Events Venue Finance Model

These Events Venue Finance Models in Excel are a comprehensive financial planning tool designed to help any events venue owner, investors, and financial analysts evaluate the financial feasibility and profitability over 5 years.

Financial Model for an Events Venue

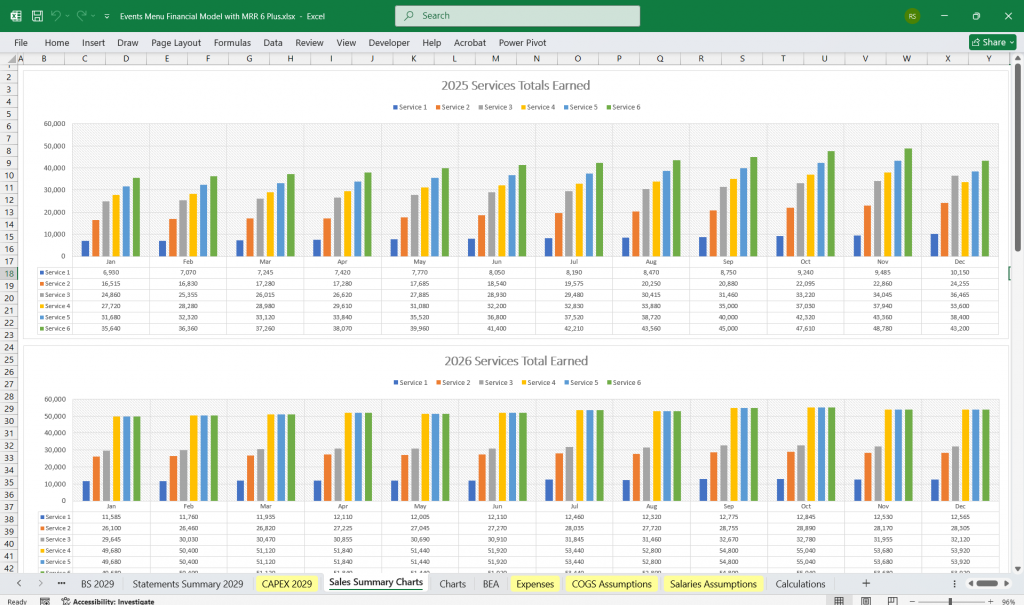

Including subscriptions and revenues from services like Birthday Parties, Corporate Events, Weddings, and Music Events. The model includes sections for the Income Statement, Cash Flow Statement, and Balance Sheet.

What Do You Get? 2 Versions In 1 Zip File

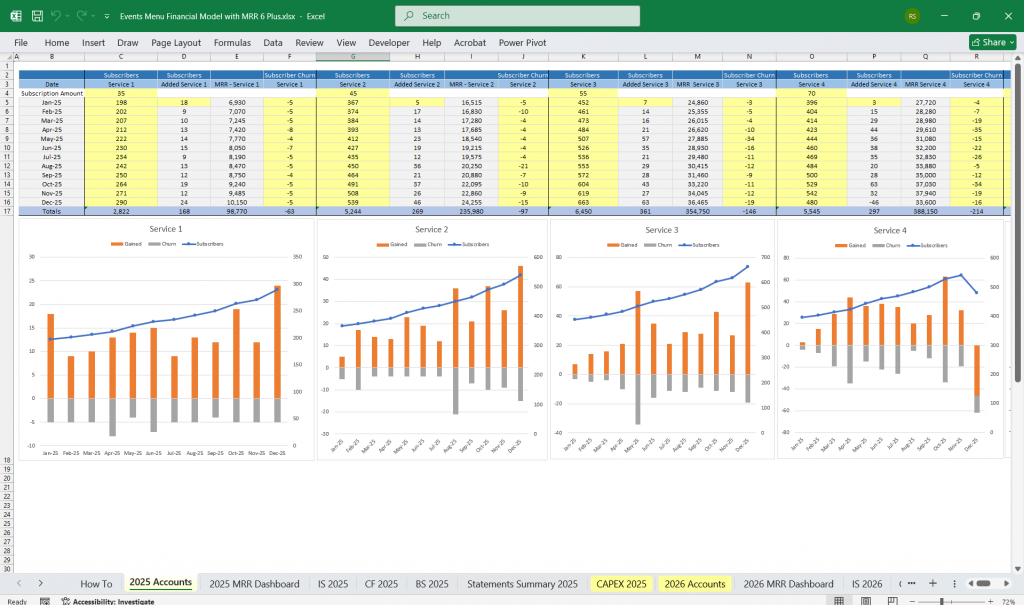

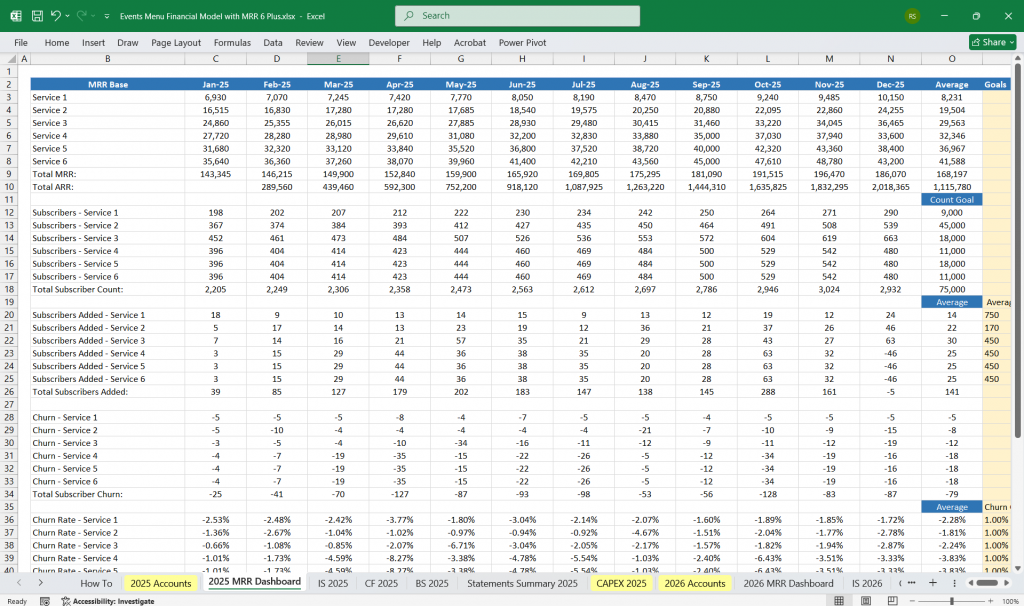

Version 1: 5-Year, 3 Statement financial model with 5 PAYG revenues for tracking and reporting of your Events Venue financials.

Version 2: 5-Year, 3 Statement with Revenue from a 6 Tier Subscription ‘Managed Service Agreements’. Build Your MSA book as quickly as possible.

Plus 5 PAYG Inputs..

Here’s an idea of a 6-tier subscription model for an events venue, with increasing benefits at each level:

1. Basic Access (Free or Low-Cost Entry Tier)

- Monthly newsletter with event updates

- Early access to event announcements

- Access to public events (pay per event)

2. Social Member ($10-$25/month)

- Everything in Basic Access

- 5-10% discount on event tickets

- Priority RSVP for select events

- 1 free drink voucher per month

3. VIP Member ($50-$75/month)

- Everything in Social Member

- 15% discount on event tickets

- Exclusive access to VIP seating areas

- 1 complimentary ticket per month

- Members-only networking events

4. Premium Member ($100-$150/month)

- Everything in VIP Member

- 25% discount on event tickets

- 2 complimentary tickets per month

- Early access to venue bookings for private events

- Complimentary bottle service or VIP experience at one event per quarter

5. Elite Member ($250-$350/month)

- Everything in Premium Member

- 50% discount on event tickets

- 4 complimentary tickets per month

- Priority access to venue rentals (with discount)

- Private concierge for event planning

- Exclusive behind-the-scenes access to special events

6. Founders/Executive Member ($500+/month)

- Everything in Elite Member

- Unlimited complimentary event tickets

- Complimentary small private event hosting (up to X guests per year)

- Name recognition on venue wall or website

- Invitations to ultra-exclusive private events

- Dedicated table at premium events

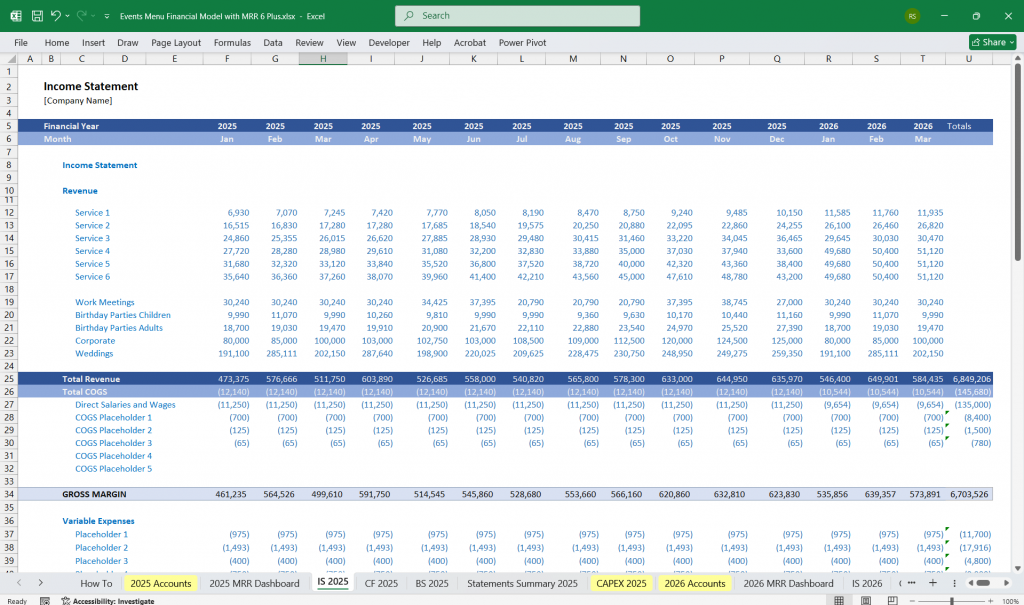

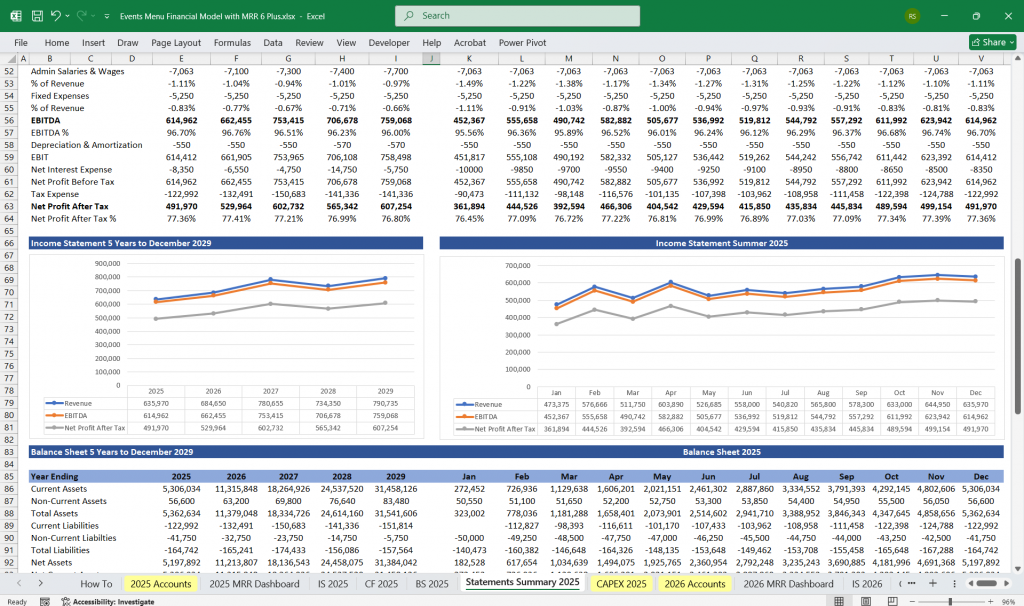

Income Statement (Profit and Loss Statement)

The Income Statement shows the venue’s financial performance over a period (monthly, quarterly, annually). It includes revenues, expenses, and profits.

Revenue Streams:

Event Subscription Services: (All Completely Editable).

- Birthday Parties: Revenue from recurring party bookings, including kids’ packages, catering, and entertainment services.

- Inputs: Number of bookings/month, average price per party, upsell options (e.g., bounce houses, custom décor).

- Corporate Events: Recurring revenue from companies subscribing to use the venue for meetings, conferences, seminars, or team-building sessions.

- Inputs: Frequency of corporate bookings, average ticket size, extra services (e.g., AV equipment, catering, branding).

- Weddings: Premium revenue for wedding services including venue rental, decorations, catering, photography, and wedding planning add-ons.

- Inputs: Number of weddings/month, tiered pricing packages (basic, premium, luxury), average guest count.

- Music Events: Income from concerts, performances, or themed music nights. This may involve rental for external organizers or revenue-sharing from ticket sales.

- Inputs: Event frequency, attendance rate, and ticket prices.

- Birthday Parties: Revenue from recurring party bookings, including kids’ packages, catering, and entertainment services.

Add-On Services:

- Catering Services: On-site catering, food/beverage packages for events.

- Décor and Theming: Custom themes, lighting, floral arrangements, and staging.

- Equipment Rentals: AV equipment, sound systems, projectors, seating arrangements, photo booths, etc.

- Event Planning Services: Full-service event coordination for all categories.

Retail Sales:

- Merchandise sold during events (e.g., promotional items, souvenirs).

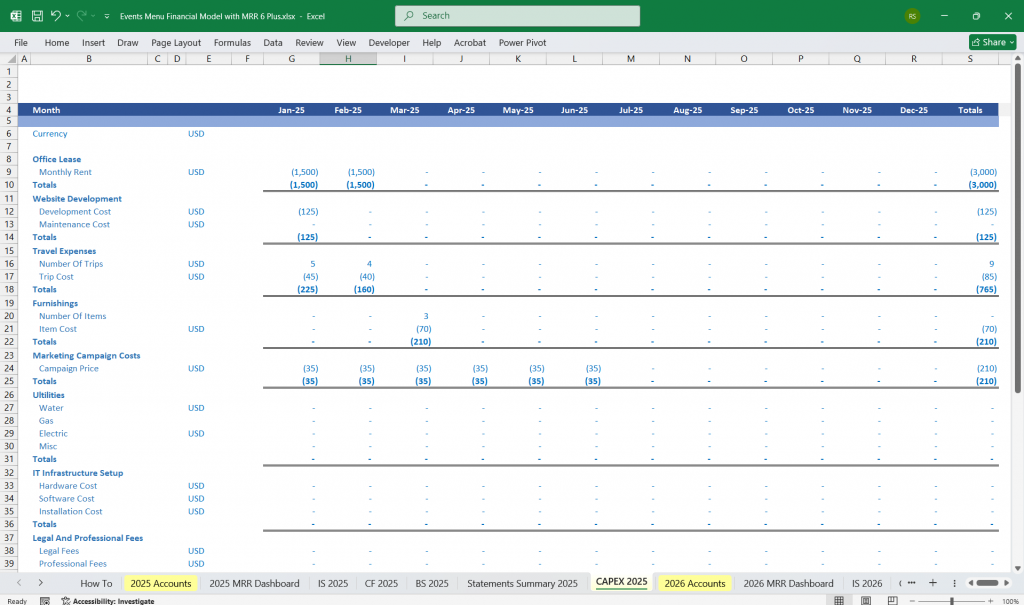

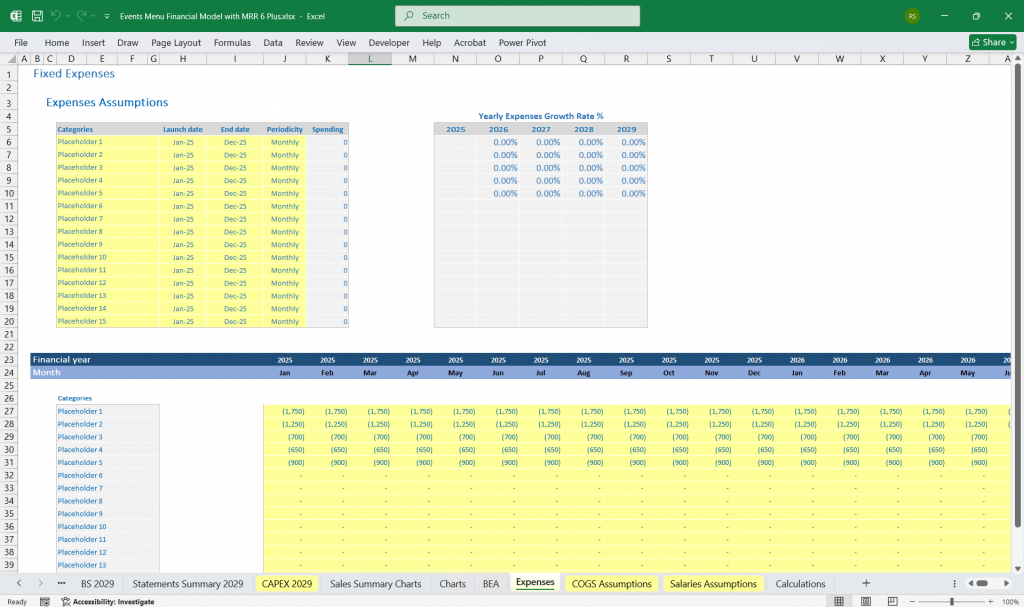

Operating Expenses:

Fixed Costs:

- Rent/Lease Payments: Cost of leasing the venue (if not owned).

- Utilities: Electricity, water, HVAC, internet, and security.

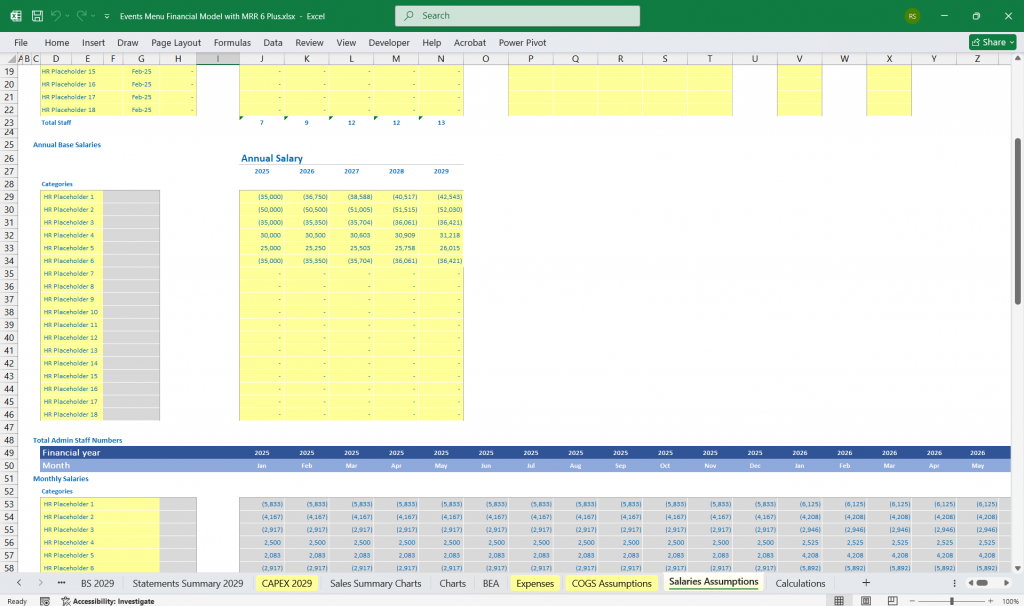

- Staff Salaries: Payment for full-time employees, such as venue managers, administrative staff, and cleaning crews.

- Insurance: Liability insurance for events, property insurance, and equipment insurance.

Variable Costs:

- Temporary/Event-Based Staff: Payments to event planners, catering staff, AV technicians, decorators, and support crews.

- Marketing Costs: Promotions, social media advertising, brochures, event listing fees, SEO campaigns, etc.

- Catering Supplies: Cost of ingredients, beverages, or third-party vendor catering fees.

- Décor and Rentals: Purchases and maintenance costs for decoration equipment, lighting, and AV gear.

- Commission Fees: Commission payments for event bookings from agencies or event organizers.

Depreciation:

- On assets like furniture, sound systems, event décor, AV equipment, and renovations.

Interest Expense:

- Cost of financing loans taken for facility improvements, equipment purchase, or startup capital.

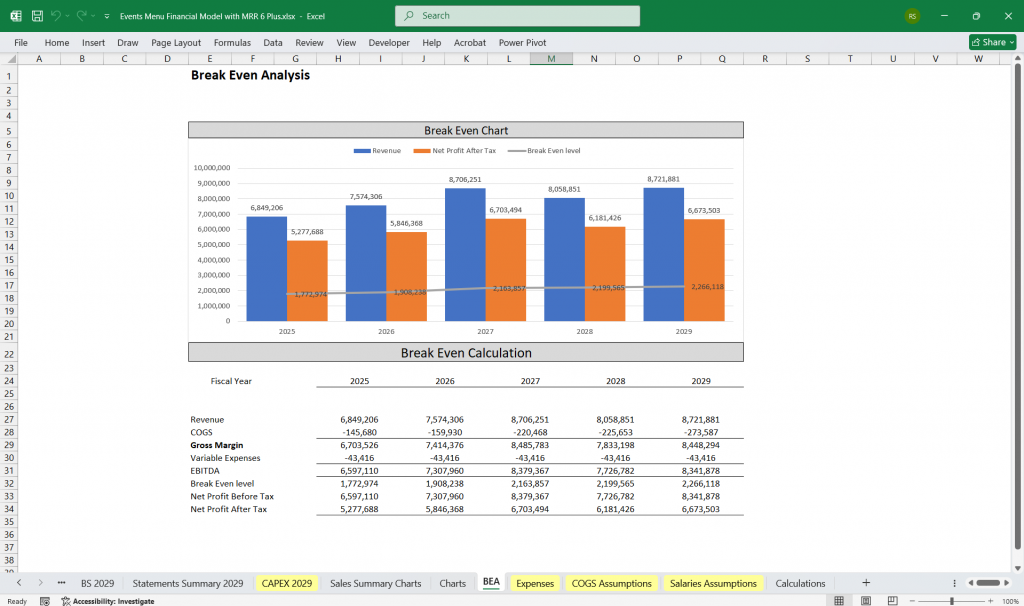

Net Profit:

- Gross Profit = Revenue – (Cost of Services + Variable Expenses).

- Operating Profit (EBIT) = Gross Profit – Fixed Costs – Marketing – Depreciation.

- Net Income = EBIT – Interest – Taxes.

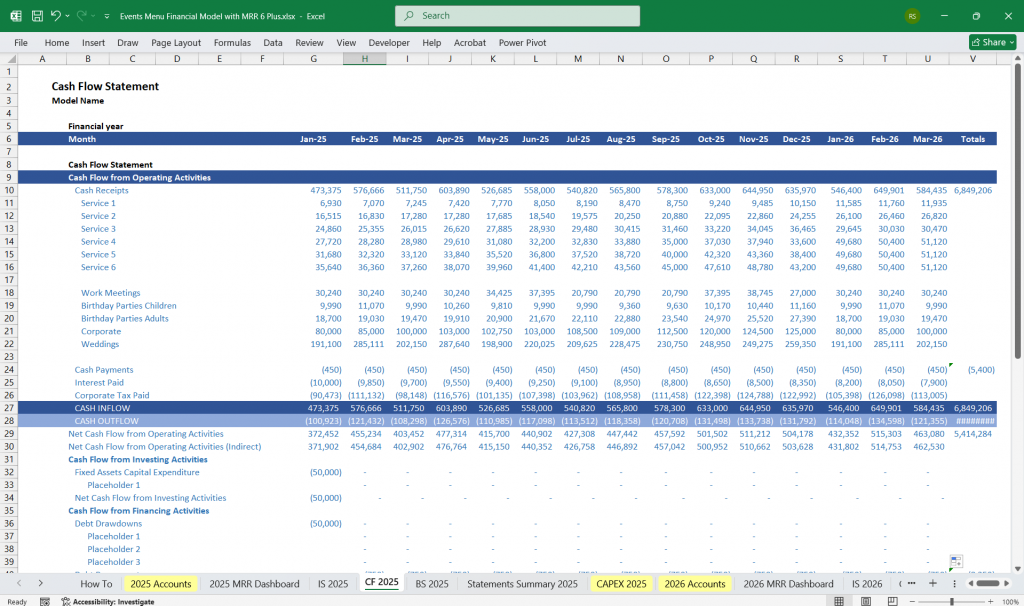

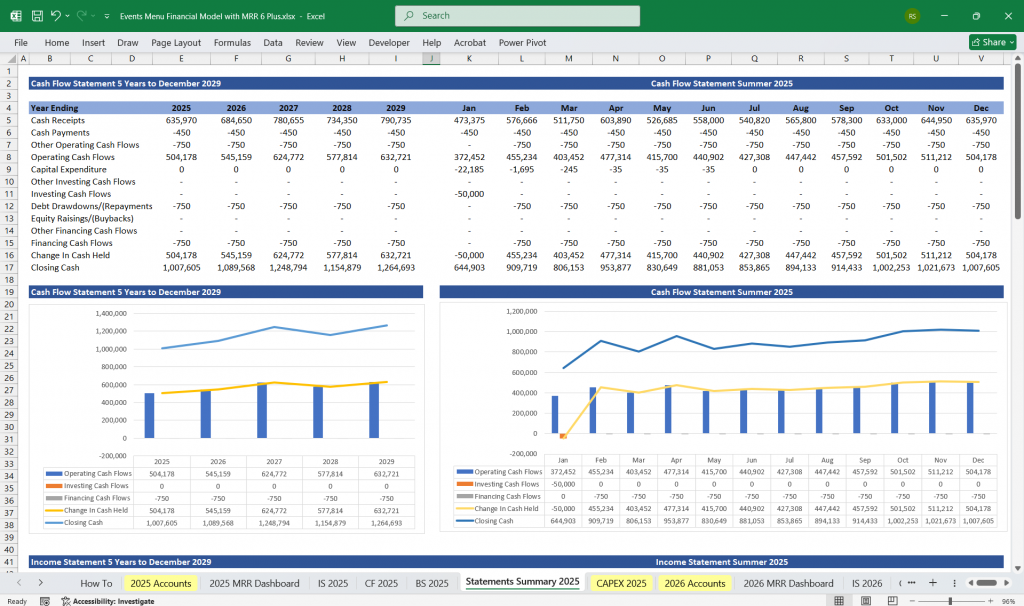

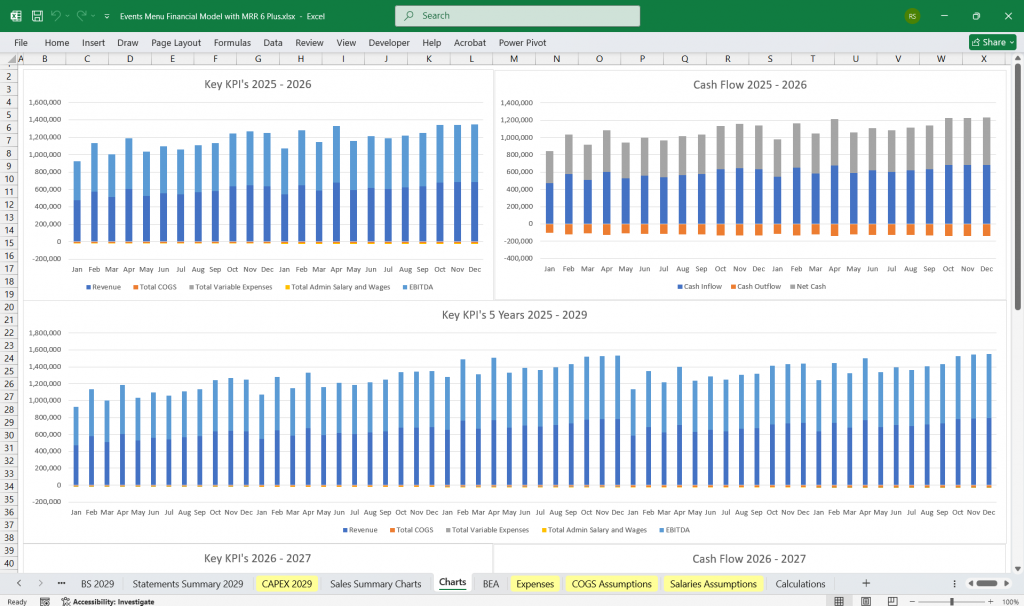

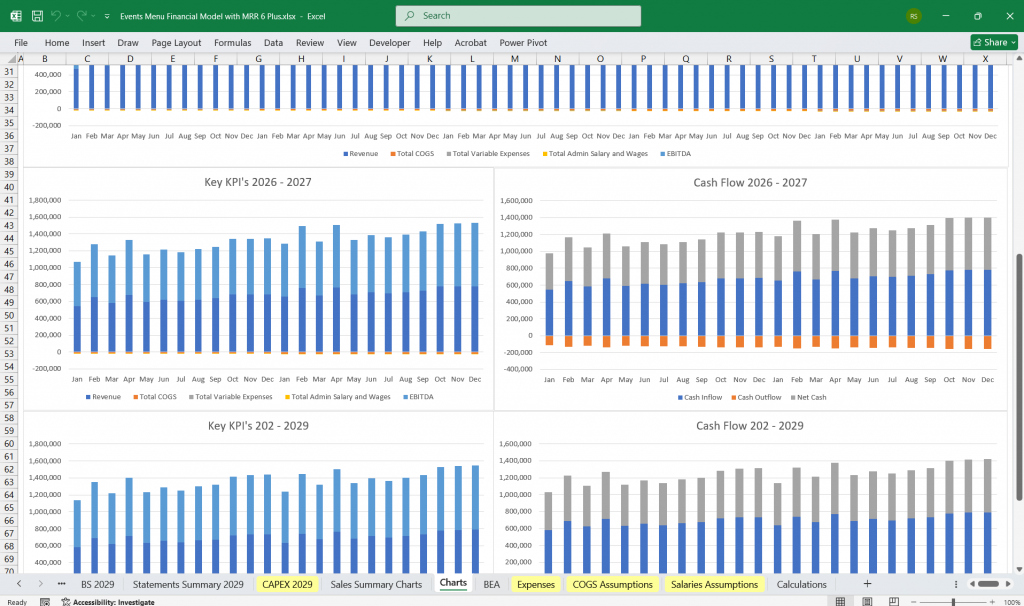

Cash Flow Statement

The Cash Flow Statement tracks cash inflows and outflows to ensure liquidity.

Operating Cash Flow:

Cash Inflows:

- Event subscription payments for birthday parties, weddings, corporate events, and music nights.

- Deposits and advance payments from event bookings.

- Payments from equipment rentals, add-on services (decor, catering), and event coordination.

Cash Outflows:

- Salaries for full-time and temporary staff.

- Payments to vendors for catering, equipment rentals, or floral services.

- Rent, utilities, and insurance expenses.

- Marketing and advertising costs.

- Maintenance costs for AV equipment and décor items.

Investing Cash Flow:

Cash Outflows:

- Purchase of equipment (e.g., audio systems, tables/chairs, lighting gear).

- Renovation or expansion costs to improve venue facilities.

- Upgrades for software systems (e.g., online event booking systems, payment tools).

Cash Inflows:

- Sale of outdated or unused event equipment.

- Income from subleasing venue space (if applicable).

Financing Cash Flow:

Cash Inflows:

- Loans or investor funding for expanding services or renovating the venue.

Cash Outflows:

- Loan repayments (principal and interest).

- Distributions or dividends paid to investors or owners.

Net Cash Flow:

- Operating + Investing + Financing Cash Flow = Net Change in Cash.

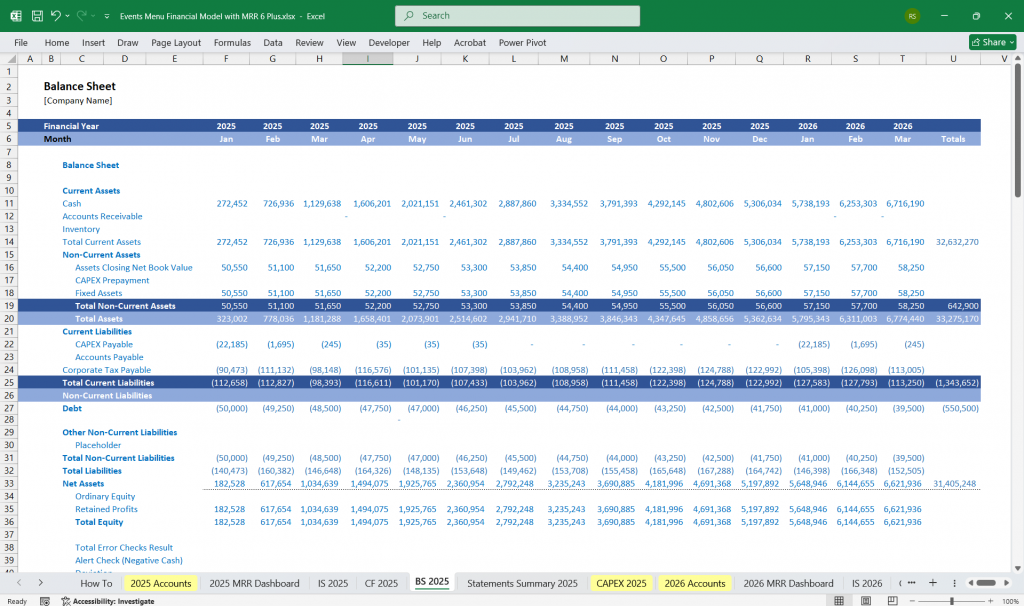

Balance Sheet

The Balance Sheet offers a snapshot of the venue’s financial health, including its assets, liabilities, and equity.

Assets:

Current Assets:

- Cash and Cash Equivalents: Available liquid funds.

- Accounts Receivable: Outstanding payments from clients (e.g., future event deposits).

- Inventory: Event supplies (e.g., decorations, catering items), food/beverage stock, and retail merchandise.

Non-Current Assets:

- Event Equipment: Furniture, AV equipment, decorations, lighting, etc.

- Leasehold Improvements: Upgrades or modifications to the rented space (e.g., flooring, soundproofing).

- Property (if owned): Book value of the venue (land, building).

- Technology Assets: Event booking systems, POS terminals, or CRM software.

Liabilities:

Current Liabilities:

- Accounts Payable: Vendor payments for catering, supplies, or event support have not yet been paid.

- Deferred Revenue: Deposits collected for future events not yet delivered.

- Short-Term Loans: Loan repayments are due within a year.

Long-Term Liabilities:

- Loans for facility construction, renovation, or equipment purchases.

Equity:

- Owner’s Equity: Capital invested by owners or shareholders.

- Retained Earnings: Accumulated profits reinvested into the venue.

Balance Sheet Equation:

- Assets = Liabilities + Equity.

Key Metrics and Ratios

To measure the performance and profitability of your event venue:

- Revenue per Event Type: Track the percentage of revenue from birthdays, weddings, corporate events, and music nights.

- Gross Margin: (Revenue – Cost of Services) / Revenue.

- Profit Margin: Net Profit / Total Revenue.

- Utilization Rate: (Number of Events Booked / Total Available Event Slots) x 100%.

- Break-Even Analysis: Fixed Costs / (Average Event Price – Variable Costs per Event).

- Deferred Revenue Ratio: Deferred Revenue / Total Liabilities (high deferred revenue suggests healthy bookings).

- Customer Acquisition Cost (CAC): Total Marketing Costs / Number of New Clients.

Conclusion

This financial model offers a comprehensive structure to manage the event venue’s profitability, cash flow, and long-term sustainability. With subscription packages for Birthday Parties, Corporate Events, Weddings, and Music Events, the venue can stabilize revenue while increasing operational efficiency. Monitoring key metrics ensures healthy growth and liquidity for ongoing operations.

Download Link On Next Page