Lithium Refinery Financial Model

Financial Model for a Lithium Refinery

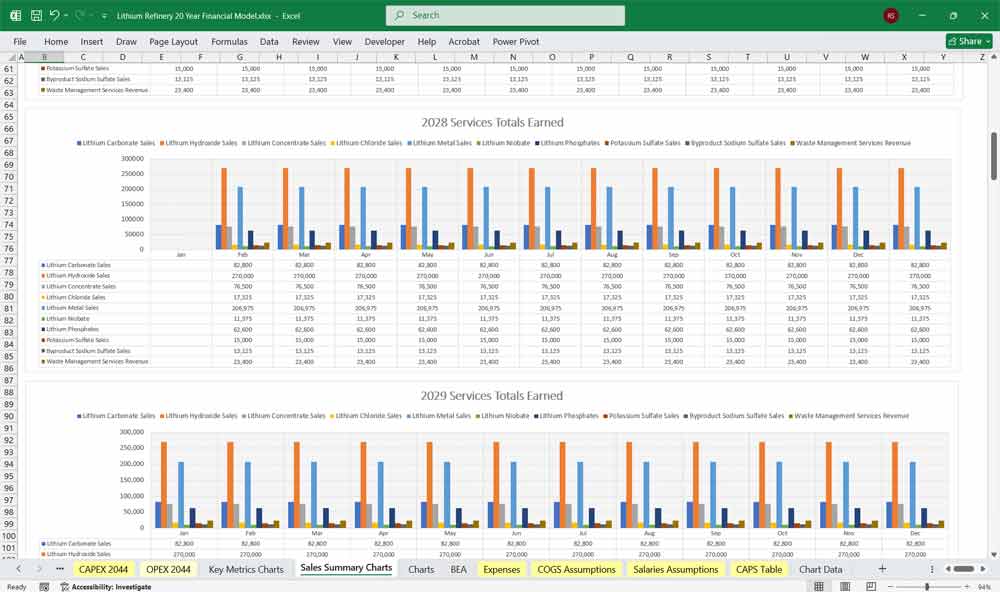

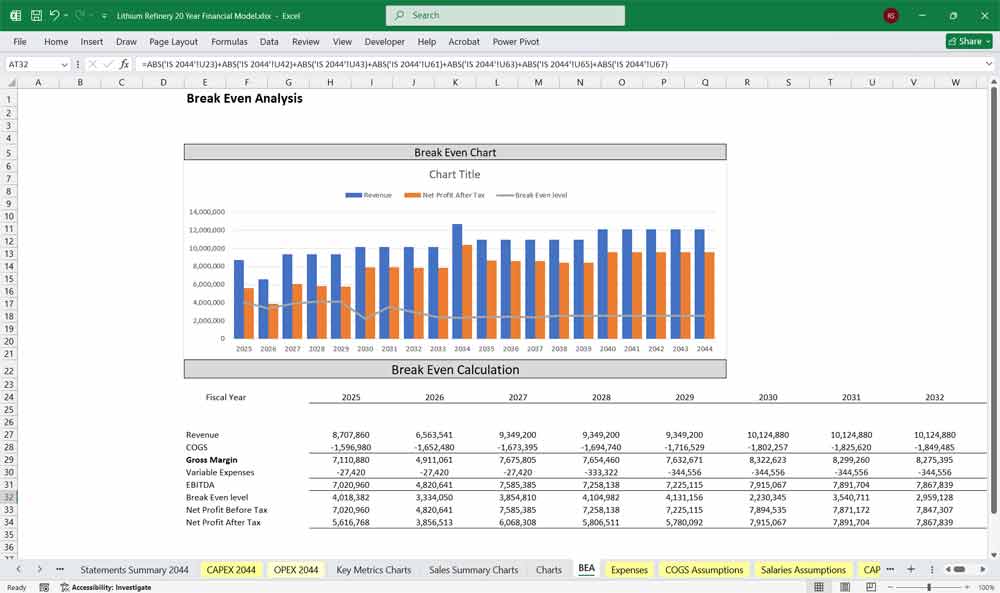

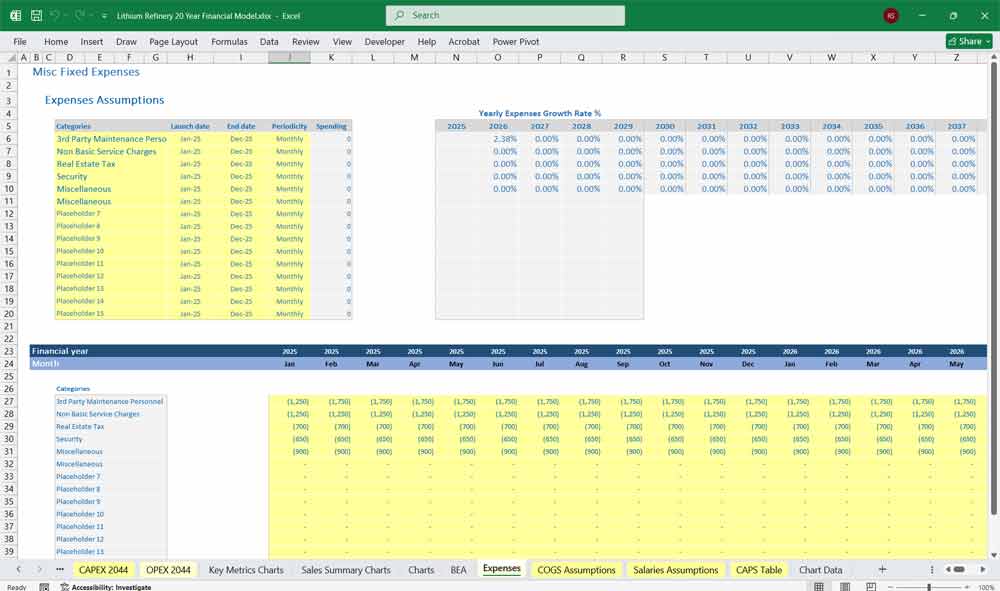

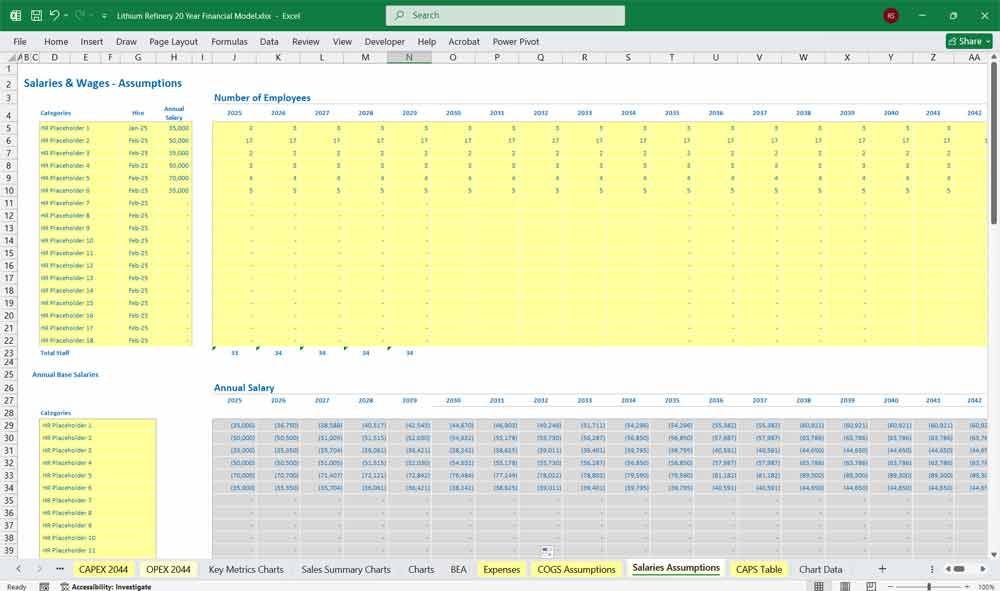

This very extensive 20 Year Lithium Refinery Model involves detailed revenue projections, cost structures, capital expenditures, and financing needs. This model provides a thorough understanding of the financial viability, profitability, and cash flow position of the refinery. Including: 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the specified revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets. Over 100 Spreadsheets in 1 Excel Workbook for the closest monitoring of your Lithium Refinery Financials.

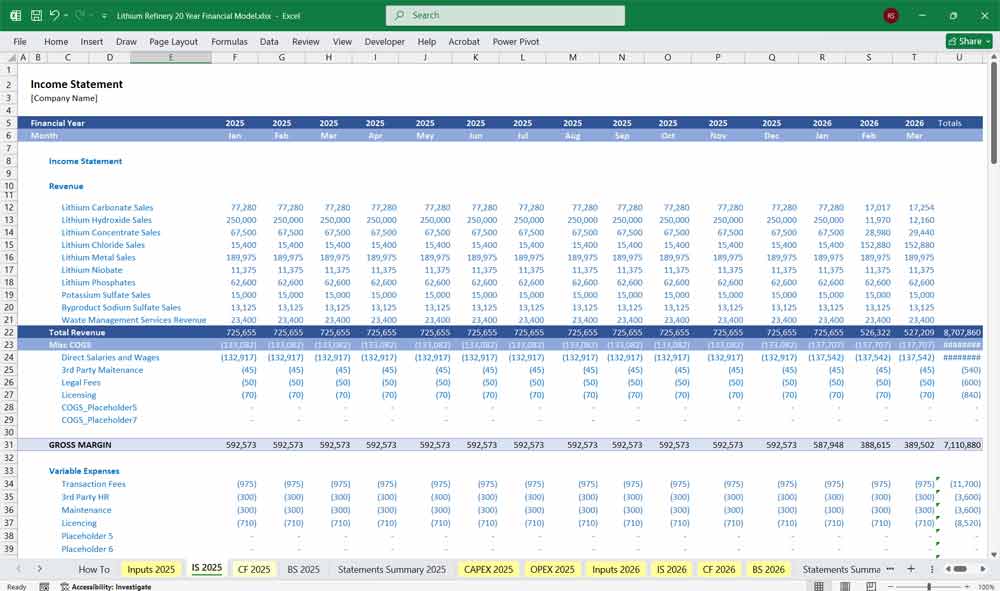

Income Statement

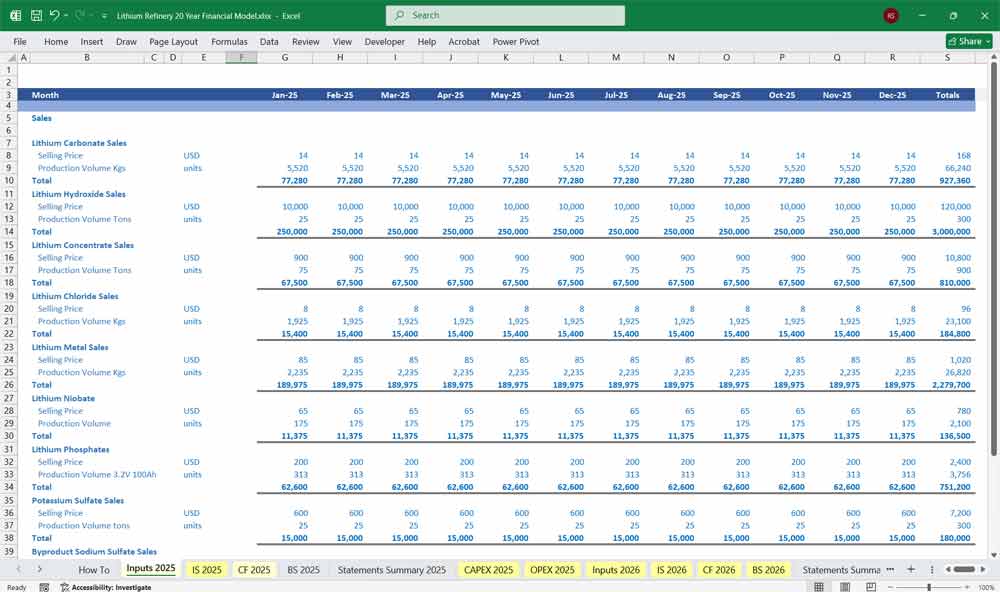

A. Revenue

Total Revenue = Σ (Unit Price × Volume) per product.

Growth Rate: 5–10% per year depending on global lithium demand.

B. Cost of Goods Sold (COGS)

Raw Material Cost (spodumene, brine)

Utilities (electricity, water, gas)

Labor (operators, technicians)

Maintenance & Consumables

Depreciation (refinery equipment)

Example:

COGS = Raw Materials + Labor + Utilities + Maintenance + Depreciation

C. Gross Profit

= Revenue – COGS

D. Operating Expenses (OPEX)

Selling, General & Admin (SG&A)

R&D (for process optimization)

Logistics (shipping to end customers)

Environmental compliance

E. EBITDA

= Gross Profit – OPEX

F. Depreciation & Amortization

Depreciation: On plant & equipment

Amortization: Licensing, patents

G. EBIT

= EBITDA – Depreciation & Amortization

H. Interest Expense

On project debt, bonds, and working capital loans

I. Taxes

Corporate Income Tax (adjusted for subsidies or tax credits)

J. Net Income

= EBIT – Interest – Taxes

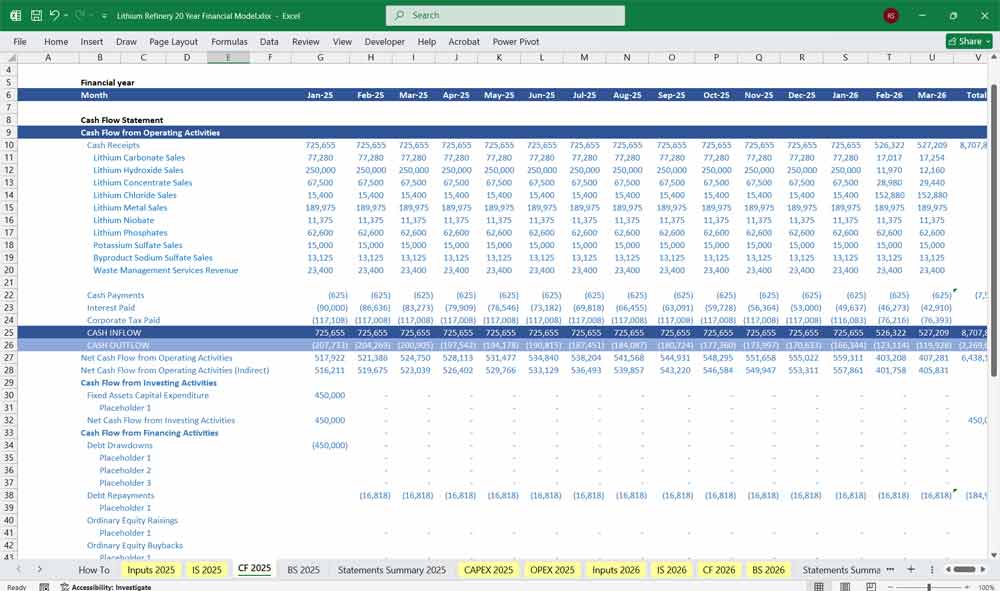

Lithum Refinery Cash Flow Statement

A. Operating Cash Flow

Starts with Net Income

Add back non-cash charges: Depreciation, Amortization

Adjust for working capital changes (Inventory, Receivables, Payables)

B. Investing Cash Flow

CapEx (new equipment, expansion lines)

Asset sales (old equipment)

Technology purchases or IP investments

C. Financing Cash Flow

Equity injections

New debt or repayments

Dividends paid

D. Net Cash Flow

Sum of A + B + C

Links to cash balance in the Balance Sheet

Lithium Refinery Balance Sheet

Assets

A. Current Assets

Cash & Cash Equivalents

Accounts Receivable (from lithium buyers)

Inventory (raw spodumene, in-process lithium, finished lithium products)

B. Non-Current Assets

PP&E: Plant, refinery equipment

Intangible Assets: Patents, licenses

Deferred Tax Assets

C. CAPEX Examples 10 Editable

Crushing And Grinding Equipment

Leaching And Solvent Extraction Tanks

Evaporation Ponds And Liners

- Precipitation And Crystallization Equipment

Liabilities

A. Current Liabilities

Accounts Payable (vendors, mining suppliers)

Short-term loans

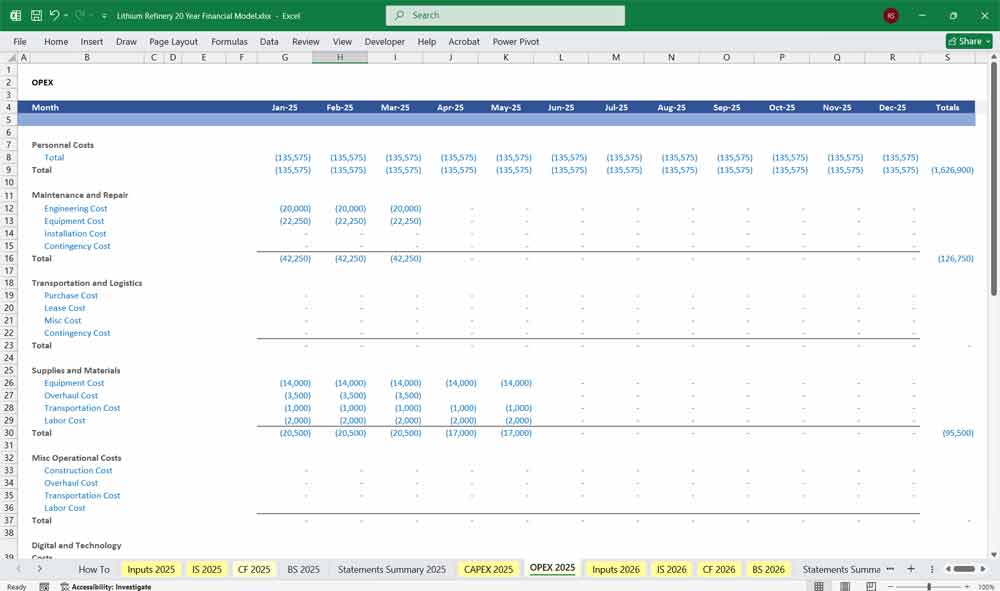

B. OPEX Examples 10 Editable

Personnel Costs

Maintenance and Repair

- Transportation and Logistics

- Supplies and Materials

C. Long-Term Liabilities

Long-term project finance loans

Environmental restoration provisions

Equity

Common Stock

Retained Earnings

Other Comprehensive Income

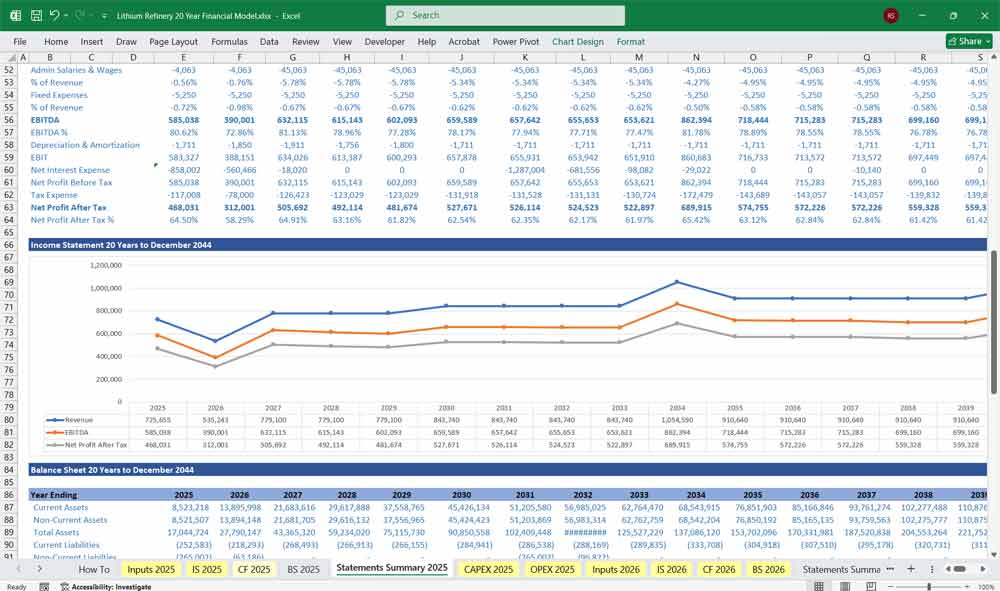

Key Financial Metrics for a Lithium Refinery

Lithium Carbonate and EV Battery Demand

Lithium carbonate is a critical component in the production of lithium-ion batteries, especially for electric vehicles (EVs). As global EV adoption accelerates due to decarbonization efforts and government incentives, the demand for battery-grade lithium carbonate continues to rise sharply. Its role in stabilizing cathode chemistry makes it a preferred material for mass-market EV battery manufacturers.

Lithium Hydroxide and Battery Cathodes

Lithium hydroxide is increasingly favored for high-nickel cathode chemistries used in next-generation lithium-ion batteries, which offer higher energy density and longer range. It is essential for NMC (nickel-manganese-cobalt) and NCA (nickel-cobalt-aluminum) cathodes. With the shift toward performance-centric EVs and stationary energy storage systems, lithium hydroxide demand is projected to outpace lithium carbonate over the next decade.

Lithium Concentrate and Upstream Intermediates

Lithium concentrate, typically in the form of spodumene, is the upstream feedstock processed into refined lithium compounds. It is mined and sold to refiners who extract lithium chemicals for downstream uses. This intermediate product is essential to the supply chain, and its availability directly impacts the global lithium refining capacity.

Lithium Chloride and Industrial Applications

Lithium chloride serves multiple roles in industrial processes, including air conditioning systems, aluminum smelting, and chemical synthesis. Its hygroscopic properties make it valuable in desiccants and specialty chemical production. While smaller in market size compared to battery-grade lithium, its industrial demand is steady and geographically diversified.

Lithium Metal and Aerospace, Special Batteries

Lithium metal is a highly reactive and energy-dense form used in solid-state batteries, defense systems, and aerospace applications. Its high performance makes it suitable for advanced battery technologies and niche sectors where weight and energy density are critical. Although production volumes are lower, it commands premium pricing and strategic interest.

Lithium Niobate and Optical Devices, Semiconductors

Lithium niobate is a specialty crystal compound used in high-frequency optical modulators, photonic devices, and semiconductor components. It enables high-speed data transmission in telecommunications and advanced computing systems. With the rise of 5G, AI, and quantum technologies, demand for lithium niobate is steadily growing in precision electronics markets.

Key Performance Metrics

Gross Margin = (Revenue – COGS) / Revenue

EBITDA Margin

Net Profit Margin

Return on Capital Employed (ROCE)

Debt-to-Equity Ratio

Cash Conversion Cycle

Scenario Analysis

Include dynamic inputs for:

Lithium price fluctuation

CAPEX scenarios

Expansion to additional refining lines (e.g., more lithium hydroxide capacity)

FX impact (export-oriented revenue vs. local costs)

ESG compliance cost assumptions

Final Notes on the Financial Model

This 20 Year Lithium Refinery Financial Model must focus on balancing capital expenditures with steady revenue growth from diversified subscription-based services. By optimizing operational costs and power efficiency and maximizing high-margin services like Lithium Carbonate and Hydroxide Sales, this model ensures sustainable profitability and cash flow stability.

Download Link On Next Page, view the full model description