Air Cargo Hub Financial Model

20-Year Financial Model for an Air Cargo Hub

This Financial Model Bundle contains 5 Excel Workbooks

1. Air Cargo Hub Financial Model for detailed monitoring of the revenue raised from the running of an Air Cargo Hub.

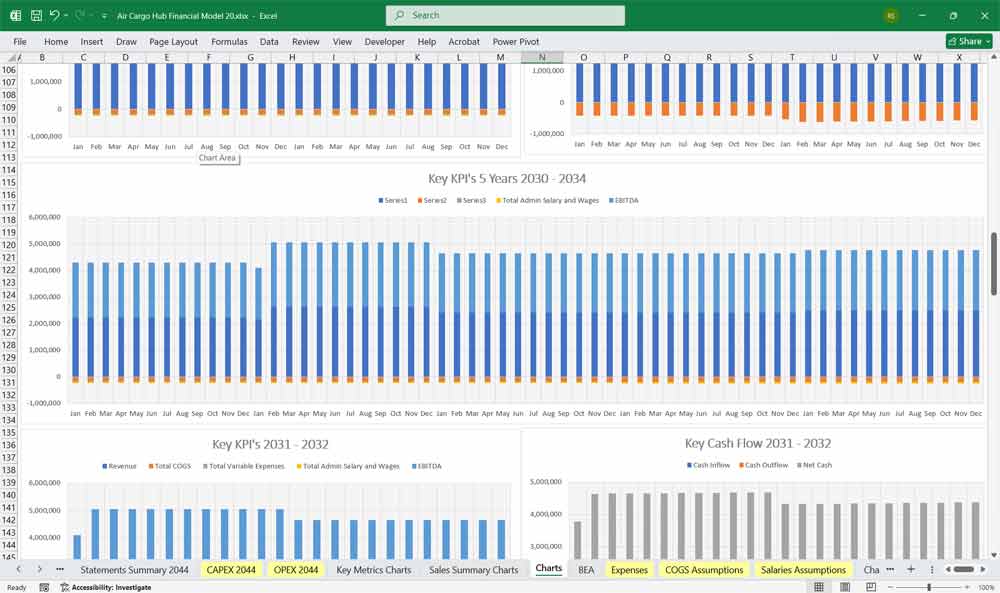

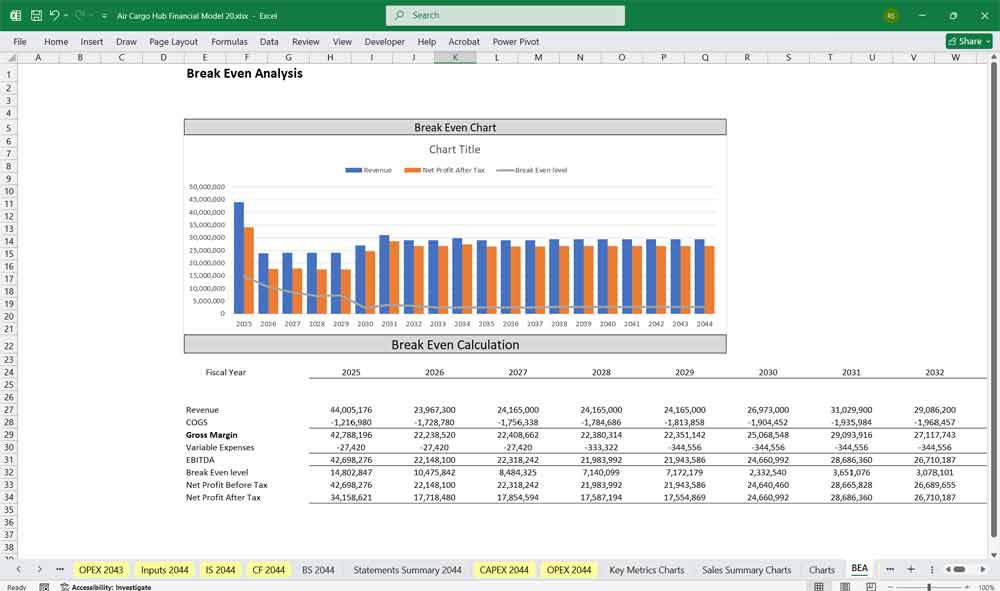

20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX Sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the specified revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets. 140 plus tabs with over 120 spreadsheets.

Bundle also contains 4 construction Excel Financial Models, each containing 9 tabs covering various individual building developments within the Cargo Hub.

2. Cargo Terminal Construction Financial Model

Each tab has 10 stage editable inputs

Civil Work Tab: Planning & Feasibility Study, Site Clearing & Earthworks, Subgrade Preparation and Base Course Installation

Building Construction Tab: Foundation Layout and Excavation, Foundation Reinforcement & Formwork, Concrete Pouring and Curing, to Interior Works & Fit-Out

Electrical Works Tab: Final Design Walkthrough, Lighting Installation, HVAC Installation to Renewable Energy Integration

Interiors Tab: Structural & Utility Rough-Ins, Rollerbed Systems, Castor Decks, Slave Pallets to Final Testing & Commissioning

Landscaping Tab: Master Planning & Design, Budgeting & Approval Meet, Clearing & Grading, Infrastructure & Hardscaping, Soil Preparation & Planting

3. Customs and Border Control Facility Construction Financial Model

4. Cold Store Warehouse Construction Financial Model

5. Storage Warehouse Construction Financial Model

MS Project MPP File, a very detailed timeline scheduling template with over 212 timeline schedules

MS Excel version of above.

29 MS Word Documents covering the project management from Business Case files with reviews, to Quality Registers, and Risk Management Strategies.

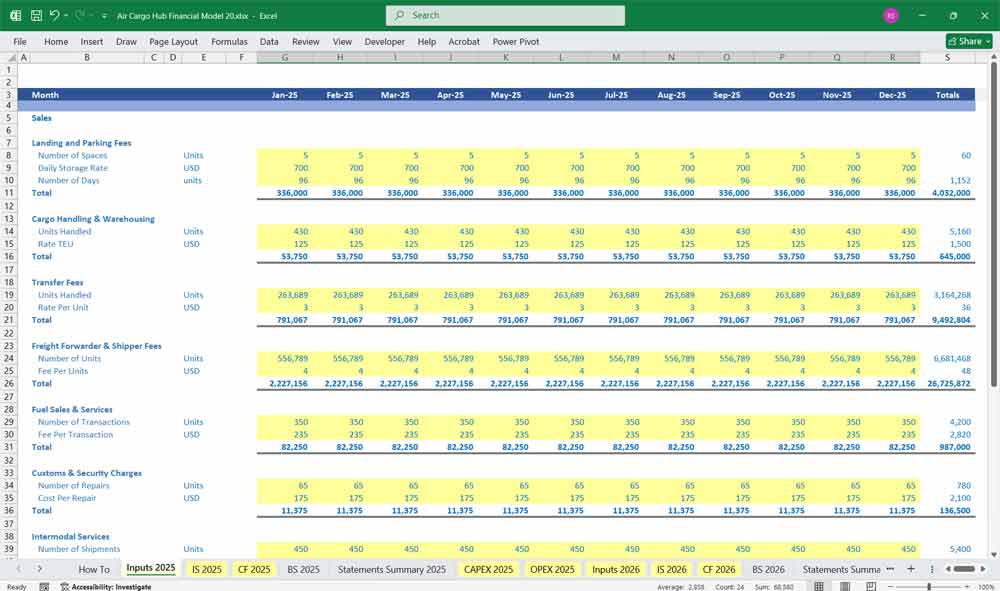

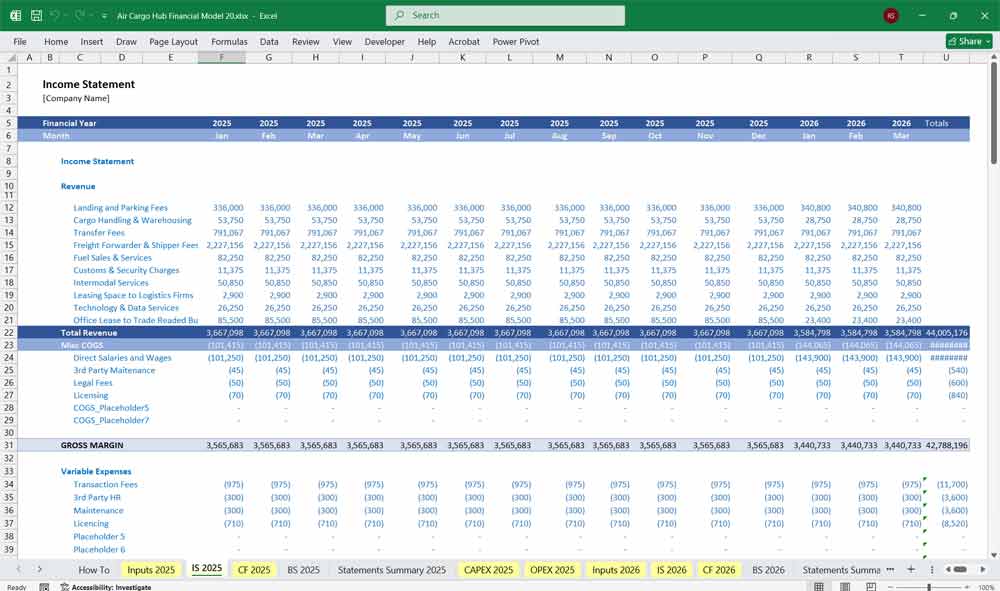

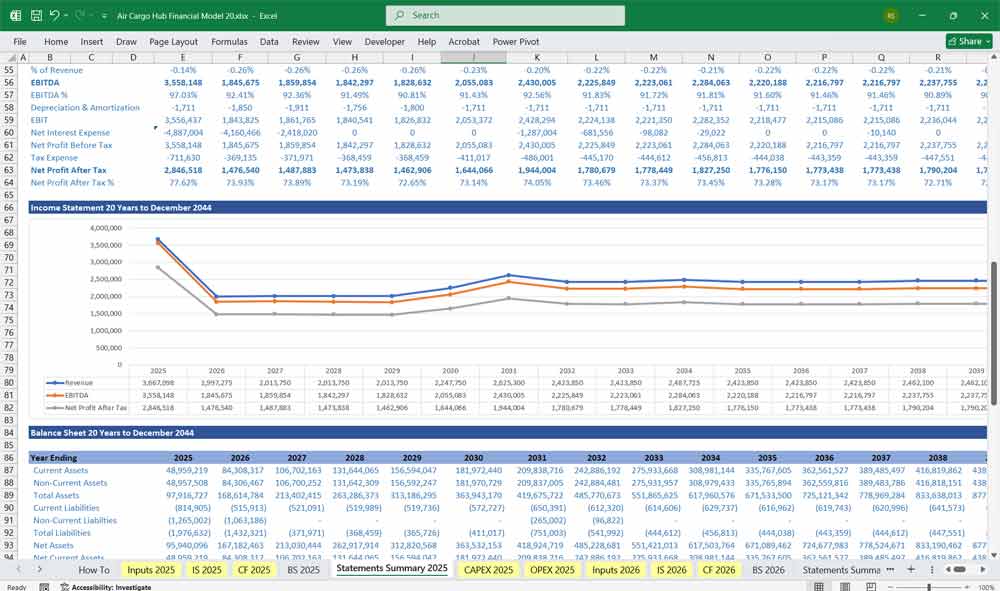

Income Statement (Profit & Loss Statement)

The Income Statement outlines the revenues, costs, and profitability of the air cargo hub.

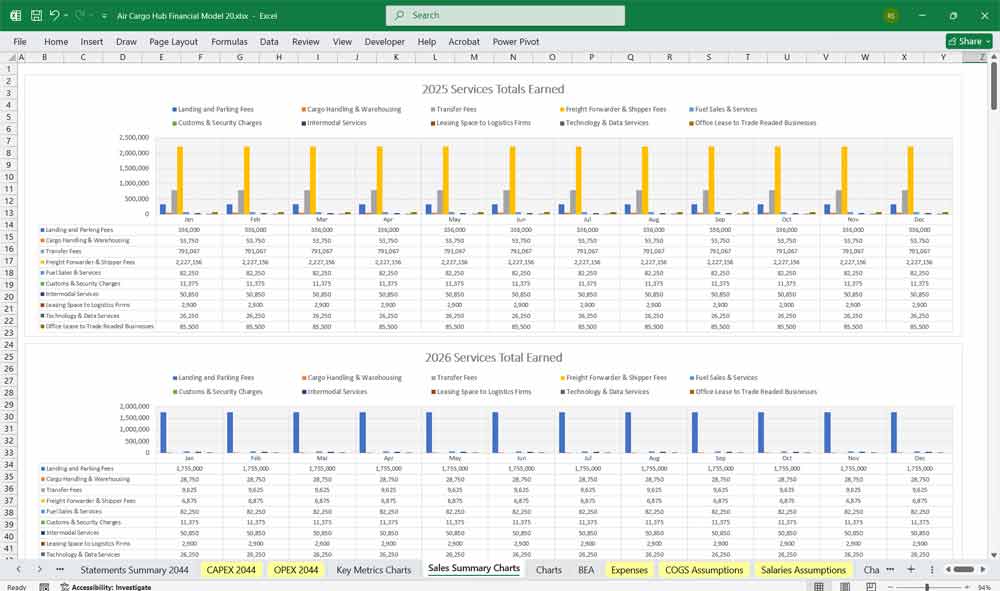

Revenue Streams:

Revenue is derived from multiple sources, categorized into the 6-Tier Subscription:

Landing & Parking Fees

- Number of cargo flights × landing fee rate per ton MTOW (Maximum Takeoff Weight) + hourly parking charges

Cargo Handling & Warehousing

- Tons of cargo handled × handling fee + warehousing rental (per m² per day)

Transfer Fees (Air-to-Air, Air-to-Truck)

- Number of interline/transfer cargo instances × fixed transfer fee

Freight Forwarder & Shipper Fees

- Fee per transaction/service or space rental charges in freight forwarder village

Fuel Sales & Services

- Fuel volume sold (liters or gallons) × markup per liter

Customs & Security Charges

- Fee per consignment or per shipment based on volume or weight

Intermodal Services

- Revenue from truck/train interconnectivity services, per shipment

Intermodal Services

- Revenue from truck/train interconnectivity services, per shipment

Leasing to Logistics Firms

- Long-term lease income (warehouses, office space, cold storage, etc.)

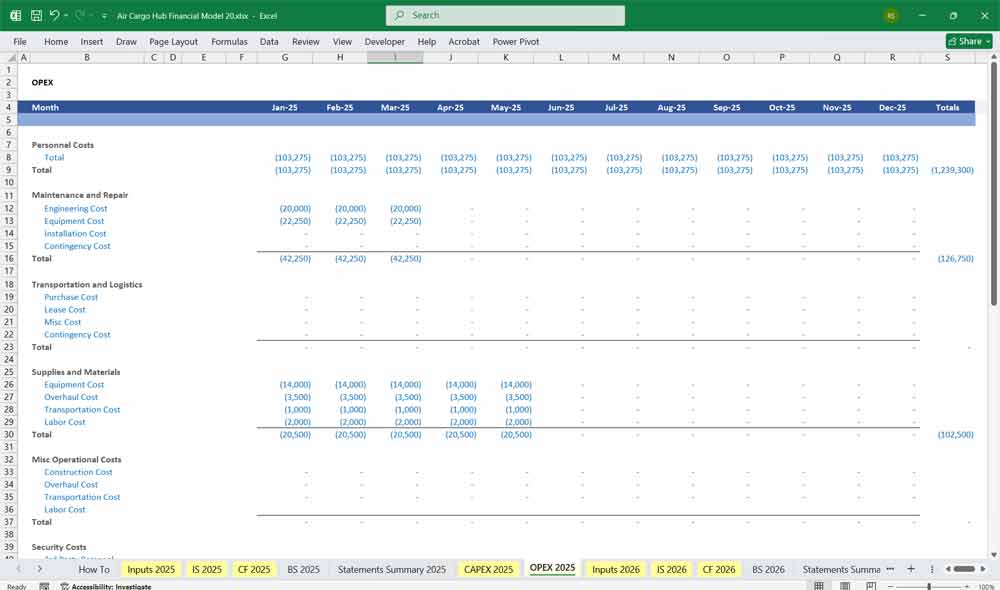

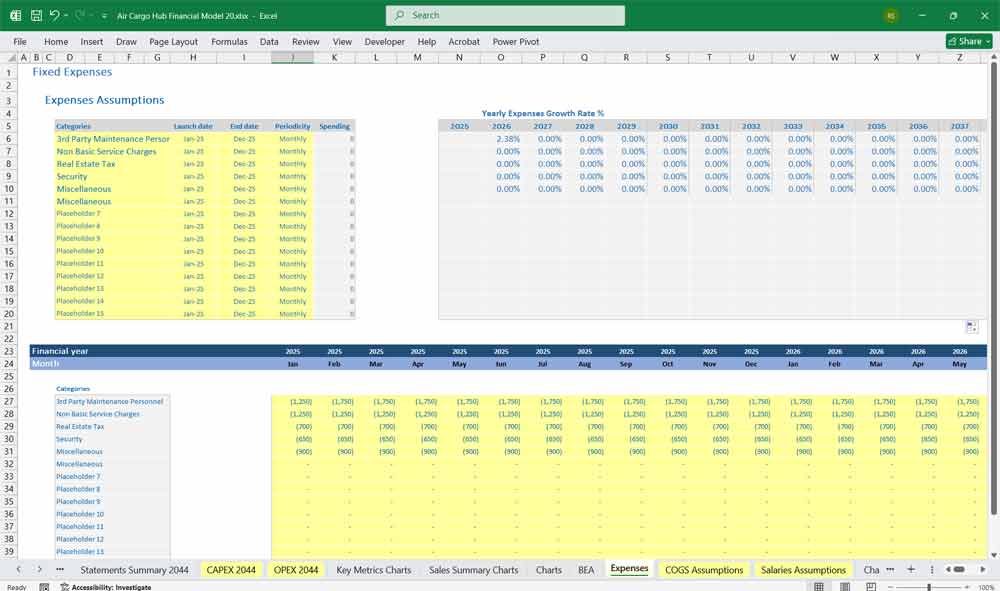

Operating Expenses

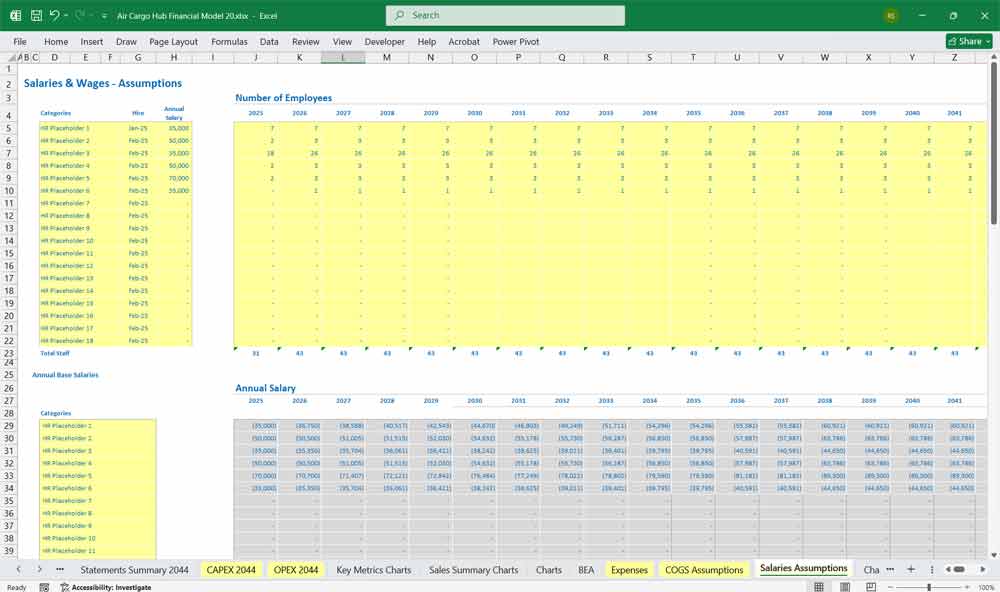

Salaries and Wages (terminal ops, customs, ground handling, etc.)

Maintenance (facilities, runways, equipment)

Utilities and IT systems

Fuel procurement costs (COGS)

Administrative expenses

Security and customs operations

Insurance

Marketing and airline incentives

Depreciation & Amortization

Based on CapEx schedule (buildings, runways, systems, vehicles)

EBITDA, EBIT, and Net Income

EBITDA = Revenue – Operating Expenses (excluding D&A)

EBIT = EBITDA – Depreciation & Amortization

Net Income = EBIT – Interest – Taxes

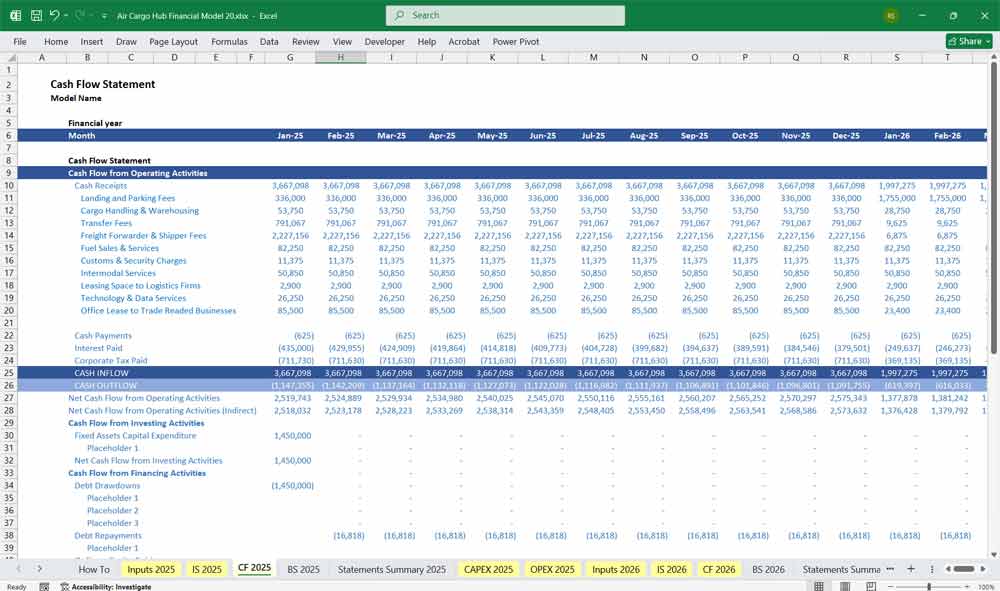

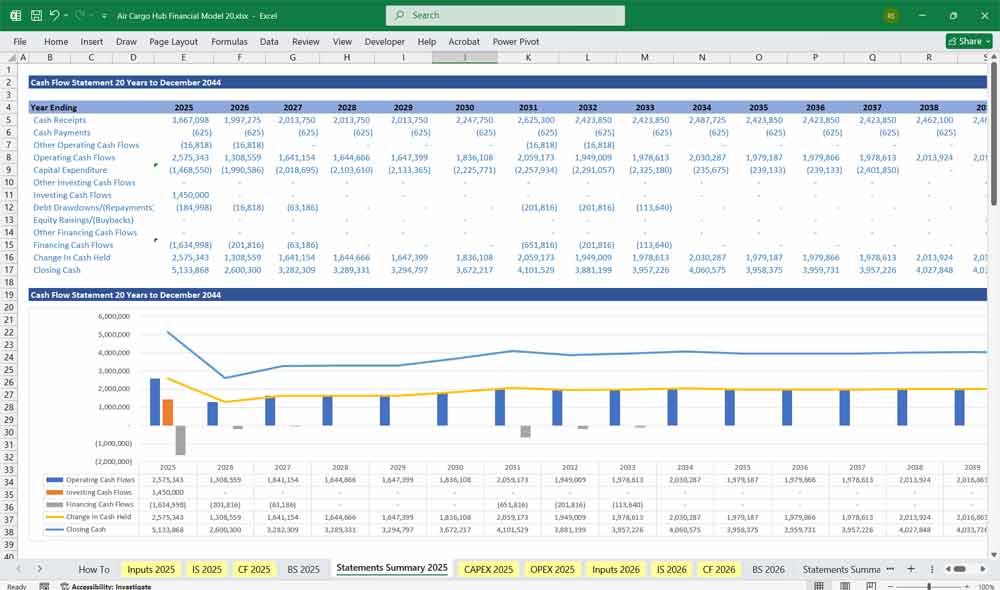

Air Cargo Hub Cash Flow Statement

Operating Activities

Cash Receipts:

All revenue items from income statement

Adjusted for changes in working capital (Accounts Receivable, Payables)

Cash Payments:

Salaries, fuel procurement, utilities, services

Taxes paid

Net working capital adjustments

Investing Activities

Capital Expenditures:

Runways, taxiways, terminals, IT systems, warehousing infrastructure

Expansion CapEx (e.g., new cargo terminals, automation tech)

Asset Sales (if any)

Financing Activities

Debt Issuance/Repayment

Equity Inflows

Interest Paid

Dividends Paid

Free Cash Flow

Operating CF – CapEx

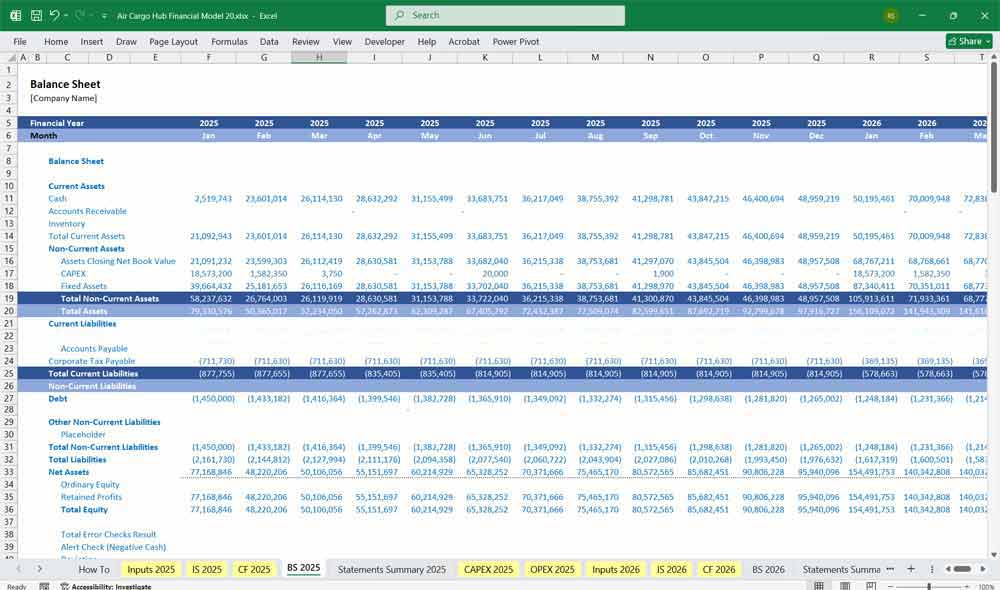

Air Cargo Hub Balance Sheet

Assets

Current Assets:

Cash & Cash Equivalents

Accounts Receivable (airlines, logistics firms, etc.)

Inventory (fuel, spare parts)

Prepaid expenses

Non-Current Assets:

Property, Plant, & Equipment (PP&E)

Runways, terminals, fuel farms, warehouses, trucks

Intangible Assets (licenses, software systems)

Right-of-Use Assets (if leased infrastructure)

Liabilities

Current Liabilities:

Accounts Payable

Accrued Salaries

Short-term Debt

Taxes Payable

Non-Current Liabilities:

Long-term Loans or Bonds

Lease Liabilities

Deferred Tax Liabilities

Equity

Share Capital

Retained Earnings

Revaluation Reserves (if applicable)

Capital Expenditure (CapEx): Initial investment in infrastructure, hardware, and construction.

Operational Expenditure (OpEx): Ongoing costs for maintenance, utilities, staffing, and software.

Cost per Rack: Total cost of operating a single server rack, including power, cooling, and maintenance.

Power Usage Effectiveness (PUE): Ratio of total energy used to energy delivered to IT equipment (lower PUE = better efficiency).

Key Financial Metrics for an Air Cargo Hub

Revenue Metrics

Monthly Recurring Revenue Predictable income from ongoing services like Cargo Handling & Warehousing, Freight Forwarder & Shipper Fees.

Revenue per Handled Units: Average income generated per package or per ton.

Revenue per Acre Leasing: Income generated per acre of physical space. Long-term lease income (warehouses, office space, cold storage, etc.)

Final Notes on the Financial Model

This 20 Year Air Cargo Hub Financial Model must focus on balancing capital expenditures with steady revenue growth from diversified services. By optimizing operational costs, and power efficiency, and maximizing high-margin services like Landing & Parking Fees, Cargo Handling & Warehousing, and Freight Forwarder & Shipper Fees, the model ensures sustainable profitability and cash flow stability.

Download Link on Next Page