Fintech as a Service Financial Model

This Fintech as a Service (FaaS) 20 Year Finance Model in Excel is a comprehensive financial planning tool designed to help FaaS companies, investors, and financial analysts evaluate the financial feasibility and profitability of your FaaS company.

Financial model for a Fintech as a Service (FaaS) company

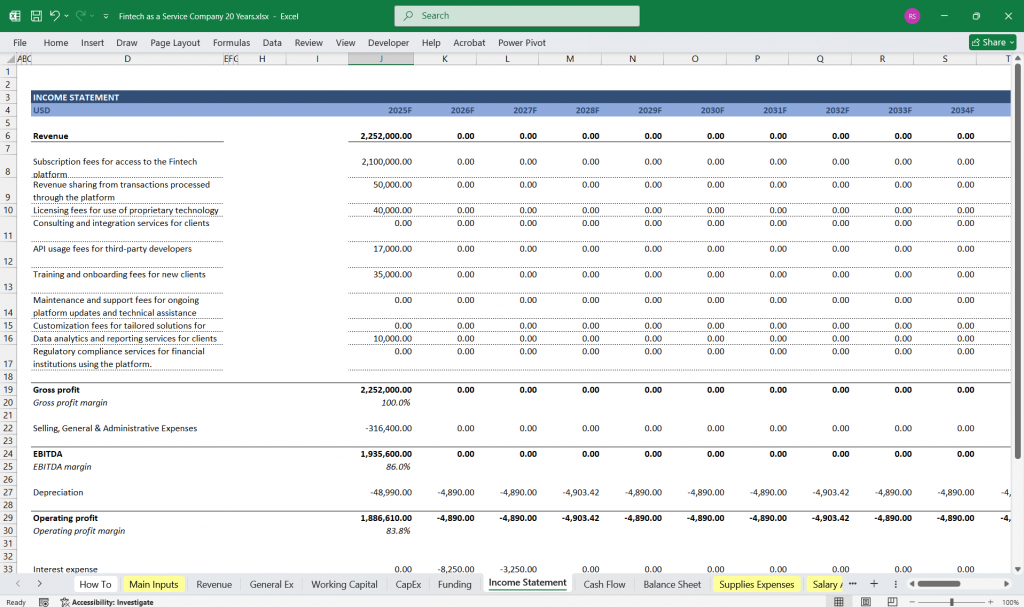

Income Statement

The Income Statement (or Profit and Loss Statement) reflects the company’s revenues, expenses, and profitability over a specific period.

Key Components:

Revenue Streams:

Subscription Revenue: Recurring revenue from customers paying for access to the FaaS platform (e.g., monthly or annual fees).

Transaction Fees: Revenue from processing transactions (e.g., payment processing, lending, or other financial services).

API Usage Fees: Revenue from third-party developers or businesses using the company’s APIs.

Professional Services: Revenue from consulting, implementation, or customization services.

Other Revenue: Any additional revenue streams (e.g., licensing, partnerships).

Cost of Goods Sold (COGS):

Infrastructure Costs: Cloud hosting, server maintenance, and other tech-related expenses.

Transaction Costs: Fees paid to payment processors, banks, or other intermediaries.

Support Costs: Customer support and onboarding expenses.

Gross Profit:

Gross Profit = Total Revenue – COGS

Gross Margin (%) = (Gross Profit / Total Revenue) * 100

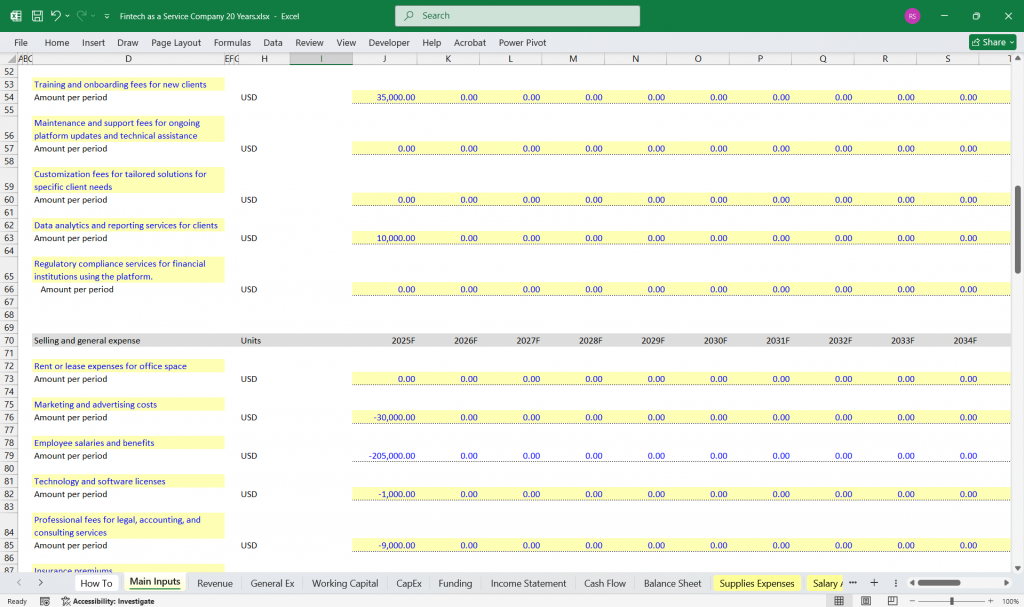

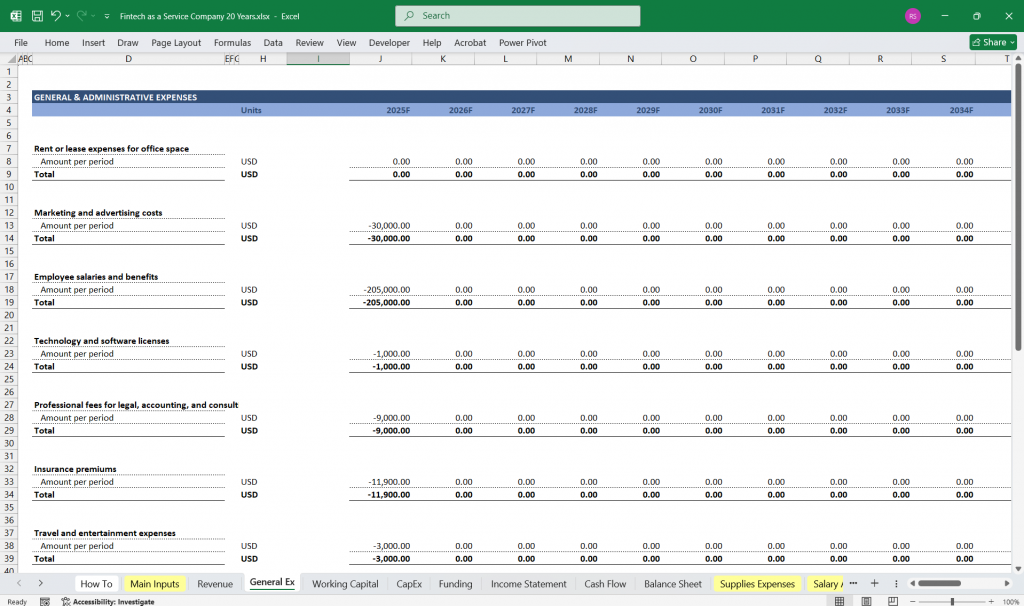

Operating Expenses:

Research & Development (R&D): Costs related to platform development, innovation, and feature enhancements.

Sales & Marketing: Costs for customer acquisition, advertising, and partnerships.

General & Administrative (G&A): Overhead costs such as salaries, office expenses, and legal fees.

Operating Income:

Operating Income = Gross Profit – Operating Expenses

Non-Operating Items:

Interest Income/Expense: Income from investments or interest paid on debt.

Other Income/Expenses: One-time items or non-core business activities.

Net Income:

Net Income = Operating Income + Non-Operating Items – Taxes

Net Profit Margin (%) = (Net Income / Total Revenue) * 100

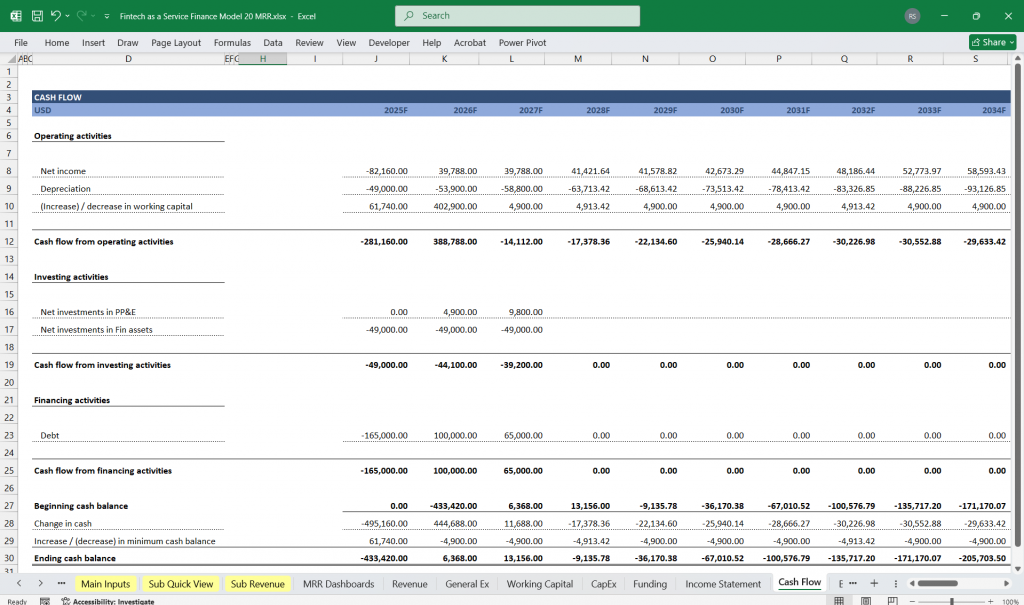

FaaS Cash Flow Statement

The Cash Flow Statement tracks the company’s cash inflows and outflows, divided into operating, investing, and financing activities.

Key Components:

Cash Flow from Operating Activities:

Net Income: Starting point, adjusted for non-cash items.

Adjustments for Non-Cash Items:

Depreciation & Amortization

Stock-Based Compensation

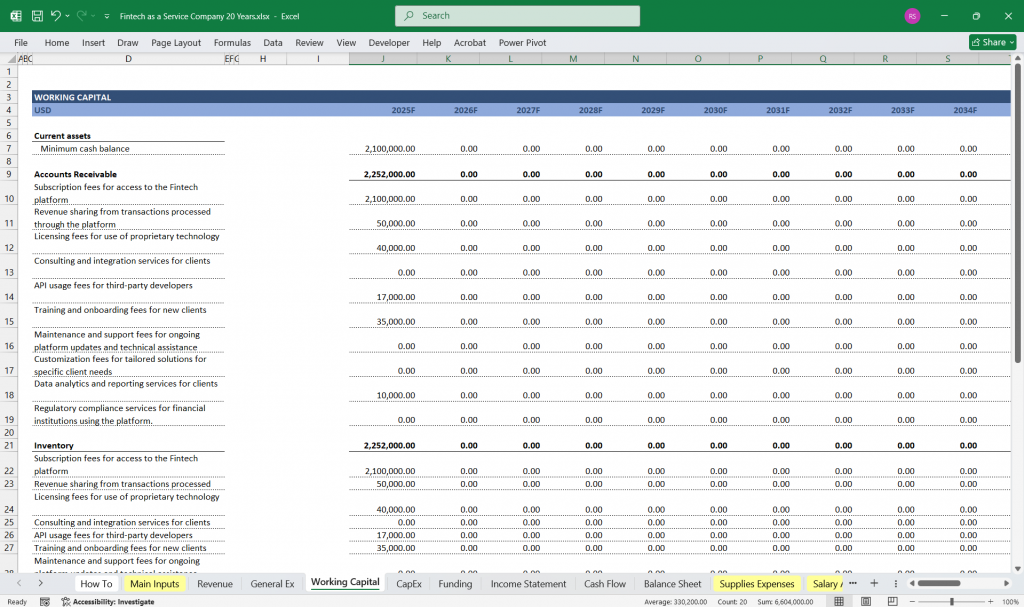

Changes in Working Capital:

Accounts Receivable (collections from customers)

Accounts Payable (payments to suppliers)

Accrued Expenses

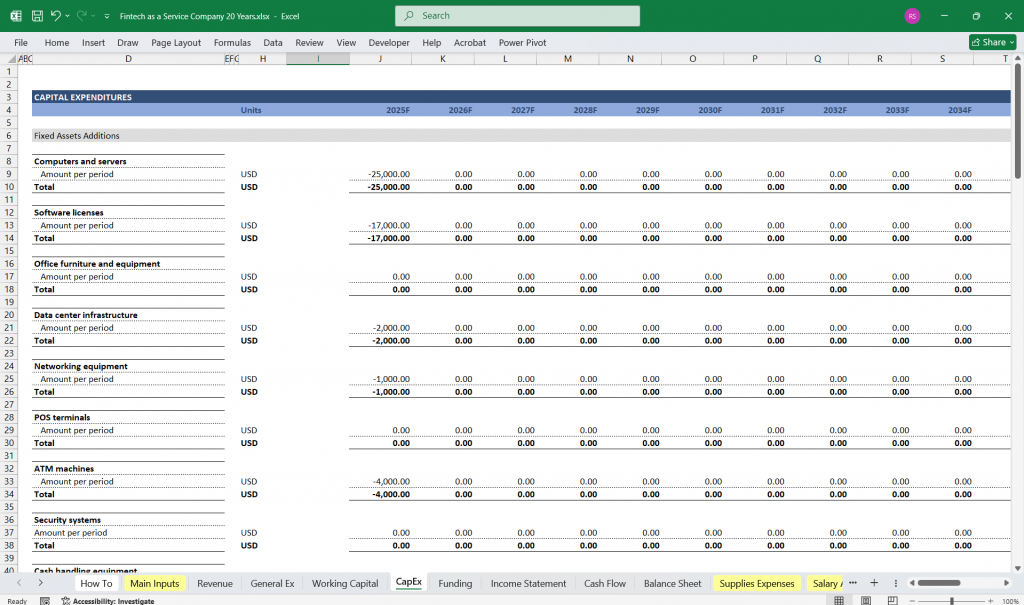

Cash Flow from Investing Activities:

Capital Expenditures (CapEx): Investments in technology, infrastructure, or equipment.

Acquisitions: Cash used to acquire other businesses or technologies.

Investments in Marketable Securities: Short-term or long-term investments.

Cash Flow from Financing Activities:

Debt Issuance/Repayment: Proceeds from loans or repayment of principal.

Equity Issuance: Proceeds from issuing shares (e.g., venture capital or IPO).

Dividends: Cash paid to shareholders (if applicable).

Net Change in Cash:

Net Change in Cash = Cash from Operations + Cash from Investing + Cash from Financing

Ending Cash Balance:

Ending Cash Balance = Beginning Cash Balance + Net Change in Cash

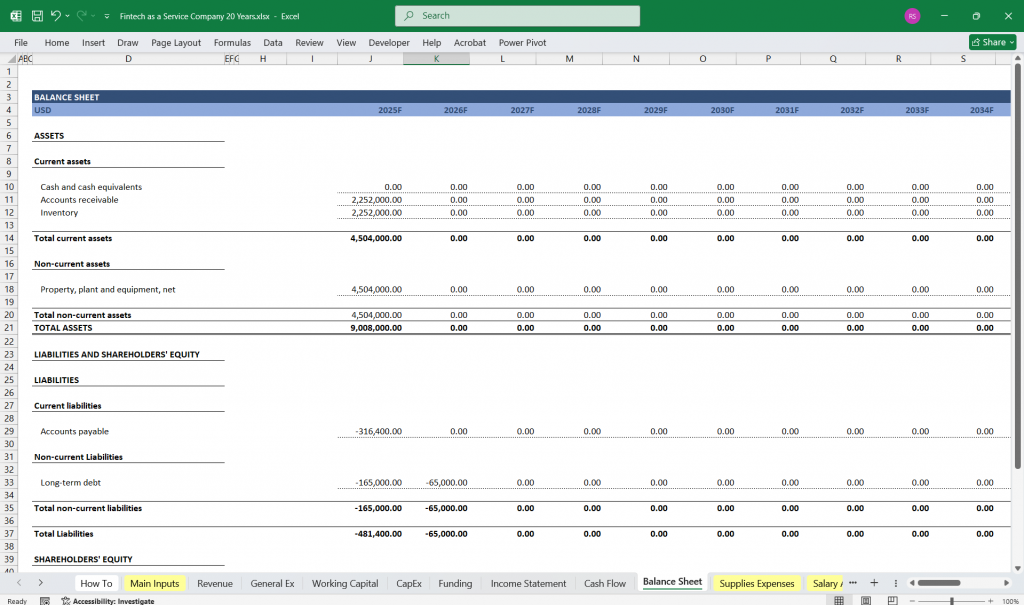

Fintech as a Service Balance Sheet

The Balance Sheet provides a snapshot of the company’s financial position at a specific point in time, showing assets, liabilities, and equity.

Key Components:

Assets:

Current Assets:

Cash & Cash Equivalents

Accounts Receivable (outstanding payments from customers)

Prepaid Expenses

Non-Current Assets:

Property, Plant & Equipment (PP&E)

Intangible Assets (e.g., patents, software)

Long-Term Investments

Liabilities:

Current Liabilities:

Accounts Payable (outstanding payments to suppliers)

Accrued Expenses (e.g., wages, taxes)

Short-Term Debt

Non-Current Liabilities:

Long-Term Debt

Deferred Revenue (e.g., prepaid subscriptions)

Equity:

Common Stock: Equity issued to shareholders.

Retained Earnings: Cumulative net income retained in the business.

Additional Paid-In Capital (APIC): Excess capital from equity issuance.

Balance Sheet Equation:

Assets = Liabilities + Equity

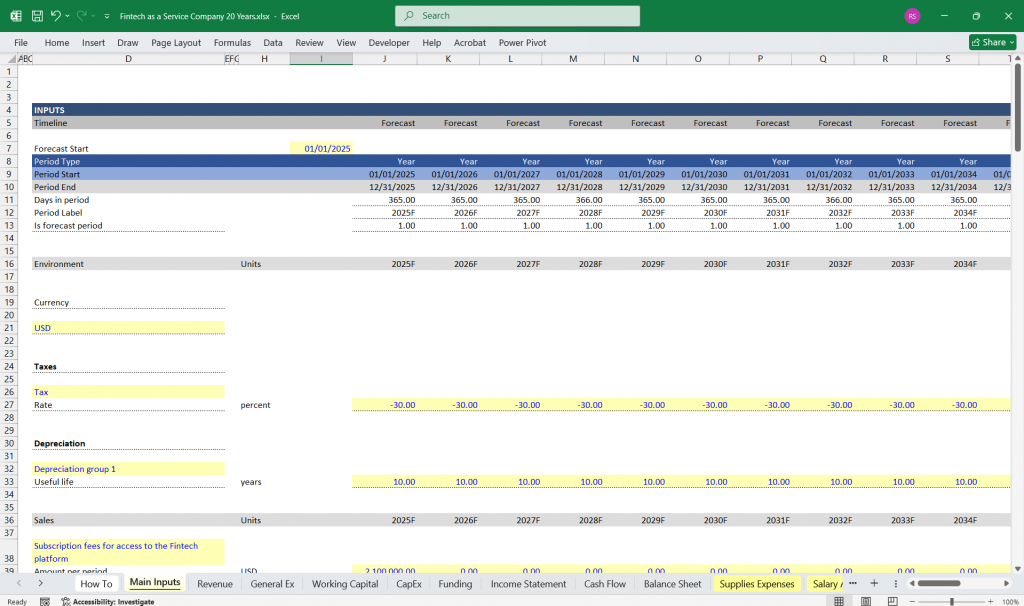

Key Assumptions and Drivers

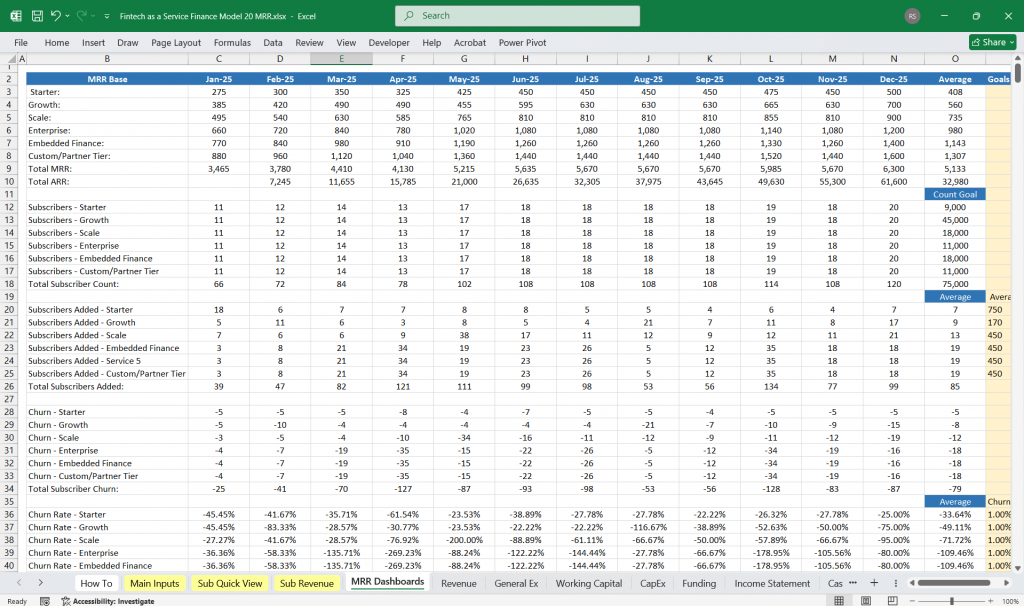

Revenue Drivers:

Number of FaaS customers

Average Revenue Per User (ARPU)

Transaction volume and fees

API usage rates

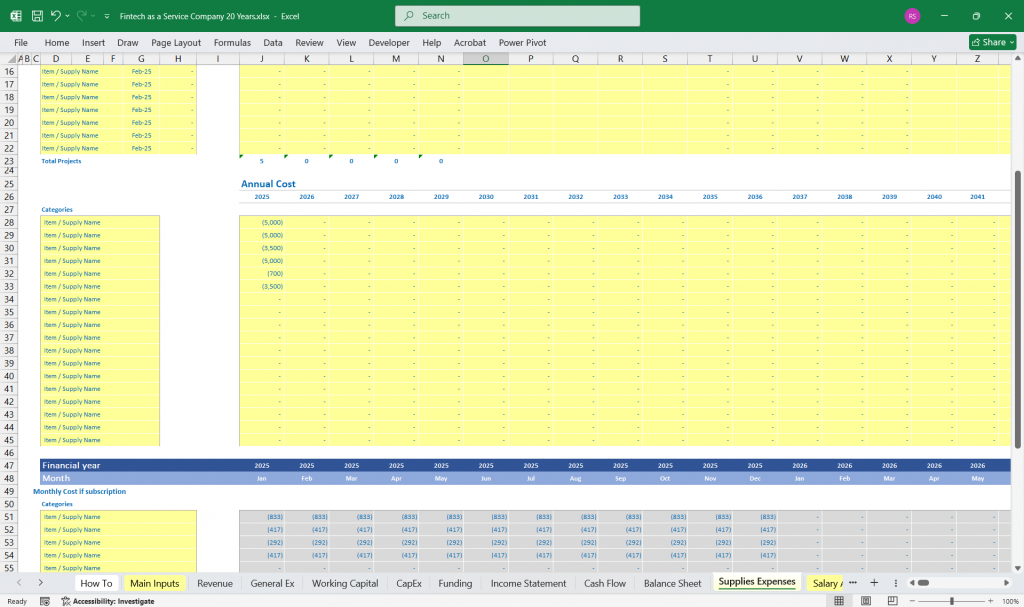

Cost Drivers:

Infrastructure scalability

Customer acquisition costs (CAC)

R&D investment as a percentage of revenue

Working Capital Assumptions:

Days Sales Outstanding (DSO)

Days Payable Outstanding (DPO)

Inventory turnover (if applicable)

Capital Structure:

Debt-to-Equity ratio

Interest rates on debt

Equity dilution from fundraising

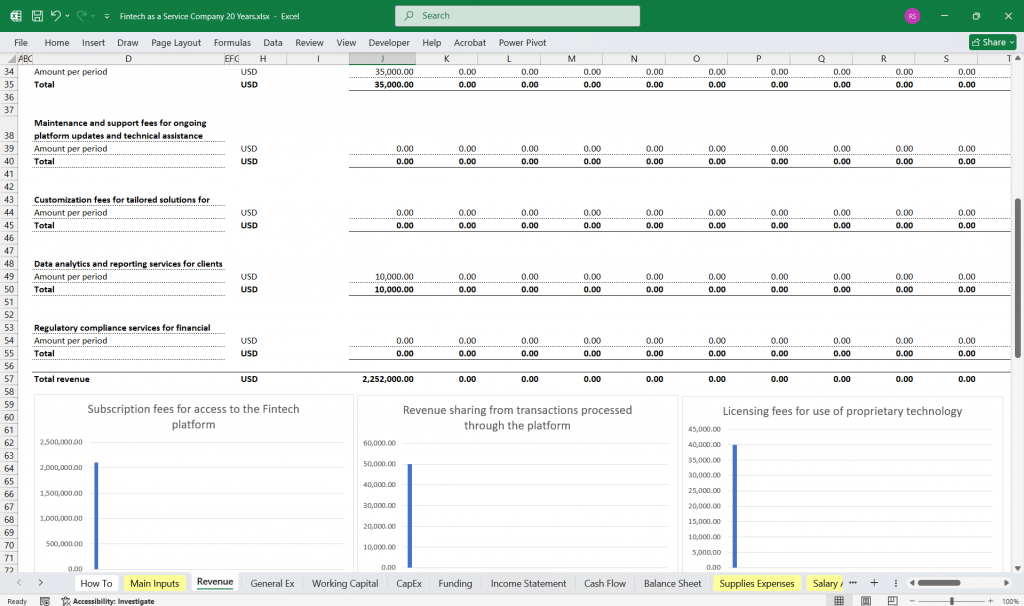

Revenue Streams

- Revenue Sharing – Percentage of transaction fees generated from payments processed through the platform.

- Licensing Fees – Charges for external entities utilizing proprietary technology.

- Consulting & Integration Services – Revenue from implementation, advisory, and integration work for clients.

- API Usage Fees – Charges based on API calls by third-party developers.

- Training & Onboarding Fees – One-time charges for onboarding new clients.

- Maintenance & Support Fees – Recurring revenue from ongoing platform updates and technical support.

- Customization Fees – One-time revenue from customized client solutions.

- Data Analytics & Reporting Services – Charges for advanced data insights provided to clients.

- Regulatory Compliance Services – Revenue from regulatory compliance support for financial institutions.

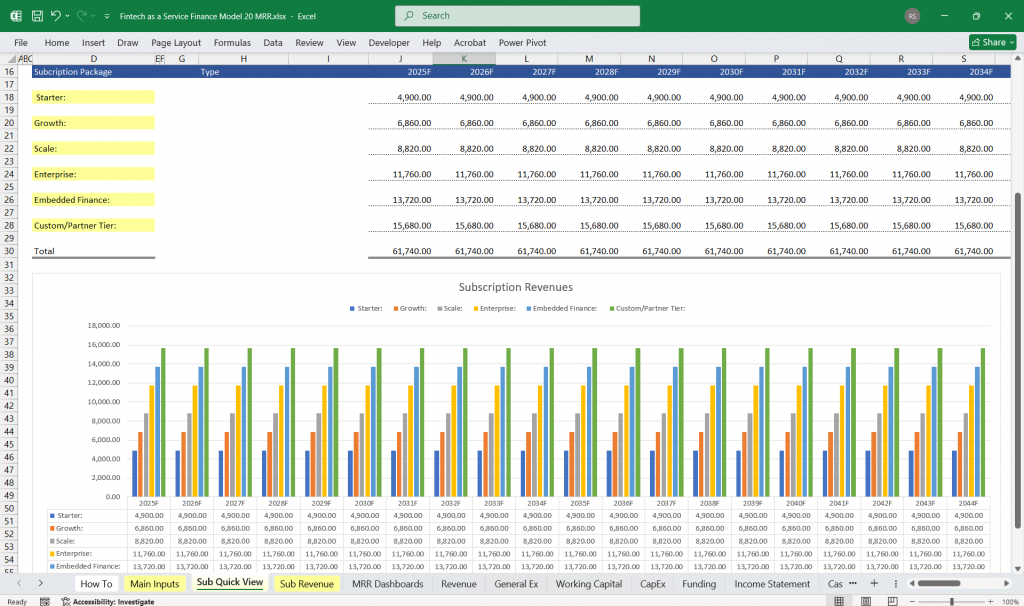

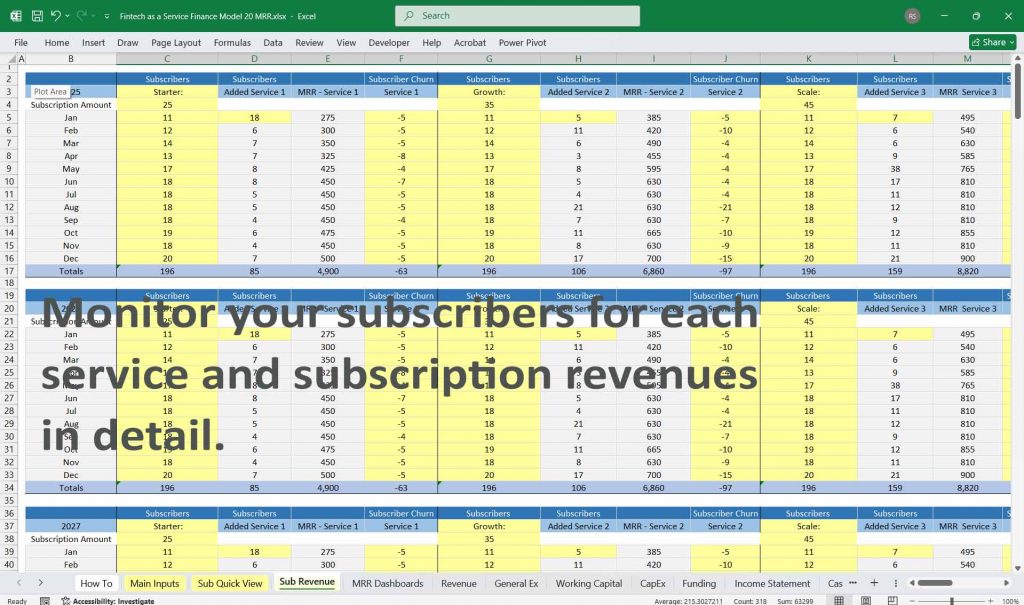

6 Tier Subscription Model

Pricing Strategy and Tier Definitions

This section outlines the pricing structure and features of each subscription tier to attract different customer segments.

Tier Details:

Tier 1: Basic Plan

Price: $10/month

Target Audience: Individual users or small teams.

Features:

Limited storage (e.g., 10 GB)

Basic customer support

Access to core features only

Upsell Opportunities: Add-ons for additional storage or features.

Tier 2: Starter Plan

Price: $25/month

Target Audience: Small businesses or startups.

Features:

Moderate storage (e.g., 50 GB)

Email support

Advanced analytics

Upsell Opportunities: Integration with third-party tools.

Tier 3: Growth Plan

Price: $50/month

Target Audience: Growing businesses.

Features:

Unlimited storage

Priority support

Customizable workflows

Upsell Opportunities: API access or advanced integrations.

Tier 4: Professional Plan

Price: $100/month

Target Audience: Mid-sized businesses or professional teams.

Features:

Advanced security features

Dedicated account manager

Team collaboration tools

Upsell Opportunities: Training or onboarding services.

Tier 5: Business Plan

Price: $250/month

Target Audience: Large businesses.

Features:

Enterprise-grade security

SLA guarantees (e.g., 99.9% uptime)

Custom reporting

Upsell Opportunities: Custom development or white-labeling.

Tier 6: Enterprise Plan

Price: $500/month (or custom pricing)

Target Audience: Enterprises with complex needs.

Features:

Fully customizable platform

24/7 premium support

On-premise deployment options

Upsell Opportunities: Long-term contracts or volume discounts.

Conclusion

This Fintech Banking financial model provides a structured approach to managing revenues, expenses, cash flows, and financial stability for your Fintech company. By tracking financial statements and key metrics, the company can optimize profitability, control costs, and plan for future expansion.

Download Available Immediately After Payment

Download Available Immediately After Payment