Web Hosting Financial Model Excel Template (2026)

20-Year Financial Model for a Web Hosting Company

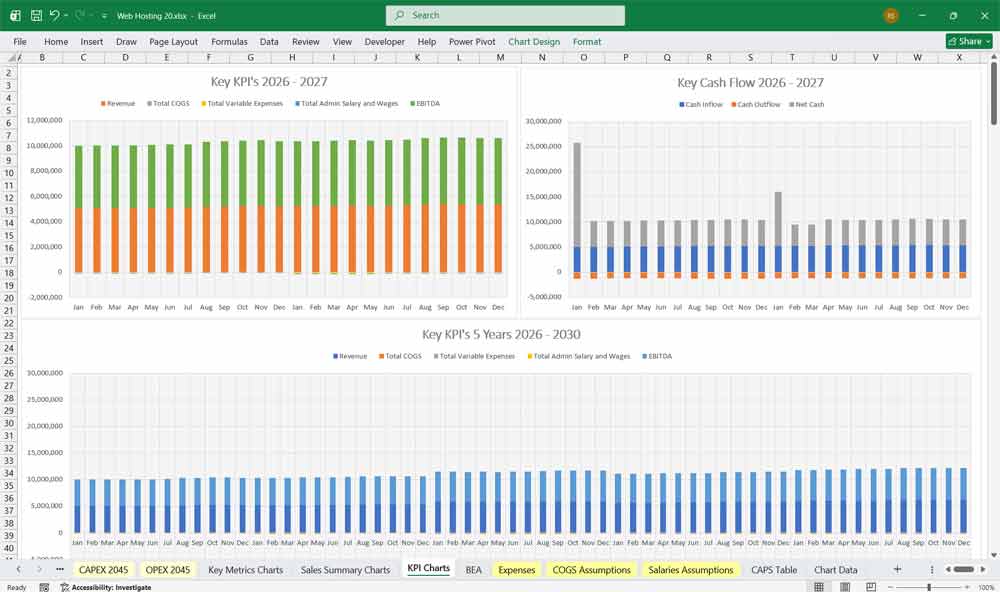

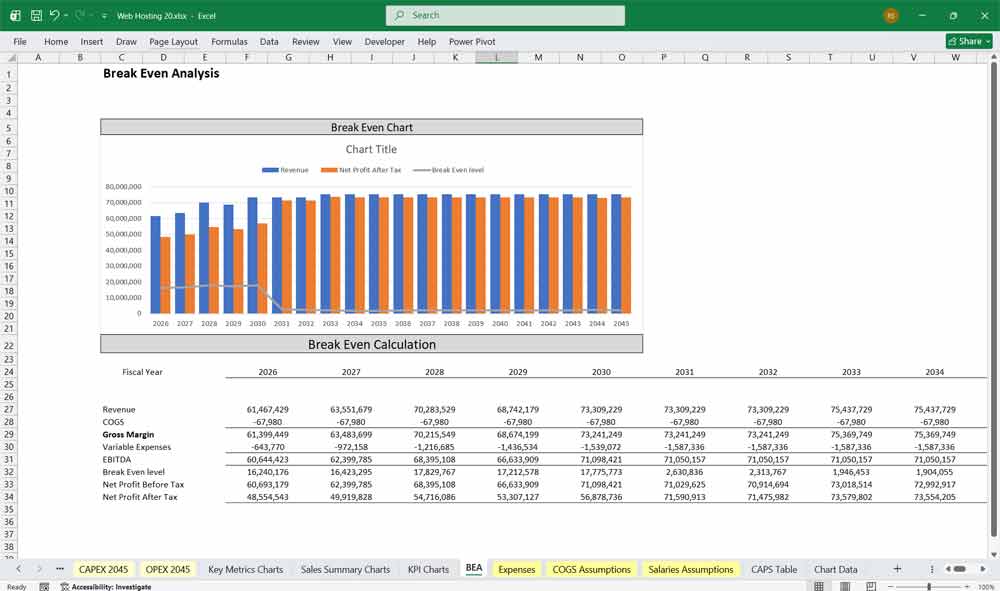

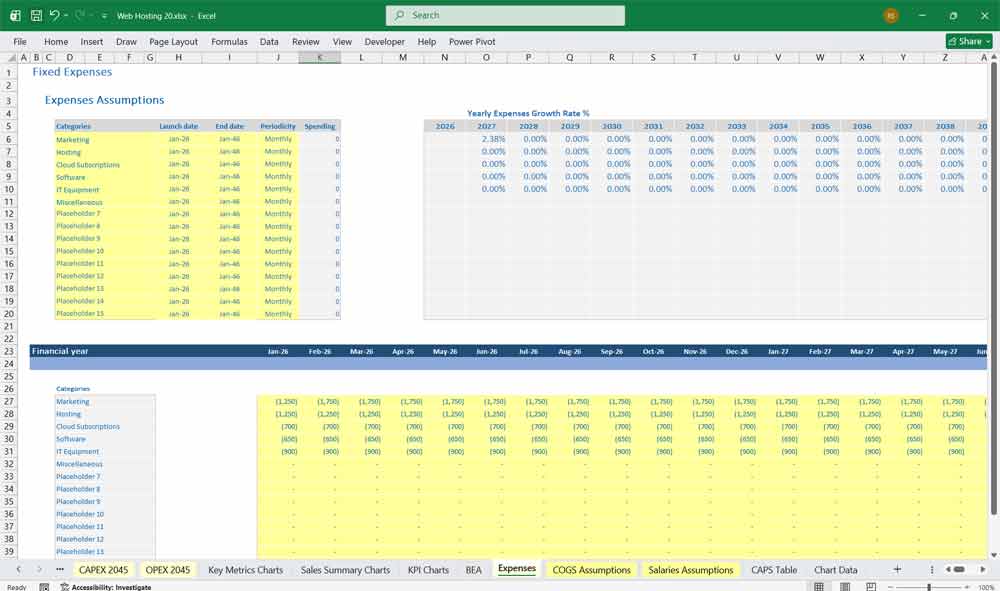

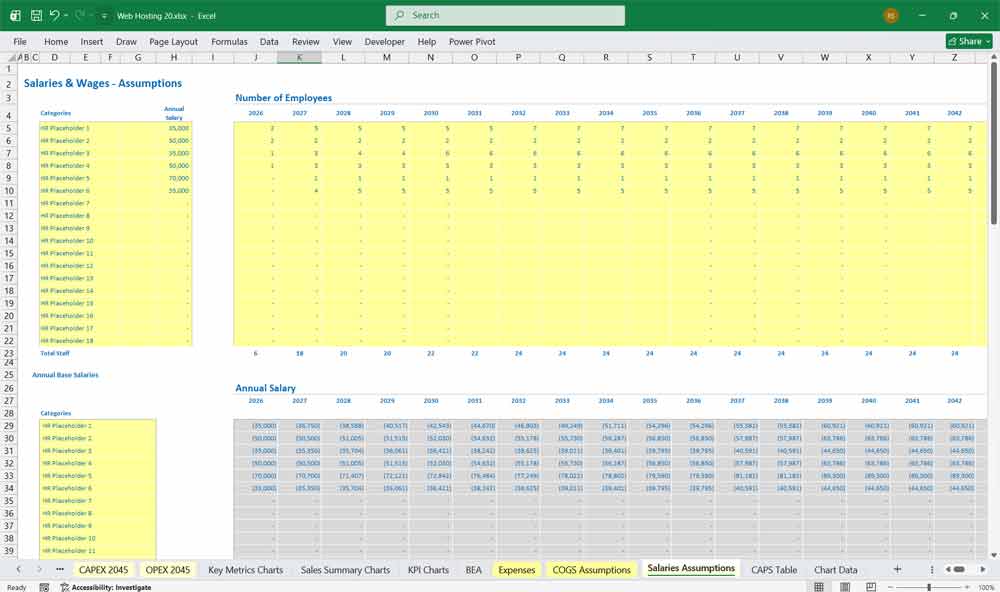

This very extensive 20 Year web hosting model involves detailed revenue projections, cost structures, capital expenditures, and financing needs. This model provides a thorough understanding of the financial viability, profitability, and cash flow position of your manufacturing company. Includes: 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts, Discounted Cash Flow (DCF) with Terminal Value, Sensitivity Analysis, and WACC Model add-on, revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets.

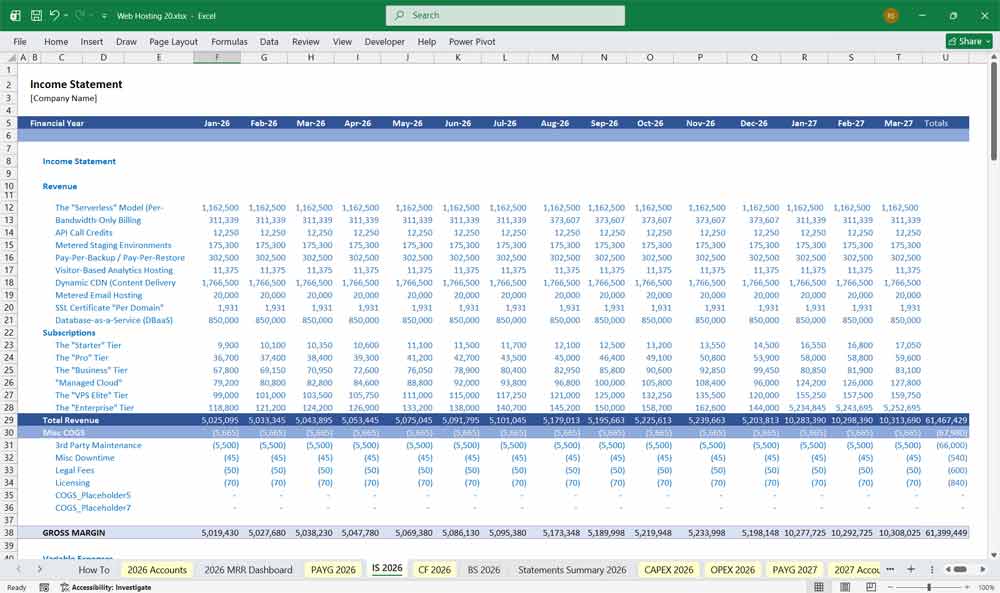

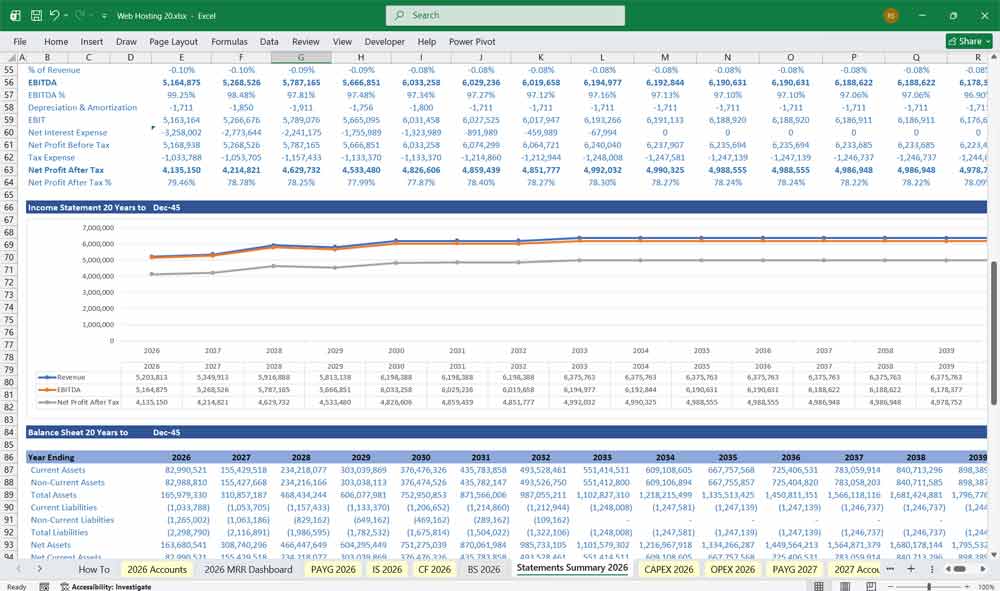

Income Statement (Profit & Loss)

The Income Statement measures your company’s profitability over a specific period (e.g., monthly or annually). For a hosting company, the key is separating the cost of delivering the service (Cost of Revenue) from the costs of acquiring customers (Sales & Marketing) and running the office (G&A).

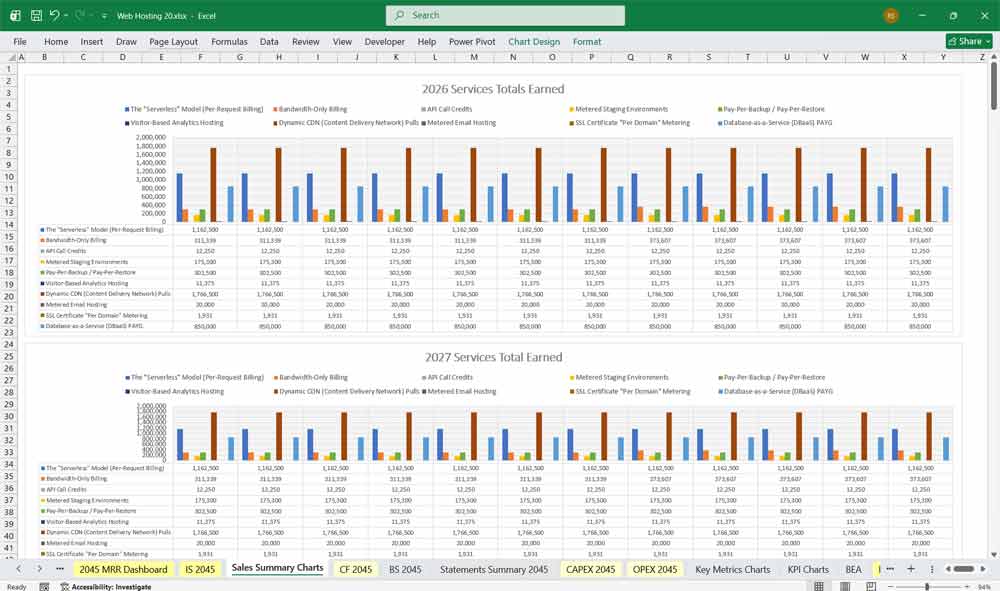

A. Revenue (Income)

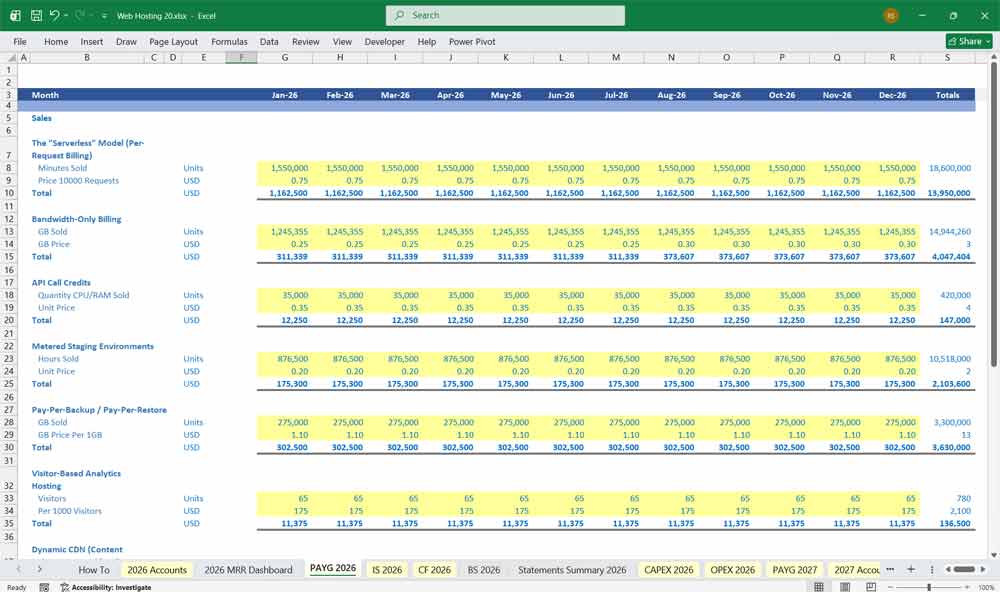

Subscription Revenue (Recurring): This is the foundation. It includes fixed monthly fees from shared hosting, VPS, and dedicated server plans. The model calculates this based on Beginning Customers + New Customers – Churned Customers, multiplied by the Average Revenue Per User (ARPU).

PAYG / Overage Revenue (Variable): This is high-margin revenue generated from usage beyond the plan limits. Examples include:

Bandwidth Overage: $0.05 per GB over the allocated limit.

Backup Fees: Charges for restoring backups or retaining long-term archives.

CPU Burst Credits: Micro-charges for exceeding baseline CPU usage.

Domain & Add-on Revenue: One-time fees for domain registrations, SSL certificate sales, and site migration services. These are treated as ancillary revenue streams.

B. Cost of Revenue (Cost of Goods Sold – COGS)

This section includes all direct costs required to keep the hosting platform online. It is typically the largest expense category.

Hardware Depreciation: The monthly depreciation of servers, networking switches, and storage arrays (usually over a 3-5 year useful life).

Data Center Costs:

Rack Rentals/Cage Space: Physical space rental in the data center.

Power & Cooling: Utility costs associated with running the servers. This is often a variable cost based on power usage effectiveness (PUE).

Bandwidth Peering/Transit: The cost the company pays to upstream providers for internet connectivity.

Technical Support Wages: Salaries for the front-line support team that helps customers troubleshoot issues.

Infrastructure Software Licensing: Costs for commercial control panels (like cPanel or Plesk) and monitoring software, often billed per server or per account.

C. Gross Profit

Calculation: Total Revenue minus Cost of Revenue.

Gross Margin: A critical KPI. Healthy hosting companies typically target gross margins between 60% and 80%. A declining margin may indicate rising data center costs or pricing pressure.

D. Operating Expenses (OpEx)

Sales & Marketing (S&M):

Advertising spend (Google Ads, Facebook, affiliate programs).

Salaries for the sales team and marketing department.

Discounts and promotional campaigns (e.g., “first month free”).

Research & Development (R&D) / Engineering:

Salaries for developers, system architects, and DevOps engineers who build and maintain the hosting platform and customer portal.

General & Administrative (G&A):

Executive salaries, accounting, and legal fees.

Office rent and corporate overhead.

E. EBITDA and Net Income

EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortization. This is a key metric to show operational cash flow potential, as it adds back the large non-cash depreciation expense from the servers.

Net Income: The “bottom line” after subtracting interest, taxes, and all other expenses. In a high-growth hosting company, Net Income might be low initially due to heavy reinvestment in servers and marketing, even if EBITDA is positive.

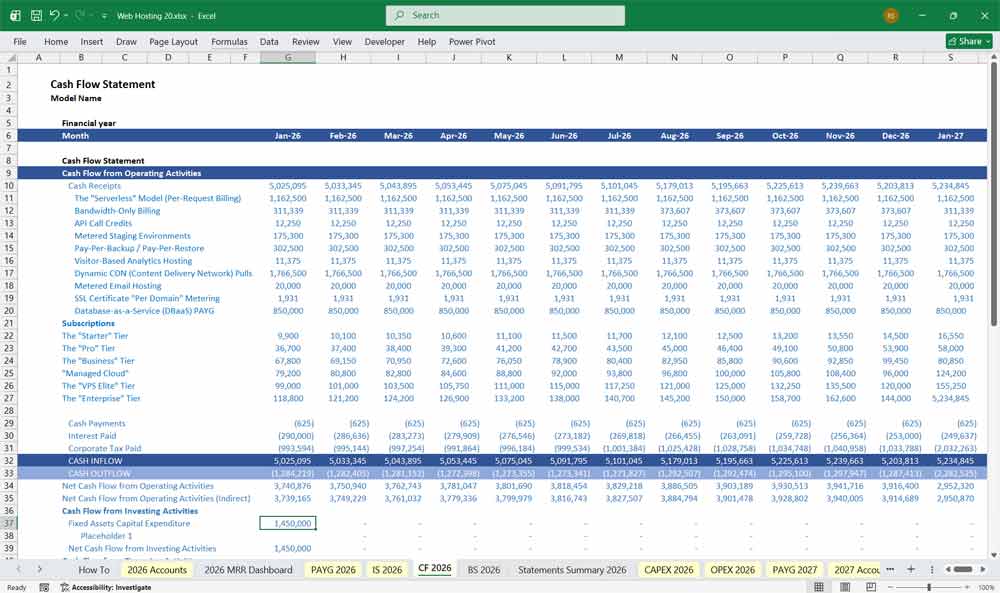

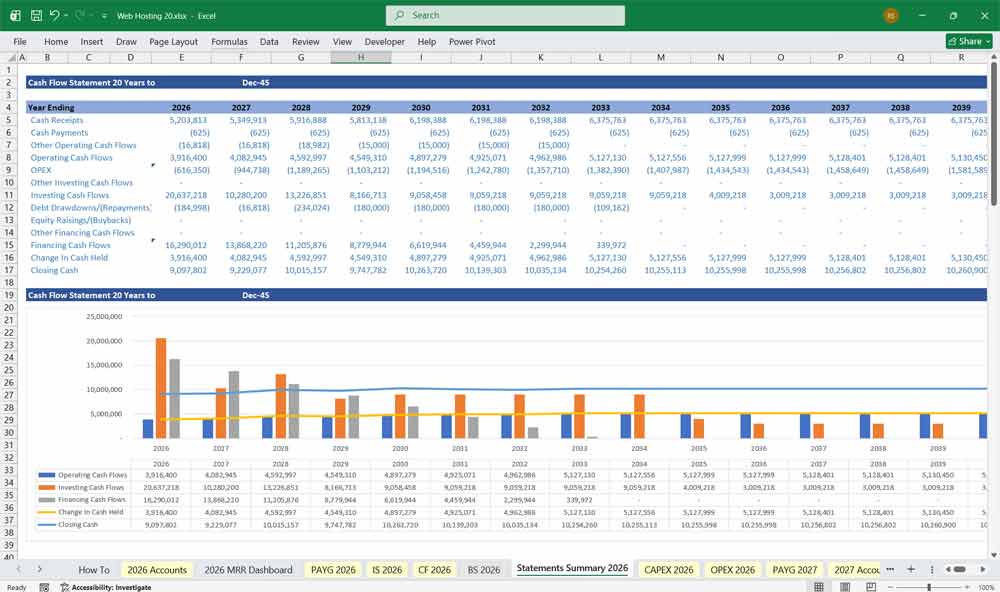

Web Hosting Company Cash Flow Statement

The Cash Flow Statement is arguably more important than the Income Statement for a hosting company because it tracks the actual movement of cash. A hosting company can be profitable on paper (Net Income) but still run out of cash if it spends millions on servers upfront.

A. Cash Flow from Operating Activities

This section adjusts Net Income for non-cash items and changes in working capital.

Net Income: Starting point from the Income Statement.

Add Back Depreciation: The largest non-cash expense. While the P&L shows a “loss” of value on the servers, the actual cash to buy them was spent years ago. Adding this back reveals the true cash generated by the business.

Changes in Working Capital:

Accounts Receivable: Hosting is usually prepaid, so this should be very low.

Deferred Revenue: This is a critical source of cash. When a customer pays for a year upfront, the cash is received now, but the revenue is recognized monthly. This creates a massive positive cash flow from operations, often funding new server purchases.

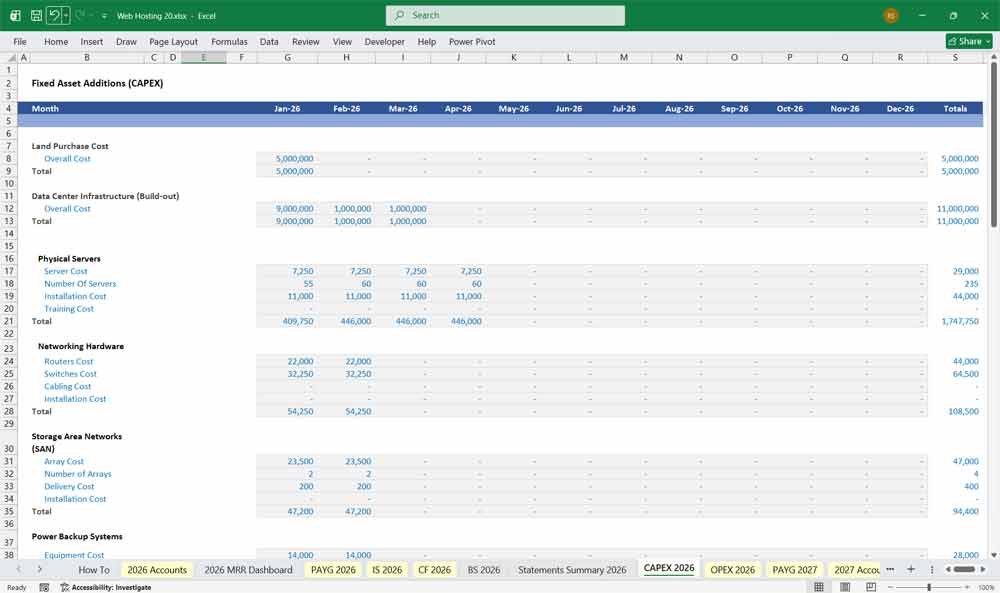

B. Cash Flow from Investing Activities

This section tracks capital expenditure (CapEx). For a hosting company, this is the “fuel line.”

Purchase of Property and Equipment (PP&E): Cash spent on new servers, storage arrays, and networking gear to support growth or replace old hardware.

Data Center Build-outs: Cash spent on setting up new cages or installing cabling.

C. Cash Flow from Financing Activities

This tracks how the company funds its operations through debt or equity.

Proceeds from Loans: If the company takes out a loan to buy a new data center rack, the cash inflow appears here.

Equipment Financing: Hosting companies often use leasing or financing to purchase servers, smoothing out the large capital hits.

Equity Investments: Cash received from investors.

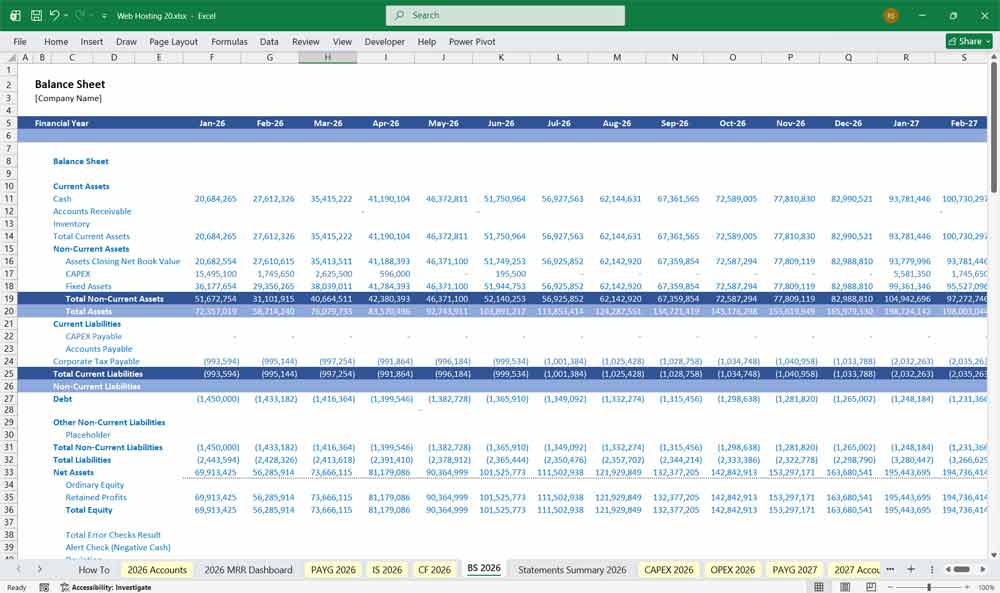

Web Hosting Company Balance Sheet

The Balance Sheet provides a snapshot of what the company owns (Assets), what it owes (Liabilities), and the owner’s stake (Equity) at a specific point in time.

A. Assets (What the Company Owns)

Current Assets:

Cash and Cash Equivalents: The lifeblood of the business, tracked via the Cash Flow Statement.

Accounts Receivable: Usually minimal, as credit cards are charged automatically.

Non-Current Assets (Fixed Assets):

Property, Plant & Equipment (PP&E): This is the largest asset on the balance sheet. It includes the historical cost of all servers, routers, and switches, minus accumulated depreciation.

Accumulated Depreciation: The contra-asset account that reduces the value of PP&E over time, matching the expense on the Income Statement.

B. Liabilities (What the Company Owes)

Current Liabilities:

Accounts Payable: Bills owed to data centers and bandwidth providers for the current month’s service.

Accrued Expenses: Wages owed to employees but not yet paid.

Deferred Revenue (Current Portion): The value of prepaid hosting subscriptions that will be recognized as revenue within the next 12 months. This is a liability because the company “owes” the service to the customer.

Long-Term Liabilities:

Deferred Revenue (Long-Term): Prepayments for service periods beyond 12 months.

Bank Loans / Equipment Financing: The portion of server loans due after one year.

C. Shareholders’ Equity

Retained Earnings: The cumulative net income (or loss) of the company since inception, minus any dividends paid. In a startup hosting company, this is often negative initially due to heavy investment, but turns positive as the subscriber base grows and stabilizes.

Web Hosting Key Metrics & Interlinking the Statements

To understand the health of the hosting company, these three statements must be viewed together through specific ratios:

Cash Flow vs. CapEx: The Cash Flow statement shows if Operating Cash Flow (largely driven by Deferred Revenue) is sufficient to cover the Investing Cash Flow (buying new servers). A healthy host generates enough cash from yearly prepayments to fund growth without needing outside financing.

Depreciation Schedule: The P&L shows Depreciation expense (reducing Net Income), which correlates to the aging of the PP&E on the Balance Sheet. When the PP&E value drops and depreciation expense decreases, it signals that the hardware is aging and a new cycle of Investing cash outflow (CapEx) is imminent.

Churn Impact: If customer churn (cancellations) increases, it immediately impacts the Income Statement (lower revenue). However, it also impacts the Balance Sheet (Deferred Revenue liability shrinks as customers are refunded or stop prepaying) and the Cash Flow Statement (new cash from operations declines).

6 Tier Subscription Model For A Web Hosting Company

1. The “Starter” Tier (Entry-Level)

Target: Students, personal bloggers, and “link-in-bio” style sites.

Core Offering: Shared hosting for a single domain.

Limitations: Capped storage (e.g., 5GB SSD) and metered bandwidth.

The Hook: Extremely low “introductory” price. Includes a free SSL certificate but lacks automated backups or a custom email domain.

2. The “Pro” Tier (The Sweet Spot)

Target: Freelancers and small professional portfolios.

Core Offering: Unlimited websites and unmetered bandwidth.

Performance: Slightly higher RAM allocation than the Starter tier to handle more concurrent visitors.

Key Features: Includes a professional email suite (3–5 accounts) and a “one-click” staging environment to test site changes before going live.

3. The “Business” Tier (E-commerce Ready)

Target: Small to medium businesses (SMBs) and online stores.

Core Offering: Enhanced security and speed.

Performance: Optimized for CMS platforms like WordPress or Magento; includes an Integrated Content Delivery Network (CDN) to lower latency.

Key Features: Daily automated backups, “Object Caching” for faster product page loads, and basic malware scanning/removal.

4. The “Managed Cloud” Tier (Scaling Phase)

Target: High-traffic blogs and growing SaaS startups.

Core Offering: Transition from shared hosting to dedicated resources on a cloud infrastructure.

Reliability: Guaranteed 99.99% uptime with auto-scaling (the ability to handle sudden traffic spikes without crashing).

Key Features: Dedicated IP address, a specialized “Success Manager” point of contact, and advanced server-side caching.

5. The “VPS Elite” Tier (The Power User)

Target: Developers and agencies managing multiple client sites.

Core Offering: Virtual Private Server (VPS) with full Root Access.

Customization: The user can choose their OS and install custom server-side software or specific PHP versions.

Key Features: High-core CPU allocation, 16GB+ RAM, and isolated environments to ensure that one site’s resource usage never affects another.

6. The “Enterprise / Dedicated” Tier (The Infrastructure)

Target: Corporations and high-security institutional clients.

Core Offering: A physical, Dedicated Server housed in the data center.

Security: Hardware-level firewalls, advanced DDoS protection, and HIPAA or PCI compliance certifications.

Key Features: 24/7 “White Glove” priority support (under 15-minute response time), custom hardware configurations, and a dedicated account engineering team.

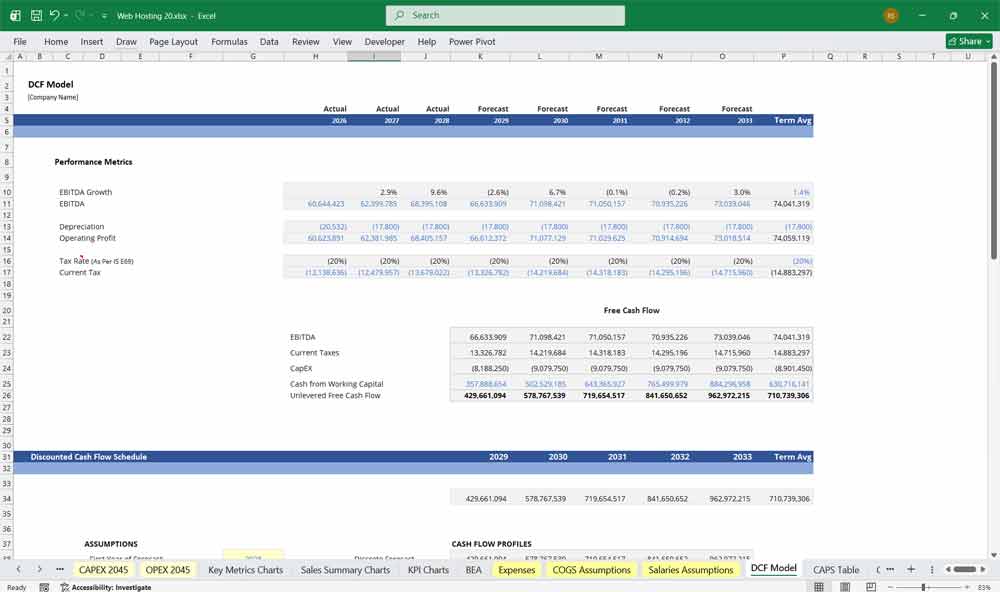

Web Hosting Company Discounted Cash Flow (DCF) with Terminal Value, Sensitivity Analysis, and WACC Model add-on

Discounted Cash Flow (DCF) Analysis

A DCF analysis for a web hosting company aims to value the business based on its ability to generate future cash flows, specifically its ability to turn prepaid subscriptions into hard currency. Given the capital-intensive nature of the industry, an analyst would project free cash flows for the next 5 to 10 years, starting with a detailed forecast of Monthly Recurring Revenue (MRR) and churn rates. These cash flows are heavily influenced by the “Cash Flow from Operations” line, which is typically robust due to deferred revenue (yearly prepayments). The analyst then discounts these future cash flows back to their present value to determine what the entire company is worth today.

Weighted Average Cost of Capital (WACC)

The WACC serves as the discount rate in the DCF model and represents the hurdle rate the hosting company must overcome to create value. For a hosting firm, the cost of debt is often tied to equipment financing for servers, while the cost of equity reflects the risk of customer churn and technological obsolescence. Because hosting companies often carry significant debt to finance data center builds, the WACC calculation must carefully balance the tax shield from that debt against the high equity risk premium demanded by investors in a competitive market. A lower WACC suggests a stable, de-risked business with predictable cash flows, making the company more valuable in the DCF model.

Sensitivity Analysis

Sensitivity Analysis is used to test the robustness of the hosting company’s valuation against changes in its most volatile assumptions. In this model, an analyst will create a data table to see how the valuation changes if the Annual Churn Rate increases from 1% to 3%, or if the Customer Acquisition Cost (CAC) spikes due to rising Google Ads prices. Typically, the valuation of a web host is most sensitive to changes in customer retention (LTV) and the assumed Terminal Growth Rate, as these dictate the long-term value of the subscriber base. This analysis helps investors understand whether the company is a high-risk bet or a resilient asset

Final Notes on the Financial Model

This 20 Year Web Hosting Company Financial Model focuses on balancing capital expenditures with steady revenue growth from a diversified product line. By optimizing operational costs, and power efficiency, and maximizing high-margin services, the models ensure sustainable profitability and cash flow stability.