Agricultural Farming Forestry Machinery Manufacturer Financial Model

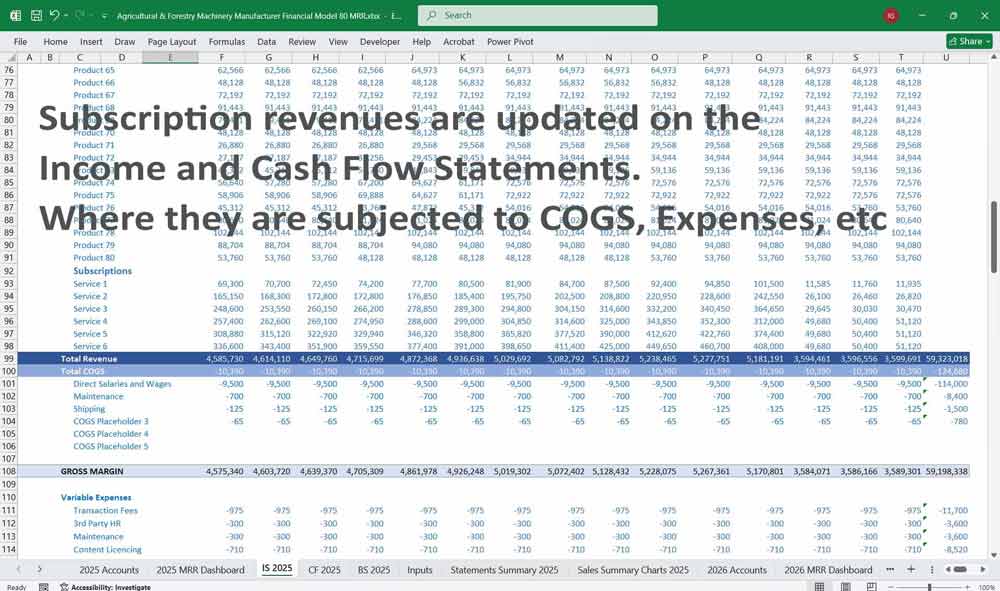

This 20-year 3-statement Excel Agricultural, Farming & Forestry Machinery Manufacturer Financial Model covers revenue streams from 80 product lines and subscriptions. With cost structures and financial statements to forecast the financial health of your farming machinery manufacturing.

Financial Model for an Agricultural Farming and Forestry Machinery Manufacturer

1. Revenue Model (Income Sources)

- Sale of Machinery: Revenue from selling tractors, harvesters, logging equipment, etc.

- Spare Parts & Accessories: Revenue from aftermarket parts and accessories.

- Maintenance & Service Contracts: Revenue from annual maintenance contracts (AMCs) and repair services.

- Leasing & Rentals: Income from leasing equipment to farmers or forestry operators.

- Technology Integration & Software Sales: Revenue from precision agriculture and forestry software.

- Government Grants & Subsidies: Incentives for sustainable agriculture/forestry machinery.

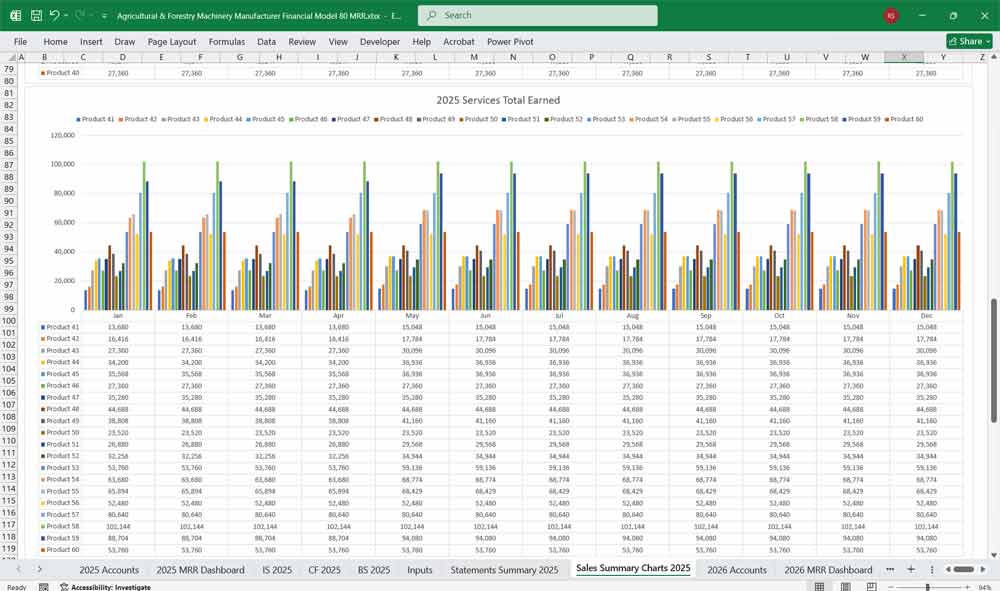

Product Line Analysis (80 Variants)

80 Products:

- Focus: Covers an extensive range to capture niche markets and enable geographic diversification.

- Key Products: Adds specialized machinery like wood debarkers or high-capacity harvesters.

– Tailors offerings for markets with unique farming and forestry needs. - Capital and Operating Costs: Higher COGS due to diverse materials sourcing and added complexity in production.

– Higher inventory costs. - Market Focus: Commercial applications, and export markets.

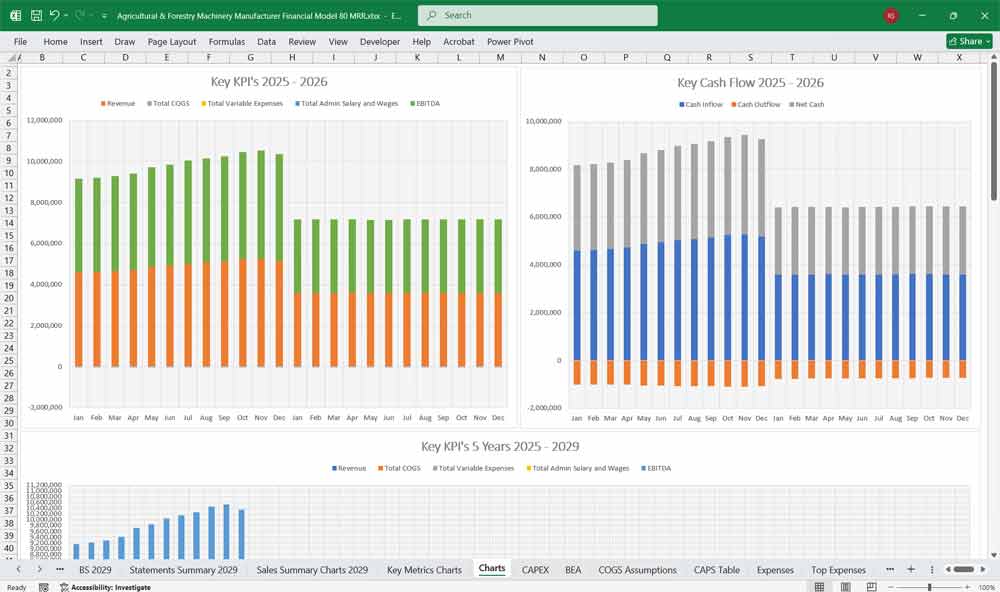

Income Statement (Profit & Loss Statement)

A. Revenue

- Revenue from Farming Machinery Sales

- Revenue from Parts & Services

- Other Revenue Streams

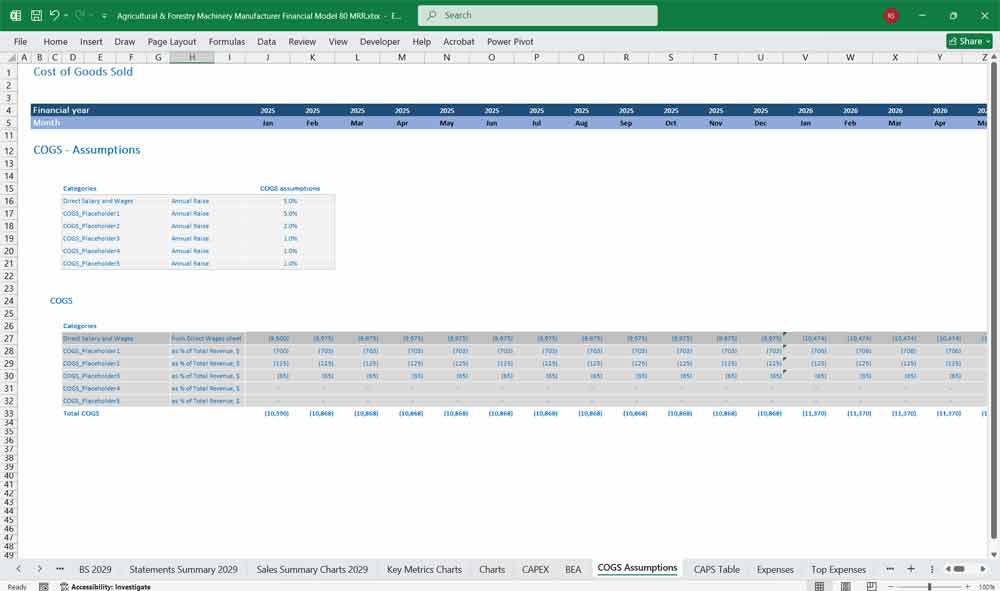

B. Cost of Goods Sold (COGS)

- Raw Material Costs (Steel, Engines, Hydraulic Components)

- Labor Costs (Manufacturing Workers)

- Factory Overheads (Electricity, Depreciation, Repairs)

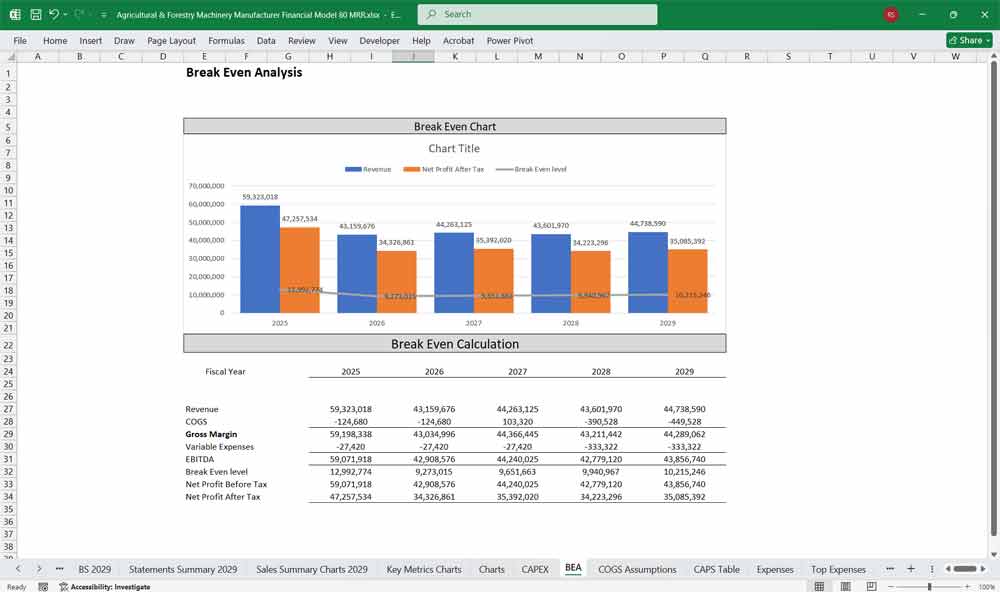

C. Gross Profit = Revenue – COGS

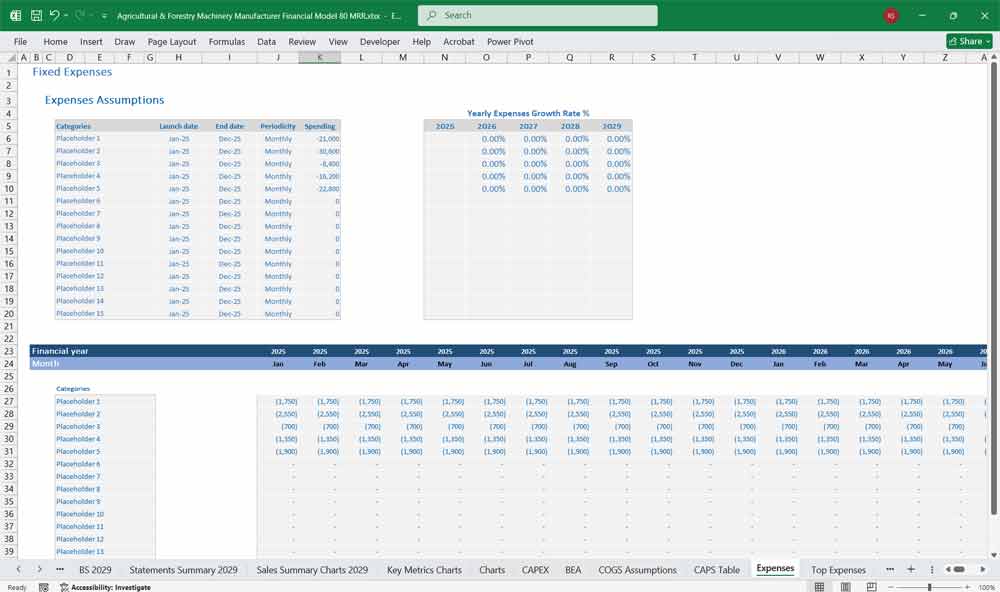

D. Operating Expenses (OPEX)

- Selling, General & Administrative Expenses (SG&A):

- Sales & Marketing Costs

- Salaries (Management & Office Staff)

- Travel & Training Expenses

- R&D Expenses:

- Innovation in Precision Farming Technology

- Engineering & Prototyping

- Depreciation & Amortization:

- Agricultural and Farming Manufacturing Plant & Equipment

- Patents & Software

E. Operating Profit (EBIT) = Gross Profit – OPEX

F. Interest Expense

- Loans & Credit Lines for Manufacturing Expansion

G. Taxes & Other Adjustments

- Corporate Income Tax

- Deferred Tax Liabilities

H. Net Profit = EBIT – Interest – Taxes

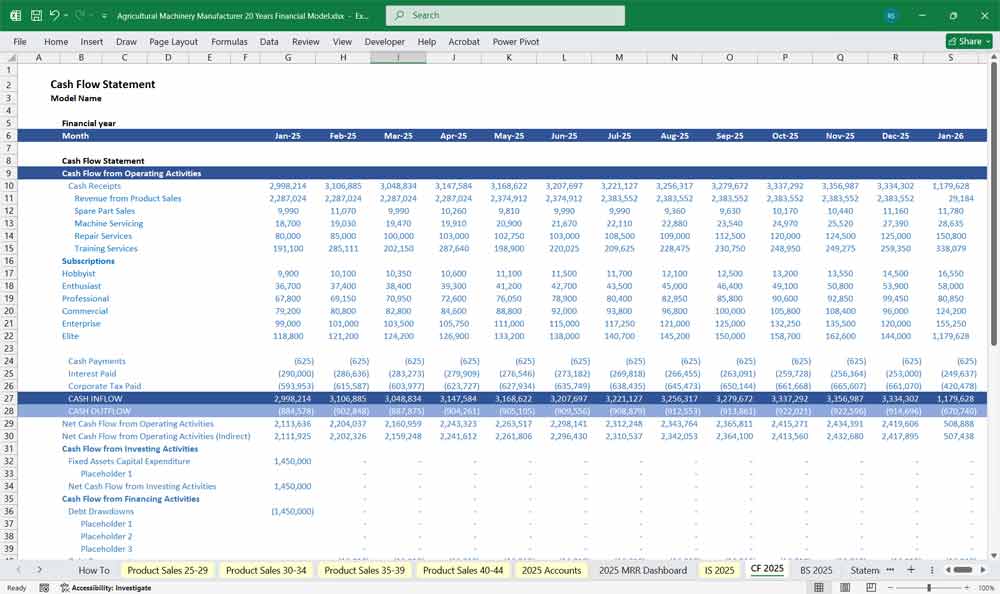

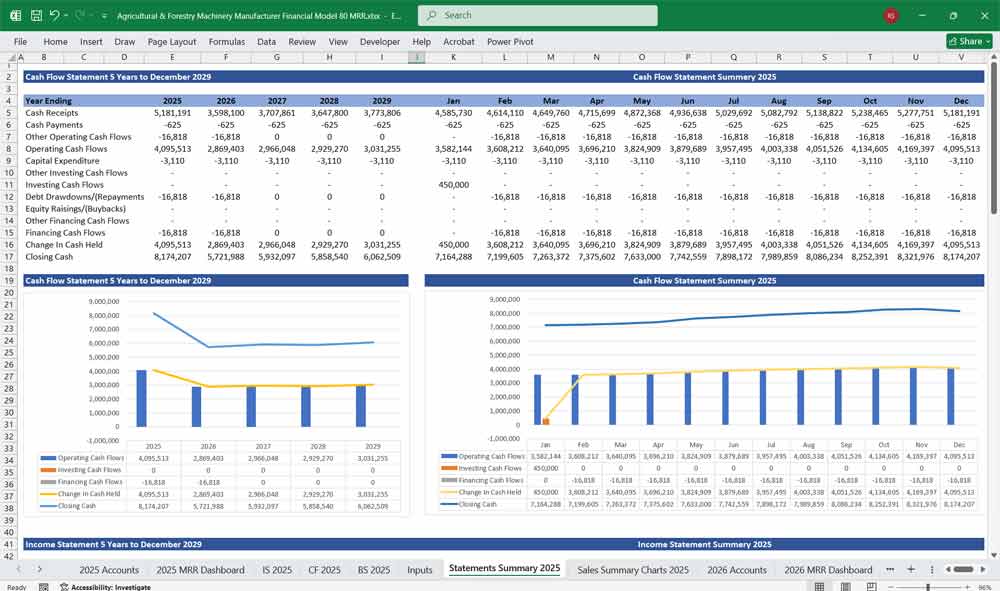

Farming Forestry Machinery Manufacturer Finance Model Cash Flow Statement

A. Cash Flow from Operating Activities

- Net Profit

- Adjustments for Non-Cash Items (Depreciation, Amortization)

- Change in Working Capital

- Inventory Changes (Raw Materials, Finished Goods)

- Accounts Receivable & Payable

- Prepaid Expenses & Accrued Liabilities

B. Cash Flow from Investing Activities

- Purchase of Machinery & Equipment (CAPEX)

- Investments in R&D & Product Development

- Land & Building Acquisitions

- Sale of Old Machinery/Assets

C. Cash Flow from Financing Activities

- Issuance of Equity or Debt

- Loan Repayments

- Dividend Payments

- Share Buybacks

D. Net Cash Flow = A + B + C

- Closing Cash Balance

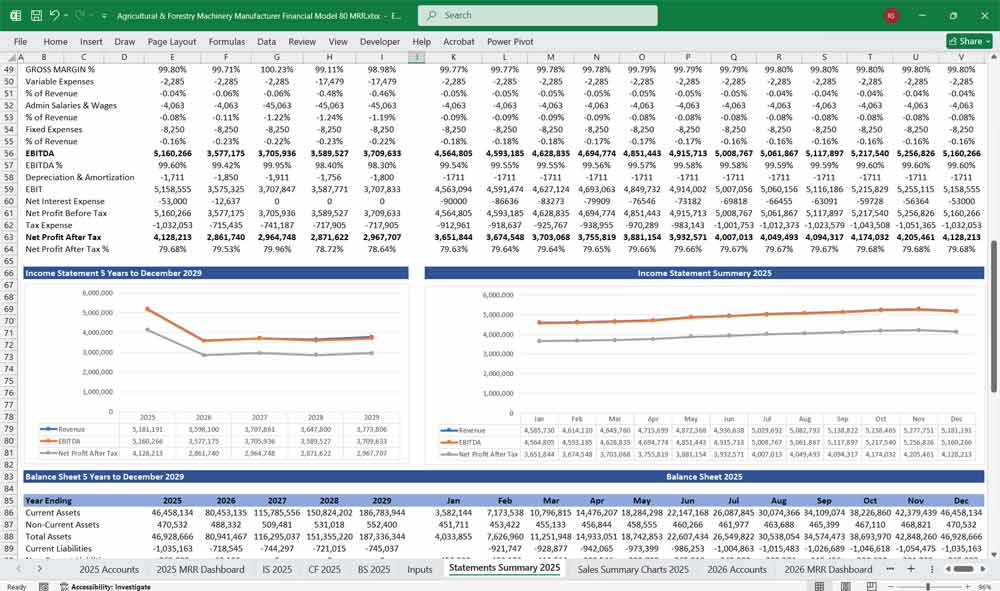

Farming Forestry Machinery Manufacturer Finance Model Balance Sheet

A. Assets

Current Assets:

- Cash & Bank Balances

- Accounts Receivable (Customer Payments Pending)

- Inventory (Raw Materials, Work-in-Progress, Finished Goods)

- Prepaid Expenses

Non-Current Assets:

- Property, Plant & Equipment (Factory, Offices, Machinery)

- Intangible Assets (Patents, Trademarks, Software)

- Long-Term Investments

B. Liabilities

Current Liabilities:

- Accounts Payable (Payments to Suppliers)

- Short-Term Loans

- Accrued Salaries & Expenses

- Taxes Payable

Long-Term Liabilities:

- Bank Loans & Debt Obligations

- Lease Obligations

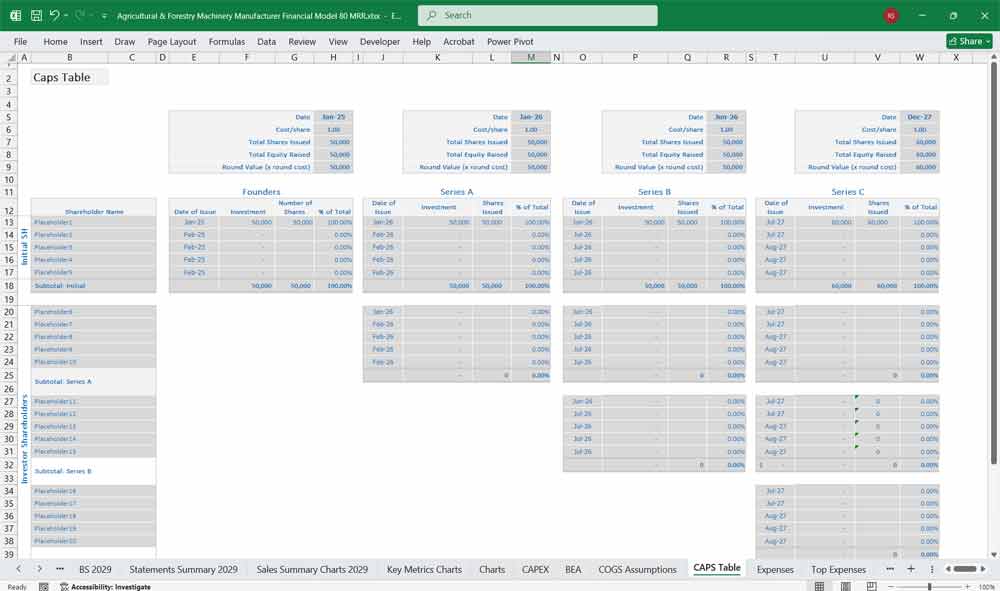

C. Shareholders’ Equity

- Paid-in Capital (Investors’ Equity Contributions)

- Retained Earnings (Cumulative Profits)

Key Financial Metrics for a Farming & Forestry Machinery Manufacturer

- Gross Profit Margin = (Gross Profit / Revenue) × 100

- Operating Profit Margin (EBIT Margin) = (EBIT / Revenue) × 100

- Net Profit Margin = (Net Income / Revenue) × 100

- Return on Assets (ROA) = (Net Income / Total Assets) × 100

- Return on Equity (ROE) = (Net Income / Shareholder Equity) × 100

- Debt-to-Equity Ratio = (Total Debt / Shareholder Equity)

- Inventory Turnover = (COGS / Average Inventory)

- Days Sales Outstanding (DSO) = (Accounts Receivable / Revenue) × 365

When structuring product lines for a farming & forestry machinery manufacturer, it’s important to organize them in a way that aligns with customer needs, market demand, and operational efficiency. Below are detailed sections for upto 80 product lines, including categorization, examples, and strategic considerations.

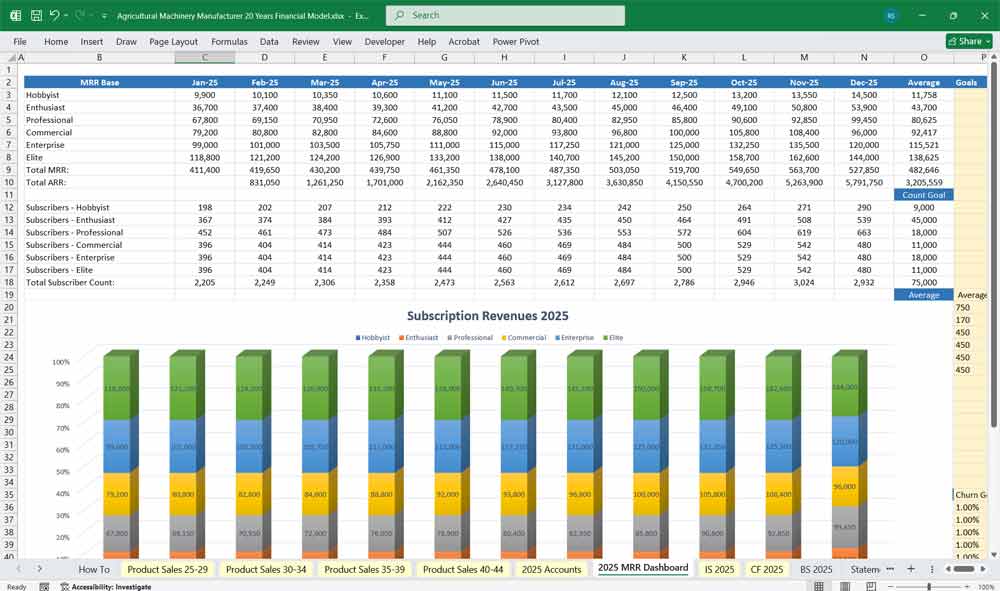

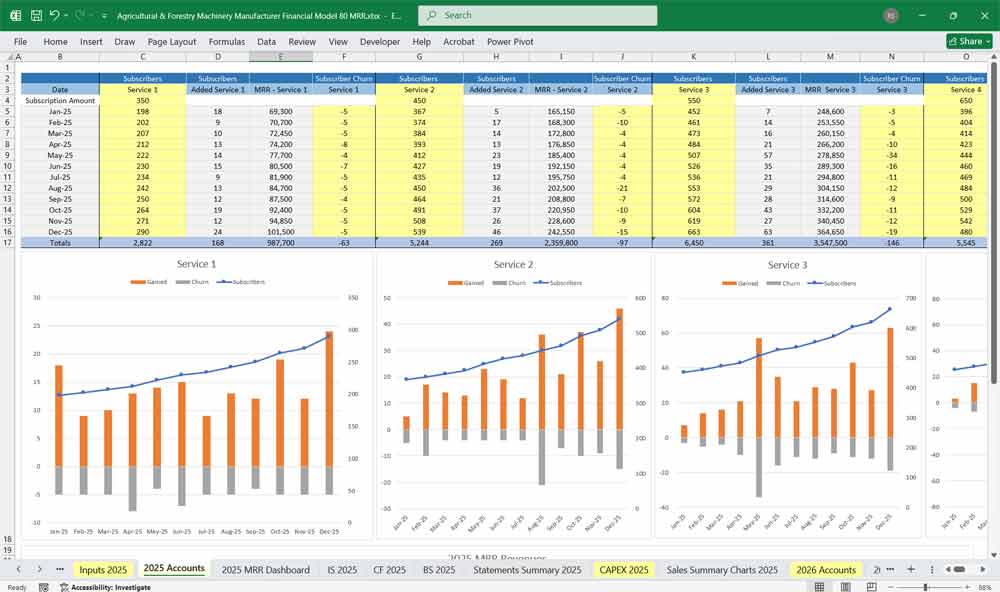

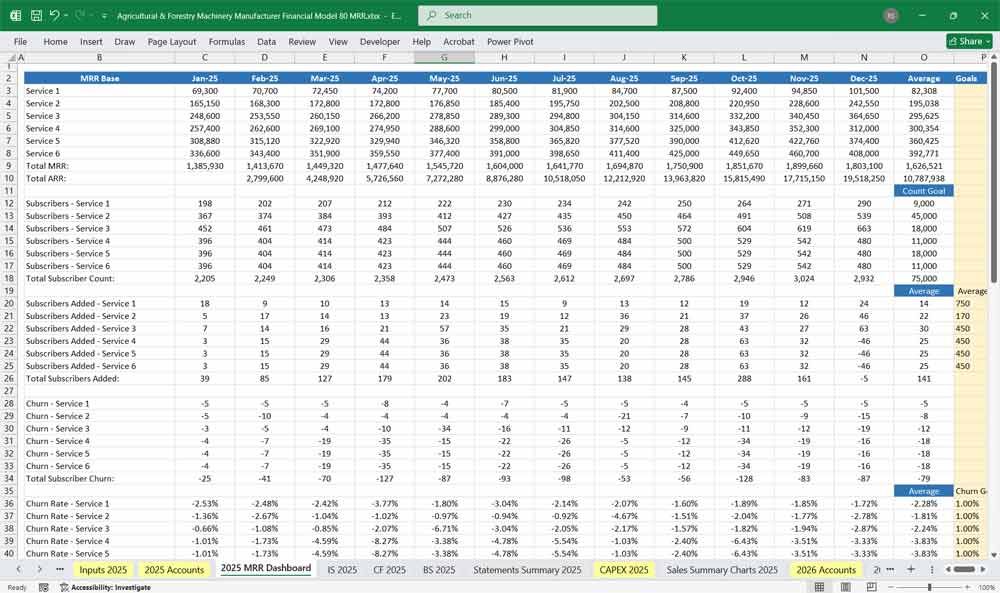

6-Tier Subscription Model for a Farming Forestry Machinery Manufacturer

Objective

Encourage customer loyalty, provide ongoing value, and generate predictable cash flow.

Tier 1: Basic Agricultural Farming Forestry Manufacturer Plan (Entry-Level)

Target Audience: Small-scale farmers or startups with minimal machinery needs.

Features:

Access to basic machinery (e.g., small tractors, basic forestry tools).

Limited usage hours per month (e.g., 50 hours).

Basic maintenance and servicing included.

Email support with a 48-hour response time.

Pricing: Low-cost or pay-as-you-go model to attract new customers.

Value Proposition: Affordable entry point for small-scale operations to access essential machinery.

Tier 2: Starter Agricultural Farming Forestry Manufacturer Plan (Growing Farms)

Target Audience: Medium-sized farms or forestry operations with moderate needs.

Features:

Access to a wider range of machinery (e.g., mid-sized tractors, chainsaws).

Increased usage hours (e.g., 200 hours per month).

Regular maintenance and servicing included.

Phone support with a 24-hour response time.

Pricing: Mid-range pricing to reflect added value.

Value Proposition: Scalable solution for growing operations with more frequent machinery needs.

Tier 3: Professional Agricultural Farming Forestry Manufacturer Plan (Established Farms)

Target Audience: Established farms or forestry operations with consistent machinery needs.

Features:

Access to advanced machinery (e.g., combine harvesters, skidders).

Higher usage limits (e.g., 500 hours per month).

Priority maintenance and servicing.

Dedicated account manager and 24/7 support.

Pricing: Higher pricing to reflect advanced features and support.

Value Proposition: Comprehensive solution for established operations with regular machinery usage.

Tier 4: Advanced Agricultural Farming Forestry Manufacturer Plan (High-Growth Operations)

Target Audience: High-growth farms or large forestry operations with complex needs.

Features:

Access to premium machinery (e.g., high-capacity harvesters, advanced forestry equipment).

Custom usage limits based on business requirements.

On-site maintenance and servicing.

Access to exclusive training and workshops.

Pricing: Premium pricing for high-value features.

Value Proposition: Tailored solutions for operations scaling rapidly and requiring high-performance machinery.

Tier 5: Enterprise Agricultural Farming Forestry Manufacturer Plan (Large Agricultural Enterprises)

Target Audience: Large agricultural enterprises or forestry companies with high-volume needs.

Features:

Access to the full range of machinery and equipment.

Unlimited usage hours.

Custom maintenance schedules and on-site servicing.

Executive-level consulting and strategic planning.

Pricing: Custom pricing based on volume and needs.

Value Proposition: End-to-end solutions for large-scale operations with extensive machinery requirements.

Tier 6: Custom Agricultural Farming Forestry Manufacturer Plan (Bespoke Solutions)

Target Audience: Businesses with unique or highly specialized needs.

Features:

Fully customized machinery solutions tailored to the client’s requirements.

Co-development of specialized equipment.

Exclusive access to beta features and early releases.

SLA-backed 24/7 premium support with a dedicated team.

Pricing: Negotiated pricing based on scope and complexity.

Value Proposition: A partnership approach to deliver maximum value for specialized operations.

- Additional Considerations Across Tiers

Scalability:

Each tier is designed to be scalable, allowing customers to upgrade as their production needs grow.Integration & API Access:

Higher tiers offer greater levels of system integration, enabling seamless connectivity with in-house systems and real-time tracking.Flexibility:

Options for rollover of unused print credits and flexible overage billing ensure that customers only pay for what they need.Value-Added Services:

Complimentary design consultations, technical support, and training workshops become more prominent in the higher tiers, adding strategic value beyond just production capacity.Service Level Agreements (SLAs):

Defined SLAs across tiers provide transparency regarding turnaround times, quality standards, and uptime guarantees, with the most rigorous SLAs reserved for Enterprise and Custom tiers.

Key Financial Metrics & Ratios on the Financial Model

- Gross Margin = (Gross Profit / Revenue) × 100

- EBITDA Margin = (EBITDA / Revenue) × 100

- Net Profit Margin = (Net Profit / Revenue) × 100

- Debt-to-Equity Ratio = (Total Liabilities / Shareholders’ Equity)

- Inventory Turnover Ratio = (COGS / Average Inventory)

- Return on Assets (ROA) = (Net Income / Total Assets) × 100

- Return on Equity (ROE) = (Net Income / Shareholders’ Equity) × 100

Sensitivity & Scenario Analysis

- Best-Case Scenario: High demand, government incentives, reduced raw material costs.

- Base-Case Scenario: Moderate sales, stable raw material prices, expected loan repayments.

- Worst-Case Scenario: Economic downturn, high interest rates, supply chain disruptions.

Conclusion

This Agricultural Farming Forestry Machinery Financial Model must focus on balancing capital expenditures with steady revenue growth from diversified product line sales, and subscription-based services. By optimizing operational costs, power efficiency, and maximizing high-margin services the model ensures sustainable profitability and cash flow stability.

Download Link On Next Page