Mining Company Financial Model

20-Year Financial Model for a Mining Company

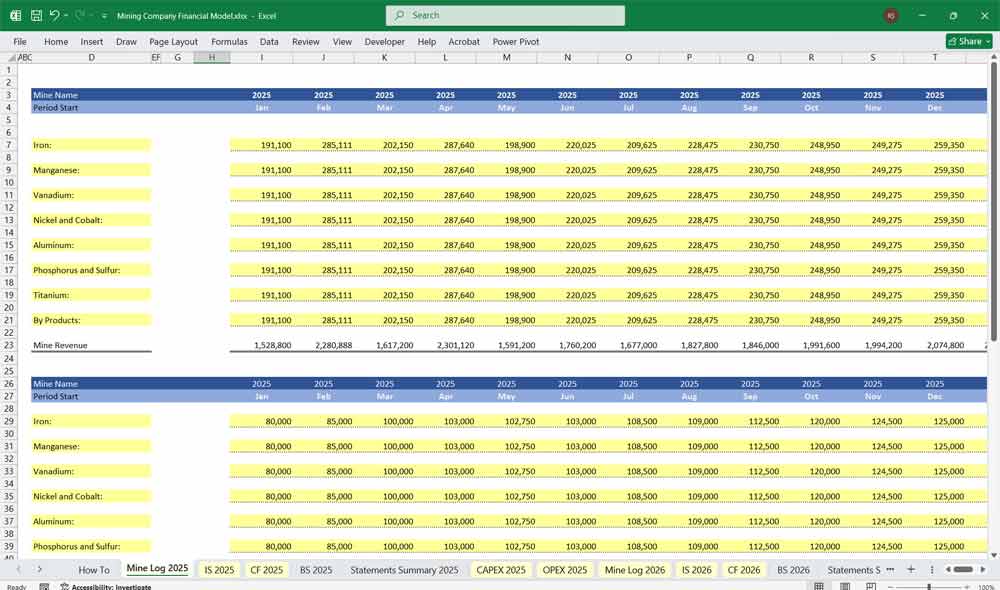

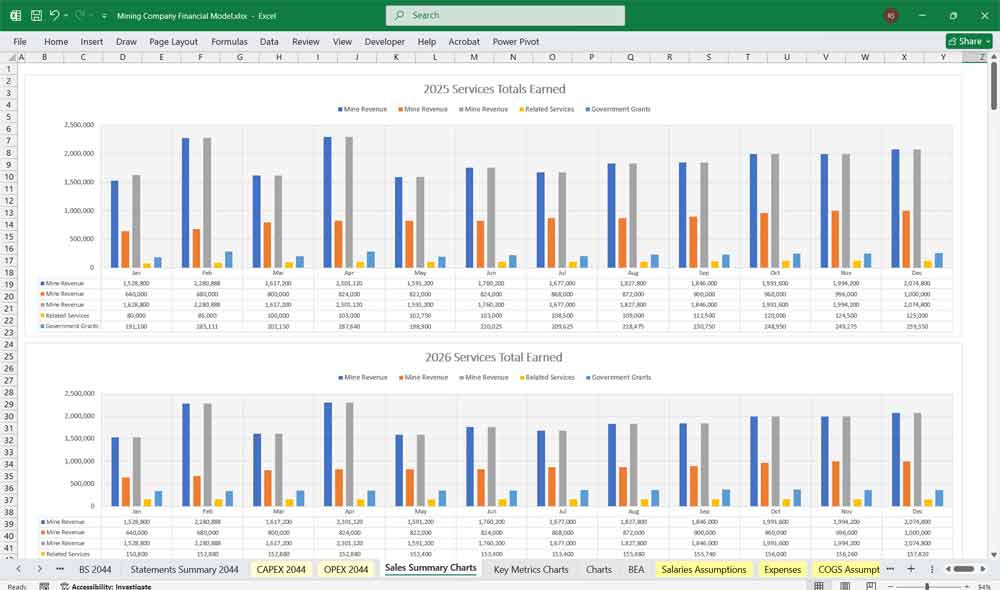

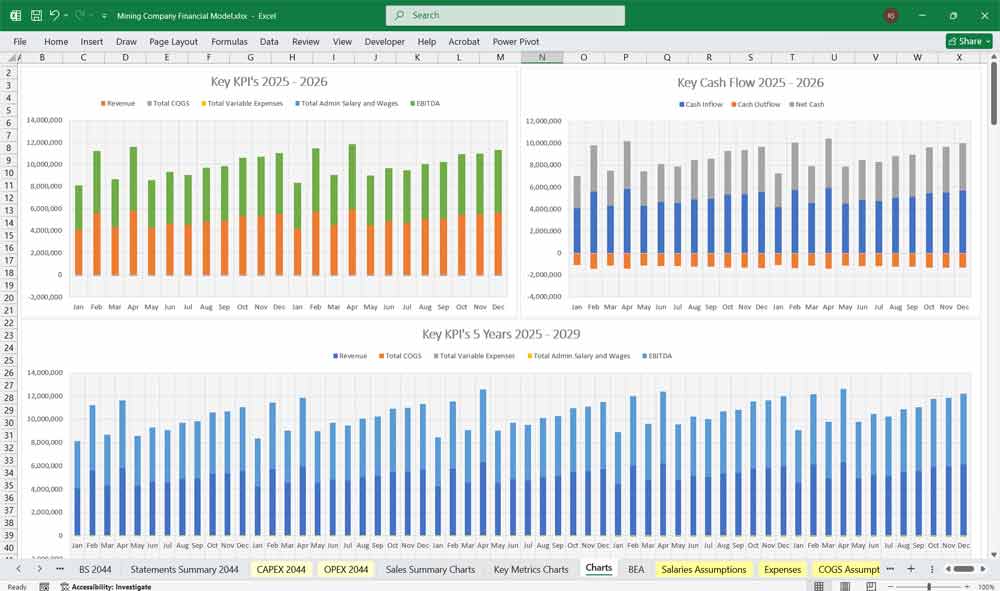

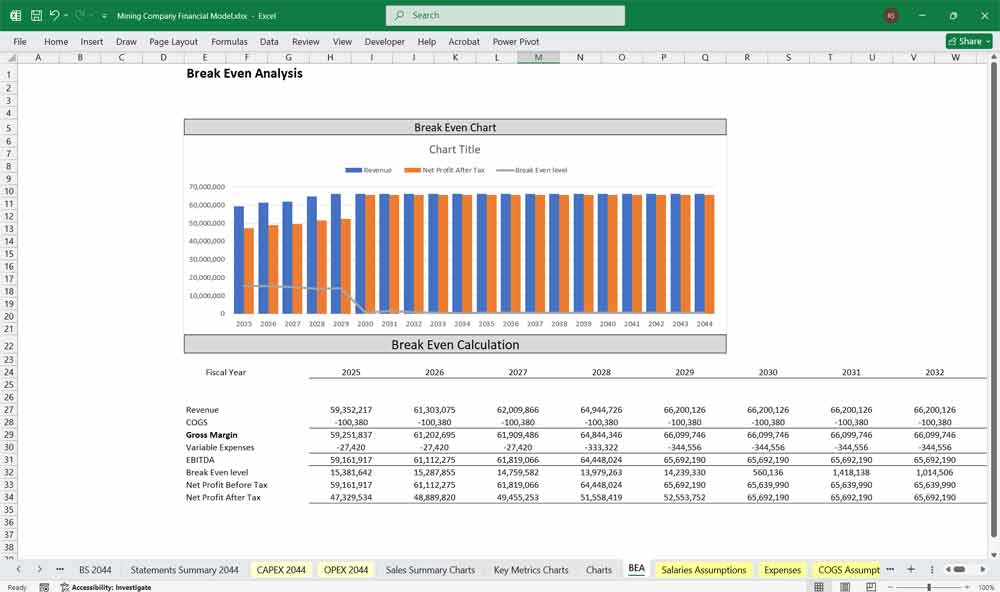

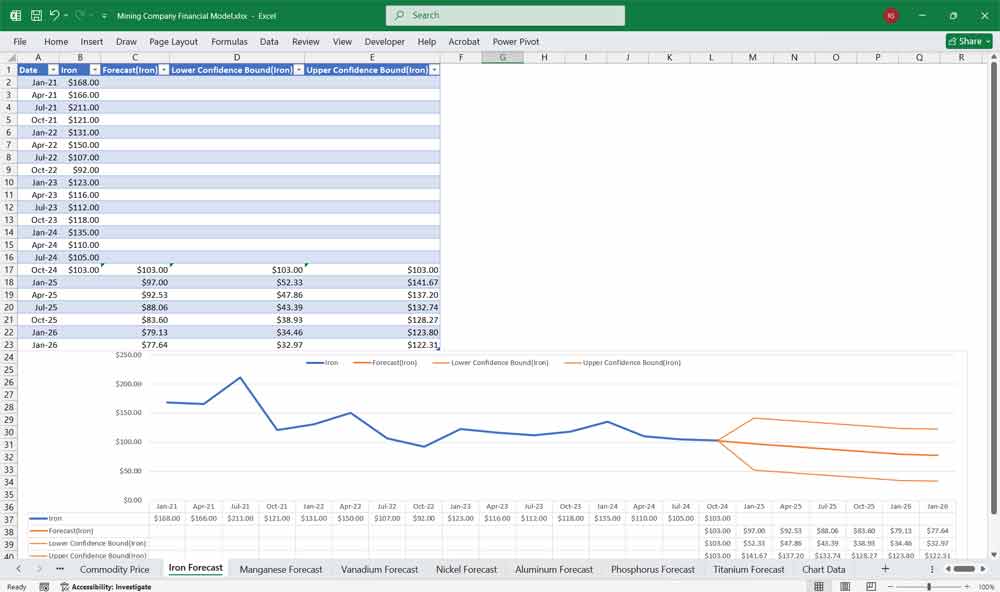

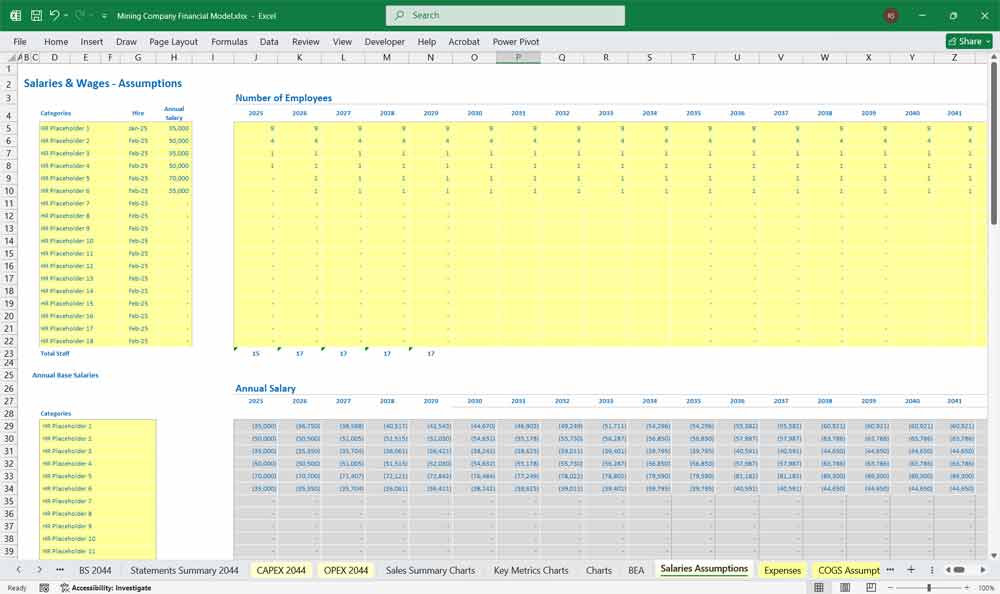

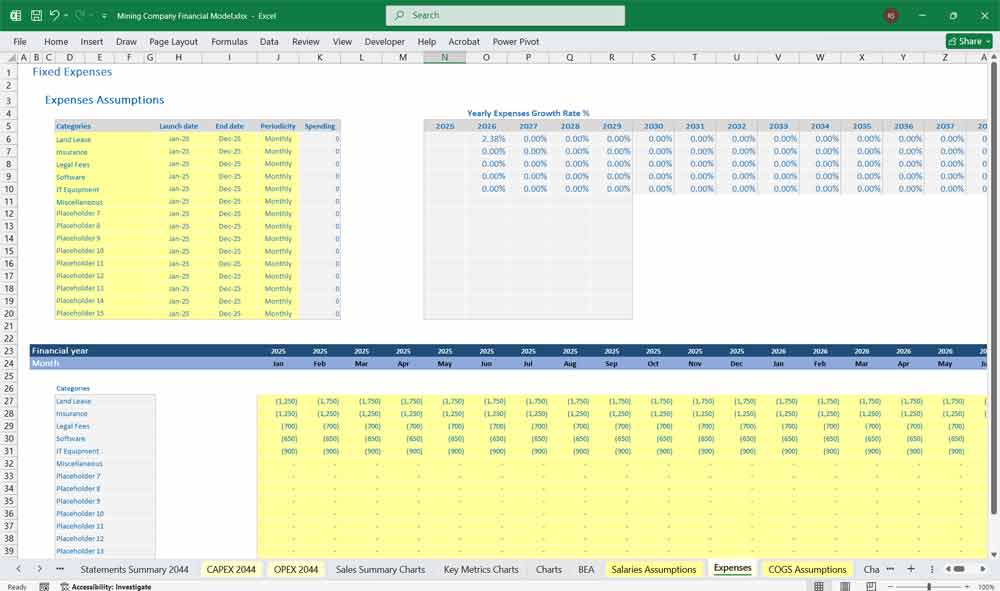

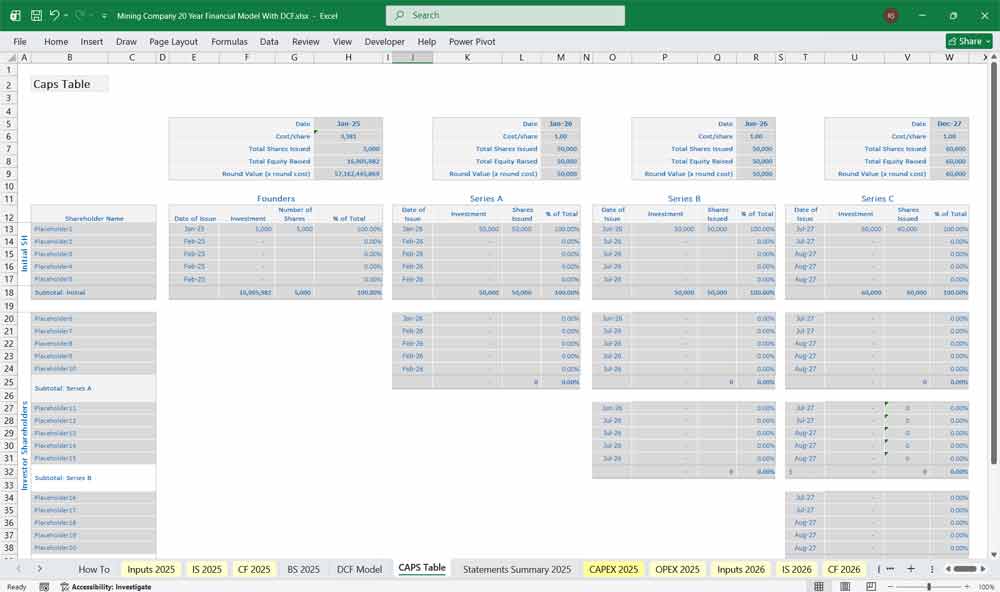

This very extensive 20 Year Mining Company Model involves detailed revenue projections, cost structures, capital expenditures, and financing needs from an Iron Ore Mining company. This model provides a thorough understanding of the financial viability, profitability, and cash flow position of the centre. Includes: 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the editable revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets. Contains commodity price forecasts for Iron, Manganese, Vanadium, Nickel, Aluminium, Phosphorus, and Titanium.

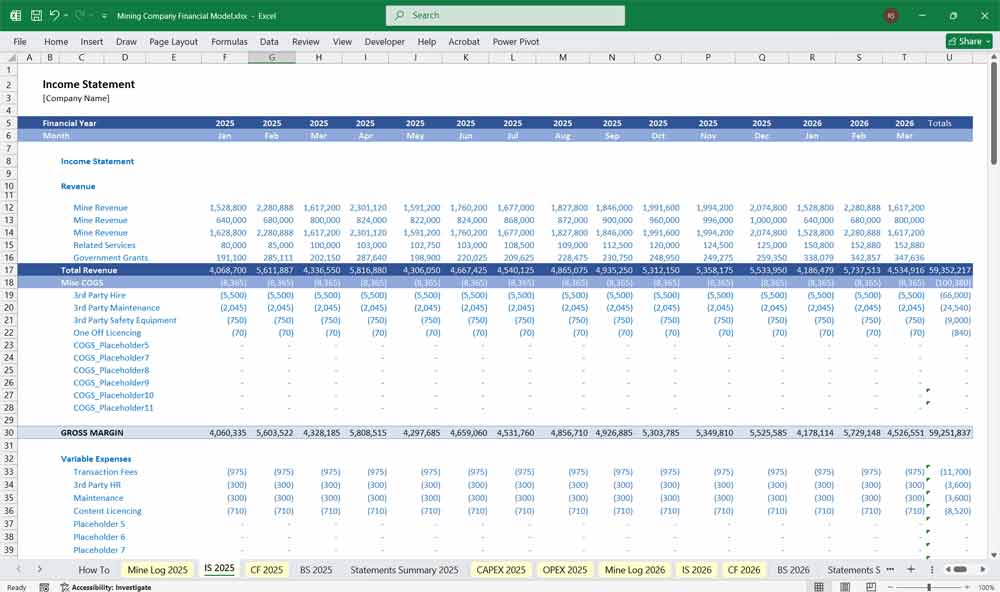

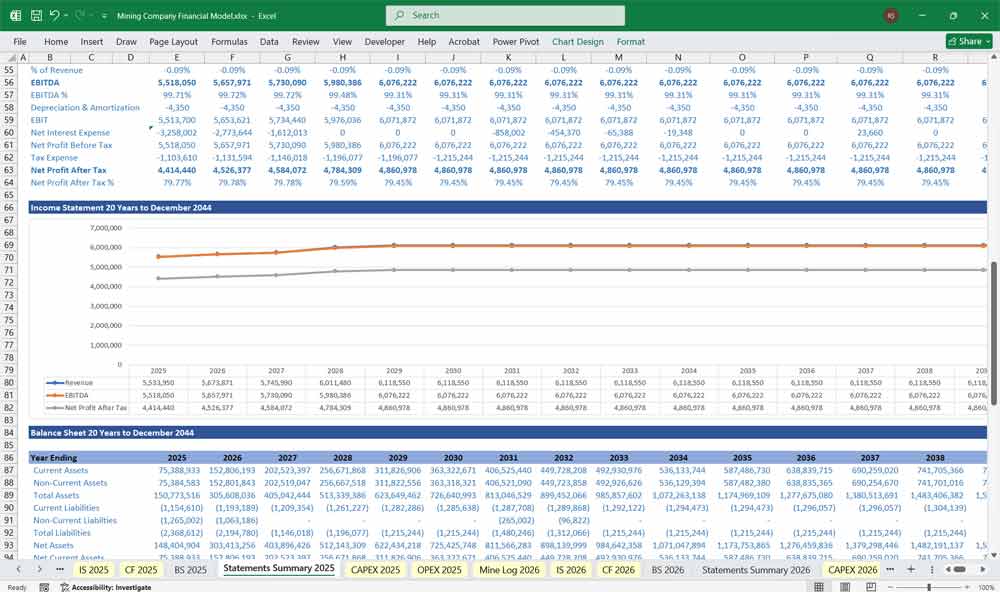

Income Statement (Profit & Loss Statement)

The Income Statement summarizes revenues, costs, and profitability over a period.

Key Components:

Revenue

Ore Sales Revenue: Quantity (tons) × Price per ton (commodity price)

By-Product Sales (if applicable, e.g., gold as a by-product of copper mining)

Adjustments for Hedging (if the company uses commodity price hedging)

Operating Costs (COGS – Cost of Goods Sold)

Mining Costs: Labor, fuel, explosives, maintenance

Processing Costs: Crushing, milling, refining

Transport & Logistics: Shipping to buyers

Royalties & Taxes: Government royalties (% of revenue)

Depreciation & Amortization: Based on mine life and capital expenditures

Gross Profit

= Total Revenue – COGS

Operating Expenses (OPEX)

General & Administrative (G&A): Salaries, office costs

Exploration Expenses: Drilling, feasibility studies

Sustaining Capital: Minor capex to maintain production

Rehabilitation Costs: Environmental provisions

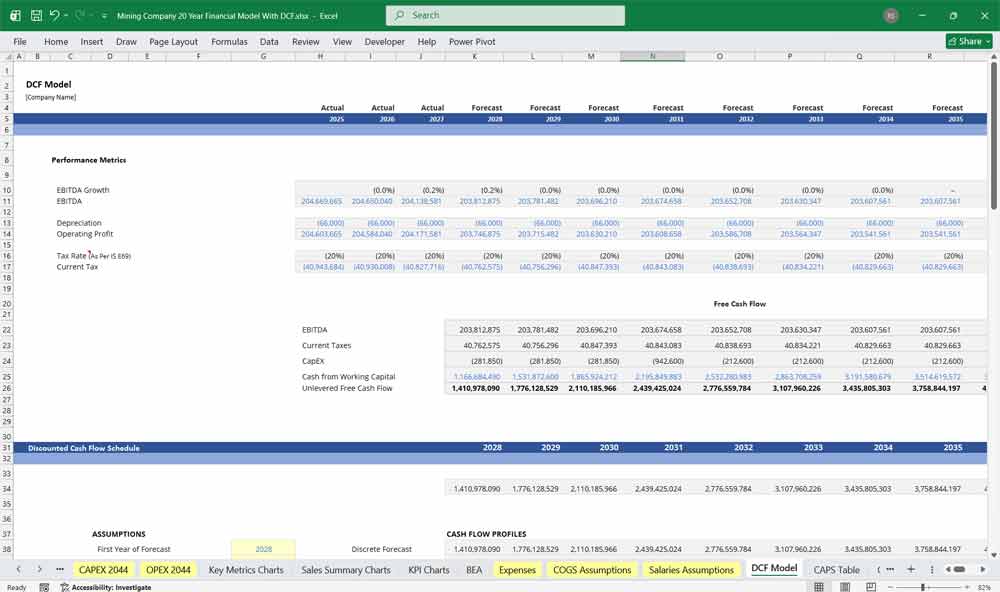

EBITDA (Earnings Before Interest, Taxes, Depreciation & Amortization)

= Gross Profit – Operating Expenses

EBIT (Earnings Before Interest & Taxes)

= EBITDA – Depreciation & Amortization

Interest Expense

Debt financing costs

Taxes

Corporate Income Tax (e.g., 30% of taxable income)

Mining-Specific Taxes (e.g., resource rent tax)

Net Income (Profit After Tax – PAT)

= EBIT – Interest – Taxes

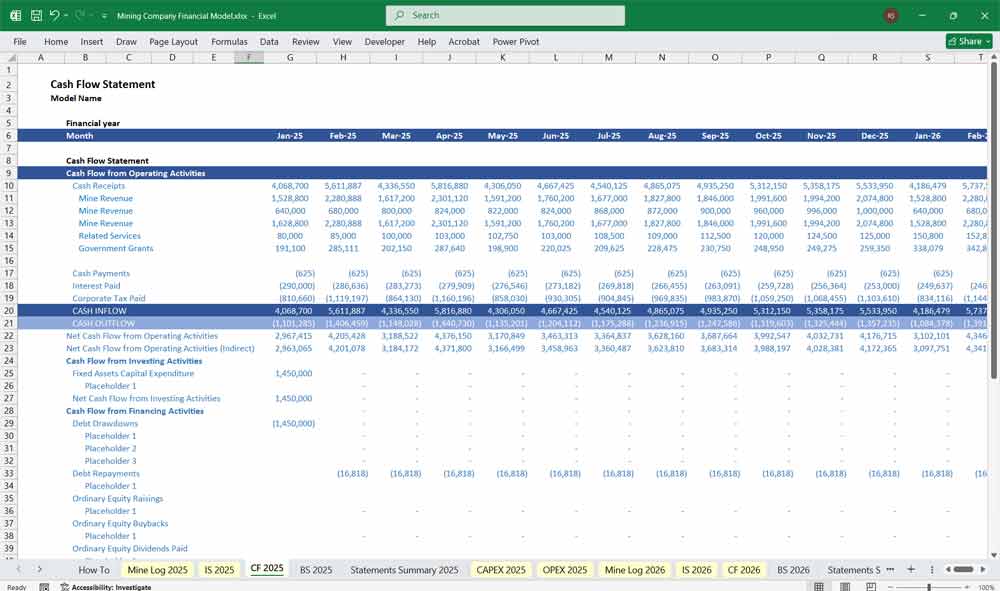

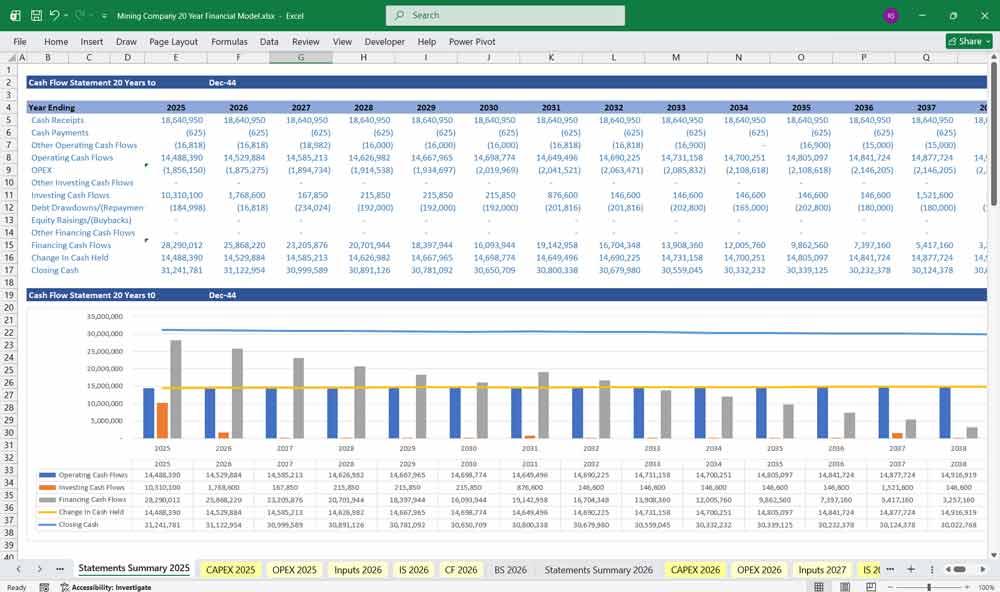

Mining Company Cash Flow Statement

The Cash Flow Statement tracks cash inflows and outflows across three categories:

A. Cash Flow from Operations (CFO)

Net Income (from Income Statement)

Adjustments for Non-Cash Items:

Depreciation & Amortization (added back)

Changes in Working Capital (inventory, receivables, payables)

Taxes Paid (cash outflow)

B. Cash Flow from Investing (CFI)

Capital Expenditures (Capex):

Development Capex: New mine construction, equipment

Sustaining Capex: Maintenance of existing operations

Exploration Expenditures

Proceeds from Asset Sales (if any)

C. Cash Flow from Financing (CFF)

Debt Issuance / Repayment

Equity Issuance (e.g., share offerings)

Dividends Paid (if applicable)

Net Change in Cash

= CFO + CFI + CFF

Ending Cash Balance

= Beginning Cash + Net Change in Cash

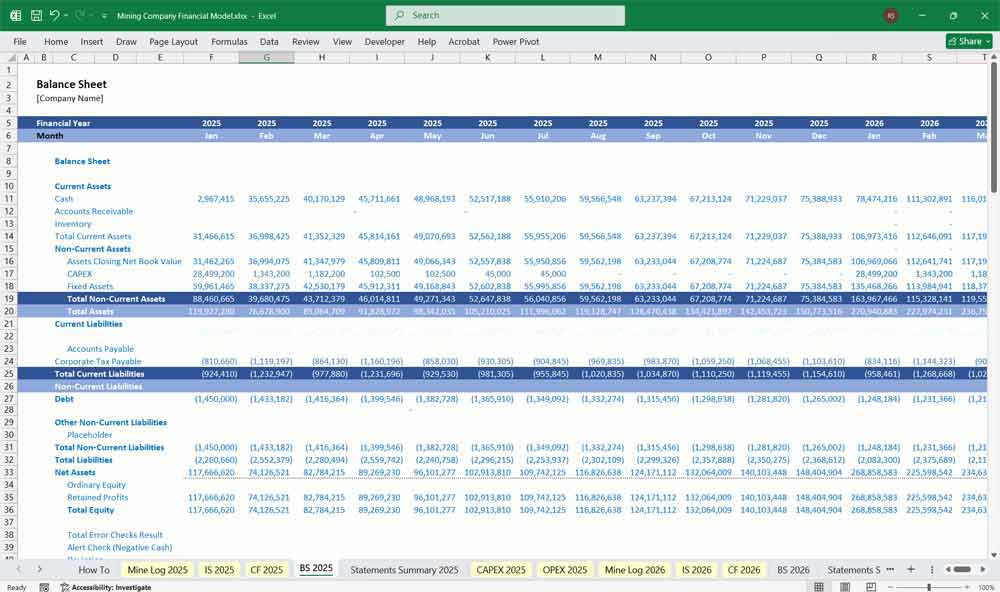

Mining Company Balance Sheet

The Balance Sheet provides a snapshot of the company’s financial position at a point in time.

Assets

Current Assets

Cash & Equivalents (from Cash Flow Statement)

Accounts Receivable (unpaid sales)

Inventory (stockpiled ore, spare parts)

Non-Current Assets

Property, Plant & Equipment (PP&E)

Mine development costs

Heavy machinery, processing plants

Less: Accumulated Depreciation

Mineral Rights & Exploration Assets

Goodwill & Intangibles (if acquired)

Liabilities

Current Liabilities

Accounts Payable (unpaid suppliers)

Short-Term Debt (due within a year)

Current Portion of Long-Term Debt

Non-Current Liabilities

Long-Term Debt (bank loans, bonds)

Deferred Tax Liabilities

Mine Rehabilitation Provisions (future environmental costs)

Shareholders’ Equity

Common Stock (issued shares)

Retained Earnings (accumulated profits)

Additional Paid-In Capital (if shares issued at a premium)

Balance Check

Total Assets = Total Liabilities + Shareholders’ Equity

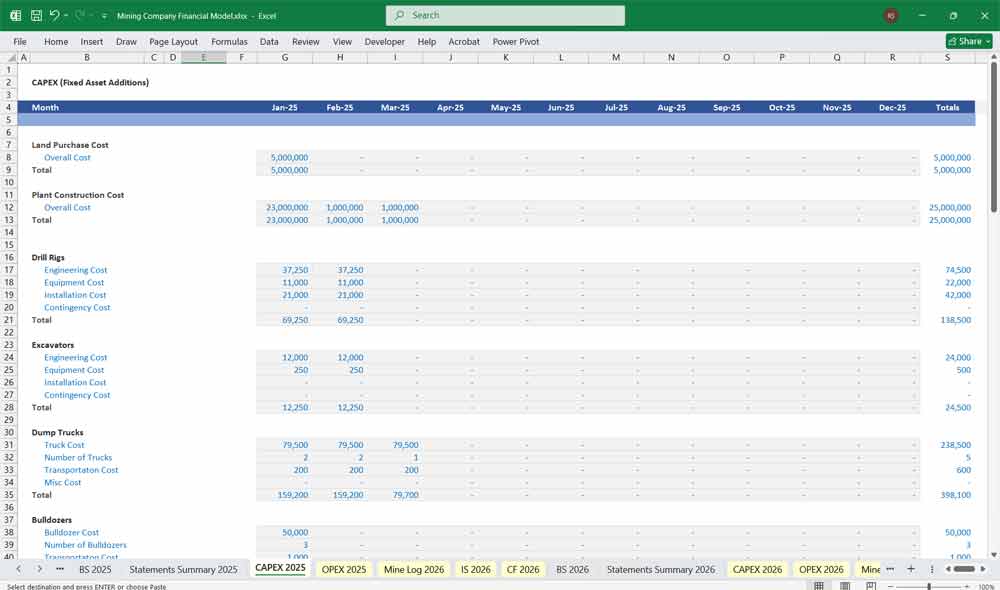

Key Components of The Mining Financial Model

Operational Assumptions: The model starts with operational data, including the amount of ore to be mined and the recovery rate (how much of the mineral is successfully extracted).

Commodity Price Forecast: The model projects future prices for the mined commodity (e.g., gold, copper) based on market research and expert forecasts. A small change in this assumption can drastically alter the model’s output.

Cost Structure: The model breaks down costs into two main categories:

Operating Costs (OPEX): These are the day-to-day costs, often measured per tonne of ore processed or per unit of metal produced (e.g., all-in sustaining costs, or AISC).

Capital Expenditures (CAPEX): These are the large, one-time investments in equipment, mine development, and infrastructure.

Additional Key Mining-Specific Metrics

EBITDA Margin = EBITDA / Revenue

Free Cash Flow (FCF) = CFO – Capex

Net Debt = Total Debt – Cash

Reserves & Resources (tonnage and grade) impact long-term revenue

Payback Period (time to recover initial investment)

Internal Rate of Return (IRR) (project profitability measure)

Benefits Of A 20-Year Financial Model

Long-Term Strategic Planning For Your Mining Company

A 20-year financial model allows a mining company to align its operations with long-term strategic goals. Since mining projects often have lifespans of decades, a multi-decade forecast helps management plan exploration, development, and production phases efficiently. It ensures that capital allocation (e.g., mine expansions, equipment upgrades) is optimized over the entire project lifecycle rather than just the short term.

Improved Mining Company Financing & Investment Decisions

Investors and lenders require visibility into a mining company’s long-term cash flows to assess risk and returns. A 20-year model provides a detailed projection of revenue, costs, and debt repayment capacity, making it easier to secure loans or equity financing. It also helps evaluate the feasibility of large-scale projects by estimating payback periods and IRR over an extended horizon.

Mining Commodity Price & Market Cycle Resilience

Mining is highly cyclical, with commodity prices fluctuating over years or decades. A 20-year model enables scenario analysis—testing how different price assumptions impact profitability. This helps companies prepare for downturns by structuring flexible debt, hedging strategies, and cost controls while maximizing gains during price upswings.

Life-of-Mine (LOM) Optimization

A 20-year financial model integrates Life-of-Mine planning, ensuring that extraction rates, processing capacity, and rehabilitation costs are economically balanced. It helps avoid premature mine closures or underutilized resources by forecasting when additional reserves need to be developed or when cost efficiencies must be implemented.

Ensures Long Term Regulatory & Environmental Compliance For Your Mining Company

Mining projects face long-term environmental and regulatory obligations, such as mine closure costs and carbon taxes. A 20-year model ensures these liabilities are accurately provisioned, avoiding financial shortfalls. It also supports sustainability planning by forecasting the costs of transitioning to cleaner technologies or meeting future ESG (Environmental, Social, and Governance) standards.

Mining Company WACC, Sensitivity Analysis, & Discounted Cash Flow (DCF) with Terminal Value, Model add-on

The Weighted Average Cost of Capital (WACC) represents the average rate your mine is expected to pay to finance its assets, combining the cost of equity and the cost of debt weighted by their respective proportions in the mine’s capital structure. WACC plays a pivotal role in investment decisions and valuation models like DCF, as it serves as the discount rate reflecting the risk and opportunity cost of capital. A lower WACC indicates cheaper financing costs and potentially higher valuation, while a higher WACC signals greater risk and cost of capital.

Sensitivity Analysis is a tool that helps measure how the uncertainty in the output of a mining model can be attributed to different sources of uncertainty in its inputs. In the context of financial modeling, it involves changing key assumptions like growth rates, discount rates, or profit margins to see how these changes impact the valuation or outcome. This analysis is crucial because it highlights which variables have the most influence on the final result, allowing decision-makers to focus on managing or monitoring those critical factors.

Discounted Cash Flow (DCF) is a fundamental valuation method used to estimate the value of an investment based on its expected future cash flows. By projecting these cash flows and then discounting them back to their present value using a discount rate, typically the weighted average cost of capital (WACC), DCF provides a clear picture of an asset’s intrinsic worth. This technique is widely used in finance to assess companies, projects, or any investments where future cash flow forecasts are available.

Final Notes on the Financial Model

This 20 Year Mining Company Financial Model must focus on balancing capital expenditures with steady revenue growth from diversified commodity mining. By optimizing operational costs, power efficiency, and maximizing high-margin services, this model helps to ensure sustainable profitability and cash flow stability.

Download Link On Next Page

Download Link On Next Page