Mobile App Financial Model

This 5-Year, 3-Statement MS Excel Mobile App Financial Model include revenue streams, cost structures, and financial statements to forecast the financial health of a mobile application. The model assumes revenue generation through subscriptions, in-app purchases, advertisements, and partnerships for total tracking of financial revenue for your mobile app.

Financial Model for a Mobile App

A mobile app can generate revenue from various sources, including:

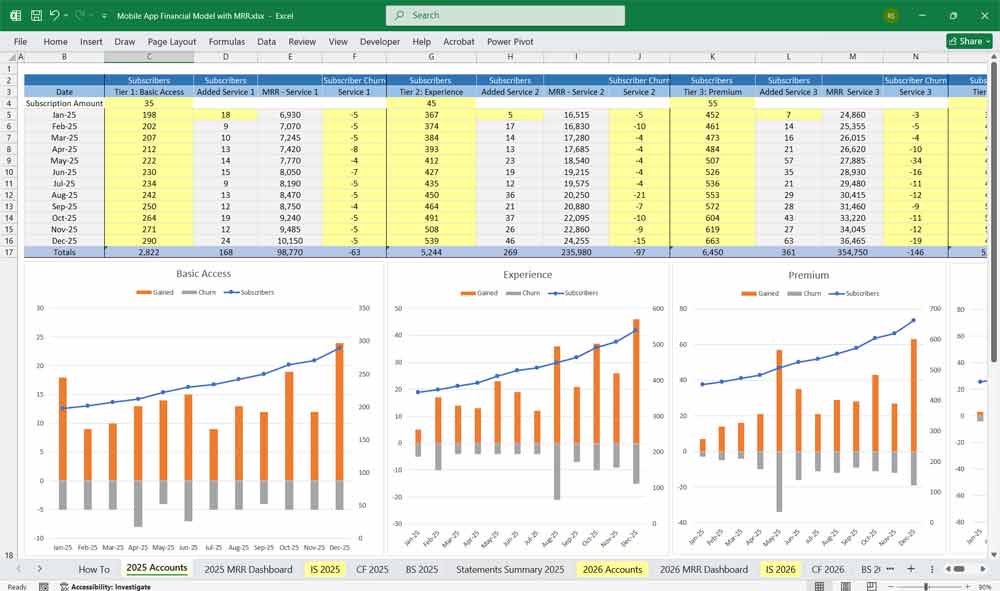

- Subscription Model (multi-tier pricing)

- In-App Purchases (one-time purchases, premium content, virtual goods)

- Advertising Revenue (banner ads, video ads, affiliate marketing)

- Sponsorships & Partnerships (corporate sponsorships, co-branded content)

- Freemium Model Upsells (free version with paid upgrades)

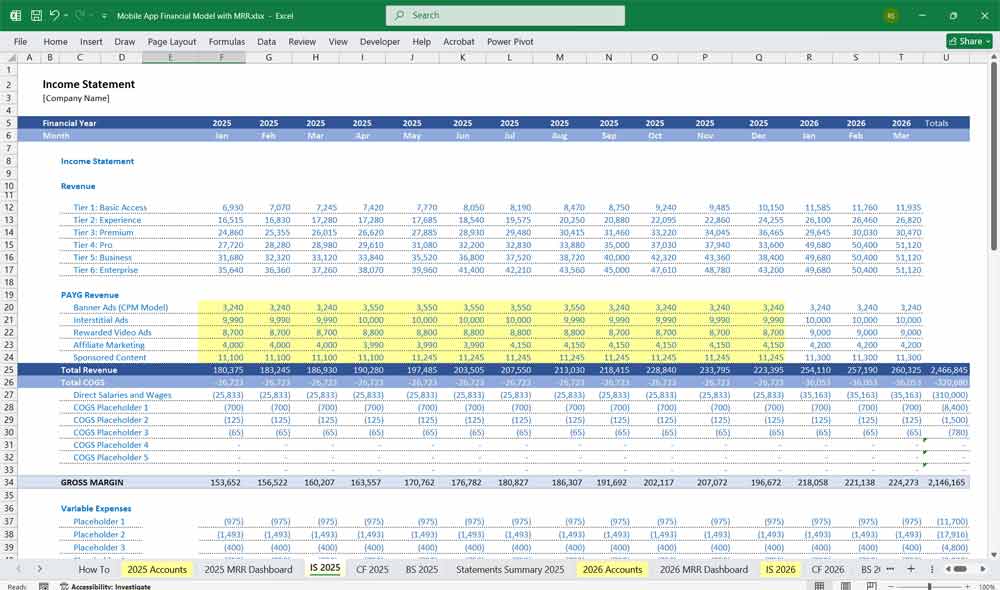

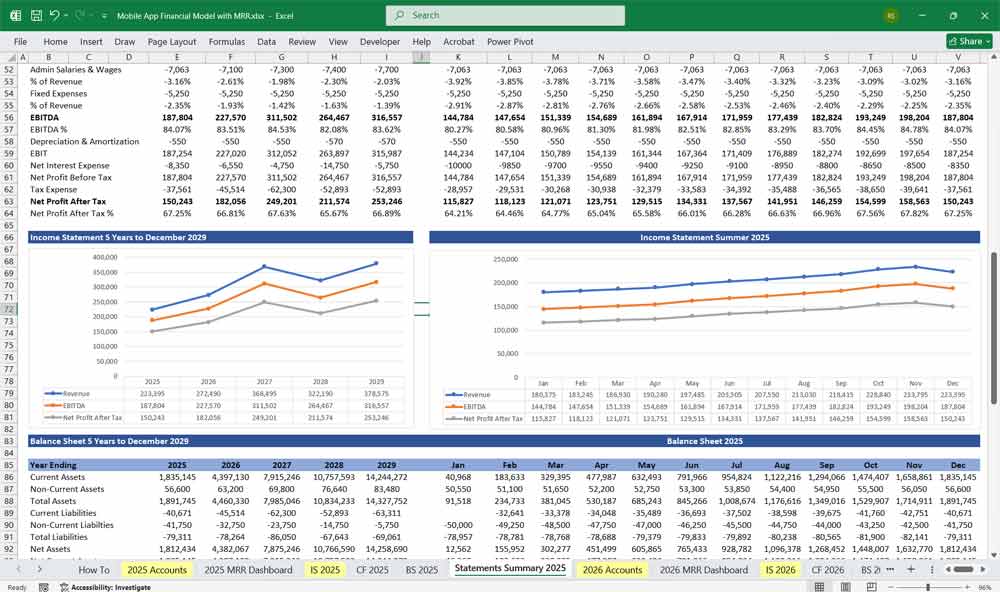

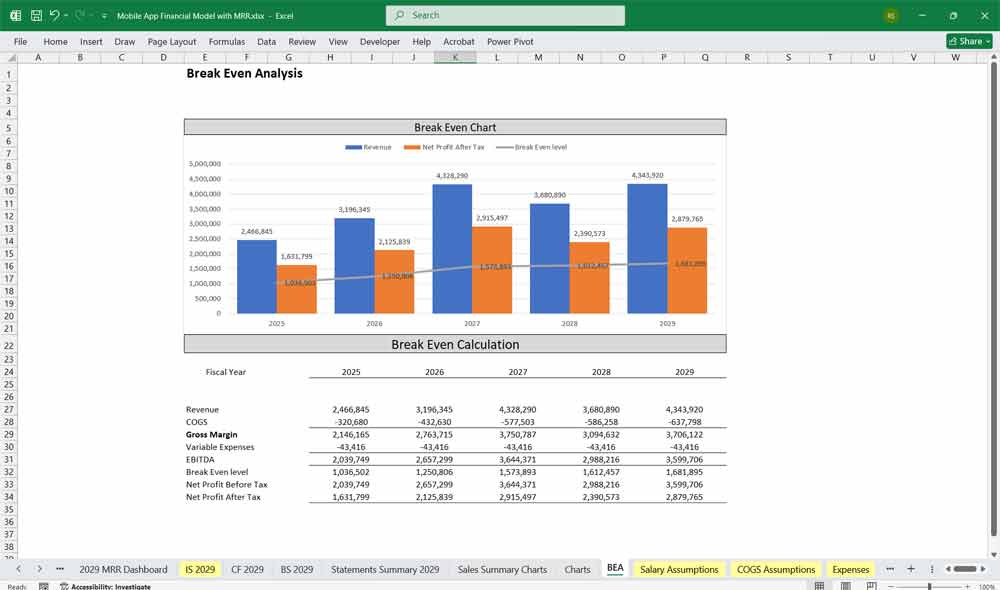

Income Statement (Profit & Loss Statement)

The income statement outlines revenue, expenses, and net income over a period.

Revenue:

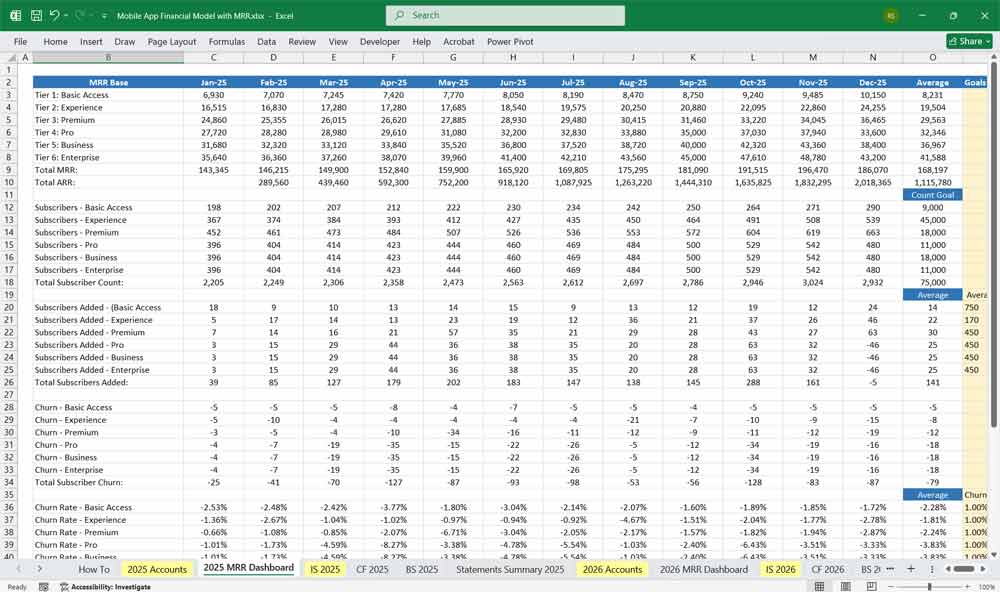

- Subscription Revenue – Based on a 6-tier subscription model.

- In-App Purchases – Revenue from one-time purchases.

- Advertising Revenue – Revenue from ad networks, sponsorships.

- Partnership Revenue – Deals with brands or other apps.

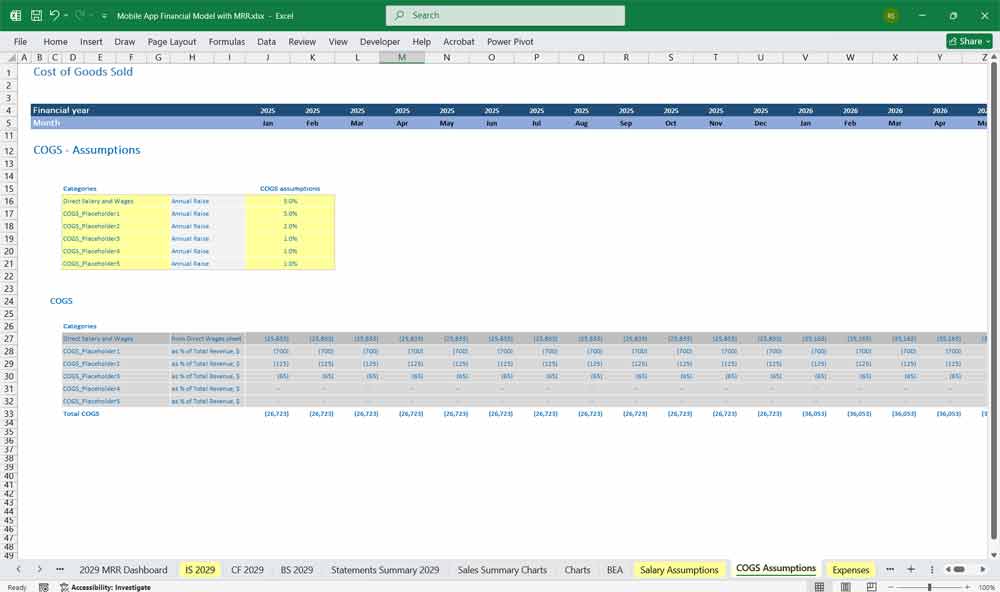

Cost of Goods Sold (COGS):

- Payment Processing Fees – Fees from App Store, Google Play, Stripe, etc.

- Server Costs – Hosting, cloud storage, bandwidth.

- Customer Support – Personnel, chatbots, ticketing system.

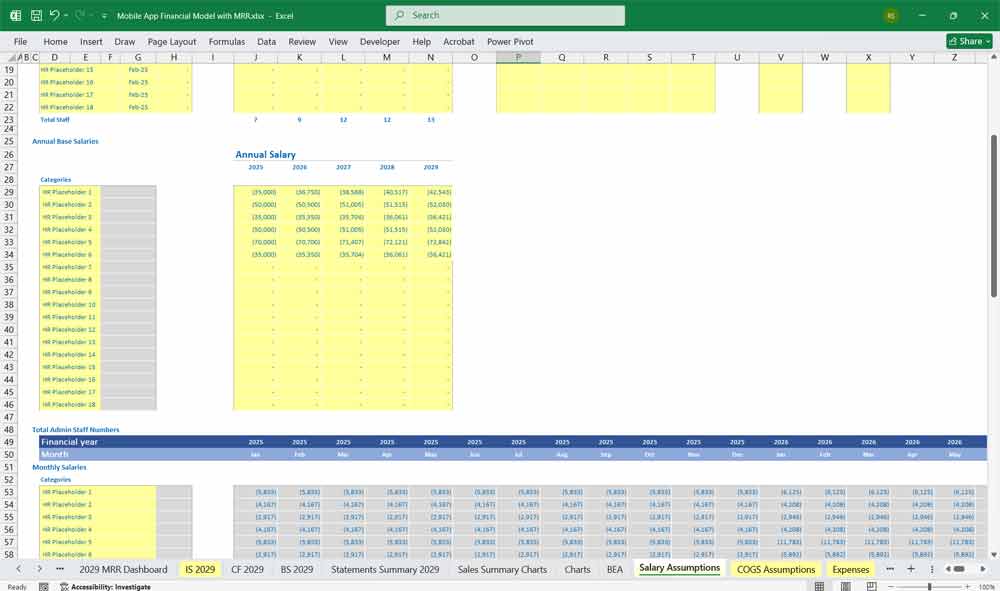

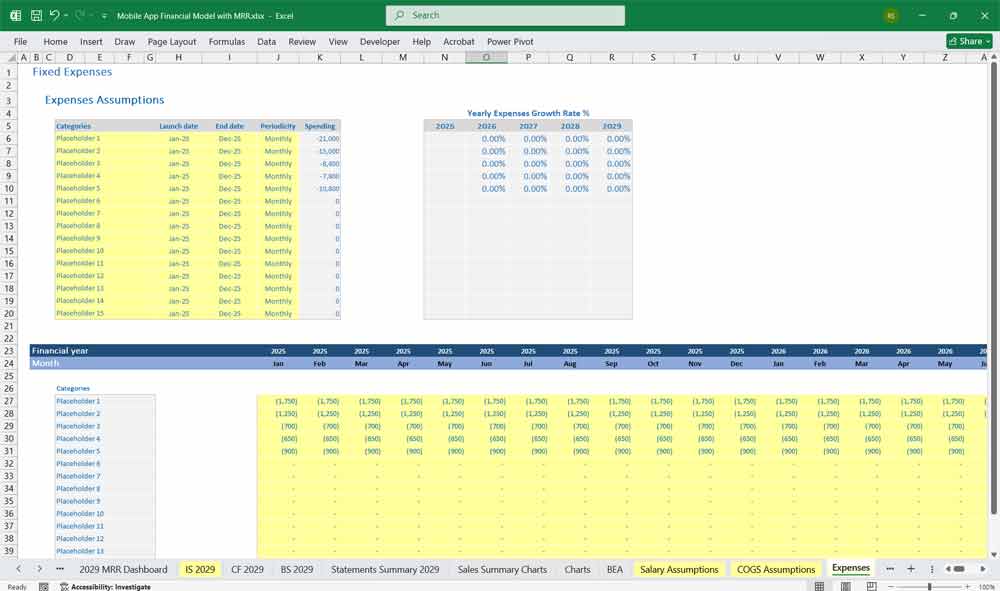

Operating Expenses:

- Development Costs – Salaries for developers, designers, QA teams.

- Marketing & User Acquisition – Social media ads, influencer marketing.

- Administrative Expenses – Office rent, legal fees, accounting.

Net Income Calculation:

Net Income = Total Revenue – (COGS + Operating Expenses + Taxes)

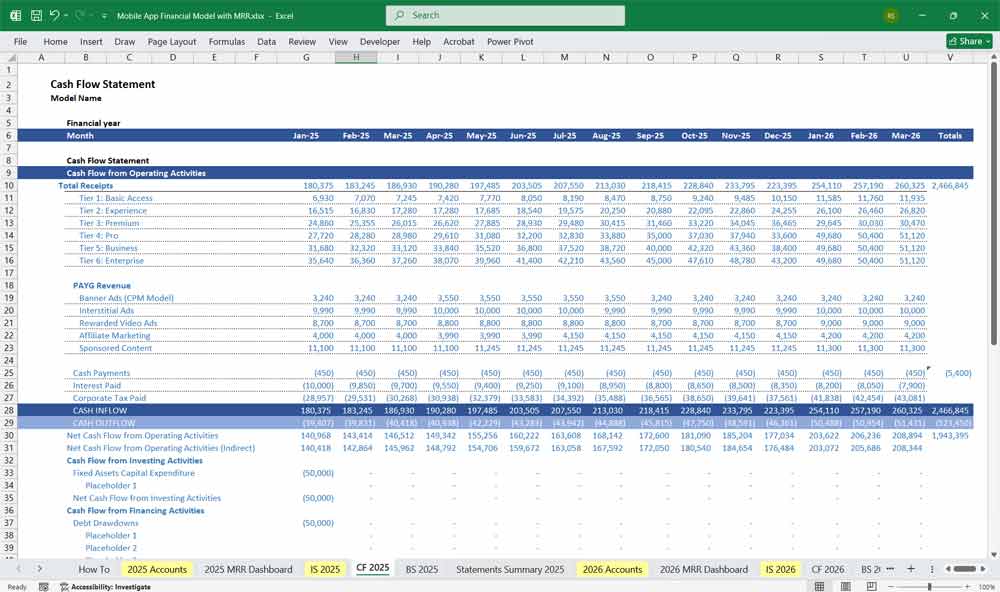

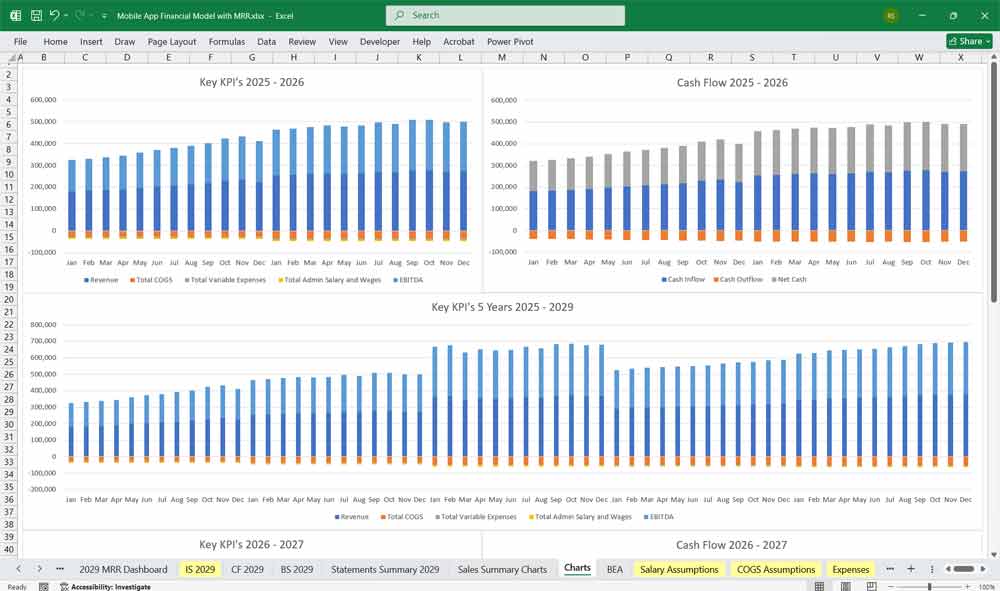

Mobile App Cash Flow Statement

The cash flow statement tracks cash inflows and outflows to assess liquidity.

Operating Cash Flow:

- Cash Inflows:

- Subscription payments

- Ad revenue payouts

- In-app purchase payments

- Cash Outflows:

- Server costs, payroll, marketing expenses

- Payment processing fees

Investing Cash Flow:

- Investment in new features, platform updates

- Capital expenditures (new server infrastructure)

Financing Cash Flow:

- Investment from venture capital or angel investors

- Loan repayments (if applicable)

Net Cash Flow = Total Inflows – Total Outflows

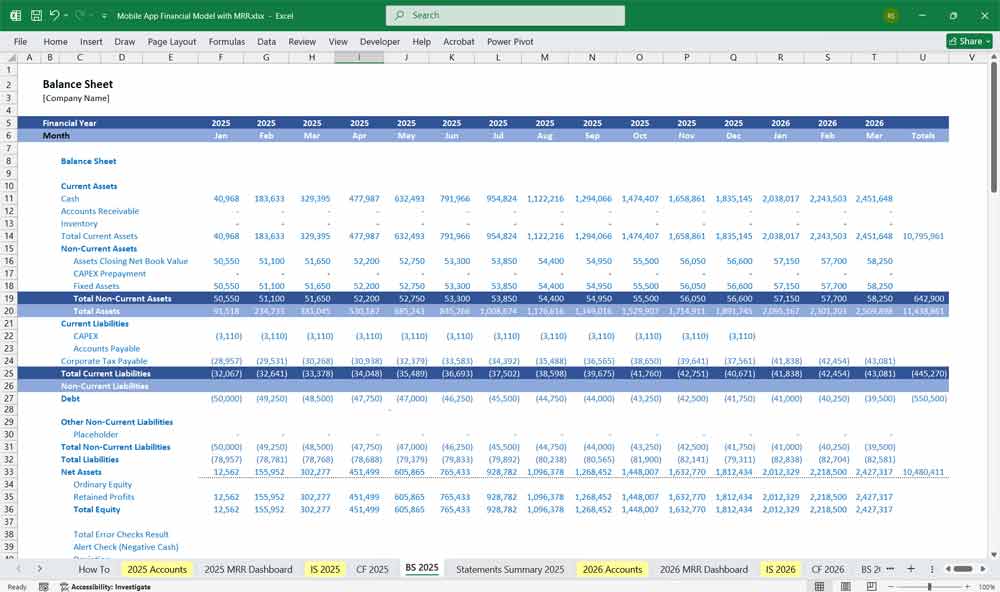

Mobile App Balance Sheet

The balance sheet provides a snapshot of the app’s financial position.

Assets:

- Current Assets:

- Cash & cash equivalents

- Accounts receivable (ad network payments pending)

- Subscription revenue due (deferred revenue)

- Long-term Assets:

- Software development costs (capitalized R&D)

- Servers, equipment

Liabilities:

- Current Liabilities:

- Vendor payments

- Ad payout obligations

- Taxes payable

- Long-term Liabilities:

- Loans, venture funding

- Deferred revenue from annual subscriptions

Equity:

- Retained earnings

- Shareholder equity (if funded by investors)

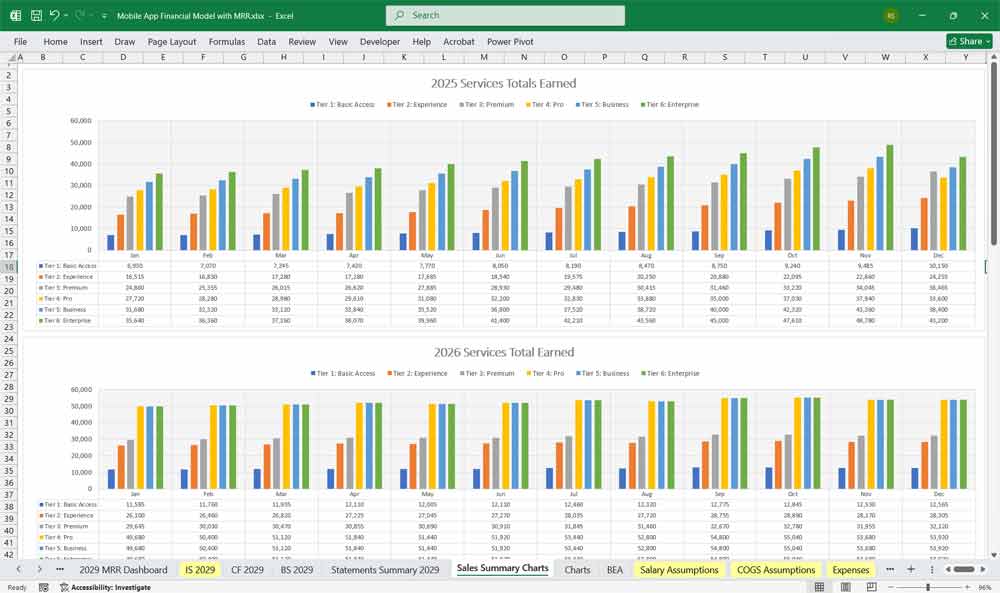

6-Tier Subscription Ideas for a Mobile App

A tiered subscription model maximizes revenue by offering varied features at different price points.

Subscription Tiers:

Tier 1: Free (Forever)

Price: $0/month

Target: Casual users, students, entry-level professionals

Features:

Basic task management (up to 50 tasks/month)

Simple Pomodoro timer (25/5 min only)

1 basic focus sound playlist

3 project templates

Limited task history (30 days)

Community support only

Monetization: Ad-supported (non-intrusive banner ads

Tier 2: Explorer

Price: $2.99/month or $29/year

Target: Serious individuals, freelancers, students

Features: (Everything in Free, plus:)

Ad-free experience

Unlimited tasks & projects

Advanced Pomodoro (custom intervals)

10+ focus sound playlists

15+ premium templates

Task priority labeling

6-month task history

Basic export (CSV/PDF)

Email mobile app support (48hr response)

Early access to new features

Tier 3: Pro

Price: $7.99/month or $79/year

Target: Professionals, solopreneurs, power users

Features: (Everything in Explorer, plus:)

AI Task Assistant (basic)

Calendar integration (2-way sync)

Focus analytics (weekly reports)

Custom project templates

Priority mobile app support (24hr response)

2-year task history

Advanced export options (Excel, JSON)

Cloud backup (encrypted)

2 “guest collaborator” slots

1GB file storage

Tier 4: Team

Price: $12.99/user/month or $129/user/year

Target: Small teams (3-10 people), startups

Features: (Everything in Pro, plus:)

Team workspaces

Shared projects & templates

Team productivity analytics

Role-based permissions

Team goal tracking

Meeting agenda templates

10GB mobile app shared file storage

Admin controls

Standard onboarding support

Monthly team reports

Minimum: 3 users

Tier 5: Enterprise

Price: $24.99/user/month (annual billing only)

Target: Medium to large organizations (10+ users)

Features: (Everything in Team, plus:)

Dedicated success manager

Custom onboarding & training

Single Sign-On (SSO) integration

Advanced mobile app security & compliance (GDPR, HIPAA-ready)

Custom feature requests (quarterly review)

API access

Unlimited file storage

Custom contract/SLA

On-premise deployment option

24/7 priority support

Minimum: 10 users

Annual commitment required

Tier 6: Enterprise Plus

Price: Custom (typically $39.99+/user/month)

Target: Large corporations, government, institutions

Features: (Everything in Enterprise, plus:)

White-label mobile app option

Full custom development (dedicated engineer)

Dedicated infrastructure

On-site training sessions

Executive analytics dashboard

Custom integration development

Quarterly strategy sessions

Disaster recovery guarantee

Advanced mobile app AI customization

Industry-specific compliance packages

Minimum: 50 users

3-year contract preferred

Key Implementation Mobile App Financial Strategies

Pricing Psychology:

Clear value stacking (each tier = 2-3x more value)

Annual discounts (save 15-20%)

Free trial for paid tiers (14 days)

Easy downgrade/upgrade paths

Churn Analysis for your Mobile App

Churn is one of the biggest revenue killers for App Developer services. A 1% reduction in churn can significantly increase profits over time. Analyzing churn by subscription tier, revenue impact, and reasons for cancellation helps implement data-driven retention strategies to maximize long-term user value.

Strategies to Reduce Churn

Retention Strategies

✅ Content Personalization: Use AI-driven recommendations to increase engagement.

✅ Loyalty Programs: Discounts for long-term subscribers.

Payment Recovery for Involuntary Churn

✅ Automated Payment Retries: Retries for failed transactions.

✅ Card Update Reminders: Notifications for expiring payment methods.

Engagement Tactics

✅ Win-Back Campaigns: Email campaigns offering discounts to churned users.

✅ Surveys & Exit Polls: Understand cancellation reasons and address pain points.

Advertising & Additional Revenue Models

A. Ad Revenue Streams For Your Mobile App

- Banner Ads (CPM Model)

- Displayed on UI screens ($1–$5 per 1,000 impressions)

- Interstitial Ads

- Shown between app transitions (higher CPM: $5–$20)

- Rewarded Video Ads

- Users watch an ad to gain an in-app reward (engagement-focused)

- Affiliate Marketing

- Revenue-sharing by promoting third-party products

- Sponsored Content

- Paid sponsorships with brands

B. Mobile App Partnerships & Co-branding

- Cross-promotions with other apps

- Exclusive sponsorship deals

C. PAYG One-Time In-App Purchases

- Digital goods (stickers, skins, themes)

- Limited-time premium content

Final Thoughts for the Financial Model

A solid Mobile App Financial Model combines multiple revenue streams, optimized pricing strategies, and strong cash flow management. The six-tier subscription model ensures a broad user base while ad revenues and in-app purchases provide alternative income sources.

Download Link On Next Page