Consulting Firm Financial Model

Financial Model for a Consulting Firm

With these financial models, you can easily monitor revenues, track variable and fixed expenditures, or set up projections for future expansion, whether moving to a new office or updating a server. If you have any questions, contact us.

There are 2 Versions of this Excel Template: Both are 5-Year 3 Statement.

Version 1: 5-Year, 3 Statement financial model for tracking and reporting of your Consulting Firm’s financials, with 5 PAYG project-based revenue streams.

Version 2: 5-Year, 3 Statement with 6 Tier Subscription and 5 PAYG project-based inputs.

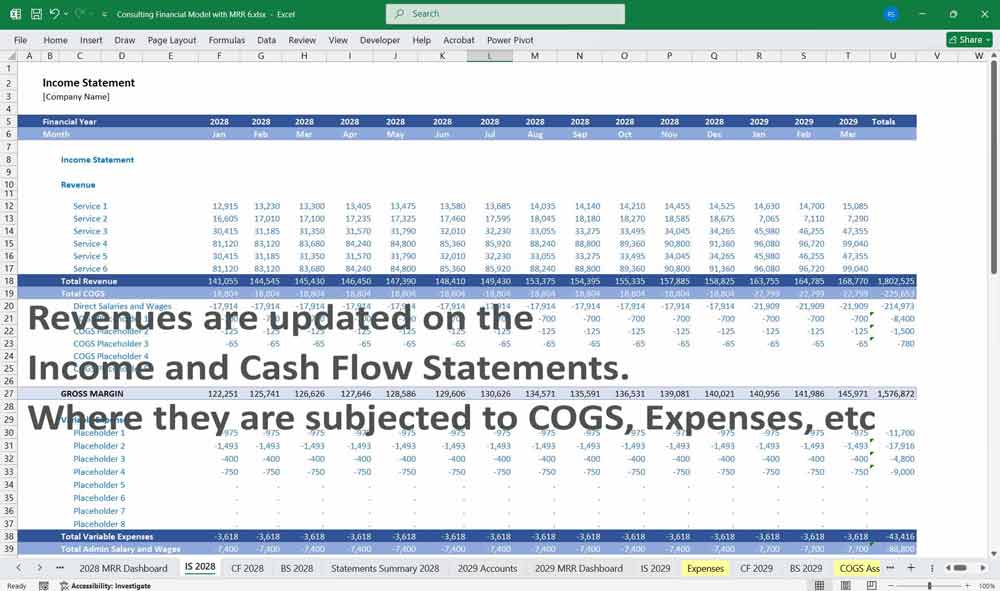

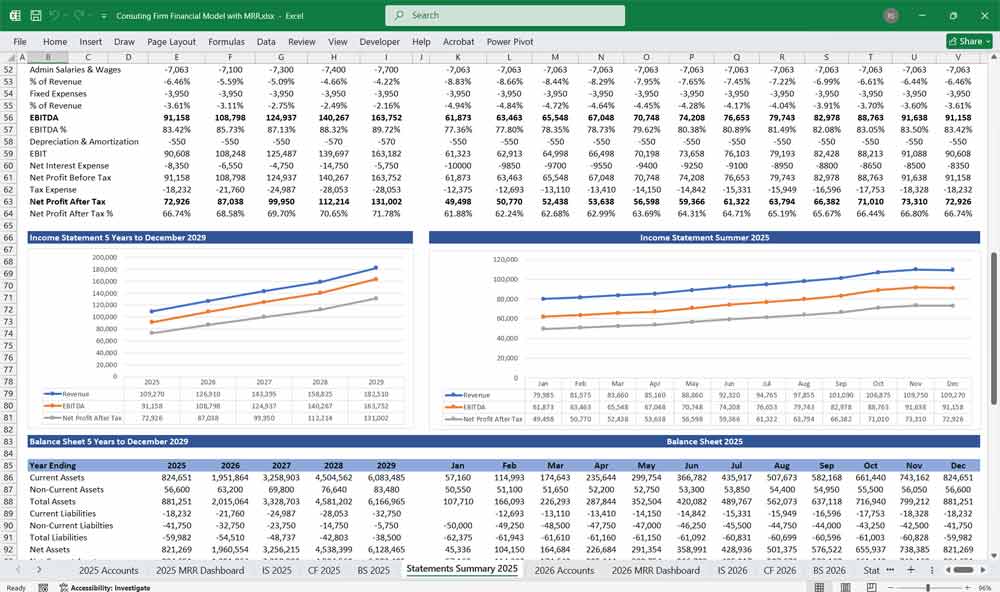

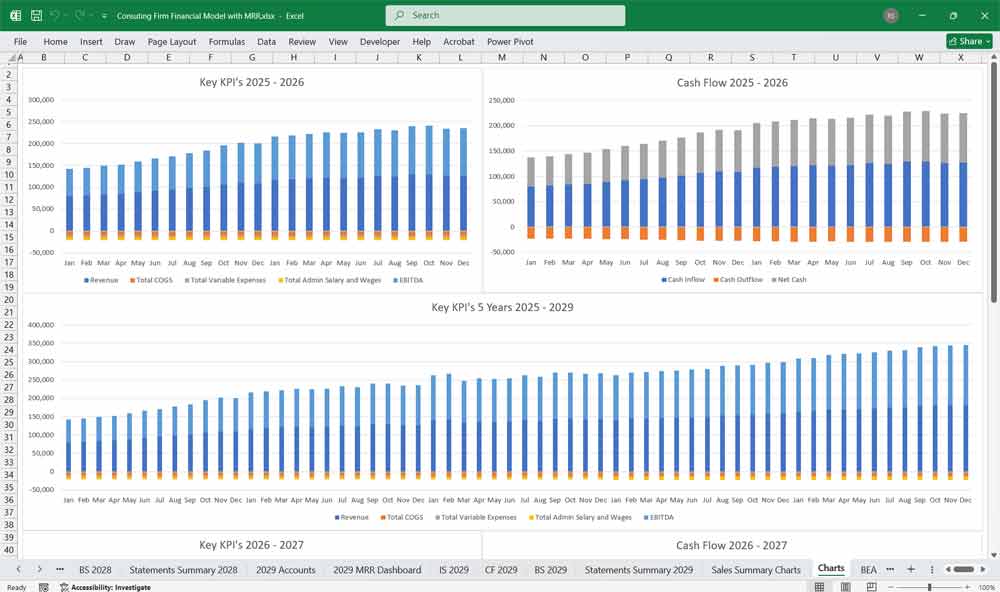

Income Statement

The Income Statement (Profit & Loss Statement) summarizes the firm’s revenues, costs, and profitability over a given period.

Revenue Streams

- Project-Based Consulting Fees – Revenue from one-time consulting projects billed per hour or per project.

- Retainer Fees – Monthly recurring fees for ongoing advisory services.

- Subscription-Based Revenue – Revenue from a membership or subscription model (detailed below).

- Training & Workshops – Revenue from corporate training, workshops, and seminars.

- Affiliate and Referral Income – Revenue from referring clients to strategic partners or software solutions.

- Other Income – Revenue from ad-hoc services, white papers, e-books, or online courses.

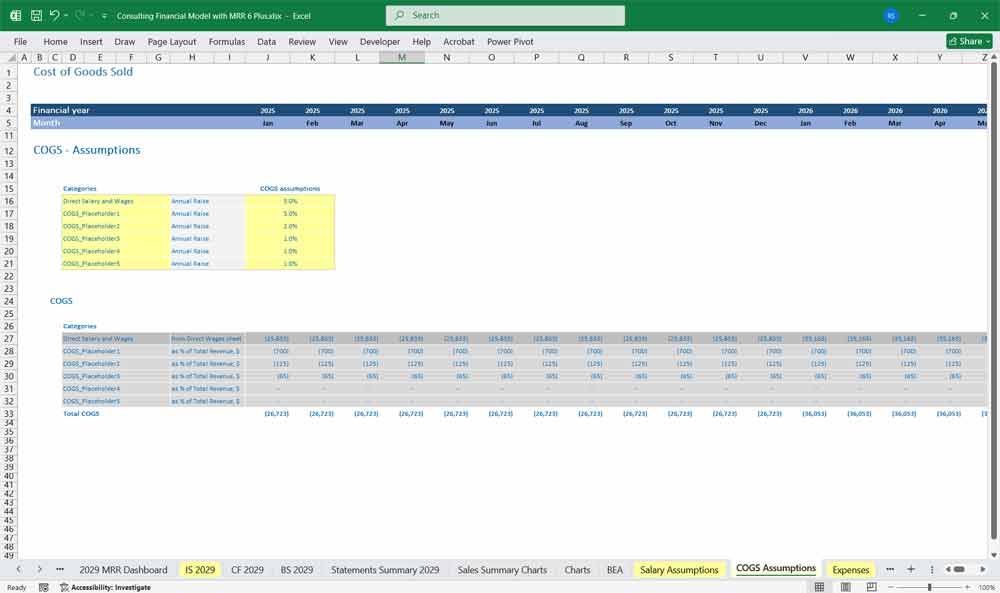

Cost of Services (COGS)

- Consultant Salaries & Contractor Fees – Payments to full-time consultants and freelance contractors.

- Software & Tools – CRM, project management, data analytics, and other professional tools.

- Travel & Accommodation – Expenses for consultants traveling to client locations.

- Professional Development – Costs related to staff training and certifications.

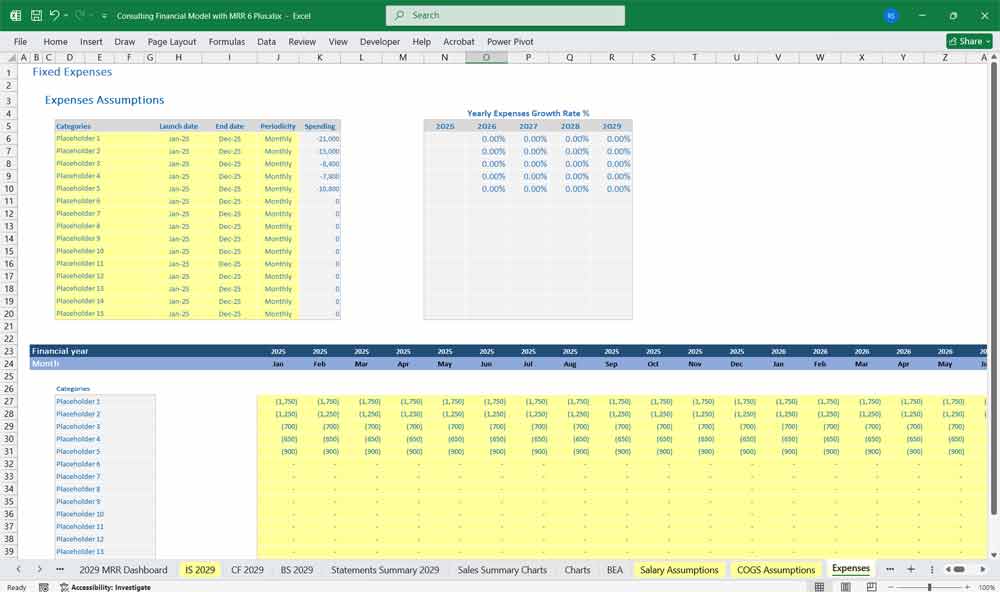

Operating Expenses (OPEX)

- General & Administrative (G&A):

- Office rent (if applicable)

- Utilities and office supplies

- Administrative salaries

- Legal & accounting fees

- Sales & Marketing:

- Digital ads (Google, LinkedIn)

- Website maintenance

- Business development salaries

- Content marketing (blogs, webinars, white papers)

- Technology & Infrastructure:

- Cloud services

- SaaS subscriptions (Zoom, HubSpot, Asana)

- Cybersecurity costs

Profitability Metrics

- Gross Profit = Revenue – COGS

- Operating Profit = Gross Profit – OPEX

- Net Profit = Operating Profit – Taxes & Interest

- EBITDA = Earnings Before Interest, Taxes, Depreciation, and Amortization

- Net Profit Margin (%) = Net Profit / Revenue

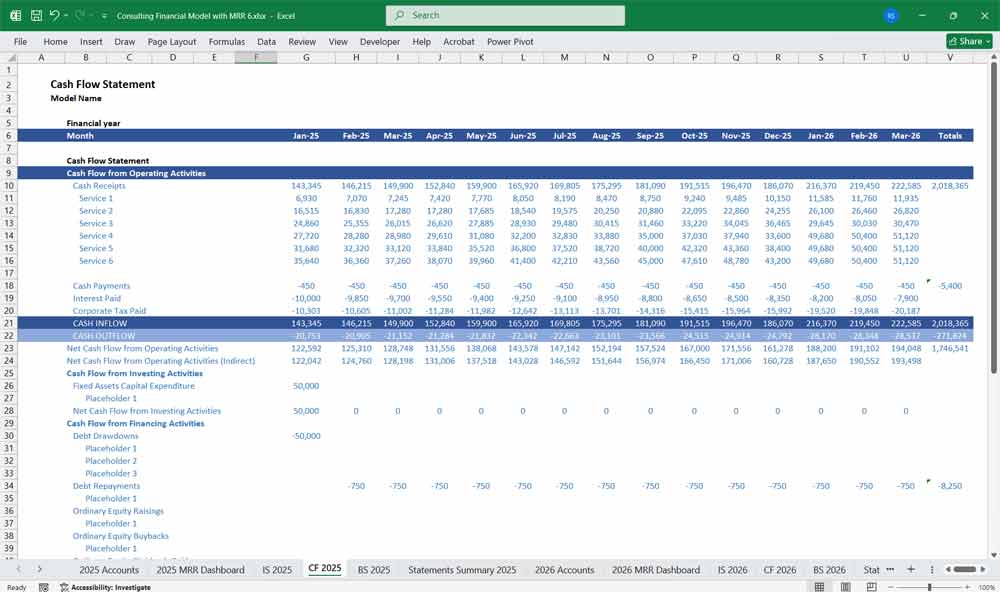

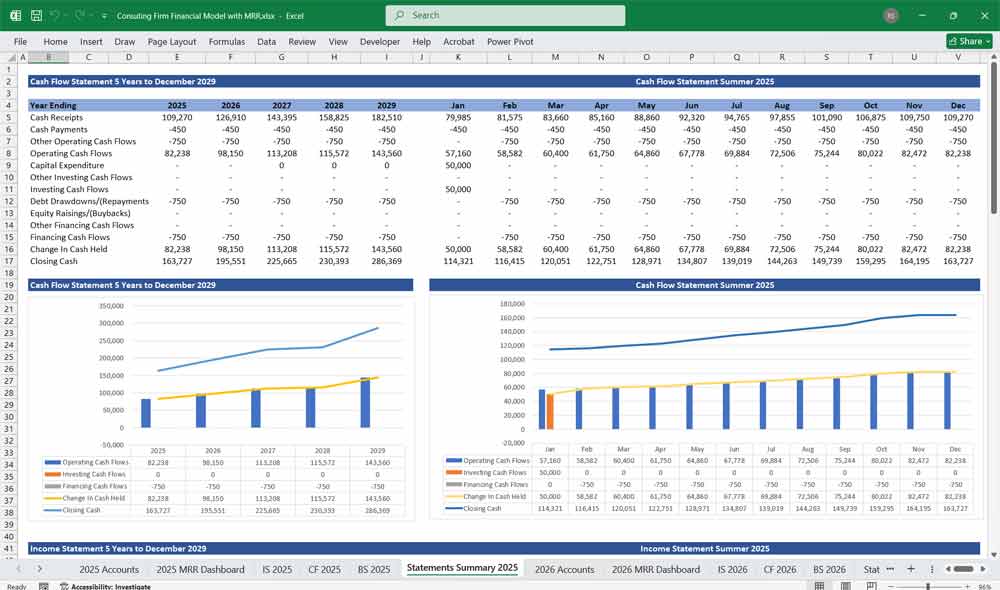

Consulting Firm Cash Flow Statement

The Cash Flow Statement tracks the movement of cash in and out of the business, divided into three sections:

Operating Cash Flow (OCF)

- Cash Inflows:

- Revenue from consulting services

- Subscription payments

- Retainer payments

- Cash Outflows:

- Payroll for consultants & staff

- Office expenses

- Marketing costs

- Software expenses

- Taxes paid

Investing Cash Flow (ICF)

- Cash Outflows:

- Purchase of new software tools

- Investment in training programs

- Office expansion (if any)

- Cash Inflows:

- Sale of old assets or refunds from software/tools

Financing Cash Flow (FCF)

- Cash Inflows:

- Loans or credit lines

- Equity financing (if applicable)

- Cash Outflows:

- Debt repayment

- Dividends (if distributing profits)

Net Cash Flow

- Net Cash Flow = Operating Cash Flow + Investing Cash Flow + Financing Cash Flow

- If positive → Business is growing sustainably.

- If negative → Firm needs additional funding or cost control.

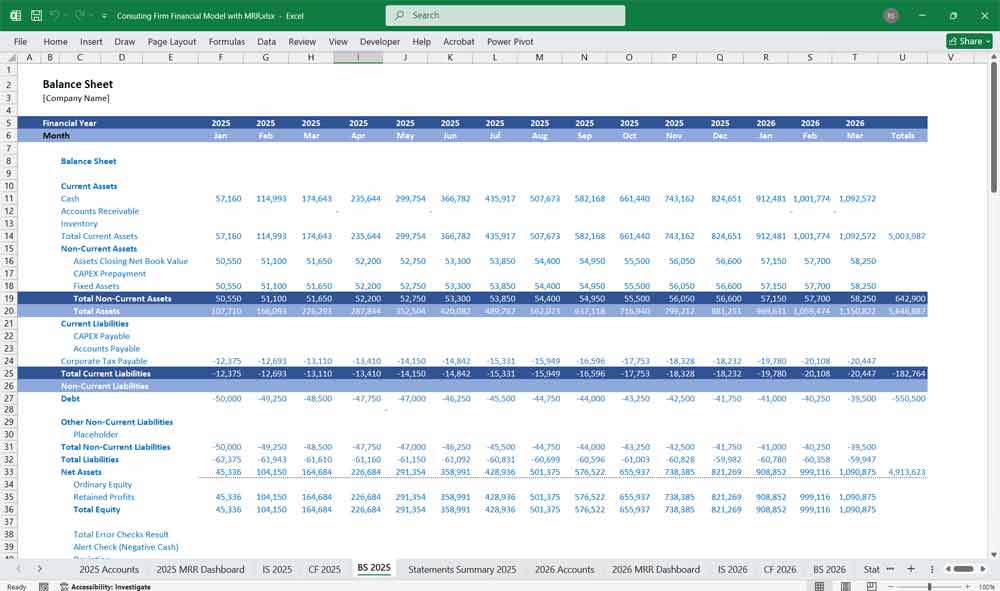

Consulting Firm Balance Sheet

The Balance Sheet provides a snapshot of the firm’s financial position at a given point in time.

Assets

Current Assets

- Cash & Cash Equivalents – Cash in hand and bank balances.

- Accounts Receivable – Unpaid invoices from clients.

- Prepaid Expenses – Advance payments for software, marketing, etc.

Non-Current Assets

- Office Equipment – Computers, office furniture.

- Intangible Assets – Brand value, domain name, trademarks.

- Software & Tools – CRM, analytics tools, etc.

Liabilities

Current Liabilities

- Accounts Payable – Unpaid vendor invoices.

- Salaries Payable – Pending salaries and consultant fees.

- Taxes Payable – Unpaid tax liabilities.

Long-Term Liabilities

- Business Loans – Loans taken for expansion or investment.

- Deferred Revenue – Advance payments for future services.

Equity

- Owner’s Equity (Capital)

- Retained Earnings (Profits reinvested into the business)

Formula:

Assets=

Liabilities+Equity

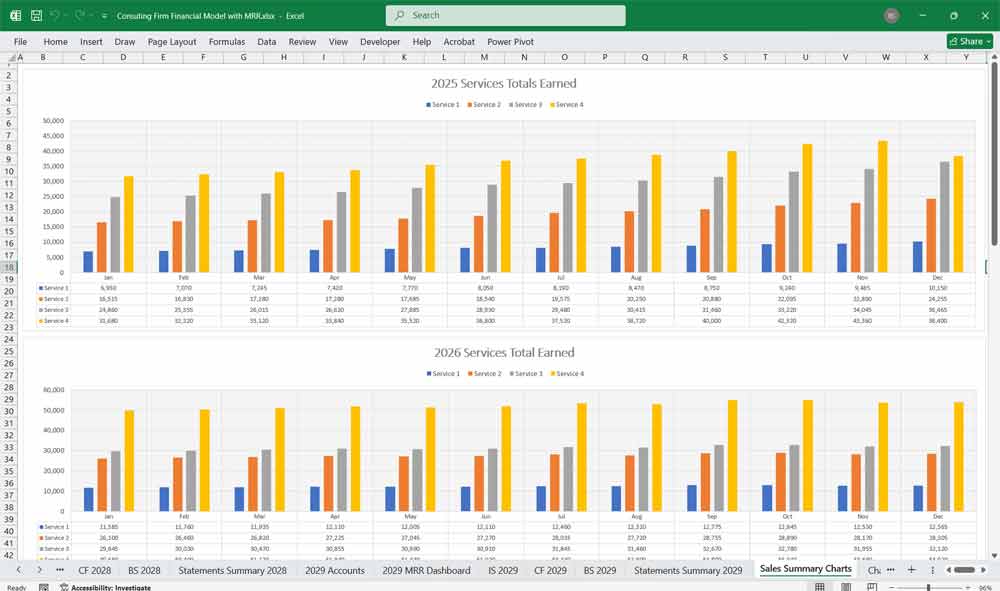

Core Consulting Firm Services

These revenue stream projections provide a comprehensive approach for a consulting company to diversify its income and address a wide range of client needs.

Strategy and a Consulting Firm

Helps businesses develop long-term growth plans.

Provides competitive market analysis.

Enhances decision-making with data-driven insights.

Operations and a Consulting Firm

Optimizes processes to reduce consulting costs.

Improves efficiency and productivity.

Streamlines supply chain and logistics.

Technology within a Consulting Firm

Assists in digital transformation initiatives.

Implements and manages IT systems.

Enhances cybersecurity measures.

Financial Statements in a Consulting Firm

Provides financial planning and forecasting.

Helps manage risks and investments.

Improves profitability through cost analysis.

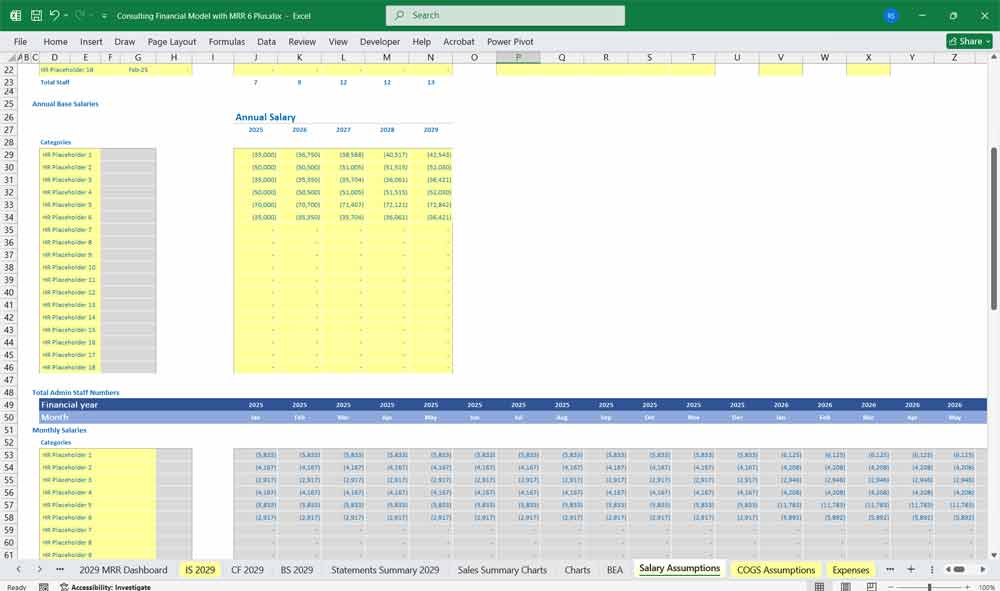

Consulting Firm Human Resources

Supports talent acquisition and retention strategies.

Enhances employee engagement and satisfaction.

Develops organisational structures and leadership pipelines.

Consulting Firms and Marketing and Sales

Improves branding and customer outreach.

Develops effective sales strategies.

Enhances ROI on marketing campaigns.

Sustainability and ESG within a Consulting Firm

Helps companies meet environmental regulations.

Develops sustainable consulting business practices.

Enhances corporate social responsibility (CSR) within consulting initiatives.

Consulting Firm and Change Management

Supports mergers, acquisitions, and restructuring.

Ensures smooth transitions and employee buy-in.

Minimizes disruption during organizational changes.

Industry-Specific Consulting Firms

Offers tailored consulting solutions for niche industries.

Provides deep expertise in sector-specific challenges.

Enhances competitive advantage within the industry.

Crisis Management And Your Consulting Firm

Provides immediate support during emergencies.

Mitigates reputational and financial risks.

Develops recovery and contingency plans.

Consulting Firm, Compliance and Regulations

Ensures adherence to legal and regulatory requirements.

Reduces risks of fines and penalties.

Keeps businesses updated on changing regulations.

Innovation and R&D Consulting Firm

Drives product development and innovation strategies.

Enhances research methodologies.

Keeps businesses ahead of competitors.

Your Consulting Firm, Data Analytics, and Business Intelligence

Leverages data for informed decision-making.

Develops predictive analytics models.

Improves operational and financial performance.

Customer Experience (CX) Consulting Firms

Enhances customer satisfaction and loyalty.

Designs seamless customer journeys.

Improves retention and lifetime value.

Consulting Firm and a

Training and Workshop Environment

Provides skill development for employees.

Enhances leadership and management capabilities.

Generates additional revenue through paid sessions.

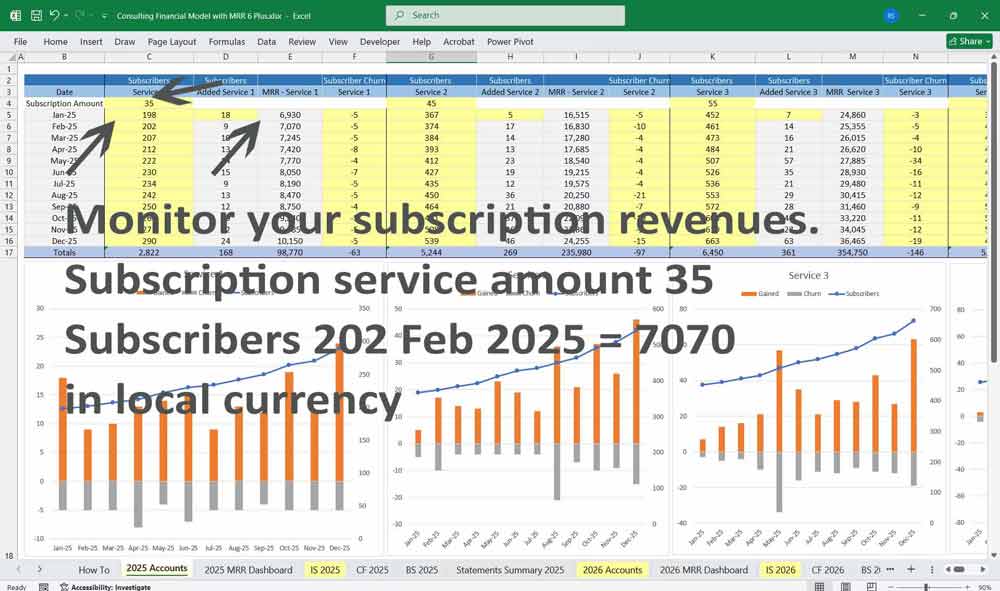

Subscription-Based Advisory Service Consulting Firm

Offers ongoing access to expert advice.

Ensures recurring revenue streams.

Builds long-term client relationships.

Productized Consulting Firm Packages

Simplifies sales with standardized offerings.

Appeals to budget-conscious clients.

Reduces customization time and costs.

Licensing Proprietary Tools or a Frameworks Consulting Firm

Monetizes unique methodologies or software consulting.

Creates passive income streams.

Enhances brand credibility and authority.

Affiliate Partnerships and Referrals Consulting Firms

Earns commissions through partnerships.

Expands service offerings without additional costs.

Builds a network of complementary service providers.

Consulting Firms, Speaking Engagements and Thought Leadership

Generates revenue through paid speaking events.

Enhances brand visibility and authority.

Attracts new clients through industry influence.

When structuring of diversifying revenue streams for you consulting company, it’s important to strategize in a way that aligns with customer needs, market demand, and operational efficiency and strategic considerations.

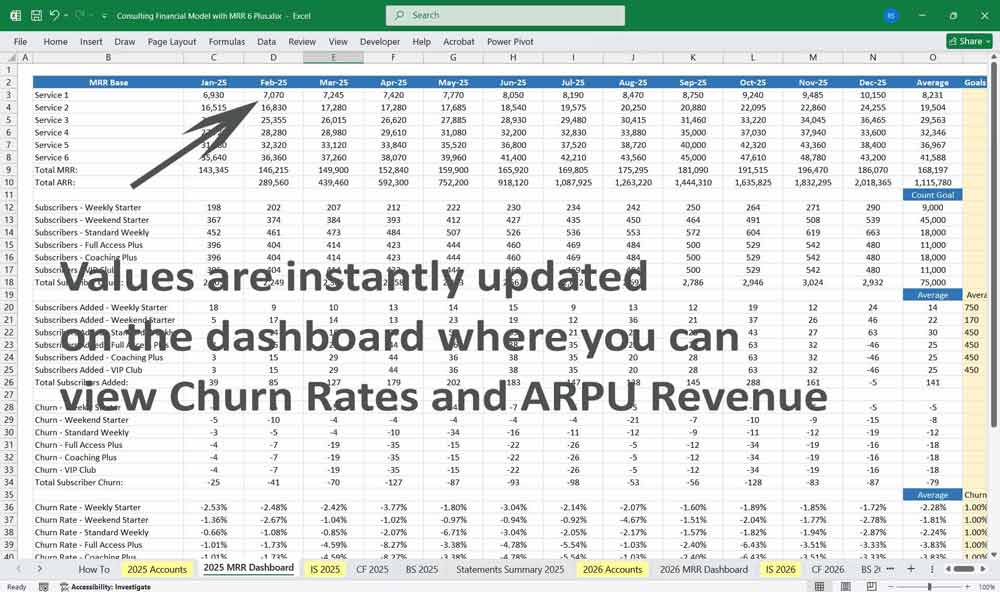

6-Tier Subscription Model for a Consulting Firm

A subscription-based revenue model provides recurring income, increasing business stability. The tiers cater to different customer needs.

Tier 1: Consulting Firm Basic Advisory (Entry-Level)

Target Audience: Startups, small businesses, or individuals seeking foundational guidance.

Services Included:

Access to a library of pre-recorded webinars, templates, and resources.

Monthly email consultations (1-2 emails per month) for general advice.

Access to a community forum or Q&A platform for peer support.

Discounts on future premium services or workshops.

Pricing: Low-cost or free to attract a wide audience.

Value Proposition: Provides foundational knowledge and light support for clients with limited budgets.

Tier 2: Consulting Firm Essential Support (Growing Businesses)

Target Audience: Small to medium-sized businesses (SMBs) needing regular but limited support.

Services Included:

Monthly 1-hour consultation call with a junior consultant.

Customized action plans or roadmaps for specific challenges.

Access to a curated resource library with industry-specific insights.

Quarterly performance reviews and progress tracking.

Pricing: Moderate, affordable for SMBs.

Value Proposition: Offers structured support for businesses looking to scale or solve specific problems.

Tier 3: Strategic Partner Consulting Firm (Mid-Market)

Target Audience: Established businesses seeking ongoing strategic guidance.

Services Included:

Bi-weekly 1-hour consultation calls with a senior consultant.

Customized strategy development and implementation support.

Access to proprietary tools, frameworks, and analytics dashboards.

Priority email support with a 24-hour response time.

Invitations to exclusive webinars and networking events.

Pricing: Mid-range, reflecting the higher level of expertise and support.

Value Proposition: Provides ongoing strategic partnership to drive growth and innovation.

Tier 4: Premium Advisory Consulting Firm (Enterprise-Level)

Target Audience: Large enterprises or high-growth companies requiring tailored solutions.

Services Included:

Weekly 1-hour consultation calls with a senior consultant or partner.

Dedicated account manager for personalized service.

In-depth market research, competitor analysis, and trend reports.

On-demand access to subject matter experts (SMEs) for specialized advice.

Custom workshops or training sessions for teams.

Pricing: High, reflecting the premium nature of the services.

Value Proposition: Delivers high-touch, tailored solutions for complex business challenges.

Tier 5: Executive Leadership Consulting Firm (C-Suite Focus)

Target Audience: C-suite executives and top leadership teams.

Services Included:

Weekly or bi-weekly strategy sessions with a senior partner or industry expert.

Executive coaching and leadership development programs.

Customized board presentations and stakeholder communication strategies.

Access to a global network of industry leaders and influencers.

Crisis management and rapid response support.

Pricing: Premium, targeting high-net-worth individuals or large corporations.

Value Proposition: Focuses on high-level decision-making, leadership, and long-term vision.

Tier 6: Bespoke Consulting Firm Custom Solutions

Target Audience: Ultra-high-net-worth individuals, Fortune 500 companies, or organizations with unique needs.

Services Included:

Fully customized consulting engagements tailored to specific goals.

24/7 access to a dedicated team of senior consultants and experts.

Comprehensive business transformation programs, including mergers, acquisitions, and digital transformation.

On-site support and immersive workshops for leadership teams.

Exclusive access to proprietary research, data, and industry insights.

Pricing: Highest tier, with pricing negotiated based on scope and complexity.

Value Proposition: Offers unparalleled, white-glove service for the most demanding and complex challenges.

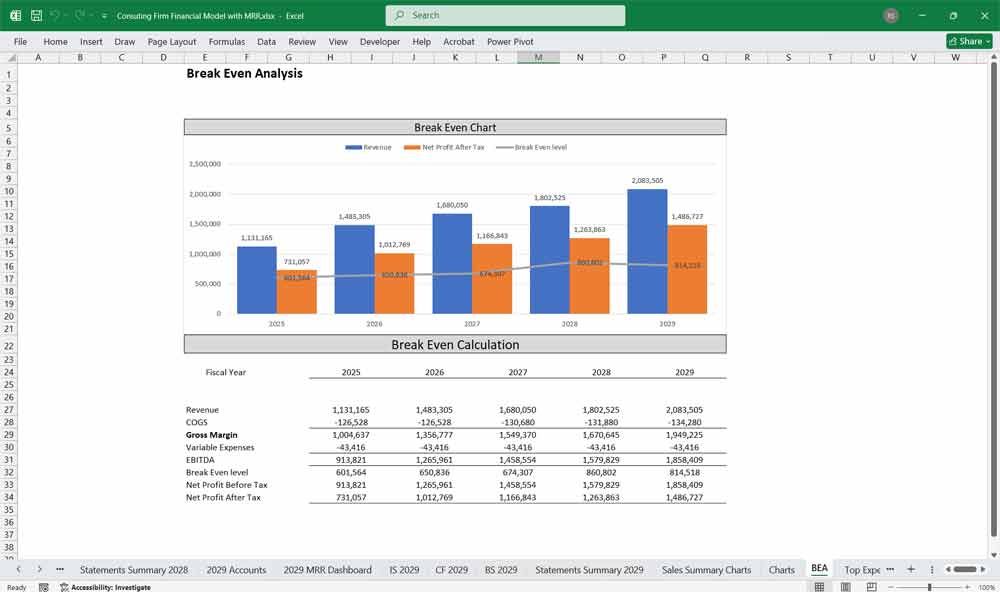

Key Financial Metrics & Projections

- Your Consulting Firms Revenue Growth Rate (CAGR over 5 Years)

- Break-Even Analysis (Months to Profitability)

- Return on Investment (ROI) & Payback Period

- Net Present Value (NPV) & Internal Rate of Return (IRR)

Final Notes on the Financial Model

- Profitability Focus: This Consulting Firm Financial Model should help your company aim for high-margin revenue streams (retainers and subscriptions) and aids:

- Cash Flow Management: Keep an eye on accounts receivable to avoid cash shortages.

- Scalability Strategy: Automate low-tier services to keep operational costs low.

- Long-Term Sustainability: Because investing in branding, client loyalty, and technology to enhance efficiency leads to long-term stability.

Download Link On Next Page

Download Link On Next Page