Genetics Company Financial Model

20-Year Financial Model for a Genetics Company

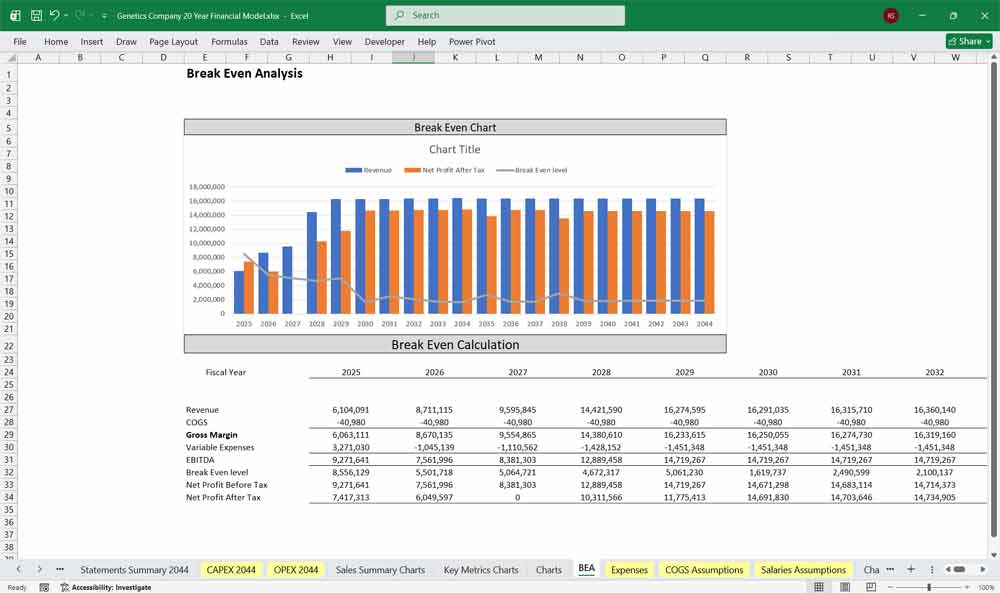

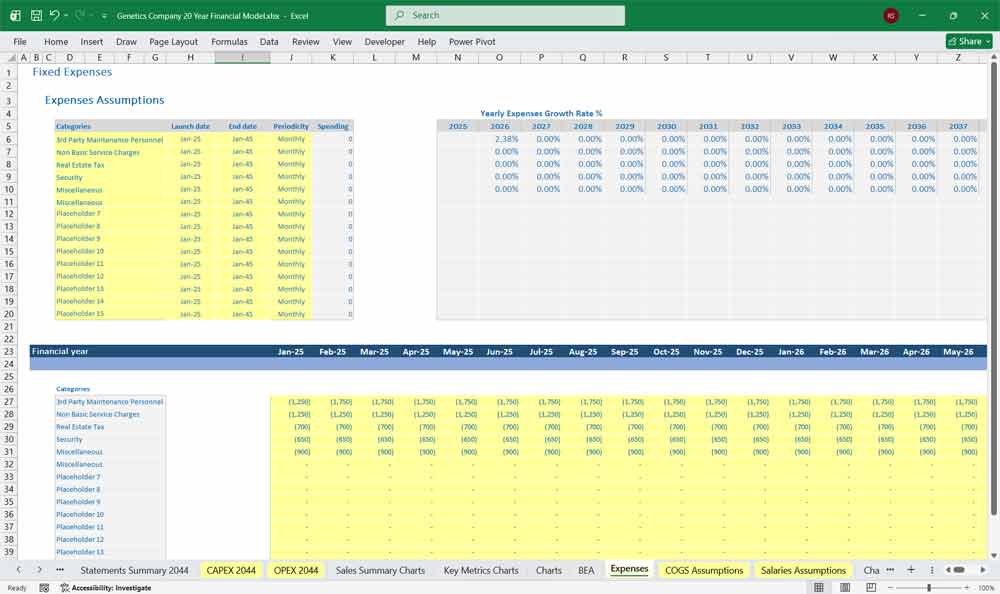

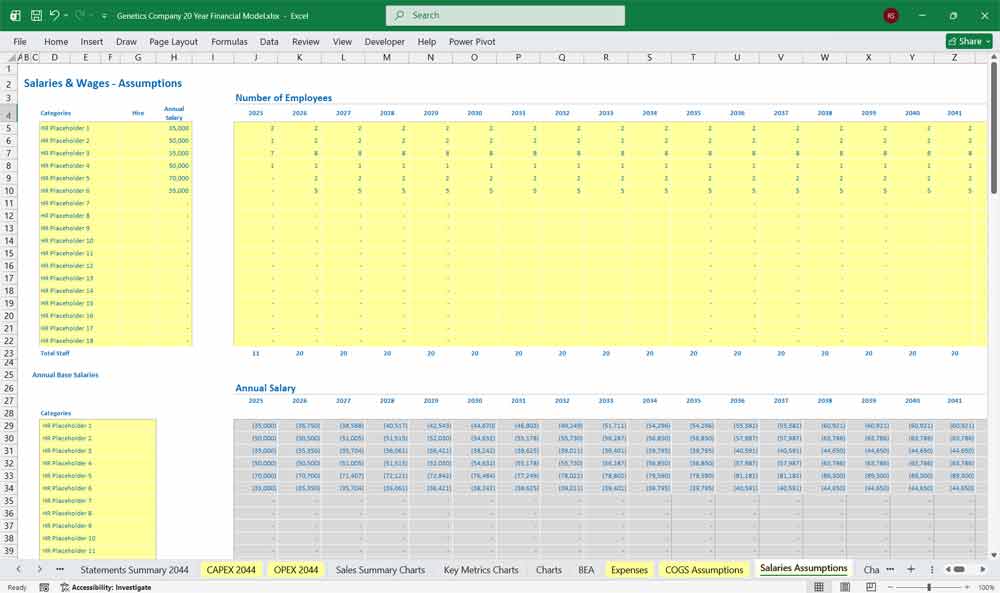

This very extensive 20 Year Genetics (Genomics) Model involves detailed revenue projections, cost structures, capital expenditures, and financing needs. This model provides a thorough understanding of the financial viability, profitability, and cash flow position of your manufacturing company. Includes: 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets.

Genetics Company Business Context

The company operates as an integrated genetics and genomics platform, combining biological research, data generation, advanced analytics, and commercial deployment across healthcare, agriculture, and environmental sectors. Its core asset is a growing proprietary genetic database supported by computational infrastructure and scientific expertise.

The financial model reflects:

Multiple revenue streams at different stages of maturity

High upfront R&D and infrastructure costs

Strong operating leverage as data assets scale

A transition from research-driven losses to data-driven profitability

Editable Revenue Model Inputs

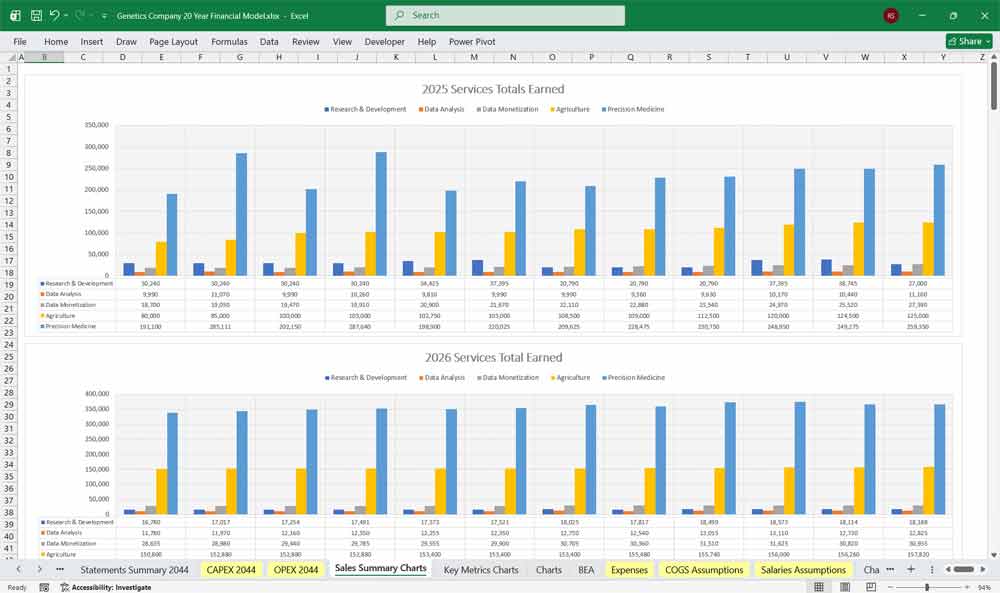

Revenues are broken down by application area rather than customer type, enabling clearer unit economics and strategic forecasting.

A. Research & Development Revenue

Nature: Contract-based and grant-supported

Customers: Universities, biotech companies, governments, NGOs

Revenue Sources

Sponsored research agreements

Grant funding (governmental & philanthropic)

Joint development programs with pharma or agribusiness

Milestone-based research payments

Financial Characteristics

Moderate margins (30–50%)

Predictable but project-based

Often cost-reimbursable (reduces downside risk)

Supports core scientific capabilities

Forecast Drivers

Number of active research contracts

Average contract value

Grant success rate

Research staff utilization rate

Data Analysis Revenue

Nature: Fee-for-service and platform-based analytics

Customers: Pharma, biotech, agribusiness, insurers, research institutions

Revenue Sources

Genomic sequencing analysis

Bioinformatics services

AI-driven genetic insights

Subscription access to analytics platforms

Financial Characteristics

Higher margins (60–75%)

Semi-recurring revenue

Scalable with compute optimization

Strong cross-sell potential

Forecast Drivers

Number of clients

Price per analysis

Subscription retention rate

Average data volume per customer

Data Monetization Revenue

Nature: Licensing and royalties

Customers: Pharmaceutical, biotech, AI/ML companies

Revenue Sources

Licensing anonymized genomic datasets

Licensing trained genetic AI models

Royalty streams from drug discovery outcomes

API access to proprietary genetic databases

Financial Characteristics

Very high margins (80–95%)

Low marginal cost

Long-tailed royalty income

Highly sensitive to regulatory constraints

Forecast Drivers

Size and quality of proprietary dataset

Number of licensing partners

Upfront license fees

Royalty rates and downstream drug success

Agriculture Revenue

Nature: Commercial product & licensing

Customers: Seed companies, farmers, agri-biotech firms

Revenue Sources

Genetically optimized crop traits

Livestock genetic testing

Yield optimization services

Licensing of plant and animal IP

Financial Characteristics

Medium-to-high margins (50–70%)

Seasonality driven

Long development cycles

Strong IP protection benefits

Forecast Drivers

Adoption rate of genetic solutions

Acreage or livestock volume covered

Pricing per genetic trait

Regulatory approval timelines

Environmental & Conservation Revenue

Nature: Government and impact-driven contracts

Customers: Governments, NGOs, conservation groups

Revenue Sources

Biodiversity monitoring services

Environmental DNA (eDNA) testing

Climate resilience genetics services

Conservation genetics projects

Financial Characteristics

Lower margins (25–45%)

Grant-heavy and mission-aligned

Enhances brand and data endpoints

Often subsidized

Forecast Drivers

Contract wins

Public funding availability

Number of monitored ecosystems

Testing frequency

Precision Medicine Revenue

Nature: Clinical and diagnostic revenue

Customers: Hospitals, insurers, patients, pharma

Revenue Sources

Genetic diagnostics

Personalized treatment recommendations

Companion diagnostics for pharma

Population genomics programs

Financial Characteristics

High margins (65–85%)

Regulated and compliance-heavy

Recurring testing revenue

Strong long-term growth potential

Forecast Drivers

Number of tests performed

Reimbursement rates

Clinical adoption rate

Regulatory approvals

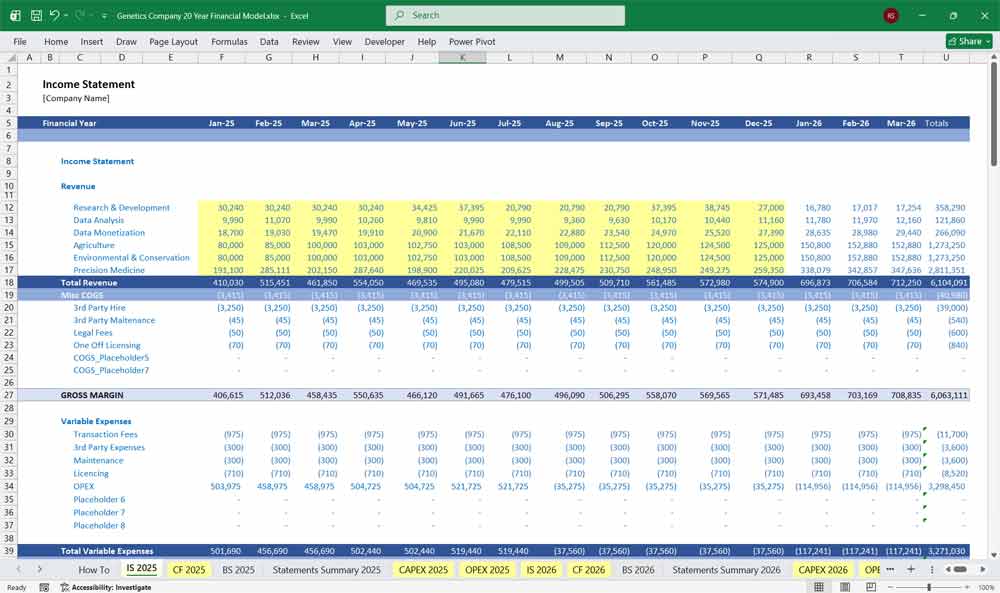

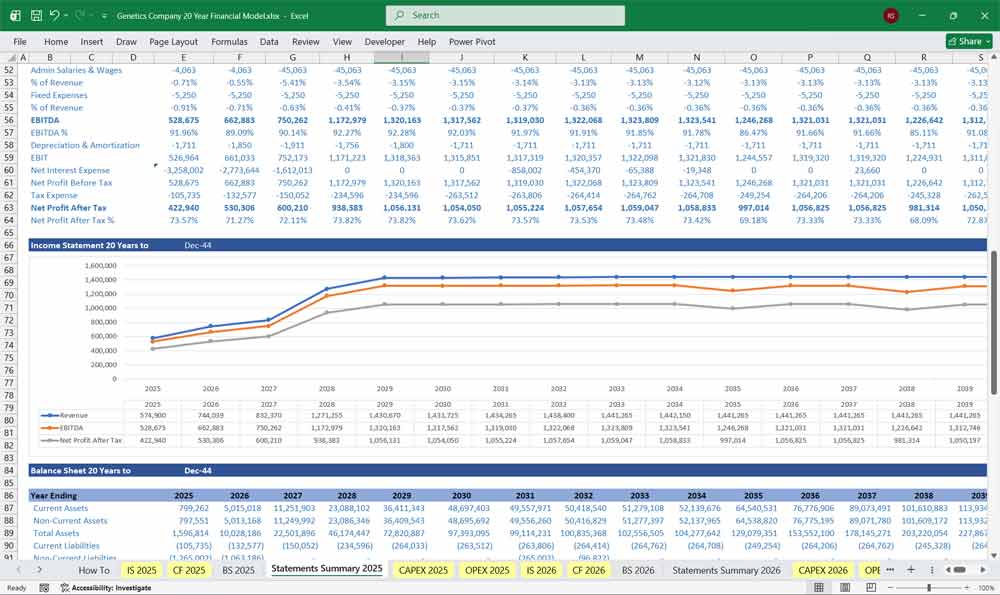

Income Statement Structure

Revenue

Research & Development

Data Analysis

Data Monetization

Agriculture

Environmental & Conservation

Precision Medicine

Total Revenue

Cost of Goods Sold (COGS)

Lab consumables

Sequencing costs

Cloud compute (variable portion)

Data storage tied to customer usage

Clinical testing materials

Gross Margin: Improves over time as data reuse increases.

Operating Expenses

Research & Development

Scientists and researchers

Lab operations

Clinical trials

Algorithm development

IP generation

Sales & Marketing

Enterprise sales teams

Partner development

Conferences and industry outreach

Customer success

General & Administrative

Executive leadership

Legal & regulatory compliance

Finance and HR

IT overhead

EBITDA

Initially negative due to R&D intensity

Turns positive as data monetization scales

Depreciation & Amortization

Sequencing equipment

Lab infrastructure

Capitalized software

Acquired IP

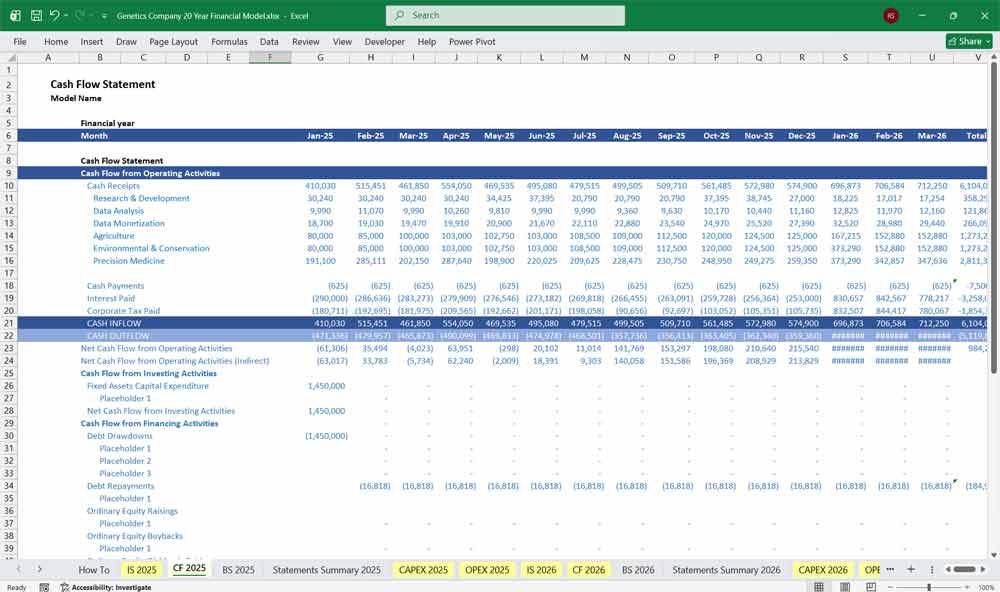

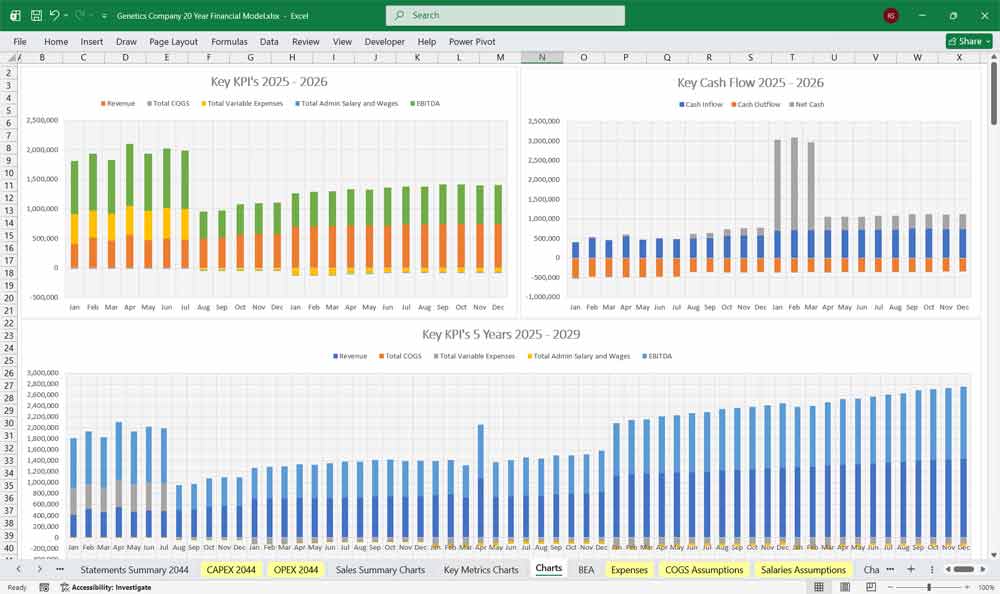

Genetics Company Cash Flow Statement

Operating Cash Flow

Net income

Add back non-cash expenses:

Depreciation & amortization

Stock-based compensation

Changes in working capital:

Accounts receivable

Deferred revenue (subscriptions & licenses)

Accrued research liabilities

Investing Cash Flow

Capital expenditures:

Sequencing machines

Laboratory build-outs

Data center investments

IP acquisitions

Strategic equity investments

Financing Cash Flow

Equity raises

Debt issuance or repayment

Government grants

Licensing advance payments

Share-based compensation tax effects

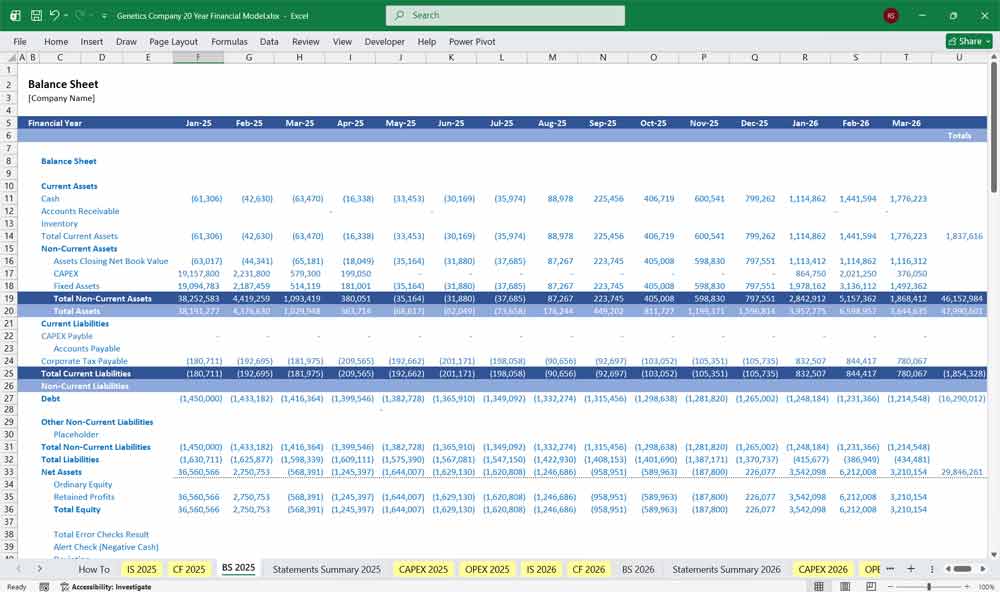

Genetics Company Balance Sheet Structure

Assets

Current Assets

Cash & equivalents

Accounts receivable

Grant receivables

Prepaid lab supplies

Non-Current Assets

Property, plant & equipment

Capitalized software & algorithms

Proprietary datasets (intangible)

Patents and licenses

Long-term investments

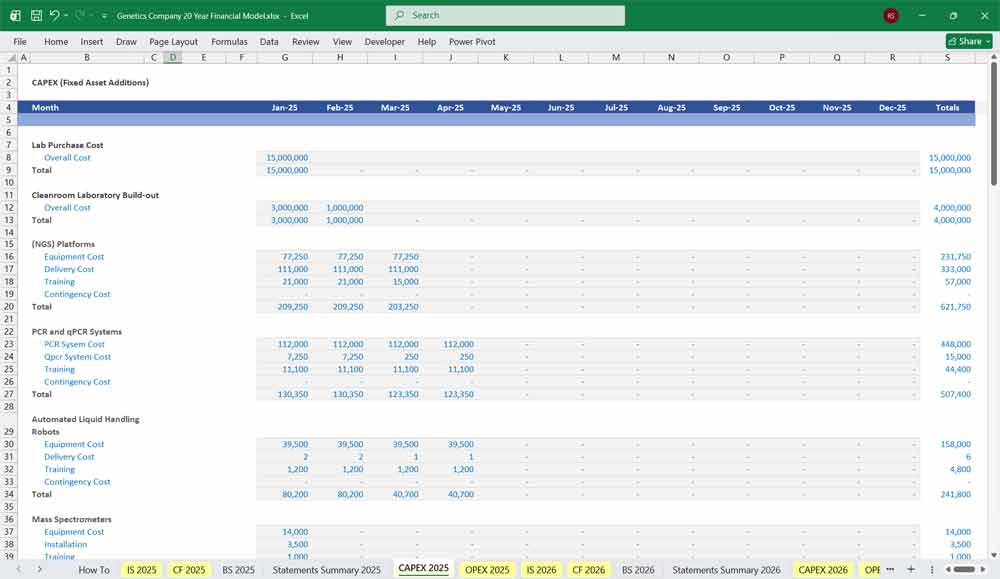

CAPEX (Fixed Asset Additions)

Cleanroom Laboratory Build-out

(NGS) Platforms

PCR and qPCR Systems

Patents and licenses

Biorepository Sample Storage Systems

- (HPC) Clusters

- Laboratory Information Management System (LIMS) Software

Liabilities

Current Liabilities

Accounts payable

Accrued lab and research expenses

Deferred revenue (subscriptions, licenses)

Short-term debt

Long-Term Liabilities

Long-term debt

Lease obligations

Deferred tax liabilities

Equity

Common stock

Additional paid-in capital

Retained earnings (or accumulated deficit)

Stock-based compensation reserves

Key Modeling Assumptions & Metrics For A Genetics (Genomics) Company

Core KPIs

Revenue per genome

Dataset growth rate

Gross margin by segment

R&D efficiency ratio

Cash burn multiple

Licensing revenue as % of total revenue

Strategic Inflection Points

Dataset critical mass

Regulatory approvals

Transition from services → platform

Shift from grant-funded → commercial revenue

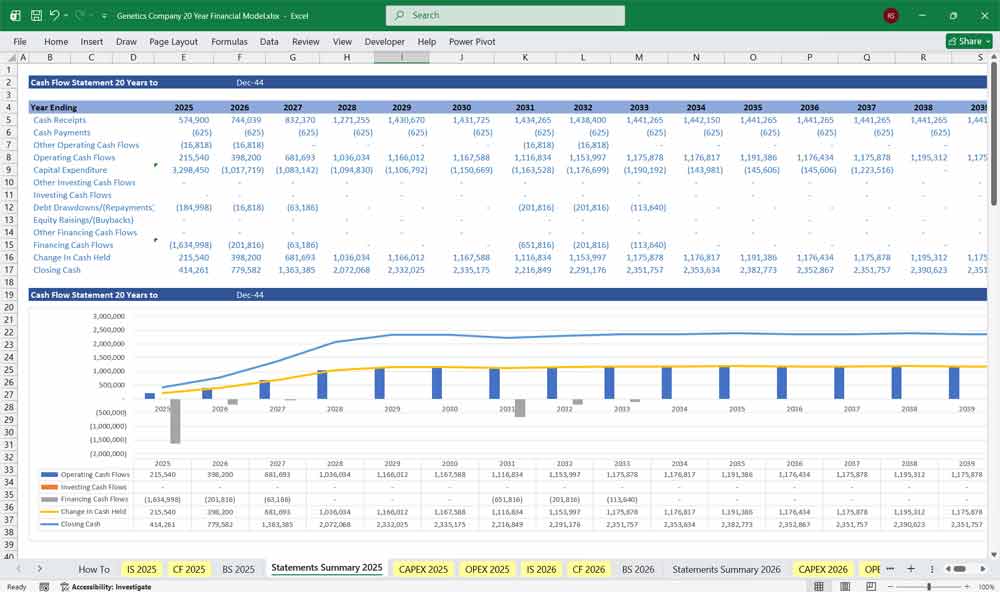

Benefits Of A 20 Year Model For A Genetics (Genomics) Company

A 20-year financial model is especially valuable for a genetics company because the industry’s core value drivers—biological discovery, dataset accumulation, and intellectual property development—unfold over long time horizons. Major investments in research infrastructure, large-scale data generation, and regulatory approvals often take a decade or more to fully mature. A long-term model allows stakeholders to realistically capture the delayed inflection points where early-stage research and analytics investments translate into high-margin licensing, precision medicine applications, and scalable commercial deployment. This perspective prevents underestimating future value that is not visible in short 3–5 year forecasts.

Long Term Strategic Planning For Your Genetics (Genomics) Company

Additionally, a 20-year model enables strategic planning across multiple sectors with different adoption and revenue cycles, such as healthcare, agriculture, and environmental applications. It helps leadership stress-test regulatory changes, technological breakthroughs, and data monetization scenarios while aligning capital allocation with long-term platform growth rather than short-term earnings volatility. By mapping how biological assets and data compound over time, the model supports more informed decisions on partnerships, IP strategy, and sustainable funding—critical for a multidisciplinary genetics company building enduring scientific and commercial impact.

Final Notes on the Financial Model

This 20 Year Genetics Company Financial Model captures the hybrid nature of a genetics company—part research institution, part data company, and part IP-driven commercial enterprise. Early-stage losses are driven by intentional investment in data and science, while long-term value emerges through scalable data monetization, precision medicine, and licensed genetic intellectual property.

Download Link On Next Page