Sheep Farm Financial Model

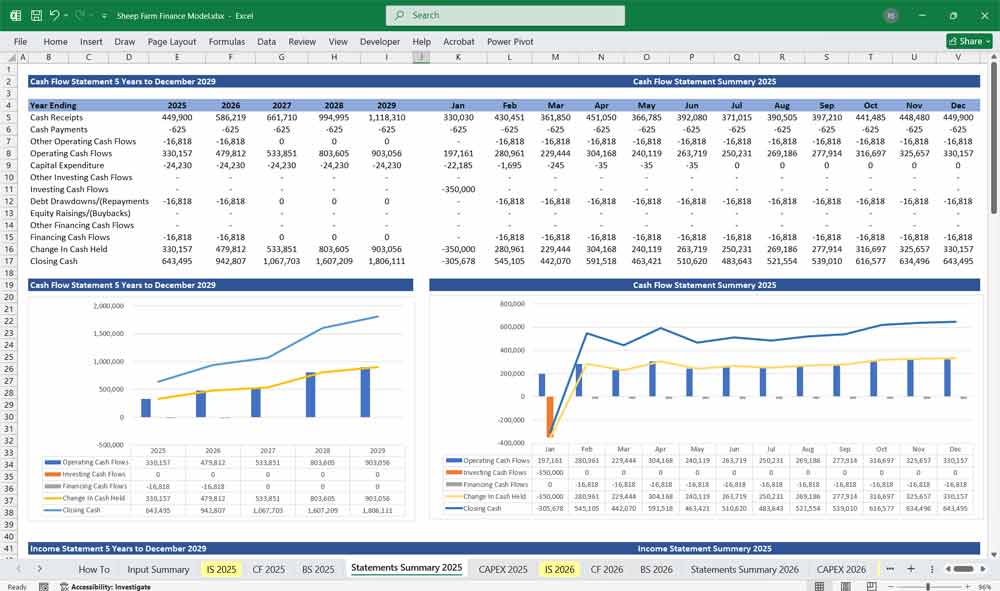

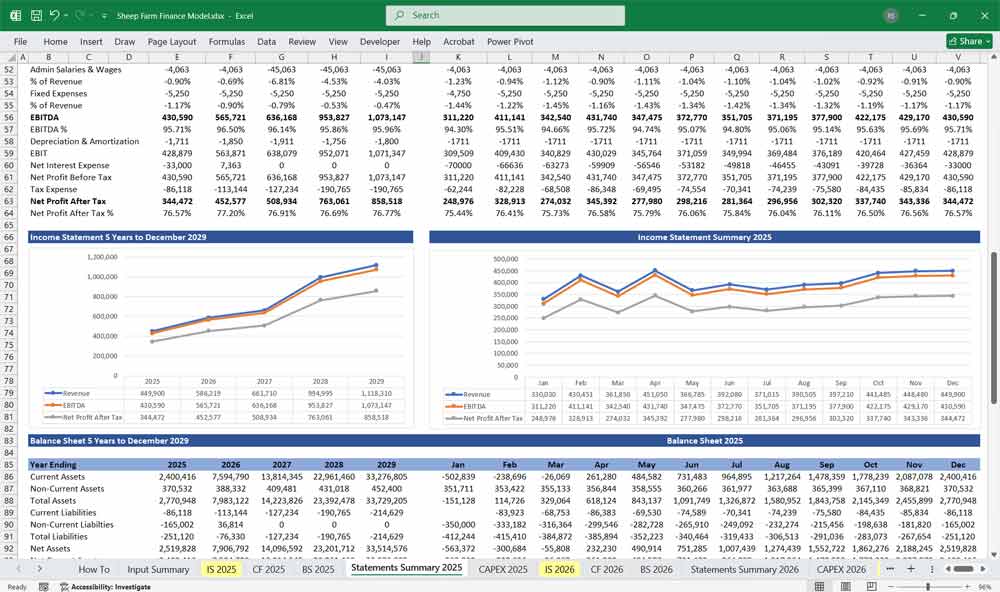

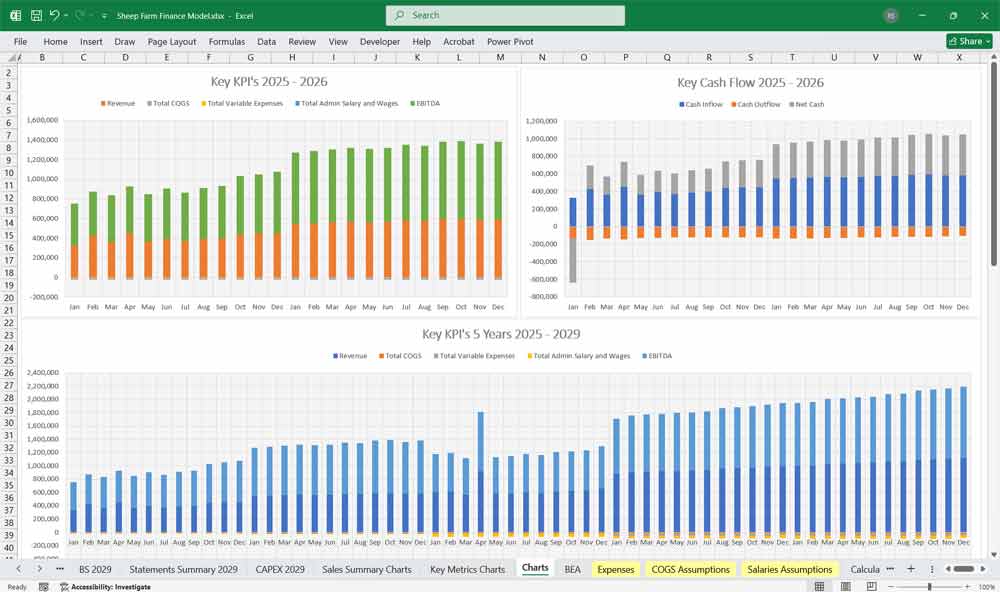

This 5-Year, 3-Statement Sheep Farm Financial Model in Excel includes revenue streams from Subscription to one-time set-up fees and consulting. Financial statements to forecast the financial health of your Sheep Farming business.

Financial Model for a Sheep Farm

This financial model for a Sheep Farm includes projections for revenue, expenses, and profitability based on various revenue streams. The key financial statements in the model include:

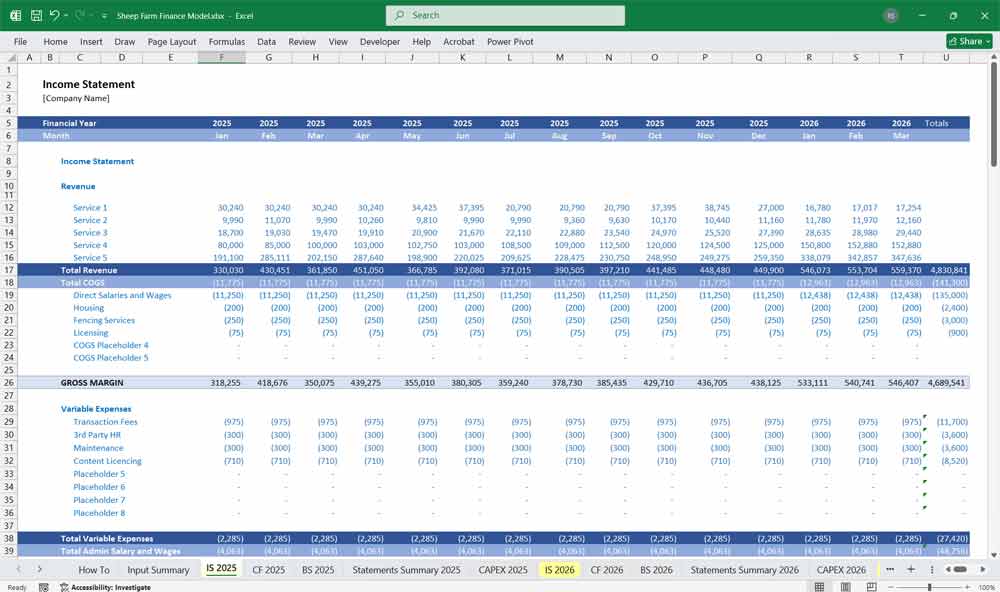

- Income Statement (Profit & Loss)

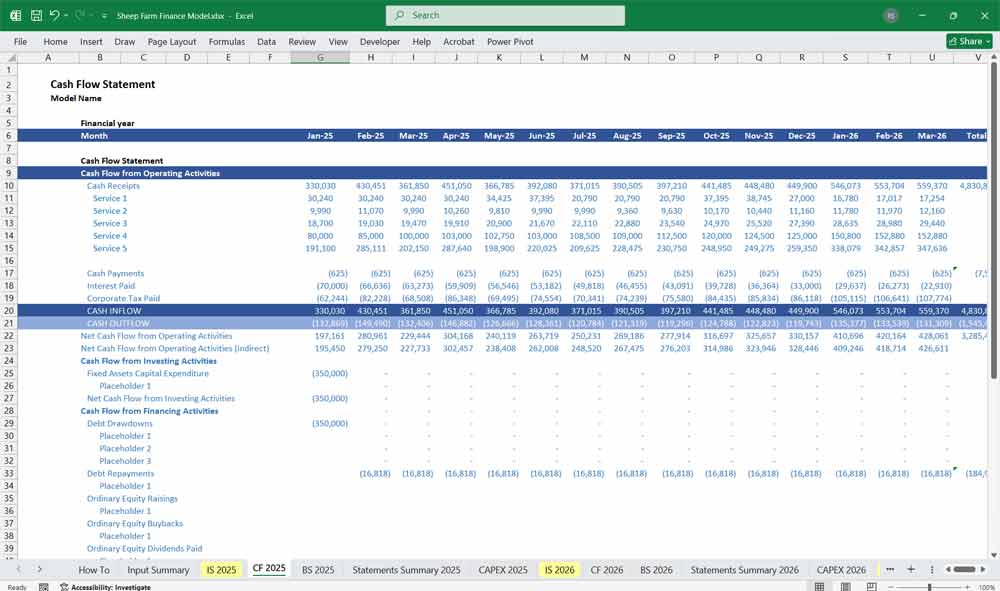

- Cash Flow Statement

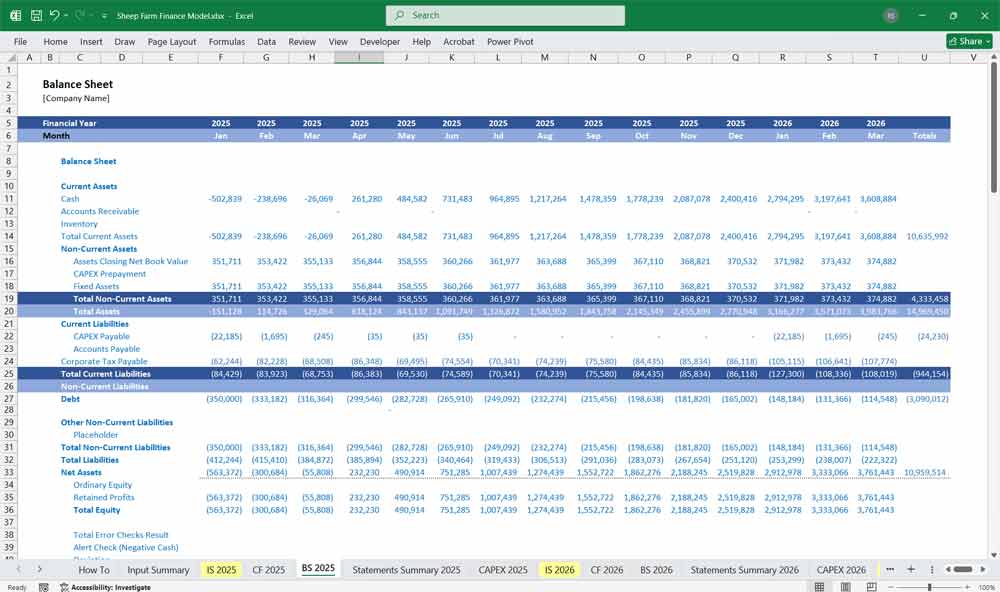

- Balance Sheet

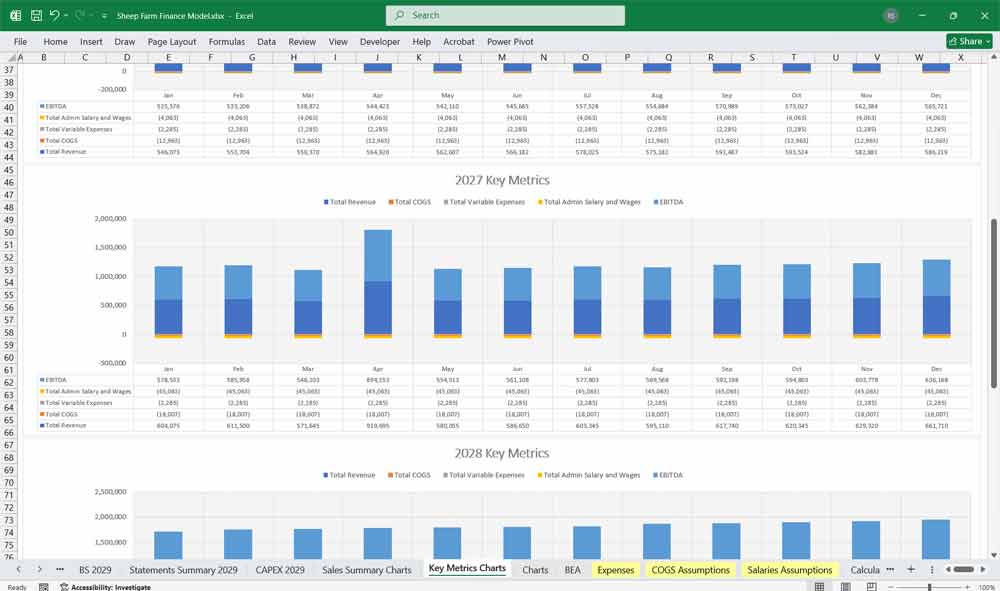

Income Statement

The Income Statement (or Profit and Loss Statement) summarizes the revenues, costs, and expenses incurred during a specific period, typically a year. It shows the profitability of the sheep farming business.

Revenue Streams

Sale of Sheep: Revenue from selling lambs, ewes, or rams for meat or breeding purposes.

Wool Sales: Revenue from selling wool, if applicable.

Manure Sales: Revenue from selling sheep manure as fertilizer.

Other Income: Grants, subsidies, or agri-tourism income (e.g., farm visits).

Cost of Goods Sold (COGS)

Feed Costs: Expenses for hay, grain, silage, or other feed.

Veterinary Costs: Vaccinations, medications, and health checks.

Breeding Costs: Artificial insemination or ram leasing fees.

Shearing Costs: Labor and equipment costs for shearing sheep.

Other Direct Costs: Transportation, tagging, and dipping.

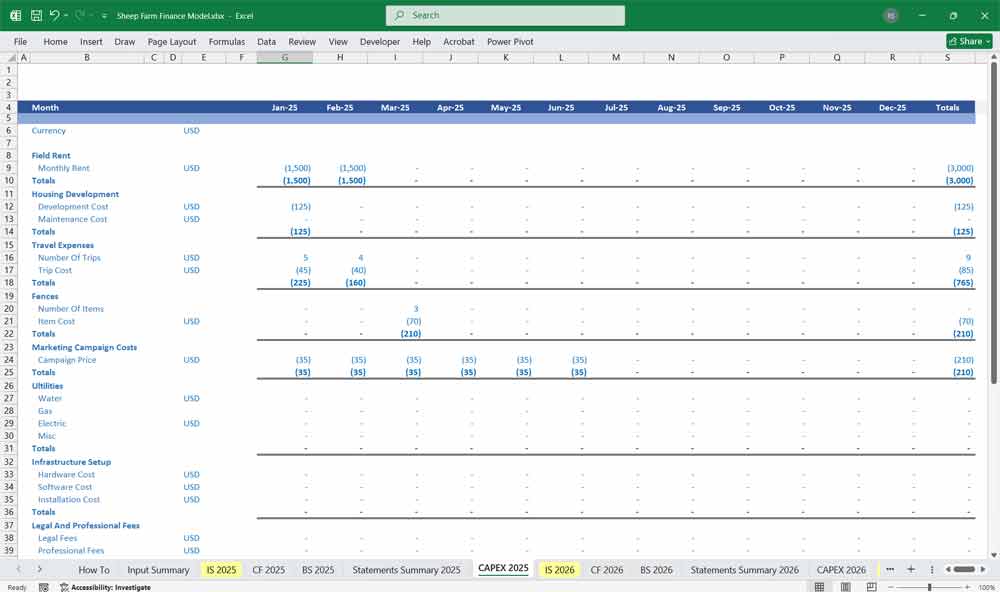

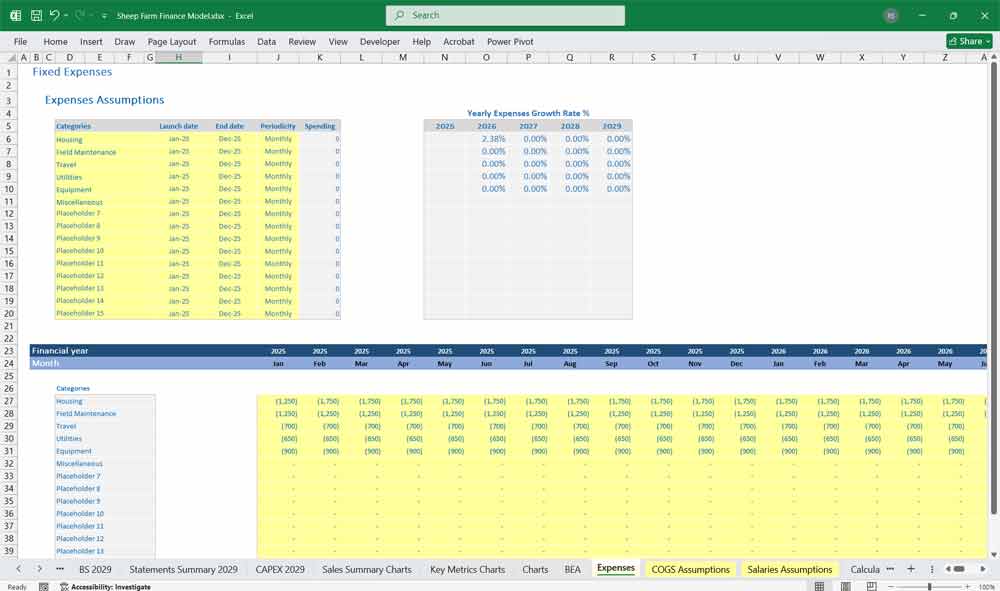

Operating Expenses

Labor Costs: Wages for farmhands, shepherds, or seasonal workers.

Utilities: Electricity, water, and heating for barns or sheds.

Maintenance: Repairs and maintenance of fencing, barns, and equipment.

Insurance: Livestock and property insurance.

Marketing and Sales: Costs associated with selling sheep or wool.

Administrative Costs: Office supplies, accounting, and legal fees.

Depreciation and Amortization

Depreciation of farm equipment, vehicles, and infrastructure (e.g., barns, fencing).

Net Income

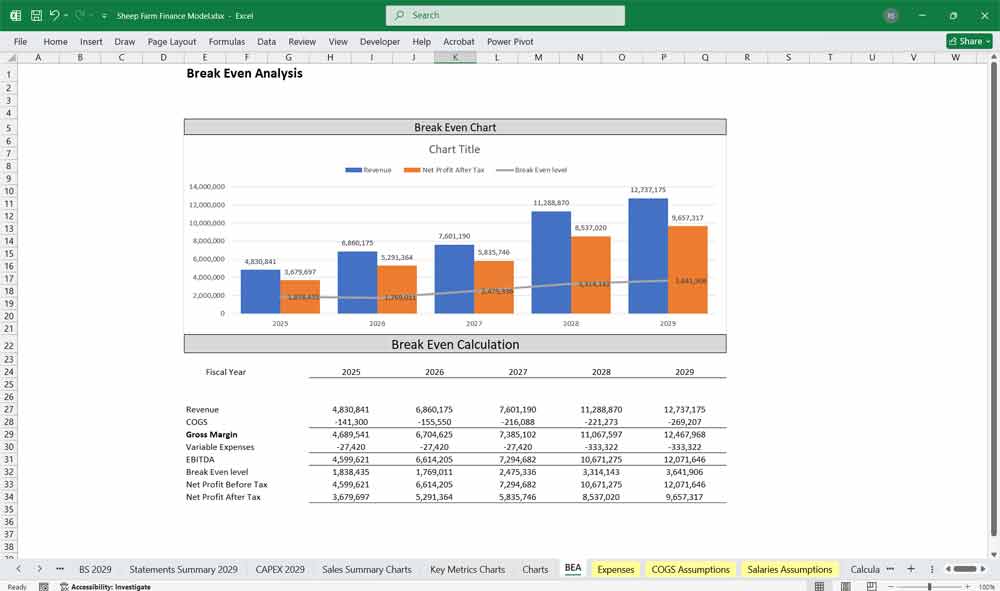

Gross Profit = Total Revenue – COGS

Operating Profit = Gross Profit – Operating Expenses

Net Profit = Operating Profit – Depreciation – Interest – Taxes

Sheep Farm Cash Flow Statement

The Cash Flow Statement tracks the inflows and outflows of cash, ensuring the farm has sufficient liquidity to operate.

Cash Inflows

Operating Activities:

Cash from sales of sheep, wool, and manure.

Subsidies or grants received.

Investing Activities:

Sale of old equipment or livestock.

Financing Activities:

Loans or equity injections from investors.

Cash Outflows

Operating Activities:

Payments for feed, veterinary services, labor, and utilities.

Investing Activities:

Purchase of new equipment, vehicles, or breeding stock.

Construction or renovation of farm infrastructure.

Financing Activities:

Repayment of loans or dividends to investors.

Net Cash Flow

Net Cash from Operating Activities = Cash Inflows (Operating) – Cash Outflows (Operating)

Net Cash from Investing Activities = Cash Inflows (Investing) – Cash Outflows (Investing)

Net Cash from Financing Activities = Cash Inflows (Financing) – Cash Outflows (Financing)

Net Change in Cash = Sum of Net Cash from Operating, Investing, and Financing Activities

Sheep Farm Balance Sheet

The Balance Sheet provides a snapshot of the farm’s financial position at a specific point in time, showing assets, liabilities, and equity.

Assets

Current Assets:

Cash and cash equivalents.

Inventory (e.g., feed, wool, and livestock ready for sale).

Accounts receivable (if sales are made on credit).

Non-Current Assets:

Breeding stock (ewes, rams).

Farm equipment (tractors, shearing tools).

Land and buildings (barns, sheds, fencing).

Accumulated depreciation (reducing the value of fixed assets over time).

Liabilities

Current Liabilities:

Accounts payable (e.g., unpaid feed or veterinary bills).

Short-term loans or lines of credit.

Non-Current Liabilities:

Long-term loans for land or equipment purchases.

Equity

Owner’s Equity:

Initial investment by the owner.

Retained earnings (accumulated profits reinvested into the farm).

Total Equity = Total Assets – Total Liabilities

Key Assumptions and Drivers

Sheep Farm Flock Size and Growth Rate

Assumption: The farm starts with a flock of 500 ewes (female sheep) and 20 rams (male sheep), with an annual growth rate of 15% through breeding and purchases.

Drivers:

Breeding efficiency (lambing rate, e.g., 1.5 lambs per ewe per year).

Mortality rate (e.g., 5% annual loss due to disease, predation, or other factors).

Purchasing additional stock to improve genetics or expand operations.

Impact: Flock size directly affects wool, meat, and milk production capacity.

Feed and Grazing Sheep Farm Management

Assumption: The farm relies on a combination of pasture grazing (70%) and supplemental feed (30%) to meet nutritional needs.

Drivers:

Pasture quality and availability (e.g., rotational grazing to maintain soil health).

Cost of supplemental feed (e.g., hay, silage, or grain).

Seasonal variations in feed requirements (e.g., higher needs during winter or lambing season).

Impact: Feed costs are a major expense, and efficient grazing management can reduce operational costs.

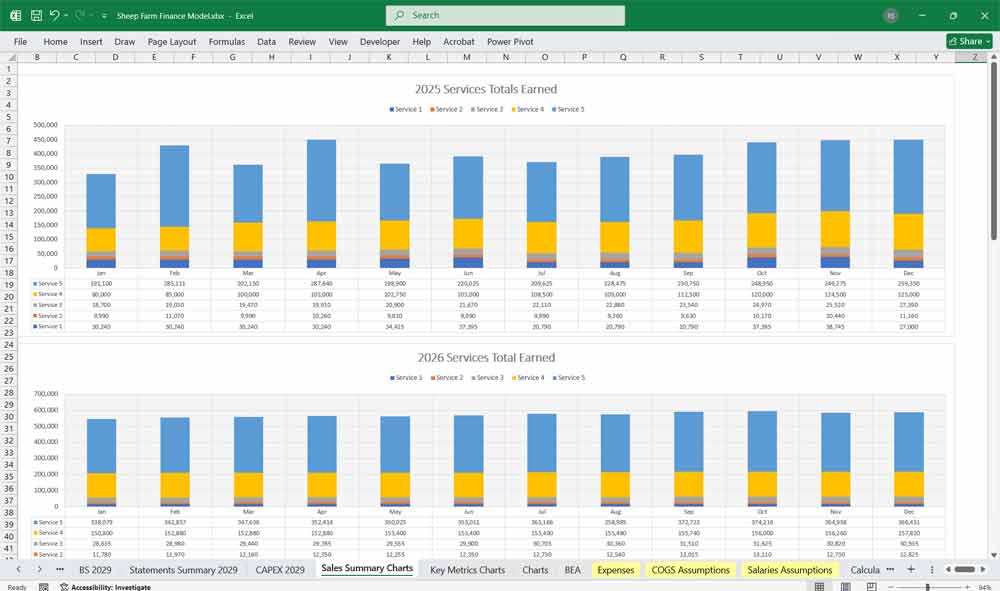

Wool, Meat, and Milk Sheep Farm Production

Assumption: The farm produces wool, lamb meat, and sheep milk, with revenue split as 40% wool, 50% meat, and 10% milk.

Drivers:

Wool yield per sheep (e.g., 4 kg per sheep annually) and market price (e.g., $5/kg).

Lambing rate and meat yield per lamb (e.g., 20 kg of meat per lamb).

Milk production per ewe (e.g., 100 liters per lactation period).

Impact: Diversifying revenue streams reduces risk and increases profitability.

Labor and Operational Sheep Farm Costs

Assumption: The farm employs 3 full-time workers and hires seasonal labor during peak periods (e.g., lambing, shearing).

Drivers:

Labor costs (e.g., wages, benefits, and training).

Machinery and equipment costs (e.g., tractors, shearing tools, milking machines).

Maintenance and repair costs for infrastructure (e.g., fences, barns, water systems).

Impact: Labor and operational costs are significant and must be managed to maintain profitability.

Health and Veterinary Sheep Farm Care

Assumption: The farm allocates 5% of its annual budget to health and veterinary care.

Drivers:

Vaccination and disease prevention programs (e.g., foot rot, parasites).

Emergency veterinary costs (e.g., complications during lambing).

Biosecurity measures to prevent disease outbreaks.

Impact: Healthy sheep are more productive, reducing losses and improving revenue.

Market Prices and Demand at the Sheep Farm

Assumption: Wool prices average 5/kg,lambmeatsellsfor5/kg,lambmeatsellsfor6/kg, and sheep milk sells for $1.50/liter.

Drivers:

Global and local market trends for wool, meat, and milk.

Consumer preferences (e.g., demand for organic or ethically sourced products).

Competition from other sheep farms or alternative products (e.g., synthetic fibers, plant-based milk).

Impact: Fluctuations in market prices can significantly affect revenue.

Environmental and Regulatory Sheep Farm Factors

Assumption: The farm complies with local environmental regulations and sustainable farming practices.

Drivers:

Land use regulations and zoning laws.

Water usage and waste management requirements.

Incentives for sustainable practices (e.g., carbon credits, grants for eco-friendly farming).

Impact: Compliance ensures long-term viability and access to incentives, while non-compliance can result in fines or operational disruptions.

Key Considerations for Financial Planning:

Revenue Projections: Estimate income based on flock size, production yields, and market prices.

Cost Management: Monitor feed, labor, and veterinary costs to maintain profitability.

Risk Mitigation: Diversify revenue streams and implement biosecurity measures to reduce risks.

Sustainability: Adopt eco-friendly practices to ensure long-term viability and access to incentives.

By understanding and managing these assumptions and drivers, a sheep farm can optimize operations, reduce risks, and maximize profitability.

Conclusion for the Financial Model

A financial model for a sheep farmer is a dynamic tool that helps in planning, budgeting, and decision-making. It requires accurate assumptions about flock size, market conditions, and operational costs. Regularly updating the model with actual performance data ensures its relevance and usefulness for managing the farm’s financial health.

Download Link On Next Page