BESS Supplier Financial Model

20-Year Financial Model for a Battery Energy Storage Systems (BESS) supplier.

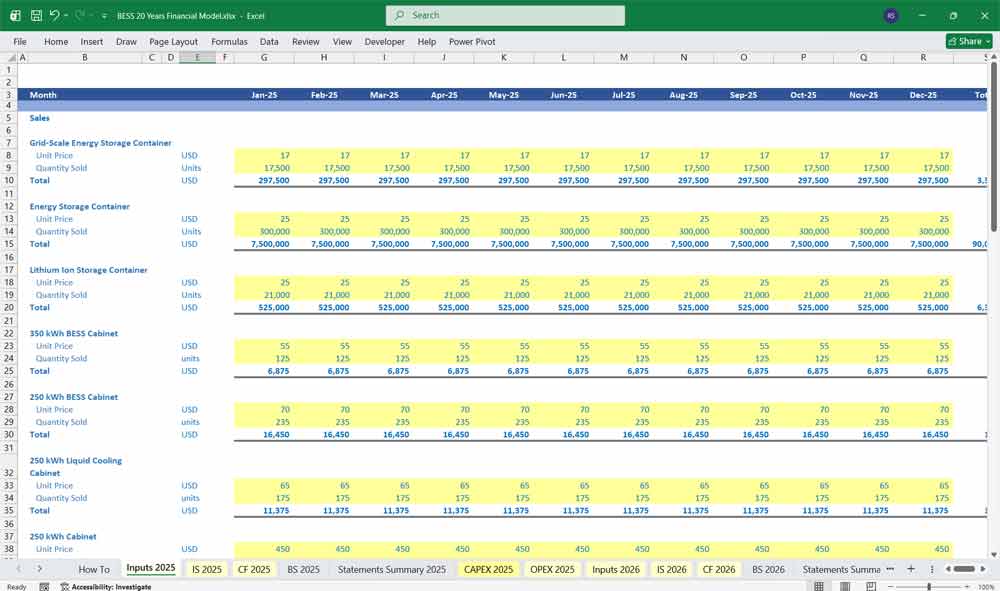

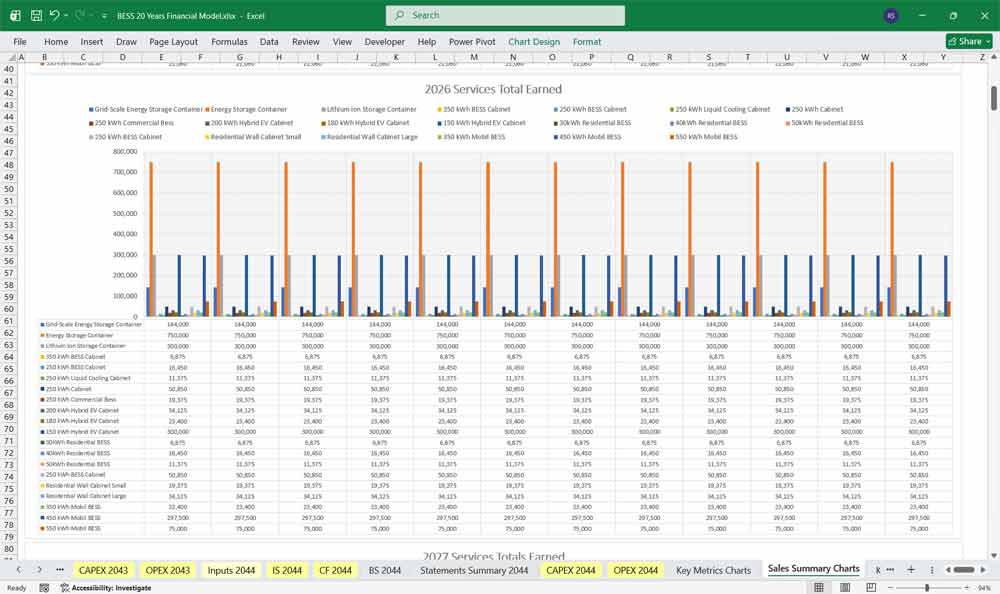

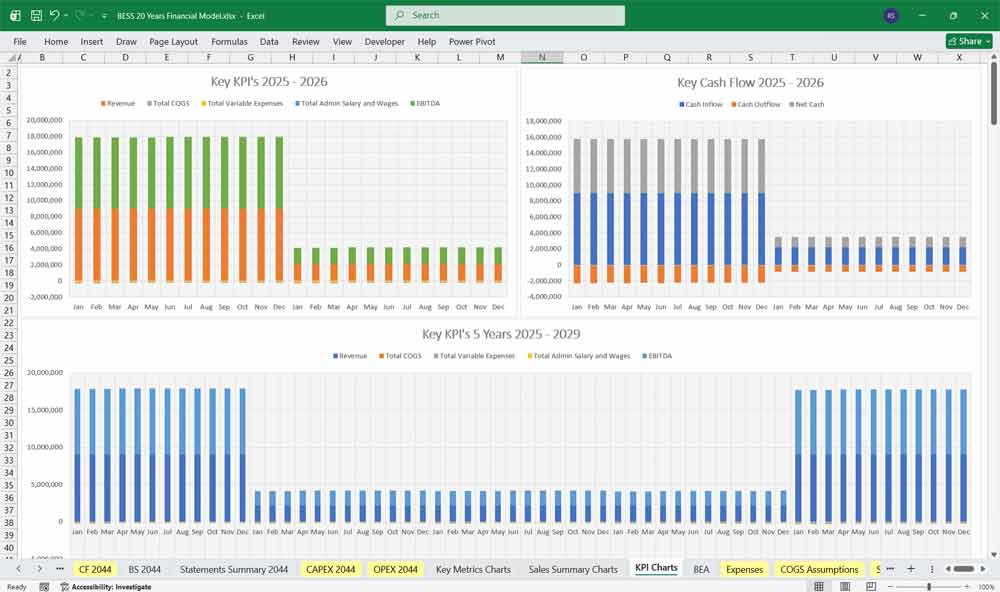

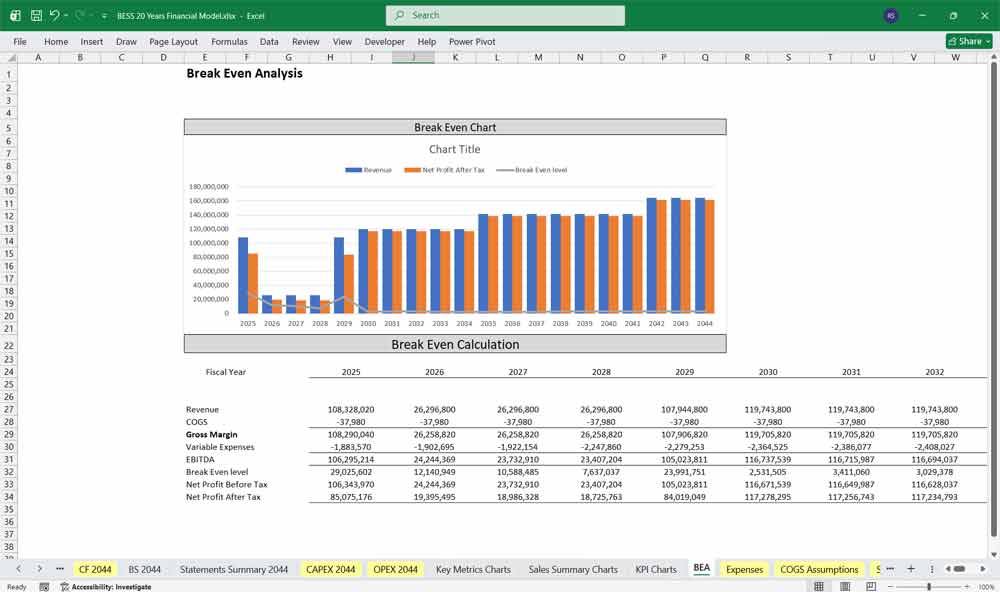

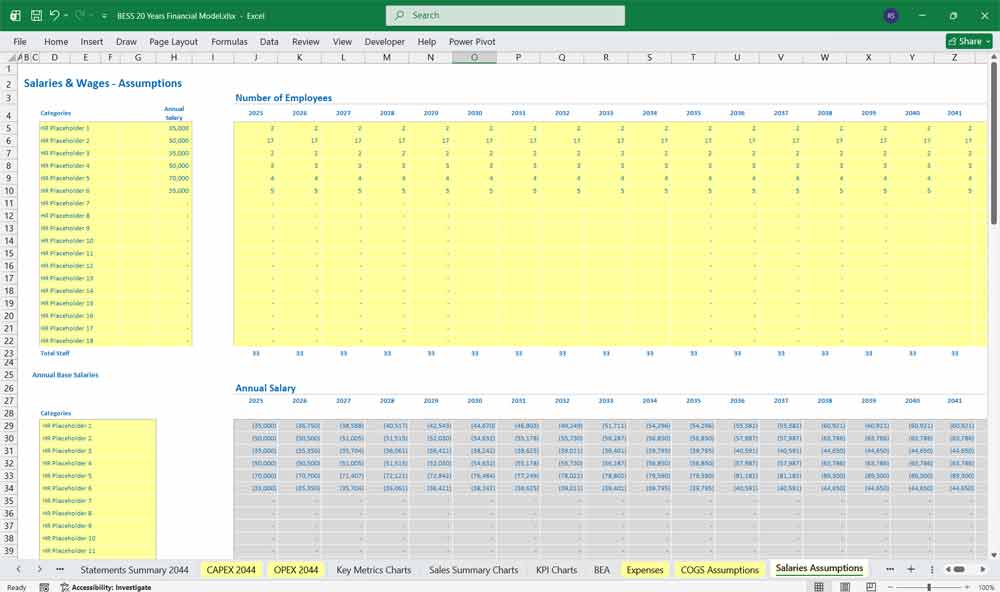

This very extensive 20 Year BESS Model involves detailed revenue projections, cost structures, capital expenditures, and financing needs. This model provides a thorough understanding of the financial viability, profitability, and cash flow position of your company. Includes: 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets. Follow this link for a dedicated page for a Battery Storage Financial Model.

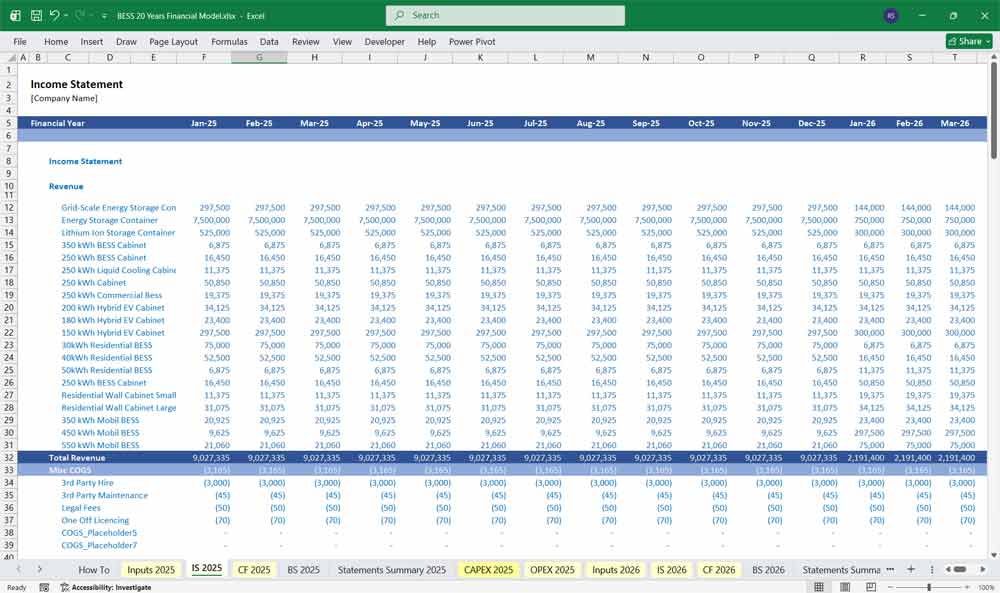

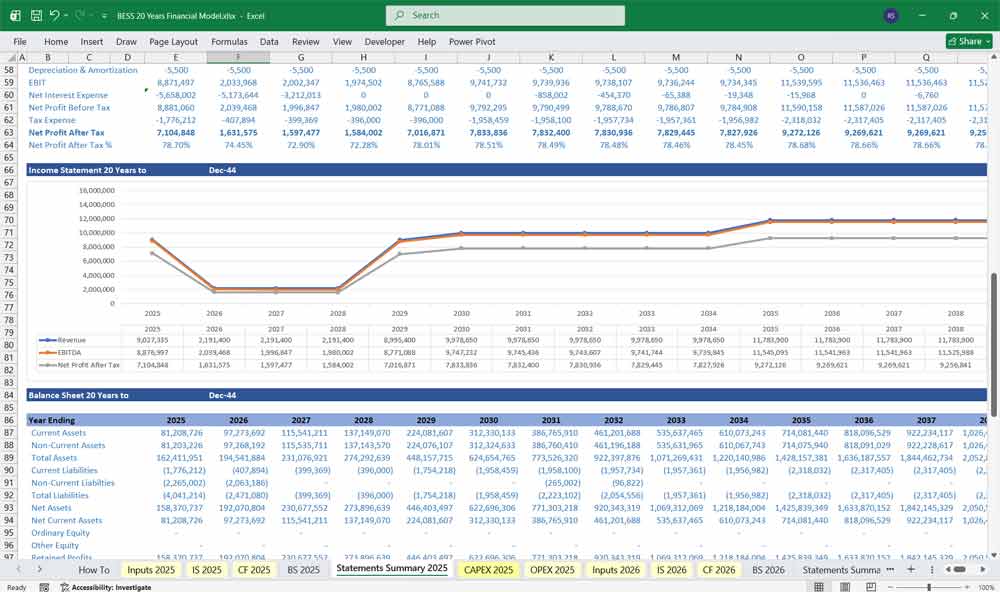

Income Statement (Profit & Loss)

The Income Statement for a BESS supplier focuses on Gross Margin per unit and the heavy investment in Research & Development (R&D).

Editable Revenue Stream Examples

Hardware Sales: Lump-sum revenue from the sale of containers, cabinets, and BMS units.

Engineering & Integration Fees: Professional services for customizing BESS configurations for specific projects.

Service & Maintenance Contracts: Post-sale revenue for annual inspections and hardware upkeep.

Cost of Goods Sold (COGS)

Raw Materials: Steel for cabinets, PCB components for BMS, cabling, and thermal management units.

Direct Labor: Wages for assembly line workers and quality control engineers.

Inbound Logistics: Shipping costs for bringing sub-components (like cells or microchips) to your facility.

Warranty Reserve Accrual: A percentage (typically 1%–3%) of every sale set aside to cover future hardware failures.

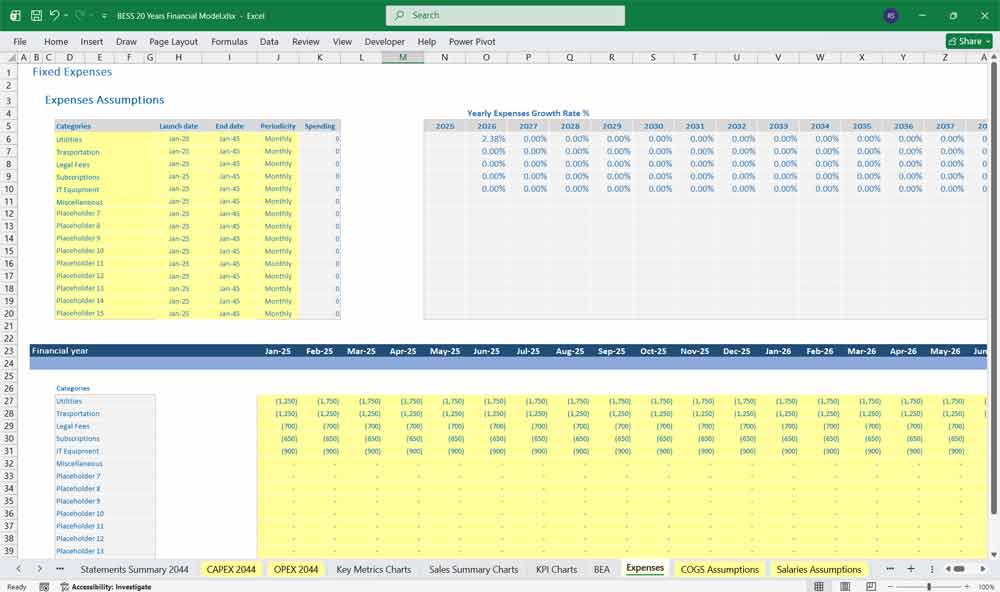

Operating Expenses (OpEx)

R&D: The largest OpEx line item, covering firmware developers and hardware engineering.

Sales & Marketing: Commissions for technical sales teams and trade show costs.

General & Admin: Office rent, executive salaries, and legal fees for IP protection.

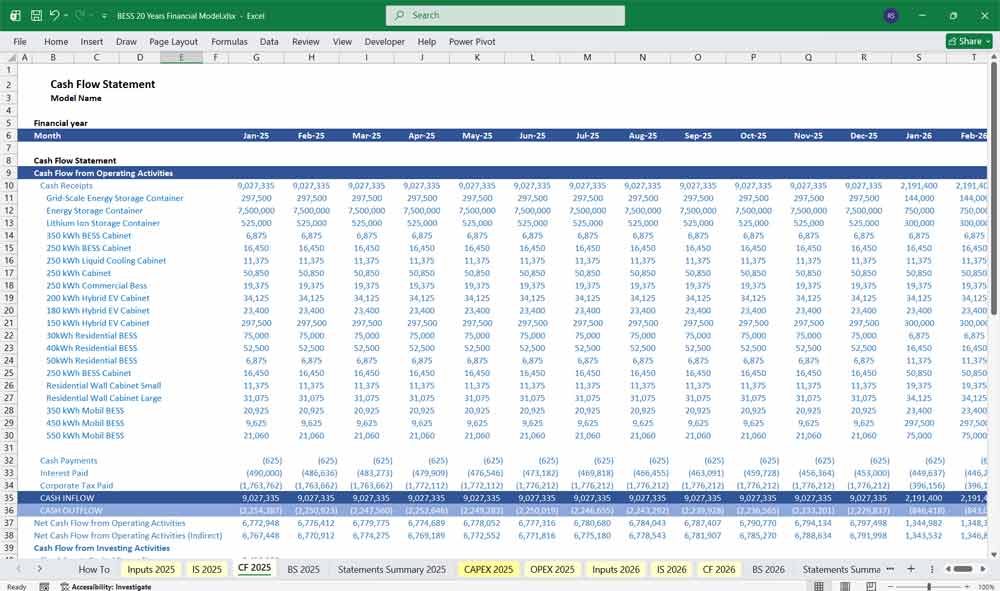

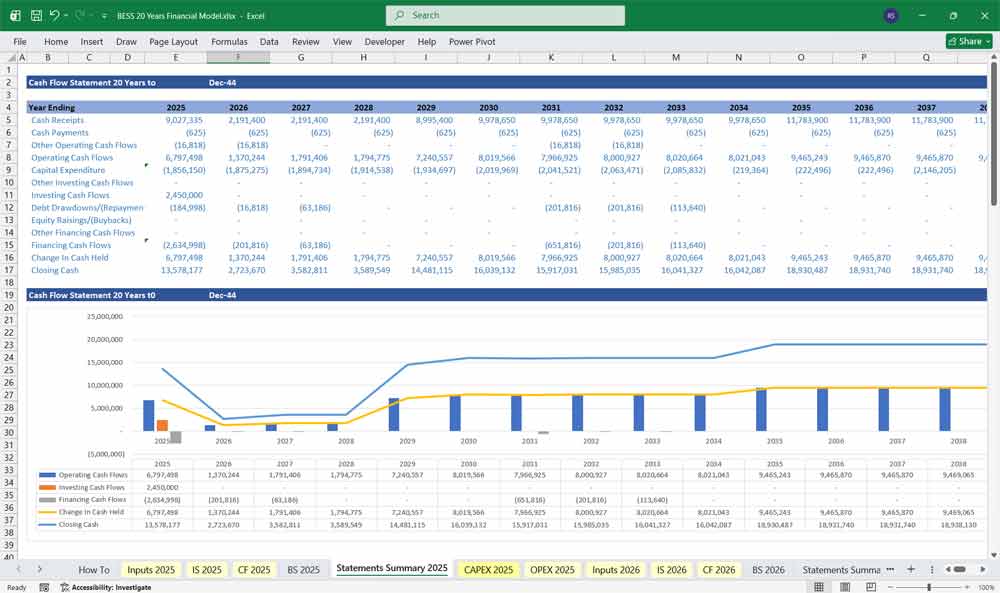

BESS Supplier Cash Flow Statement (CFS)

In hardware, Cash is King. The CFS reveals the “Cash Gap”—the period between paying for raw materials and receiving payment from a customer.

Operating Activities

Net Income: Starting point from the P&L.

Change in Working Capital: This is the most volatile section. A massive sale of 50 containers will cause a huge “outflow” in inventory (cash gone) and an “inflow” in accounts receivable (cash not yet received).

Depreciation & Amortization: Adding back non-cash expenses from factory machinery and capitalized software.

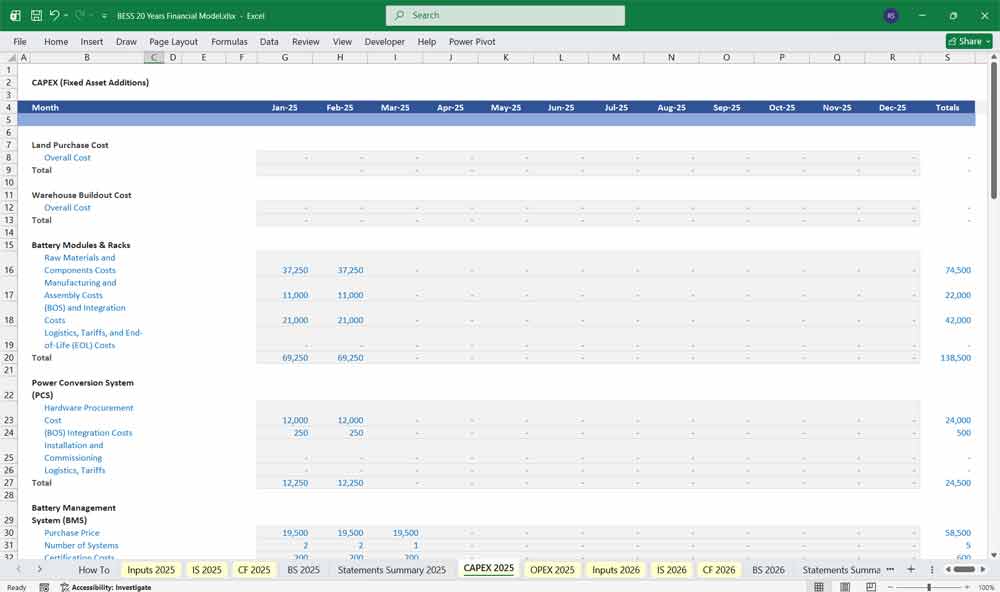

Investing Activities

Capital Expenditures (CapEx): Investment in assembly line automation, testing chambers, and factory expansion.

Capitalized R&D: Labor hours spent developing the next version of the BMS hardware.

Financing Activities

Equity/Debt Issuance: Raising capital to fund growth.

Inventory Financing: Drawing on a line of credit to purchase raw materials ahead of a large order.

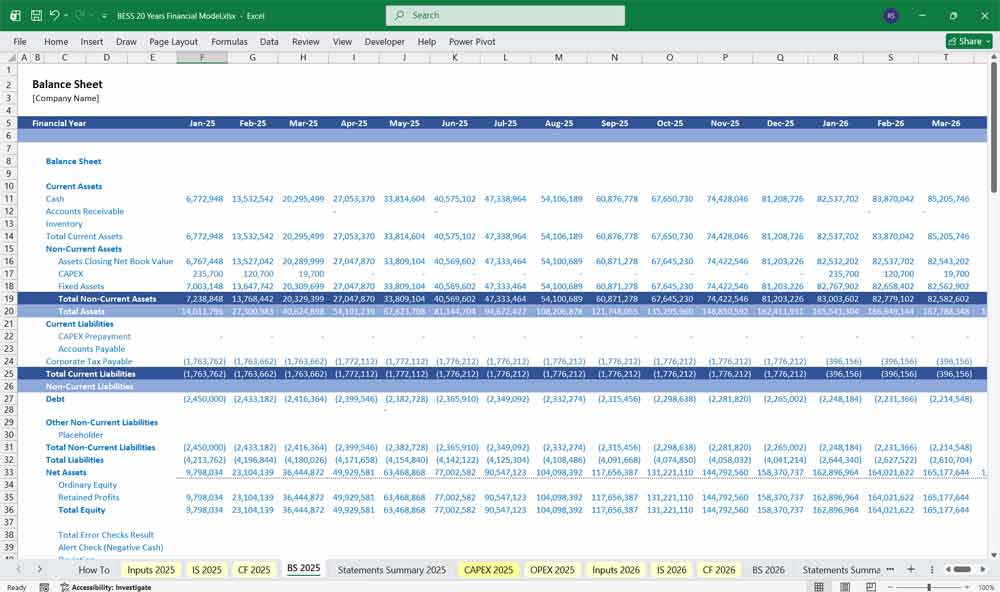

BESS Supplier Balance Sheet

The Balance Sheet for a Battery Energy Storage Systems (BESS) supplier is dominated by Inventory Management and Long-term Warranty Provisions.

Assets

Cash & Equivalents: Crucial for managing the long production cycles of hardware.

Inventory: Divided into three categories:

Raw Materials: Unassembled steel, PCB boards, and sensors.

Work in Progress (WIP): Units currently on the assembly line.

Finished Goods: Completed cabinets ready for shipment.

Accounts Receivable: Payments owed by developers (often on 30/60/90-day terms).

Intangible Assets: Capitalized R&D costs for proprietary BMS software and patents.

Liabilities

Accounts Payable: Short-term debt to your own component suppliers.

Deferred Revenue: Cash received for long-term maintenance contracts that hasn’t been “earned” yet.

Warranty Provision: A long-term liability representing the estimated cost of repairing or replacing faulty units over the next 10–15 years.

Debt: Revolving credit lines used to finance inventory purchases.

Overview & Key Model Drivers

Core Business Lines:

Hardware Sales: BMS units, prefabricated cabinets (small-scale), containerized solutions (large-scale), and ancillary components (cooling, safety, wiring).

Project Development: Turnkey BESS solutions for utilities/IPPs.

Key Drivers & Assumptions:

Sales Volume (MWh): Driven by market demand (grid services, renewables integration, C&I).

Average Selling Price (ASP) per MWh: Decreasing trend due to battery cost reductions, but value-added software can stabilize margins.

Bill of Materials (BOM) Cost: Linked to raw material prices (lithium, electronics) and cell procurement.

R&D Intensity: High – critical for BMS algorithm development and system integration.

Sales Cycle: Long (6-24 months) for large container projects; shorter for standardized cabinets.

Working Capital: Heavy due to inventory holdings and receivables from large projects.

BESS Supplier Financial Model: Advantages of Up to 20 Year Model

A 20-year financial model gives a BESS Supplier the ability to plan around long product lifecycles and extended contract horizons. In both domestic and commercial industries. Commercial contracts can span 15–20 years, and equipment lifespans often exceed two decades. A long-term model ensures that capital investment decisions—like designing and constructing new products or expanding production capacity—are aligned with the revenue and cash flow timelines they are meant to serve.

Look Closer Into BESS Supplier Investments

Long-range modeling allows management to capture the full return on R&D and innovation investments. In the Modular Battery Energy Storage System (BESS), new material systems or manufacturing processes can take years to develop, certify, and commercialize. A 20-year horizon shows not only the upfront development costs but also the long-term payoff in reduced production costs, expanded product lines, and higher market share over time.

Up To 20 Years Of BESS Company Projections

With 20 years of projections, the business can stress test market and technology scenarios. For example, the model can incorporate demand surges from programs, downturns from automotive slowdowns, or disruptions from competing materials. This long view supports more resilient strategic planning by highlighting how different economic cycles and technological shifts affect profitability and cash flow across decades.

Final Notes on the Financial Model

This 20 Year BESS Supplier Financial Model focuses on balancing capital expenditures with steady revenue growth from a diversified product line. By optimizing operational costs, and power efficiency, and maximizing high-margin sales, the models ensure sustainable profitability and cash flow stability.

Download Link On Next Page