Container Port Financial Model

Financial Model for a Container Port

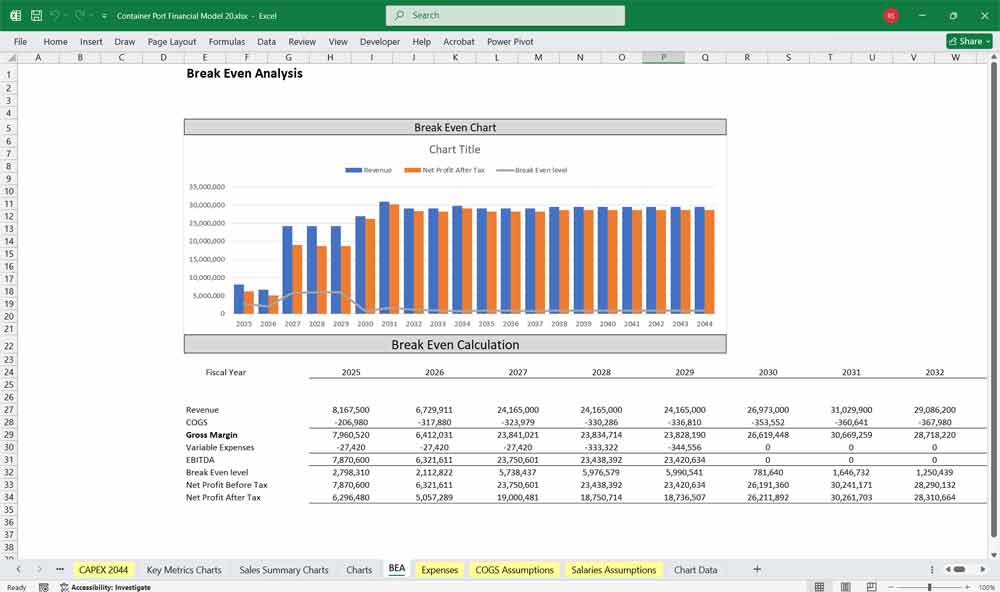

This 20-Year Container Port Financial Model involves detailed revenue projections, cost structures, capital expenditures, and financing needs. The model provides an understanding of the financial viability, profitability, and cash flow position of the business.

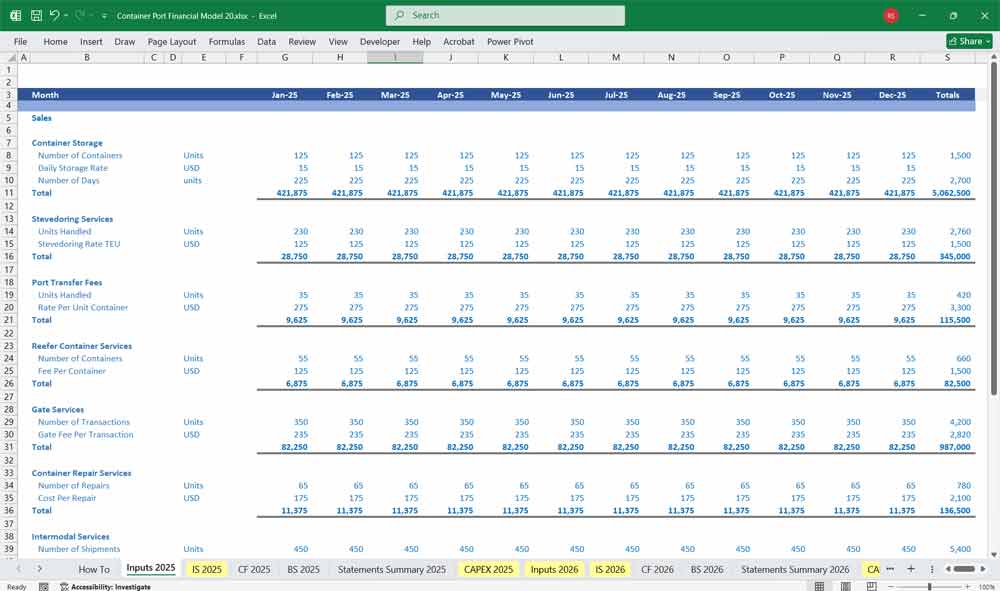

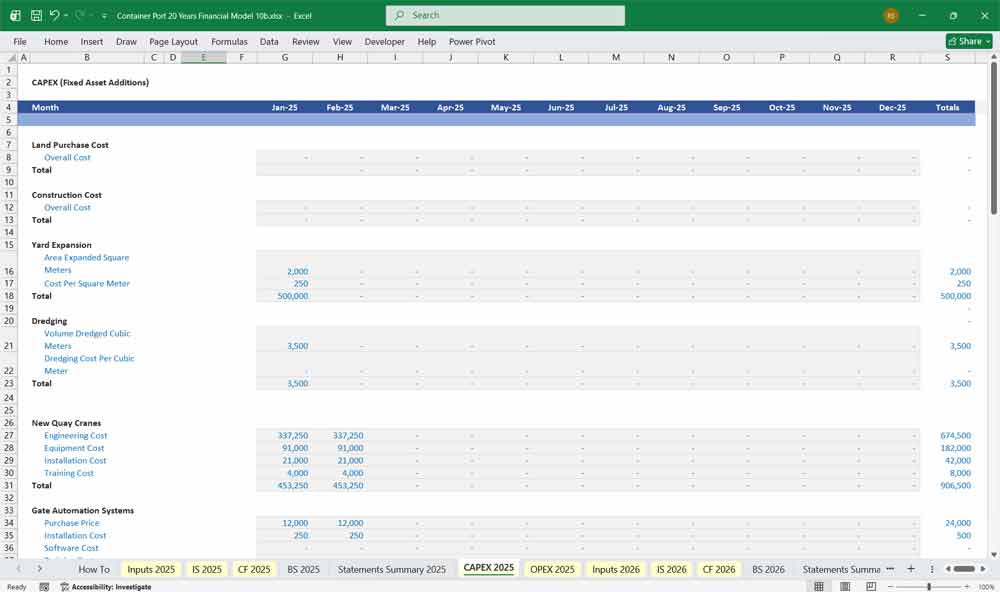

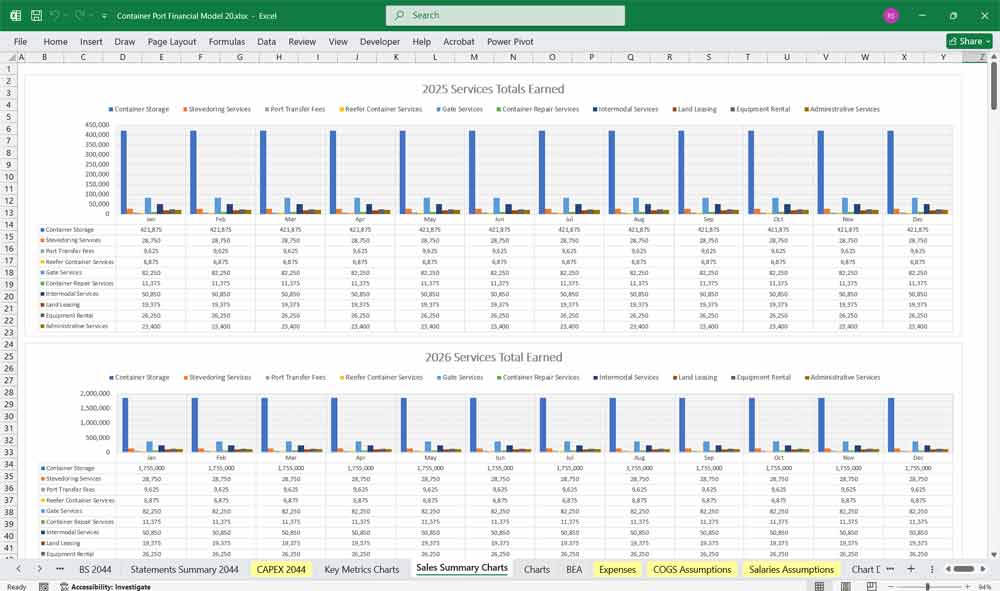

20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX Sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the specified revenue streams, BEA charts, sales summary charts, employee salary sheets and expenses sheets.

Income Statement (Profit & Loss Statement)

Revenue Section: (Fully Editable. 8 Shown there Are 10 In The Model)

- Container Storage Fees

- Stevedoring Services

- Port Transfer Fees

- Reefer Container Services

- Container Port Gate Services

- Container Repair Services

- Intermodal Services

- Parking Space Leasing

Operating Expenses:

- Port Labor Costs (stevedores, truck operators, security, administration)

- Equipment Maintenance (cranes, trucks, reefer power supply)

- Port Infrastructure Maintenance (berths, gates, terminals)

- Utilities (electricity, water, reefer power supply)

- Security & Insurance

Depreciation & Amortization:

- Depreciation of port equipment, cranes, and infrastructure over time.

Operating Profit (EBIT):

= Total Revenue – Operating Expenses – Depreciation

Net Profit Before Tax:

= EBIT – Interest Expense

Net Profit After Tax:

= Net Profit Before Tax – Taxes

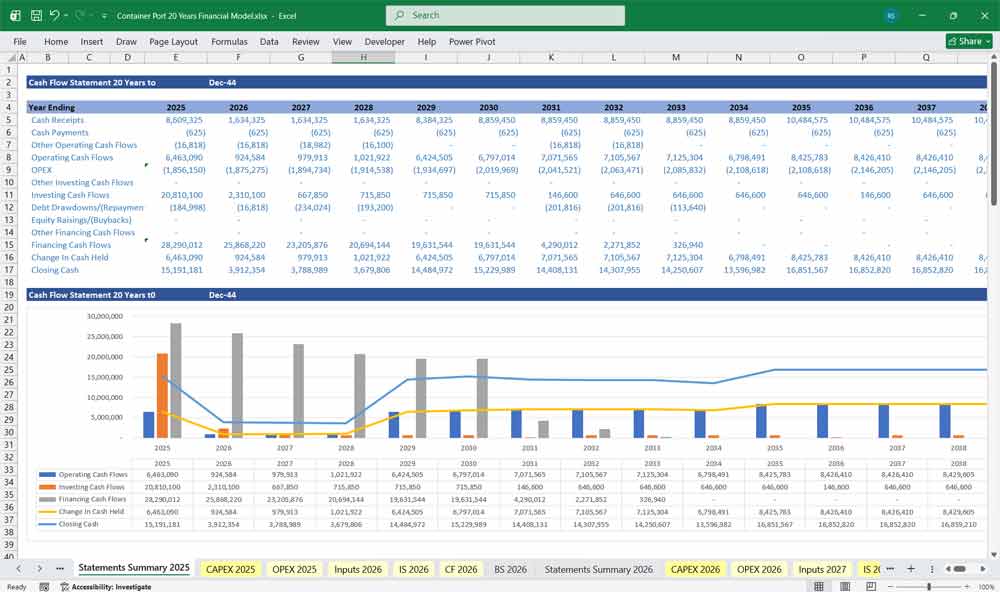

Container Port Cash Flow Statement

Operating Cash Flows:

Cash Inflows:

- Revenue from services

- Lease payments from parking spaces

Cash Outflows:

- Port labor costs

- Equipment maintenance

- Port utility expenses

- Insurance & security costs

Investing Cash Flows:

- Capital Expenditures (CAPEX):

- Purchase of new cranes, trucks, port infrastructure upgrades

- Proceeds from Asset Sales:

- Sale of old equipment, land leases

Financing Cash Flows:

- Debt Financing: Loan proceeds for expansion projects

- Debt Repayments: Loan repayments, interest expenses

- Dividend Payments: To investors/shareholders

Net Cash Flow:

= Operating Cash Flow + Investing Cash Flow + Financing Cash Flow

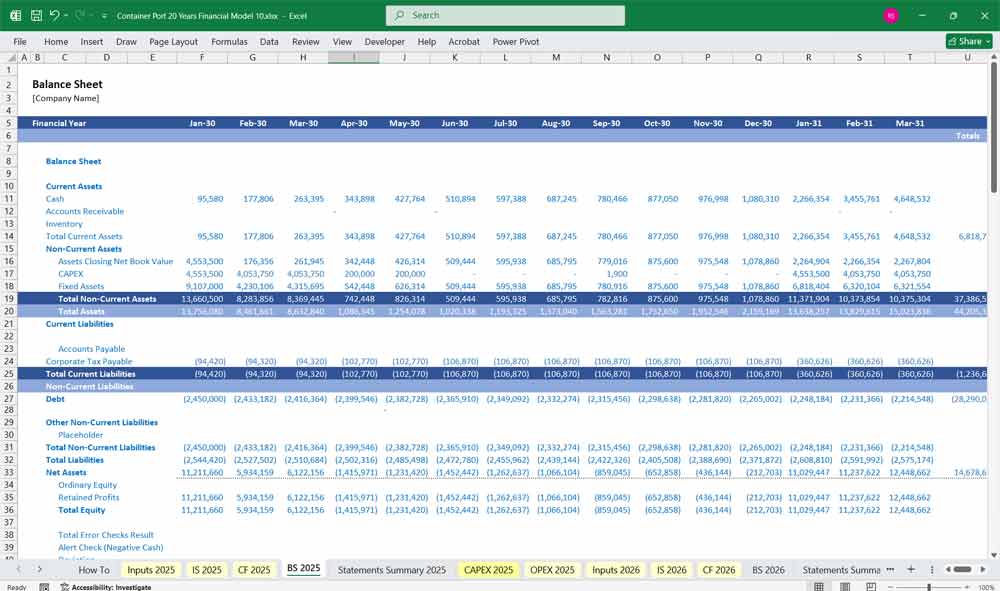

Container Port Balance Sheet

Assets:

Current Assets:

- Cash & Cash Equivalents

- Accounts Receivable (outstanding payments from customers)

- Inventory (spare parts for port equipment)

Non-Current Assets:

- Port Infrastructure (berths, storage yards, terminal buildings)

- Equipment (cranes, trucks, reefer power supply units)

- Land Lease Agreements

Liabilities:

Current Liabilities:

- Accounts Payable (supplier payments due)

- Short-Term Debt (working capital loans)

- Salaries Payable

Long-Term Liabilities:

- Bank Loans (for port expansion)

- Bonds Payable (if the port issues bonds for financing)

Equity:

- Shareholder Capital (investment from owners or investors)

- Retained Earnings (accumulated profits reinvested into the port)

Balance Sheet Equation:

Total Assets = Total Liabilities + Equity

Revenue Streams (All Fully Editable)

1.1 Container Storage Fees

- Revenue from storing containers in the port terminal beyond the free storage period.

- Fee Structure: Charges are based on container size (20ft, 40ft), storage duration (per day), and type (dry, reefer, hazardous).

- Example Rates:

- Dry Container: $20/day (20ft), $35/day (40ft)

- Reefer Container: $60/day (20ft), $100/day (40ft)

1.2 Stevedoring Container Services

- Charges for loading and unloading containers from vessels.

- Fee Structure: Based on container moves (loading/unloading), type of cargo, and vessel type.

- Example Rates:

- $150 per 20ft container

- $250 per 40ft container

1.3 Container Transfer Fees

- Fees charged for moving containers within the port (between quayside, storage yard, and intermodal connections).

- Fee Structure: Per container, based on distance and mode of transfer (truck, rail).

- Example Rates:

- Internal truck transfer: $40/container

- Rail transfer: $75/container

1.4 Reefer Container Services

- Fees for powering and monitoring refrigerated containers.

- Fee Structure: Per reefer plug-in per day, monitoring fees per hour.

- Example Rates:

- Electricity: $75/day per container

- Monitoring: $20/hour

1.5 Container Port Gate Services

- Fees for container entries and exits through the port gate.

- Fee Structure: Based on vehicle type, container type, and congestion pricing.

- Example Rates:

- Truck Entry Fee: $15 per trip

- Congestion Surcharge: +10% during peak hours

1.6 Container Repair Services

- Charges for repairing damaged containers within the port.

- Fee Structure: Per repair job based on container damage level.

- Example Rates:

- Minor Repairs: $150 per container

- Major Repairs: $500 per container

1.7 Intermodal Services (Rail & Truck Container Transfers)

- Revenue from transferring containers between the port and inland locations.

- Fee Structure: Distance-based per container move.

- Example Rates:

- Rail Transfer: $200 per container

- Trucking: $150 per container (short haul), $500 per container (long haul)

1.8 Parking Space Leasing For Container Trucks

- Leasing parking spaces for trucks and container chassis within the port.

- Fee Structure: Per hour, per day, or monthly lease agreements.

- Example Rates:

- Hourly: $10

- Daily: $50

- Monthly: $1,000 per space

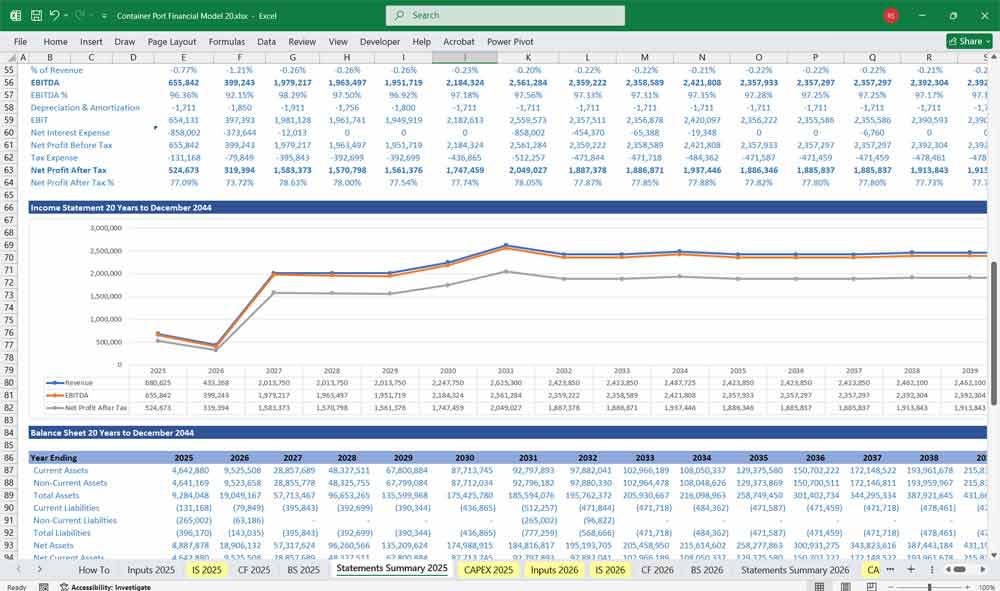

Key Performance Metrics

- EBITDA Margin = (EBITDA / Total Revenue) × 100

- Net Profit Margin = (Net Profit / Total Revenue) × 100

- Debt-to-Equity Ratio = Total Debt / Shareholder Equity

- Return on Assets (ROA) = Net Profit / Total Assets

- Return on Equity (ROE) = Net Profit / Shareholder Equity

- Asset Turnover Ratio = Total Revenue / Total Assets

Conclusion for the Financial Model

Container Port Financial Model

This financial model provides a comprehensive framework to analyze the profitability, operational efficiency, and financial health of a container port. Each revenue stream contributes to overall income, while operating expenses and capital expenditures must be managed efficiently to ensure long-term profitability.

Download Link On Next Page