Battery Storage Financial Model

20-Year Financial Model for a Battery Storage (BESS).

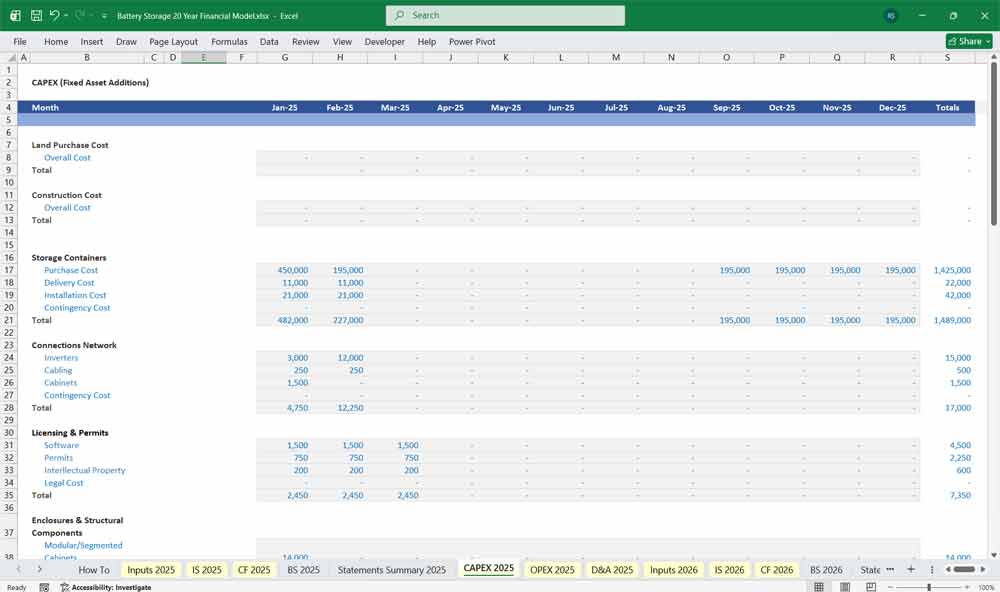

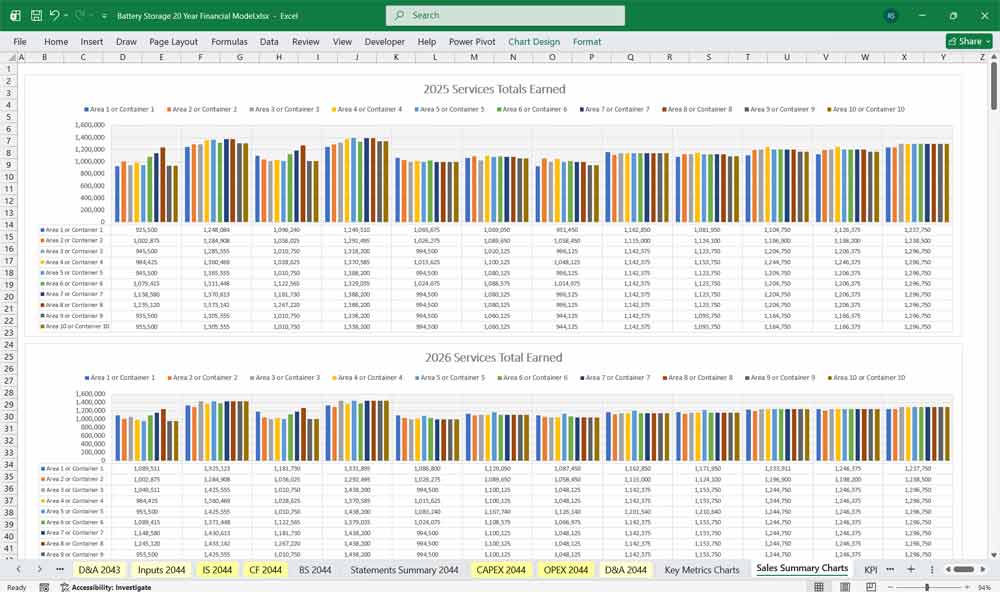

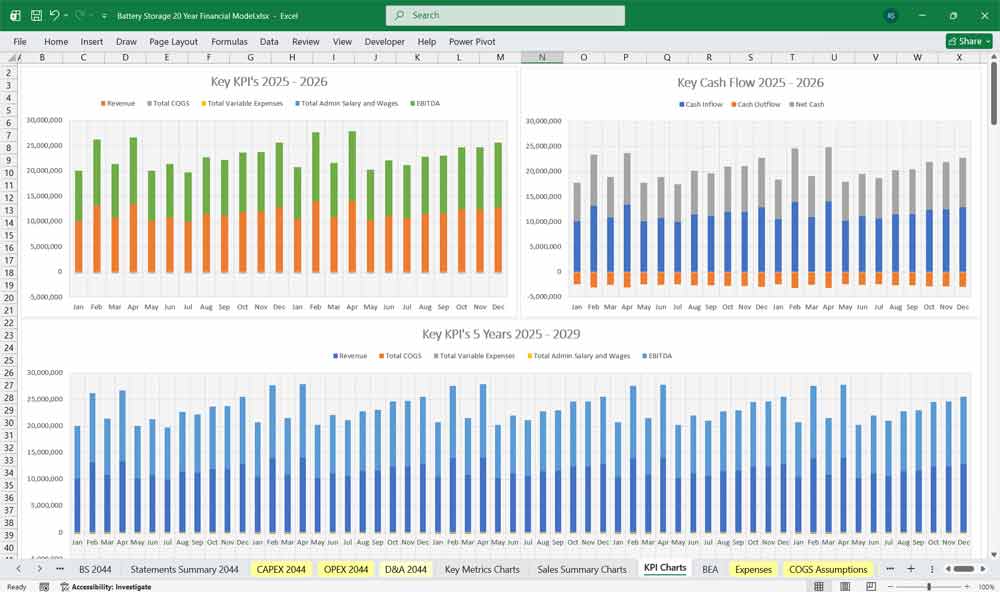

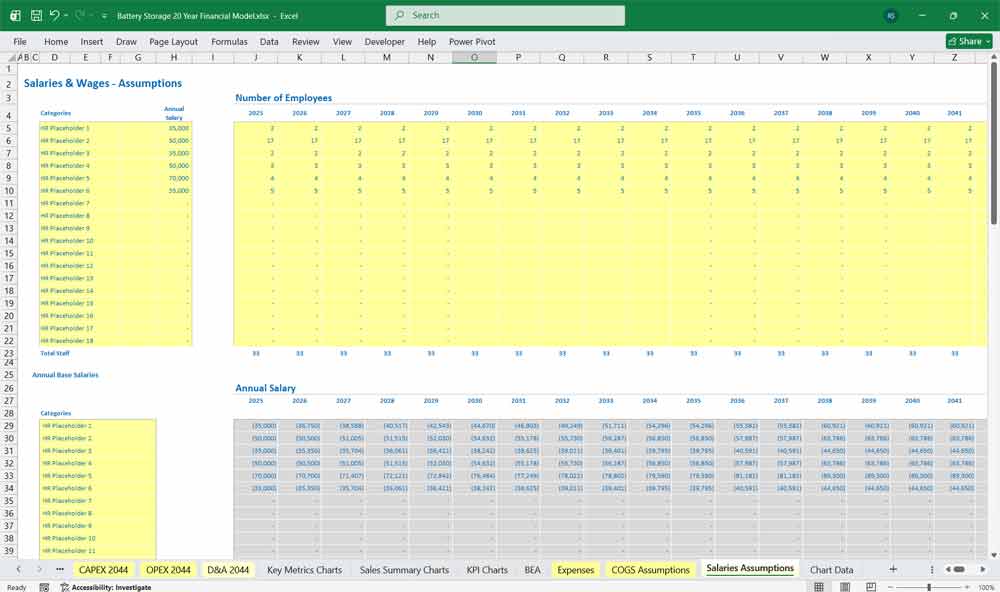

This very extensive 20-year, 3-statement BESS Model involves detailed revenue projections, cost structures, and capital expenditures. This model provides a thorough understanding of the financial viability, profitability, and cash flow position of your battery storage finances. Covers Capacity Degradation, Depreciation Loss Percentages and Battery Storage Depreciation Value. Includes: 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets. Follow this link if you sell products for BESS storage, Grid-Scale Energy Storage Containers, BESS Cabinets, Liquid Cooling Cabinets, for a dedicated model

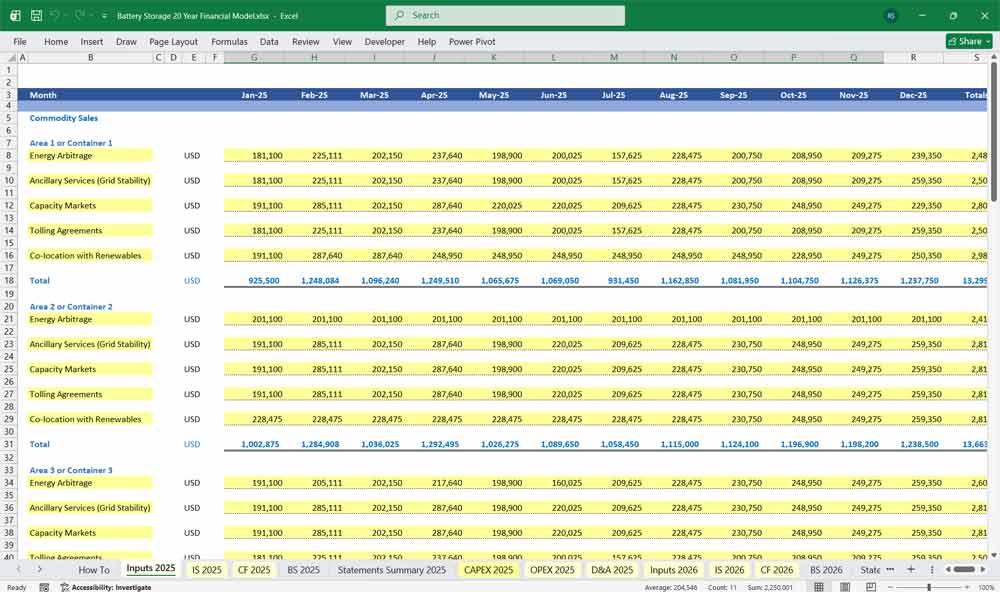

Editable Revenue within the Model

Energy Arbitrage Revenue

Energy arbitrage revenue arises from charging the battery during low-price periods and discharging during high-price periods.

Revenue is driven by:

Hourly or sub-hourly price spreads

Effective usable energy capacity after degradation

Round-trip efficiency losses

Annual number of cycles

Gross arbitrage revenue is calculated based on discharged energy multiplied by the price differential. Charging costs (energy purchased) are deducted to arrive at net arbitrage revenue. As the battery degrades, usable energy capacity declines, directly reducing arbitrage revenue over time.

Ancillary Services Revenue (Grid Stability)

Ancillary services revenue comes from providing services such as:

Frequency regulation

Spinning reserve

Voltage support

Fast frequency response

Revenue may be:

Capacity-based (availability payments)

Performance-based (accuracy and response speed)

Energy-based (limited energy dispatch)

These revenues depend primarily on power capacity (MW), not energy capacity (MWh), and therefore degrade more slowly than arbitrage revenues. However, severe degradation or inverter limitations can reduce available capacity and performance scores.

Capacity Market Revenue

Capacity markets pay the BESS for being available during system stress events.

Revenue drivers include:

Accredited capacity (MW)

Capacity auction clearing prices

Derating factors applied by system operators

Forced outage rates

Capacity degradation reduces accredited capacity over time, leading to a gradual decline in capacity revenues unless augmentation is performed.

Tolling Agreement Revenue

Under tolling agreements, a third party controls the dispatch of the battery and pays a fixed or semi-fixed fee.

Revenue characteristics:

Stable, predictable cash flow

Often indexed to inflation

Limited exposure to merchant price risk

Tolling revenues are usually based on contracted power and energy availability, with penalties for non-performance due to degradation or outages.

Co-location with Renewables Revenue

Does your Battery Storage work with Co-located BESS systems to generate additional value?

Storing curtailed renewable energy

Increasing capture of high-price periods

Avoiding grid export constraints

Improving renewable project PPA value

Revenue is derived from:

Incremental energy sales

PPA price uplift

Reduced curtailment losses

Shared interconnection savings

Editable revenues that are highly dependent on renewable generation profiles and grid congestion patterns.

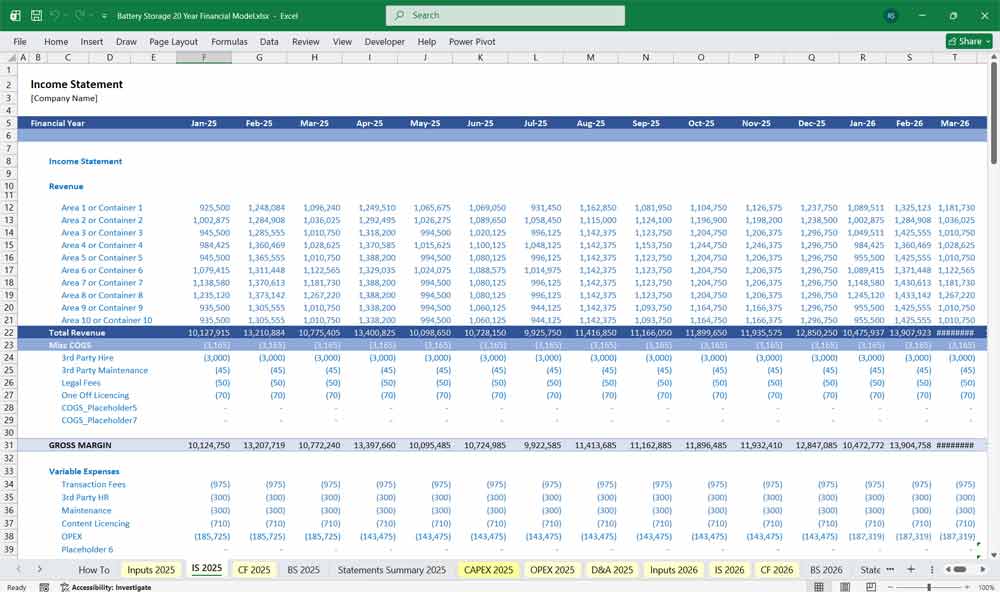

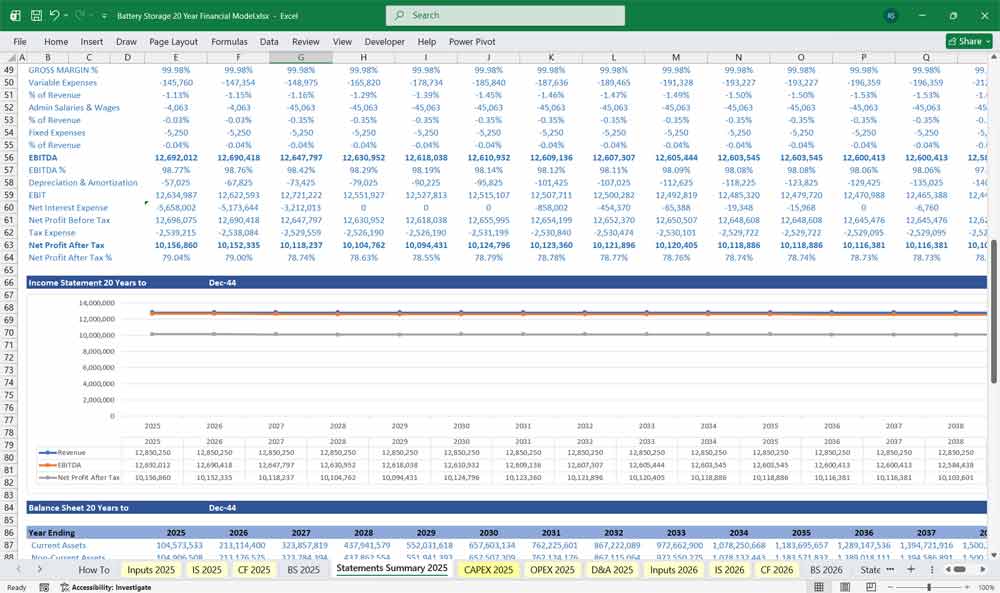

Income Statement

The Income Statement reflects annual profitability.

Key components:

Total Revenue from all revenue streams

Less energy purchase costs

Less fixed and variable operating expenses

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

Less depreciation

Earnings Before Interest and Taxes (EBIT)

Less interest expense

Earnings Before Tax (EBT)

Less taxes

Net Income

Degradation reduces revenue over time, while depreciation remains fixed unless asset augmentation is modeled.

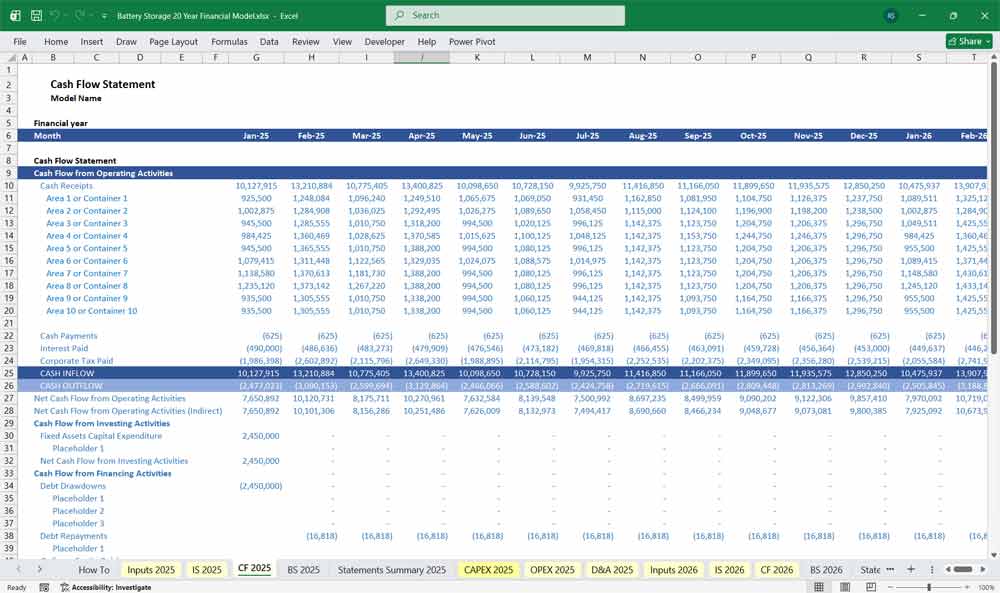

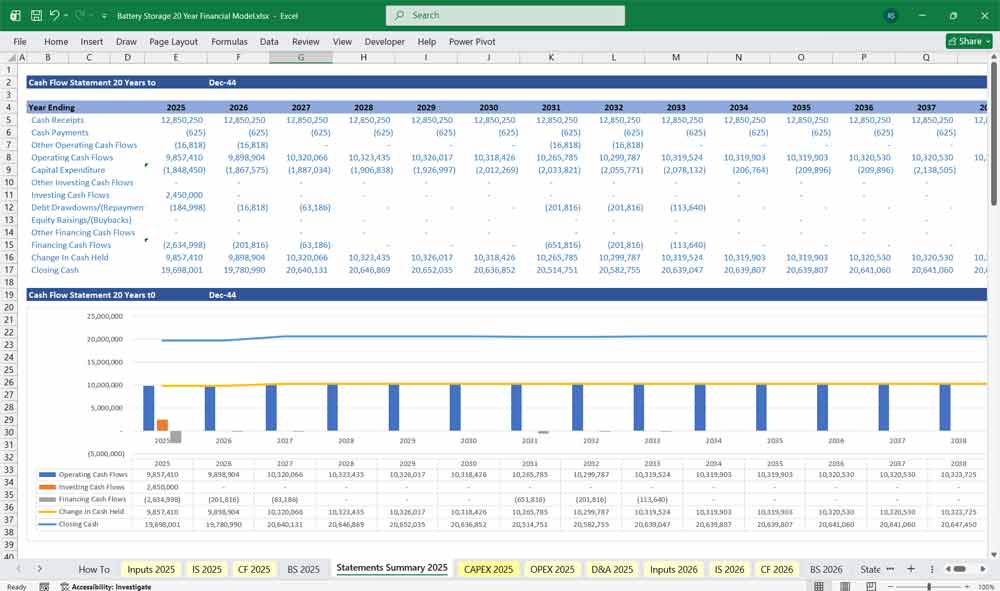

Battery Storage Cash Flow Statement

The Cash Flow Statement tracks liquidity.

7.1 Operating Cash Flow

Includes:

EBITDA

Less cash taxes

Plus/minus working capital changes

Operating cash flow declines over time due to degradation unless offset by price escalation or augmentation.

Investing Cash Flow

Includes:

Initial capital expenditure

Battery augmentation or replacement costs

End-of-life decommissioning costs

Residual or salvage value (if any)

Financing Cash Flow

Includes:

Debt drawdowns

Debt principal repayments

Interest payments

Equity injections

Dividends or distributions

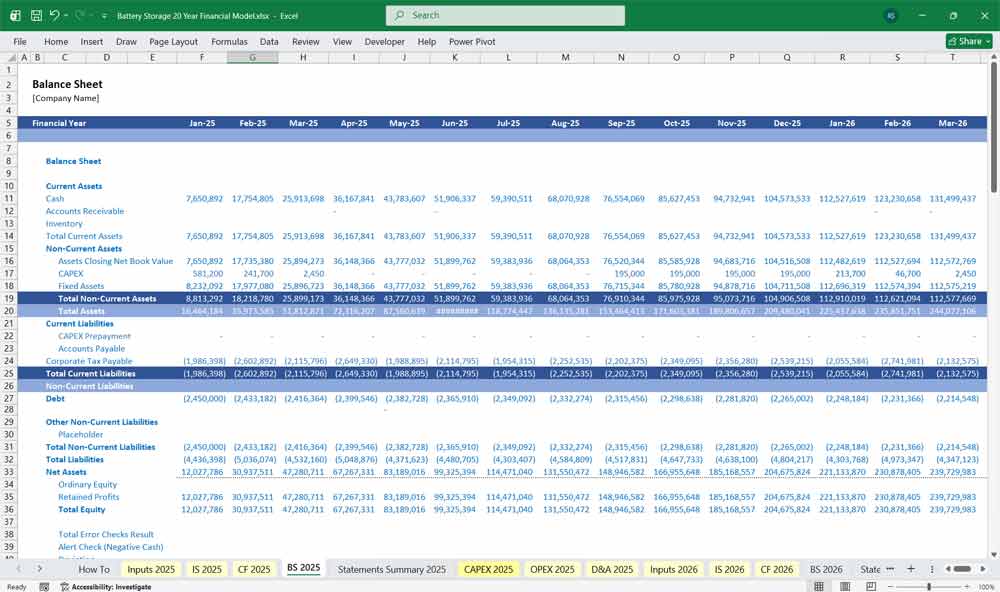

Battery Storage Balance Sheet

The Balance Sheet reflects the financial position.

8.1 Assets

Net fixed assets (CAPEX minus accumulated depreciation)

Cash and cash equivalents

Accounts receivable

Restricted reserves (DSRA, maintenance reserve)

Liabilities

Long-term debt

Current portion of debt

Accounts payable

Accrued operating expenses

Equity

Paid-in capital

Retained earnings

Current year net income

As depreciation accumulates and debt amortizes, equity increases if the project remains profitable.

Key Financial Outputs For A Battery Storage Energy System (BESS)

The model typically produces:

Project IRR and Equity IRR

Net Present Value (NPV)

Debt Service Coverage Ratio (DSCR)

Payback period

Sensitivity to price spreads, degradation, and CAPEX

Capacity Degradation and Efficiency Loss

Capacity Degradation

Battery capacity degrades due to cycling and calendar aging.

Typical assumptions:

Annual degradation rate: 1.5%–3.0%

End-of-life capacity: 60%–80% of original

Degradation applied to usable MWh capacity

Degradation impacts:

Reduced arbitrage volumes

Reduced capacity market accreditation

Lower ancillary service availability

Potential contract penalties

Monitor Efficiency Loss

Round-trip efficiency may decline slightly over time.

Typical assumption:

Initial efficiency: 88%–92%

Annual efficiency loss: 1%–3%

Monitor these increases in charging costs and view how they reduce net arbitrage margins.

Battery Storage Financial Model Operating Costs

Fixed Operating Expenses

Fixed O&M costs include:

Site lease

Asset management

Software and EMS licenses

Insurance

Monitoring and reporting

These costs are usually escalated annually by inflation.

Variable Operating Expenses

Variable costs depend on usage and include:

Energy losses due to inefficiency

Maintenance tied to cycling

Degradation-related replacement reserves

Performance penalties

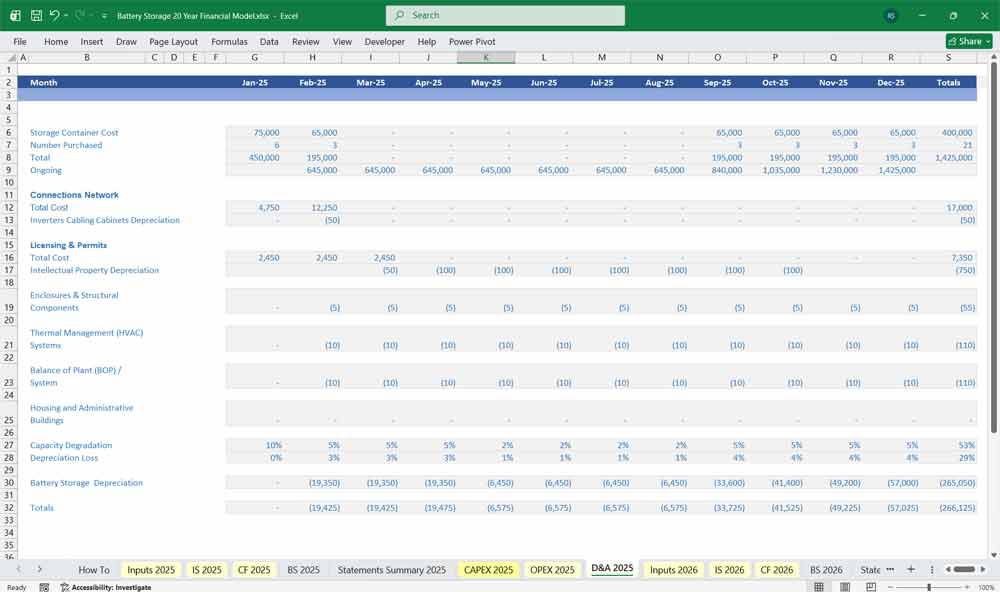

Dedicated Depreciation & Amortization Tab For A Battery Storage Model

View Depreciation and Depreciation Loss Percentages

Depreciation

Editable BESS assets depreciated

Capacity Degradation

- Depreciation Loss Percentage

Battery Storage Depreciation)

- Networking Inverters Cabling Cabinets

- Enclosures & Structural Components

- Intellectual Property Depreciation

- Thermal Management (HVAC) Systems

- Balance of Plant (BOP) / System

Typical depreciation life:

10–15 years for batteries

20–25 years for balance-of-plant and civil works

Battery Storage Financial Model: Advantages of Up to 20 Year Model

A 20-year financial model gives a BESS owner the ability to plan around long product lifecycles and extended contract horizons. In both domestic and commercial industries. Commercial contracts can span 15–20 years, and equipment lifespans often exceed two decades. A long-term model ensures that capital investment decisions—like designing and constructing new products or expanding production capacity—are aligned with the revenue and cash flow timelines they are meant to serve.

Offers A Closer Look At Battery Storage Investments

Long-range modeling allows management to capture the full return on R&D and innovation investments. In the Modular Battery Energy Storage System (BESS), new material systems or manufacturing processes can take years to develop, certify, and commercialize. A 20-year horizon shows not only the upfront development costs but also the long-term payoff in reduced production costs, expanded product lines, and higher market share over time.

Up To 20 Years Of Battery Storage Projections

With 20 years of projections, the business can stress test market and technology scenarios. For example, a 20-year model can incorporate demand surges from programs, downturns from slowdowns, or disruptions from competing materials. This long view supports more resilient strategic planning by highlighting how different economic cycles and technological shifts affect profitability and cash flow across decades.

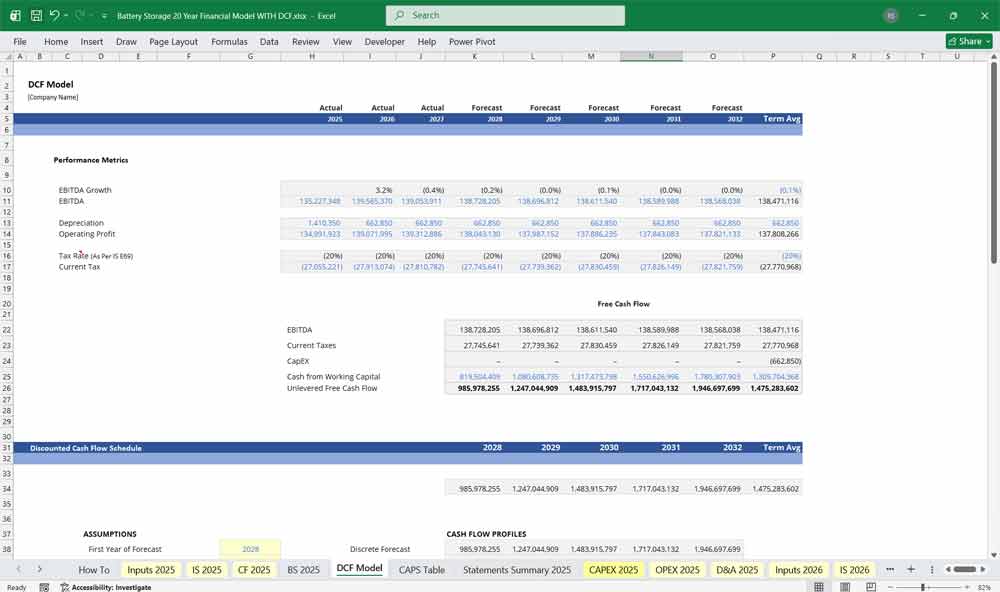

Battery Storage Discounted Cash Flow (DCF) with Terminal Value, Sensitivity Analysis, and WACC Model add-on

DCF (Discounted Cash Flow) for a BESS

The DCF (Discounted Cash Flow) (5-year forecast period for high-growth, detailed projections) model add-on is a valuation that estimates what your Battery Storage is worth today based on its projected future cash flows. The principle is that money you receive in the future is worth less than money you have now. This helps find the present value; you “discount” those future cash flows back to today using a specific rate.

WACC for a BESS

WACC (Weighted Average Cost of Capital) is the discount rate used in a DCF for your Battery Storage. It represents the average cost of raising money from all sources—both equity (shareholders) and debt (lenders). A higher WACC means future cash flows are worth less in today’s terms, leading to a lower valuation. It’s the “hurdle rate” a company must clear to create value.

Sensitivity Analysis for a BESS

Battery Storage Sensitivity Analysis is a “what-if” tool that tests how much the DCF valuation changes when you alter its key assumptions, like the WACC or long-term growth rate. Instead of a single valuation number, it produces a range of outcomes, showing which inputs the model’s result is most sensitive to. This helps identify the biggest risks and provides a more robust, realistic valuation range.

Final Notes on the Financial Model

This 20 Year Battery Storage Financial Model focuses on balancing capital expenditures and Capacity Degradation Depreciation Loss Percentage, against steady revenue growth from a diversified product line. By optimizing operational costs, and power efficiency, and maximizing high-margin sales, the models ensure sustainable profitability and cash flow stability.

Download Link On Next Page

Download Link On Next Page