SaaS CRM Financial Model

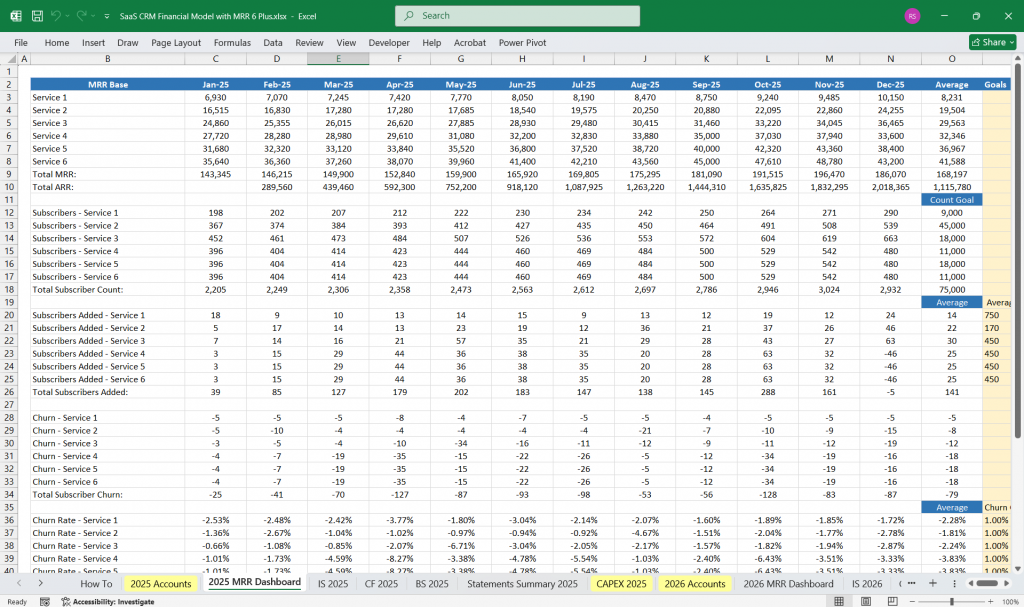

Here’s a comprehensive breakdown of the Excel SaaS CRM Financial Model covering the Income Statement, Cash Flow Statement, and Balance Sheet. With revenues from project-based work and subscriptions. Cost structures and financial model statements to forecast the financial health of your SaaS business.

Financial Model for a SaaS CRM Company

Covering key components such as the Income Statement, Cash Flow Statement, and Balance Sheet.

What Do You Get? 2 Versions In 1 Zip File

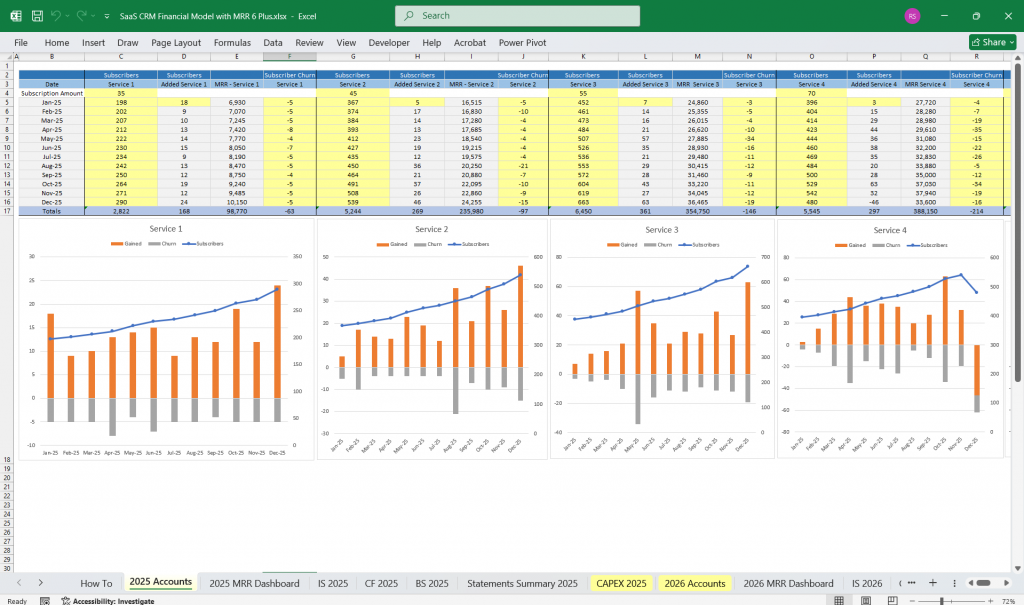

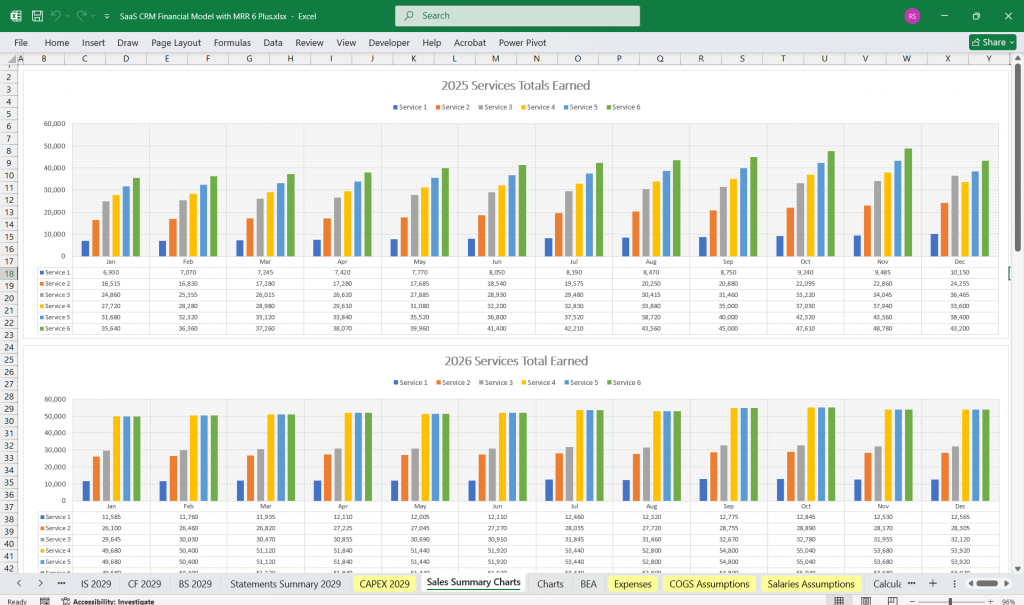

Version 1: 5-Year, 3 Statement Financial model with 5 PAYG project-based revenue streams and reporting of your SaaS CRM financials.

Version 2: 5-Year, 3 Statement with a 6 Tier Subscription revenue ‘Managed Service Agreements’. Build your MSA book as quickly as possible.

You would typically sell your services at tiered 12-month agreements that increase in price as SLAs (Service Level Agreement) and monthly consulting hours scale upwards.

Plus 5 PAYG Revenues.

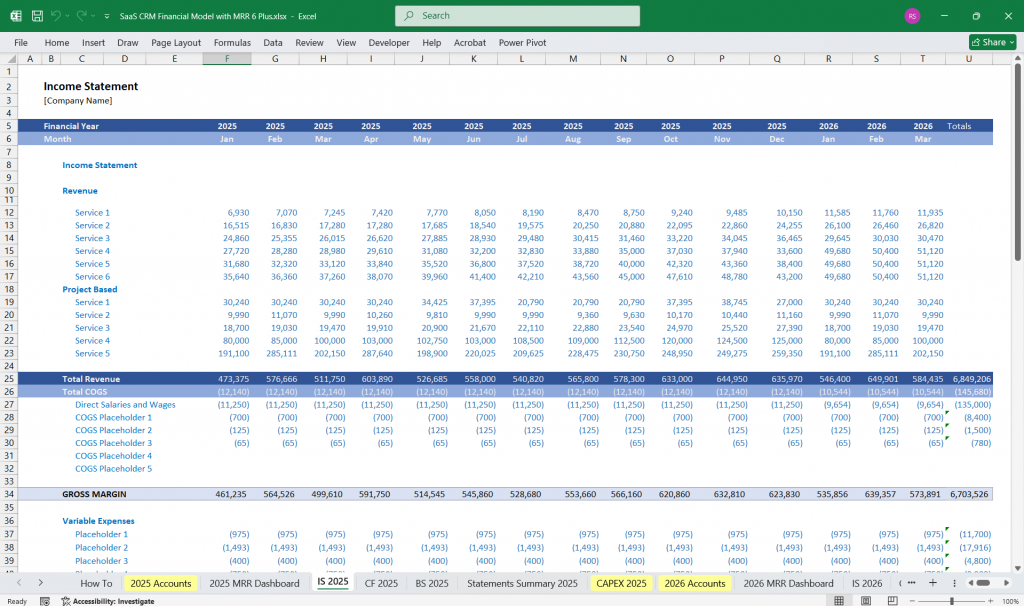

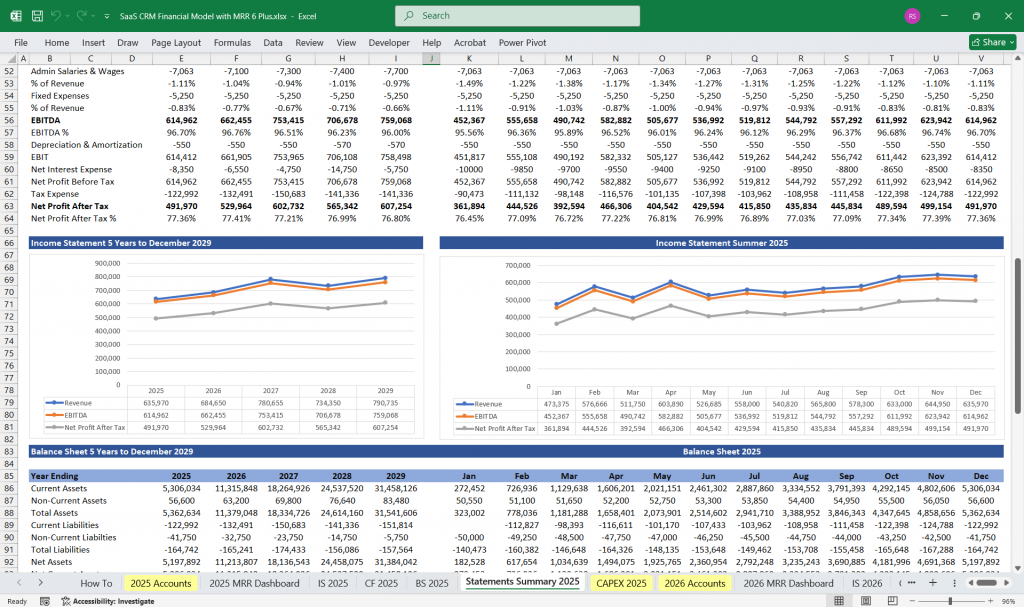

Income Statement (Profit & Loss Statement)

The income statement tracks revenue, expenses, and profitability over a specific period.

Revenue

- Subscription Revenue (MRR & ARR)

- Monthly and Annual Plan revenues

- Tiered pricing (e.g., Basic, Professional, Enterprise)

- Professional Services Revenue

- Onboarding, consulting, training fees

- Add-on Revenue

- API access, integrations, analytics upgrades

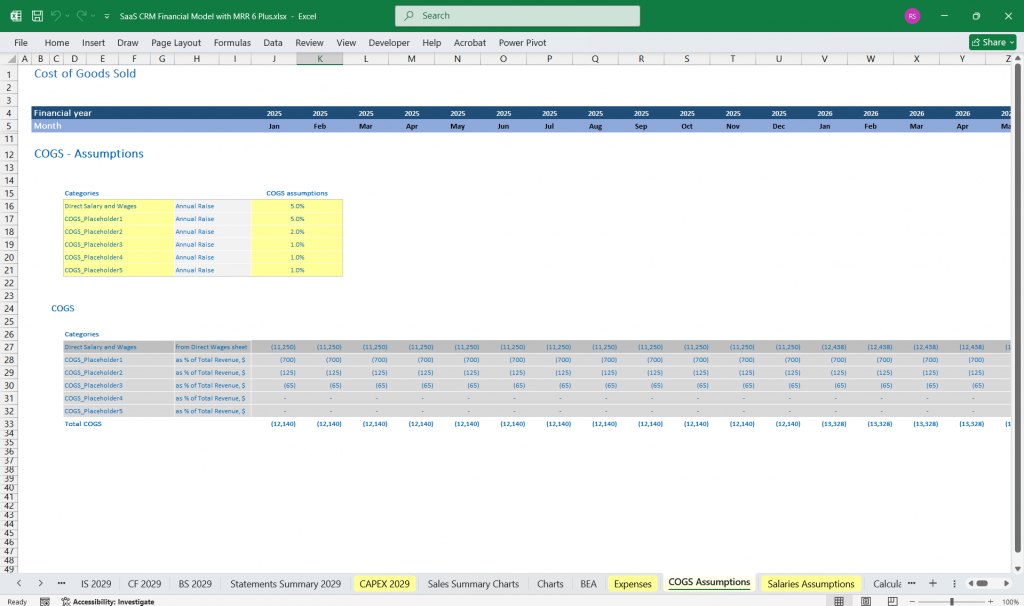

Cost of Goods Sold (COGS)

- Hosting Costs (Cloud server costs)

- Customer Support Costs (Salaries, ticketing tools)

- Third-party Software Fees (APIs, payment processing)

Gross Profit = Revenue – COGS

Gross Margin (%) = (Gross Profit / Revenue) * 100

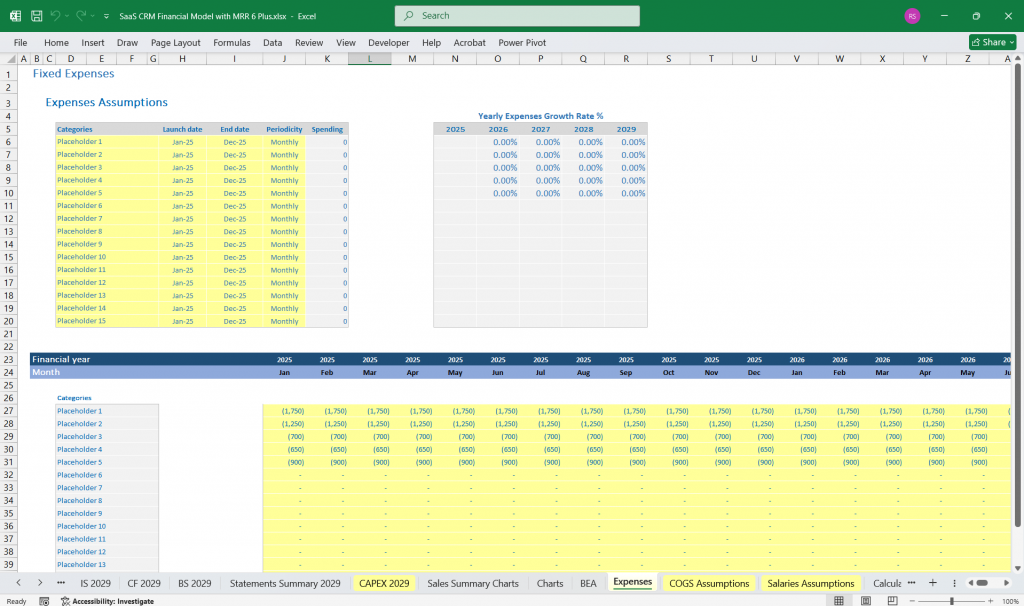

Operating Expenses

- Sales & Marketing (S&M)

- Paid ads (Google, Facebook, LinkedIn)

- Sales team salaries & commissions

- Webinars, trade shows, content marketing

- Research & Development (R&D)

- Developer salaries

- Product design and testing

- Software tools for development

- General & Administrative (G&A)

- Office rent, utilities

- HR, legal, accounting expenses

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

= Gross Profit – Operating Expenses

Other Expenses

- Depreciation & Amortization (Software development, capitalized expenses)

- Interest Expense (Loan repayments, credit lines)

- Taxes (Corporate income tax)

Net Income = EBITDA – Other Expenses – Taxes

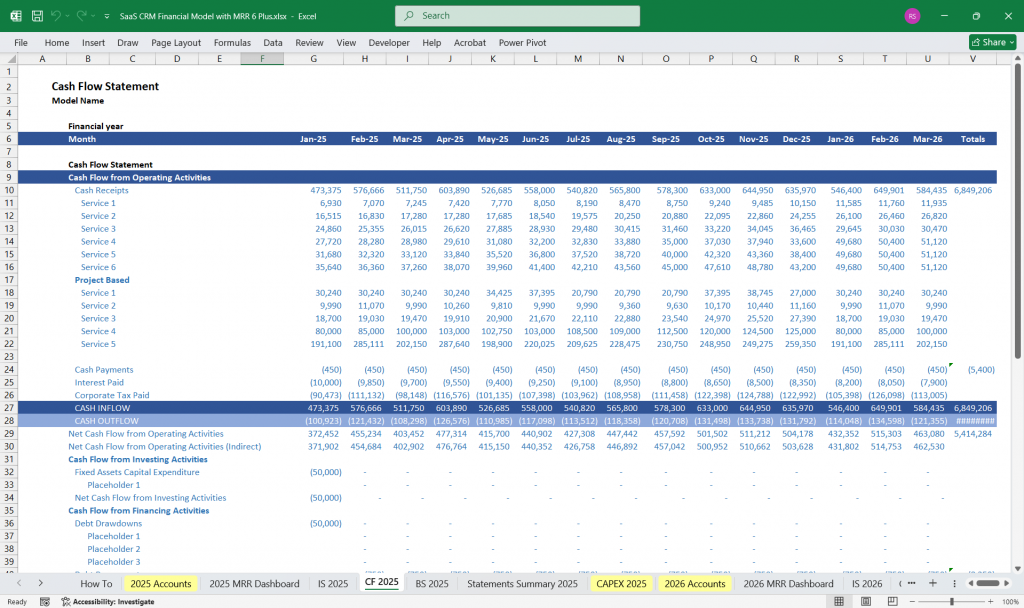

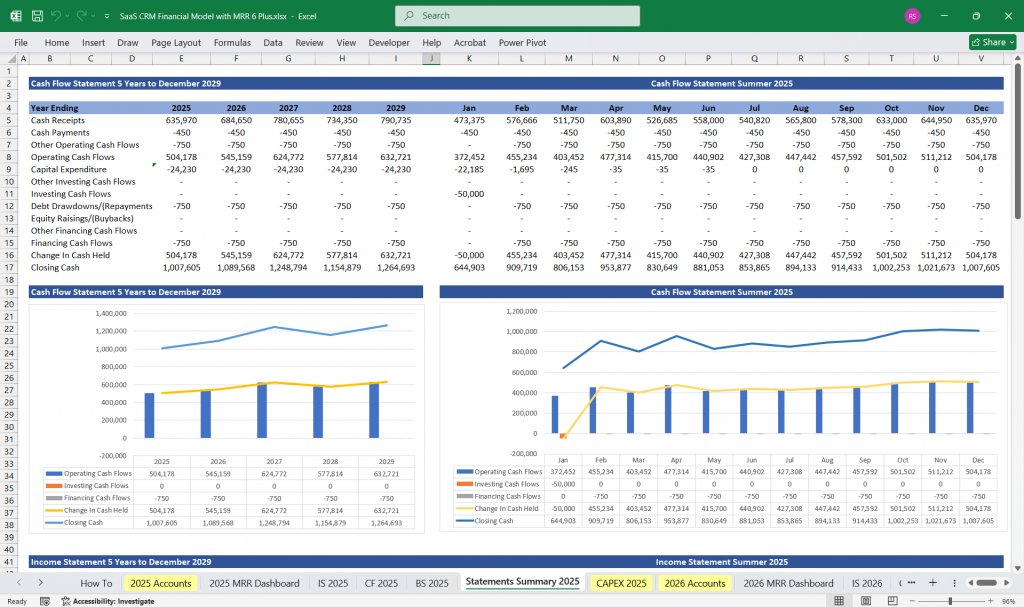

SaaS CRM Financial Model Cash Flow Statement

The cash flow statement shows how cash moves in and out of the business.

Operating Cash Flow

- Net Income (From Income Statement)

- Adjustments for Non-Cash Items

- Depreciation & Amortization

- Stock-based compensation

- Changes in Working Capital

- Increase/decrease in Accounts Receivable

- Increase/decrease in Accounts Payable

- Deferred Revenue (Prepaid subscriptions)

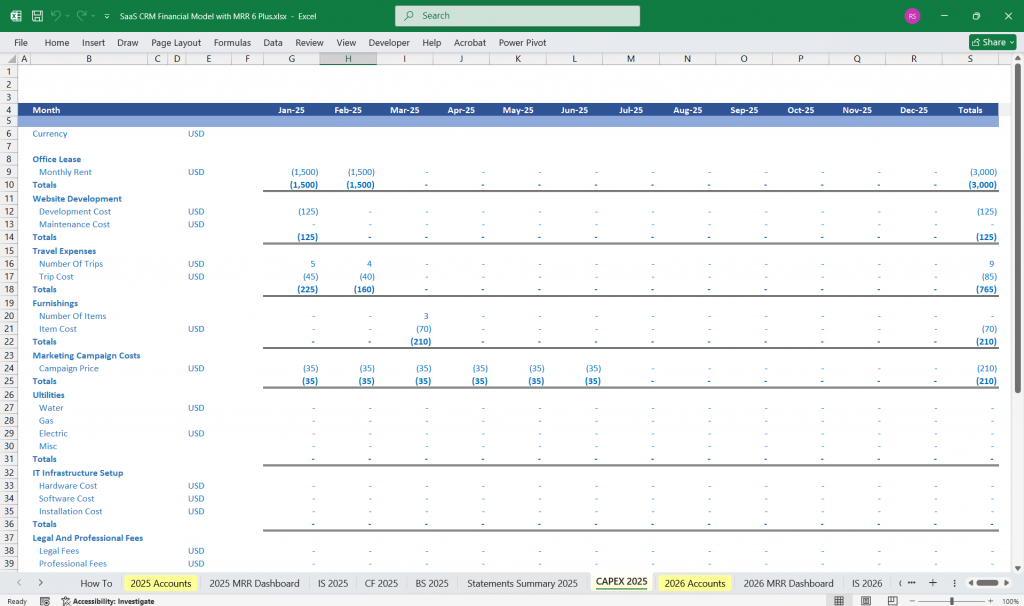

Investing Cash Flow

- Capital Expenditures (CapEx)

- Investments in software development

- Office equipment, new servers

- Acquisitions of Other Companies

- Mergers, acquisitions, or partnerships

Financing Cash Flow

- Equity Financing

- Venture capital funding rounds (Seed, Series A, B, C)

- Debt Financing

- Loans, credit lines, interest payments

- Stock Buybacks & Dividends

- Rare in growth-stage SaaS companies

Net Cash Flow = Operating Cash Flow + Investing Cash Flow + Financing Cash Flow

Ending Cash Balance = Beginning Cash + Net Cash Flow

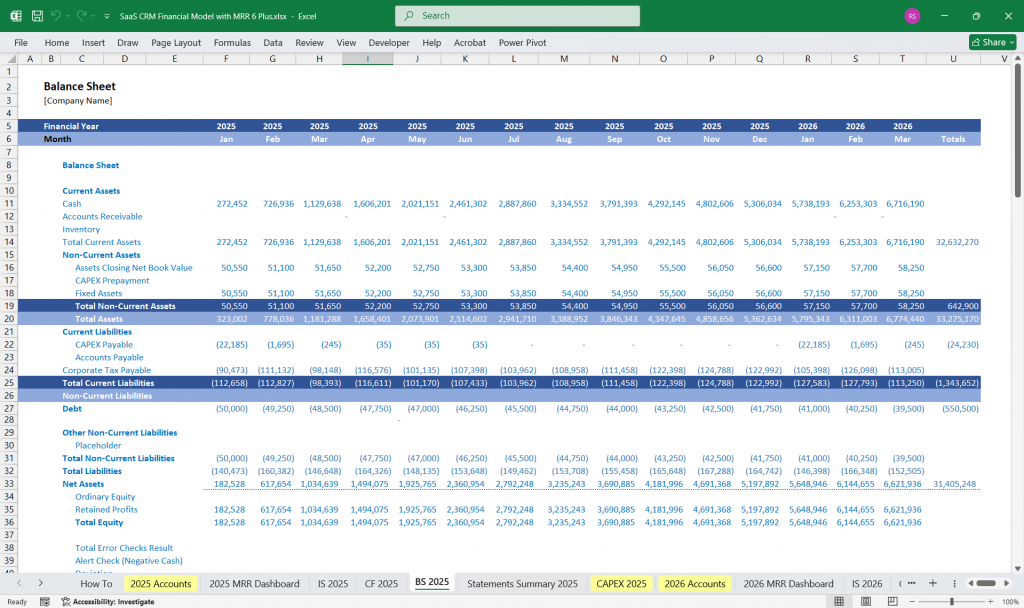

SaaS CRM Financial Model Balance Sheet

The balance sheet provides a snapshot of the company’s financial position at a specific time.

Assets

Current Assets

- Cash & Cash Equivalents (Bank balances)

- Accounts Receivable (Unpaid customer invoices)

- Deferred Revenue (Short-Term) (Prepaid annual subscriptions)

- Prepaid Expenses (Software licenses, cloud services)

Non-Current Assets

- Intangible Assets (Capitalized software development costs)

- Property, Plant & Equipment (PP&E) (Office space, IT equipment)

- Long-Term Investments (Acquisitions, equity investments)

Liabilities

Current Liabilities

- Accounts Payable (Unpaid bills for vendors, services)

- Deferred Revenue (Short-Term) (Revenue collected but not yet earned)

- Short-Term Debt (Loans maturing within a year)

Non-Current Liabilities

- Long-Term Debt (Convertible notes, venture debt)

- Deferred Revenue (Long-Term) (Multi-year contracts)

- Lease Obligations (Office space rent)

Equity

- Common Stock & Additional Paid-In Capital (Investor funding)

- Retained Earnings (Cumulative net income over time)

- Stock-Based Compensation Reserves (Employee Stock Options)

Assets = Liabilities + Equity

Key Assumptions and Drivers for a SaaS CRM Company

Before diving into financial statements, a financial model for a SaaS CRM company must include key assumptions:

SaaS CRM – Revenue Streams

- SaaS Subscription tiers (monthly/annual plans)

- One-time setup or onboarding fees

- Add-ons and premium features

- SaaS CRM API access fees for integrations

- SaaS Professional services (consulting, training)

SaaS CRM – Customer Acquisition

- SaaS Marketing budget allocation

- SaaS Cost per lead (CPL) analysis

- SaaS Conversion rate optimization

- Sales team commissions and incentives

- SaaS Partner or affiliate program costs

SaaS CRM – Churn and Retention Analysis

- SaaS Monthly churn rate tracking

- Customer Lifetime Value (CLV) calculation

- Win-back campaign costs

- SaaS Onboarding process effectiveness

- SaaS Support team impact on retention

SaaS CRM – Pricing Strategy

- SaaS Tiered pricing model development

- Freemium vs. premium analysis

- Competitor pricing benchmarks

- Value-based pricing alignment

- SaaS Discount strategies and their impact

SaaS CRM – Cost of Goods Sold (COGS)

- SaaS Cloud hosting and infrastructure costs

- SaaS Data storage and processing fees

- Support team expenses

- SaaS Third-party integrations

- SaaS Software licenses and maintenance

SaaS CRM – Operational Expenses

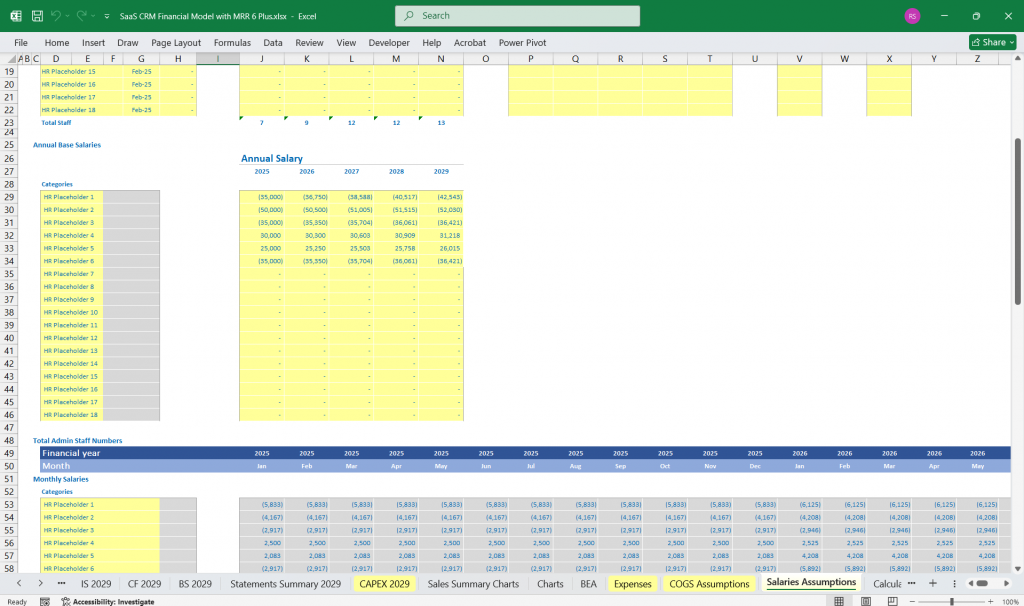

- Salaries and headcount planning

- SaaS Office and remote work infrastructure

- SaaS Sales and marketing spend

- SaaS Research and development (R&D)

- General and administrative (G&A) expenses

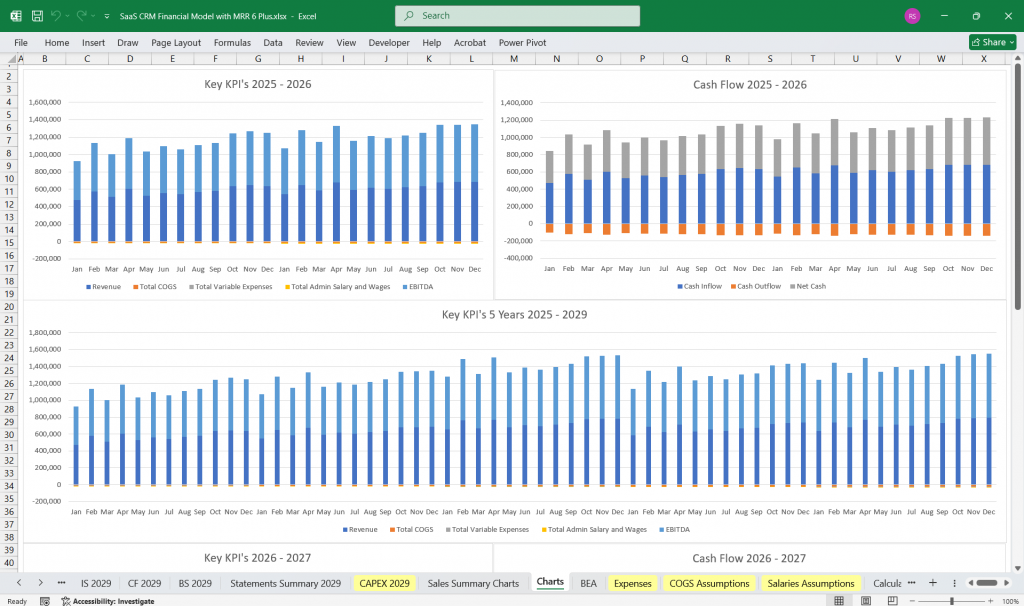

SaaS CRM – Key Performance Indicators (KPIs)

- SaaS and Monthly Recurring Revenue (MRR)

- Customer Acquisition Cost (CAC)

- SaaS CRM Churn rate and Net Revenue Retention (NRR)

- SaaS Average Revenue Per User (ARPU)

- Payback period on CAC

SaaS CRM – Cash Flow Management

- SaaS Forecasting cash inflows and outflows

- Managing deferred revenue

- Planning for capital expenditures

- SaaS Scenario modeling for growth vs. churn

- Building cash reserves for stability

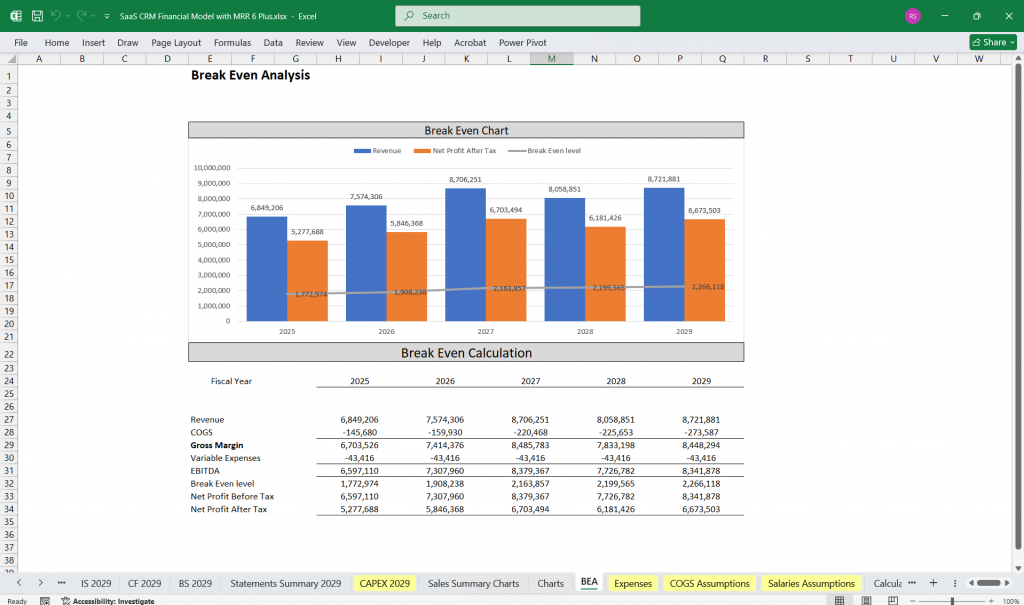

SaaS CRM – Break-Even Analysis

- Fixed vs. variable costs assessment

- SaaS Sales volume required to break even

- Time to profitability estimation

- Impact of pricing changes on break-even

- Sensitivity analysis for SaaS growth scenarios

SaaS CRM – Growth Projections

- Monthly SaaS user acquisition forecasts

- SaaS Revenue growth rate assumptions

- SaaS Expansion into new markets or segments

- SaaS Upsell and cross-sell potential

- SaaS Product development and feature rollouts

Financial Metrics

- Gross Margin (%) (Revenue – COGS) / Revenue

- Net Profit Margin (%) (Net Income / Revenue)

- Burn Rate (Monthly operating expenses)

- Runway (Cash balance / Burn rate)

- ARR & MRR (Annual and Monthly Recurring Revenue)

- Rule of 40 (Growth rate + Profitability > 40%)

6-Tier Subscription Model for a SaaS CRM Company

1. Free SaaS CRM Tier (Freemium Plan)

Target Audience: Solo entrepreneurs, freelancers, and startups testing the CRM before committing.

Features:

✅ Basic contact management (up to 500 contacts)

✅ Limited SaaS CRM pipeline management (1 sales pipeline)

✅ Task and activity tracking

✅ Email integration (basic syncing)

✅ Basic reports & SaaS CRM dashboards

✅ Community support

Pricing Strategy:

- Free forever but heavily encourages upsells to paid tiers through usage limits.

- Monetize via add-ons, integrations, or premium customer support.

Value Proposition:

- Low-friction onboarding for potential long-term customers.

- Users experience core CRM functionality before upgrading.

2. Starter SaaS CRM Tier ($15 – $25/user/month)

Target Audience: Small businesses & startups needing more than the free plan but with a limited budget.

Features:

✅ Everything in Free Tier +

✅ Unlimited SaaS CRM contacts & sales pipelines

✅ Email tracking & templates

✅ Calendar & meeting scheduling

✅ Mobile SaaS CRM app access

✅ 5GB cloud storage per user

✅ Standard customer support

Pricing Strategy:

- Priced competitively for small teams (2-10 users).

- Keeps features simple yet effective to prevent churn.

Value Proposition:

- Affordable automation & sales tracking for growing teams.

- Helps small businesses improve productivity without high costs.

3. Growth SaaS CRM Tier ($40 – $60/user/month)

Target Audience: Mid-sized businesses scaling their sales and customer success efforts.

Features:

✅ Everything in Starter Tier +

✅ Advanced sales automation (e.g., auto-follow-ups)

✅ AI-powered lead scoring

✅ Custom SaaS CRM workflow automation

✅ Social media integrations

✅ 50GB cloud storage per user

✅ Standard API access

✅ 24/7 SaaS CRM chat & email support

Pricing Strategy:

- Positioned as the best value-for-money tier.

- Encourages annual subscriptions with 10-20% discount.

Value Proposition:

- Boosts efficiency through automation and AI insights.

- Designed for companies expanding their sales & marketing efforts.

4. Professional SaaS CRM Tier ($80 – $120/user/month)

Target Audience: Established companies with complex sales processes and larger teams.

Features:

✅ Everything in Growth Tier +

✅ Advanced CRM customization (custom fields, dashboards)

✅ Territory & team-based sales management

✅ AI-driven SaaS CRM predictive analytics

✅ Multi-currency & multi-language SaaS CRM support

✅ 100GB cloud storage per user

✅ Premium API access & integrations

✅ Dedicated SaaS CRM account manager

Pricing Strategy:

- Ideal for businesses requiring scalability & customization.

- Encourages long-term contracts (discounts for 2-3 year deals).

Value Proposition:

- Enables highly customized CRM workflows.

- Ideal for organizations with regional/global teams.

5. Enterprise SaaS CRM Tier ($150 – $250/user/month, custom pricing for large teams)

Target Audience: Large corporations & enterprises needing high security, compliance, and integrations.

Features:

✅ Everything in Professional Tier +

✅ Enterprise-grade SaaS CRM security (SSO, HIPAA, SOC 2 compliance)

✅ Custom AI-driven analytics dashboards

✅ Advanced role-based SaaS CRM access controls

✅ Unlimited cloud storage

✅ Priority 24/7 phone & chat support

✅ Custom API limits & SLA-backed SaaS CRMuptime guarantee

✅ Onboarding & SaaS CRM training services

Pricing Strategy:

- Custom quotes based on seats, storage, and integrations.

- Focus on multi-year contracts (3-5 years) with enterprise discounts.

Value Proposition:

- Ultimate security, scalability, and integrations for enterprises.

- Dedicated customer success team for onboarding & support.

6. Elite/White-Label SaaS CRM Tier ($500+/user/month, fully custom pricing)

Target Audience: Large corporations, franchises, and companies needing a white-labeled CRM solution.

Features:

✅ Everything in Enterprise Tier +

✅ Fully white-labeled CRM (custom branding & UI)

✅ Dedicated private cloud hosting

✅ AI-powered SaaS CRM business intelligence tools

✅ On-premise deployment (if needed)

✅ 99.99% uptime SLA with dedicated server clusters

✅ Full-scale API customization & SaaS CRM developer support

✅ Personalized team training & consulting services

Pricing Strategy:

- Completely custom pricing, tailored for big-ticket clients.

- Heavy focus on multi-year contracts (5+ years).

Value Proposition:

- Designed for organizations wanting full control & branding over their CRM.

- Best for franchises, SaaS resellers, and large enterprises with unique needs.

Key Takeaways for the 6-Tier SaaS CRM Model

The freemium strategy captures leads and drives upgrades.

Tiered pricing ensures that businesses of all sizes find a suitable plan.

Customization & API access become key differentiators at higher tiers.

Annual & multi-year discounts increase customer lifetime value (LTV).

Enterprise & Elite tiers offer white-labeling and security for high-value clients.

Final Notes on the Financial Model

Financial model for a SaaS CRM Company

- Scenario Analysis: Create best-case, base-case, and worst-case projections.

- Break-even Analysis: Determine sales volume required to cover fixed & variable costs.

- Sensitivity Analysis: Assess how changes in raw material costs, pricing, or demand impact profitability.

This structured model helps a SaaS CRM business address a broad market spectrum, offering the right balance between cost, production capacity, support, and customization at each subscription and project based level.

Download Link On Next Page