Hotel Financial Model

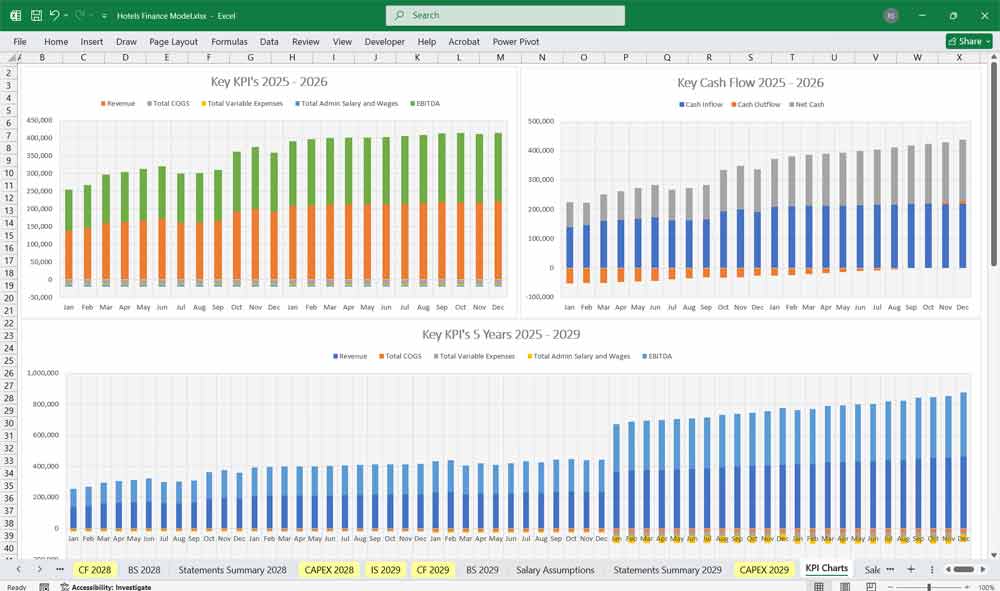

This 5-Year, 3-Statement Excel Hotel Financial Model includes revenue streams from room bookings, restaurants, bars, etc. Cost structures, and financial statements to forecast the financial health of your hotel.

Financial Model for a Hotel

Overview of the Financial Model

A hotel financial model projects the revenue, expenses, and financial position of a hotel business over a period (typically 5-10 years). It helps investors, owners, and managers make informed decisions.

The model consists of three main financial statements:

- Income Statement (Profit & Loss Statement) – Shows revenues, costs, and profitability.

- Cash Flow Statement – Tracks cash inflows and outflows.

- Balance Sheet – Displays assets, liabilities, and equity.

Revenue Streams

A. Room Bookings (Accommodation Revenue)

- Average Daily Rate (ADR) – The average revenue earned per occupied room.

- Occupancy Rate – The percentage of available rooms that are occupied.

- Revenue Per Available Room (RevPAR) – ADR × Occupancy Rate.

- Formula for Room Revenue: Room Revenue=Available Rooms×Occupancy Rate×ADR×Days in Period\text{Room Revenue} = \text{Available Rooms} \times \text{Occupancy Rate} \times \text{ADR} \times \text{Days in Period}Room Revenue=Available Rooms×Occupancy Rate×ADR×Days in Period

B. Food & Beverage Revenue

- Restaurant Revenue – Based on the number of guests, average spend per guest, and covers served.

- Bar Revenue – Estimated based on the average check size and guest volume.

- Event Catering Revenue – Revenue from in-house or off-site catering services.

C. Events & Conference Revenue

- Revenue from hosting weddings, corporate events, and meetings.

- Formula: Event Revenue=Number of Events×Average Revenue per Event\text{Event Revenue} = \text{Number of Events} \times \text{Average Revenue per Event}Event Revenue=Number of Events×Average Revenue per Event

D. Other Revenue Streams

- Spa & Wellness Services

- Parking Fees

- Laundry Services

- Commissions from Tour Bookings

- Retail Shops or Gift Stores

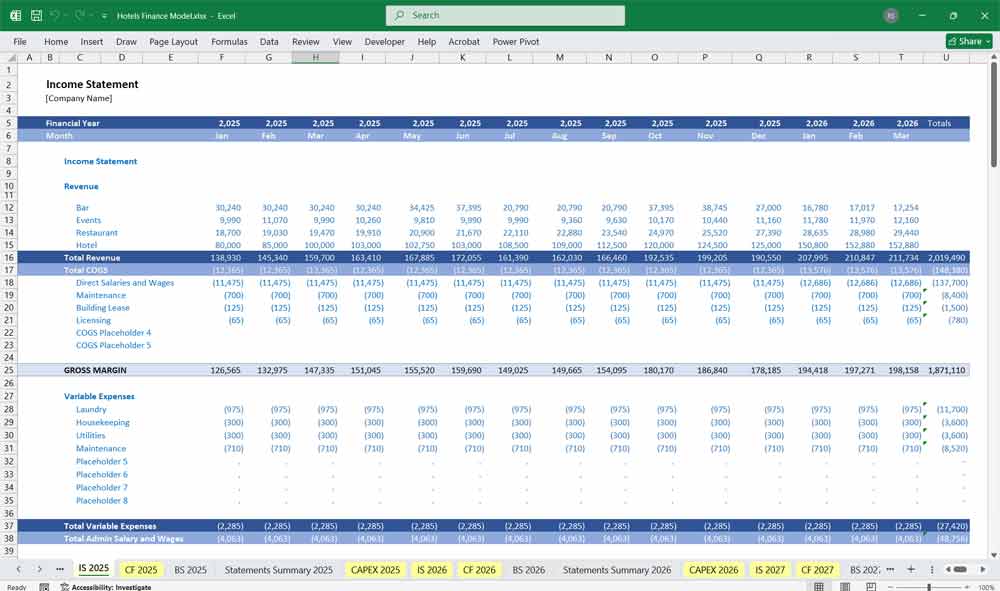

Income Statement (Profit & Loss Statement)

A. Revenue Section

- Room Revenue (Bookings)

- Food & Beverage Revenue (Restaurant, Bar, Events)

- Other Revenue (Spa, Parking, Commissions, etc.)

B. Cost of Goods Sold (COGS)

- Direct Costs for F&B – Cost of ingredients, beverages.

- Housekeeping & Room Supplies – Cleaning products, toiletries.

- Event Costs – Decorations, staff, catering costs.

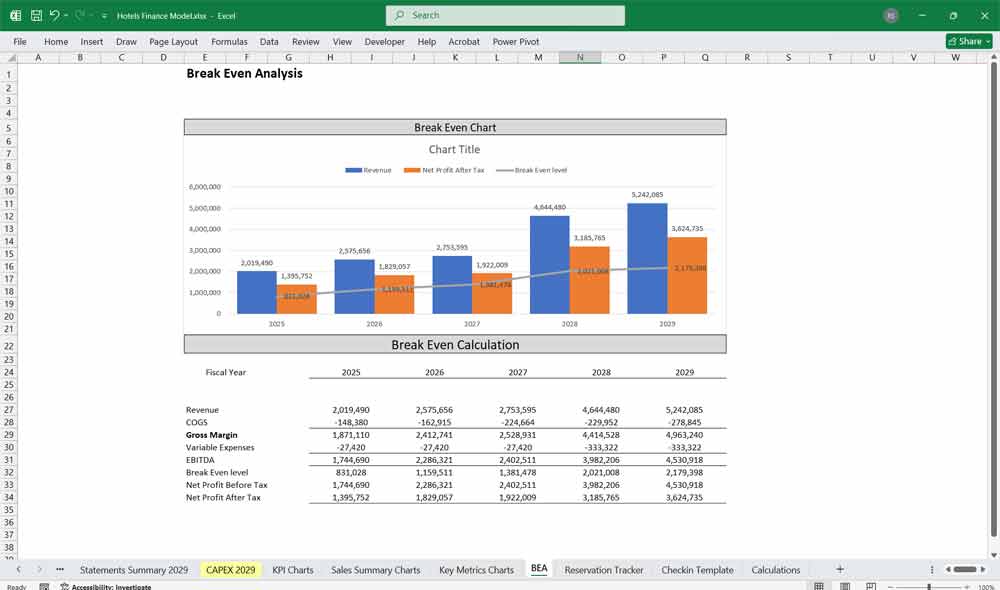

C. Gross Profit

Gross Profit=Total Revenue−COGS\text{Gross Profit} = \text{Total Revenue} – \text{COGS}Gross Profit=Total Revenue−COGS

D. Operating Expenses

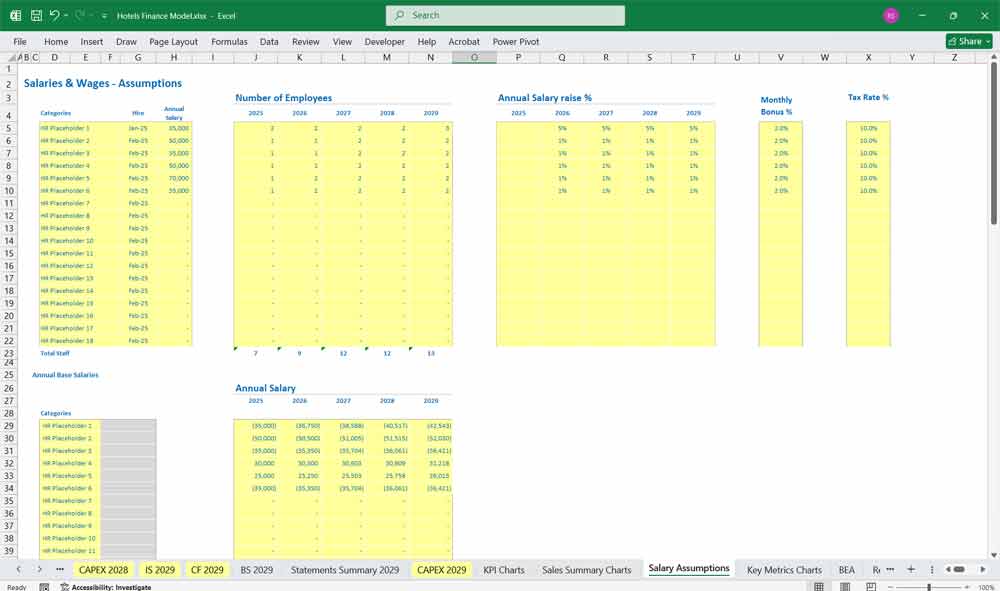

- Salaries & Wages (Staff salaries, benefits)

- Utilities (Electricity, water, internet)

- Marketing & Sales (Advertising, website management)

- Repairs & Maintenance (Building, equipment)

- Administrative Costs (Office supplies, software)

- Property Management Fees

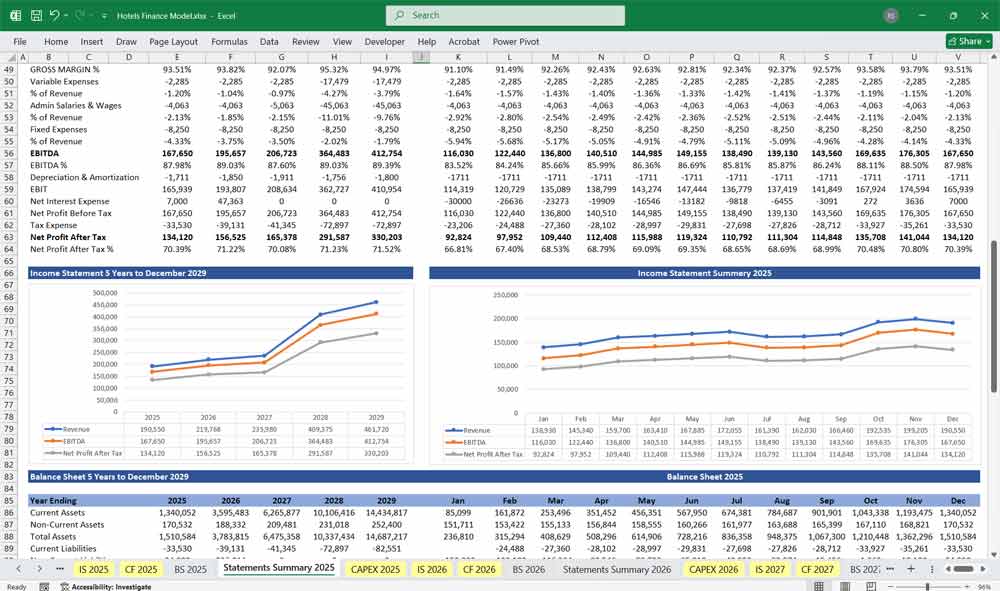

E. Earnings Before Interest, Taxes, Depreciation & Amortization (EBITDA)

EBITDA=Gross Profit−Operating Expenses\text{EBITDA} = \text{Gross Profit} – \text{Operating Expenses}EBITDA=Gross Profit−Operating Expenses

F. Depreciation & Amortization

- Depreciation of property, plant, and equipment (PPE).

- Amortization of intangible assets.

G. Interest & Taxes

- Interest on Loans – If the hotel has financed debt.

- Corporate Taxes – Taxation on profits.

H. Net Profit (Bottom Line)

Net Profit=EBITDA−Depreciation−Interest−Taxes\text{Net Profit} = \text{EBITDA} – \text{Depreciation} – \text{Interest} – \text{Taxes}Net Profit=EBITDA−Depreciation−Interest−Taxes

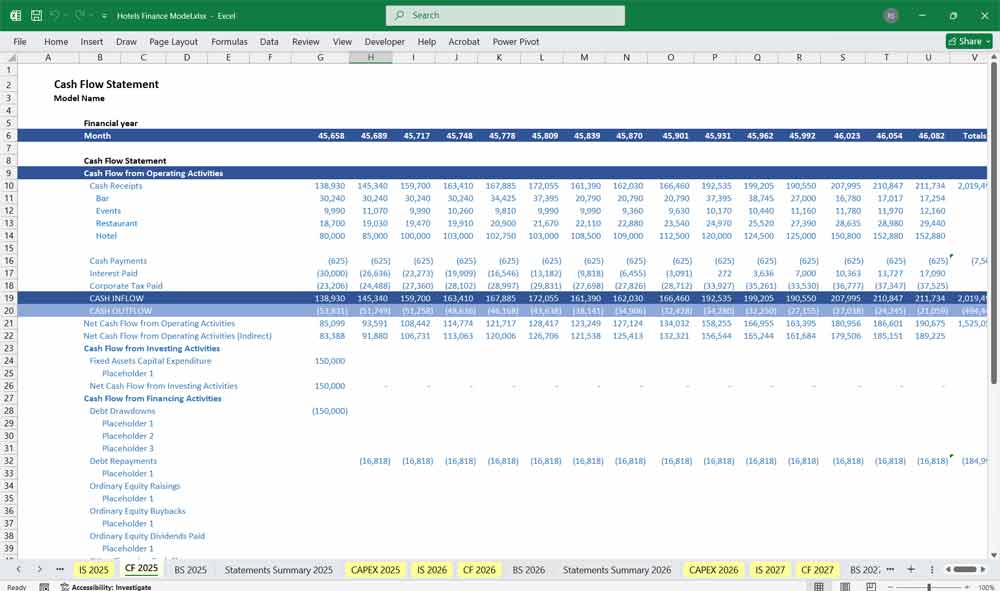

Hotel Cash Flow Statement

The cash flow statement tracks cash movements from operations, investing, and financing.

A. Operating Cash Flow

- Cash Inflows: Revenue from room bookings, F&B sales, and events.

- Cash Outflows: Employee wages, supplier payments, utilities.

Formula:

Net Operating Cash Flow=Net Profit+Depreciation−Changes in Working Capital {Net Operating Cash Flow} = {Net Profit} + \{Depreciation} – {Changes in Working Capital}Net Operating Cash Flow=Net Profit+Depreciation−Changes in Working Capital

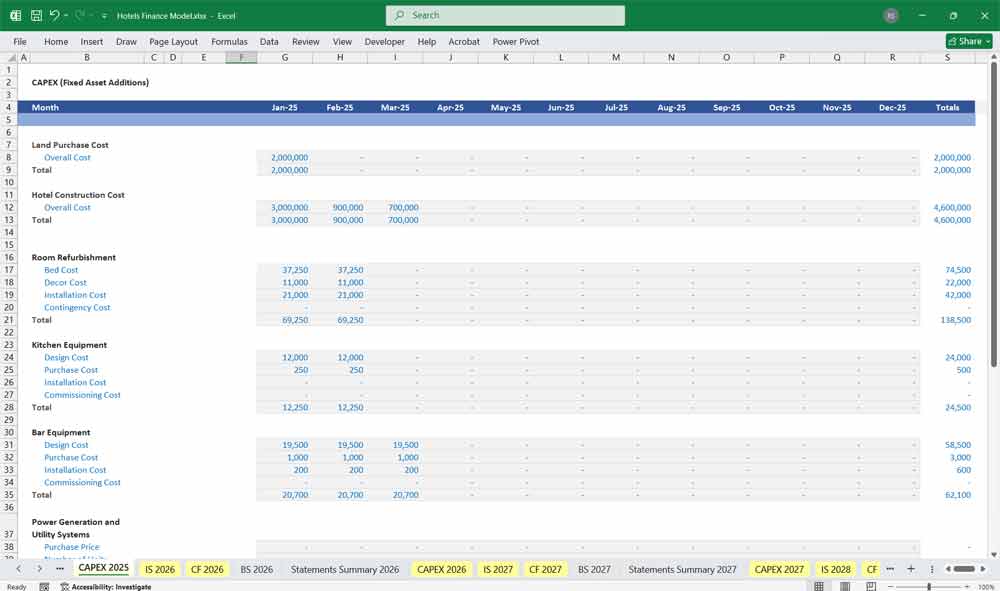

B. Investing Cash Flow

- Cash Outflows: Property purchases, renovations, new equipment.

- Cash Inflows: Asset sales.

C. Financing Cash Flow

- Cash Inflows: Loans, equity investments.

- Cash Outflows: Loan repayments, dividend payments.

Formula:

Net Cash Flow=Operating Cash Flow+Investing Cash Flow+Financing Cash Flow {Net Cash Flow} = {Operating Cash Flow} + {Investing Cash Flow} + {Financing Cash Flow}Net Cash Flow=Operating Cash Flow+Investing Cash Flow+Financing Cash Flow

Hotel Balance Sheet

A. Assets

- Current Assets

- Cash & Bank Balances

- Accounts Receivable (Outstanding customer payments)

- Inventory (Food, beverages, housekeeping supplies)

- Non-Current Assets

- Property, Plant & Equipment (Hotel building, furniture, vehicles)

- Intangible Assets (Brand name, goodwill)

B. Liabilities

- Current Liabilities

- Accounts Payable (Hotel Suppliers, vendors)

- Short-Term Debt (Due within a year)

- Accrued Expenses (Unpaid salaries, utilities)

- Long-Term Liabilities

- Long-Term Loans (Mortgages, business loans)

C. Equity

- Owner’s Equity (Initial investments)

- Retained Earnings (Profits reinvested in the business)

Formula:

Total Assets=Total Liabilities+Owner’s Equity {Total Assets} = {Total Liabilities} + {Owner’s Equity} Total Assets = Total Liabilities+Owner’s Equity

Hotel Advertising Additional Expenses

Add Revenue Costs

- Banner Ads (CPM Model)

- Interstitial Ads

- Social Media Video Ads

- Affiliate Marketing

- Sponsored Content

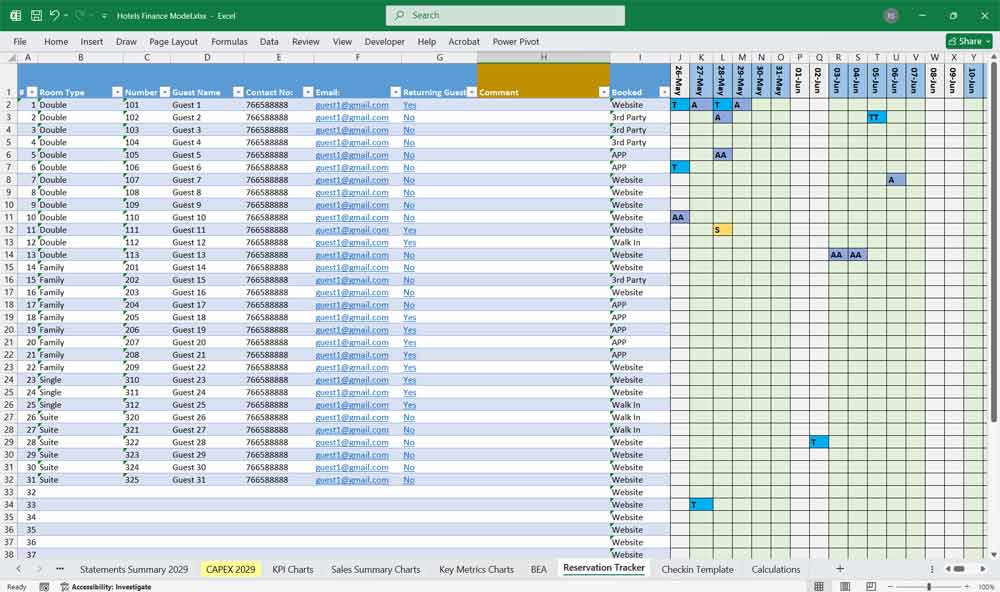

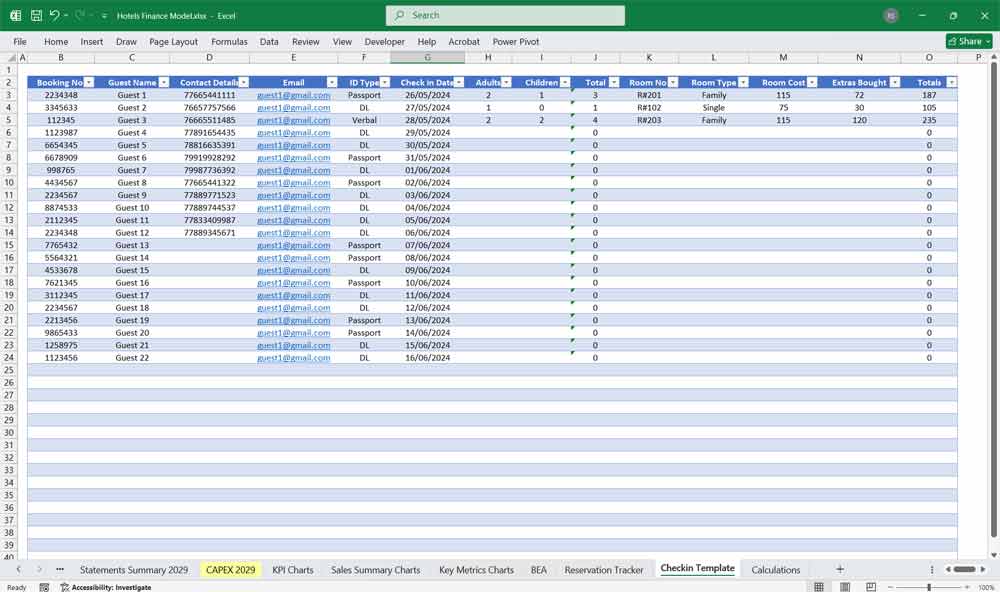

Integration with Hotel Reservation Tracker and Check-in Template

This financial model integrates a reservation tracker and check-in template, crucial tools for managing hotel operations. The reservation tracker is linked to revenue forecasts, providing detailed projections based on expected occupancy rates, average daily rates (ADR), and revenue per available room (RevPAR). It allows the hotel to model revenue fluctuations based on seasonality, booking lead times, and anticipated cancellations or no-shows.

The check-in template is designed to streamline the guest arrival process, tracking check-in times, room assignments, and special requests. This template helps optimize the allocation of staff and resources, ensuring an efficient check-in process that enhances guest satisfaction. The financial impact of these operational aspects, such as labor costs associated with check-ins or revenue from upselling during check-in, is captured in the model, ensuring accurate reflection in the Income Statement and Cash Flow Statement.

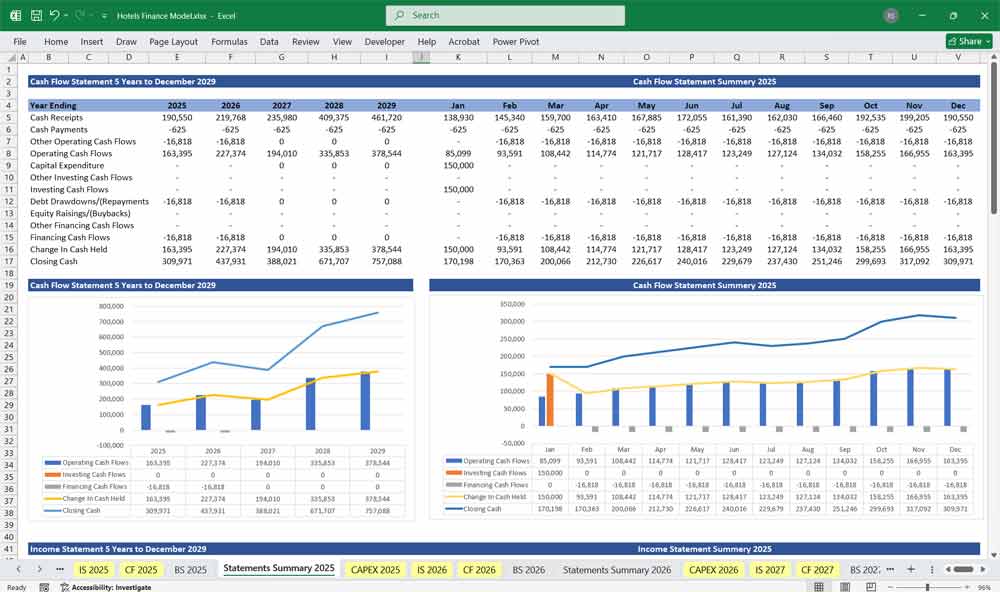

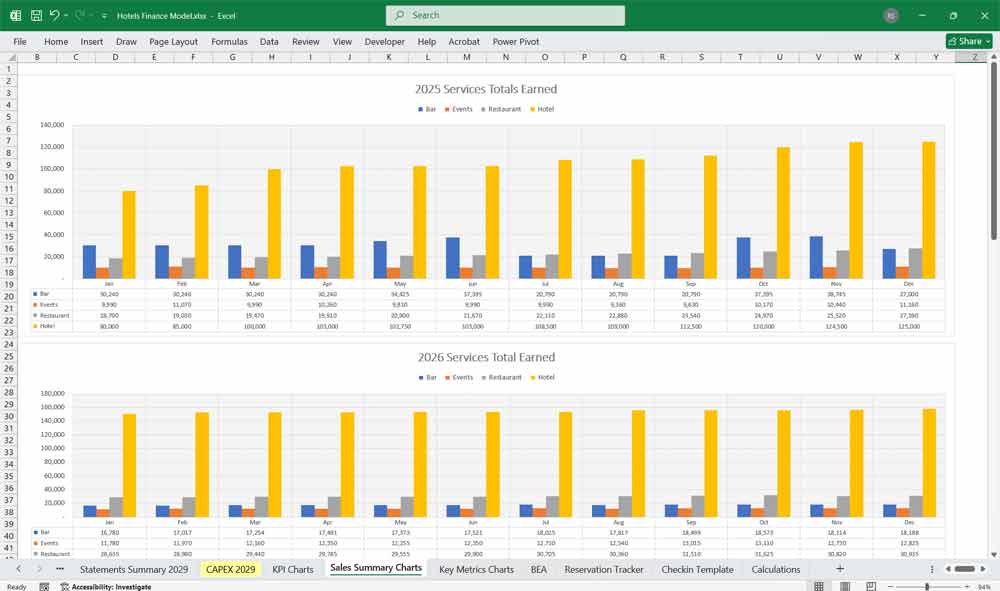

5-Year Hotel Roadmap

A 5-year financial model provides a crucial strategic roadmap for hotel owners and operators. It moves beyond short-term budgeting to forecast revenue streams from rooms, food and beverage, and events, while simultaneously projecting major expenses. This long-view analysis is indispensable for setting realistic performance targets, guiding operational decisions, and aligning the entire management team around a unified financial vision for the future.

View 5 Years Of Hotel Financial Investment

Furthermore, this model is an essential tool for securing investment and managing capital. Whether seeking funding for a new build, a major renovation, or new amenities, a robust 5-year projection demonstrates the property’s potential for profitability and return on investment to banks and investors. It also allows management to strategically plan for significant capital expenditures (CapEx), such as room refurbishments or system upgrades, by forecasting the necessary cash flow.

View Emerging Hotel Financial Opportunities

Ultimately, the greatest benefit is enhanced resilience and proactive management. By modeling various scenarios—such as economic downturns, shifts in travel demand, or increased competition—management can stress-test the business and develop contingency plans. This transforms the financial model from a static document into a dynamic tool for navigating uncertainty, identifying potential risks early, and capitalizing on emerging opportunities to ensure long-term stability and growth.

Overall view Of Financial Model

This Hotel financial model provides a robust framework for understanding and forecasting the hotel’s financial performance. It integrates operational data from the reservation tracker and check-in template, offering valuable insights into how these activities drive revenue and affect costs, ultimately supporting better strategic decisions and financial planning.

Download Link On Next Page