (protein bases, packaging, additives)

Work-in-Progress

Finished Goods (products ready for shipment)

Prepaid Expenses (insurance, advertising contracts)

Non-Current Assets

Property, Plant & Equipment (manufacturing equipment, warehouses, offices)

Intangibles (patents, trademarks, product formulations, brand value)

Investments (subsidiaries, joint ventures, equity stakes in distributors)

B. Liabilities

Current Liabilities

Accounts Payable (suppliers, co-manufacturers)

Accrued Expenses (salaries payable, marketing campaign accruals)

Short-Term Debt (working capital loans, credit lines)

Non-Current Liabilities

Long-Term Debt (bank loans, bonds)

Lease Liabilities (warehouses, equipment financing)

Deferred Tax Liabilities

C. Equity

Paid-In Capital (from founders, investors, private equity)

Retained Earnings (accumulated profits reinvested into business)

Other Reserves (currency translation, revaluation reserves if applicable)

Assets = Liabilities + Equity

Key Financial Metrics for a Sports Nutrition Manufacturer

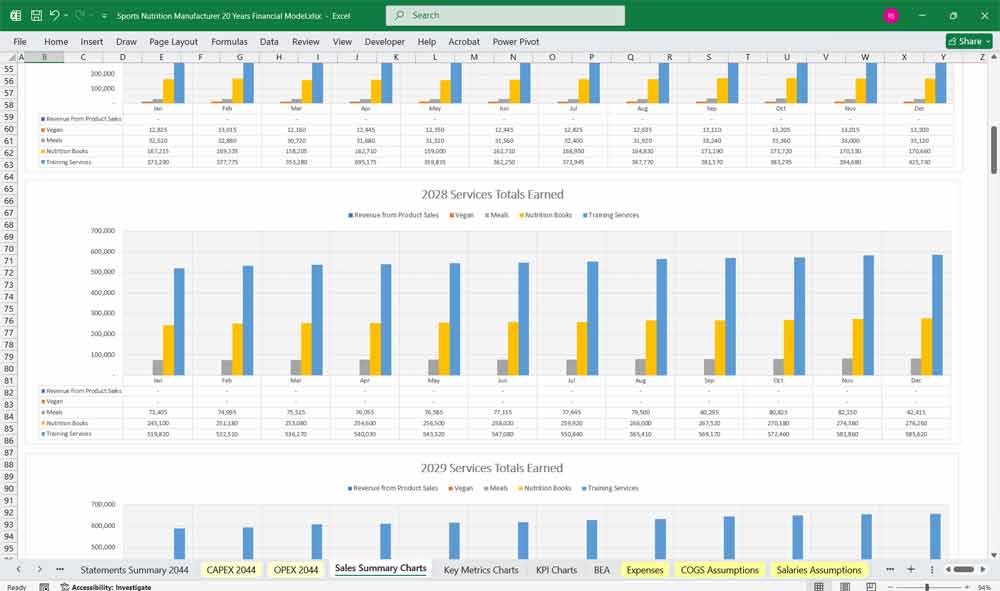

Revenue Metrics

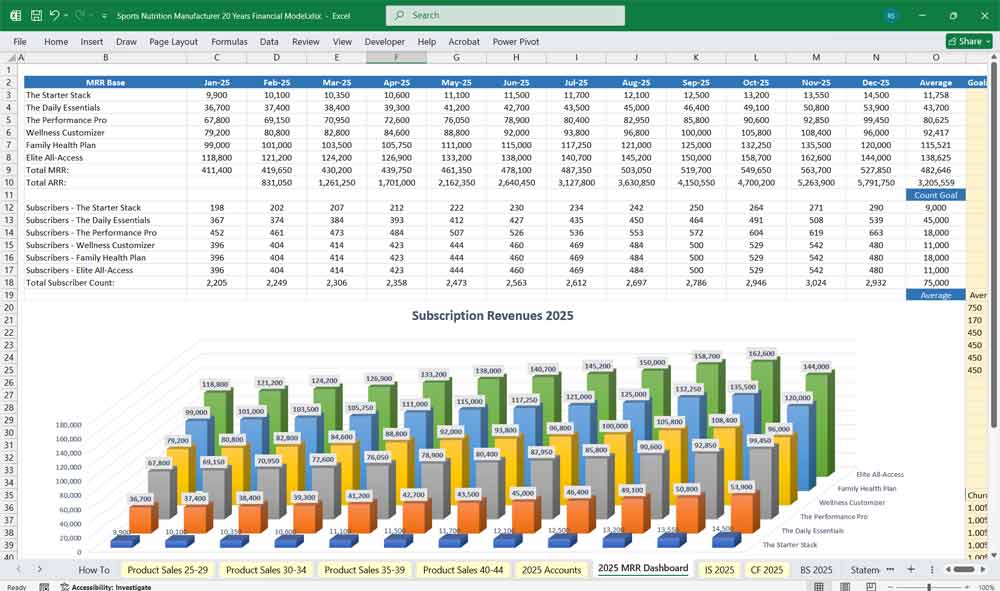

Monthly Recurring Revenue (MRR): Predictable income from ongoing services like colocation, cloud hosting, or managed services.

Annual Recurring Revenue (ARR): Yearly equivalent of MRR, providing a long-term revenue outlook.

Revenue per sale from 80 product lines: Income generated per item sale.

Cost Metrics

Capital Expenditure (CapEx): Initial investment in New Blending and Mixing Machinery and Sachet and Pouch Filling Machines, etc.

Operational Expenditure (OpEx): Ongoing costs, Personnel Costs, Wholesale Supplies and Materials.

Cost per Sale: Total cost of item and distribution of saleable items.

Power Usage Effectiveness (PUE): Ratio of total energy used to energy delivered to Manufacturing equipment (lower PUE = better efficiency).

6 Subscription Tier Ideas for a Sports Nutrition Supplements Manufacturer

Here are six subscription tier ideas for a nutrition supplements manufacturer, designed to offer value to different types of customers. Already added to the model, but all are fully editable.

1. The Starter Stack

This tier is perfect for new customers or those looking for a simple, single-product subscription. It’s an easy entry point to get people familiar with your products without a high commitment.

Pricing: One product subscription, such as a monthly supply of protein powder or a multivitamin.

Benefits: A small discount (e.g., 10%) on the single product, flexible delivery dates, and a welcome guide.

Bonus Idea: Offer a “starter kit” with a shaker bottle or pill organizer for the first shipment.

2. The Daily Essentials

Targeting customers who want to cover their basic nutritional needs. This tier bundles a few complementary, everyday supplements.

Pricing: A bundle of 2–3 core products, like a multivitamin, fish oil, and a probiotic.

Benefits: A more significant discount (e.g., 15–20%) on the bundled products, plus educational content on the benefits of each supplement.

Bonus Idea: Include a “cheat sheet” with suggested timing for each supplement.

3. The Performance Pro

This tier is designed for serious athletes and fitness enthusiasts who need a comprehensive stack to support their training goals.

Pricing: A premium bundle of 4–5 specialized products, such as protein powder, pre-workout, creatine, and BCAAs.

Benefits: A substantial discount (e.g., 25%), early access to new products, and a complimentary “Pro-Level” workout or nutrition guide.

Bonus Idea: Offer a limited-edition t-shirt or gym bag with the first delivery.

4. The Wellness Customizer

For customers who want a tailored approach to their health. This tier allows them to build their own supplement stack from a curated selection.

Pricing: Tiered pricing based on the number of products selected (e.g., choose any 3 for X price, any 5 for Y price).

Benefits: The flexibility to change products each month based on their needs, plus a free one-on-one consultation with a registered dietitian or nutritionist once a year.

Bonus Idea: Provide a short quiz on the website to help them select their initial product combination.

5. The Family Health Plan

This tier is perfect for households where multiple people use supplements. It provides a convenient and cost-effective way to get products for the entire family.

Pricing: A bulk subscription with a larger quantity of popular products or the option to mix and match from a family-friendly selection.

Benefits: The best per-unit price, an exclusive “Family Health” e-book with recipes and wellness tips, and free shipping.

Bonus Idea: Include a kid-friendly product, like a chewable vitamin, as a first-shipment bonus.

6. The Elite All-Access

This is your top-tier offering for the most loyal and high-value customers. It provides the ultimate convenience and exclusive benefits.

Pricing: A premium monthly fee that includes a custom selection of products.

Benefits: All products at cost or a massive discount, a dedicated account manager, quarterly check-ins with a nutrition expert, and exclusive access to new and limited-run products before anyone else.

Bonus Idea: Offer a branded subscription box with premium packaging and a personalized note each month.

Additional Considerations in the Model

Scenario Analysis: Seasonal sales spikes (New Year fitness goals, summer, competition seasons).

Sensitivity Analysis: Impact of raw material cost swings (e.g., whey protein prices), marketing spend efficiency, and distribution margin shifts.

KPIs for Sports Nutrition Industry:

Gross Margin % (key driver due to raw material volatility)

Marketing Spend as % of Sales

Inventory Turnover (shelf-life sensitivity of products)

Customer Acquisition Cost (CAC) & Lifetime Value (LTV) for D2C

EBITDA Margin

Benefits of a 20-year financial model For A Sports Nutrition Company

provides long-term visibility into the growth trajectory of a sports nutrition manufacturer. It allows the company to project revenues across different product categories—such as protein powders, energy drinks, and supplements—while accounting for changing consumer preferences and evolving distribution channels. By extending the time horizon, management can better anticipate when to expand production capacity, enter new markets, or diversify product lines.

Better Capital Planning For Your Sports Nutrition Company

Such a model also helps in capital planning and investment decisions. A manufacturer may require significant upfront spending on production facilities, equipment, and R&D. A 20-year outlook enables the business to assess when these investments will pay off and how to balance them with financing strategies. It also provides clarity on when external funding, whether through equity or debt, may be needed to support growth without straining liquidity.

Long Term View For Sports Nutrition Manufacturing

From a risk management perspective, a long-term model allows the company to test various scenarios such as raw material cost fluctuations, supply chain disruptions, or regulatory changes. By running sensitivity analyses, management can understand how resilient the business is under different market conditions. This foresight helps in developing contingency strategies and building financial buffers to safeguard against volatility in the sports nutrition industry.

20 Years of Sports Nutrition Manufacturing Projections

Finally, a 20-year model is a powerful tool for stakeholder communication. Investors, lenders, and strategic partners often require detailed financial projections to evaluate the company’s long-term viability. Presenting a robust model demonstrates credibility, professionalism, and strategic foresight, enhancing the company’s ability to secure financing and partnerships. For a sports nutrition manufacturer, this can mean the difference between incremental growth and scaling into a globally recognized brand.

Final Notes on the Financial Model

This 20 Year Sports Nutrition Financial Model must focus on balancing capital expenditures with steady revenue growth from diversified product lines. By optimizing operational costs, and power efficiency, and maximizing high-margin services, the model ensures sustainable profitability and cash flow stability.

Download Link On Next Page