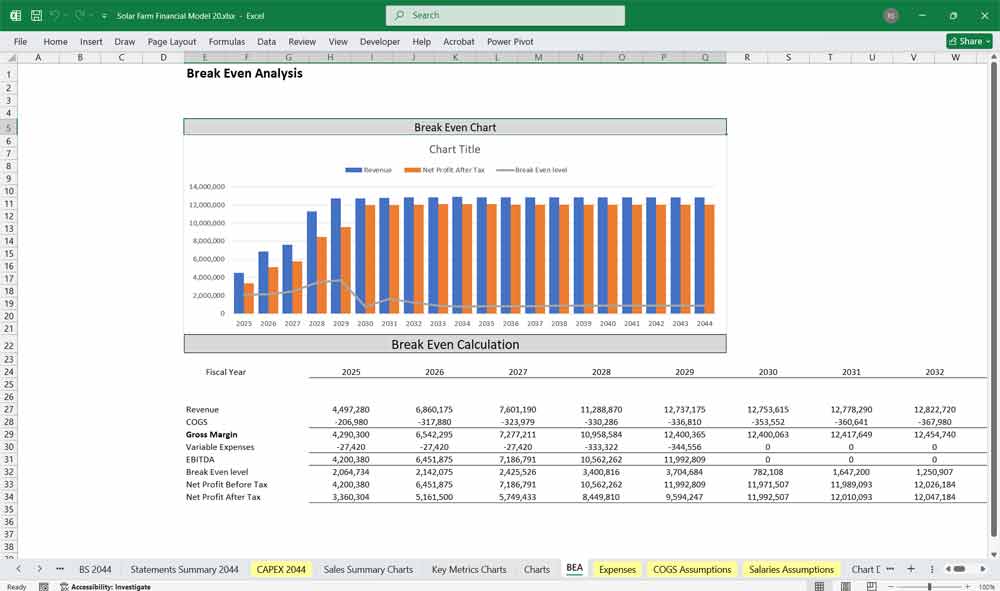

20 Year Solar Farm Financial Model

This Solar Farm Financial Model in Excel is a comprehensive financial planning tool designed to help owners, investors, and financial analysts evaluate financial feasibility and profitability over 20 years.

Financial Model For A Solar Farm

Key Assumptions and Drivers

This 20 Year Solar Farm Financial Model typically captures all the critical financial metrics and revenue streams while integrating the operating and capital expenditure involved in running the business. (Here’s 5-Year Model)

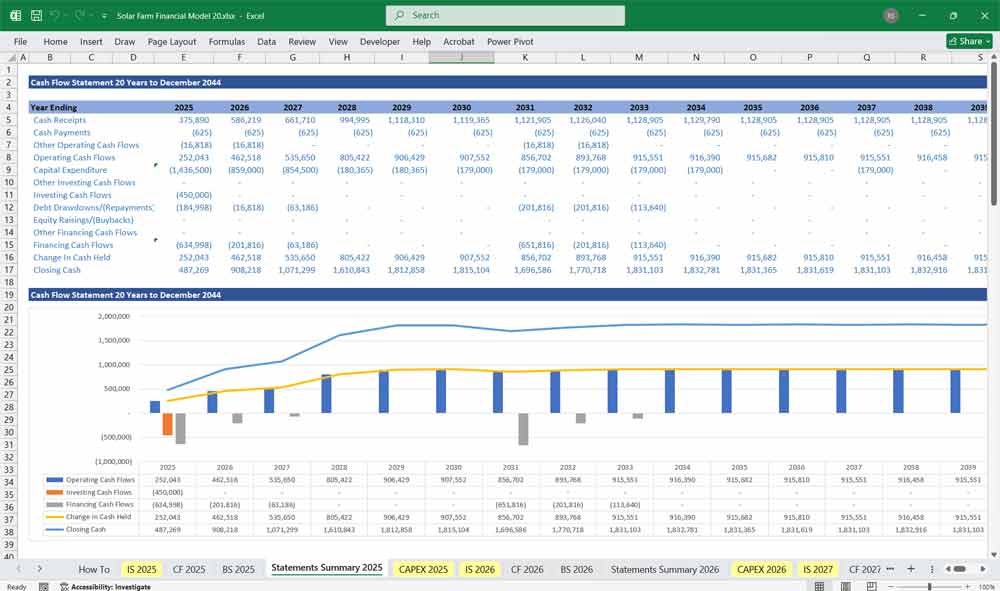

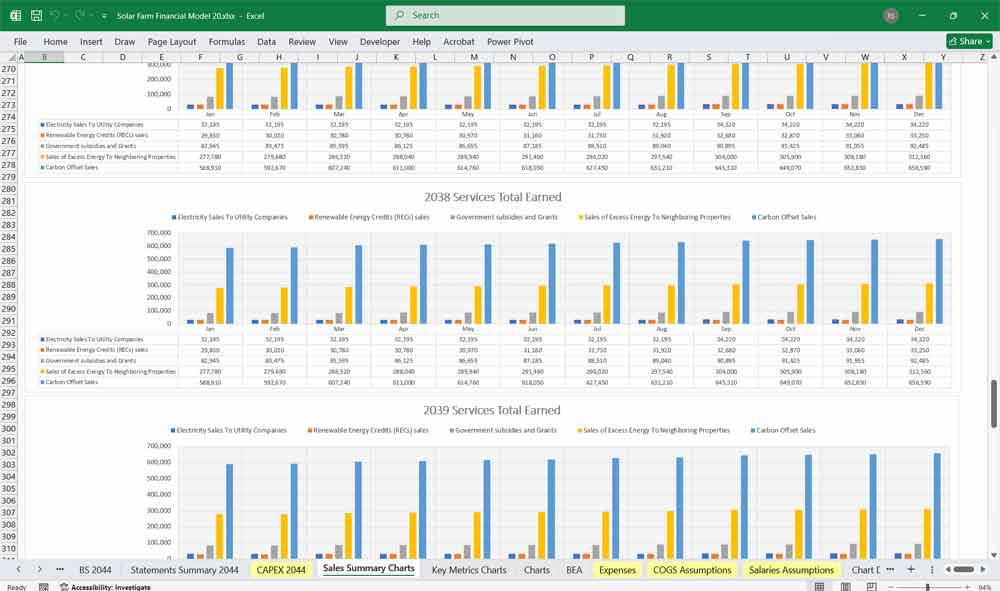

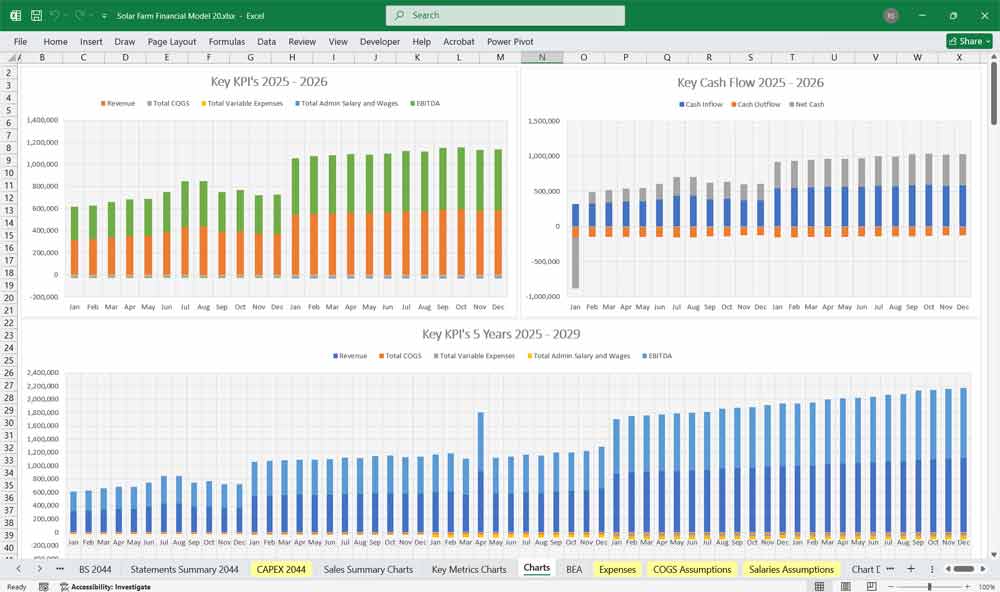

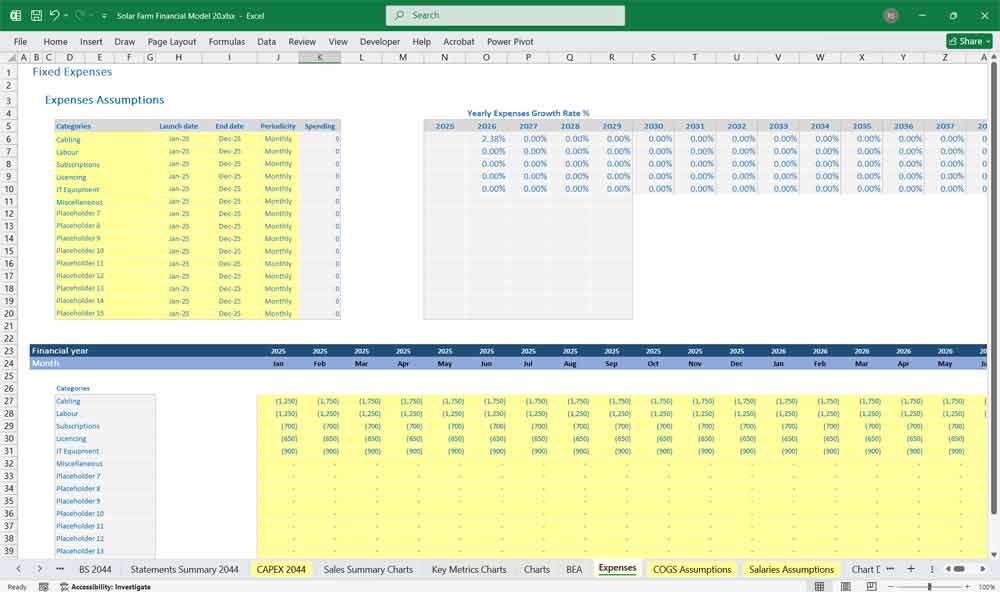

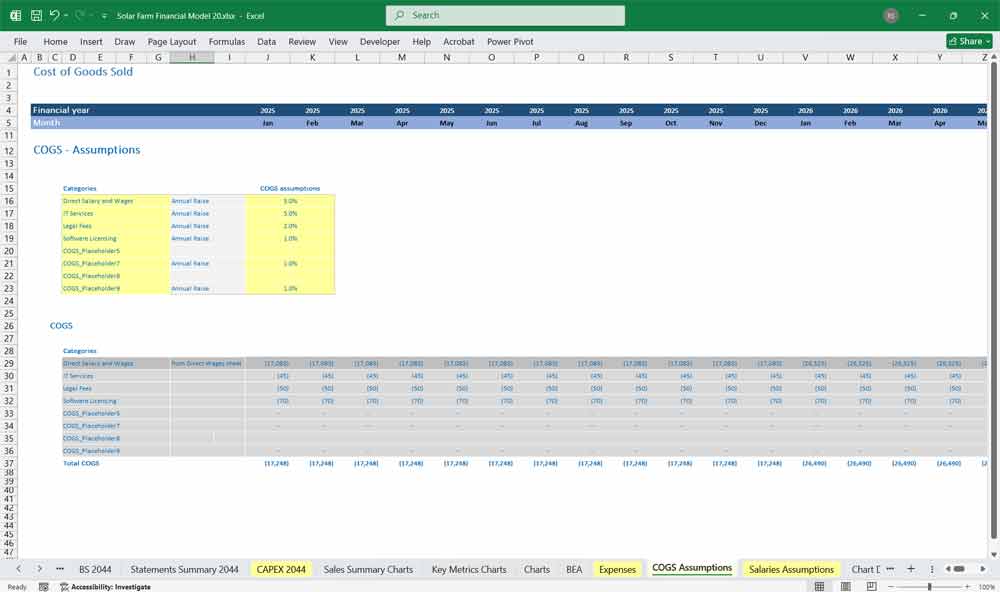

Includes 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX Sheets, OPEX Sheets, Summary Statements, and Revenue Forecasting Charts—all tailored with the specified revenue streams. Also features BEA charts, electricity sales summaries, salary breakdowns, and expense sheets. In total, over 100 spreadsheets of financial monitoring for comprehensive tracking of your Solar Farm.

Project Capacity: Size of the solar farm (e.g., 50 MW).

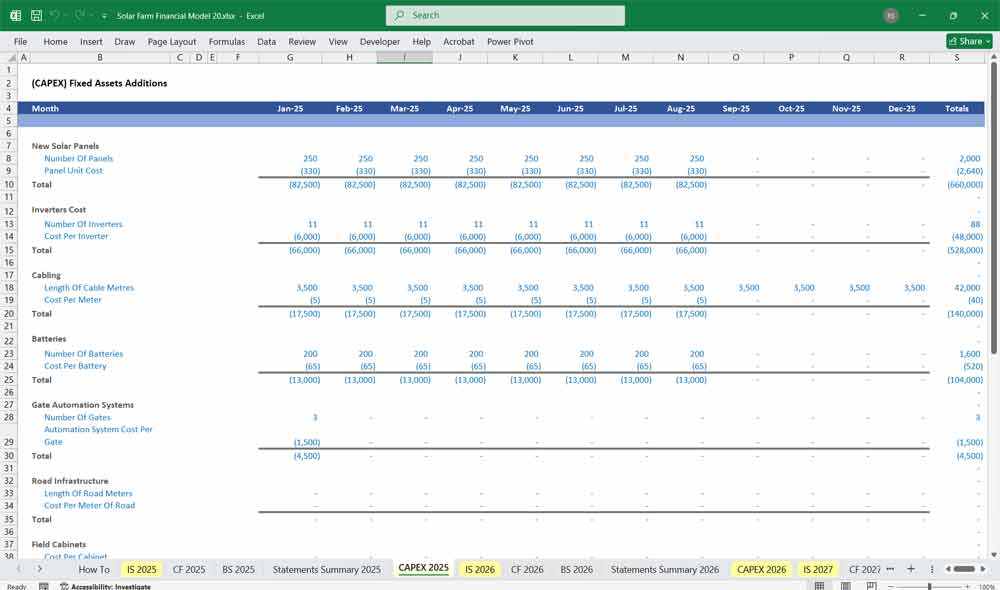

Capital Expenditure (CapEx): Total upfront investment required (e.g., $1,000,000 per MW).

Operating Expenditure (OpEx): Annual operating costs (e.g., $20,000 per MW).

Energy Production: Estimated annual energy output (e.g., 1,500 MWh per MW).

Tariff/PPA Rate: Price per MWh under a Power Purchase Agreement (PPA) or feed-in tariff (e.g., $50/MWh).

Degradation Rate: Annual reduction in energy output due to panel degradation (e.g., 0.5% per year).

Debt Financing: Loan amount, interest rate, and repayment terms (e.g., 70% debt at 5% interest over 15 years).

Tax Rate: Corporate tax rate (e.g., 25%).

Discount Rate: Used for Net Present Value (NPV) calculations (e.g., 8%).

Solar Farm And Investment Attraction

Solar energy has emerged as a highly attractive investment opportunity due to its long-term financial benefits, environmental sustainability, and growing global demand for clean energy. Investors are drawn to solar energy projects because of their predictable cash flows, low operational costs, and eligibility for government incentives such as tax credits and subsidies. Additionally, solar farms offer scalability, allowing for incremental investments and adaptability to various markets. The shift toward renewable energy aligns with global climate goals, making solar energy a future-proof investment that not only generates returns but also contributes to a sustainable and resilient energy infrastructure. This combination of financial stability, environmental impact, and innovation makes solar energy a compelling choice for both institutional and individual investors.

Solar Farms and Financial Incentives

A Solar Farm can benefit from a wide range of financial incentives that make it an economically viable and attractive option for individuals, businesses, and governments. These incentives include federal and state tax credits, such as the Investment Tax Credit (ITC), which significantly reduce upfront costs. Additionally, solar projects often qualify for grants, rebates, and subsidies aimed at promoting renewable energy adoption. Net metering policies allow solar energy producers to sell excess electricity back to the grid, generating additional revenue. Furthermore, Renewable Energy Certificates (RECs) provide another income stream by monetizing the environmental benefits of solar power. These financial incentives not only lower the barrier to entry but also enhance the return on investment, making solar energy a financially appealing choice for sustainable energy solutions.

Solar Farm and Long-term Profitability

Solar farms offer exceptional long-term profitability due to their low operational costs, predictable energy output, and minimal maintenance requirements. Once installed, solar panels have a lifespan of 25-30 years or more, providing a stable and consistent source of revenue through energy sales, net metering, and Renewable Energy Certificates (RECs). The absence of fuel costs and protection against rising energy prices further enhance financial stability. Additionally, solar farms benefit from government incentives, such as tax credits and subsidies, which improve return on investment. As global demand for clean energy grows and technology advances, solar farms are poised to remain a lucrative and sustainable investment, ensuring long-term profitability while contributing to a greener future.

Solar Farm and Government Support

Solar farms receive substantial government support, making them a highly attractive investment in the renewable energy sector. Governments worldwide offer financial incentives such as tax credits, grants, and subsidies to reduce upfront costs and encourage solar adoption. Policies like net metering allow solar farm operators to sell excess energy back to the grid, creating additional revenue streams. Renewable energy mandates and favorable regulatory frameworks further promote the development of solar projects. Additionally, public-private partnerships and initiatives aimed at achieving climate goals provide a supportive environment for solar farm growth. This robust government backing not only lowers financial barriers but also ensures long-term viability and alignment with global sustainability objectives.

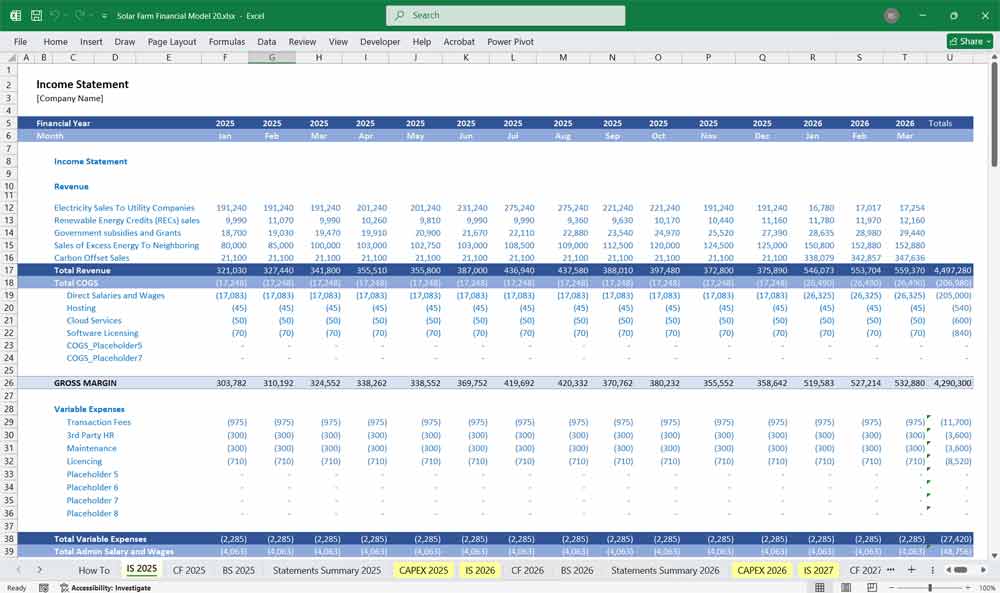

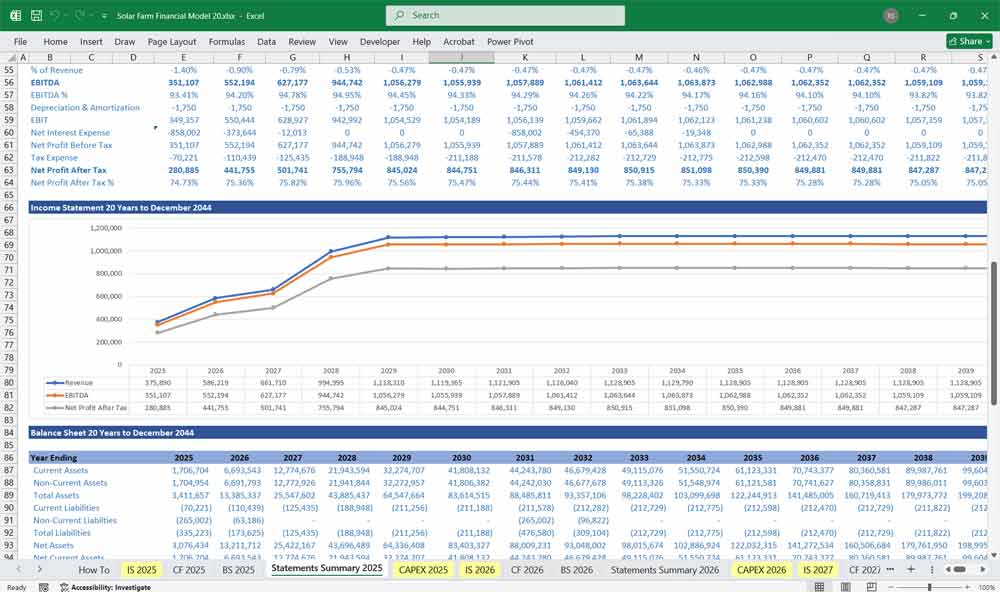

Solar Farm Financial Model Income Statement

The Income Statement shows the profitability of the solar farm over time.

Revenue

Energy Sales: Calculated as Energy Production (MWh) × Tariff/PPA Rate ($/MWh).

Example: 50 MW × 1,500 MWh/MW × 50/MWh=50/MWh=3,750,000 annually.

Operating Expenses (OpEx)

Fixed and variable costs, including maintenance, insurance, land lease, and administrative costs.

Example: 50 MW × 20,000/MW=20,000/MW=1,000,000 annually.

Depreciation

Straight-line depreciation over the asset’s useful life (e.g., 25 years).

Example: 50,000,000CapEx/25years=50,000,000CapEx/25years=2,000,000 annually.

Interest Expense

Interest on debt financing.

Example: 35,000,000loan×535,000,000loan×51,750,000 annually (reduces as debt is repaid).

Earnings Before Tax (EBT)

Revenue – OpEx – Depreciation – Interest Expense.

Tax

EBT × Tax Rate.

Example: 1,000,000EBT×251,000,000EBT×25250,000.

Net Income

EBT – Tax.

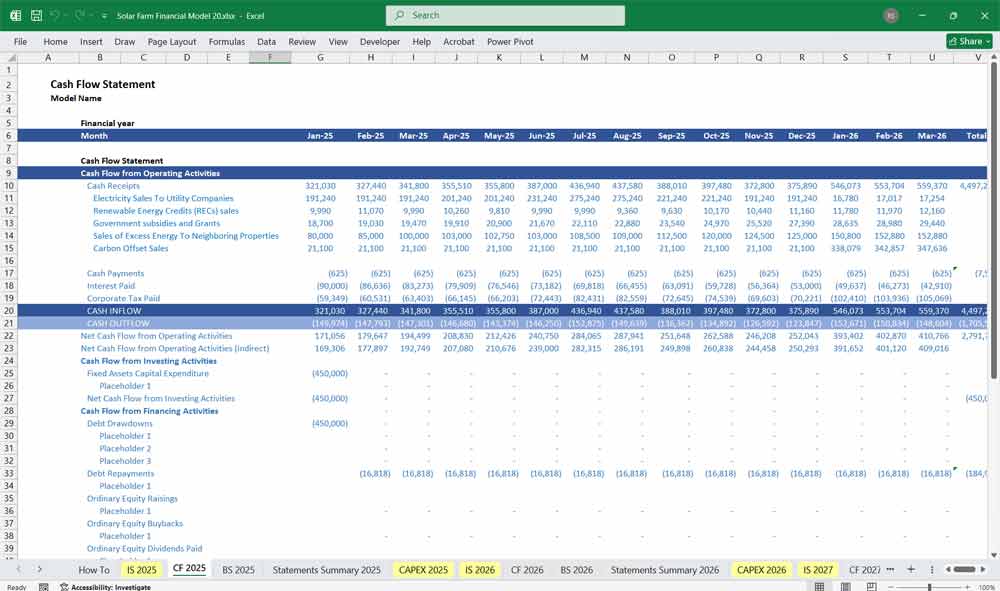

Solar Farm Cash Flow Statement

The Cash Flow Statement tracks the cash inflows and outflows over the project’s life.

Cash Inflows

Energy Sales: Same as revenue in the Income Statement.

Debt Financing: Initial loan proceeds.

Cash Outflows

CapEx: Initial investment in solar panels, inverters, land, and construction.

OpEx: Annual operating costs.

Debt Repayment: Principal and interest payments.

Taxes: Paid annually.

Net Cash Flow

Cash Inflows – Cash Outflows.

Free Cash Flow (FCF)

Net Cash Flow available to equity holders after all expenses and debt repayments.

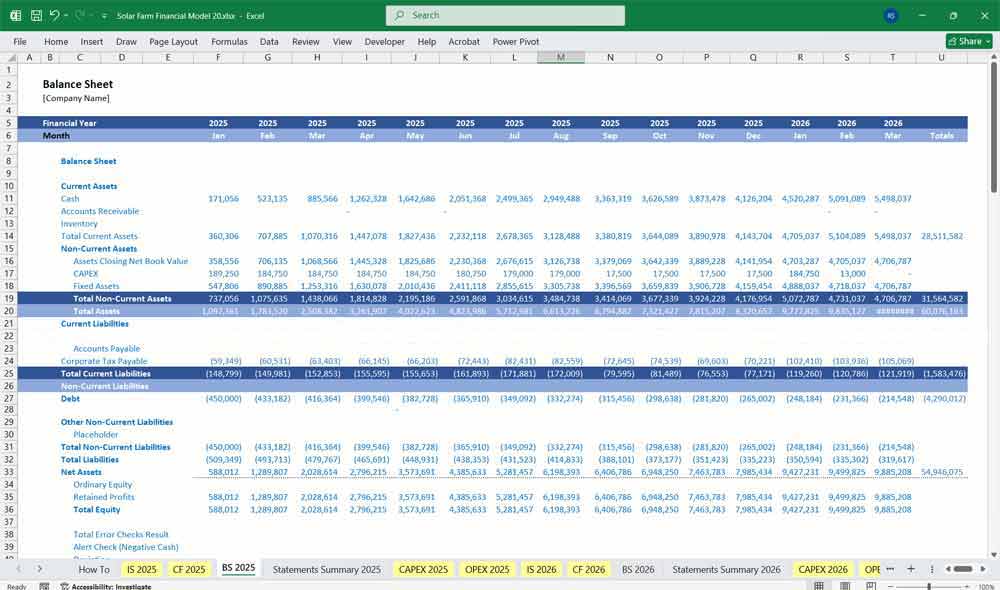

Solar Farm Financial Model Balance Sheet

The Balance Sheet provides a snapshot of the solar farm’s financial position at a given point in time.

Assets

Fixed Assets: Solar panels, inverters, land, and infrastructure (net of depreciation).

Cash: Cumulative cash balance from the Cash Flow Statement.

Liabilities

Debt: Outstanding loan balance.

Accounts Payable: Unpaid operating expenses.

Equity

Retained Earnings: Cumulative net income minus dividends (if any).

Initial Equity: Equity contribution from investors.

Solar Farm Key Metrics

Net Present Value (NPV): Discounted value of future cash flows.

Internal Rate of Return (IRR): Discount rate that makes NPV zero.

Payback Period: Time to recover the initial investment.

Debt Service Coverage Ratio (DSCR): Net operating income / debt service.

Key metrics for evaluating the performance and viability of a solar farm include Capacity Factor, which measures the actual energy output compared to its maximum potential, typically ranging from 15-25% for solar farms. Levelized Cost of Energy (LCOE) is critical for assessing the long-term cost competitiveness of the project. Return on Investment (ROI) and Internal Rate of Return (IRR) are essential financial metrics to determine profitability. Energy Yield quantifies the total energy produced annually, while Payback Period estimates the time required to recoup initial investments. Additionally, Operations and Maintenance (O&M) Costs and Degradation Rates of solar panels help evaluate long-term efficiency and sustainability. These metrics collectively provide a comprehensive view of a solar farm’s financial and operational performance.

Sensitivity Analysis For The Financial Model

To assess the project’s robustness, perform sensitivity analysis on key variables:

Energy Production: Impact of lower-than-expected output.

Tariff Rate: Impact of changes in PPA rates.

CapEx: Impact of cost overruns.

Interest Rates: Impact of higher borrowing costs.

This 20 Year Solar Farm Financial Model provides a comprehensive framework for evaluating the feasibility and profitability of a solar energy farm. It can be built in Excel or specialized financial modeling software, and should be tailored to the specific project’s parameters and market conditions.

Download Link On Next Page