Manufacturing Startup Financial Model

This 20-Year, 3-Statement Excel Manufacturing StartUp Financial Model includes revenue streams from 10 product lines, cost structures, and financial statements to forecast the financial health of your start-up.

Financial Model for a Manufacturing Startup

Benefits Of a 20-Year Model For Your Startup

A 20-year financial model is highly beneficial for a manufacturing startup as it provides a long-term strategic roadmap that goes beyond immediate concerns.

This extended timeline allows the startup to accurately model the full cycle of capital expenditure (CapEx) for machinery and facilities, including their eventual replacement and maintenance costs, which are substantial in manufacturing. It enables a more realistic assessment of scaling production over time, factoring in necessary investments in automation, R&D for product improvements, and market penetration strategies that often take a decade or more to mature.

Furthermore, a 20-year view is essential for demonstrating long-term viability to potential investors or lenders, especially those interested in sustainable returns, by projecting net present value (NPV) and internal rate of return (IRR) based on stable, mature operations, thereby maximizing valuation and securing better financing terms.

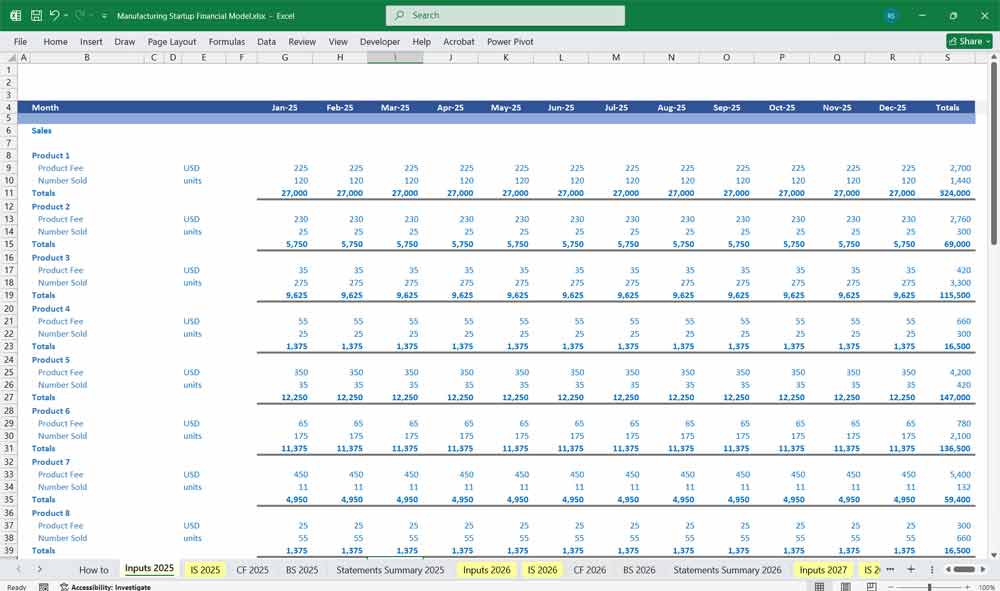

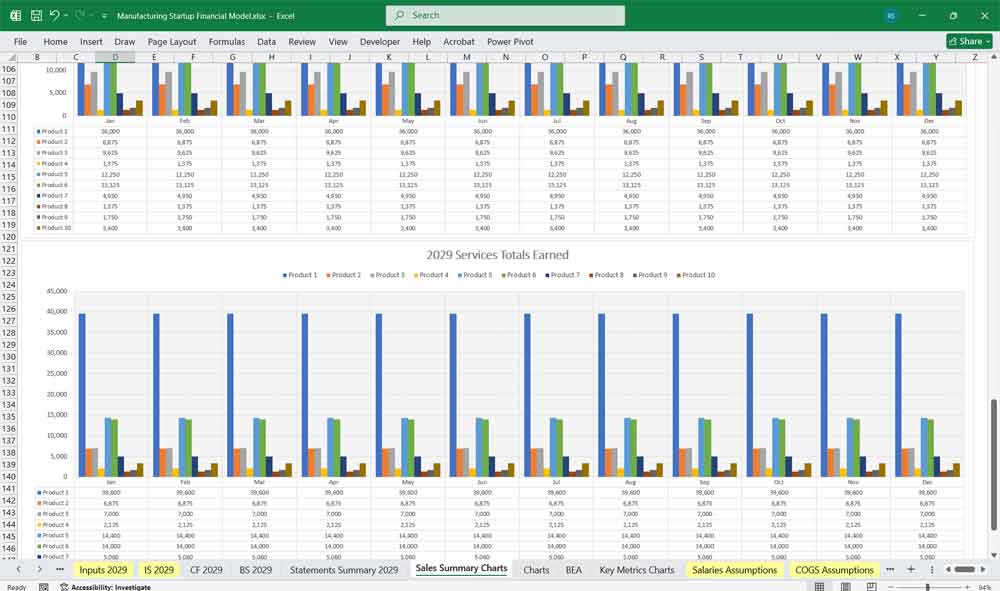

1. Revenue Model (Feasibility/Projections)

These Manufacturing startup models have 10 product lines (easily add more), each with unique pricing and sales volume projections. The revenue models include:

Product Lines:

- Product A

- Product B

- Product C

- Product D

- Product E

- Product F

- Product G

- Product H

- Product I

- Product J

Revenue Drivers:

- Sales Volume per product line

- Pricing per unit

- Growth rate in sales

- Market penetration assumptions

- Seasonal demand fluctuations

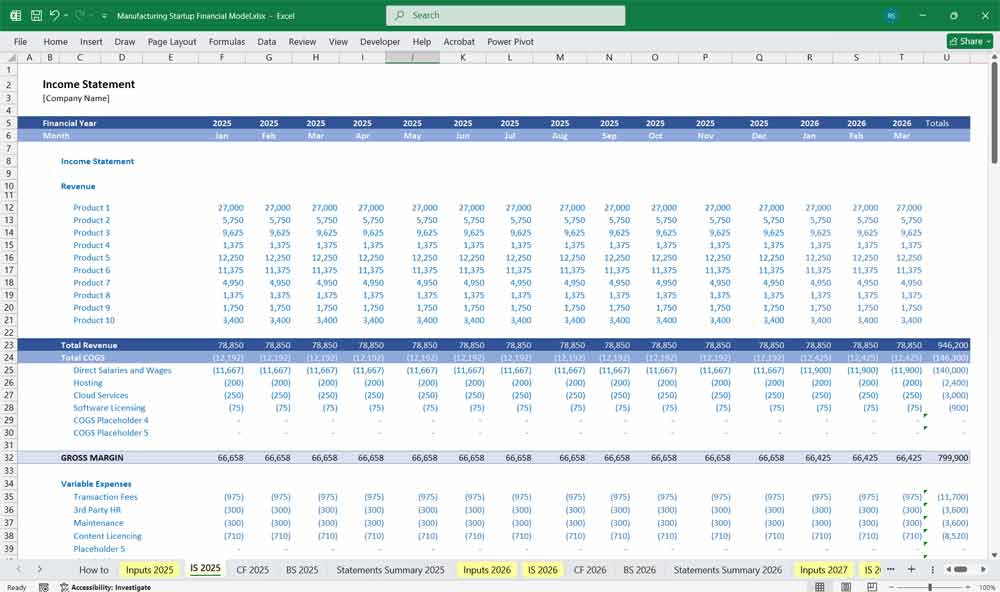

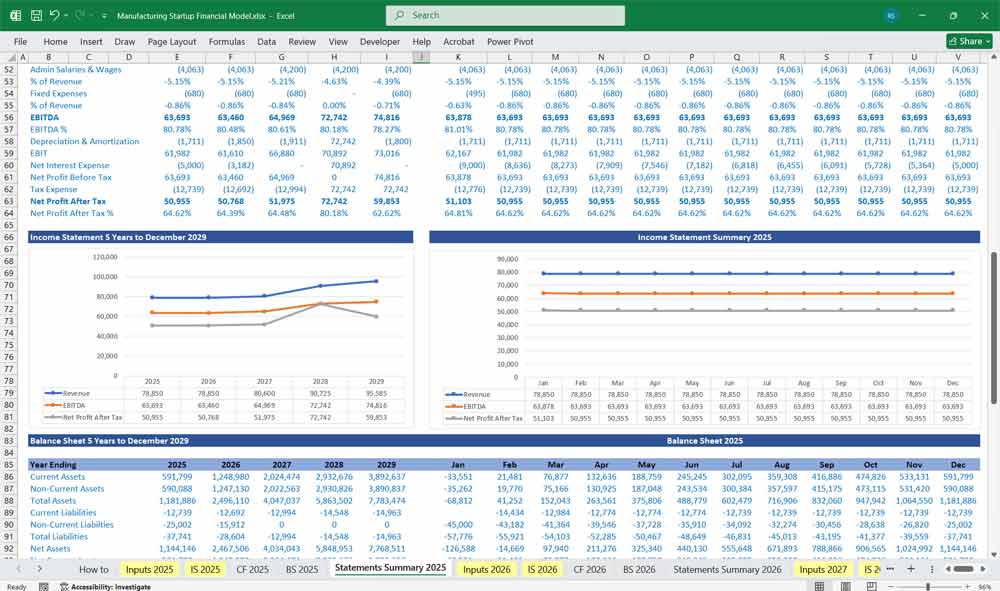

Income Statement (Profit & Loss Statement)

The Income Statement provides an overview of revenue, expenses, and profitability.

Revenue Section:

- Sales Revenue: Total revenue from all 10 product lines.

- Other Income: Possible additional revenue from consulting, licensing, or scrap material sales.

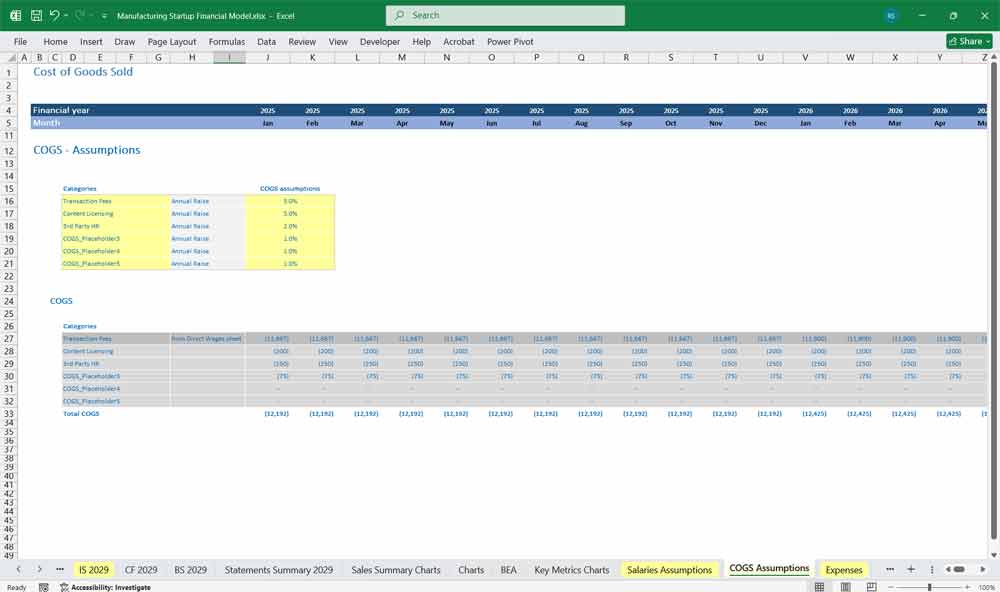

Cost of Goods Sold (COGS):

- Raw Material Costs (per product line)

- Direct Labor Costs (workers involved in production)

- Manufacturing Overhead: Factory utilities, rent, depreciation of machinery

Gross Profit = Revenue – COGS

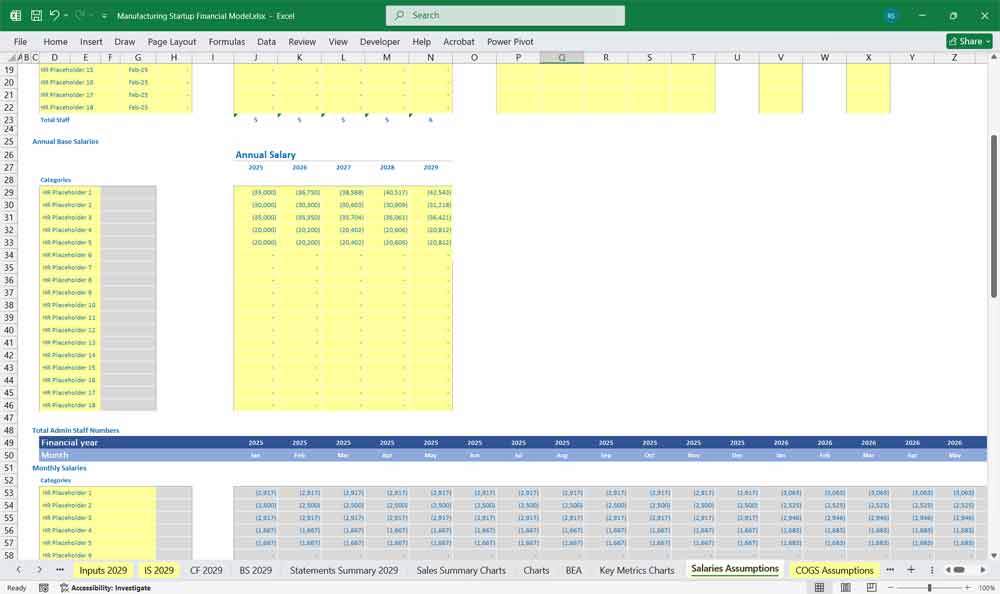

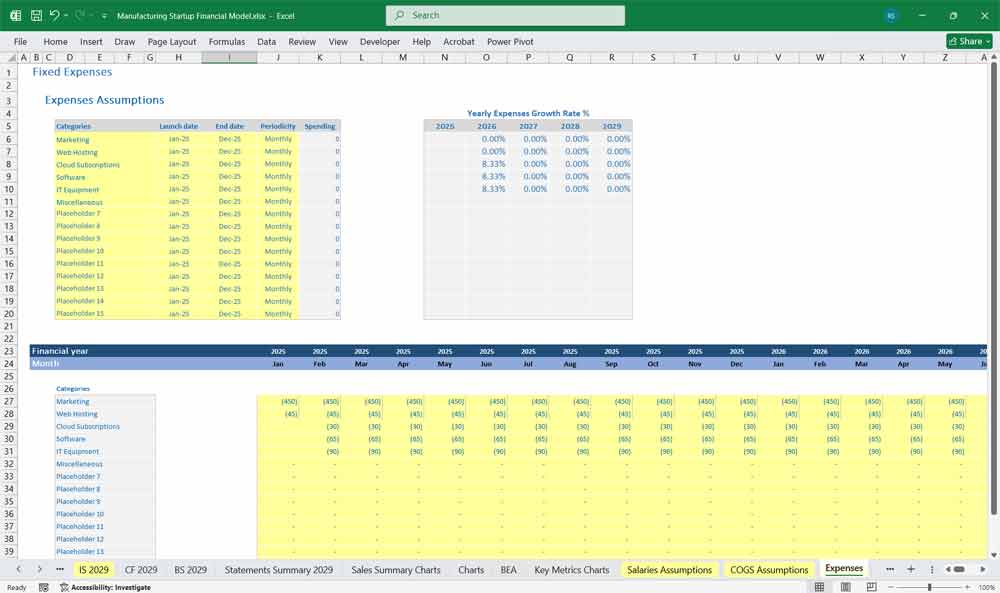

Operating Expenses (OPEX):

- Salaries & Wages (non-production employees)

- Marketing & Advertising (branding, promotions)

- Research & Development (R&D) (new product innovation)

- Rent & Utilities (non-manufacturing space)

- Depreciation & Amortization (capital assets)

- Insurance & Taxes

Operating Profit = Gross Profit – OPEX

Other Expenses:

- Loan Interest Payments

- Taxes

Net Profit = Operating Profit – Other Expenses

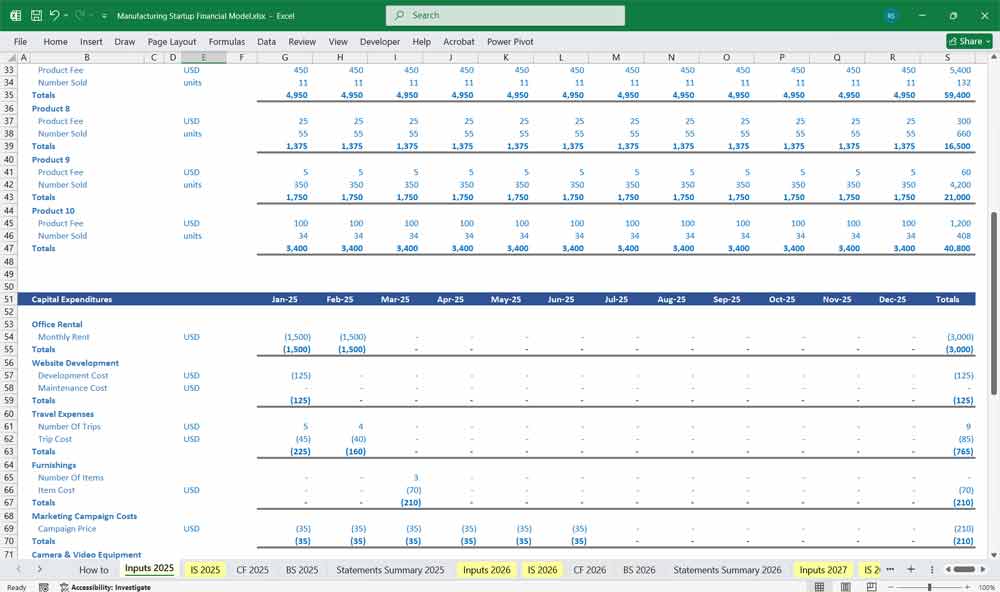

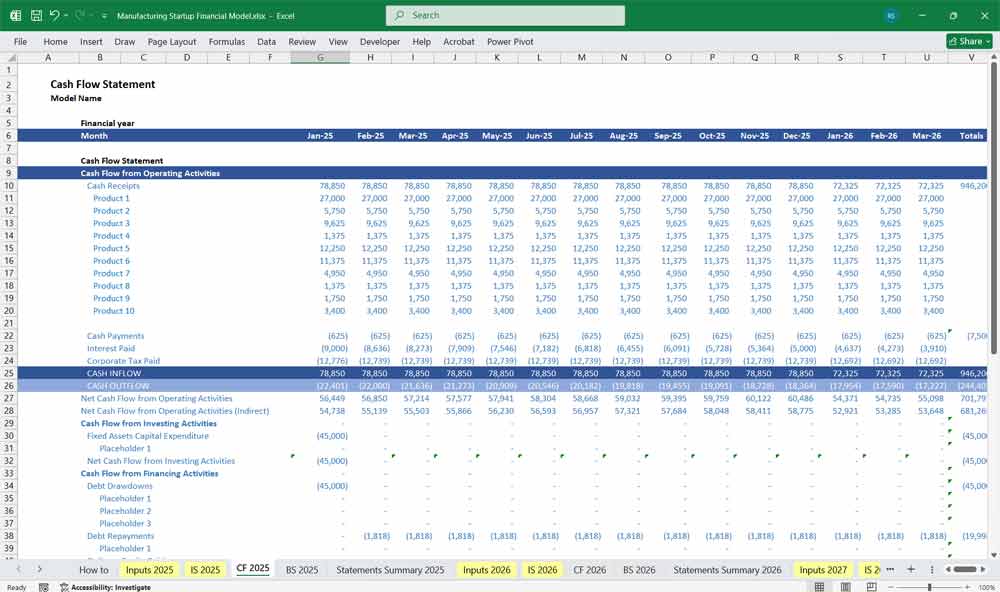

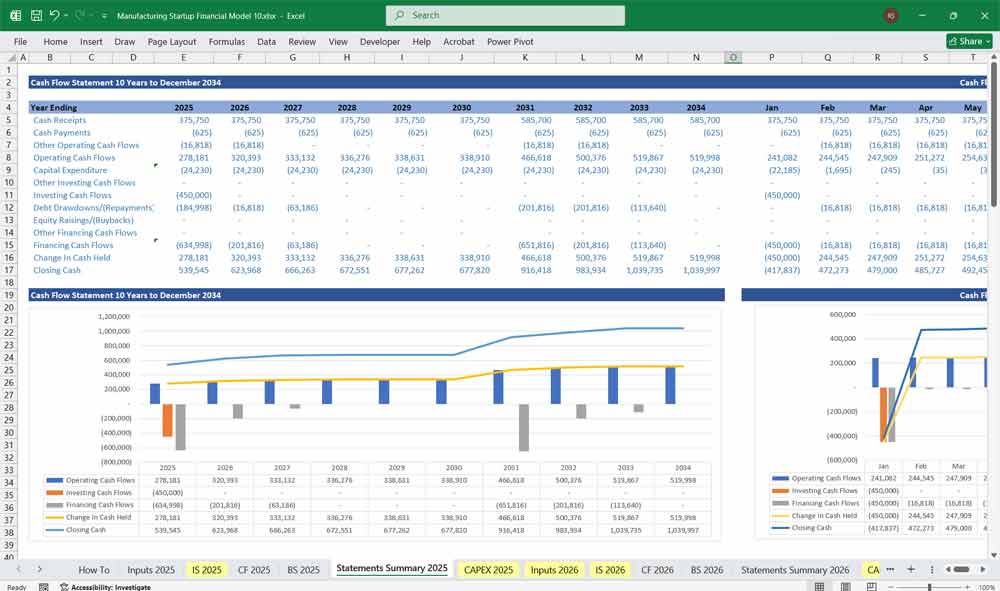

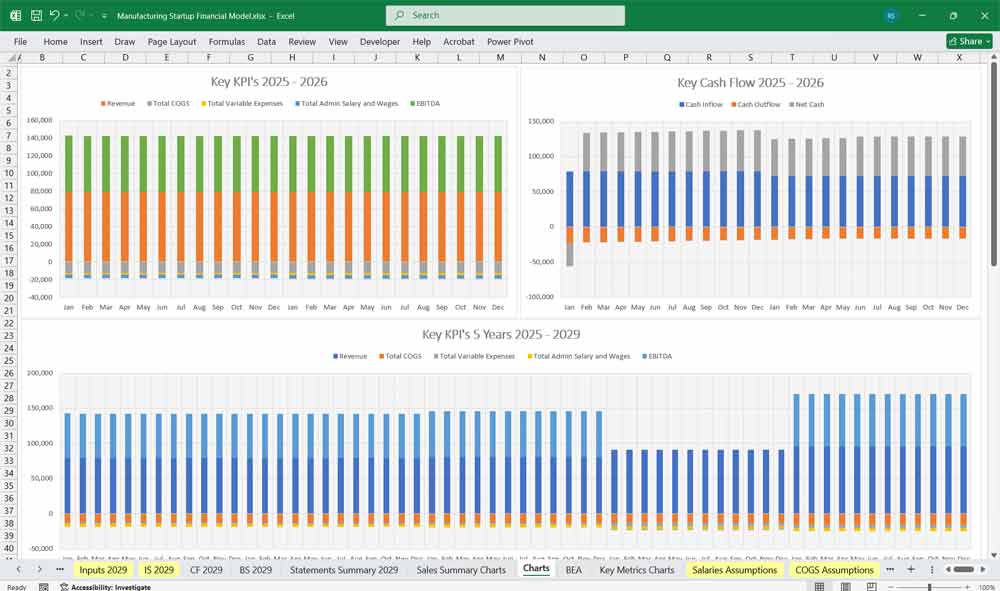

Manufacturing Startup Cash Flow Statement

This tracks how cash moves in and out of the business.

Cash Inflows:

- Sales Receipts from 10 product lines

- Investment Inflows (equity or debt financing)

- Grants & Subsidies (if applicable)

Cash Outflows:

Operating Activities:

- Raw material purchases

- Salaries and wages

- Utilities and rent

- Marketing expenses

Investing Activities:

- Purchase of machinery & equipment

- Research & Development costs

Financing Activities:

- Loan repayments

- Dividend payments (if applicable)

Net Cash Flow = Total Inflows – Total Outflows

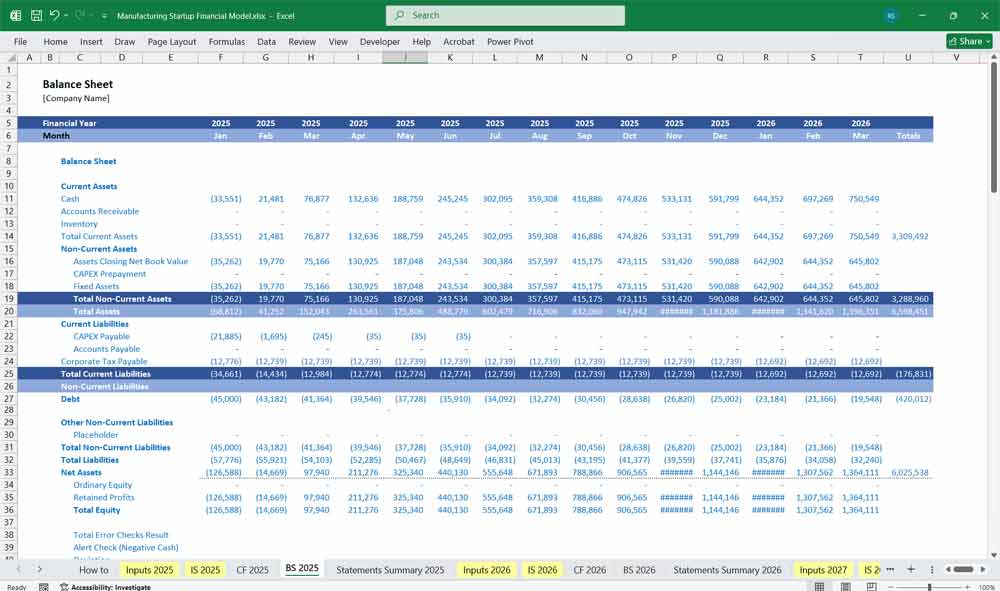

Manufacturing Startup Balance Sheet

The Balance Sheet provides a snapshot of financial health at a given time.

Assets:

Current Assets:

- Cash & Cash Equivalents

- Accounts Receivable (unpaid customer invoices)

- Inventory (raw materials, work-in-progress, finished goods)

Fixed Assets (Property, Plant & Equipment):

- Machinery

- Buildings & Leasehold Improvements

- Vehicles

Intangible Assets:

- Patents, Trademarks, and Goodwill

Liabilities:

Current Liabilities:

- Accounts Payable (suppliers, utilities)

- Short-term loans

- Employee salaries payable

Long-term Liabilities:

- Bank Loans

- Equipment financing

Equity:

- Owner’s Equity / Retained Earnings

- Invested Capital (from founders or investors)

Assets = Liabilities + Equity

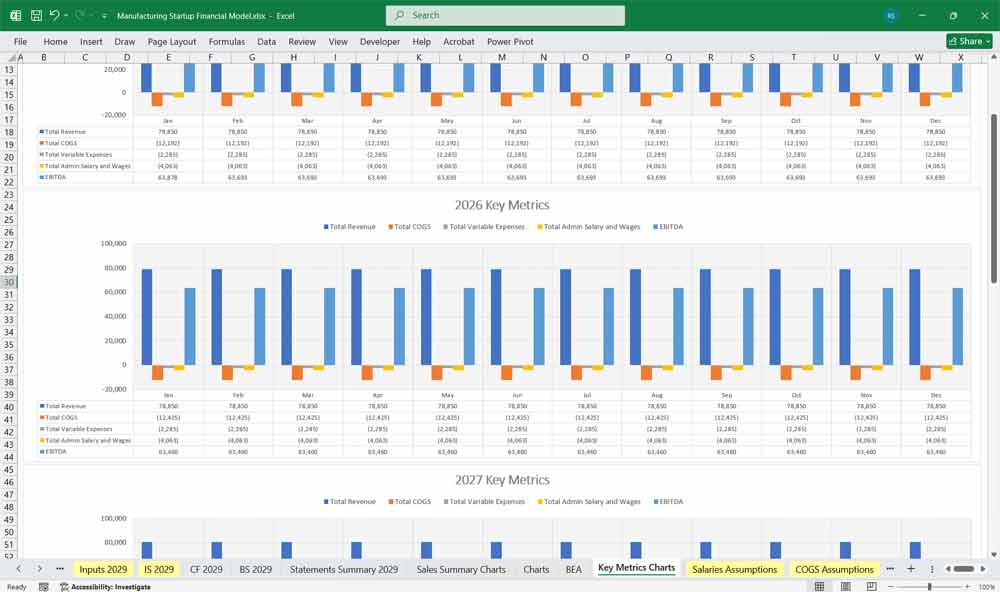

Key Financial Metrics for a Manufacturing Startup

- Gross Profit Margin = (Gross Profit / Revenue) × 100

- Operating Profit Margin (EBIT Margin) = (EBIT / Revenue) × 100

- Net Profit Margin = (Net Income / Revenue) × 100

- Return on Assets (ROA) = (Net Income / Total Assets) × 100

- Return on Equity (ROE) = (Net Income / Shareholder Equity) × 100

- Debt-to-Equity Ratio = (Total Debt / Shareholder Equity)

- Inventory Turnover = (COGS / Average Inventory)

- Days Sales Outstanding (DSO) = (Accounts Receivable / Revenue) × 365

When structuring product lines for a glass manufacturer, it’s important to organize them in a way that aligns with customer needs, market demand, and operational efficiency.

Advertising & Additional Startup Expenses

A. Ad Revenue Costs

- Banner Ads (CPM Model)

- Displayed on UI screens

- Interstitial Ads

- Shown between app transitions

- Social Media Video Ads

- Users watch an ad to gain an in-app reward (engagement-focused)

- Affiliate Marketing

- Revenue-sharing by promoting third-party products

- Sponsored Content

- Paid sponsorships with brands

B. Free Samples

- Production costs (stickers, skins, themes)

- Limited-time products

Product Line Categorization for a Manufacturing Startup

1. Manufacturing Startup Industry Selection and Market Research

Focus: Identify the industry your startup will operate in (e.g., electronics, textiles, automotive, food processing, etc.).

Possible Products:

Consumer electronics (e.g., smart home devices, wearables).

Sustainable packaging materials.

Custom CNC-machined parts for industries.

Eco-friendly apparel or footwear.

Considerations:

Analyze market demand and competition.

Identify gaps in the market (e.g., eco-friendly, affordable, or high-performance products).

Study regulatory requirements and certifications.

2. Product Design and Manufacturing Startup Development

Focus: Create innovative, functional, and manufacturable products.

Possible Products:

Modular furniture for small spaces.

IoT-enabled industrial sensors.

Biodegradable cutlery and tableware.

Custom 3D-printed prosthetics.

Considerations:

Use CAD software for prototyping.

Collaborate with designers and engineers.

Test prototypes for functionality and durability.

3. Sourcing Raw Materials and Suppliers For Your Manufacturing Startup

Focus: Secure high-quality, cost-effective materials.

Possible Products:

Recycled plastic products (e.g., storage containers, outdoor furniture).

Organic skincare products.

Lightweight composite materials for automotive parts.

Considerations:

Build relationships with reliable suppliers.

Evaluate material costs and lead times.

Consider sustainable or locally sourced materials.

4. Manufacturing Process and Startup Technology

Focus: Choose the right production methods and equipment.

Possible Products:

Automated assembly of electronic components.

Injection-molded plastic goods.

Laser-cut metal parts for machinery.

Considerations:

Decide between in-house production or outsourcing.

Invest in automation for efficiency.

Implement quality control systems.

5. Facility Setup and Startup Location

Focus: Establish a production facility that meets your needs.

Possible Products:

Small-batch artisanal goods (e.g., handmade soaps, candles).

Large-scale production of automotive components.

Food processing (e.g., snacks, beverages).

Considerations:

Choose a location with access to suppliers and customers.

Ensure compliance with zoning and safety regulations.

Optimize layout for workflow efficiency.

6. Supply Chain and Manufacturing Startup Logistics

Focus: Develop a reliable system for sourcing, production, and distribution.

Possible Products:

Perishable goods (e.g., frozen foods, fresh produce).

High-demand consumer electronics.

Customized machinery parts.

Considerations:

Partner with logistics providers for timely delivery.

Implement inventory management software.

Plan for contingencies (e.g., delays, shortages).

7. Quality Assurance and Startup Compliance

Focus: Ensure products meet industry standards and customer expectations.

Possible Products:

Medical devices (e.g., surgical instruments, diagnostic tools).

Children’s toys (safety compliance).

Food products (health and safety standards).

Considerations:

Obtain necessary certifications (e.g., ISO, FDA, CE).

Conduct regular quality checks.

Address customer feedback for continuous improvement.

8. Manufacturing Startup Marketing and Branding

Focus: Build a strong brand and reach your target audience.

Possible Products:

Luxury goods (e.g., watches, leather accessories).

Eco-friendly home appliances.

Customized promotional products (e.g., branded merchandise).

Considerations:

Develop a unique value proposition.

Use digital marketing (e.g., social media, SEO).

Attend trade shows and industry events.

9. Sales and Distribution Channels for a Startup

Focus: Identify the best ways to sell and deliver your products.

Possible Products:

Direct-to-consumer (e.g., e-commerce platforms).

B2B sales (e.g., supplying parts to manufacturers).

Retail partnerships (e.g., supermarkets, specialty stores).

Considerations:

Choose between online, offline, or hybrid sales models.

Build relationships with distributors and retailers.

Offer flexible payment and delivery options.

10. Financial Planning and Manufacturing Startup Funding

Focus: Secure funding and manage finances effectively.

Possible Products:

High-margin niche products (e.g., luxury items).

Scalable products with low production costs (e.g., software-enabled hardware).

Crowdfunded products (e.g., innovative gadgets).

Considerations:

Create a detailed business plan with financial projections.

Explore funding options (e.g., venture capital, loans, grants).

Monitor cash flow and expenses closely.

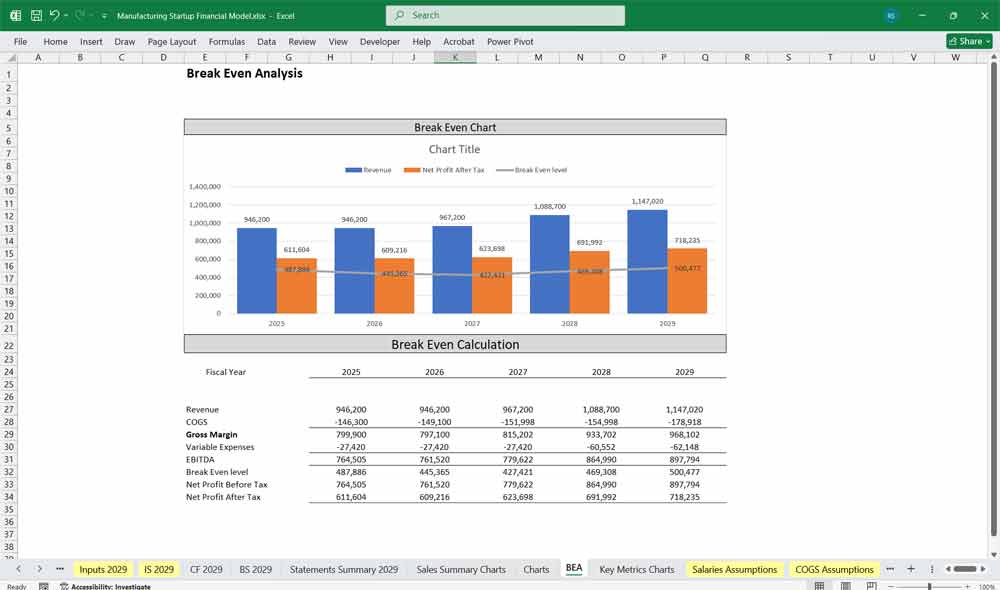

Conclusions on the Financial Model

Financial model for a Manufacturing Startup

- Scenario Analysis: Create best-case, base-case, and worst-case projections.

- Break-even Analysis: Determine sales volume required to cover fixed & variable costs.

- Sensitivity Analysis: Assess how changes in raw material costs, pricing, or demand impact profitability.

This 20-year financial model provides a structured way to project profitability, cash flow, and financial stability for a manufacturing startup.

Download Link On Next Page