Packaging Manufacturer Financial Model

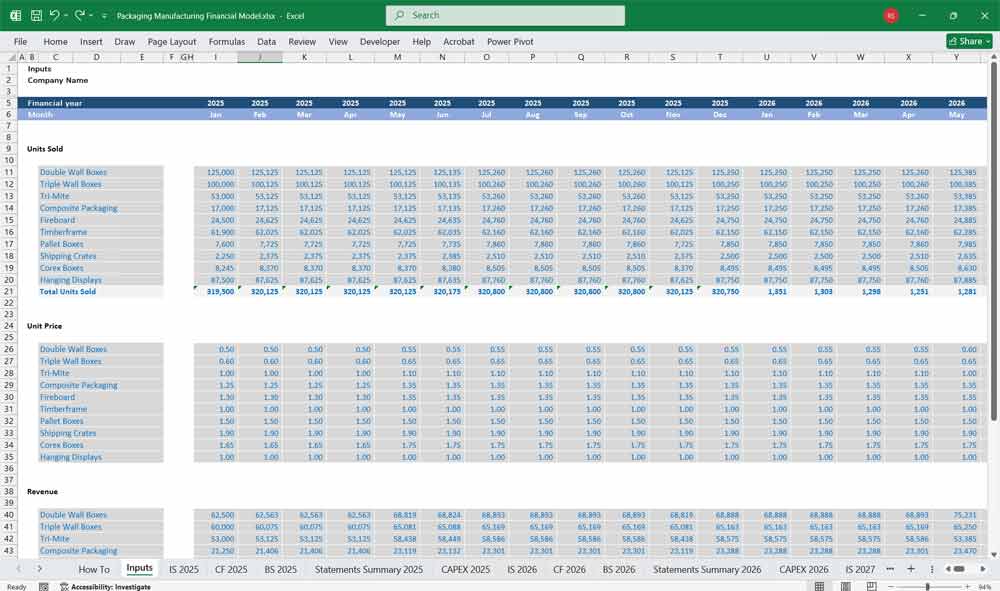

80 Product Line Packaging Manufacturer Financial Model in Excel is a comprehensive financial planning tool designed to help business owners, investors, and financial analysts evaluate the financial feasibility and profitability of your Packaging Manufacturing over 20 years.

Financial Model for a Packaging Manufacturer

Financial models for a packaging manufacturing company serve as a tool for forecasting financial performance, analyzing profitability, and ensuring long-term sustainability.

Up to 80 product lines and a 6-tier subscription add-on for those offering a subscription ordering option. If you don’t offer a subscription, just leave those cells blank; the model still works perfectly.

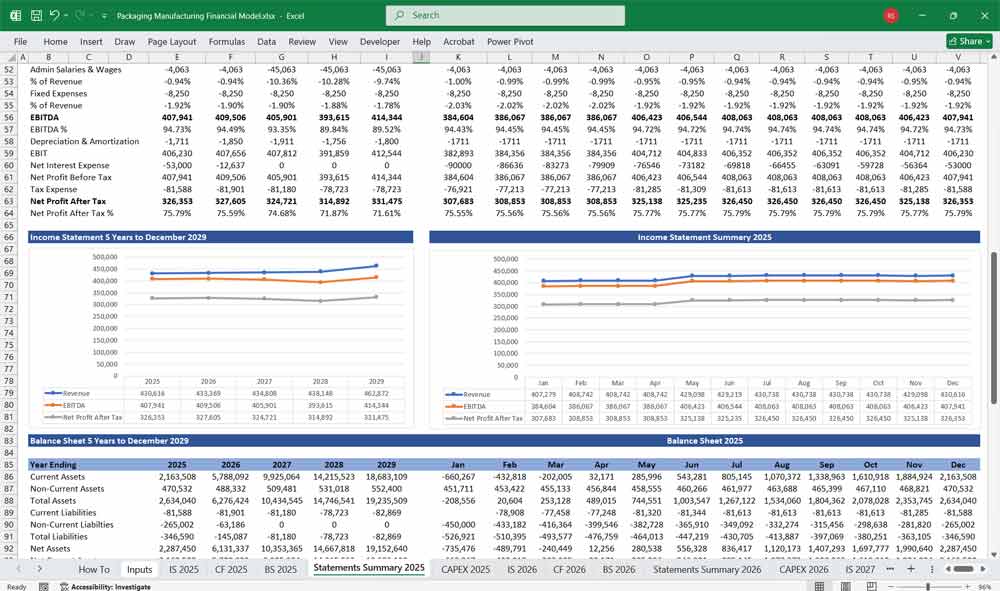

- Income Statement (Profit & Loss)

- Cash Flow Statement

- Balance Sheet

Additionally, key assumptions, operational drivers, and financial ratios are included to enhance decision-making.

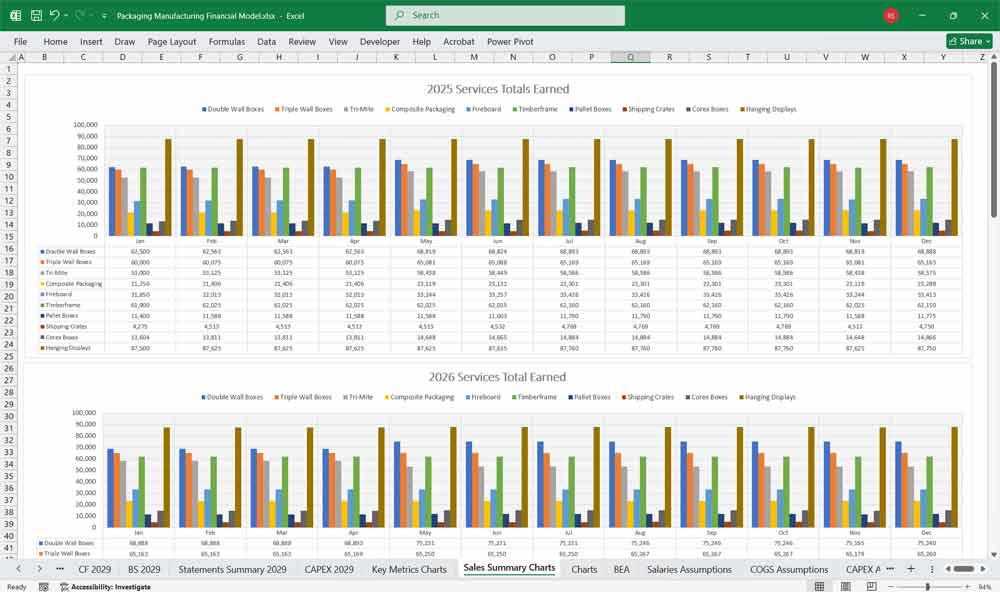

Possible Revenue Streams (All fully editable)

1. Product-Specific Sales Revenue:

Each product category contributes to revenue, modeled separately:

– Double-Walled Boxes:

– Sold to medium to large businesses for moderate-strength needs.

– Revenue calculated as Units Sold × Price per Unit.

– Triple-Walled Boxes:

– Heavy-duty packaging for industrial uses.

– Higher pricing reflects durability and premium materials.

– Composite Packaging:

– Includes multi-material (e.g., plastic + fiber) solutions.

– Suited for specialized shipping, commands premium pricing.

– Fiberboard Boxes:

– Lightweight but sturdy boxes, popular for retail and small e-commerce.

– Priced lower but sold in higher volumes.

– Pallet Boxes:

– Used for large goods or bulk shipments.

– Typically sold to wholesalers or manufacturers.

– Shipping Crates:

– Heavy-duty wooden or composite crates for secure transport of goods.

– Includes custom design options, leading to varied pricing.

– Corex Boxes:

– Plastic corrugated boxes with superior durability.

– Used for reusability-focused industries such as healthcare and logistics.

Income Statement (Profit & Loss Statement)

The Income Statement presents the company’s revenues, expenses, and profitability over a specific period. It includes the following key sections:

A. Revenue

- Product Sales Revenue: Income from the sale of various types of packaging materials (e.g., plastic, paper, metal packaging).

- Service Revenue (if applicable): Revenue from additional services such as custom printing, branding, or design.

- Other Income: Rental income from assets, interest income, or any government grants.

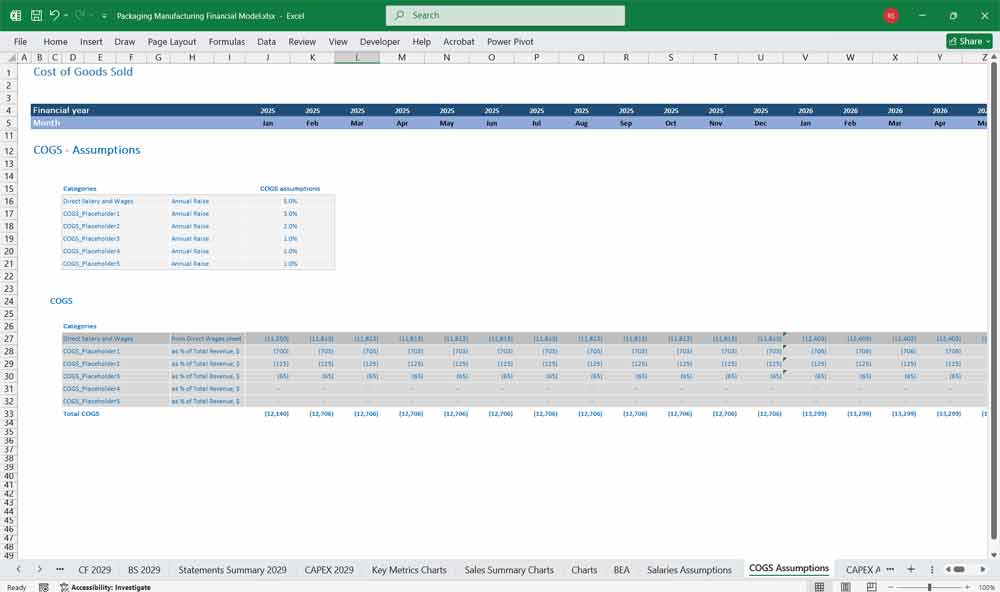

B. Cost of Goods Sold (COGS)

- Raw Materials Cost: Cost of plastic, paper, cardboard, ink, adhesives, and other raw materials.

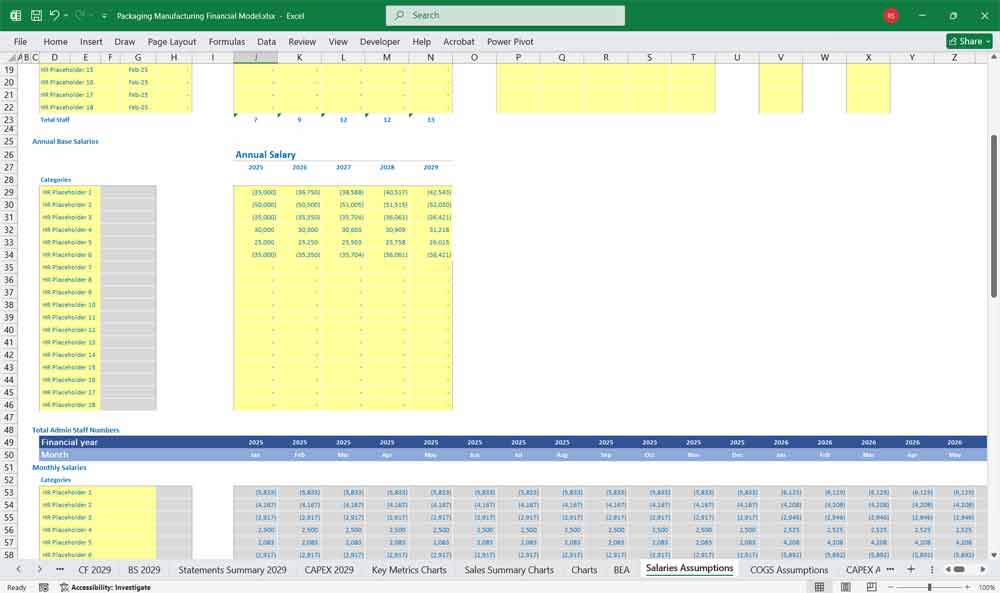

- Direct Labor: Salaries and wages for factory workers involved in production.

- Manufacturing Overheads: Depreciation of machinery, utilities (electricity, water, gas), and factory rent.

C. Gross Profit

- Gross Profit = Revenue – COGS

- Indicates the profitability of core operations before indirect expenses.

D. Operating Expenses (OPEX)

- Selling & Marketing Expenses: Advertising, trade shows, commissions for sales agents.

- Administrative Expenses: Office rent, salaries for executives, legal fees, insurance, and technology costs.

- Research & Development (R&D): Costs associated with improving packaging materials or creating eco-friendly alternatives.

E. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

- EBITDA = Gross Profit – Operating Expenses

- A measure of operational profitability before accounting for financing and tax costs.

F. Depreciation & Amortization

- Depreciation on manufacturing equipment and amortization of intangible assets such as patents or brand trademarks.

G. EBIT (Earnings Before Interest & Taxes)

- EBIT = EBITDA – Depreciation & Amortization

H. Interest Expense

- Interest payments on loans, credit lines, or bonds.

I. Taxes

- Corporate income taxes based on applicable tax rates.

J. Net Profit (Net Income)

- Net Profit = EBIT – Interest Expense – Taxes

- Represents the final profitability available to shareholders.

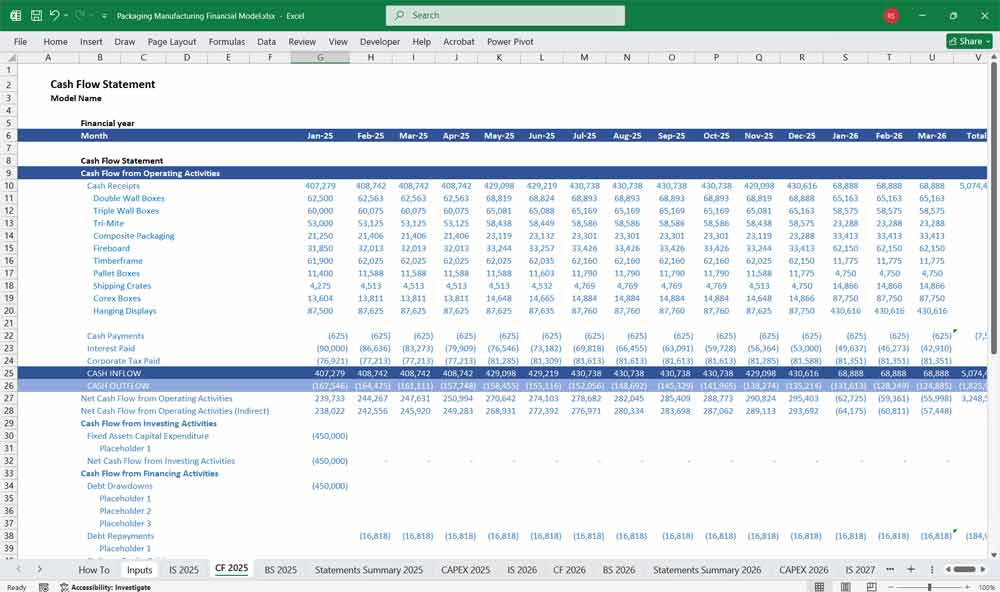

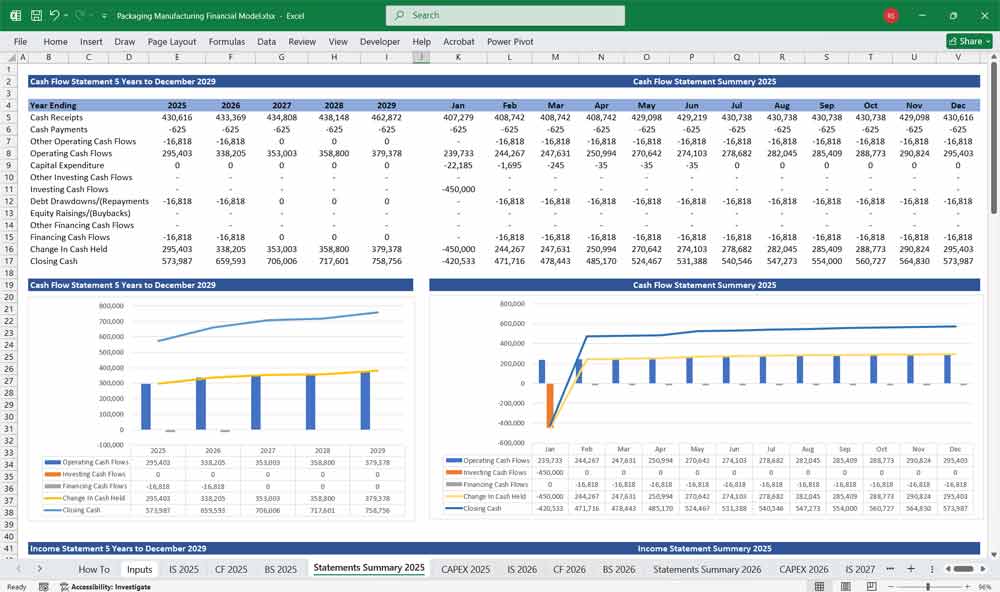

Packaging Manufacturer Cash Flow Statement

The Cash Flow Statement tracks cash inflows and outflows, categorized into three activities:

A. Cash Flow from Operating Activities

- Net Income (from the Income Statement)

- Adjustments for Non-Cash Items:

- Depreciation & Amortization

- Changes in Working Capital:

- Accounts Receivable: Cash tied up in unpaid invoices

- Inventory: Raw materials, work-in-progress, finished goods

- Accounts Payable: Payments owed to suppliers

B. Cash Flow from Investing Activities

- Capital Expenditures (CapEx): Purchase of new machinery, factory expansion, technology upgrades.

- Sale of Fixed Assets: Income from selling old machinery or land.

- Investments in Subsidiaries or Joint Ventures.

C. Cash Flow from Financing Activities

- Debt Issuance/Repayment: New loans taken vs. repayment of existing loans.

- Equity Issuance/Buyback: Raising capital via shares or repurchasing stock.

- Dividend Payments: Distributions to shareholders.

D. Net Change in Cash

- Total Cash Flow = Operating + Investing + Financing Activities

- Ending Cash Balance = Beginning Cash Balance + Net Change in Cash

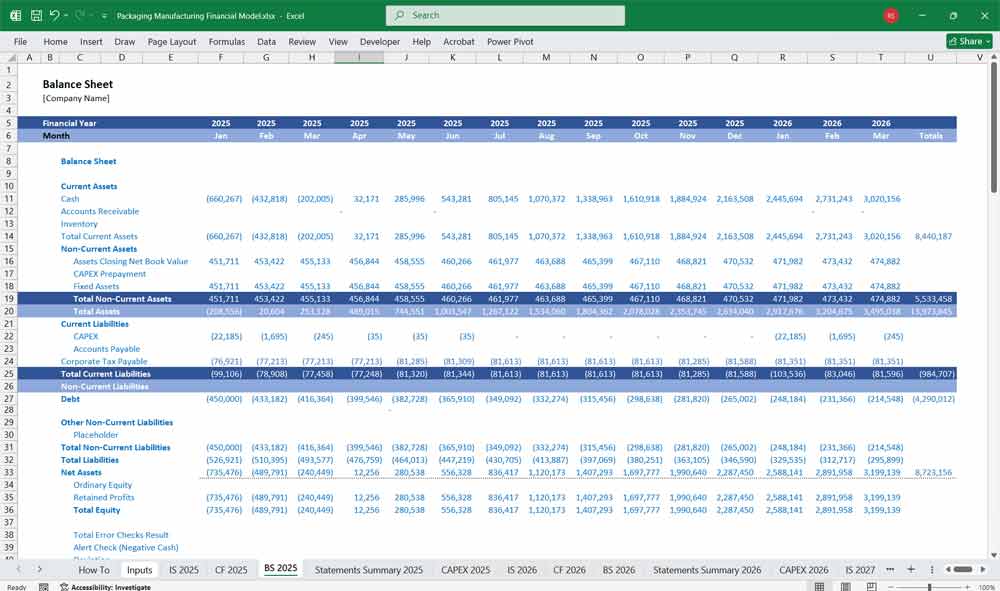

Packaging Manufacturer Balance Sheet

The Balance Sheet provides a snapshot of the company’s financial position at a given time. It consists of three main sections:

A. Assets

Current Assets (Short-Term, Liquid Assets)

- Cash & Cash Equivalents: Cash reserves for operations.

- Accounts Receivable: Money owed by customers.

- Inventory: Raw materials, in-progress goods, finished goods.

- Prepaid Expenses: Rent, insurance, or utilities paid in advance.

Non-Current Assets (Long-Term Assets)

- Property, Plant, and Equipment (PP&E): Factories, machinery, office buildings.

- Intangible Assets: Trademarks, patents, goodwill.

B. Liabilities

Current Liabilities (Due within 12 months)

- Accounts Payable: Outstanding payments to suppliers.

- Short-Term Debt: Loan repayments due in the short term.

- Accrued Expenses: Salaries, taxes, and other outstanding costs.

Non-Current Liabilities (Long-Term Obligations)

- Long-Term Debt: Bank loans, bonds payable.

- Deferred Tax Liabilities: Future tax obligations.

C. Shareholders’ Equity

- Common Stock & Additional Paid-in Capital: Equity funding.

- Retained Earnings: Cumulative profits reinvested in the business.

- Total Equity = Assets – Liabilities

Additional Financial Considerations

To ensure a robust financial model, the following elements should be included:

1. Key Assumptions & Drivers

- Sales Volume & Pricing Strategy

- Raw Material Cost Trends

- Manufacturing Efficiency & Production Yields

- Debt Financing & Interest Rates

- Market Growth & Competition

2. Financial Ratios

- Gross Margin = Gross Profit / Revenue

- Operating Margin = EBIT / Revenue

- Net Profit Margin = Net Income / Revenue

- Current Ratio = Current Assets / Current Liabilities

- Debt-to-Equity Ratio = Total Debt / Total Equity

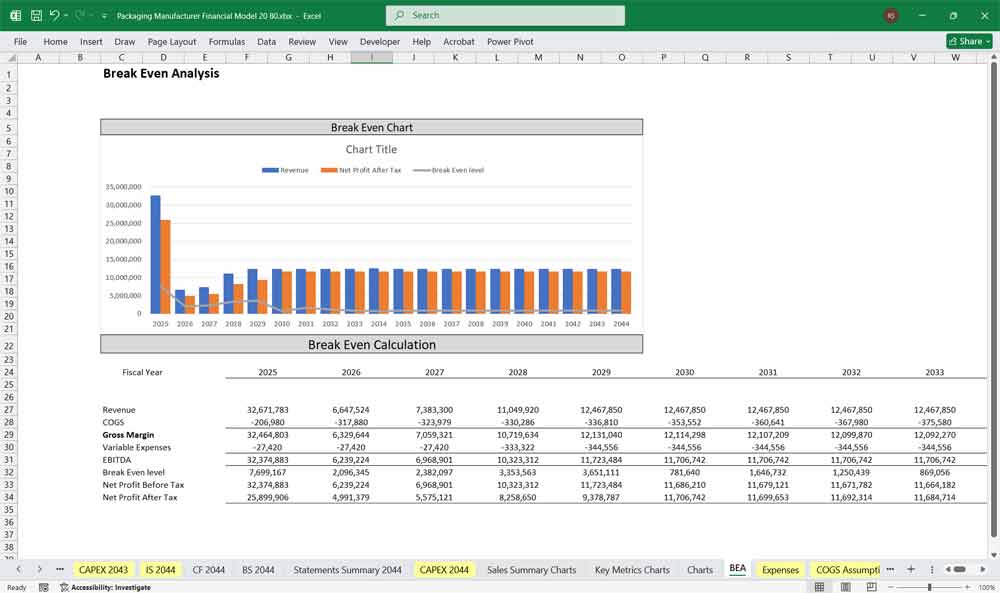

3. Scenario Analysis

- Best Case: Increased demand, lower costs, higher profitability.

- Base Case: Steady growth with stable cost structures.

- Worst Case: Rising raw material prices, economic downturn.

80 product lines tailored for a Packaging Manufacturer.

1. Retail Packaging Solutions

Custom retail box packaging for consumer products

Window display packaging for enhanced product visibility

Luxury rigid box packaging for premium retail items

Hang tab packaging for point-of-sale retail display

2. Food & Beverage Packaging Manufacturer

Eco-friendly food-grade packaging for dry goods

Liquid-safe beverage packaging for bottles and cartons

Resealable snack packaging for freshness preservation

Microwaveable meal packaging for convenience foods

3. E-commerce Packaging Manufacturer

Corrugated mailer box packaging for online orders

Tamper-evident e-commerce packaging for secure delivery

Return-ready packaging for simplified online returns

Custom branded subscription packaging for DTC businesses

4. Industrial Packaging Manufacturer

Heavy-duty industrial packaging for machinery parts

Pallet-ready bulk packaging for supply chain optimization

Weather-resistant packaging for outdoor equipment

Shock-absorbing foam insert packaging for fragile items

5. Pharmaceutical & Medical Packaging Manufacturer

Tamper-proof pharmaceutical packaging for medicine safety

Sterile medical device packaging for hospital use

Child-resistant pill packaging for health compliance

Blister packaging for unit-dose pharmaceuticals

6. Cosmetic & Beauty Packaging Manufacturer

Premium cosmetic packaging for skincare products

Airless pump packaging for serums and creams

Sustainable beauty packaging for eco-conscious brands

Compact cosmetic display packaging for retail shelves

7. Electronics & Tech Packaging Manufacturer

Anti-static electronics packaging for sensitive devices

Custom molded tech packaging for secure gadget shipping

Modular accessory packaging for cables and chargers

Retail-ready tech packaging for point-of-sale units

8. Agricultural & Horticultural Packaging Manufacturer

Moisture-resistant agricultural packaging for produce

Ventilated fruit & vegetable packaging for freshness

Soil and seed packaging with custom branding

Compostable horticultural packaging for sustainable farming

9. Beverage Packaging Manufacturer

Bottle carrier packaging for craft beverages

Six-pack can packaging with die-cut handles

Branded coffee bean packaging with degassing valve

Wine gift box packaging with insert dividers

10. Bakery & Confectionery Packaging Manufacturer

Windowed pastry box packaging for bakeries

Custom cake packaging with secure locking tabs

Heat-sealable candy packaging for confections

Chocolate bar packaging with foil and sleeve options

11. Frozen Food Packaging Manufacturer

Insulated frozen food packaging with thermal lining

Leak-resistant meat and seafood packaging

Vacuum-sealed frozen produce packaging

Resealable frozen dessert packaging with branding

12. Eco-Friendly Packaging Manufacturer

Recyclable paperboard packaging for low-impact brands

Plant-based compostable packaging alternatives

Biodegradable packaging films for eco solutions

Reusable packaging for circular economy models

13. Promotional & Gift Packaging Manufacturer

Custom holiday-themed packaging for promotions

Magnetic closure gift box packaging for luxury items

Branded promotional packaging for corporate events

Seasonal packaging with limited edition designs

14. Apparel & Fashion Packaging Manufacturer

Foldable clothing packaging for apparel brands

Luxury garment packaging with ribbon closures

Shoe box packaging with reinforced lids

Accessory packaging for ties, belts, and jewelry

15. Automotive & Hardware Packaging Manufacturer

Durable parts packaging for automotive components

Pegboard tool packaging for retail hanging displays

Screw and bolt packaging with compartment inserts

Oil and lubricant pouch packaging for auto service kits

16. Pet Product Packaging Manufacturer

Treat pouch packaging with resealable zippers

Pet toy packaging with perforated tear strips

Branded pet food packaging with oxygen barriers

Supplement packaging for pet vitamins and tablets

17. Office & Stationery Packaging Manufacturer

Pen and marker packaging with die-cut slots

Notebook and binder packaging for retail bundles

Paper ream packaging with reinforced edges

Printer cartridge packaging with protective inserts

18. Toy & Hobby Packaging Manufacturer

Clamshell toy packaging for tamper protection

Custom board game packaging with component trays

Puzzle box packaging with full-color graphics

Collectible toy packaging with clear windows

19. Luxury & Specialty Packaging Manufacturer

Embossed and foil-stamped luxury packaging for upscale goods

Velvet-lined jewelry packaging with magnetic lids

Fragrance packaging with custom inserts and branding

Handcrafted artisan product packaging for boutique items

20. Hazardous Material & Safety Packaging Manufacturer

UN-certified hazardous material packaging for transport

Chemical-resistant packaging for industrial use

Safety indicator packaging for biohazard materials

Leak-proof spill control packaging for labs and logistics

Conclusion On The Financial Model

Well-structured 80 product line financial model for a packaging manufacturer ensures effective financial planning and strategic decision-making. By incorporating revenue forecasting, cost control, cash flow management, and balance sheet stability, businesses can optimize their operations and maintain profitability.

Download Link On Next Page