Electronics Manufacturer Financial Model

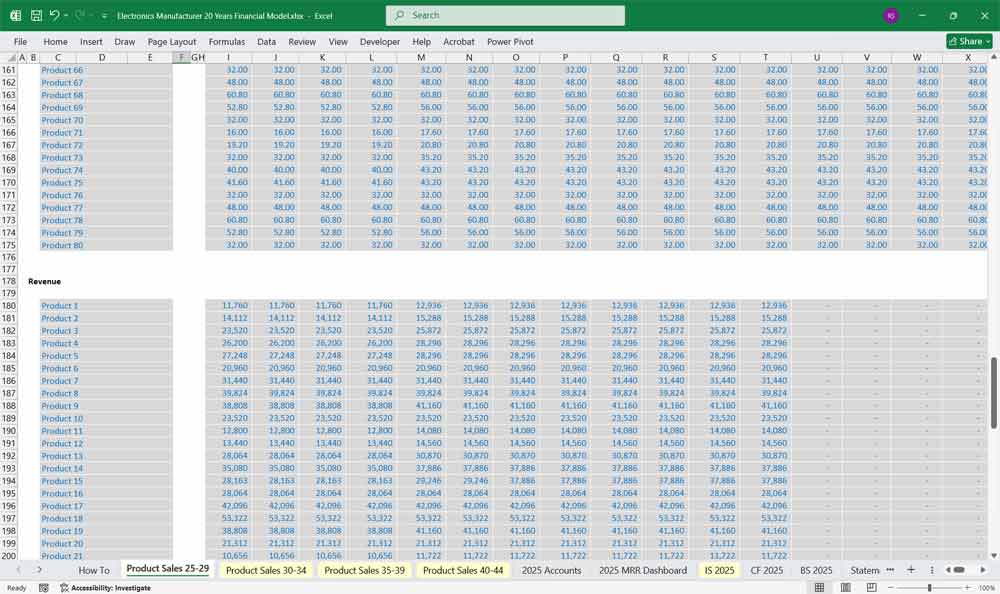

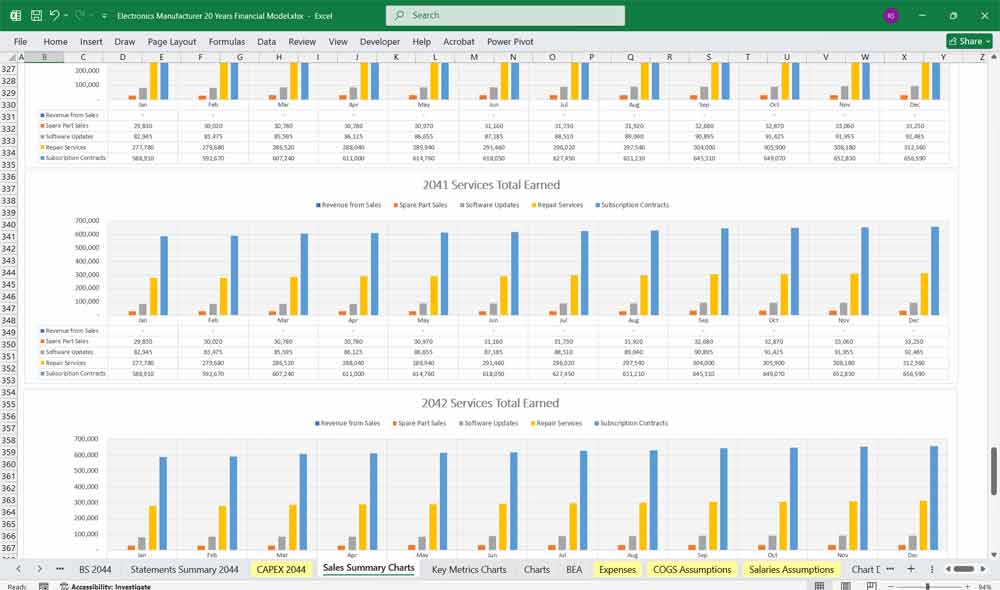

This 20-Year, 3-Statement Excel Electronics Manufacturer Financial Model includes revenue streams from 80 product lines and subscription services, expenditure structures, and financial statements to forecast the financial health of your Electronics Manufacturing.

Financial Model for an Electronics Manufacturer

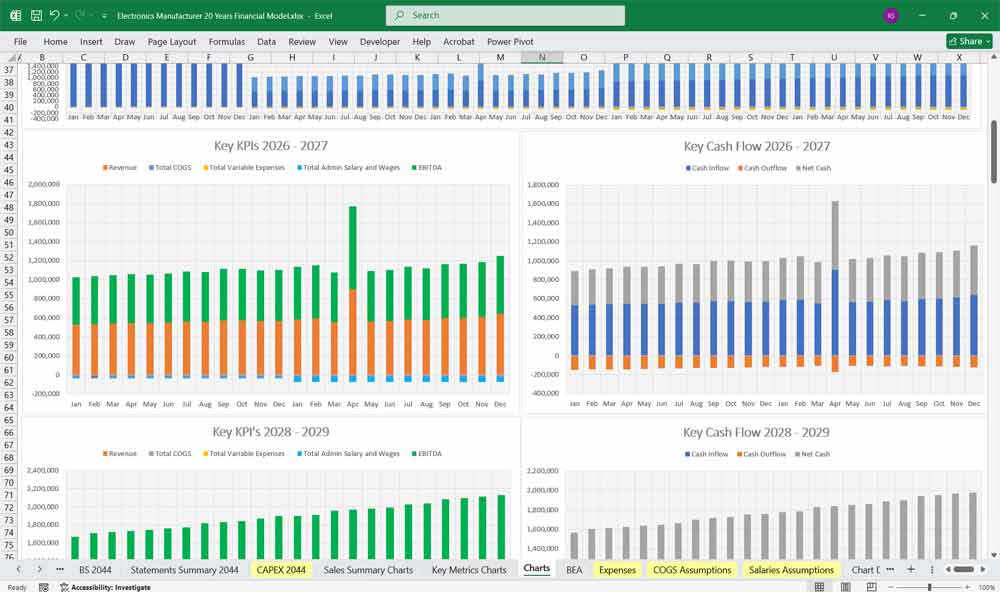

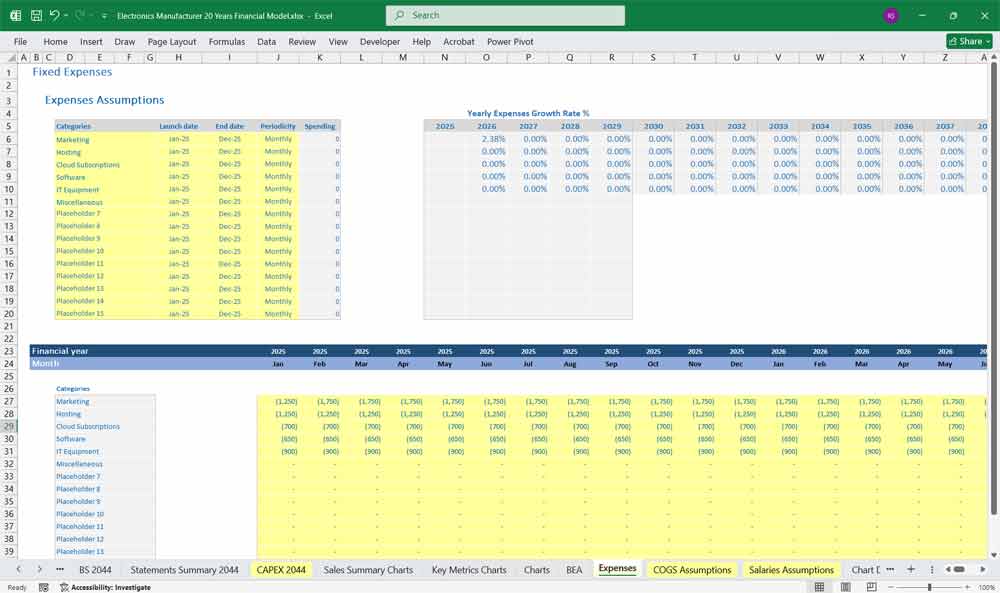

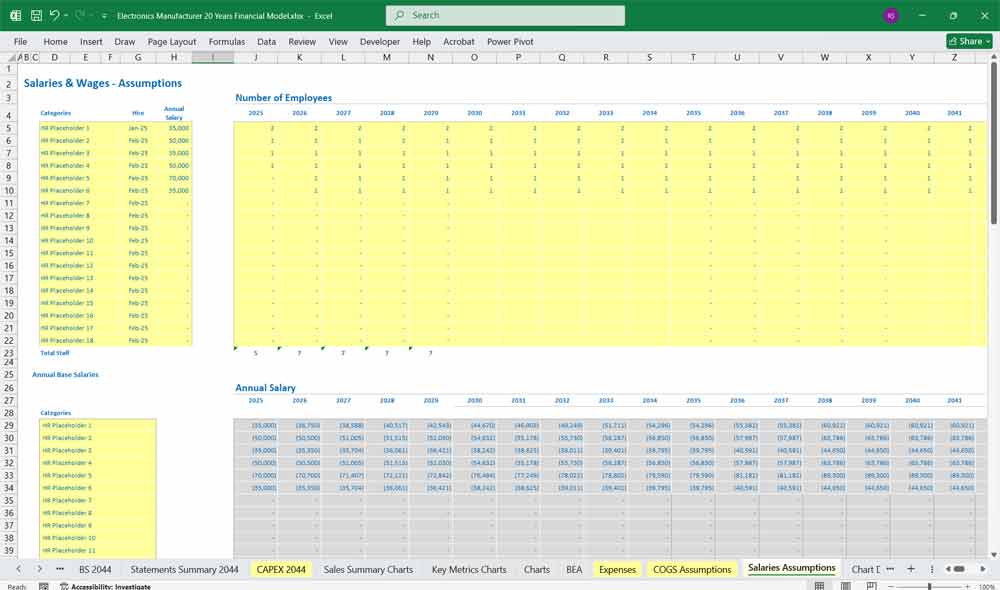

This very extensive 20-Year 140-tab Excel Workbook involves detailed revenue projections, cost structures, capital expenditures, and financing needs. Provides a thorough understanding of the financial viability, profitability, and cash flow. Including: 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX tables, 80 product line statement summaries, and revenue forecasting charts with the specified revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets.

Revenue Drivers

Electronic Units Sold: Breakdown by product category (e.g., consumer electronics, industrial equipment, IoT devices).

Average Selling Price (ASP): Price per unit, adjusted for discounts and bulk sales.

Growth Rate: Year-over-year (YoY) revenue increase based on market trends.

Cost Drivers

Cost of Goods Sold (COGS): Typically 60-70% of revenue, covering raw materials (semiconductors, metals, plastics), labor, and manufacturing overhead.

Operating Expenses:

R&D: 5-10% of revenue for product innovation.

Sales & Marketing: 8-12% of revenue for promotions and distribution.

General & Administrative (G&A): Fixed costs (salaries, rent) + variable costs (~2% of revenue).

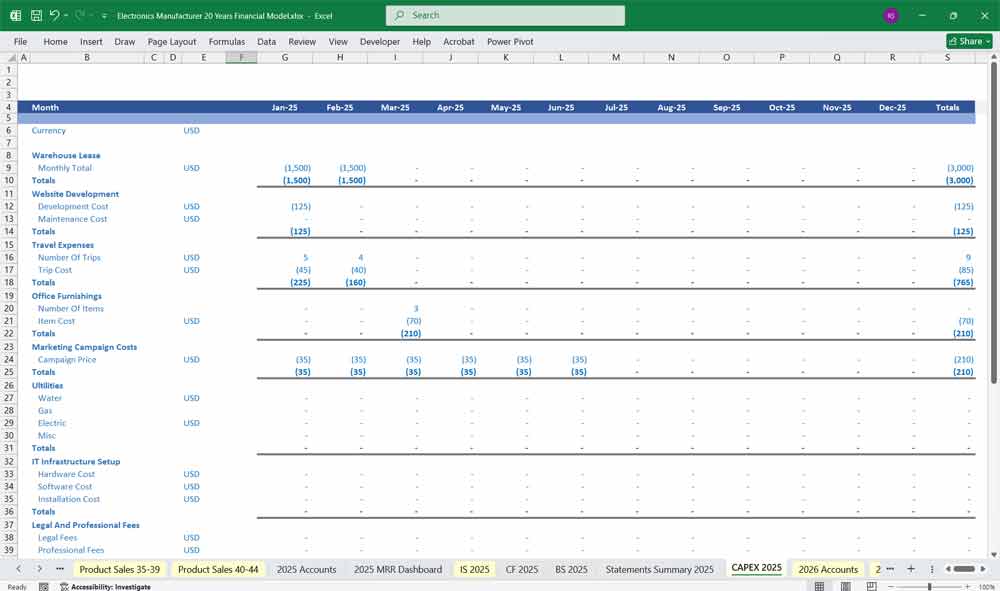

Capital Expenditures (CapEx)

Investments in machinery, equipment, and facility upgrades.

Depreciation: Straight-line method over 5-10 years.

Working Capital

Inventory Days: 60-90 days (time to sell inventory).

Accounts Receivable (AR) Days: 30-60 days (time to collect payments).

Accounts Payable (AP) Days: 30-45 days (time to pay suppliers).

Financing

Debt: Interest rate, repayment schedule.

Equity: Issuance of new shares or dividend payouts.

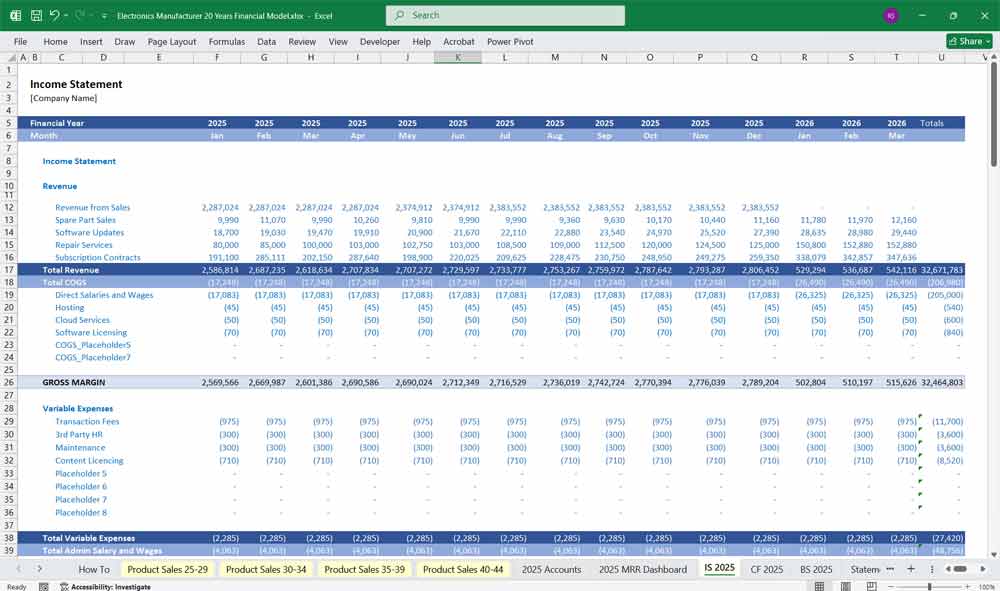

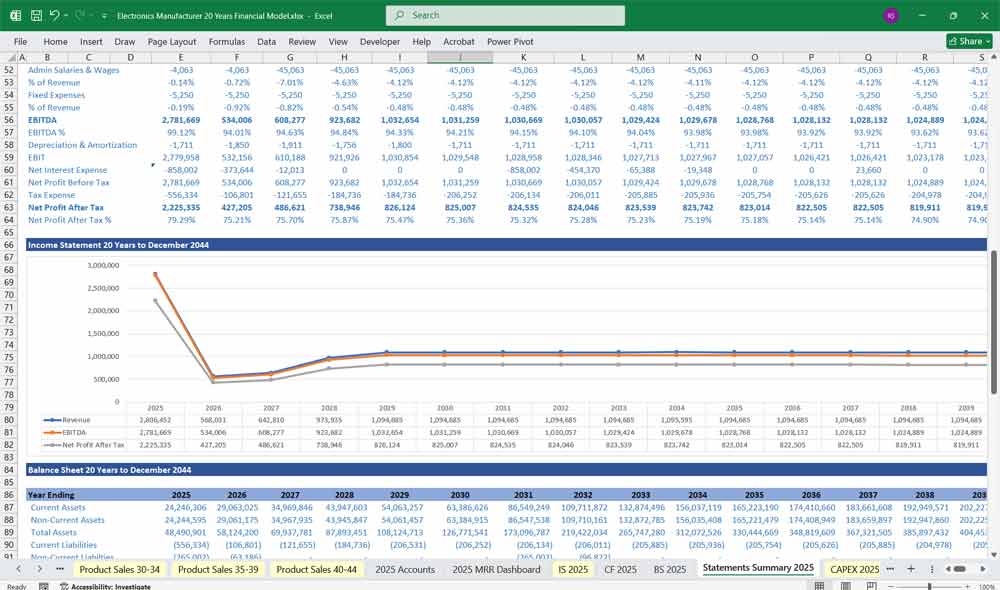

Income Statement (Profit & Loss – P&L)

The Income Statement shows profitability over a period (monthly/quarterly/annually).

Revenue

Total sales from electronics products, calculated as Units Sold × ASP.

Cost of Goods Sold (COGS)

Direct production costs, typically 65% of Revenue.

Gross Profit

Revenue – COGS.

Operating Expenses

R&D: 7% of Revenue.

Sales & Marketing: 10% of Revenue.

G&A: Fixed costs + 2% of Revenue.

EBITDA (Earnings Before Interest, Taxes, Depreciation, Amortization)

Gross Profit – Operating Expenses.

Depreciation & Amortization

Allocation of CapEx over useful life (e.g., machinery cost spread over 5 years).

EBIT (Operating Income)

EBITDA – Depreciation & Amortization.

Interest Expense

Cost of debt financing: Outstanding Debt × Interest Rate.

Pre-Tax Income (EBT)

EBIT – Interest Expense.

Income Tax Expense

Corporate tax (e.g., 25% of EBT).

Net Income

Final profit after all expenses: EBT – Taxes.

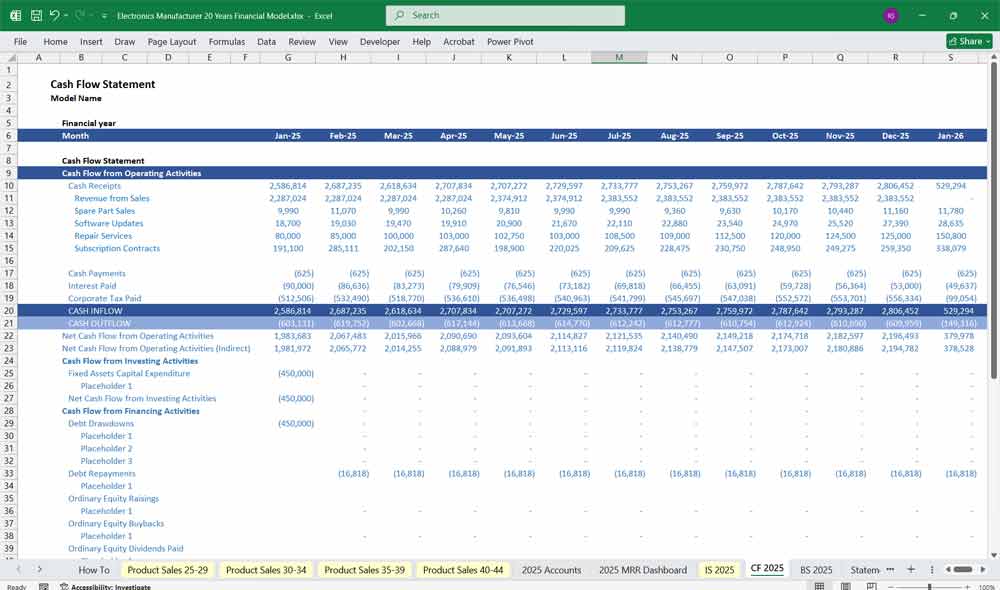

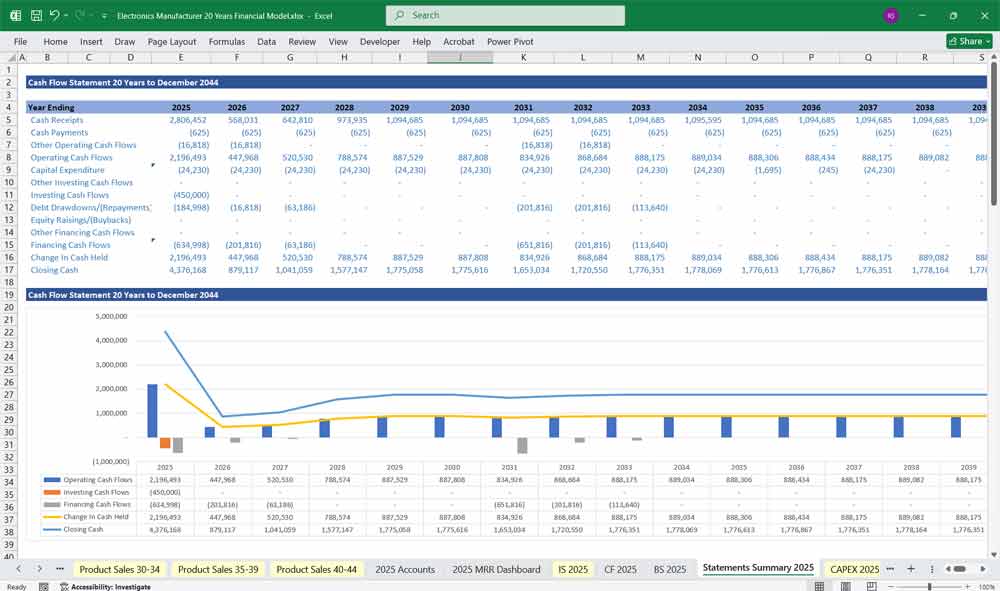

Electronics manufacturer Cash Flow Statement

Tracks cash inflows and outflows across Operating, Investing, and Financing Activities.

Operating Activities

Net Income: From the Income Statement.

Add Back Depreciation & Amortization: Non-cash expense.

Changes in Working Capital:

Accounts Receivable: Increase = cash outflow, decrease = cash inflow.

Inventory: Increase = cash outflow, decrease = cash inflow.

Accounts Payable: Increase = cash inflow, decrease = cash outflow.

Investing Activities

Capital Expenditures (CapEx): Cash spent on machinery, equipment.

Asset Sales: Cash received from selling old equipment.

Financing Activities

Debt Issuance/Repayment: New loans or repayments.

Equity Issuance/Dividends: Shareholder investments or payouts.

Net Cash Flow

Sum of Operating + Investing + Financing Cash Flow.

Ending Cash Balance

Beginning Cash + Net Cash Flow (used in the Balance Sheet).

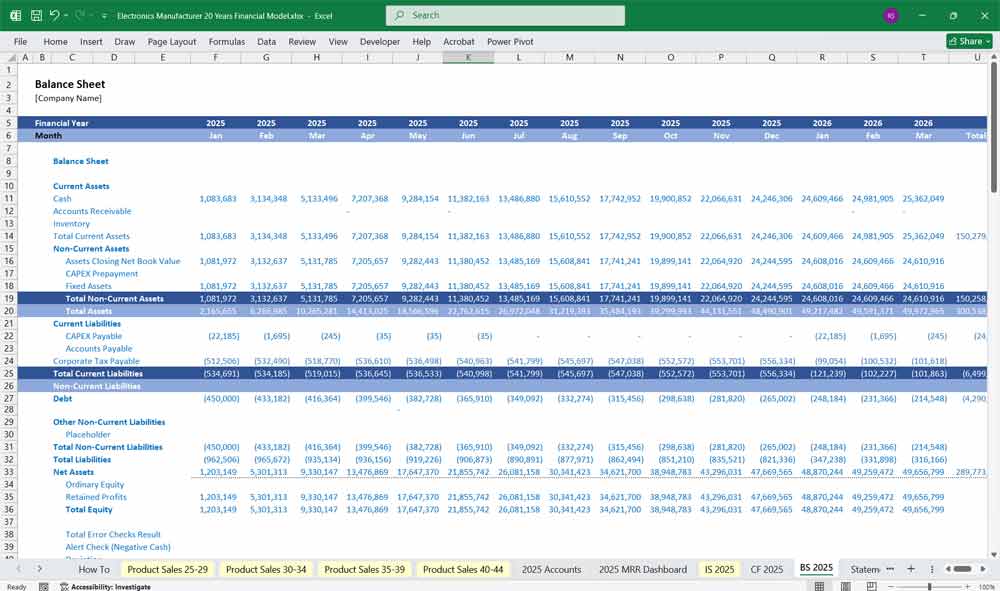

Electronics Manufacturer Balance Sheet

A snapshot of the company’s financial position (Assets = Liabilities + Equity).

Assets

Current Assets

Cash & Equivalents: From Cash Flow Statement.

Accounts Receivable: Revenue × (AR Days / 365).

Inventory: COGS × (Inventory Days / 365).

Non-Current Assets

Property, Plant, Equipment (PP&E): Net of depreciation (Prior PP&E + CapEx – Depreciation).

Liabilities & Equity

Current Liabilities

Accounts Payable: COGS × (AP Days / 365).

Short-Term Debt: Debt due within a year.

Non-Current Liabilities

Long-Term Debt: Loans due beyond a year.

Shareholders’ Equity

Common Stock: Initial equity + new issuances.

Retained Earnings: Prior RE + Net Income – Dividends.

Total Liabilities & Equity

Must equal Total Assets.

Key Financial Metrics

Gross Margin: Gross Profit / Revenue.

Operating Margin: EBIT / Revenue.

Net Profit Margin: Net Income / Revenue.

Current Ratio: Current Assets / Current Liabilities.

Debt-to-Equity (D/E): Total Debt / Shareholders’ Equity.

Free Cash Flow (FCF): Operating Cash Flow – CapEx.

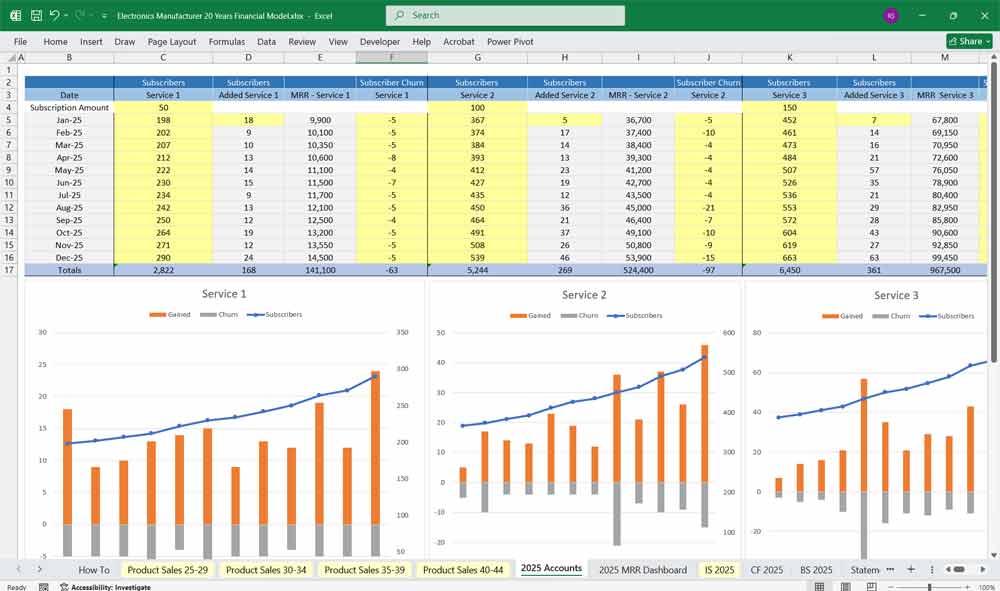

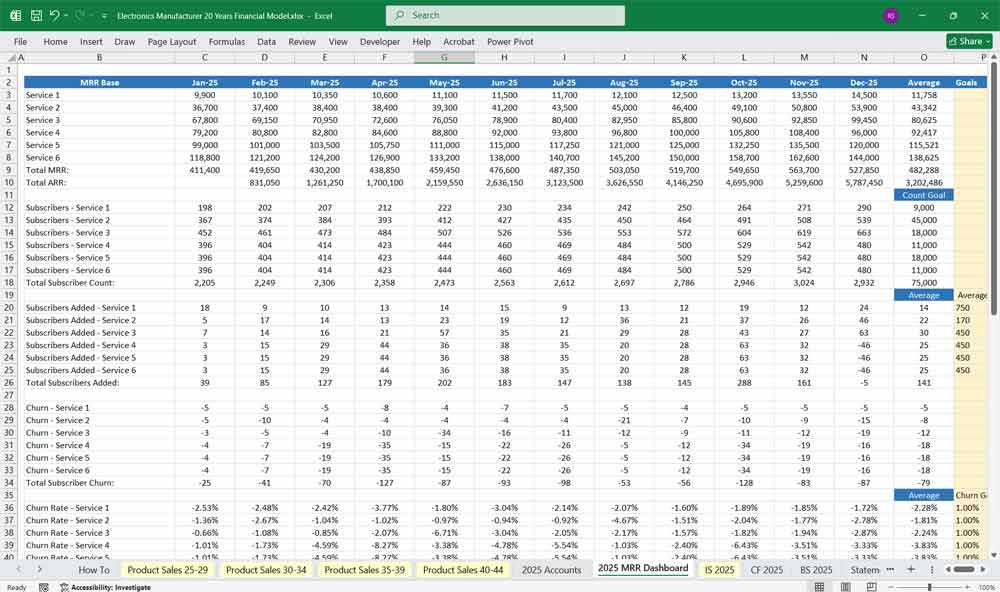

6-Tier Subscription Model for an Electronics Manufacturer

A subscription model can provide recurring revenue, enhance customer loyalty, and improve cash flow predictability. Below is a 6-tier subscription model tailored for an electronics manufacturer, with detailed pricing, features, and target customers.

1. Free Electronics Tier (Basic Access)

Target Audience: Casual users, first-time buyers, budget-conscious consumers.

Price: $0/month

Features:

Access to basic product manuals & troubleshooting guides.

Limited warranty (30 days).

Email support (48-hour response time).

Discounts on spare parts (5% off).

Early access to sales & promotions.

Upsell Opportunity: Encourage upgrades to premium tiers for better support and perks.

2. Standard Electronics Tier (Essential Support)

Target Audience: Regular consumers, small businesses.

Price: $9.99/month

Features:

Extended warranty (1 year).

Priority email & chat support (24-hour response).

Free firmware updates.

Discounts on accessories (10% off).

Exclusive member-only deals.

Basic device diagnostics via app.

Value Proposition: Affordable protection and faster support for frequent users.

3. Pro Electronics Tier (Enhanced Services)

Target Audience: Tech enthusiasts, freelancers, SMEs.

Price: $24.99/month

Features:

Extended warranty (2 years).

24/7 phone & live chat support.

On-demand remote technical assistance.

Free battery replacement (once per year).

15% discount on all products & repairs.

Early access to beta firmware & new products.

Differentiator: Premium support and cost-saving perks for power users.

4. Business Tier (SME & Corporate Electronics Solutions)

Target Audience: Small & medium businesses, startups.

Price: $49.99/month (per device or bulk pricing available)

Features:

Multi-device coverage (up to 10 devices).

On-site repair service (next business day).

Dedicated account manager.

Advanced device analytics & health reports.

20% discount on bulk orders.

Loaner devices during repairs.

Why Businesses Love It: Minimizes downtime and optimizes device performance.

5. Enterprise Tier (Custom Electronics Solutions)

Target Audience: Large corporations, government agencies.

Price: Custom pricing (starts at $199/month per device)

Features:

Unlimited device coverage.

24/7 VIP support with SLA guarantees.

Custom firmware & security solutions.

Predictive maintenance & AI-driven diagnostics.

Priority hardware upgrades.

White-glove installation & training.

Key Benefit: Tailored solutions for mission-critical operations.

6. Elite Electronics Tier (Luxury & Concierge Service)

Target Audience: High-net-worth individuals, executives, luxury buyers.

Price: $499+/month

Features:

Personal tech concierge (dedicated expert).

Same-day device replacement & repair.

Custom-designed limited-edition products.

Invitations to exclusive product launches.

Complimentary premium accessories.

Global support (worldwide coverage).

Luxury Appeal: Bespoke service for elite customers who demand the best.

Key Considerations for Implementation

✅ Flexible Billing: Monthly/annual plans with discounts for long-term commitments.

✅ Tier Upgrades: Easy migration between tiers with prorated pricing.

✅ Cancellation Policy: Transparent terms with refund options.

✅ Customer Segmentation: Use analytics to recommend the best tier for each user.

1. Electronics Sales – Direct-to-Consumer (DTC) E-Commerce

Launch a branded online store with exclusive electronics models.

Offer subscription-based memberships for early access to new electronics products.

Implement flash sales & limited-time discounts to drive urgency.

Integrate AI-powered product recommendations.

Provide bundled deals (e.g., phone + accessories at a discount).

2. Electronics Sales – Retail Partnerships

Expand shelf space in big-box retailers (Best Buy, Walmart).

Negotiate consignment deals to reduce inventory risk.

Train retail staff to upsell higher-margin electronics products.

Offer retailer-exclusive SKUs to avoid price wars.

Use POP (point-of-purchase) displays to boost visibility.

3. Electronics Sales – B2B Bulk Sales

Target corporate clients for bulk laptop/phone purchases.

Offer leasing/financing options for businesses.

Provide white-labeling for enterprise electronics customers.

Bundle IT support services with hardware sales.

Pitch government/education sector contracts.

4. Electronics Sales – Subscription Hardware Models (See Above)

“Phone-as-a-Service” with monthly rental plans.

Upgrade cycles (e.g., new device every 12/24 months).

Tiered pricing (basic, premium, enterprise hardware tiers).

Add-ons like insurance, cloud storage, or premium electronics support.

Partner with telecoms for bundled connectivity plans.

5. Electronics Sales – Refurbished/Pre-Owned Market

Certified refurbished program with warranty guarantees for your electronics products.

Trade-in incentives for old electronics devices.

Sell renewed units on Amazon Renewed/eBay.

Partner with eco-conscious brands for recycling campaigns.

Offer discounts on accessories with refurbished electronics purchases.

6. Electronics Sales – Licensing & White-Labeling

License proprietary tech to other electronics manufacturers.

Sell OEM electronics components (e.g., screens, batteries) to competitors.

White-label manufacturing for startups/private labels.

Offer firmware/software licensing for third-party devices.

Monetize patents through royalties.

7. Electronics Sales – Global Expansion

Localize products for emerging markets (e.g., budget devices for India/Africa).

Partner with regional distributors for faster market penetration and electronics sales revenue.

Offer duty-free/tax-free deals in export-heavy regions.

Adapt to regional compliance standards (CE, FCC, BIS).

Use localized marketing (e.g., TikTok for Asia, WhatsApp for LatAm).

8. Electronics Sales – Limited Editions & Collaborations

Co-branded devices with fashion/luxury brands (e.g., Gucci smartwatch).

Gamer-edition laptops/phones with exclusive specs.

Artist-designed custom skins/covers (sold at a premium).

Collectors’ items with NFTs for authenticity.

Pop-up launch events with electronics influencer partnerships.

9. Electronics Sales – After-Sales Monetization

Sell extended warranties with accidental damage coverage for your electronics product catalogue.

Premium tech support plans (24/7 access, on-site repairs).

Accessory ecosystem (cases, chargers, smart home devices).

Software subscriptions (antivirus, cloud storage).

Paid training/webinars for advanced device usage.

10. Electronics Sales – Data & Value-Added Services

Monetize anonymized usage data (with user consent).

Offer IoT analytics for smart home/industrial clients.

Ad-supported electronics devices (e.g., cheaper tablets with ads).

AI-powered predictive maintenance services.

B2B SaaS tools for device fleet management.

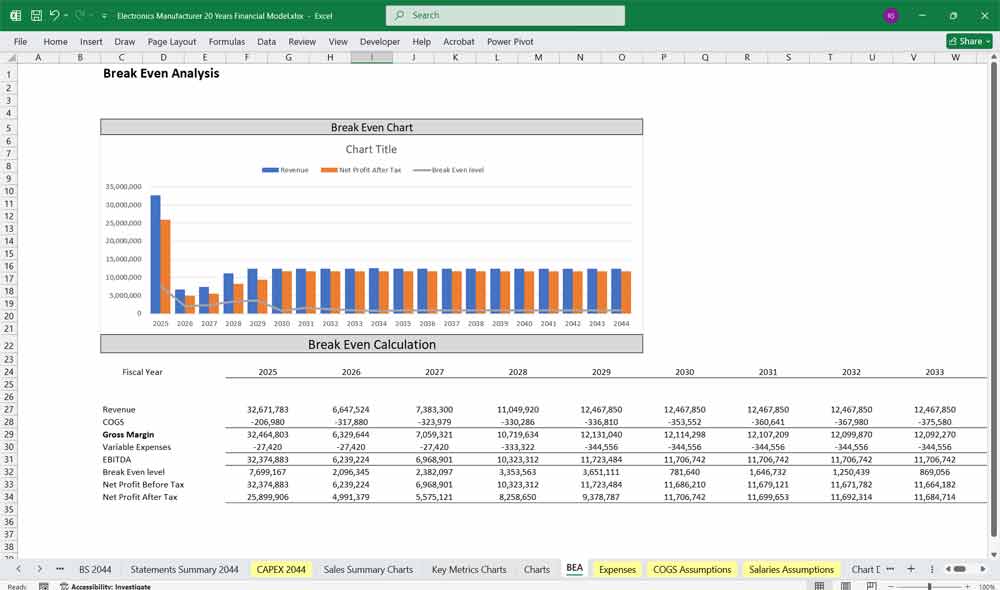

Sensitivity & Scenario Analysis

Best Case/Worst Case: Adjust revenue growth, COGS %, and OpEx to test profitability.

Break-even Analysis: Determine minimum sales volume to cover costs.

This model is built in Excel with dynamic formulas linking all three statements:

Net Income flows into Retained Earnings (Balance Sheet) and Cash Flow.

CapEx affects PP&E (Balance Sheet) and Depreciation (Income Statement).

Debt impacts Interest Expense (Income Statement) and Cash Flow.

Final Notes on the Financial Model

This 20-Year Electronics Manufacturer Financial Model must focus on balancing capital expenditures with steady revenue growth from diversified product lines. Be sure to optimise operational costs, power efficiency, and maximise high-margin products, this model ensures sustainable profitability and cash flow stability.

Download Link On Next Page