Electrical Equipment Manufacturer Financial Model

Here’s a comprehensive breakdown of the Excel template for an Electrical Equipment Manufacturer Financial Model, covering the Income Statement, Cash Flow Statement, and Balance Sheet. With revenues from 80 product lines and a Subscription Add-On. Cost structures and financial model statements to forecast the financial health of your electrical product manufacturing.

Financial Model for an Electrical Equipment Manufacturer

20 Year 3 Statement covering key components such as the Income Statement, Cash Flow Statement, and Balance Sheet.

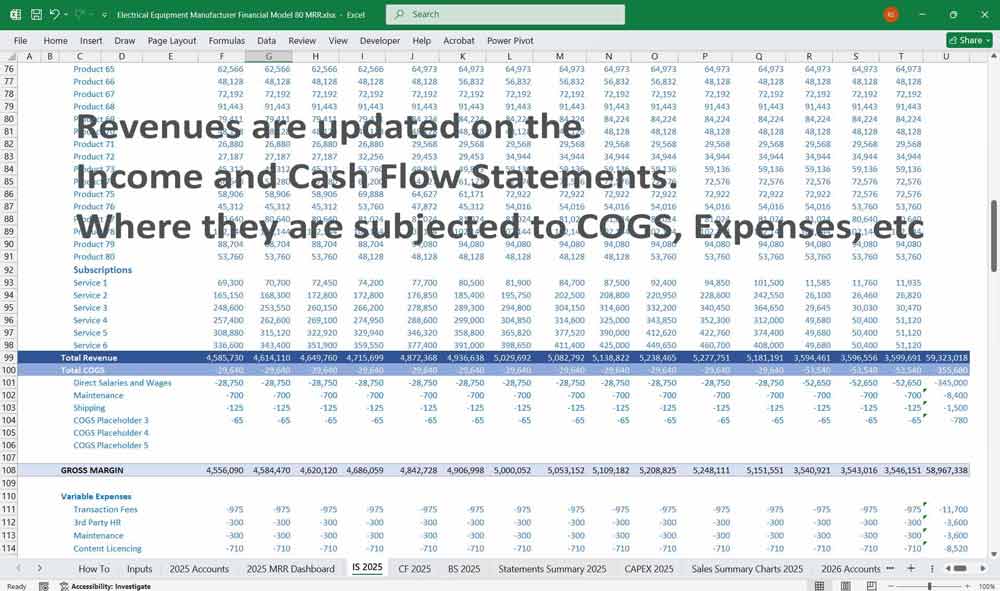

Income Statement

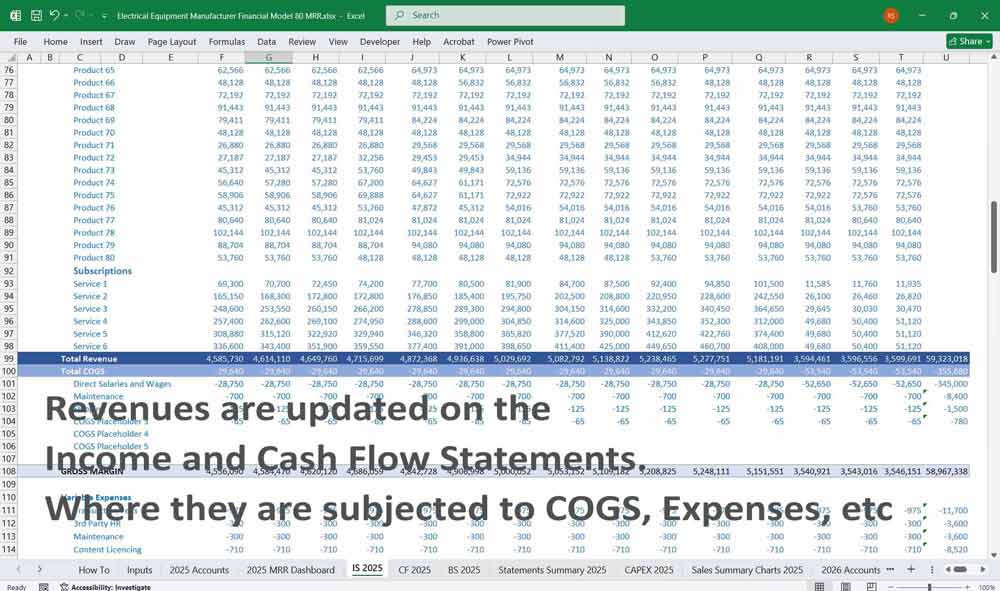

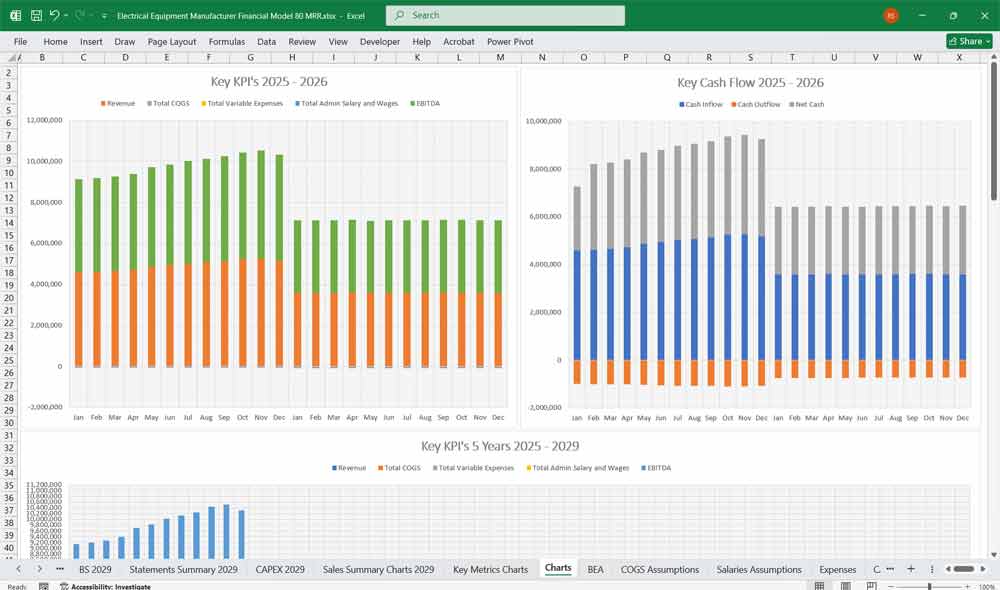

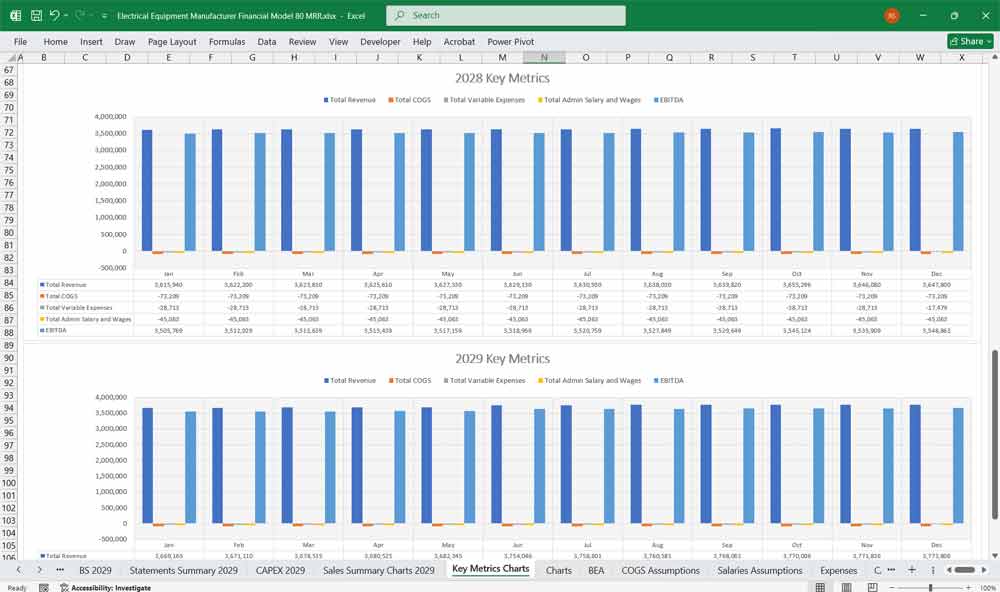

The Income Statement projects the company’s revenues, costs, and profitability over a specific period (e.g., monthly, quarterly, or annually).

Basic Product Lines

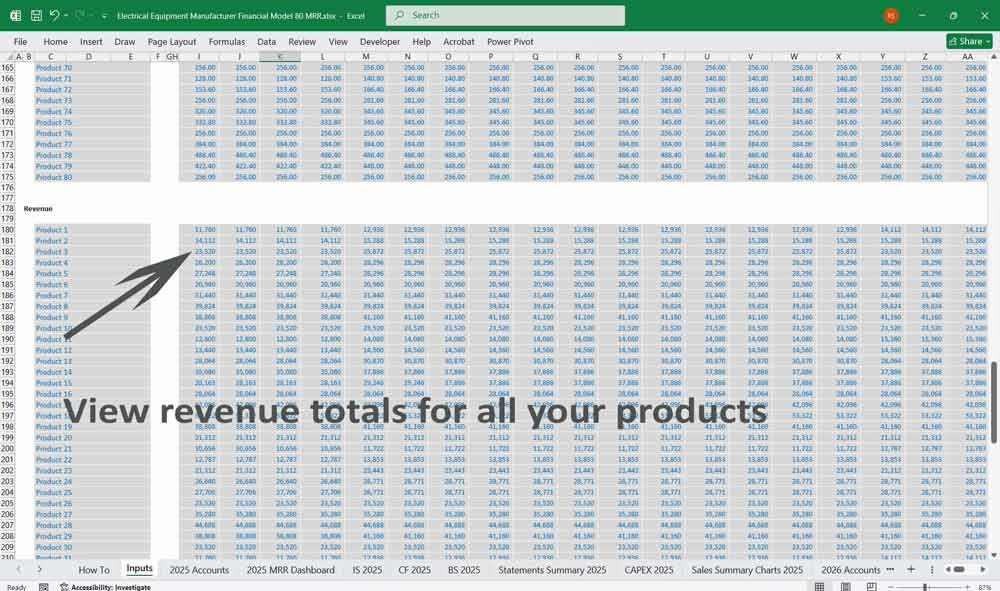

Revenue:

Sales from electronics product lines, broken down by product category (e.g., transformers, electric circuit breakers, switches).

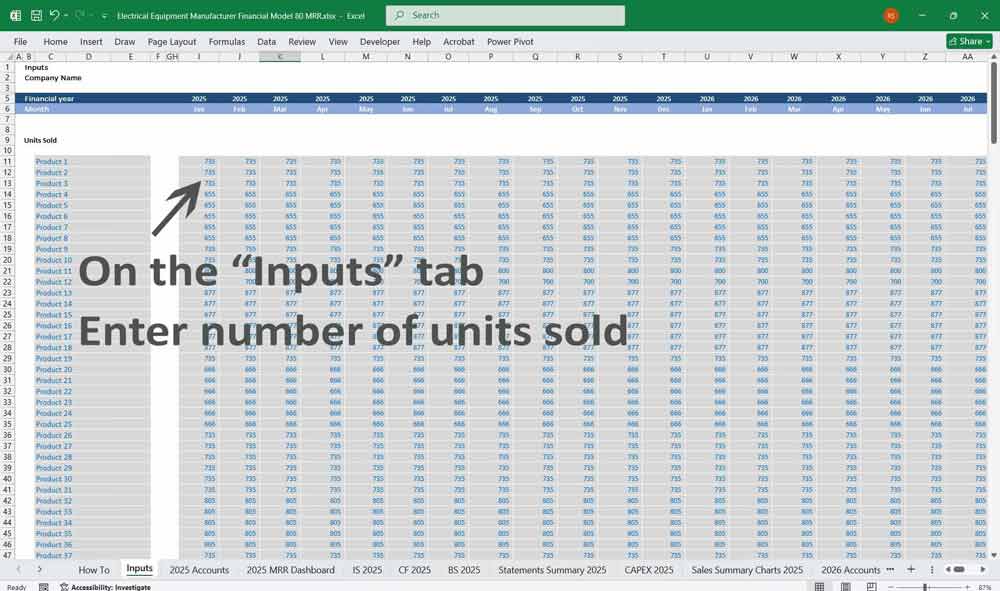

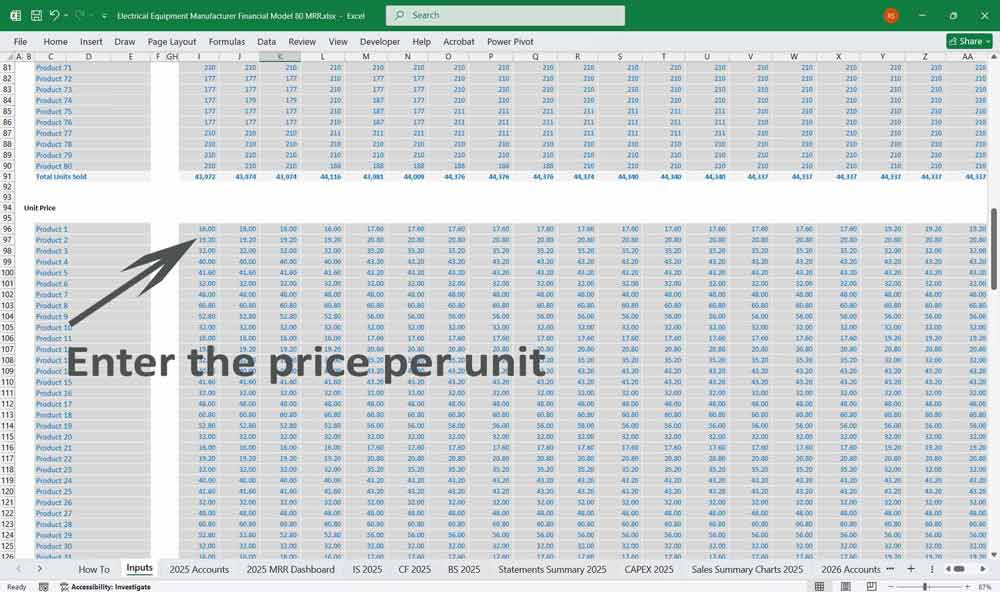

Assumptions: Unit sales volume, average selling price (ASP), and growth rate.

Cost of Goods Sold (COGS):

Direct costs associated with electrical equipment manufacturing (e.g., raw materials, labor, and overhead).

Assumptions: Cost per unit, economies of scale, and supplier pricing.

Gross Profit:

Revenue minus COGS.

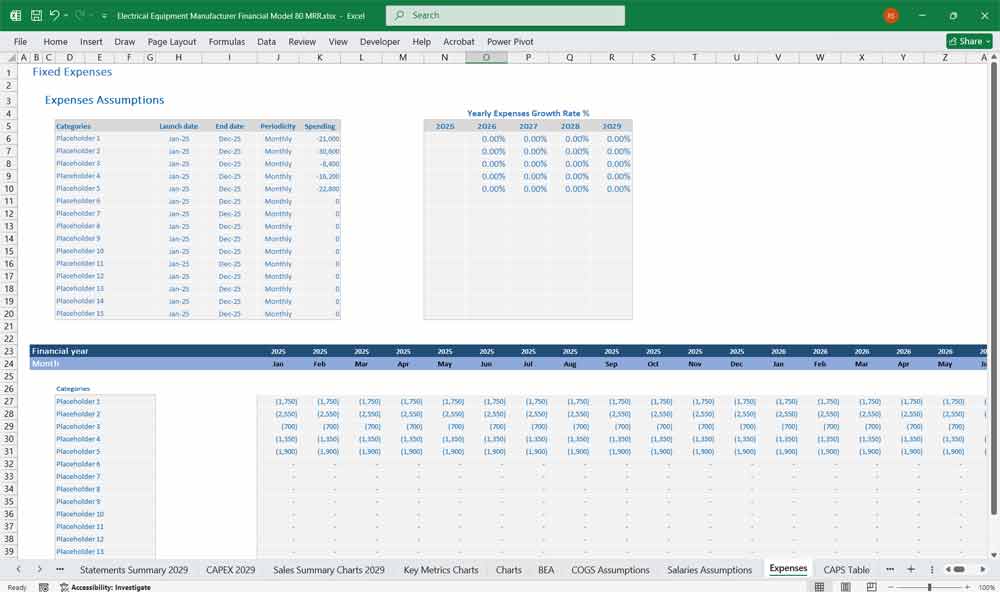

Operating Expenses:

Fixed and variable costs, including electronics R&D, marketing, sales, and administrative expenses.

Operating Income (EBIT):

Gross profit minus operating expenses.

Interest Expense:

Interest on debt (if applicable).

Net Income:

EBIT minus interest and taxes.

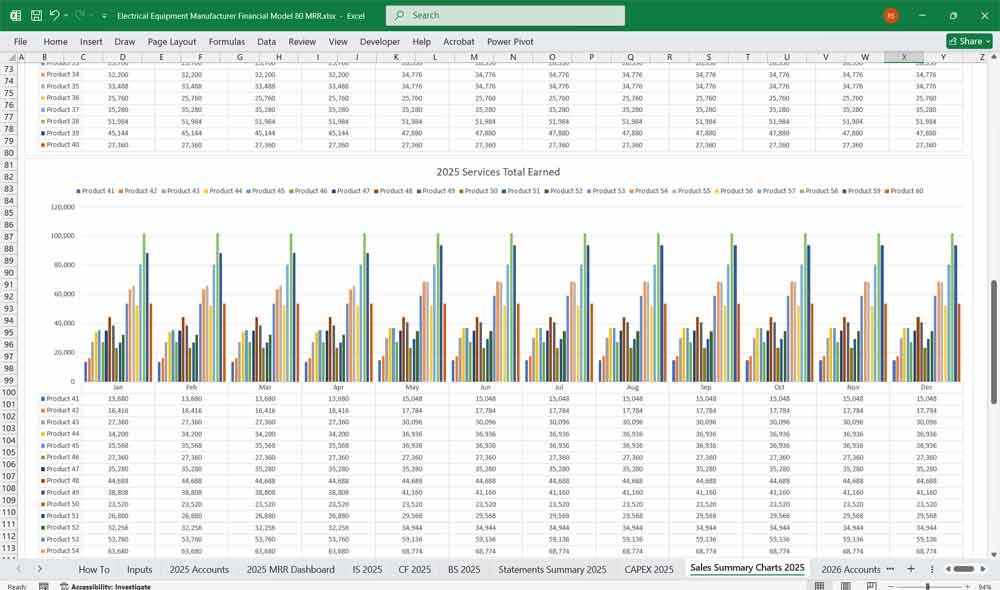

80 Product Lines

Revenue:

Sales from 80 electric product lines, including more diversification of new products.

Assumptions: Higher sales volume due to expanded product portfolio, potential cannibalization, and market penetration.

Cost of Goods Sold (COGS):

Increased COGS due to higher production volume and potential complexity in manufacturing.

Gross Profit:

Revenue minus COGS (may show economies of scale if production efficiency improves).

Operating Expenses:

Higher electronics R&D and marketing expenses to support the expanded product lines.

Operating Income (EBIT):

Gross profit minus operating expenses.

Interest Expense:

May increase if additional debt is taken to fund expansion.

Net Income:

EBIT minus interest and taxes.

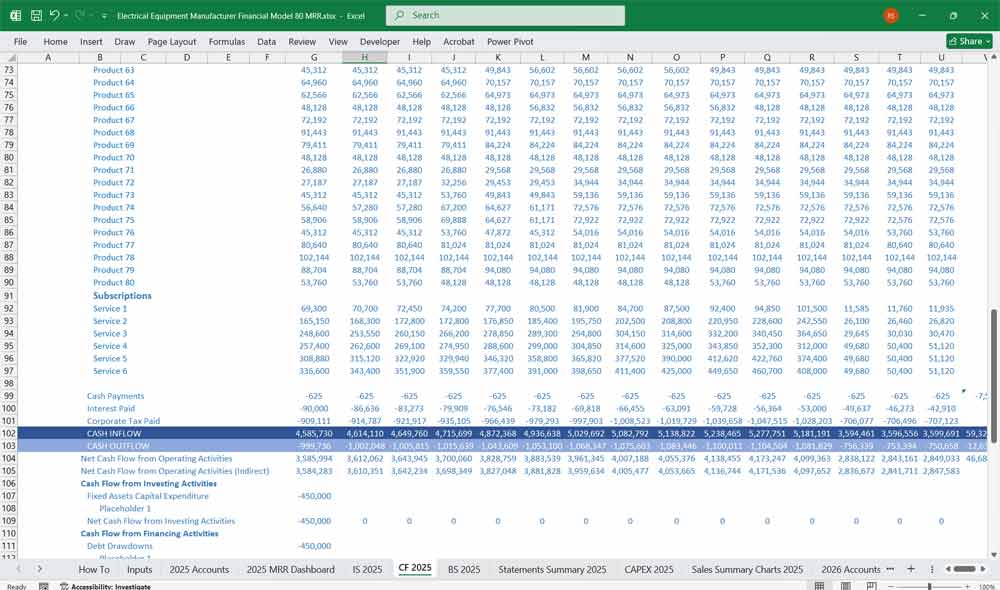

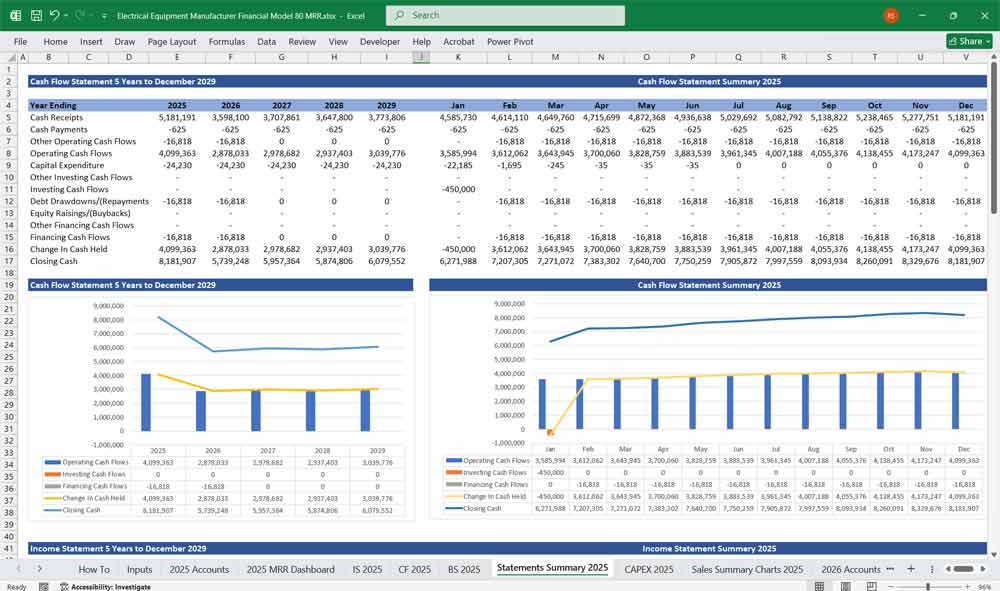

Electrical Equipment Manufacturer Cash Flow Statement

The Cash Flow Statement tracks the company’s cash inflows and outflows, divided into Operating Activities, Investing Activities, and Financing Activities.

Basic Product Lines

Operating Activities:

Cash from sales, minus cash paid for COGS, operating expenses, and taxes.

Assumptions: Payment terms for receivables and payables.

Investing Activities:

Capital expenditures (CapEx) for machinery, equipment, and facilities.

Assumptions: Depreciation schedules and maintenance costs.

Financing Activities:

Cash from debt or equity financing, minus repayments and dividends.

Net Change in Cash:

Sum of cash flows from operating, investing, and financing activities.

80 Product Lines

Operating Activities:

Higher cash inflows from increased electronics sales, offset by higher COGS and operating expenses.

Investing Activities:

Increased CapEx for additional production lines and equipment.

Financing Activities:

Potential increase in debt or equity to fund expansion.

Net Change in Cash:

May show lower cash reserves initially due to higher upfront costs.

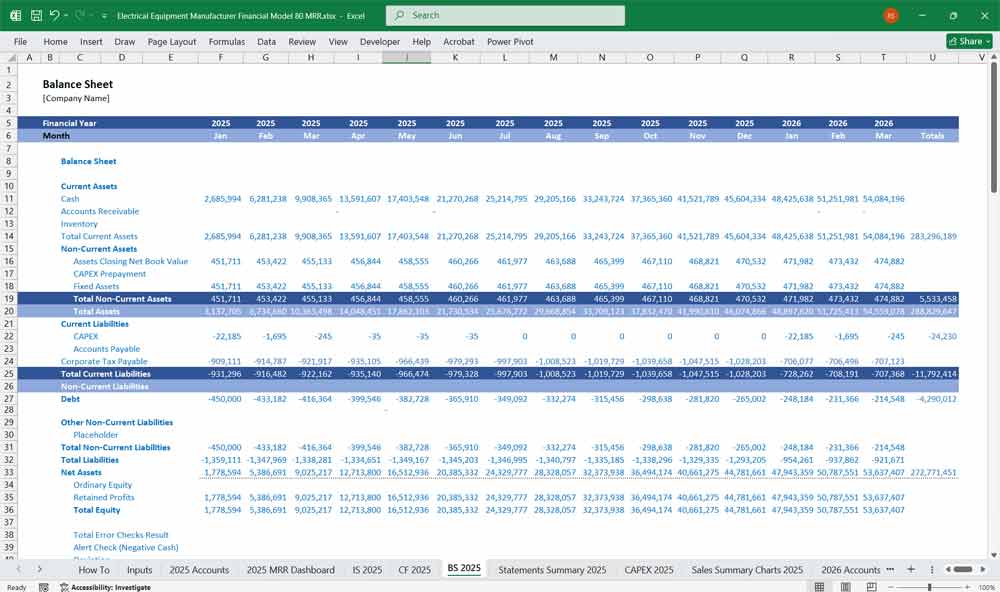

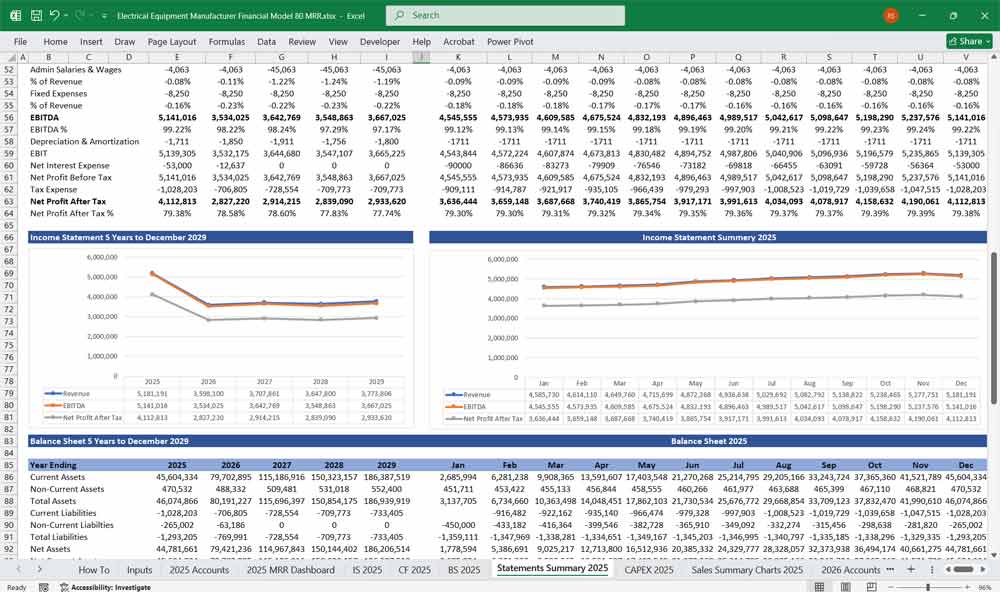

Electrical Equipment Manufacturer Balance Sheet

The Balance Sheet provides a snapshot of the company’s financial position at a specific point in time, showing Assets, Liabilities, and Equity.

Product Lines

Assets:

Current Assets: Cash, accounts receivable, inventory.

Fixed Assets: Property, plant, and equipment (PP&E), net of depreciation.

Liabilities:

Current Liabilities: Accounts payable, short-term debt.

Long-Term Liabilities: Long-term debt, deferred taxes.

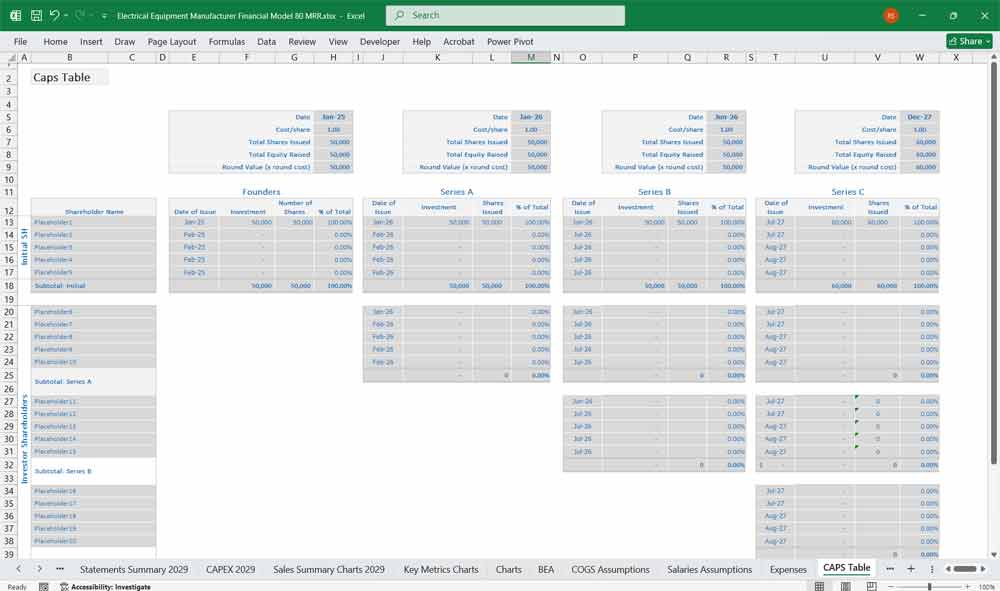

Equity:

Shareholder equity, retained earnings.

80 Product Lines

Assets:

Current Assets: Higher inventory and receivables due to increased electronics sales.

Fixed Assets: Higher PP&E due to expansion.

Liabilities:

Current Liabilities: Increased payables and short-term debt.

Long-Term Liabilities: Potential increase in long-term debt.

Equity:

Retained earnings may grow if profitability increases.

Key Assumptions and Drivers for an Electrical Equipment Manufacturer

Revenue Growth:

Market demand, pricing strategy, and product mix.

Cost Structure:

Raw material costs, labor rates, and production efficiency.

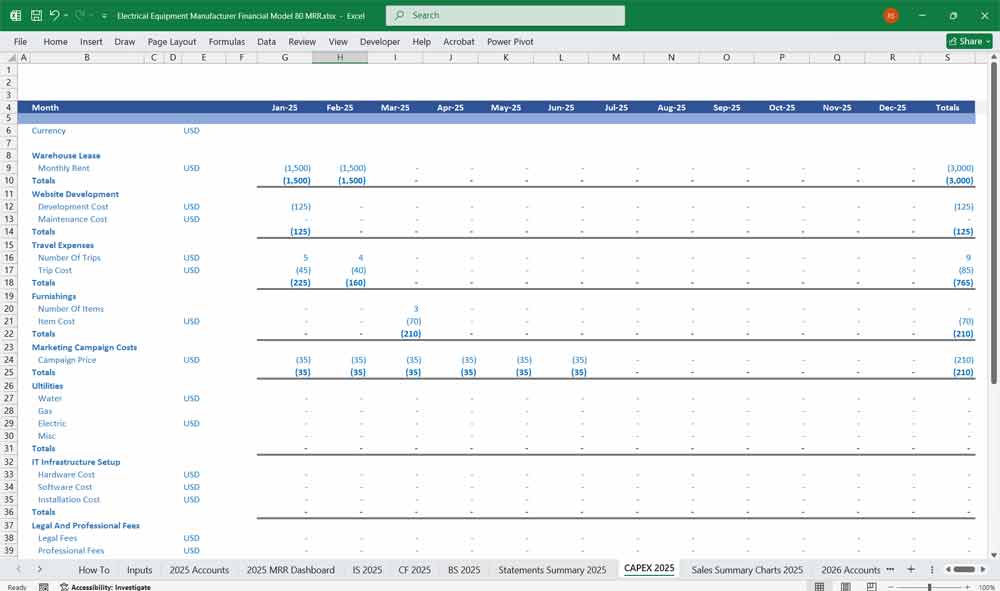

Capital Expenditures:

Investment in new machinery and facilities for expansion.

Working Capital:

Inventory turnover, receivables collection period, and payables terms.

Financing:

Debt-to-equity ratio, interest rates, and dividend policy.

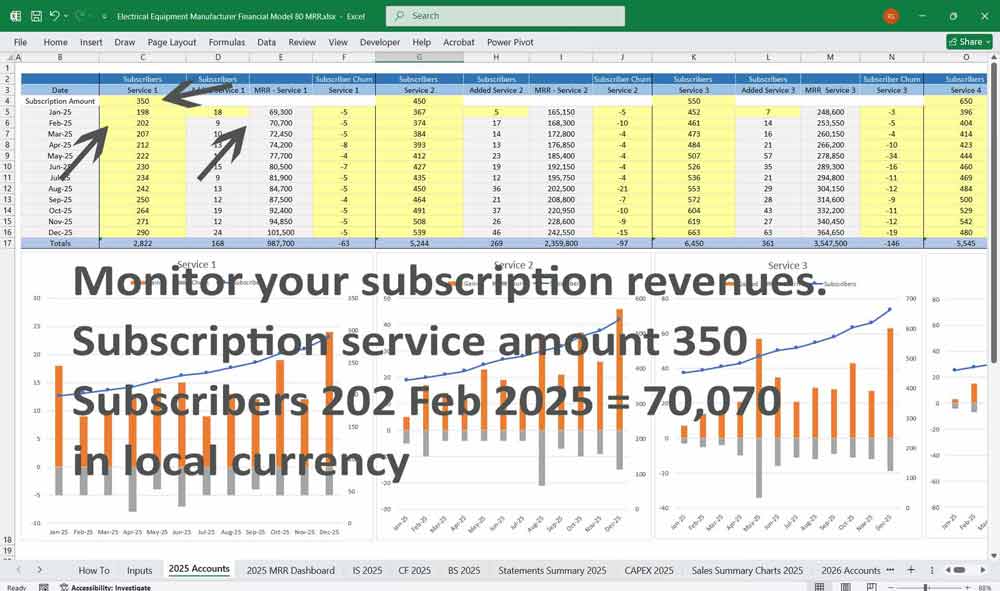

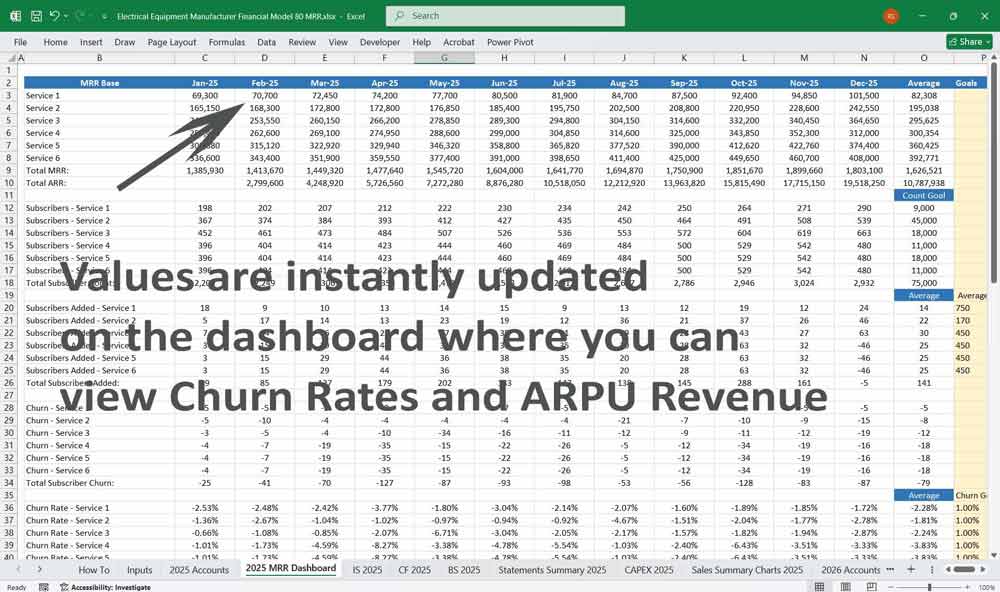

6-Tier Subscription Model for an Electrical Equipment Manufacturer

A recurring revenue business model where customers pay for access to products, services, or solutions at different levels of value. Each tier offers progressively more features, benefits, or services, catering to different customer segments.

Tier 1: Basic Electrical Equipment Access

Target Audience: Small businesses, startups, or customers with minimal needs.

Features:

Access to a limited catalog of standard electrical equipment (e.g., basic circuit breakers, switches, and connectors).

Online product documentation and user manuals.

Email support with a 48-hour response time.

Monthly product updates and safety tips.

Pricing:

Low monthly fee (e.g., $50/month).

Revenue Model:

Recurring subscription revenue from a large volume of small customers.

Value Proposition:

Affordable entry point for businesses with basic electrical equipment needs.

Tier 2: Standard Electrical Equipment Access

Target Audience: Medium-sized businesses or contractors.

Features:

Access to a broader range of products, including mid-tier equipment (e.g., energy-efficient transformers, advanced circuit breakers).

Priority email support with a 24-hour response time.

Access to basic troubleshooting guides and online training videos.

Discounts on bulk purchases (e.g., 5% off orders over $1,000).

Pricing:

Moderate monthly fee (e.g., $150/month).

Revenue Model:

Higher recurring revenue from customers needing more advanced products and support.

Value Proposition:

Enhanced product access and support for growing businesses.

Tier 3: Premium Electrical Equipment Access

Target Audience: Large businesses, industrial facilities, or advanced contractors.

Features:

Access to the full product catalog, including premium and custom equipment (e.g., high-capacity transformers, smart grid solutions).

Phone and chat support with a 12-hour response time.

Access to advanced troubleshooting tools and on-demand technical consultations.

Exclusive webinars and training sessions.

Discounts on bulk purchases (e.g., 10% off orders over $5,000).

Pricing:

Higher monthly fee (e.g., $500/month).

Revenue Model:

Significant recurring revenue from high-value customers.

Value Proposition:

Comprehensive product access and premium support for demanding applications.

Tier 4: Pro Eelectrical Equipment Access

Target Audience: Enterprises, OEMs, or system integrators.

Features:

Access to cutting-edge and custom-engineered electrical equipment.

Dedicated account manager and 24/7 priority support.

On-site technical assistance and installation support.

Customized training programs for employees.

Advanced analytics and reporting tools for equipment performance.

Discounts on bulk purchases (e.g., 15% off orders over $10,000).

Pricing:

Premium monthly fee (e.g., $1,000/month).

Revenue Model:

High-margin recurring revenue from enterprise-level customers.

Value Proposition:

Tailored solutions and white-glove service for large-scale operations.

Tier 5: Enterprise Electrical Equipment Access

Target Audience: Multinational corporations, utilities, or government entities.

Features:

Access to exclusive, high-capacity, and custom-engineered solutions (e.g., grid-scale transformers, industrial automation systems).

Dedicated engineering and design support for custom projects.

24/7 on-call technical support and emergency response.

Predictive maintenance and IoT-enabled equipment monitoring.

Customized training and certification programs.

Volume-based discounts and flexible payment terms.

Pricing:

Custom pricing based on project scope and volume.

Revenue Model:

High-value, long-term contracts with recurring and project-based revenue.

Value Proposition:

End-to-end solutions for mission-critical applications.

Tier 6: Partner Electrical Equipment Access

Target Audience: Strategic partners, distributors, or resellers.

Features:

Access to the entire electronics product catalog, including exclusive partner-only products.

Co-branding and white-labeling opportunities.

Dedicated partner support team and joint marketing initiatives.

Advanced sales and technical training for partner teams.

Access to partner portals for order tracking, inventory management, and sales analytics.

Volume-based discounts and revenue-sharing agreements.

Pricing:

Custom pricing based on partnership terms and volume commitments.

Revenue Model:

Recurring revenue from partner sales and shared profits.

Value Proposition:

Strategic collaboration to expand market reach and drive mutual growth.

Key Considerations for the 6-Tier Subscription Model

Customer Segmentation:

Clearly define the target audience for each tier to ensure alignment with customer needs.

Pricing Strategy:

Use tiered pricing to capture value at different levels while maintaining affordability for smaller customers.

Scalability:

Ensure the model can scale with customer growth and evolving needs.

Customer Retention:

Offer incentives for customers to upgrade tiers as their needs grow.

Technology Integration:

Use subscription management software to handle billing, customer onboarding, and support.

Performance Metrics:

Track metrics like customer acquisition cost (CAC), lifetime value (LTV), churn rate, and tier upgrade rates.

The 6-tier subscription model version provides a structured approach for an electrical equipment manufacturer to generate recurring revenue; it helps build customer loyalty and caters to a wider range of customer needs. Each tier is designed to deliver increasing value, ensuring that customers can find a plan that meets their requirements while driving profitability for the manufacturer.

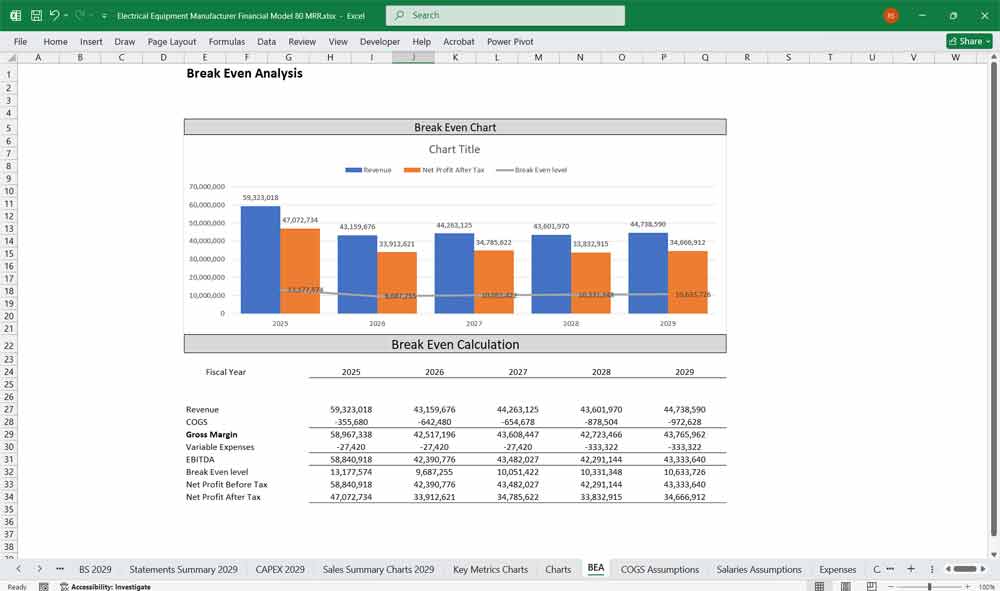

Final Notes on the Financial Model

Financial model for an Electrical Equipment Manufacturer

- Scenario Analysis: Create best-case, base-case, and worst-case projections.

- Break-even Analysis: Determine the sales volume required to cover fixed & variable costs.

- Sensitivity Analysis: Assess how changes in raw material costs, pricing, or demand impact profitability.

This structured model will help any Electrical manufacturing company address a broad market spectrum, offering the right balance between cost, production capacity, and support.

Download Link On Next Page