Desalination Plant Financial Model

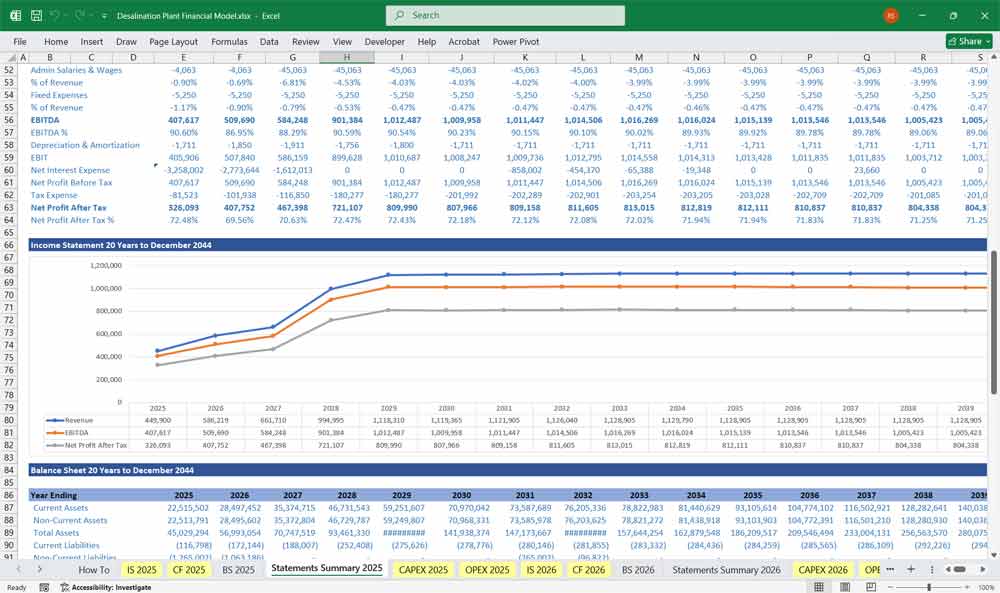

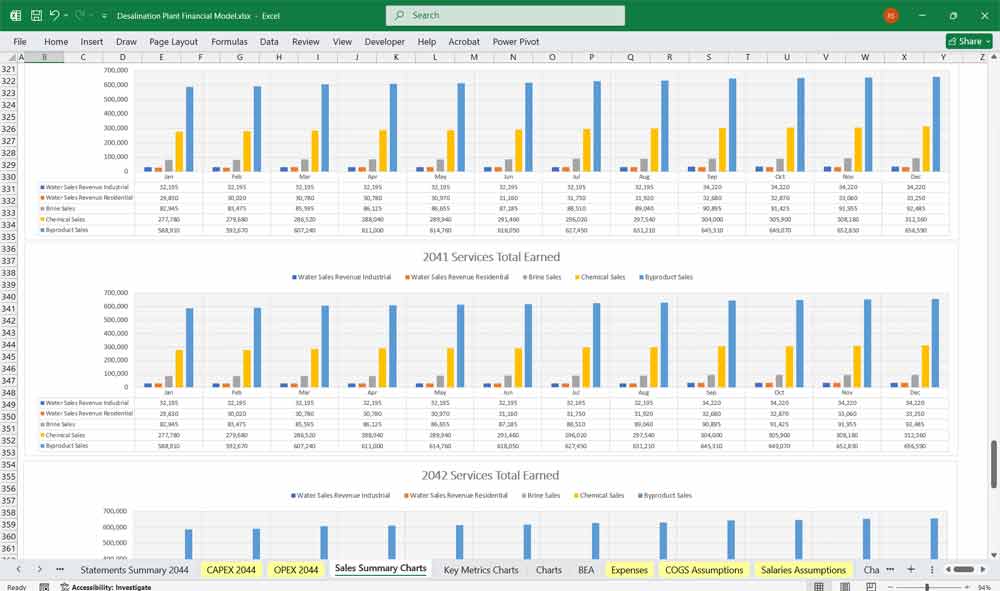

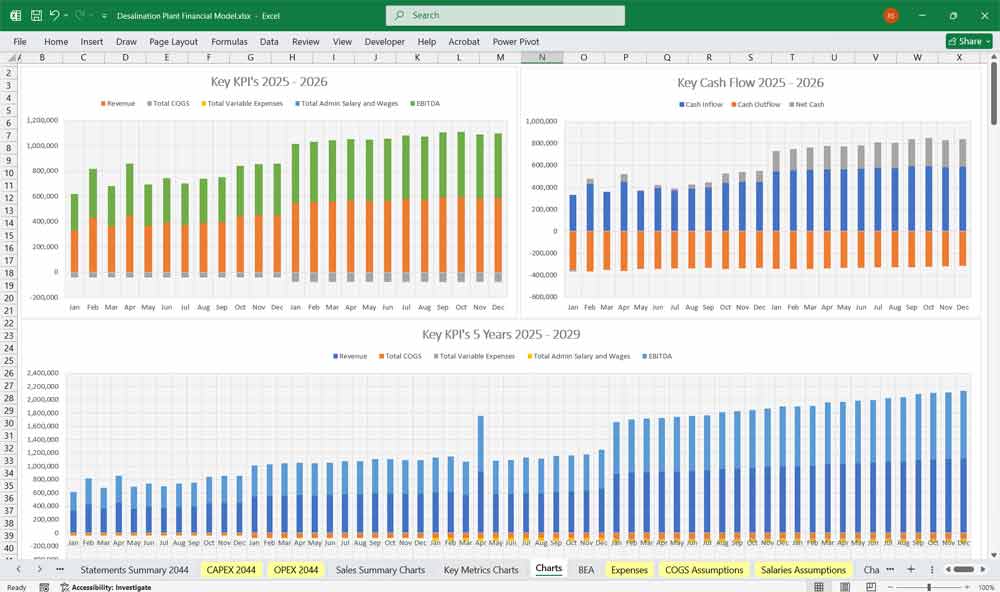

This 20-Year, 3-Statement Excel Desalination Plant Financial Model includes editable revenue streams from Residential and Industrial Water Sales, Brine, and Chemicals, as well as cost structures, Discounted Cash Flow (DCF) with Terminal Value, Sensitivity Analysis, WACC, and financial statements, to forecast the financial health of your Desalination Plant.

20-Year Financial Model for a Desalination Plant

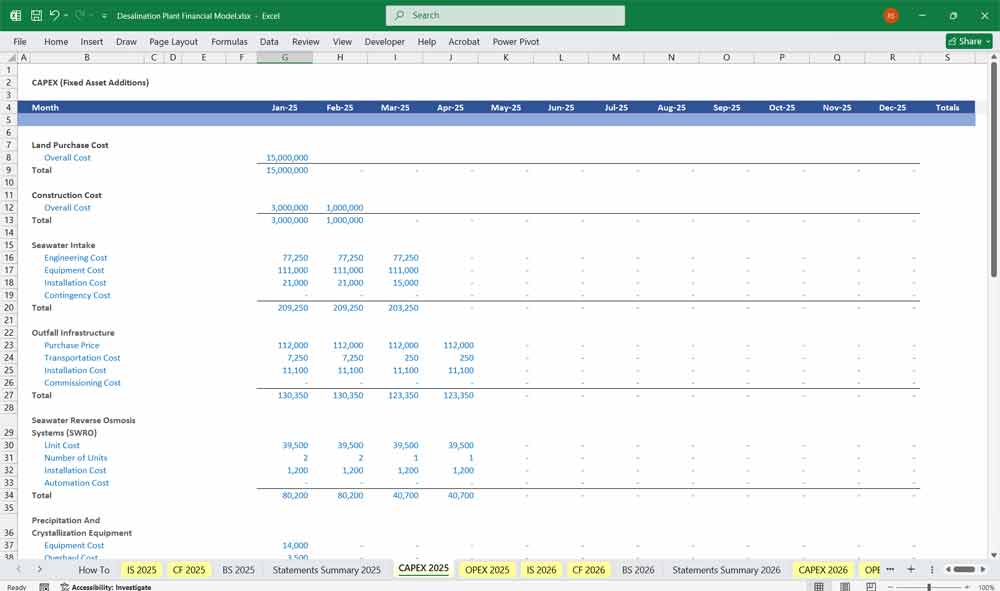

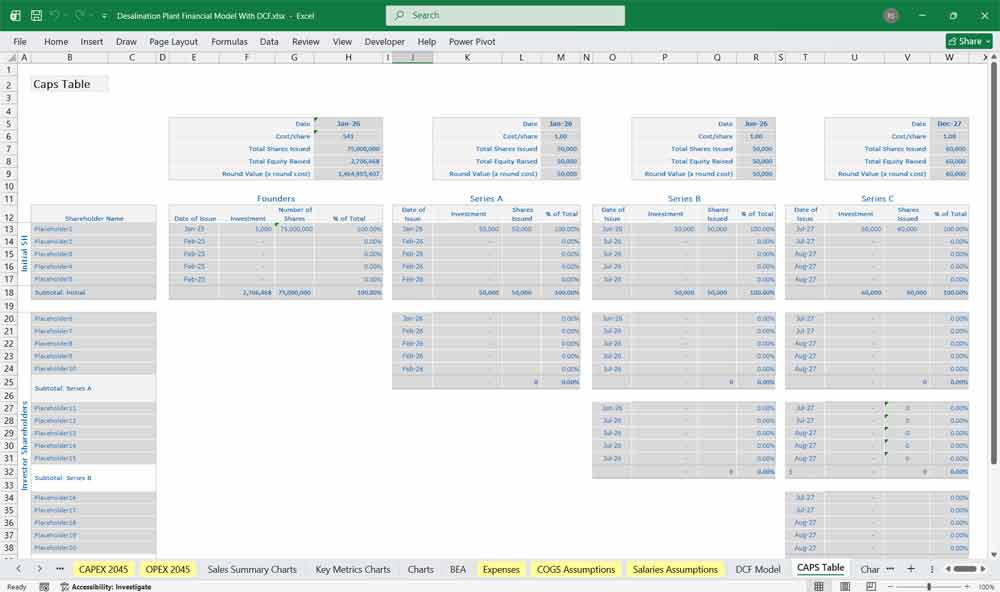

This very extensive 20 Year Desalination Plant Model involves detailed revenue projections, cost structures, capital expenditures, and financing needs. This model provides a thorough understanding of the financial viability, profitability, and cash flow position of the plant. Including: 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the specified revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets. Over 120 spreadsheets of financial data to monitor.

Revenue Streams (Editable)

A. Industrial Water Sales Revenue

Sold in bulk (e.g., per cubic meter or long-term contracts).

Revenue Calculation:

Contracted Volume (m³/year) × Price per m³

Key Assumptions:

Annual price escalation (e.g., 3%).

Take-or-pay contracts to ensure minimum revenue.

B. Residential Water Sales Revenue

Tiered pricing based on consumption levels.

Revenue Calculation:

Number of Households × Avg. Consumption (m³/month) × Price per m³ × 12

Key Assumptions:

Population growth affects demand.

Possible government-regulated pricing.

C. Brine Sales Revenue

High-salinity byproduct sold to salt/mineral companies.

Revenue Calculation:

Volume of Brine (m³/year) × Price per m³

Key Assumptions:

If not sold, disposal costs may apply.

D. Chemical Sales Revenue

Extracted chemicals (e.g., magnesium, chlorine).

Revenue Calculation:

Volume of Chemicals (tons/year) × Market Price per ton

E. Byproduct Sales Revenue

Minerals, waste heat, or other reusable materials.

Revenue Calculation:

Quantity Sold × Unit Price

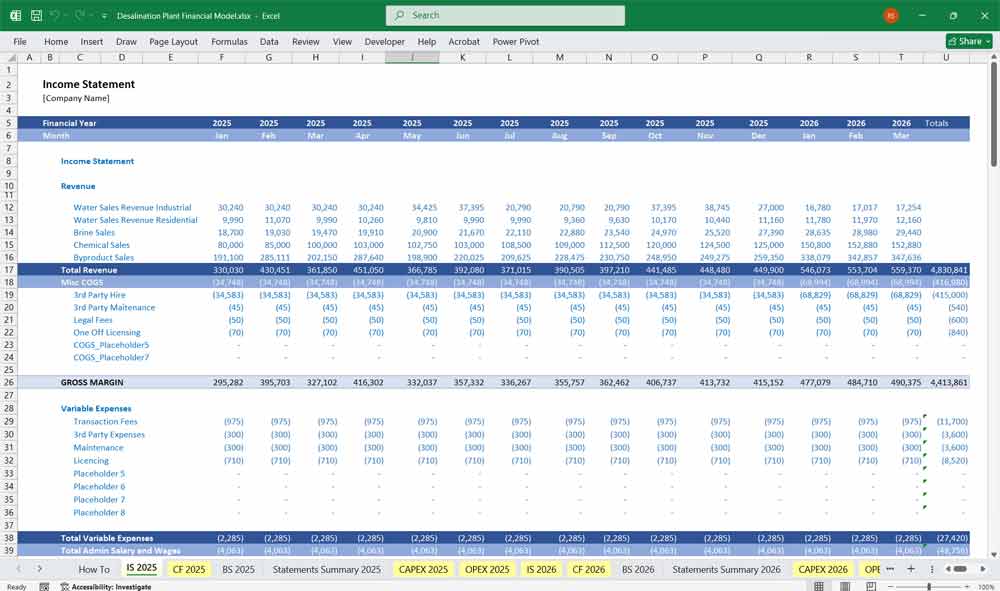

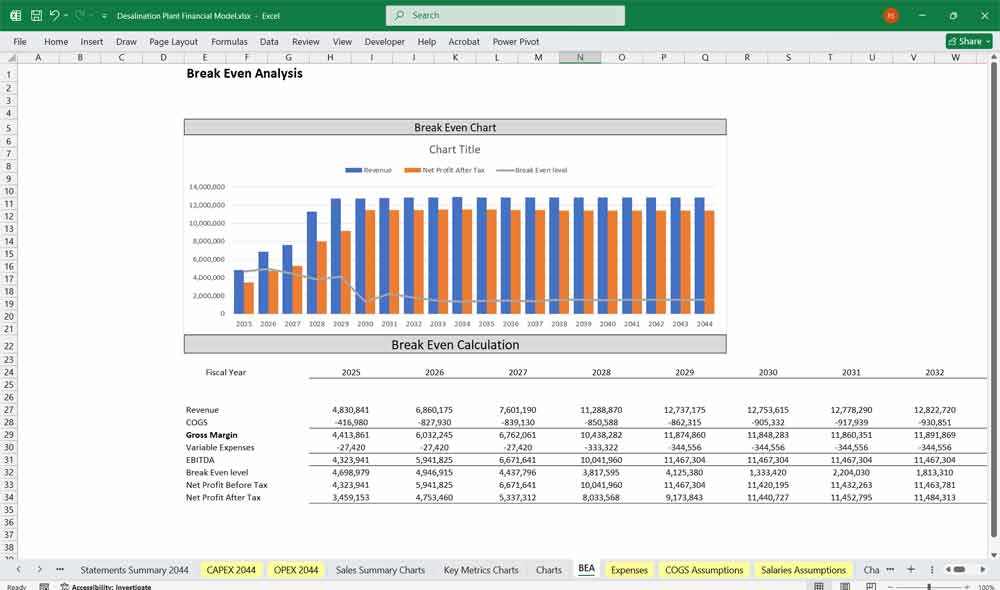

Income Statement (Profit & Loss)

Revenue

Sum of all revenue streams (Industrial, Residential, Brine, Chemicals, Byproducts).

Cost of Goods Sold (COGS)

Variable Costs:

Energy (40-60% of COGS).

Chemicals, labor, maintenance.

Gross Profit

Revenue – COGS

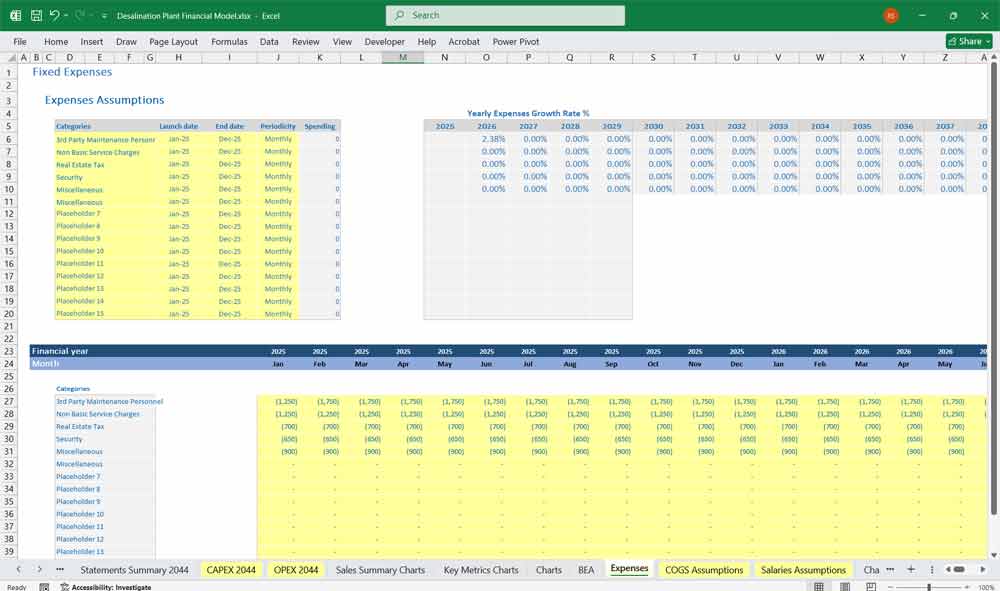

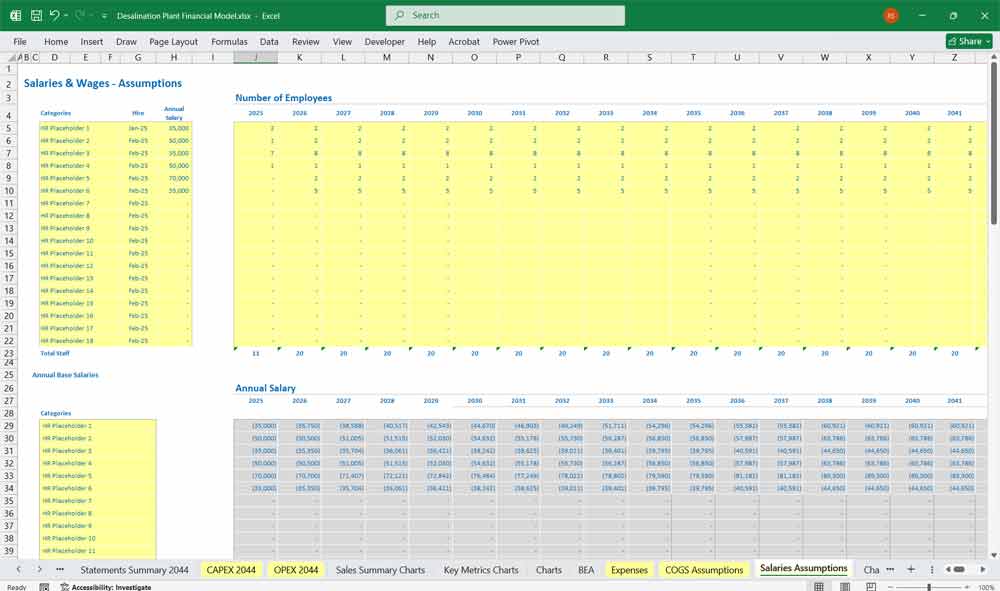

Operating Expenses (OPEX)

Fixed Costs:

Salaries, administration, permits, insurance.

EBITDA (Earnings Before Interest, Taxes, Depreciation & Amortization)

Gross Profit – OPEX

Depreciation & Amortization

Straight-line over asset life (e.g., 20 years for plant infrastructure).

EBIT (Earnings Before Interest & Taxes)

EBITDA – Depreciation & Amortization

Interest Expense

Cost of debt financing.

Taxes

EBIT × Corporate Tax Rate

Net Income (Profit After Tax)

EBIT – Interest – Taxes

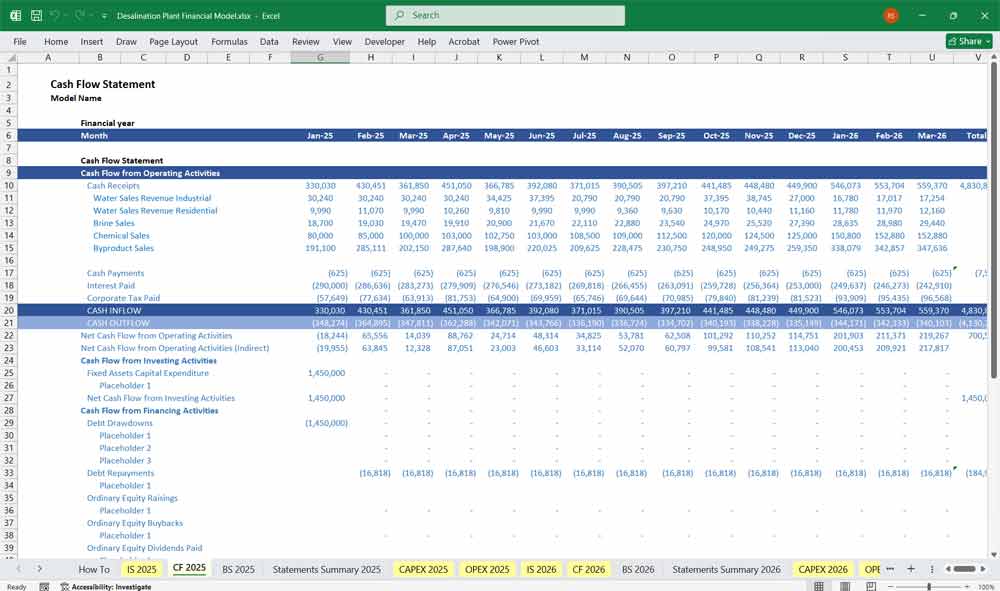

Desalinaton Plant Cash Flow Statement

Operating Cash Flow

Net Income + Depreciation ± Changes in Working Capital

Accounts receivable, inventory, payables.

Investing Cash Flow

Capital Expenditures (Capex)

Plant construction, equipment, technology upgrades.

Financing Cash Flow

Debt Issuance/Repayment + Equity Financing

Net Cash Flow

Operating + Investing + Financing Cash Flow

Closing Cash Balance

Opening Cash + Net Cash Flow

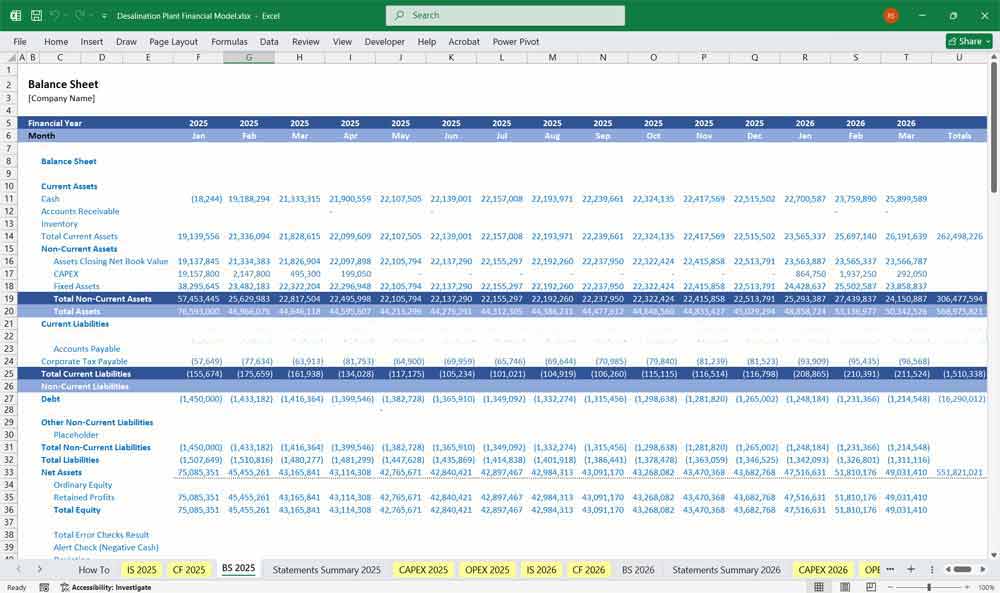

Desalination Plant Balance Sheet

Assets

Current Assets

Cash & cash equivalents.

Accounts receivable (unpaid water bills).

Inventory (chemicals, spare parts).

Non-Current Assets

Property, Plant & Equipment (PP&E).

Accumulated Depreciation.

Liabilities

Current Liabilities

Accounts payable (suppliers, contractors).

Short-term debt.

Long-Term Liabilities

Bank loans, bonds (10-20 years).

Equity

Shareholder equity (initial investment + retained earnings).

Key Financial Metrics for a Desalination Plant

Revenue Metrics

Monthly Recurring Revenue (MRR): Predictable income from ongoing services like Residential and Industrial Water Sales.

Annual Recurring Revenue (ARR): Yearly equivalent of MRR, providing a long-term revenue outlook.

Revenue per Litre of Chemical Sales: Income generated per litre, reflecting refinery efficiency.

Cost Metrics

Capital Expenditure (CapEx): Initial investment in infrastructure, industrial construction.

Operational Expenditure (OpEx): Ongoing costs for maintenance, utilities, staffing, supplies and materials.

Waste Water Treatment: Total cost of operating and engineering costs, including power and maintenance.

Power Generation Capacity Expansion: Ratio of Generator Cost to energy delivered to achieve greater efficiency.

Sensitivity & Scenario Analysis for the Desalination Plant

Base Case: Expected demand and costs.

Optimistic Case: Higher demand, lower energy costs.

Pessimistic Case: Lower sales, regulatory constraints on brine disposal.

This model provides a complete financial framework for evaluating a desalination plant’s profitability, cash flow sustainability, and balance sheet health.

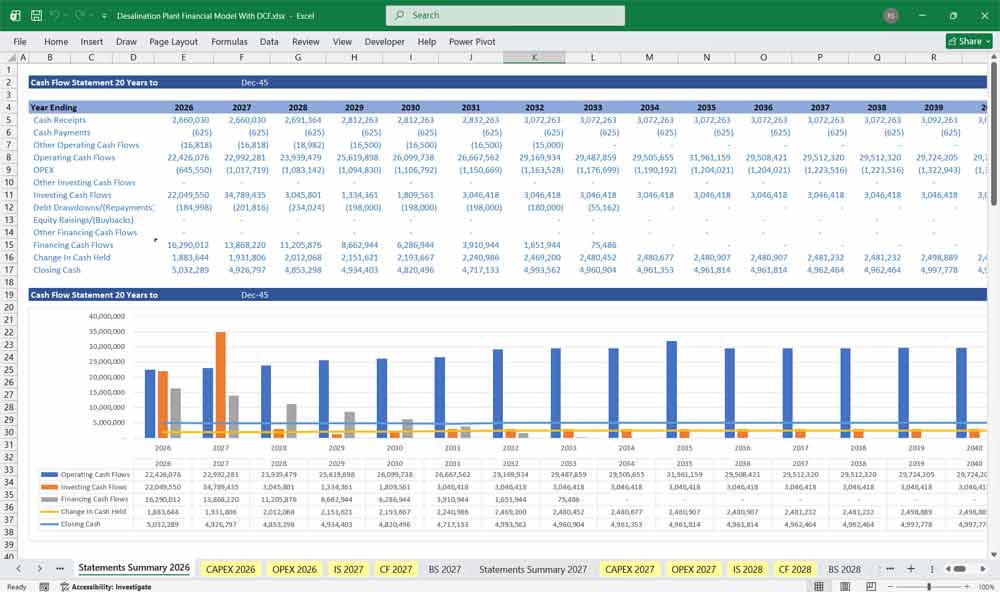

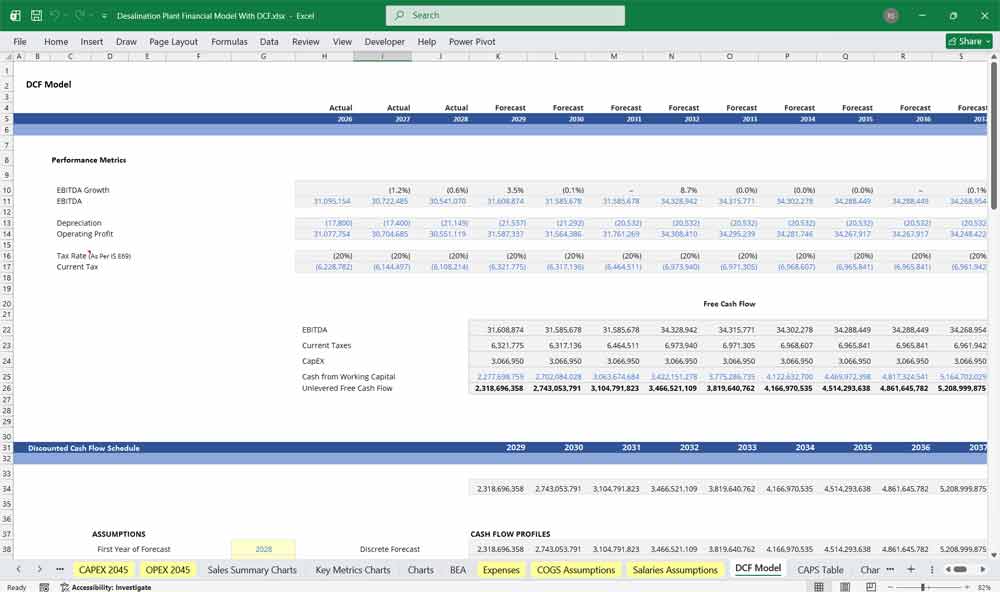

Discounted Cash Flow (DCF) Valuation for a Desalination Plant

1. Overview of DCF Valuation

The DCF valuation estimates the present value of the desalination plant by forecasting its future cash flows and discounting them back to today’s value. This approach helps determine whether the project is financially viable.

Key Steps:

Project Free Cash Flows (FCF)

Calculate Terminal Value (TV)

Discount Cash Flows to Present Value (PV)

Determine Enterprise Value (EV) and Equity Value

Projecting Free Cash Flows (FCF)

Free Cash Flow = EBIT × (1 – Tax Rate) + Depreciation & Amortization – CapEx – Change in Working Capital

Assumptions:

Forecast Period: 10-20 years (typical for infrastructure).

Revenue Growth: 2-5% annually (based on water demand).

EBIT Margin: 20-40% (depends on efficiency).

Tax Rate: 20-30% (jurisdiction-dependent).

CapEx: High in early years, then maintenance (~5% of initial Capex).

Desalination Discounted Cash Flow (DCF) with Terminal Value, Sensitivity Analysis, and WACC Model add-on

DCF: Valuing Life-Sustaining Infrastructure

In a Discounted Cash Flow (DCF) analysis for your desalination plant, the model is built on the foundation of long-term “Water Purchase Agreements” (WPAs), which often span 10 to 20 years. These contracts provide highly predictable revenue streams, usually structured with a fixed “capacity charge” to cover debt and a variable “output charge” to cover operational costs like chemicals and membrane replacements. This 20-year DCF accounts for the periodic replacement of reverse osmosis (RO) membranes and high maintenance CapEx, ensuring that the Net Present Value (NPV) reflects the true cost of maintaining water quality standards over the facility’s entire lifecycle.

WACC: Pricing Utility Stability and Energy Exposure

The Weighted Average Cost of Capital (WACC) for a desalination plant often reflects a “utility-grade” risk profile, characterized by stable cash flows and low correlation with broader market volatility. Because these projects are frequently structured as Public-Private Partnerships (PPPs), they can often access lower-cost infrastructure debt, which significantly reduces the WACC. However, the discount rate must still account for the energy intensity of the process; if the plant does not have a captive renewable energy source, the WACC may include a premium to reflect the risk of volatile grid electricity prices or potential carbon taxes that could squeeze the equity IRR over two decades.

Sensitivity Analysis: Stress-Testing Energy Prices and Salinity

For a desalination plant, Sensitivity Analysis is the primary tool for managing the “energy-to-water” margin. Since electricity can represent up to 50% of the total operating cost, a sensitivity table showing a $10/MWh shift in power costs is vital to see if the water remains affordable under the contractual “pass-through” mechanisms. Additionally, analysts must stress-test for environmental variables, such as changes in feedwater salinity or temperature, which can force the plant to consume more power to maintain output. By testing the impact of a 10% decrease in membrane efficiency, the analysis reveals the project’s resilience to both technical degradation and fluctuating macroeconomic conditions.

Final Notes on the Financial Model

This 20-Year Desalination Plant Financial Model must focus on balancing capital expenditures with steady revenue growth from diversified services. By optimizing operational costs, and power efficiency, and maximizing high-margin services like industrial water and chemical sales, the model ensures sustainable profitability and cash flow stability.

Download Link On Next Page

Download Link On Next Page