Recycling Centre Financial Model

Financial Model for a Recycling Centre

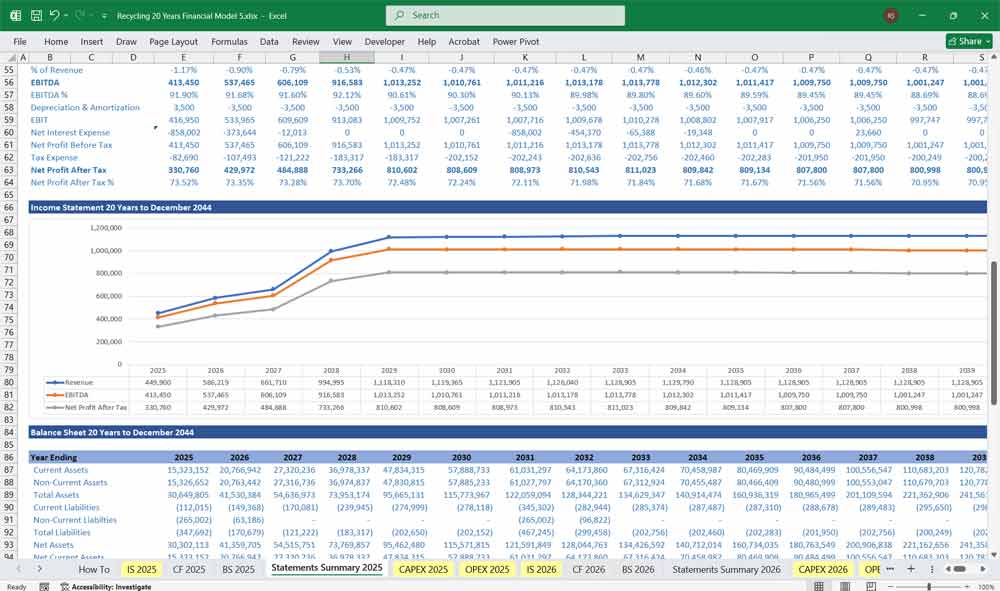

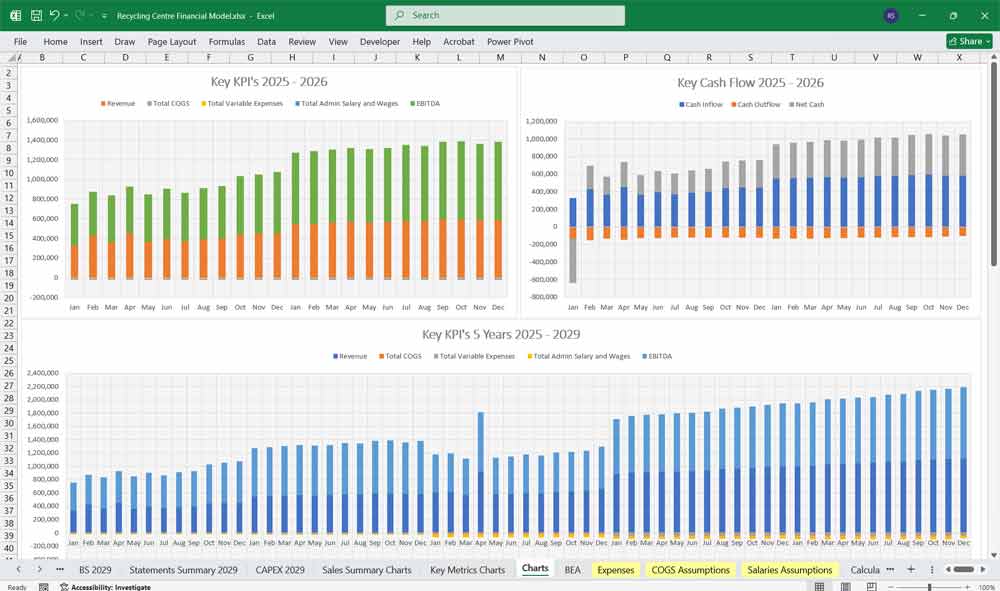

Covering key components such as the Income Statement, Cash Flow Statement, and Balance Sheet.

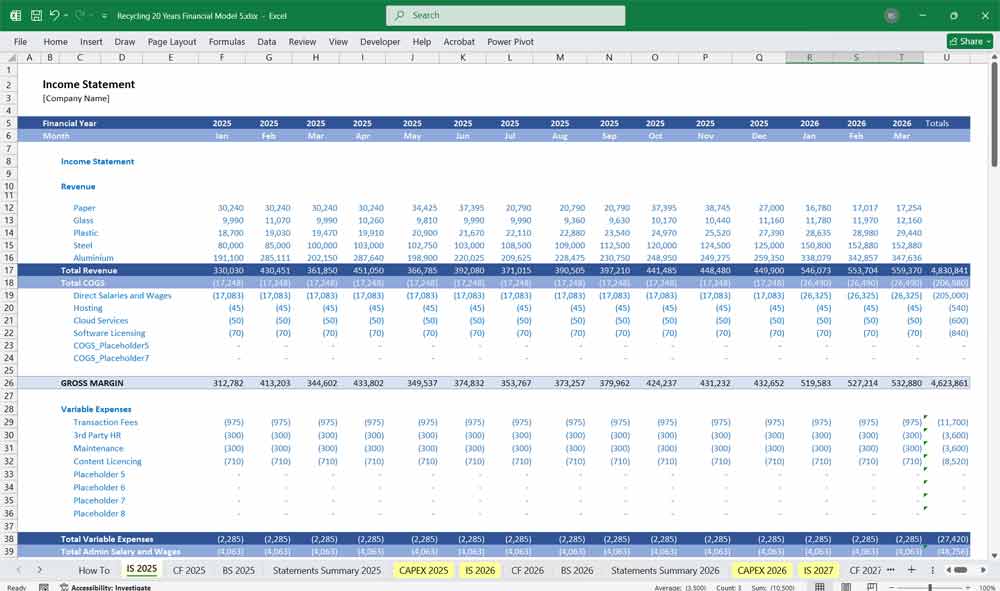

Income Statement (Profit & Loss Statement)

The Income Statement provides a snapshot of the Recycling Centre’s profitability over a specific period and gives a straightforward picture of whether a company has made a profit or a loss throughout the year.

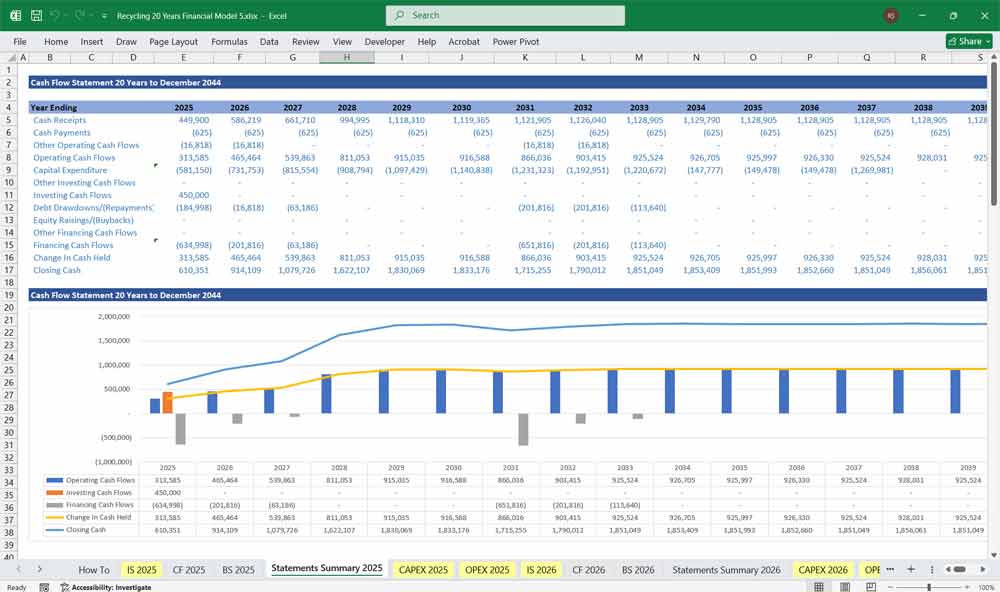

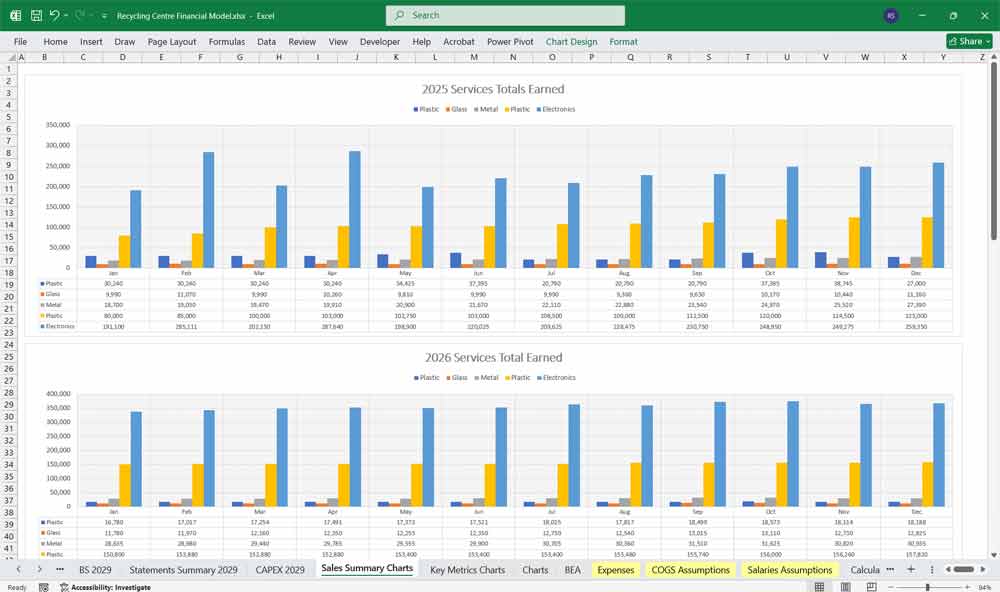

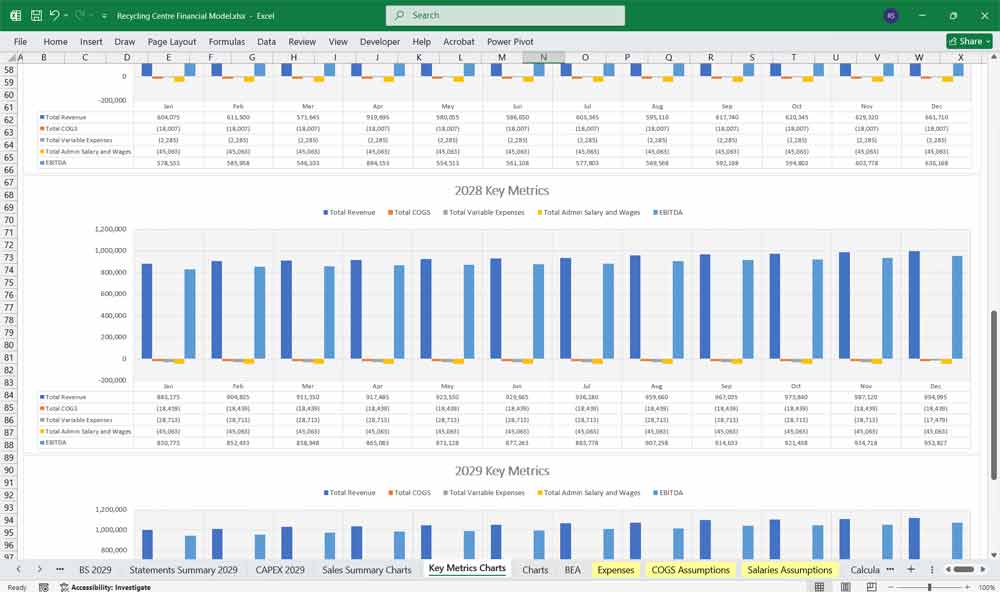

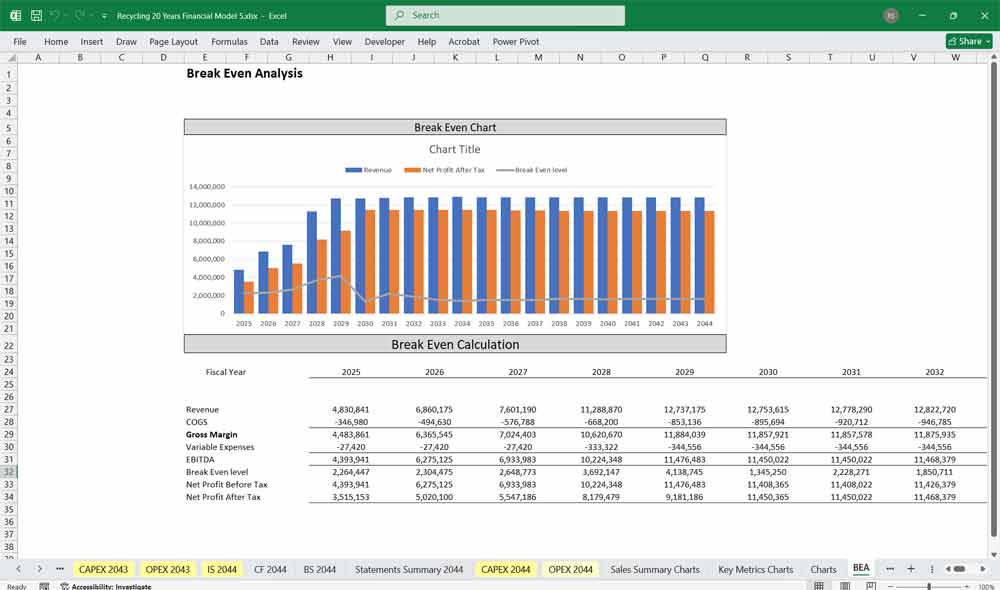

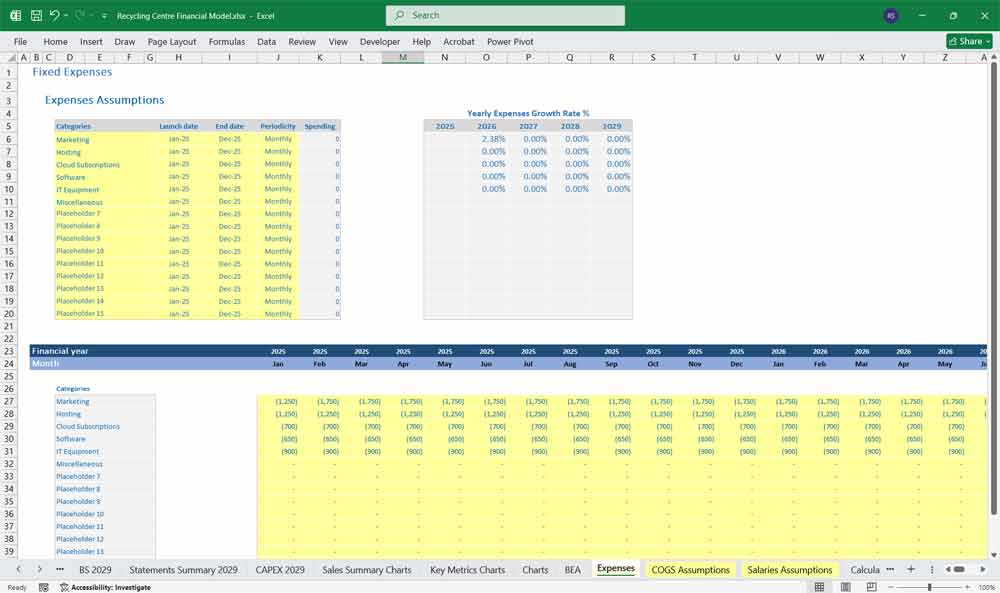

20x Income and Cash Flow Statements, Balance Sheets, CAPEX and OPEX Spreadsheets, Statement Summary Sheets and Charts, and Revenue Forecasting Charts with the income revenue streams, 20 year BEA charts, sales summary charts, employee salary tabs and expenses sheets. 140 spreadsheets in 1 Excel Workbook.

Revenue Streams

- Sale of Recycled Materials: Revenue from selling processed materials such as plastic, glass, metal, paper, and electronics.

- Collection Fees: Charges to households, businesses, or municipalities for waste collection services.

- Government Grants & Subsidies: Support from local, state, or federal authorities to encourage recycling.

- Carbon Credits & Environmental Incentives: Earnings from trading carbon credits for reducing environmental impact.

- Recycling Program Partnerships: Revenue from collaborations with corporations or organizations to process their waste.

- Consulting & Educational Services: Income from sustainability programs, awareness campaigns, or consulting services.

- Scrap & By-product Sales: Revenue from selling leftover scrap material not processed into primary recycled products.

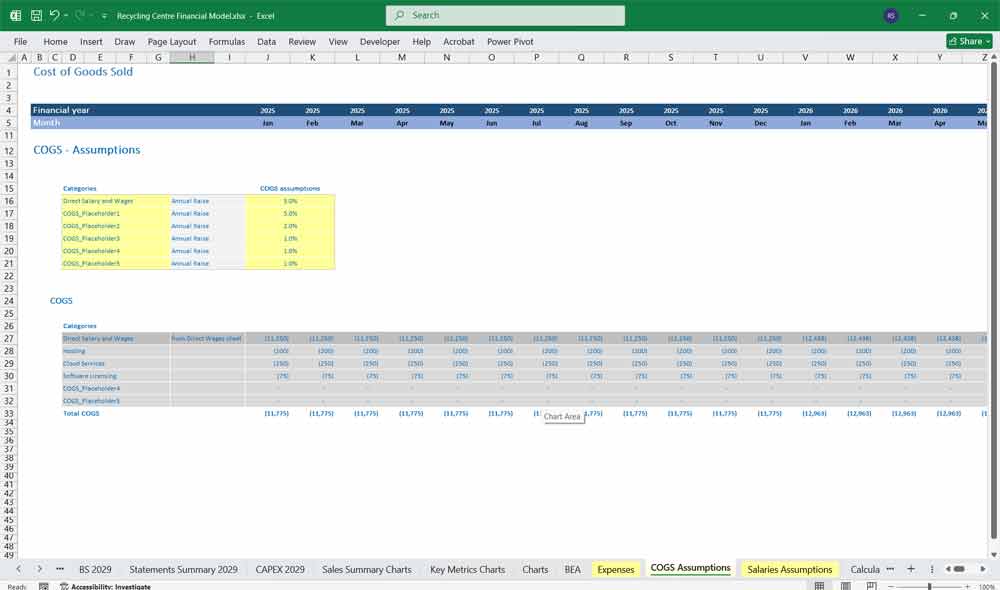

Cost of Goods Sold (COGS)

- Collection & Transportation Costs: Fuel, vehicle maintenance, and driver wages.

- Sorting & Processing Costs: Labor and machinery costs for sorting, shredding, and refining materials.

- Facility Utilities & Maintenance: Power, water, and maintenance expenses for recycling plants.

- Depreciation of Equipment: Allocation of costs for recycling machinery and plant infrastructure.

- Storage & Inventory Costs: Expenses related to warehousing recycled goods.

Gross Profit

(Revenue – COGS = Gross Profit)

Operating Expenses (OPEX)

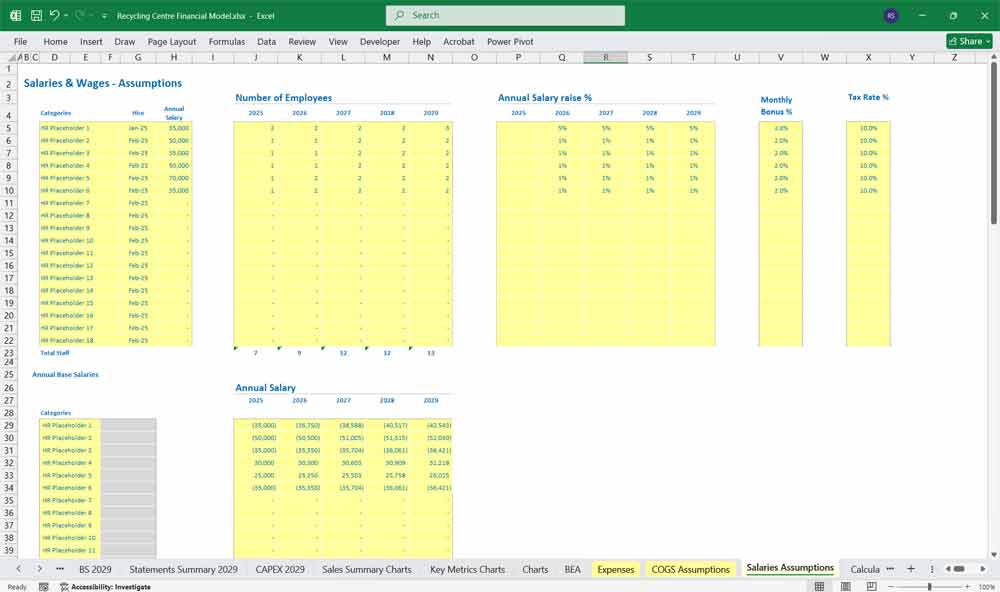

- Salaries & Wages: Employee compensation, including plant workers, drivers, and administrative staff.

- Rent & Lease Costs: If the recycling plant or land is rented.

- Marketing & Sales Costs: Advertising, partnerships, and community engagement expenses.

- Regulatory Compliance Costs: Fees for permits, environmental compliance, and certifications.

- Insurance Costs: Policies covering property, liability, workers’ compensation, and business interruption.

- Research & Development (R&D): Costs for improving recycling technology and processes.

- General Administrative Expenses: Office supplies, professional fees, and other overheads.

Operating Profit (EBIT)

(Gross Profit – OPEX = EBIT)

Interest & Taxes

- Interest Expense: Costs of servicing loans or lease obligations.

- Income Tax Expense: Taxes based on pre-tax income.

Net Profit

(EBIT – Interest – Taxes = Net Profit)

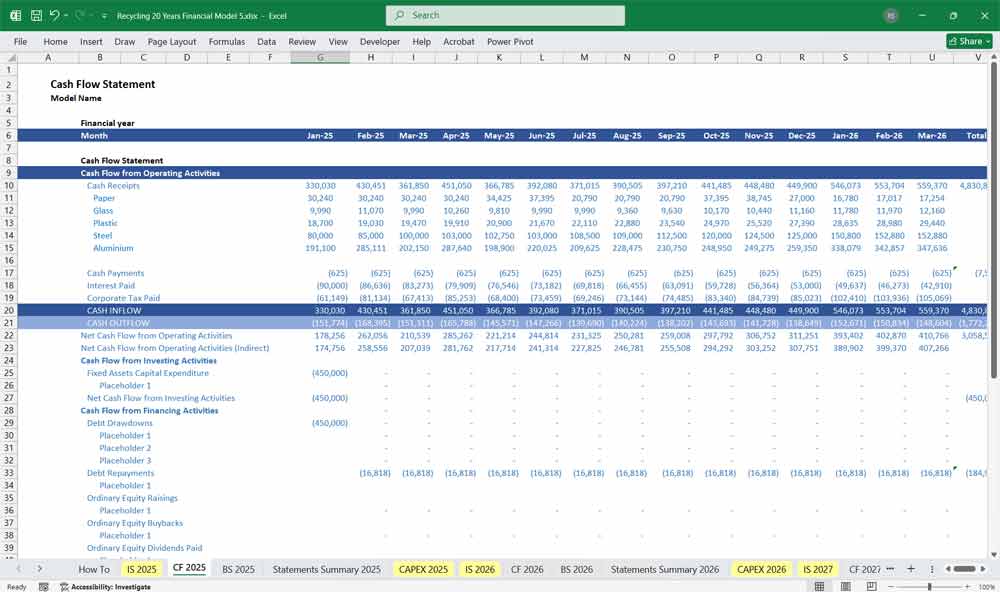

Recycling Centre Cash Flow Statement

The Cash Flow Statement tracks the movement of cash in and out of the business.

Operating Activities

- Cash Inflows:

- Revenue from recycled material sales

- Collection fees from customers

- Government grants & incentives received

- Cash Outflows:

- Salaries & wages

- Payment for raw materials and inventory

- Utility bills, rent, and maintenance expenses

- Taxes and regulatory fees

Investing Activities

- Cash Inflows:

- Sale of old machinery or equipment

- Income from financial investments (if any)

- Cash Outflows:

- Purchase of new recycling equipment

- Investment in facility expansion or upgrades

Financing Activities

- Cash Inflows:

- Bank loans or grants received

- Issuance of equity or capital infusion from investors

- Cash Outflows:

- Loan repayments

- Dividend payments (if applicable)

Net Cash Flow

(Total Inflows – Total Outflows = Net Cash Flow)

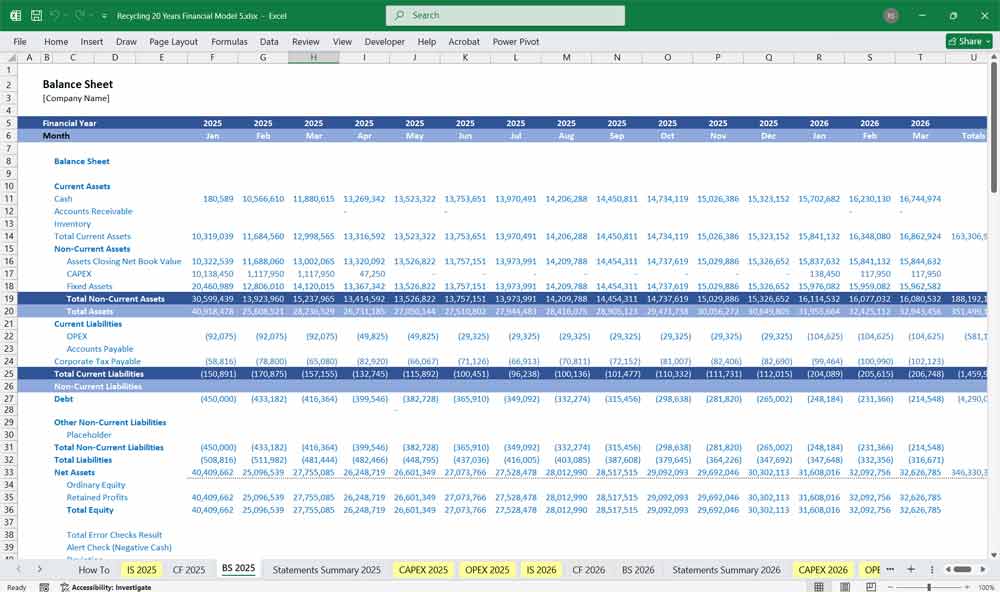

Recycling Centre Balance Sheet

The Balance Sheet provides a financial snapshot at a given point in time, giving a viewpoint of, assets, liabilities, and because of this, it is crucial for stakeholders to evaluate the company’s financial health.

Assets

Current Assets

- Cash & Cash Equivalents: Cash on hand, bank deposits, and short-term investments.

- Accounts Receivable: Payments owed by customers, businesses, or municipalities.

- Inventory: Processed recyclable materials ready for sale.

- Prepaid Expenses: Advance payments for rent, insurance, or supplies.

Non-Current Assets

- Property, Plant & Equipment (PP&E): Land, buildings, machinery, vehicles, and processing equipment.

- Accumulated Depreciation: Reduction in asset values over time.

- Long-Term Investments: Bonds, shares, or other long-term financial investments.

Liabilities

Current Liabilities

- Accounts Payable: Outstanding payments to suppliers and service providers.

- Short-Term Debt: Bank loans or credit obligations due within one year.

- Accrued Expenses: Wages, taxes, and other expenses incurred but not yet paid.

Non-Current Liabilities

- Long-Term Debt: Loans or financial obligations beyond one year.

- Deferred Tax Liabilities: Taxes payable in the future due to temporary differences.

Equity

- Owner’s Equity / Shareholder’s Equity: Initial investment and retained earnings.

- Retained Earnings: Accumulated net profits reinvested into the business.

Balance Sheet Formula

(Assets = Liabilities + Equity)

Key Assumptions and Drivers for a Recycling Centre

Revenue Growth:

Market demand, pricing strategy, and recyclable product mix.

Cost Structure:

Raw material costs, labor rates, and production efficiency.

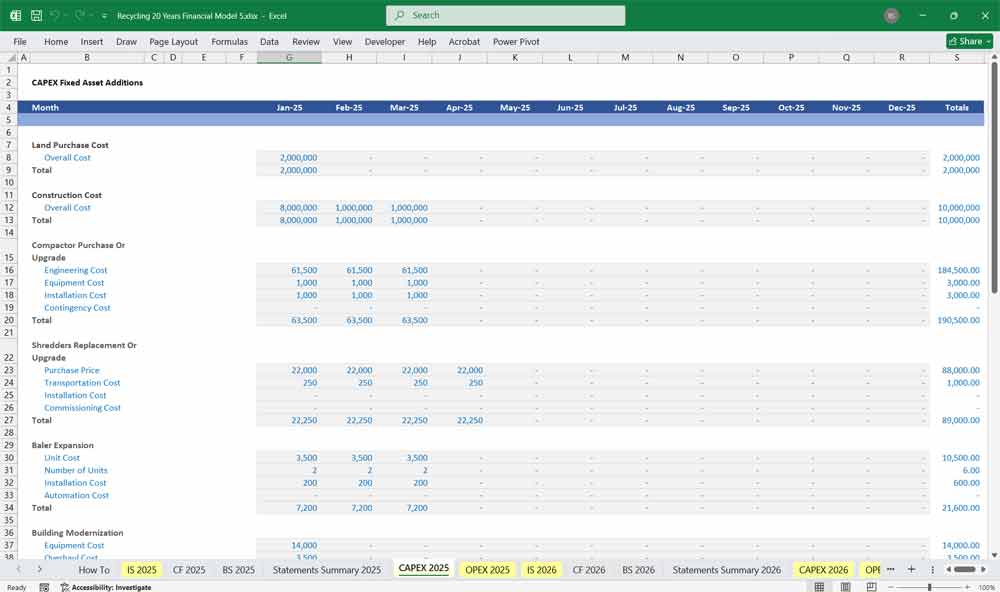

Capital Expenditures:

Investment in new machinery and facilities for expansion.

Working Capital:

Inventory turnover, receivables collection period, and payables terms.

Financing:

Debt-to-equity ratio, interest rates, and dividend policy.

Revenue Assumptions

- Sales of Recycled Materials: 150,000 in Year 1, growing at 10% per year.

- Collection Fees: 50,000 in Year 1, growing at 8% annually.

- Government Grants & Incentives: 25,000 annually (fixed).

- Other Income (Scrap Sales, Consulting, Carbon Credits, etc.): 15,000, growing at 5% annually.

Recycling Centre Collection Fees

- Residential pickup fees

- Commercial recycling centre collection contracts

- Community drop-off fees

- Bulk collection services

Recycling Centre Material Sales

- Scrap metal recycling centre sales

- Paper and cardboard recycling sales

- Glass recycling revenue

- Plastic resale revenue

Recycling Centre E-Waste Processing

- Electronics dismantling and recycling centre fees

- Component resale

- Precious metal recovery

- Data destruction and recycling services

Recycling Centre Organic Waste

- Compost recycling sales

- Organic fertilizer production

- Biogas generation

- Landscaping material sales

Recycling Centre Textile Waste

- Clothing recycling resale

- Fabric recycling fees

- Industrial rags production

- Fiber repurposing

Recycling Centre Tire Processing

- Crumb rubber production

- Tire-derived fuel sales

- Construction material resale

- Whole tire recycling resale for reuse

Recycling Centre Battery Processing

- Recycling Centre Lithium-ion recovery

- Lead-acid battery processing fees

- Rare recycling metal extraction

- Battery recycling, refurbishment, and resale

Recycling Centre Construction Debris

- Concrete crushing fees

- Wood recycling salvage sales

- Metal scrap recycling revenue

- Reclaimed bricks and tiles sales

Recycling Centre Hazardous Waste

- Chemical processing fees

- Hazardous material transport fees

- Specialized containment sales

- Environmental compliance recycling centre services

Recycling Centre Water and Wastewater

- Greywater recycling centre treatment services

- Industrial recycling wastewater processing

- Water resale for irrigation

- Sludge management fees

Recycling Centre Public-Private Partnerships

- Government recycling centre collection contracts

- Public awareness campaign funding

- Subsidized recycling infrastructure grants

- Municipal recycling incentives

Recycling Centre Corporate Sponsorships

- Recycling centre branded collection bins

- Co-branded educational campaigns

- Sponsored recycling events

- Corporate sustainability partnerships

Recycling Centre Educational Programs

- School field trip fees

- Community recycling workshop fees

- Educational recycling material sales

- Corporate training sessions

Recycling Centre Consulting Services

- Recycling Centre Waste audit services

- Sustainability strategy consulting

- Compliance reporting assistance

- Circular recycling economy planning

Recycling Centre Equipment Rentals

- Recycling Centre Bin and Container Rentals

- Recycling Centre Compactor Rentals

- Conveyor system rentals

- Specialized sorting recycling equipment rentals

Recycling Centre Carbon Credit Sales

- Recycling Centre Carbon offset recycling sales

- Renewable energy credits

- Corporate carbon footprint reduction and recycling services

- Verified carbon projects management

Recycling Centre Art and Upcycling Sales

- Upcycled product sales

- Artist space rentals

- Art workshop fees

- Custom recycled art commissions

Recycling Centre Data Reporting Services

- Recycling Centre impact reports

- Corporate sustainability metrics

- Compliance data analysis

- Waste recycling diversion tracking services

Recycling Centre Event Hosting

- Recycling centre awareness fairs

- Recycling Centre Zero-waste event management

- Community cleanup sponsorships

- Eco-friendly market spaces

Recycling Centre Grant and Subsidy Programs

- Government recycling centre grant applications

- Research and development funding

- Innovation subsidies

- International sustainability grants

Expense Assumptions

- Cost of Goods Sold (COGS): 45% of total revenue.

- Salaries & Wages: Starts at 80,000 and increases by 5% per year.

- Facility & Utility Costs: Starts at 30,000 and grows by 4% annually.

- Marketing & Sales Expenses: 5% of revenue.

- Administrative Expenses: 7% of revenue.

- Equipment Depreciation: 20,000 annually (straight-line method).

- Interest Expense: 10,000 annually on loan repayment.

Final Notes on the Financial Model

- Scenario Analysis: Create best-case, base-case, and worst-case projections.

- Break-even Analysis: Determine the sales volume required to cover fixed & variable costs.

- Sensitivity Analysis: Assess how changes in raw material costs, pricing, or demand impact profitability.

This Recycling Centre Financial Model structure will help any recycling company address a broad market spectrum, offering the right balance between cost, production capacity, and support.

Download Link On Next Page