Real Estate Private Equity Fund Financial Projection Model

20-Year Financial Model for a Real Estate Private Equity (REPE) Fund

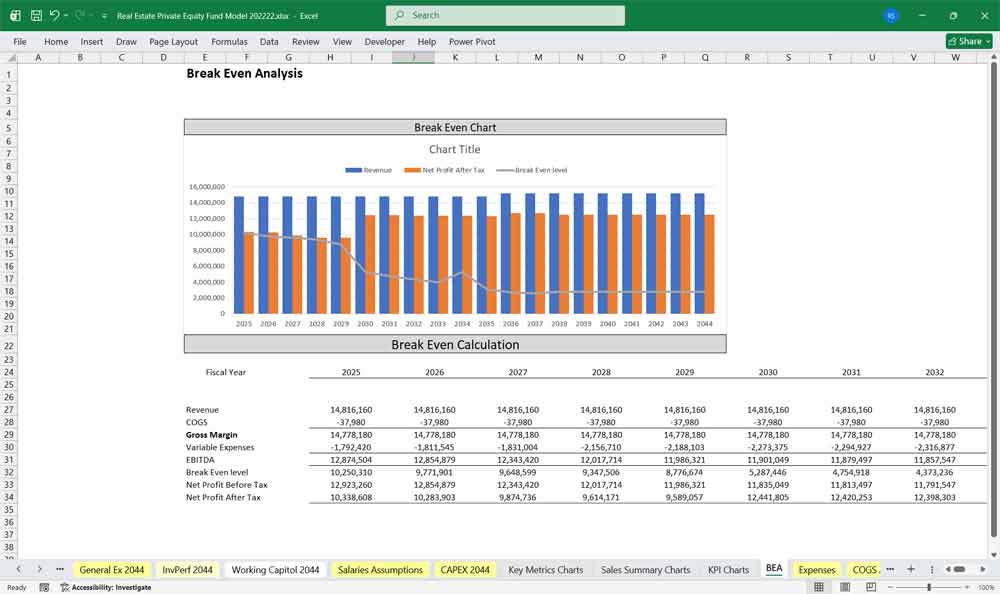

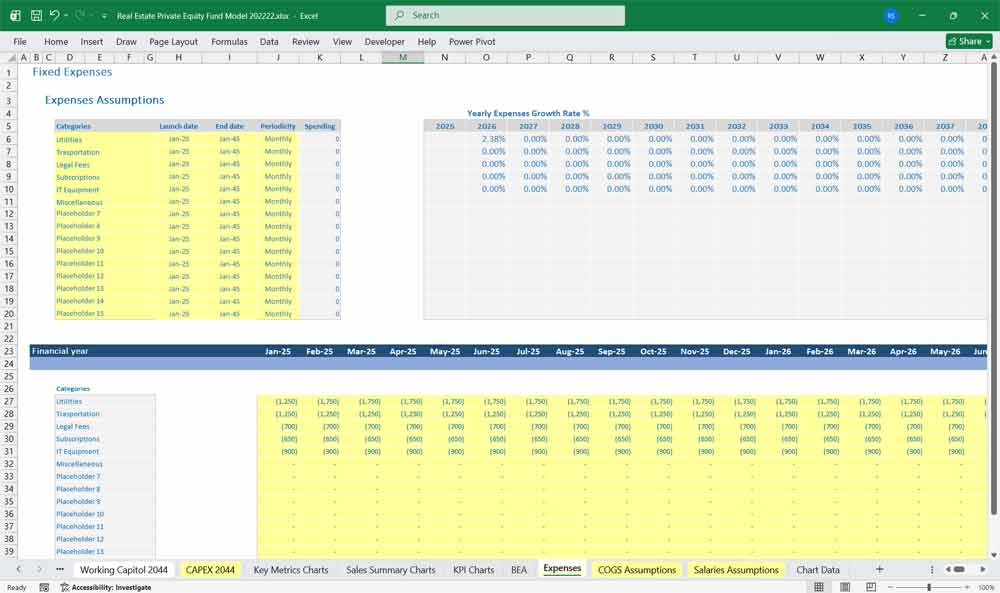

This very extensive 20 Year Private Equity Model involves detailed revenue projections, cost structures, WACC, MOIC, capital expenditures, and financing needs. This model provides a thorough understanding of the financial viability, profitability, and cash flow position of your manufacturing company. Includes: 20x Income Statements, Cash Flow Statements, Balance Sheets, Investor Performance, General Expenses, Working Capital, and CAPEX sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets—over 185 Spreadsheets in 1 Excel Workbook. CMBS Financial Model: Commercial Mortgage Asset-Backed Securities

Overview of the REPE Fund Financial Model

This Real Estate Private Equity Fund Financial Projection Model is designed to forecast the economic performance of a pooled real estate investment vehicle over its life (up to 20 years). The model integrates property-level operations, capital structure, fund-level cash flows, and investor returns.

The model is usually built on three interconnected layers:

Asset-level operating model

Fund-level aggregation and capital structure

Investor-level returns and performance metrics

The core financial statements—Income Statement, Cash Flow Statement, and Balance Sheet—are prepared at the property or fund level, depending on modeling complexity.

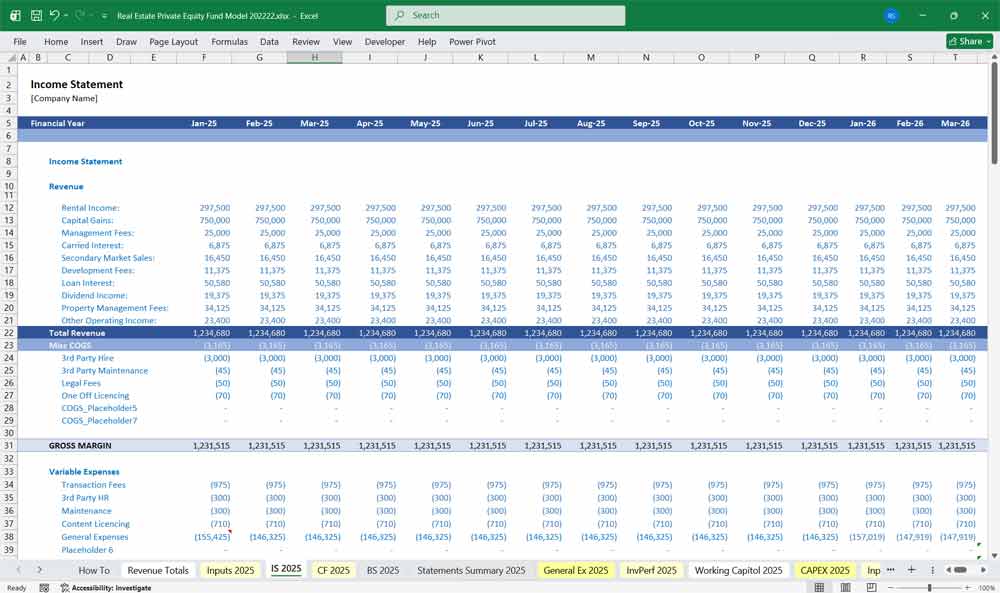

Income Statement (Operating Performance)

The Income Statement measures profitability from real estate operations over each projection period.

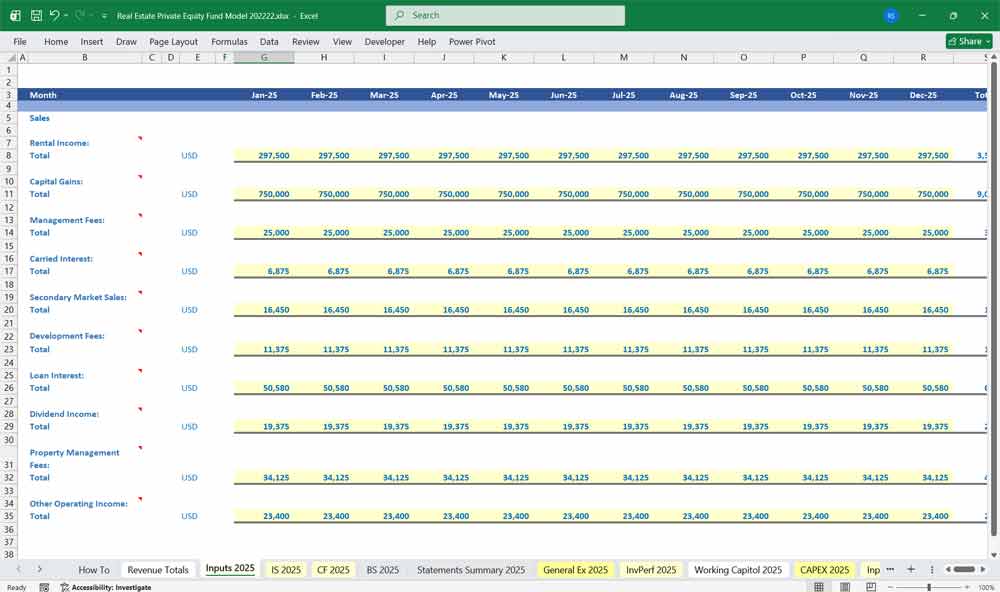

Editable Rental and Operating Income

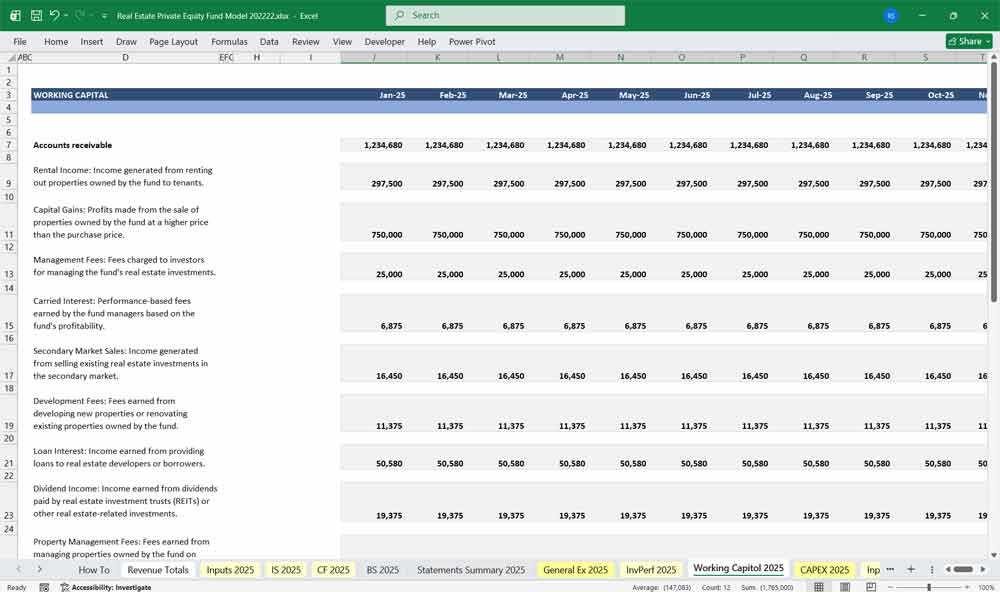

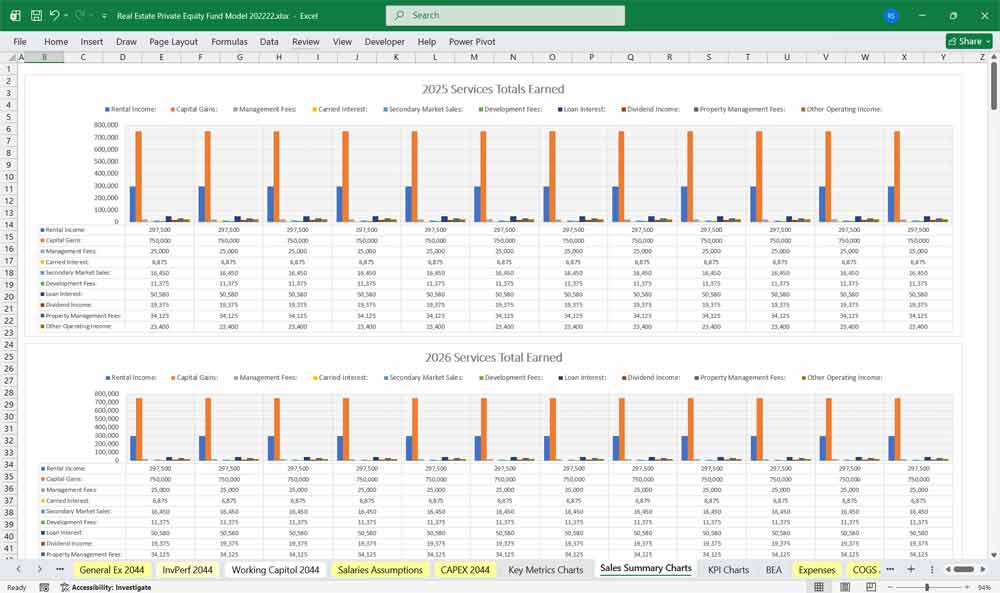

Rental Income: Income generated from renting out properties owned by the fund to tenants.

Capital Gains: Profits made from the sale of properties owned by the fund at a higher price than the purchase price.

Management Fees: Fees charged to investors for managing the fund’s real estate investments.

Carried Interest: Performance-based fees earned by the fund managers based on the fund’s profitability.

- Secondary Market Sales: Income generated from selling existing real estate investments in the secondary market.

- Development Fees: Fees earned from developing new properties or renovating existing properties owned by the fund.

- Loan Interest: Income earned from providing loans to real estate developers or borrowers.

- Property Management Fees: Fees earned from managing properties owned by the fund on behalf of investors.

- Dividend Income: Income earned from dividends paid by real estate investment trusts (REITs) or other real estate-related investments.

- Other miscellaneous income earned by the fund through various business activities.

Operating Expenses

Rental Income: Income generated from renting out properties owned by the fund to tenants.

Insurance

Repairs and maintenance

Utilities

Property management fees

Payroll (if applicable)

Administrative and marketing costs

Net Operating Income (NOI)

Calculated as Effective Gross Income minus Operating Expenses

NOI is the primary value driver in real estate and the basis for valuation

Capital Expenditures and Leasing Costs

(Usually excluded from NOI but relevant for cash flow)

Recurring capital expenditures

Tenant improvements

Leasing commissions

Financing Costs

Interest expense on senior debt, mezzanine debt, or preferred equity

Amortization of loan fees

Interest-only versus amortizing debt impacts

Net Income

NOI minus financing costs and depreciation (if included)

Depreciation is often included for accounting purposes but excluded from cash flow analysis

Net income is less important than cash flow in REPE, but still tracked

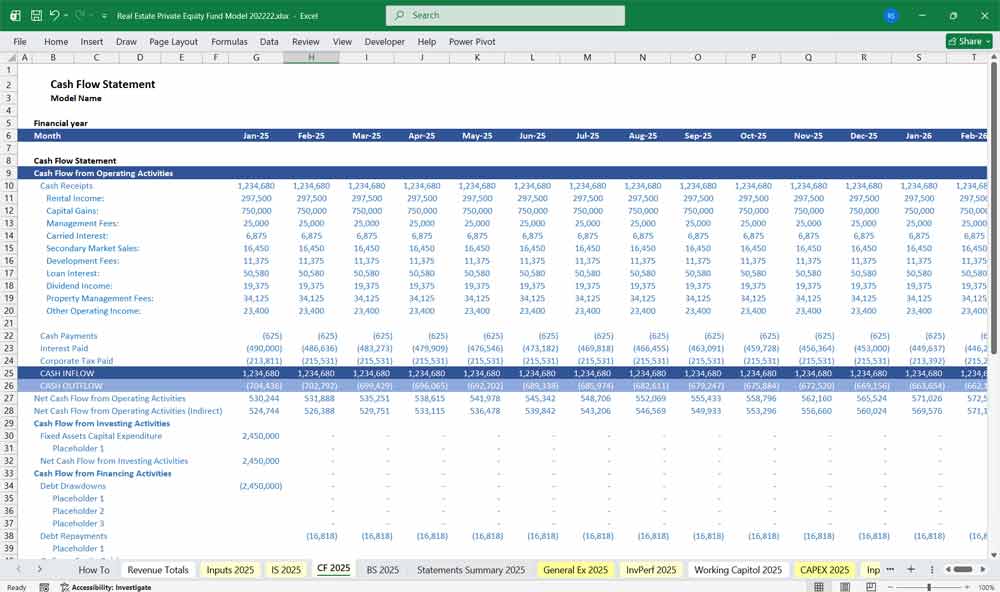

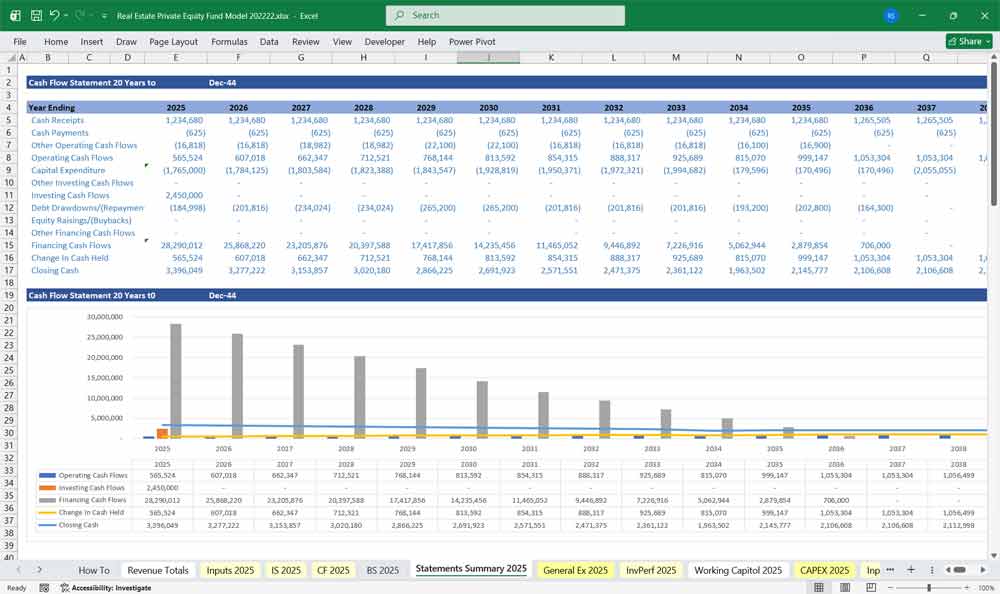

Real Estate Private Equity Fund Cash Flow Statement (Liquidity and Returns) (REPE)

The Cash Flow Statement is the most important statement in a REPE model, as it determines distributions and investor returns.

Operating Cash Flow

Starts with Net Operating Income

Adjusted for:

Capital expenditures

Leasing costs

Changes in working capital (if modeled)

Results in Cash Flow Before Debt Service

Financing Cash Flow

Debt service payments (interest and principal)

Loan origination and refinancing proceeds

Scheduled amortization and balloon payments

Optional prepayments or refinancing events

Cash Flow After Debt Service

Cash available to equity before fund-level expenses

Basis for distributions

Fund-Level Cash Flows

Management fees

Asset management fees

Organizational expenses

Operating reserves

Equity Contributions and Distributions

Initial equity contributions during acquisition phase

Follow-on capital calls for capex or operating shortfalls

Periodic cash distributions

Sale or recapitalization proceeds at exit

Exit Cash Flow

Terminal value calculated using:

Exit capitalization rate applied to forward NOI, or

Discounted sale price assumptions

Sale proceeds net of:

Remaining debt balances

Transaction costs

Net cash distributed to equity investors

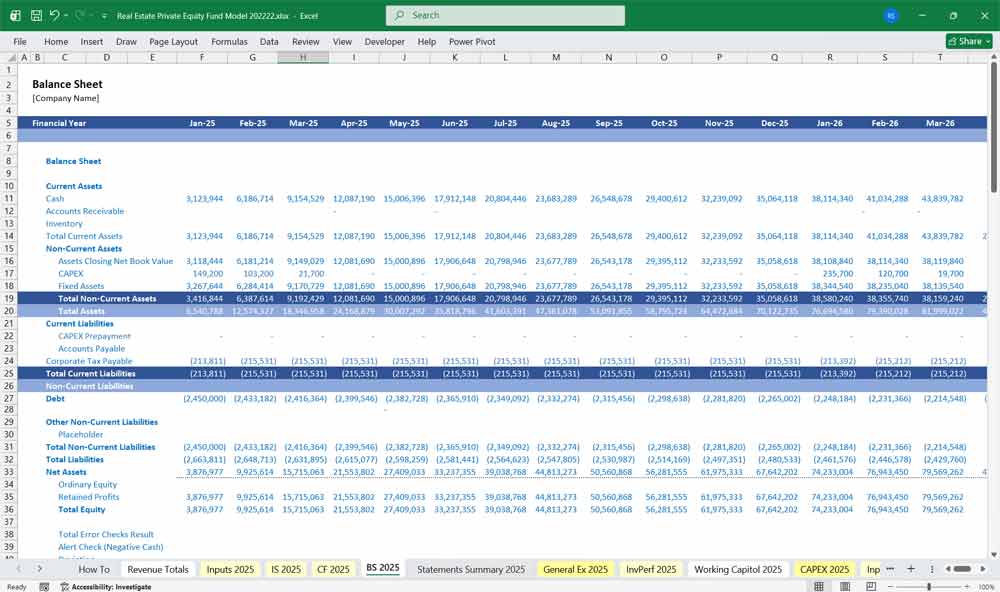

Real Estate Private Equity Fund Balance Sheet (Capital Structure and Value) (REPE)

The Balance Sheet tracks asset value, liabilities, and equity over time.

Assets

Real estate assets recorded at:

Initial acquisition cost

Adjusted for capital improvements

Less accumulated depreciation (if modeled)

Cash balances and reserves

Accounts receivable and prepaid expenses (optional detail)

Liabilities

Outstanding senior mortgage balances

Mezzanine loans or preferred equity instruments

Accrued interest payable

Accounts payable and accrued expenses

Equity

Contributed capital from investors

Retained earnings or cumulative losses

Net asset value (NAV) of the fund

Equity balance changes reflect cash flows, profits, and distributions

Real Estate Private Equity (REPE) Capital Structure and Leverage Assumptions

The model defines how assets are financed:

Interest rates (fixed or floating)

Debt terms and maturities

Amortization schedules

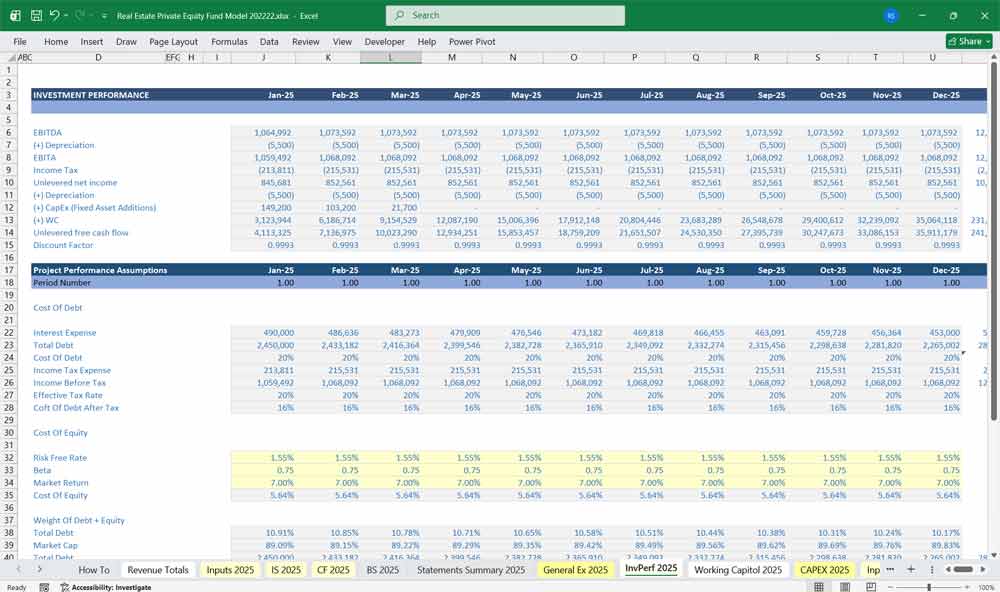

Weighted Average Cost of Capital (WACC)

WACC represents the blended cost of all capital invested in the property or fund.

Components of WACC

Cost of Equity:

Target internal rate of return (IRR)

Risk-adjusted return expectations

Cost of Debt:

Interest rate net of tax shield (if applicable)

Capital Structure Weights:

Proportion of equity versus debt

WACC Calculation Logic

WACC equals the weighted average of the after-tax cost of debt and the cost of equity

Used as:

A discount rate for unlevered cash flows

A benchmark for value creation

A comparison against project IRR

In REPE, WACC is often used conceptually rather than mechanically, as equity returns are more directly measured via IRR and MOIC.

Investor Return Metrics

Internal Rate of Return (IRR)

Measures the annualized return based on timing of cash flows

Highly sensitive to exit timing and leverage

Multiple on Invested Capital (MOIC)

Calculated as total distributions divided by total contributed capital

Indicates absolute value creation

Common benchmarks:

1.5x to 2.0x for core strategies

2.0x to 3.0x for value-add or opportunistic strategies

Cash-on-Cash Return

Annual distributions divided by invested equity

Measures ongoing income yield

Purpose and Use of the Model

The REPE Financial Projection Model is used to:

Evaluate acquisitions and dispositions

Communicate returns to investors

Support financing and refinancing decisions

Monitor portfolio performance

Support valuation and fundraising efforts

Final Notes on the Financial Model

This 20 Year Real Estate Private Equity Fund Financial Projection Model focuses on balancing capital expenditures with steady returns. By optimizing expenditure costs, and efficiency, and maximizing high-margin services, the models ensure sustainable profitability and cash flow stability.

Download Link On Next Page