Shipping Vessel Charter Financial Model

Excel 20-Year Shipping Vessel Charter Financial Model, covering the Income Statement, Cash Flow Statement, and Balance Sheet. Cost structures and financial statements to forecast the financial health of your Vessel Charter business.

Financial Model for a Shipping Vessel Charter Company

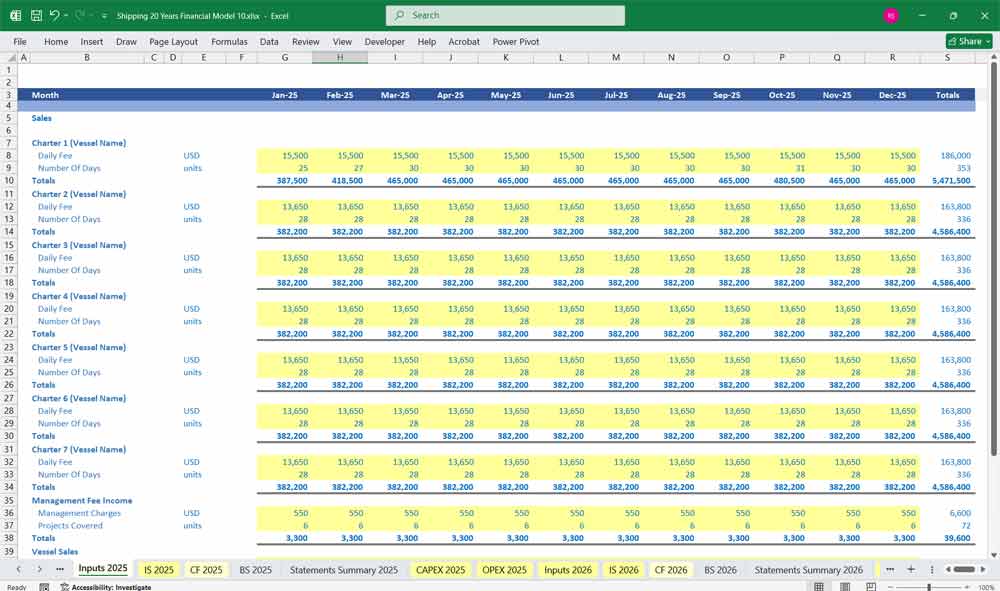

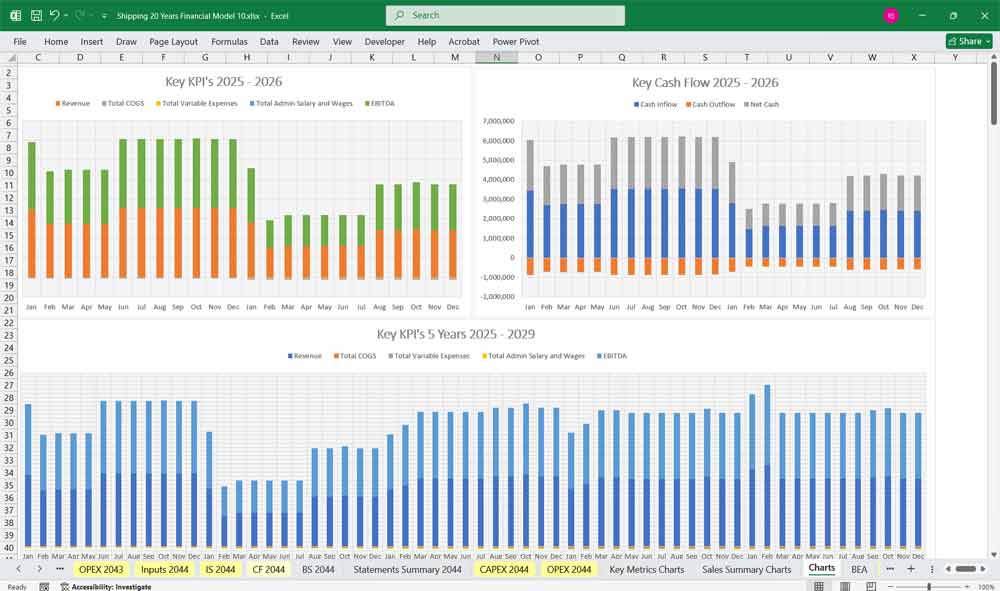

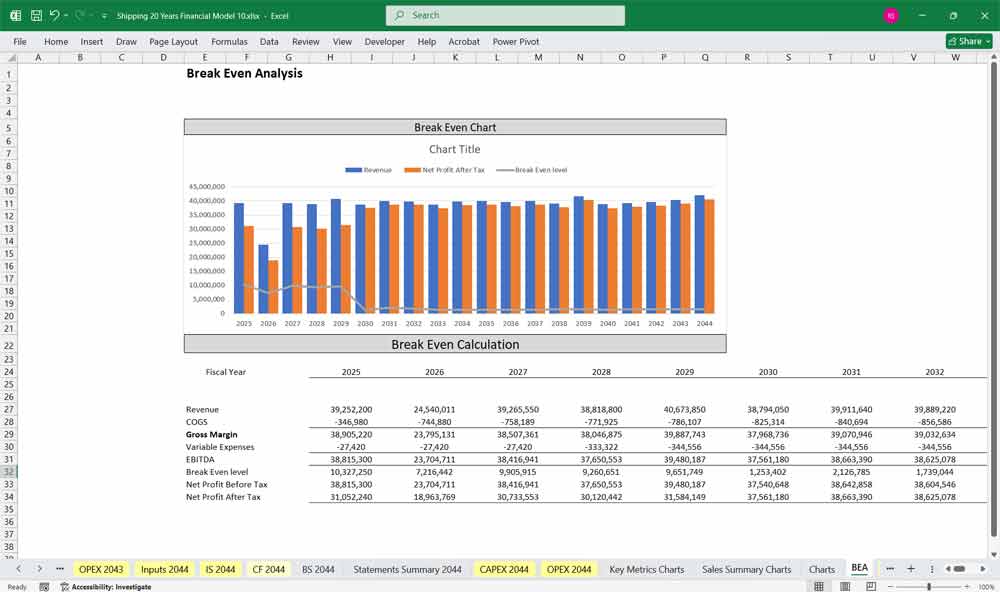

This 20-year financial model for a shipping broker provides a structured forecast of the business’s financial performance. It includes projections for revenues from BIMCO and/or standard leasing charters via daily fees totalled to monthly revenues, as well as expenses, cash flow, and financial position, based on key business drivers such as commission rates, shipping volume, and market trends.

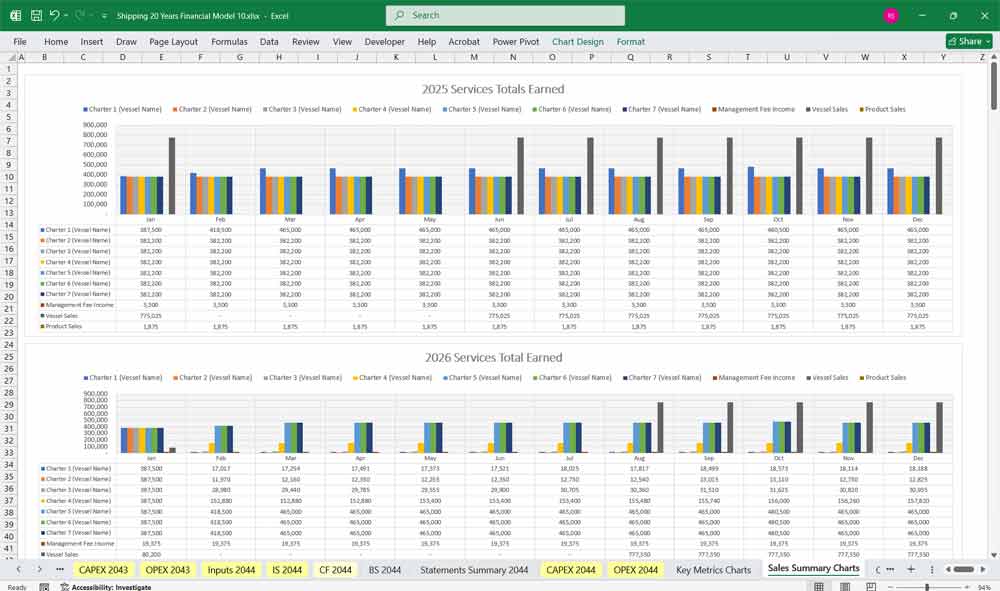

20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX Sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the specified revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets. Over 100 Spreadsheets for close monitoring of your BIMCO and standard charter services, vessel sales, management and other product revenue.

Key Components of the Shipping Brokerage Financial Model

The financial model consists of the following sections:

- Revenue Model – How the shipping broker earns money.

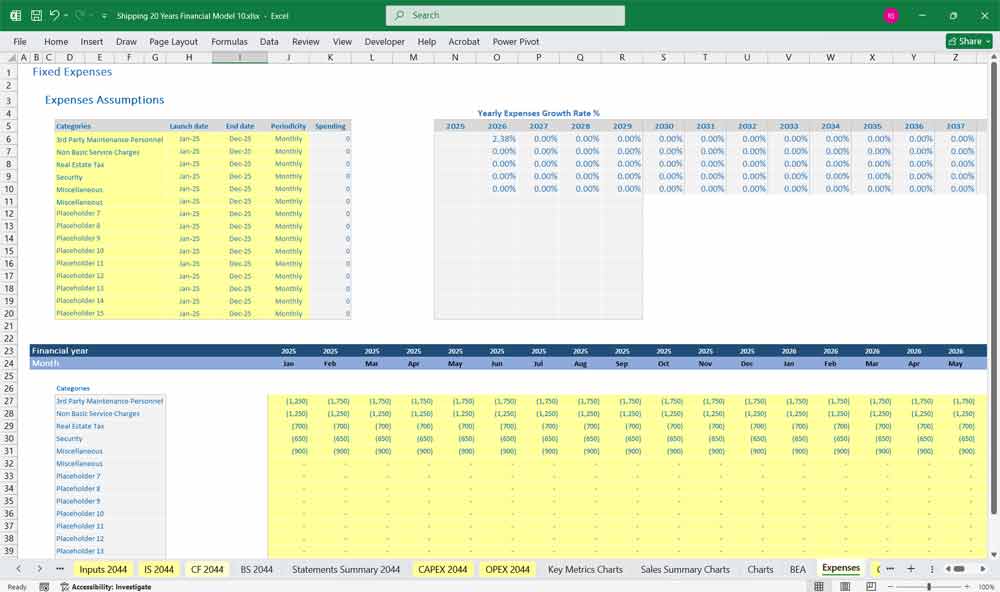

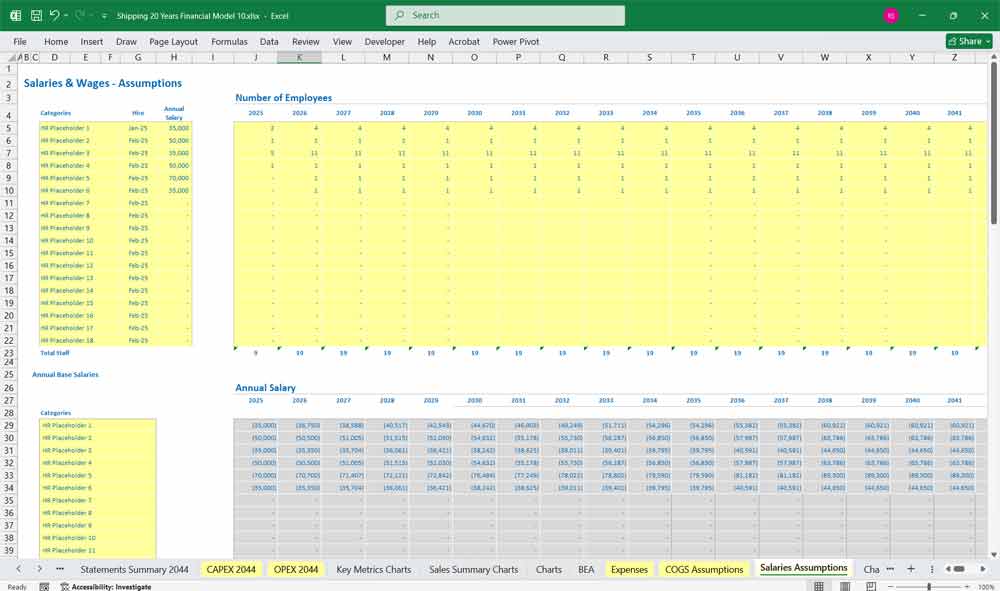

- Operating Expenses – Costs related to running the business.

- Income Statement – Profitability analysis.

- Cash Flow Statement – Liquidity and cash movements.

- Balance Sheet – Financial position at a given time.

- Key Metrics & Sensitivity Analysis – Performance indicators and risk assessment.

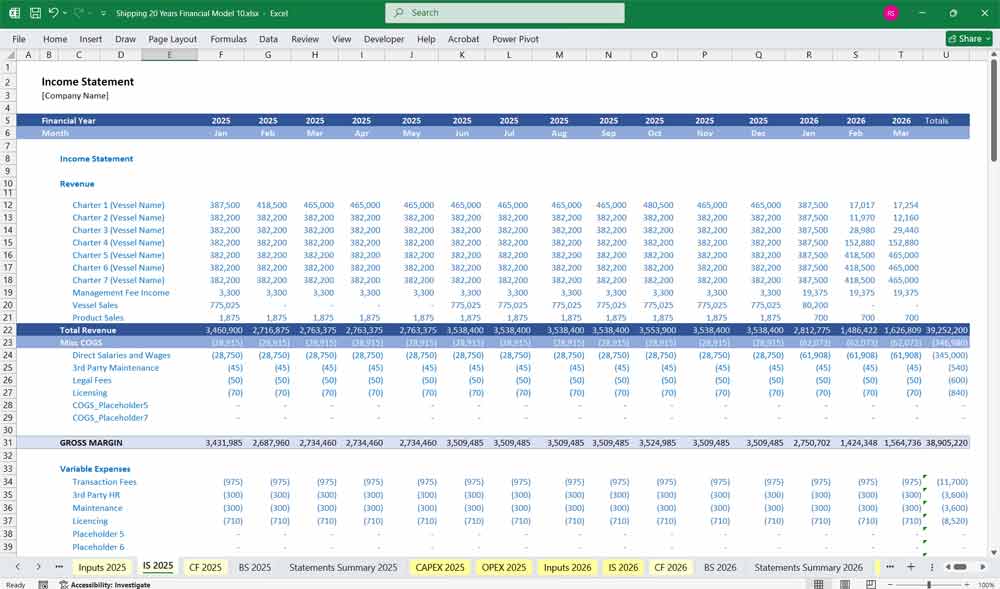

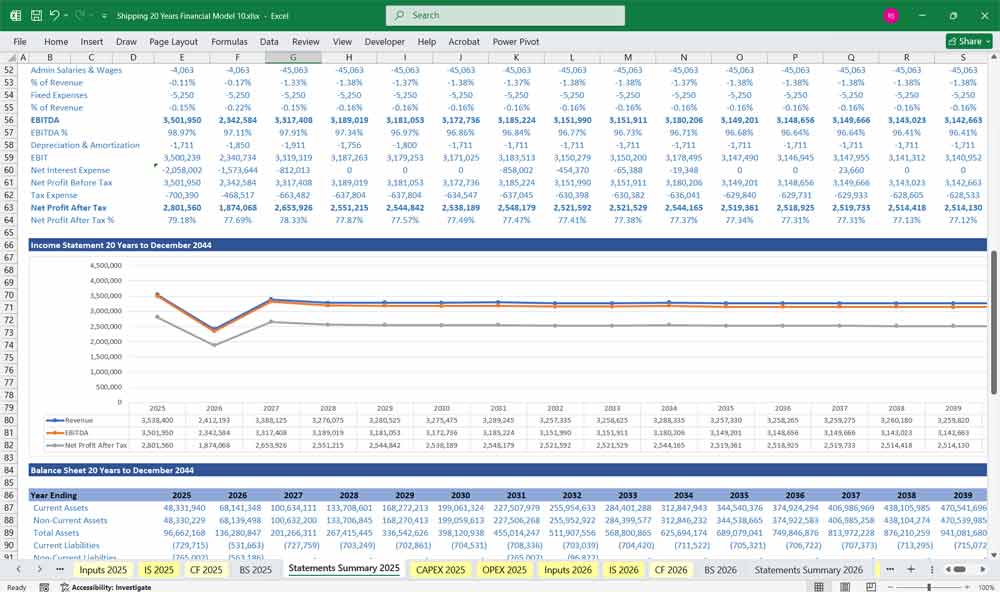

Income Statement (Profit & Loss Statement)

The Income Statement (P&L) tracks revenue, expenses, and profitability over a given period (monthly, quarterly, annually).

Revenue Streams

- Shipping Vessel Charter Revenue

- BIMCO Charter

- Vessel Service Fees

- Management Fees

- Vessel Sales

- Product Sales

Expenses:

- Shipping Vessel Operating Expenses

- Crew Wages and Benefits

- Fuel Costs

- Port Fees and Maintenance

- Insurance and Regulatory Compliance

Operating Income

Other Income/Expenses:

- Interest Expense

- Miscellaneous Income

Net Other Expenses

Net Income Before Taxes

Income Tax ExpenseNet Income

Key Notes:

The Shipping Vessel Charter Income is the primary revenue driver, reflecting earnings from long-term and spot charters.

Shipping Vessel Operating Costs are a significant portion of expenses, including crew, maintenance, and fuel.

Depreciation of the Shipping Vessel fleet is a non-cash expense that impacts profitability.

Gains or losses from the sale of Shipping Vessel assets can significantly affect net profit.

The income statement highlights the cyclical nature of the shipping industry, influenced by charter rates, fuel prices, and global trade demand.

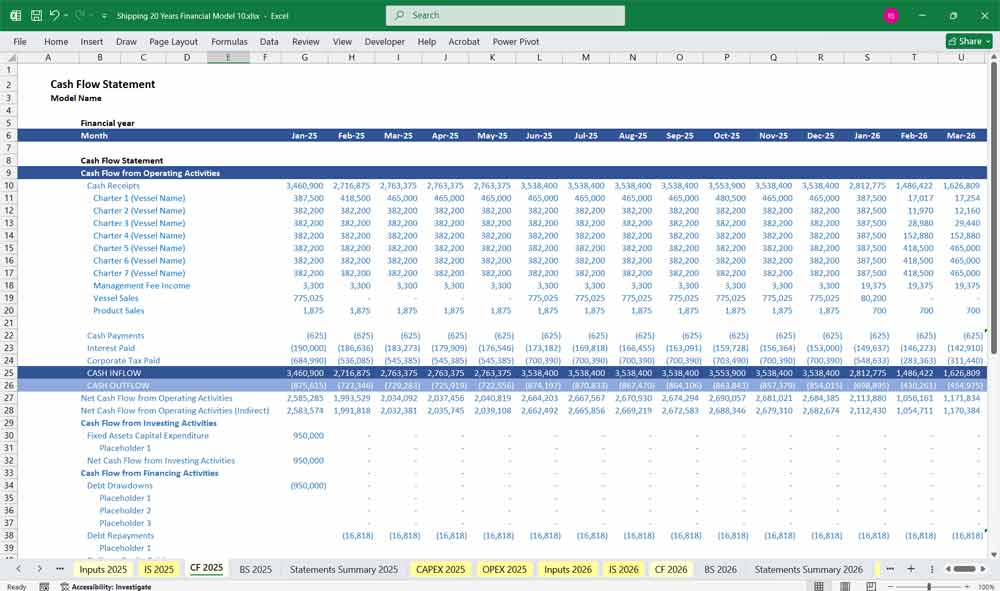

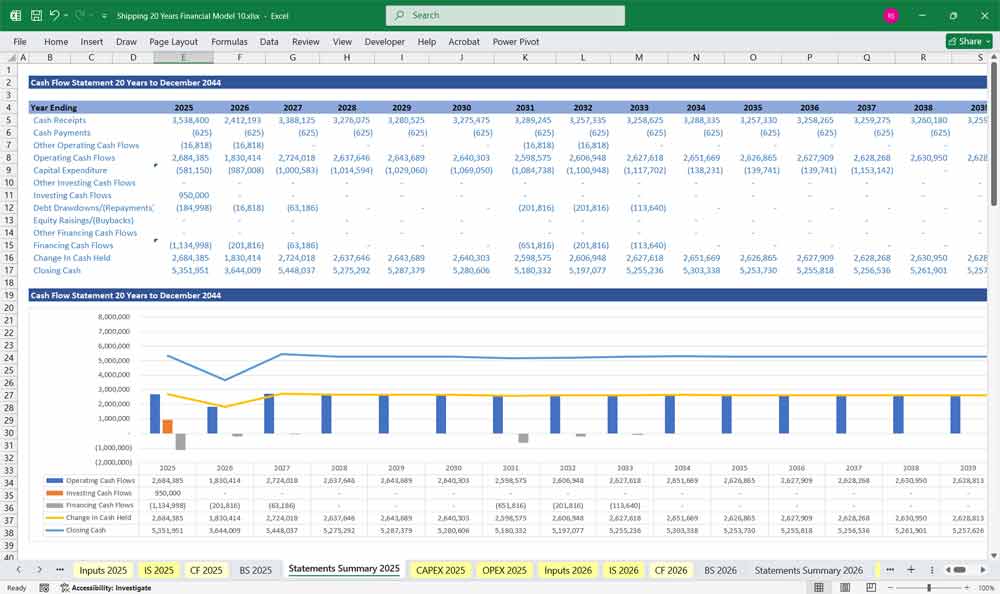

Shipping Vessel Charter Cash Flow Statement

The Cash Flow Statement tracks cash inflows and outflows to ensure liquidity.

Cash Flows from Operating Activities:

- Cash Receipts from Shipping Vessel Charter Cash Flows

- Receipts from Other Shipping Vessel Services

- Payments for Shipping Vessel Operating Expenses

- Cash Payments for Crew Wages and Benefits

- Payments for Fuel and Port Fees

Net Cash Flows from Operating Activities

Cash Flows from Investing Activities:

- Purchase of New Shipping Vessels: Cash spent on acquiring new vessels to expand or modernize the fleet.

- Proceeds from Sale of Old Shipping Vessels: Cash received from selling older vessels or those no longer efficient.

- Upgrades and Refits of Existing Vessels: Investment in major upgrades, overhauls, or technology enhancements for existing vessels.

- Purchase of Equipment and Spare Parts: Acquisition of specialized maritime equipment or spare parts to support vessel operations.

- Investment in Port Facilities or Infrastructure: Cash spent on partnerships or improvements at ports frequently used by the company.

- Acquisition of Other Companies or Assets: Buying stakes in other shipping companies or acquiring strategic maritime assets.

Cash Flows from Financing Activities:

- Proceeds from Shipping Vessel Charter Cash Flows Financing

- Repayment of Loans Related to Shipping Vessel Charter Cash Flows

- Dividends Paid

Net Cash Flows from Financing Activities

Net Increase in Cash and Cash Equivalents

Cash and Cash Equivalents at Beginning of Year

Cash and Cash Equivalents at End of Year

This statement emphasizes “Shipping Vessel Charter Cash Flows” five times as requested while providing a clear overview of cash inflows and outflows.

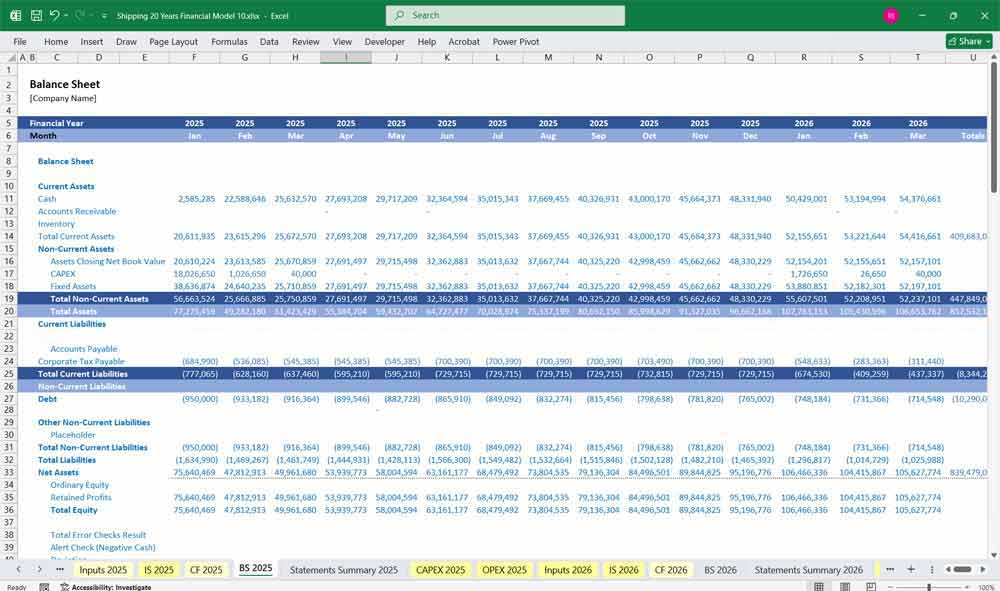

Shipping Vessel Charter Financial Model Balance Sheet

The Balance Sheet provides a snapshot of assets, liabilities, and equity.

Assets:

Current Assets:

- Cash and Cash Equivalents: Liquid funds available for immediate use, such as cash in hand or in bank accounts.

- Accounts Receivable – Shipping Vessel Charter: Payments owed by customers for vessel charters that haven’t been collected yet.

- Prepaid Expenses: Costs paid in advance, like insurance, port fees, or maintenance contracts.

- Fuel Inventory: Value of fuel stored onboard or at port facilities, ready for use in vessel operations.

- Spare Parts and Supplies: Inventory of parts and supplies required for vessel maintenance and repairs.

- Short-Term Investments: Any temporary investments made to generate returns while waiting to use funds.

Non-Current Assets:

- Shipping Vessels (Net of Depreciation)

- Shipping Vessel Charter Equipment

- Total Non-Current Assets

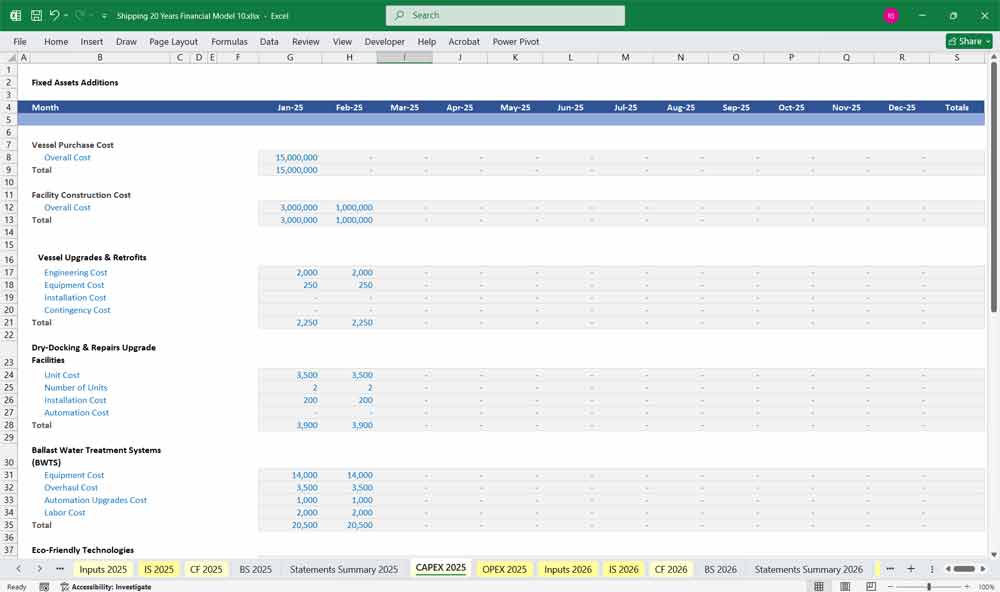

CAPEX (10 Editable Examples)

- Shipping Vessel Purchases (Net of Depreciation)

- Vessel Upgrades & Retrofits

- Dry-Docking & Repairs Upgrade Facilities

- Ballast Water Treatment Systems (BWTS)

OPEX (10 Editable Examples)

- Personnel Costs

- Maintenance and Repair

- Fuel and Lubricants

- Provisions & Stores

Total Assets

Liabilities:

Current Liabilities:

- Accounts Payable – Shipping Vessel Charter Expenses

- Short-Term Debt

- Total Current Liabilities

Non-Current Liabilities:

- Long-Term Debt – Shipping Vessel Charter Financing

- Total Non-Current Liabilities

Total Liabilities

Equity:

- Common Stock

- Retained Earnings

Total Equity

Total Liabilities and Equity

Ship Charter Key Financial Metrics

1. Revenue Metrics

Time Charter Equivalent (TCE) Revenue:

Measures the average daily revenue earned per vessel after deducting voyage expenses.

Formula: TCE = (Charter Revenue – Voyage Costs) / Charter Days.

Spot Charter Rates:

The daily rate earned for vessels chartered on the spot market.

Indicates market demand and pricing trends.

Fleet Utilization Rate:

The percentage of time vessels are employed (on charter) versus idle.

Formula: Utilization Rate = (Charter Days / Total Available Days) x 100.

2. Vessel Charter Cost Metrics

Daily Operating Expense (OPEX):

The average daily vessel charter cost to operate a vessel, including crew wages, maintenance, and insurance.

Formula: OPEX = Total Operating Costs / Total Operating Days.

Voyage Costs:

Expenses incurred during voyages, such as fuel, port charges, and canal dues.

Total Cost per Vessel:

Includes operating costs, voyage costs, and capital costs (e.g., depreciation).

3. Vessel Charter Profitability Metrics

Gross Profit Margin:

Measures profitability after deducting charter voyage and operating costs.

Formula: Gross Profit Margin = (Revenue – Voyage Costs – Operating Costs) / Revenue x 100.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization):

Reflects core vessel charter profitability before non-cash and financing expenses.

Formula: EBITDA = Revenue – Voyage Costs – Operating Costs.

Net Profit Margin:

The percentage of vessel charter revenue remaining as profit after all expenses, including taxes and interest.

Formula: Net Profit Margin = Net Income / Revenue x 100.

4. Vessel Liquidity and Cash Flow Metrics

Cash Flow from Operations (CFO):

Measures cash generated from chartering activities.

Indicates the company’s ability to fund operations and repay debt.

Free Cash Flow (FCF):

Cash remaining after brokerage capital expenditures (e.g., vessel purchases, upgrades).

Formula: FCF = CFO – Capital Expenditures.

Liquidity Ratio:

Assesses the company’s ability to meet short-term obligations.

Formula: Current Ratio = Current Assets / Current Liabilities.

5. Vessel Charter Leverage and Solvency Metrics

Debt-to-Equity Ratio:

Measures the proportion of debt used to finance the charter fleet versus equity.

Formula: Debt-to-Equity Ratio = Total Debt / Total Equity.

Interest Coverage Ratio:

Assesses the company’s ability to pay interest on its debt.

Formula: Interest Coverage Ratio = EBITDA / Interest Expense.

Loan-to-Value (LTV) Ratio:

The ratio of outstanding debt to the market value of the fleet.

Indicates the financial risk associated with vessel financing.

6. Charter Fleet Performance Metrics

Average Daily Earnings (ADE):

The average daily revenue earned per vessel charter across the fleet.

Formula: ADE = Total Revenue / Total Charter Days.

Vessel Age Profile:

The average age of the fleet, which impacts operating costs and charter rates.

Charter Coverage Ratio:

The ratio of contracted revenue days to total available days.

Indicates revenue visibility and shipping vessel charter market demand.

7. Shipping Vessel Market and Valuation Metrics

Price-to-Earnings (P/E) Ratio:

Compares the Shipping Vessel Charter company’s share price to its earnings per share (EPS).

Formula: P/E Ratio = Share Price / EPS.

Enterprise Value-to-EBITDA (EV/EBITDA):

Measures the company’s valuation relative to its core earnings.

Formula: EV/EBITDA = (Market Cap + Debt – Cash) / EBITDA.

Key Notes:

These metrics help stakeholders evaluate the company’s operational efficiency, profitability, and financial stability.

TCE and Fleet Utilization Rate are particularly critical for assessing charter performance.

Debt-to-Equity Ratio and Interest Coverage Ratio are vital for understanding financial risk.

Regular monitoring of these metrics ensures informed decision-making and strategic planning in the volatile shipping industry.

Final Notes on the 20-Year Financial Model

Model Integration

- Interdependencies: Cash flow projections directly influence the income statement and balance sheet through interest income, reserves, and tranche payments.

- Scenario Analysis: Embedded functionality to test various market assumptions like property value depreciation, default rates, and interest rate spikes.

- Investor Reporting: Schedules for interest/principal payouts and performance updates tailored to tranche types.

Shipping Vessel Charter Financial Model

This structured model helps a BIMCO Charter Company service address a broad market spectrum, offering the right balance between cost, leasing, sales, support, and customization.

Download Link On Next Page