Chemical Manufacturer Financial Model

Financial Model for a Chemical Manufacturer

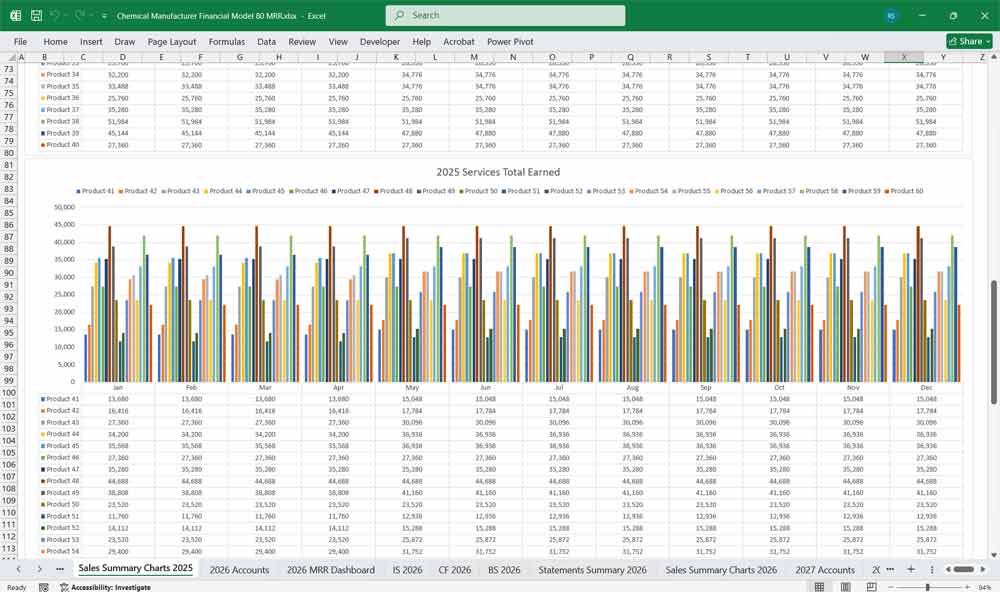

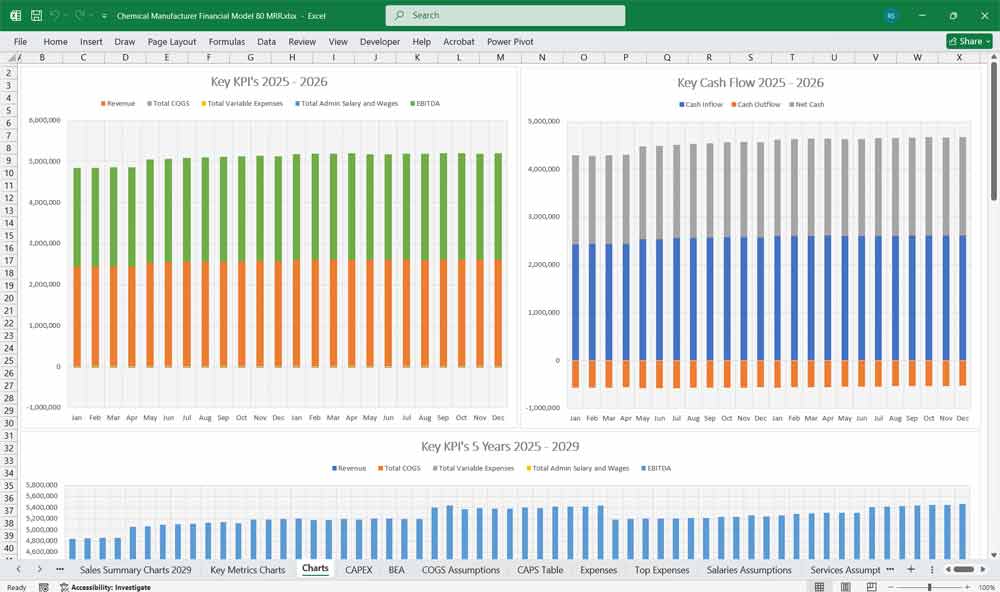

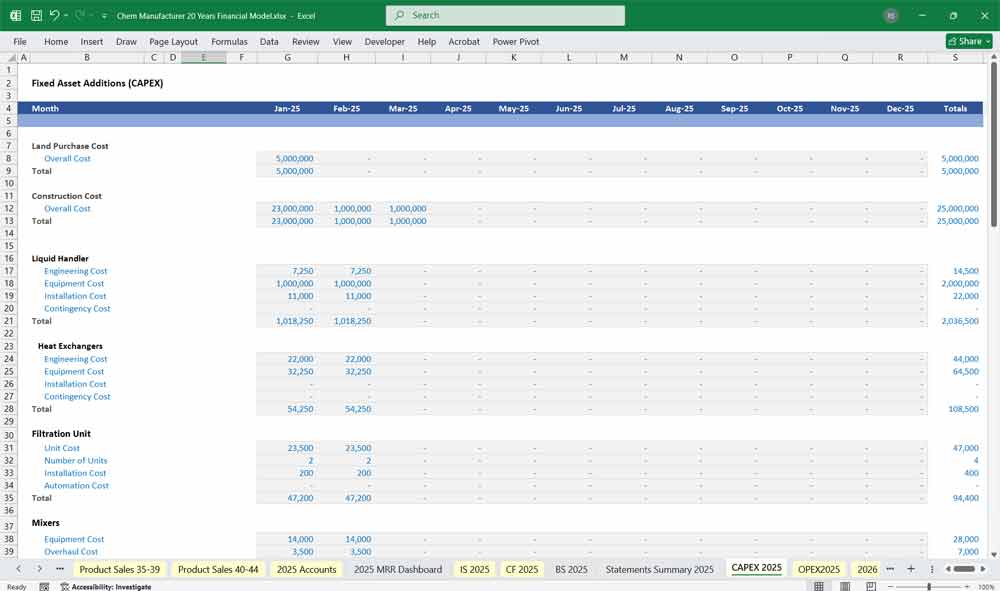

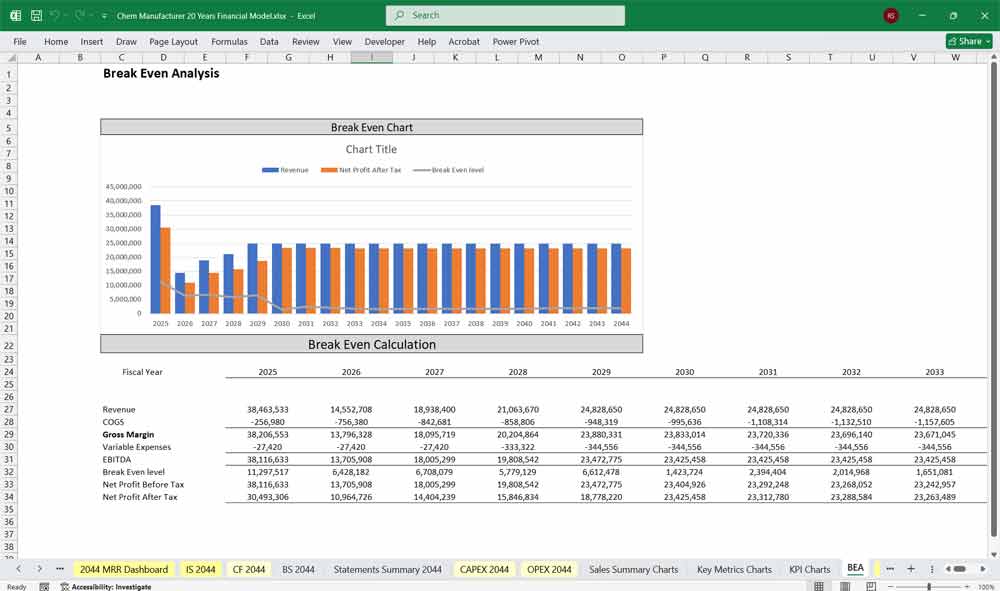

20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX Sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the specified revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets. Sodium Hydroxide Plant Model.

20-year, 3-statement, up to 80 product lines, a 6-tier subscription for those companies offering that option for sales. Require more product lines for your Composite Materials, Industrial Adhesives, Elastomers, Agrochemicals, and Fluids and Lubricants?. Talk to us.

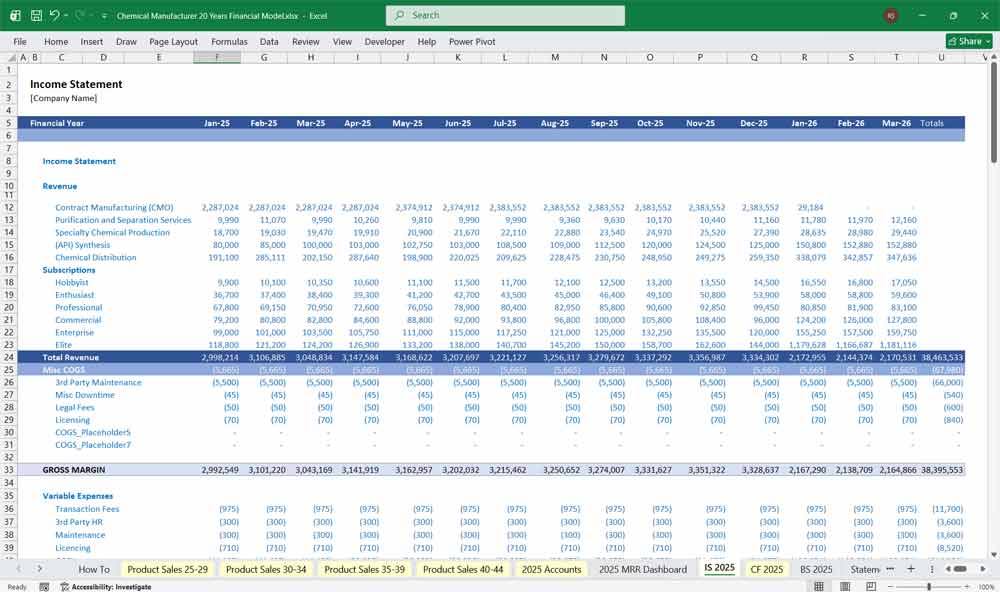

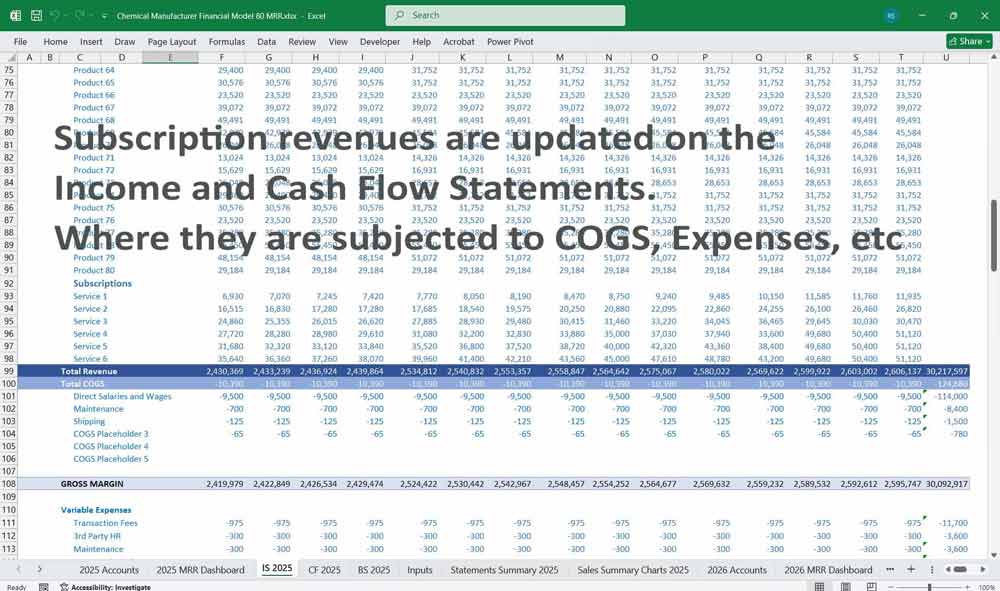

Income Statement (Profit & Loss Statement)

The Income Statement projects revenues, costs, and profitability over time.

Chemical Manufacturing Revenue Section

- Editable Gross Revenues From: Total sales from chemical products, or Contract Manufacturing (Toll Manufacturing), Purification and Separation Services, Specialty Chemical Formulation, Active Pharmaceutical Ingredient (API) Synthesis, Chemical Distribution and Logistics

- Bulk chemicals (e.g., industrial chemicals, raw materials)

- Speciality chemicals (e.g., adhesives, coatings, performance materials)

- Custom synthesis & contract manufacturing

- Less: Discounts & Returns

- Net Revenue (Net Sales)

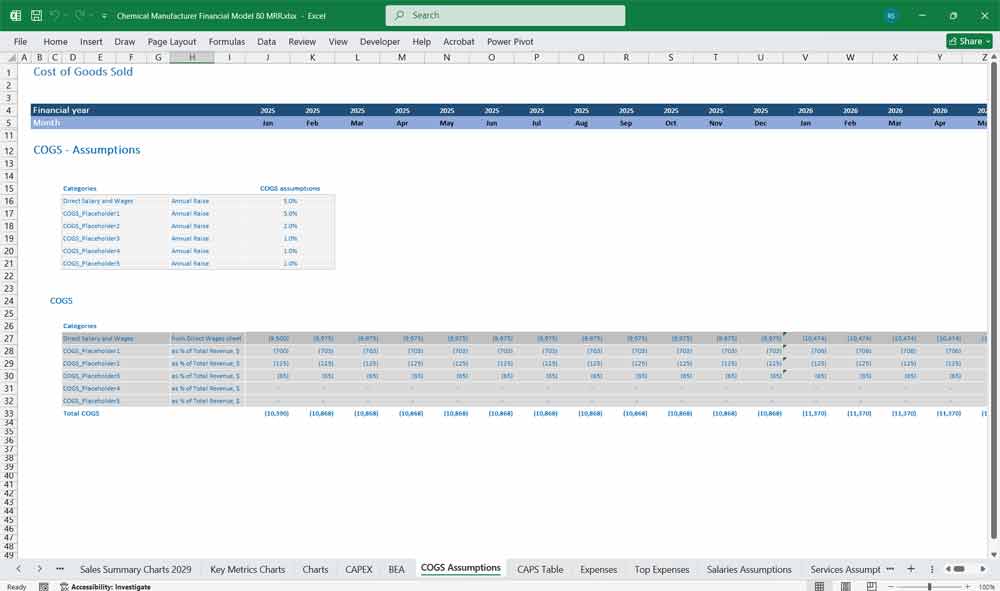

Cost of Goods Sold (COGS)

- Raw Materials Cost: Cost of raw materials (e.g., petrochemicals, catalysts, solvents)

- Direct Labor Costs: Salaries & wages for plant workers

- Utilities & Energy Costs: Electricity, gas, and water usage for chemical processes

- Manufacturing Overheads: Depreciation of plant equipment, maintenance, and repairs

- Freight & Logistics: Costs of shipping raw materials and finished products

Gross Profit = Net Revenue – COGS

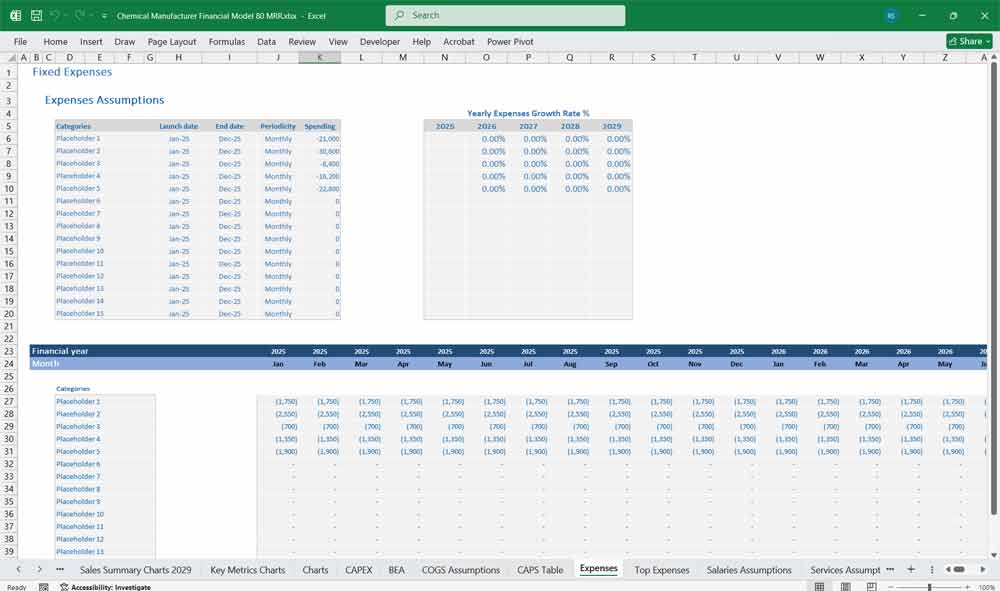

Operating Expenses (OPEX)

- Selling & Distribution Costs:

- Marketing expenses, sales commissions, transportation, and warehousing

- General & Administrative (G&A) Expenses:

- Salaries for executives, administrative staff, and R&D personnel

- Office rent, IT expenses, and professional fees

- Research & Development (R&D):

- Investment in new chemical formulations, testing, and pilot production

- Depreciation & Amortization:

- Non-cash expense recognizing asset depreciation

Operating Profit (EBIT) = Gross Profit – Total Operating Expenses

Other Income & Expenses

- Interest Income: Income from investments or deposits

- Interest Expense: Debt servicing costs on loans and credit facilities

- Foreign Exchange Gains/Losses: Impact of currency fluctuations

- Extraordinary Gains/Losses: One-time write-offs, asset sales, or restructuring costs

Profit Before Tax (EBT) = Operating Profit + Other Income – Interest Expense

Taxes & Net Profit

- Income Tax Expense

- Net Profit = Profit Before Tax – Taxes

- Earnings Per Share (EPS) Calculation

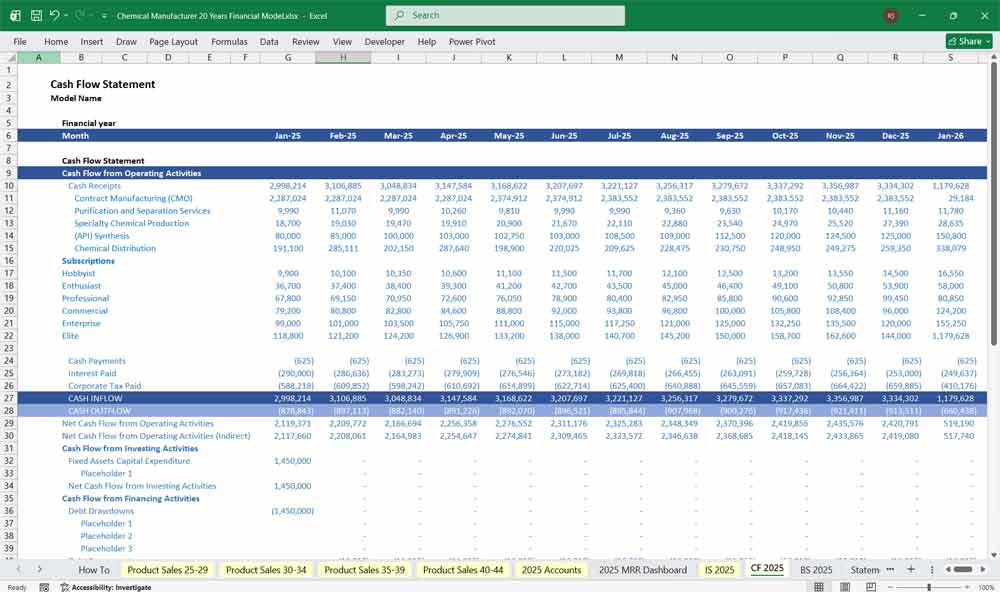

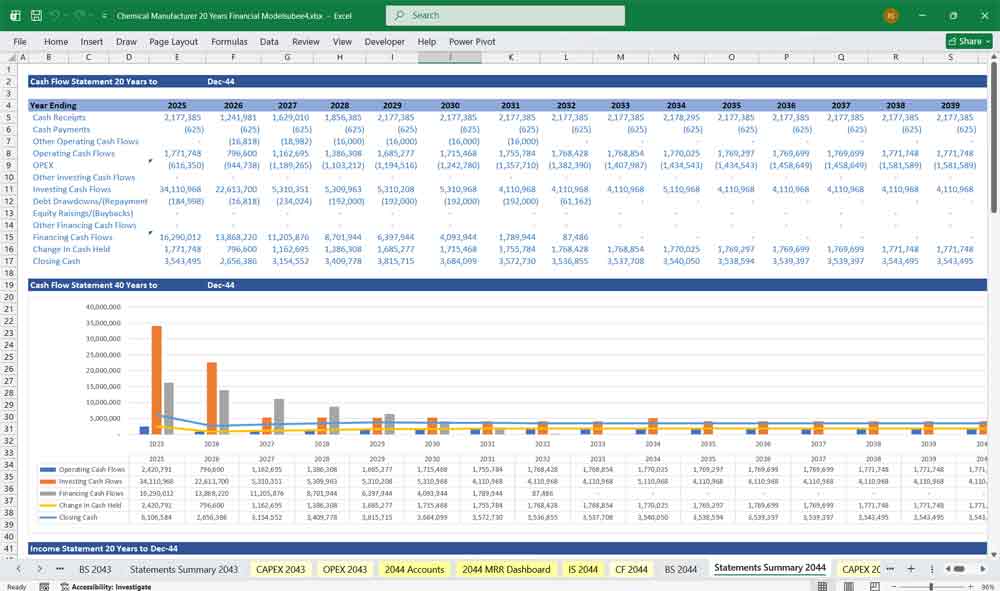

Chemical Manufacturer Cash Flow Statement

The Cash Flow Statement tracks cash movements under three main sections:

Operating Activities (Cash Flow from Operations – CFO)

- Net Profit (from Income Statement)

- Add: Non-Cash Expenses (Depreciation & amortization)

- Changes in Working Capital:

- Inventory Changes: Increase/decrease in raw materials & finished goods

- Accounts Receivable: Cash collected vs. outstanding customer payments

- Accounts Payable: Payments to suppliers

- Other Current Liabilities & Accruals

Net Cash Flow from Operating Activities = Cash Inflows – Cash Outflows

Investing Activities (Cash Flow from Investing – CFI)

- Capital Expenditures (CapEx):

- Purchase of new chemical manufacturing machinery, expansion of production capacity

- Investments in Subsidiaries or Joint Ventures

- Sale of Assets (if any)

Net Cash Flow from Investing = Asset Sales – Capital Expenditures

Financing Activities (Cash Flow from Financing – CFF)

- Debt Issued or Repaid:

- Loans taken from banks, repayment of existing debt

- Equity Raised or Dividends Paid:

- New stock issuance, share buybacks, dividends to shareholders

- Interest Payments on Loans

Net Cash Flow from Financing = Debt/Equity Inflows – Repayments & Dividends

Net Cash Flow Calculation

Total Net Cash Flow = CFO + CFI + CFF

- Add opening cash balance to derive the closing cash balance.

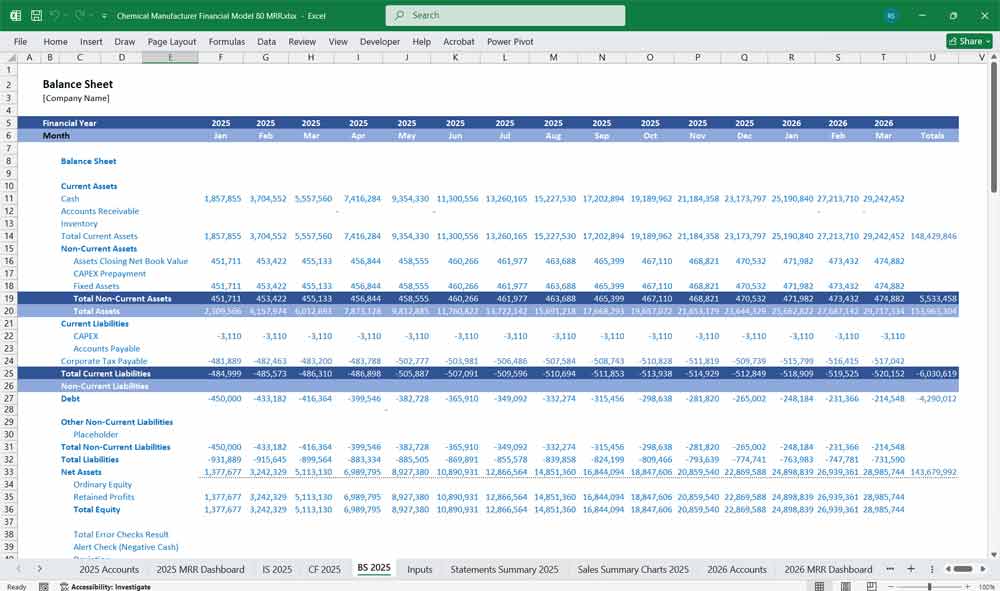

Chemical Manufacturer Balance Sheet

The Chemical Manufacturer Financial Model Balance Sheet provides a snapshot of the company’s financial position at a given time.

Assets Section

Current Assets:

- Cash & Cash Equivalents: Bank balances, marketable securities

- Accounts Receivable: Pending payments from customers

- Inventory:

- Raw materials, work-in-progress (WIP), finished goods

- Prepaid Expenses: Advance payments for utilities, rent, insurance

Non-Current Assets:

- Property, Plant & Equipment (PP&E):

- Land, buildings, chemical processing plants, reactors, storage tanks

- Depreciation is deducted from the asset value

- Intangible Assets:

- Patents, trademarks, R&D costs, goodwill from acquisitions

- Investments:

- Subsidiaries, joint ventures, financial assets

Total Assets = Current Assets + Non-Current Assets

Liabilities Section

Current Liabilities:

- Accounts Payable: Amount owed to suppliers

- Short-Term Borrowings: Bank overdrafts, working capital loans

- Accrued Expenses & Taxes Payable: Pending operating expenses & tax liabilities

Non-Current Liabilities:

- Long-Term Debt: Bank loans, bonds, term loans

- Deferred Tax Liabilities

Total Liabilities = Current Liabilities + Non-Current Liabilities

CAPEX OPEX Section

CAPEX:

- New Plants and Equipment

- Buildings

- Production and Decarbonization R&D

OPEX:

- Raw Materials

- Maintenance

- Marketing

Equity Section (Shareholders’ Equity)

- Share Capital: Issued stock & retained earnings

- Reserves & Surplus: Accumulated profits, revaluation reserves

- Retained Earnings: Profits reinvested in the business

Total Equity = Share Capital + Reserves + Retained Earnings

Total Liabilities & Equity = Total Assets

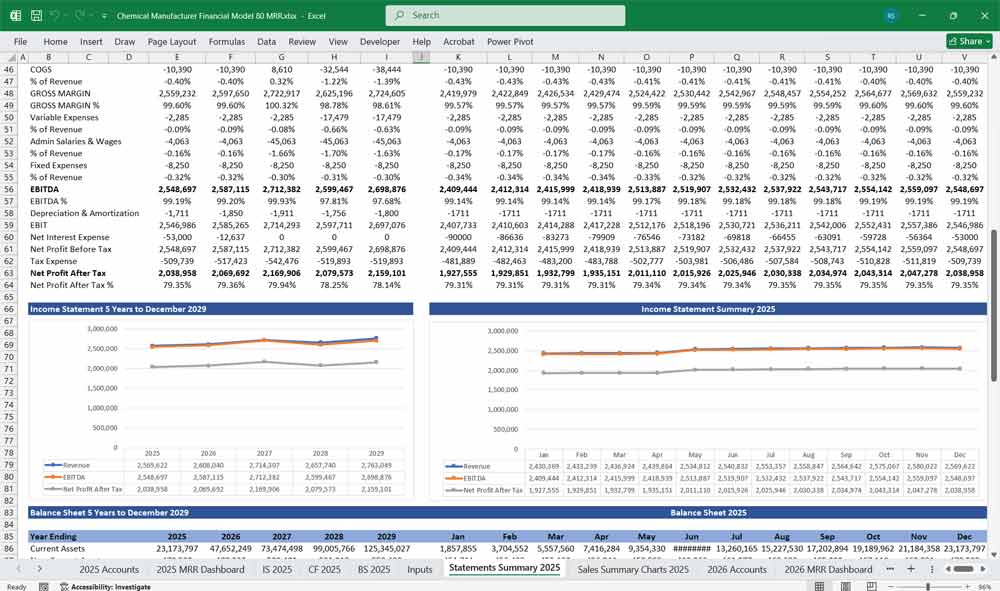

Key Financial Metrics for a Chemical Manufacturer

- Gross Profit Margin = (Gross Profit / Revenue) × 100

- Operating Profit Margin (EBIT Margin) = (EBIT / Revenue) × 100

- Net Profit Margin = (Net Income / Revenue) × 100

- Return on Assets (ROA) = (Net Income / Total Assets) × 100

- Return on Equity (ROE) = (Net Income / Shareholder Equity) × 100

- Debt-to-Equity Ratio = (Total Debt / Shareholder Equity)

- Inventory Turnover = (COGS / Average Inventory)

- Days Sales Outstanding (DSO) = (Accounts Receivable / Revenue) × 365

Editable Product Line Categorization for a Chemical Manufacturer

Product Lines

Target Audience: Small to medium-sized businesses, niche markets, and regional customers.

Focus: A balanced portfolio that covers essential chemical categories while maintaining manageable complexity.

Categorization of Product Lines:

Industrial Chemicals (10 Lines):

Solvents (e.g., acetone, ethanol, toluene).

Acids (e.g., sulfuric acid, hydrochloric acid).

Bases (e.g., sodium hydroxide, ammonia).

Oxidizing agents (e.g., hydrogen peroxide).

Specialty Chemicals (10 Lines):

Adhesives and sealants.

Surfactants and emulsifiers.

Catalysts for industrial processes.

Corrosion inhibitors.

Agrochemicals (5 Lines):

Fertilizers (e.g., nitrogen-based, phosphate-based).

Herbicides and pesticides.

Soil conditioners.

Pharmaceutical Chemical Intermediates (5 Lines):

Active Pharmaceutical Ingredients (APIs).

Excipients (e.g., binders, fillers).

Solvents for drug formulation.

Cleaning and Sanitization Chemicals (5 Lines):

Disinfectants (e.g., chlorine-based, quaternary ammonium compounds).

Detergents and degreasers.

Sanitizers for food processing.

Water Treatment Chemicals (5 Lines):

Coagulants and flocculants.

pH adjusters (e.g., lime, soda ash).

Biocides for microbial control.

Strategic Considerations:

Market Focus: Prioritize high-demand categories like industrial and specialty chemicals.

Operational Efficiency: Limit the number of SKUs per product line to reduce complexity.

Customer Segmentation: Tailor offerings to regional or niche markets (e.g., agrochemicals for agricultural regions).

Sustainability: Include eco-friendly or green chemical options to meet regulatory and customer demands.

80 Product Lines

Target Audience: Medium to large enterprises, global markets, and diverse industries.

Focus: A comprehensive portfolio that addresses a wide range of industries and applications, with a focus on customization and innovation.

Categorization of Product Lines:

Industrial Chemicals (20 Lines):

Expanded solvent offerings (e.g., glycol ethers, ketones).

Specialty gases (e.g., nitrogen, argon).

Polymer precursors (e.g., ethylene, propylene).

Lubricants and additives.

Specialty Chemicals (20 Lines):

Advanced adhesives for electronics and automotive industries.

High-performance coatings (e.g., anti-corrosion, UV-resistant).

Flame retardants and plasticizers.

Customized surfactants for personal care products.

Agrochemicals (10 Lines):

Expanded herbicide and pesticide formulations.

Biostimulants and micronutrient fertilizers.

Seed treatment chemicals.

Organic and bio-based agrochemicals.

Pharmaceutical Chemical Intermediates (10 Lines):

Expanded API offerings for different therapeutic areas.

Advanced excipients for controlled-release formulations.

Solvents and reagents for pharmaceutical R&D.

Cleaning and Sanitization Chemicals (10 Lines):

Specialty cleaners for healthcare and food industries.

Eco-friendly cleaning agents.

High-concentration disinfectants.

Customized formulations for industrial equipment cleaning.

Water Treatment Chemicals (10 Lines):

Advanced coagulants for wastewater treatment.

Scale inhibitors for boilers and cooling systems.

Specialty biocides for industrial water systems.

Reverse osmosis chemicals.

Personal Care and Chemical Cosmetics (5 Lines):

Emollients and moisturizers.

Preservatives and stabilizers.

Fragrance ingredients.

Food and Beverage Additives (5 Lines):

Preservatives and antioxidants.

Flavor enhancers.

Stabilizers and thickeners.

Strategic Considerations:

Global Reach: Ensure product lines meet international regulatory standards (e.g., REACH, FDA).

Customization: Offer tailored formulations for key clients in industries like automotive, electronics, and healthcare.

Innovation: Invest in R&D to develop cutting-edge products (e.g., bio-based chemicals, nanotechnology).

Sustainability: Expand eco-friendly and circular economy-focused product lines.

Supply Chain Optimization: Implement advanced inventory and logistics systems to manage the increased complexity.

Customer Support: Provide technical expertise and consulting services to help clients select the right products.

With 80 editable product lines, the model aids companies looking for a larger share of the market, caters to diverse industries, and offers more specialized solutions, while also increasing operational complexity and requiring greater investment in R&D and supply chain management.

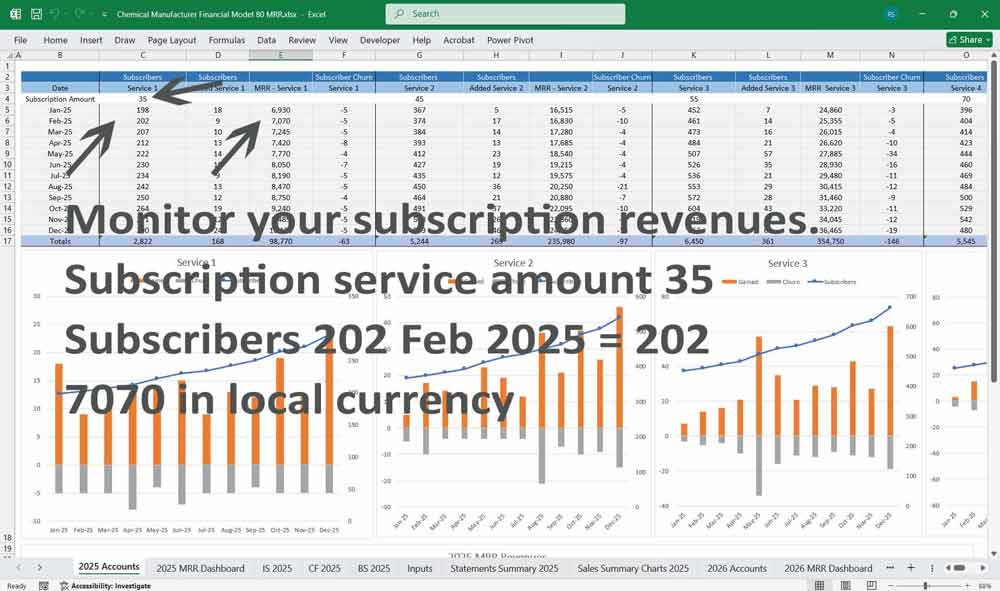

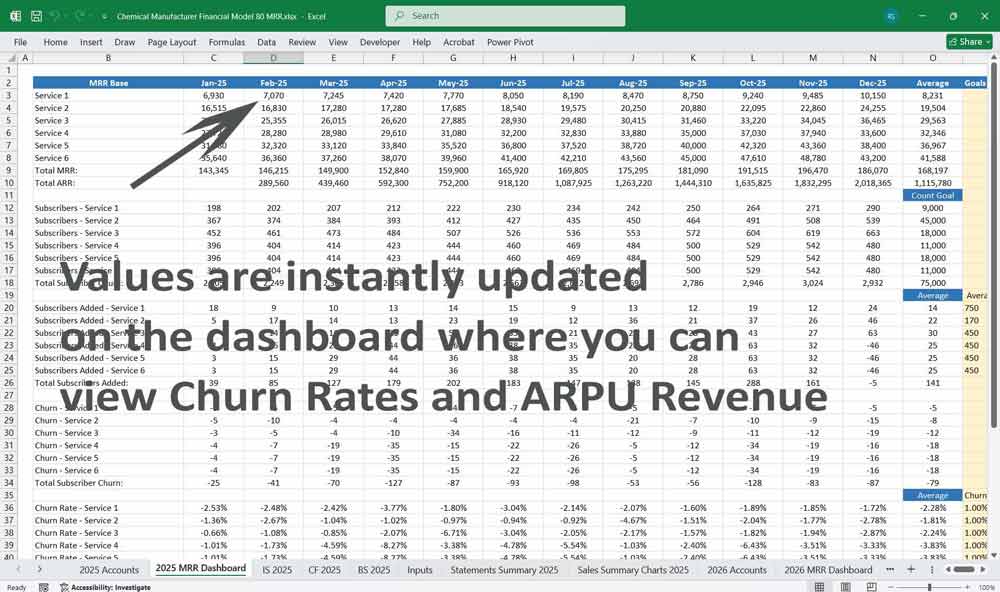

6-tier subscription model for a chemical manufacturer

This involves structuring offerings that cater to different customer segments, from small businesses to large enterprises. Each tier should provide increasing value, services, and benefits to justify the higher price points.

Tier 1: Basic Chemical Access

Target Audience: Small businesses, startups, or occasional buyers.

Price: Low-cost entry point.

Features:

Access to a limited catalog of standard chemical products.

Basic technical data sheets and safety information.

Email support with a 48-hour response time.

Monthly newsletter with industry insights and product updates.

No minimum order quantity (MOQ) but limited to smaller batch sizes.

Standard shipping with no expedited options.

Value Proposition: Affordable access to essential chemicals with minimal support, ideal for businesses with low-volume needs.

Tier 2: Standard Chemical Support

Target Audience: Growing businesses with regular but moderate chemical needs.

Price: Moderate, with a slight increase from Tier 1.

Features:

Access to a broader range of standard and specialty chemicals.

Priority email support with a 24-hour response time.

Access to basic technical consultations (2 hours/month).

Discounts on bulk orders (5-10%).

Expedited shipping options available.

Quarterly webinars on chemical applications and safety.

Value Proposition: Enhanced support and product access for businesses scaling their operations.

Tier 3: Premium Chemical Access

Target Audience: Medium-sized enterprises with consistent chemical demands.

Price: Mid-range, reflecting added benefits.

Features:

Full access to the entire product catalog, including specialty and custom formulations.

Dedicated account manager for personalized service.

Advanced technical consultations (5 hours/month).

Customized packaging and labeling options.

Discounts on bulk orders (10-15%).

Priority shipping and logistics support.

Access to exclusive industry reports and market analysis.

Value Proposition: Tailored solutions and premium support for businesses with more complex needs.

Tier 4: Enterprise Chemical Solutions

Target Audience: Large enterprises with high-volume and specialized requirements.

Price: Higher, reflecting enterprise-level services.

Features:

Custom chemical formulations and R&D collaboration.

Dedicated technical support team with 24/7 availability.

Unlimited technical consultations.

Volume-based discounts (15-20%).

Customized supply chain and inventory management solutions.

On-site technical training and safety workshops.

Quarterly business reviews to optimize chemical usage and costs.

Value Proposition: Comprehensive, end-to-end solutions for large-scale operations with a focus on customization and efficiency.

Tier 5: Chemicals and Strategic Partnerships

Target Audience: Key accounts and long-term partners with significant influence in the industry.

Price: High, reflecting the strategic nature of the relationship.

Features:

Co-development of new chemical products and technologies.

Exclusive access to pre-release products and innovations.

Joint marketing and branding opportunities.

Dedicated R&D team for collaborative projects.

Highest tier of volume-based discounts (20-25%).

Customized global logistics and warehousing solutions.

Invitations to exclusive industry events and networking opportunities.

Value Proposition: A collaborative partnership that drives innovation and mutual growth, tailored for industry leaders.

Tier 6: Global Elite Chemical Solutions

Target Audience: Multinational corporations and industry giants with global operations.

Price: Premium, reflecting the highest level of service and exclusivity.

Features:

Bespoke chemical solutions tailored to global operations.

Dedicated global account team with regional representatives.

Access to proprietary technologies and patents.

Priority in R&D pipelines and innovation projects.

Customized sustainability and compliance programs.

Highest volume-based discounts (25-30%).

Exclusive access to executive-level strategic planning sessions.

Global logistics optimization and real-time tracking.

Value Proposition: Unparalleled service, innovation, and support for the most demanding and influential clients in the industry.

Additional Considerations Across Tiers

Scalability:

Each tier is designed to be scalable, allowing customers to upgrade as their production needs grow.Integration & API Access:

Higher tiers offer greater levels of system integration, enabling seamless connectivity with in-house systems and real-time tracking.Flexibility:

Options for rollover of unused print credits and flexible overage billing ensure that customers only pay for what they need.Value-Added Services:

Complimentary design consultations, technical support, and training workshops become more prominent in the higher tiers, adding strategic value beyond just production capacity.Service Level Agreements (SLAs):

Defined SLAs across tiers provide transparency regarding turnaround times, quality standards, and uptime guarantees, with the most rigorous SLAs reserved for Enterprise and Premium tiers.

Final Notes on the Financial Model

Financial model for a Chemical manufacturer

- Scenario Analysis: Create best-case, base-case, and worst-case projections.

- Break-even Analysis: Determine sales volume required to cover fixed & variable costs.

- Sensitivity Analysis: Assess how changes in raw material costs, pricing, or demand impact profitability.

This structured 20-Year Chemical Manufacturer Financial Model addresses a broad market spectrum, offering the right balance between cost, production capacity, support, and customization at each subscription level.

Download Link On Next Page

Download Link On Next Page