SaaS Software Financial Model

This 5-Year, 3-Statement SaaS Software Financial Model in Excel is a great tool for viewing all your revenues and projections from your SaaS Software development projects.

Financial Model for SaaS Software

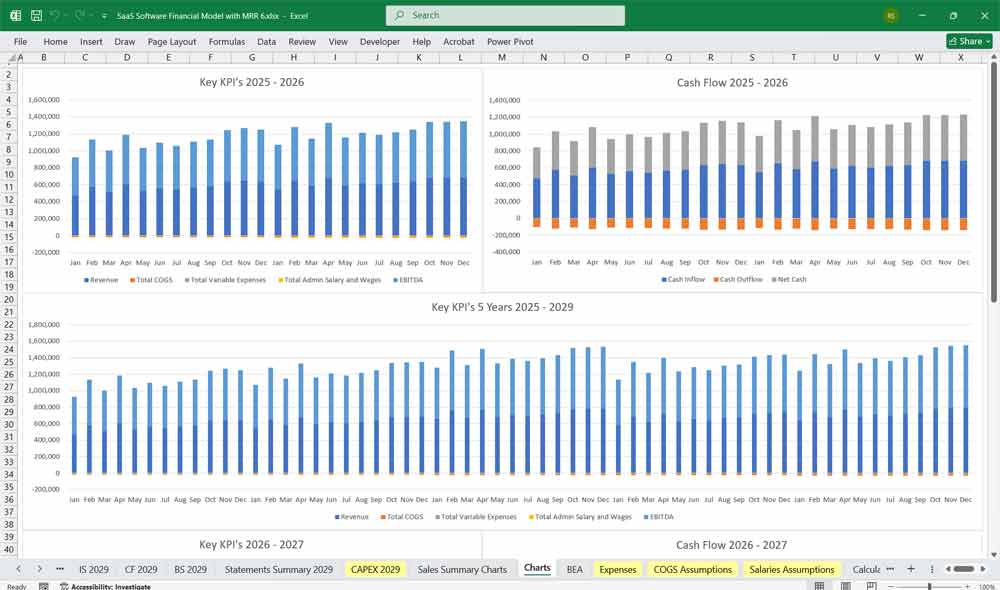

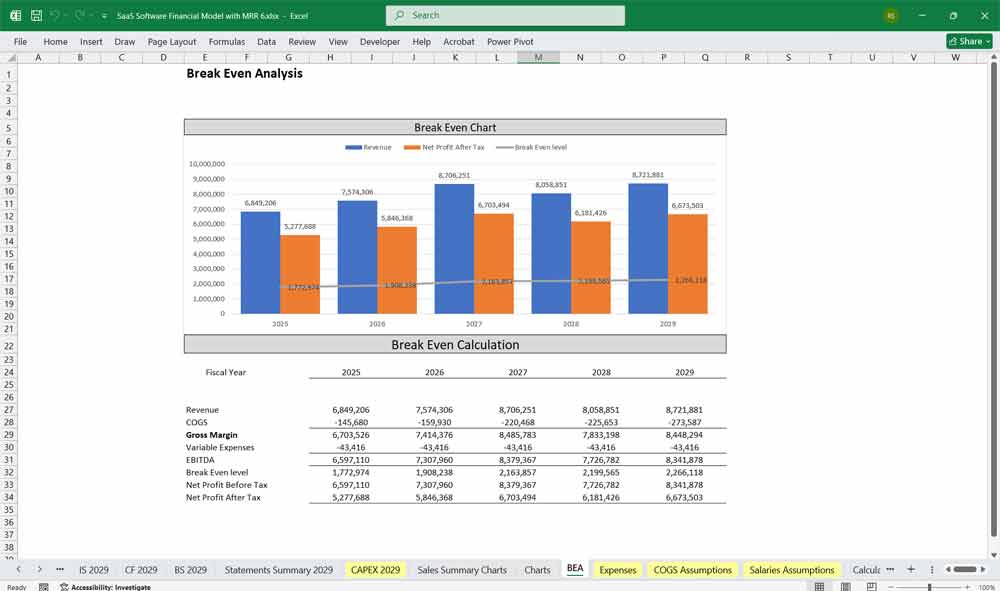

Robust financial model for a SaaS (Software-as-a-Service) company to forecast revenue, expenses, cash flow, and key metrics over a 5 year period. Below is a detailed breakdown of the Income Statement, Cash Flow Statement, and Balance Sheet, along with key SaaS-specific metrics.

Version 1: 5-year 3 statement with 5 PAYG project-based revenue inputs.

Version 2: The same as above, plus a 6-tier subscription for ongoing subscription-based software sales.

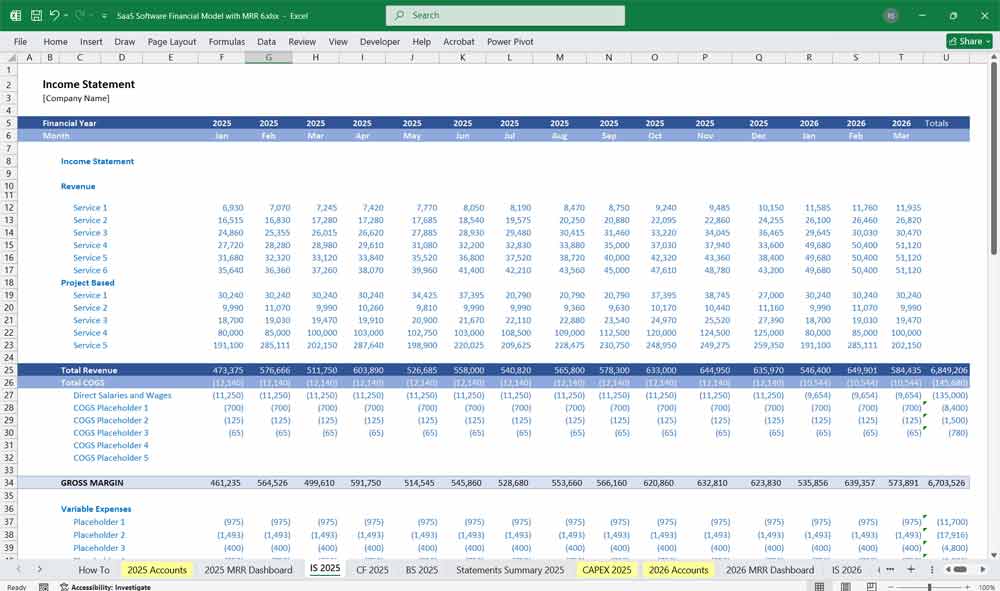

Income Statement (Profit & Loss – P&L)

The Income Statement shows revenue, costs, and profitability over time.

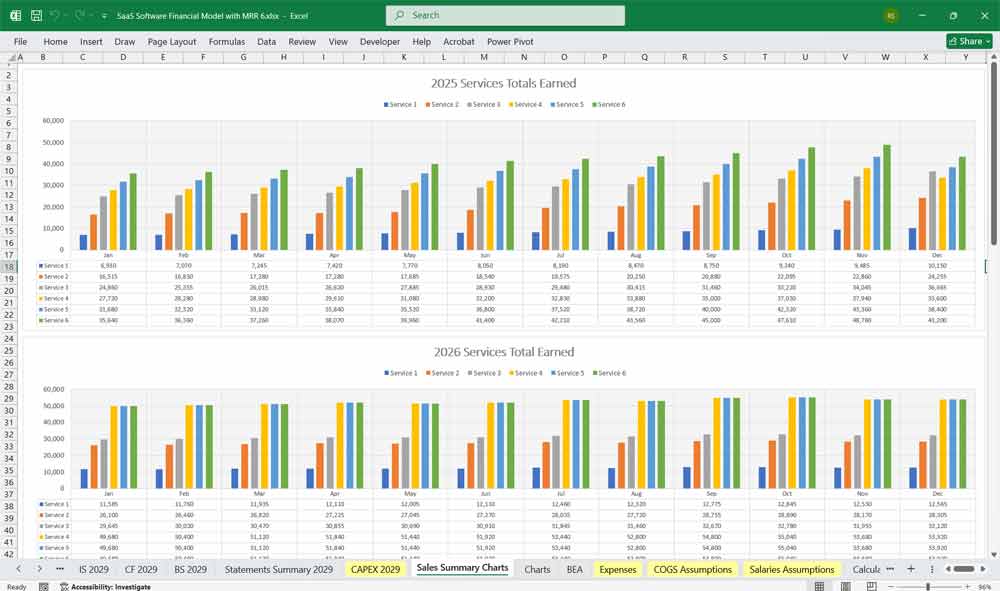

Revenue

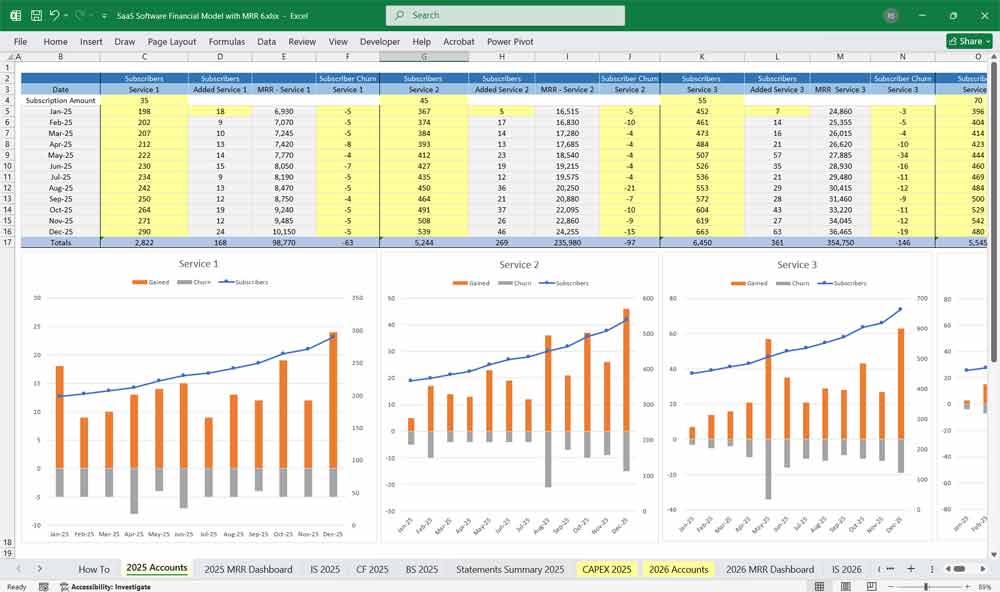

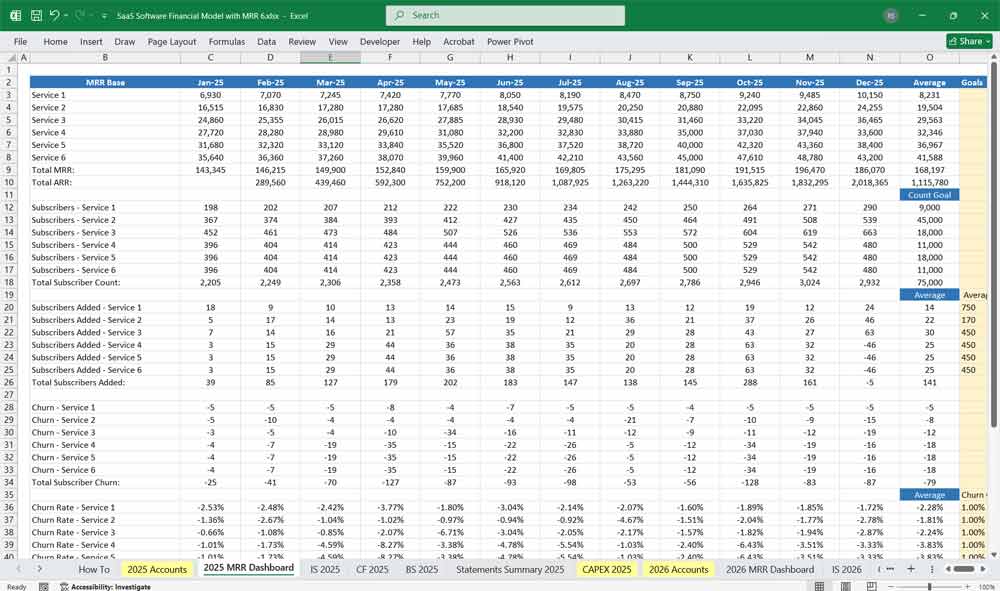

Monthly Recurring Revenue (MRR)

New MRR (from new customers)

Expansion MRR (upsells/cross-sells)

Churned MRR (lost revenue from cancellations/downgrades)

Net MRR Growth = (New MRR + Expansion MRR) – Churned MRR

Annual Recurring Revenue (ARR) = MRR × 12

One-Time Revenue (e.g., setup fees, professional services)

Cost of Revenue (COGS)

Hosting & Infrastructure (AWS, Azure, etc.)

Third-party software licenses

Payment processing fees (~2-3% of revenue)

Customer support & success teams

Gross Profit = Revenue – COGS

Gross Margin (%) = (Gross Profit / Revenue) × 100 (Target: 70-85%)

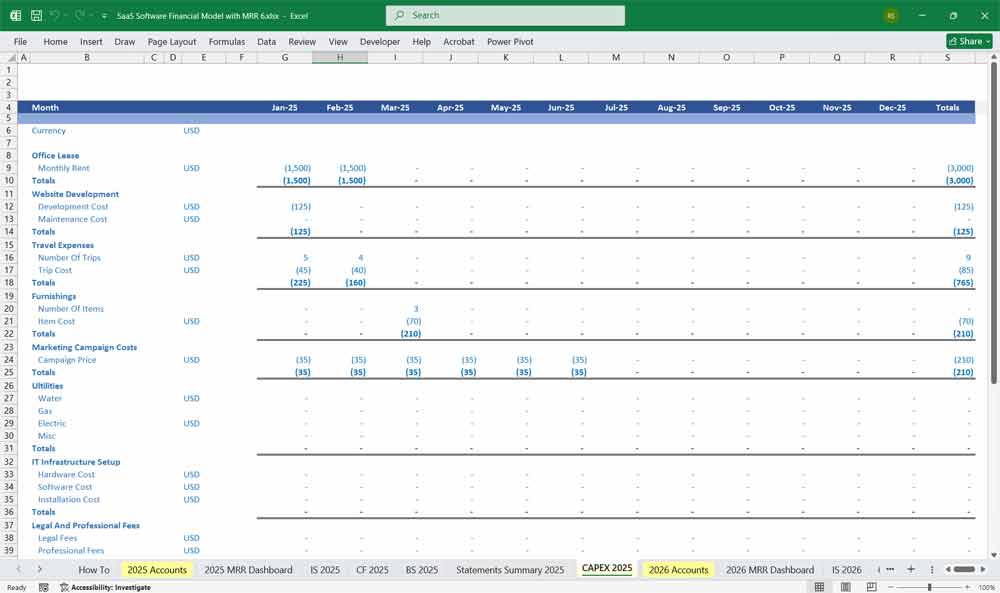

Operating Expenses (OPEX)

Sales & Marketing (S&M)

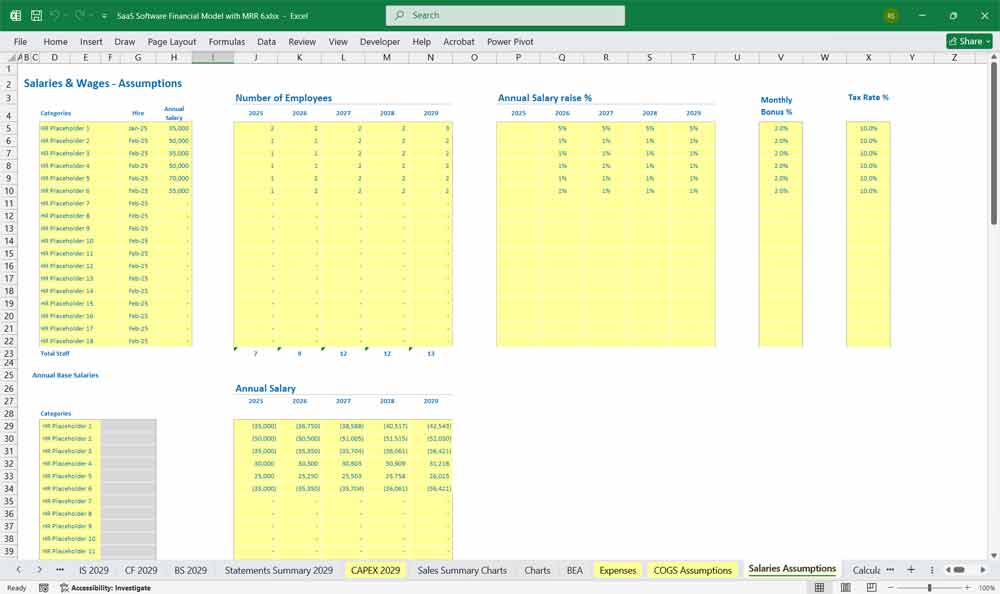

Salaries & commissions

Digital ads (Google, LinkedIn, etc.)

Content marketing & SEO

Events & partnerships

Research & Development (R&D)

Engineering salaries

Cloud & DevOps costs

Software tools (GitHub, Jira, etc.)

General & Administrative (G&A)

Executive salaries

Legal & accounting

Office rent & utilities

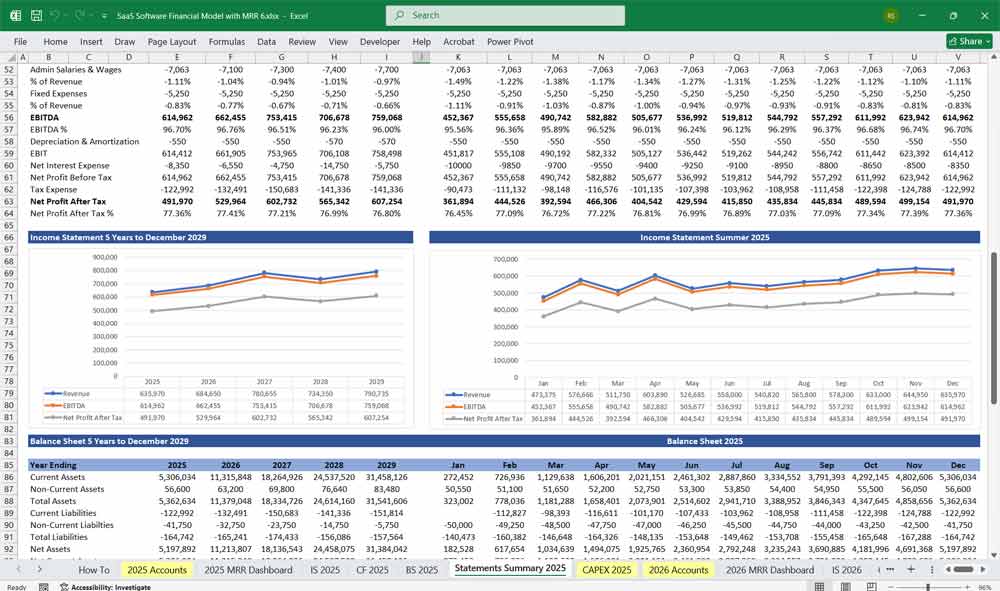

EBITDA & Net Profit

EBITDA = Gross Profit – OPEX (Earnings Before Interest, Taxes, Depreciation, Amortization)

Net Profit = EBITDA – Depreciation – Amortization – Taxes – Interest

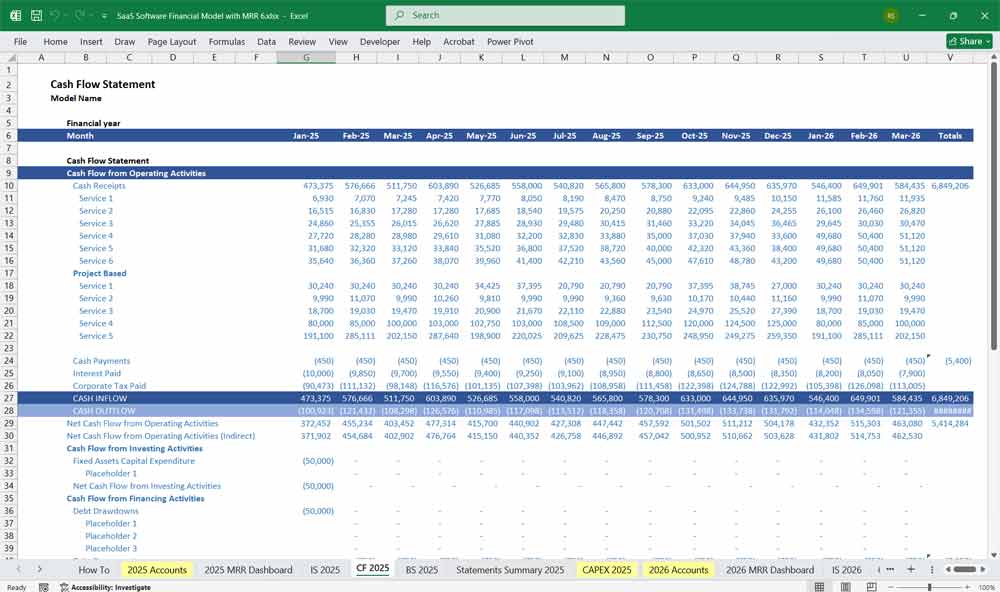

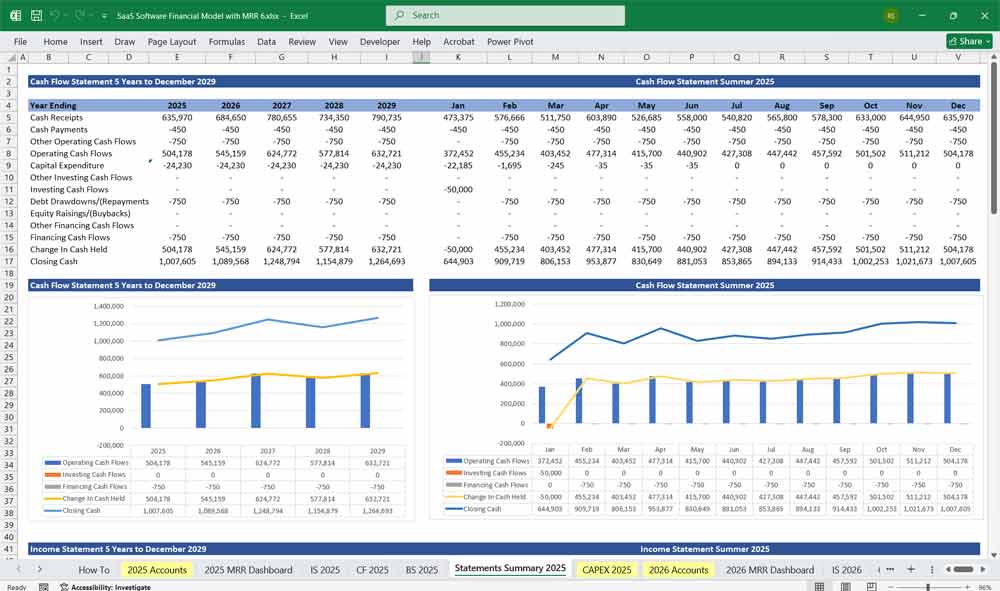

SaaS Software Cash Flow Statement

Tracks cash inflows and outflows to ensure liquidity.

Cash Flow from Operations (CFO)

Net Income (from P&L)

Adjustments:

(+) Depreciation & Amortization (non-cash expenses)

(-) Changes in Working Capital (accounts receivable, prepaid expenses)

Cash Flow from Investing (CFI)

Capital Expenditures (CapEx) – servers, office equipment

SaaS development costs (if capitalized)

Cash Flow from Financing (CFF)

Equity raised (venture capital, angel investors)

Debt (loans, convertible notes)

Dividends or share buybacks (rare in early-stage SaaS)

Net Cash Flow = CFO + CFI + CFF

Ending Cash Balance = Beginning Cash + Net Cash Flow

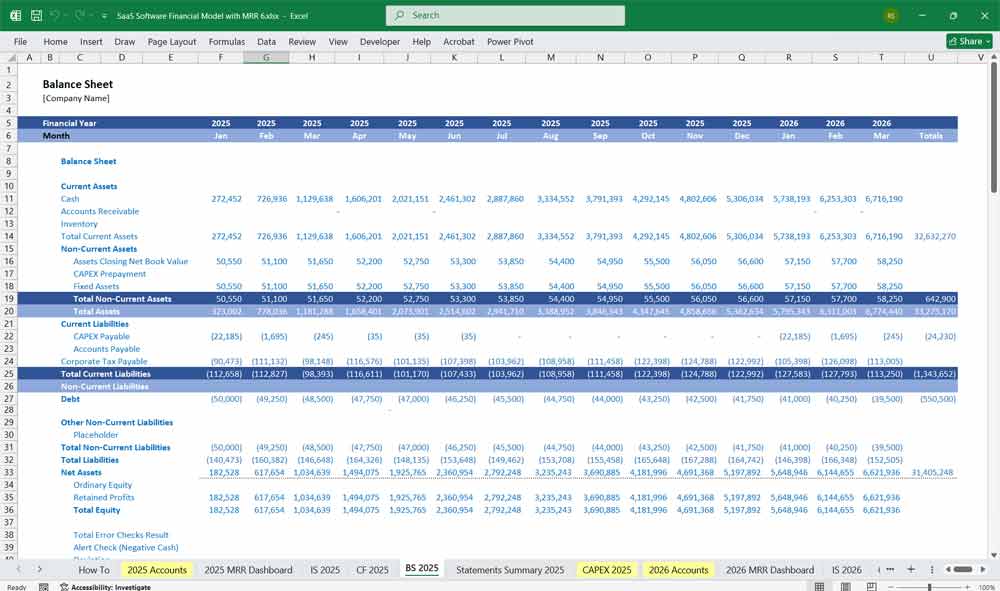

SaaS Software Balance Sheet

Shows assets, liabilities, and equity at a point in time.

Assets

Current Assets

Cash & cash equivalents

Accounts receivable (unpaid invoices)

Prepaid expenses

Long-Term Assets

Property & equipment (if any)

Capitalized software development costs

Liabilities

Current Liabilities

Accounts payable (unpaid bills)

Deferred revenue (unearned revenue from annual subscriptions)

Short-term debt

Long-Term Liabilities

Long-term debt

Lease obligations

Equity

Common stock

Retained earnings (accumulated profits)

Additional paid-in capital (investor funds)

Key SaaS Metrics to Track

Customer Acquisition Cost (CAC) = Sales & Marketing Spend / New Customers Acquired

Lifetime Value (LTV) = (Avg. Revenue per User × Gross Margin %) / Churn Rate

LTV:CAC Ratio (Target: 3x or higher)

Churn Rate = (Churned Customers / Total Customers) × 100

Quick Ratio = (New MRR + Expansion MRR) / Churned MRR (Target: >4x)

6-Tier Subscription Model for a SaaS Company

A well-structured 6-tier subscription model allows a SaaS company to cater to different customer segments, from small businesses to large enterprises, while maximizing revenue through upsells and cross-sells. Below is a detailed breakdown of six subscription tiers, including pricing, features, target audience, and key differentiators.

1. Free SaaS Tier (Freemium)

Target Audience: Startups, solopreneurs, small businesses testing the software.

Pricing: $0

Key Features:

Basic functionality with limited usage (e.g., 1 user, 10 GB storage).

Entry-level support (community forums, knowledge base).

Branded watermark on exports.

No API access.

Upsell Path: Conversion to “Starter” or “Pro” tiers via in-app prompts.

Monetization Strategy: Lead generation for paid tiers.

2. Starter SaaS Tier

Target Audience: Small businesses, freelancers needing essential features.

Pricing: 19–19–49/month (billed annually for discount).

Key Features:

All Free Tier features + ad-free experience.

1–5 users, 50 GB storage.

Basic analytics & reporting.

Email support (24–48 hour response).

Limited integrations (e.g., Zapier, Google Workspace).

Upsell Path: Highlight limitations (e.g., “Need more users? Upgrade to Pro!”).

Monetization Strategy: Low-cost entry point for SMBs.

3. Professional SaaS Tier (Most Popular)

Target Audience: Growing businesses, mid-sized teams.

Pricing: 99–99–199/month (annual billing preferred).

Key Features:

Everything in Starter + advanced features.

10–20 users, unlimited storage.

Custom reporting & dashboards.

Priority support (12–24 hour response).

API access (limited calls/month).

Single Sign-On (SSO) via Google/Microsoft.

Upsell Path: Push for “Business” tier with advanced security & compliance.

Monetization Strategy: Balances affordability with high perceived value.

4. Business SaaS Tier

Target Audience: Established companies needing scalability & security.

Pricing: 499–499–999/month (custom annual contracts).

Key Features:

All Professional features + enterprise-grade tools.

25–100 users, role-based permissions.

Advanced security (SAML, audit logs).

Dedicated account manager.

SLA guarantees (99.9% uptime).

White-labeling options.

Upsell Path: Custom “Enterprise” solutions for large deployments.

Monetization Strategy: High-margin tier with strong retention.

5. Enterprise SaaS Tier (Custom Pricing)

Target Audience: Large corporations, government agencies.

Pricing: $2,500+/month (negotiated contracts).

Key Features:

Everything in Business + fully customizable.

Unlimited users, on-premise/hybrid deployment.

24/7 VIP support with SLAs.

Custom integrations & workflows.

Compliance certifications (SOC 2, GDPR, HIPAA).

Training & onboarding services.

Upsell Path: Multi-year contracts, add-on professional services.

Monetization Strategy: High-touch sales, long-term revenue.

6. SaaS Partner/Reseller Tier

Target Audience: Agencies, consultants, white-label partners.

Pricing: Volume-based discounts (30–50% off retail).

Key Features:

All Enterprise features + reseller rights.

Co-branding & private labeling.

Revenue-sharing/affiliate programs.

API access for embedding into their products.

Dedicated partner support.

Upsell Path: Expand partnership with training & co-marketing.

Monetization Strategy: Expands market reach via third-party sales.

Key Considerations for a 6-Tier SaaS Model:

Clear Differentiation: Each tier should justify its price jump with tangible value.

Upsell Pathways: Use feature gating to encourage upgrades (e.g., “This report requires Pro”).

Churn Reduction: Offer annual discounts & tiered support to retain customers.

Pricing Testing: Continuously A/B test pricing pages for optimal conversion.

SaaS (Software as a Service) Development

Professional project management significantly impacts a financial model by shifting traditional capital expenditures (CapEx) to operational expenditures (OpEx). Unlike on-premise solutions, SaaS software development requires ongoing cloud infrastructure costs, subscription-based revenue recognition, and continuous updates, affecting cash flow projections and profitability timelines. Efficient project management ensures timely releases, scalability, and customer retention—key drivers of recurring revenue. Metrics like Customer Acquisition Cost (CAC), Lifetime Value (LTV), and churn rate become critical in forecasting growth and sustainability. The pay-as-you-go SaaS model also demands flexible budgeting for R&D, customer support, and scaling infrastructure, altering long-term financial planning compared to traditional software sales.

Final Notes on the Financial Model

This 5-Year SaaS Software Financial Model must focus on balancing capital expenditures with steady revenue growth from diversified subscription-based services. By optimizing operational and service costs, and maximizing high-margin services like Project Management, HR, and CMS, the model aids profitability and cash flow stability.

Download Link on Next Page

Download Link On Next Page