Rare Earth Magnet Recycling Financial Model Excel

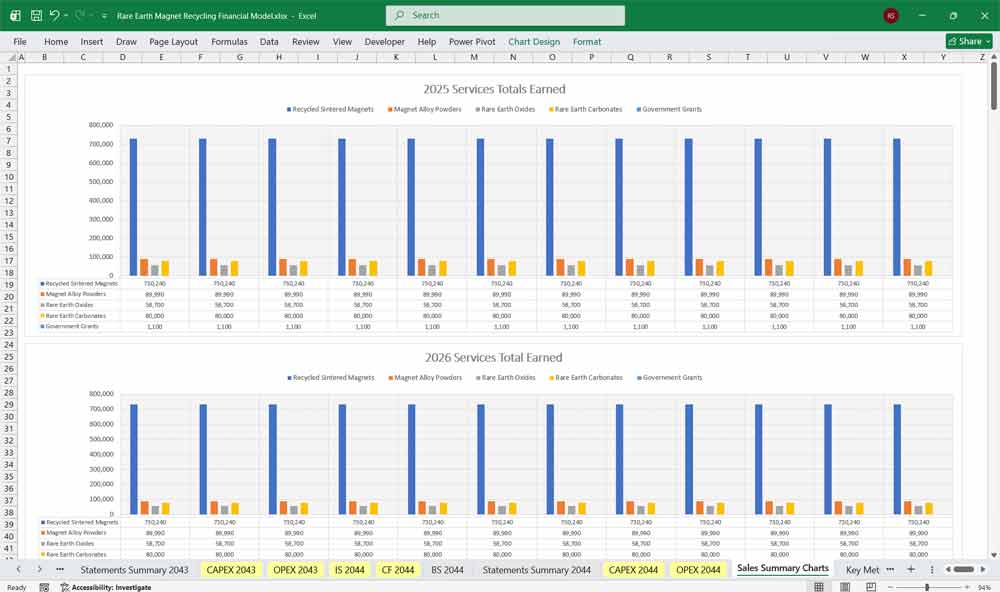

This 20-Year, 3-Statement Rare Earth Magnet Recycling Financial Model Excel includes editabe revenue streams from Recycled Sintered Magnets, Magnet Alloy Powders, Rare Earth Oxides, Rare Earth Carbonates to Government Grants, cost structures, and financial statements to forecast the financial health of your rare earth magnet recycling, REM facility.

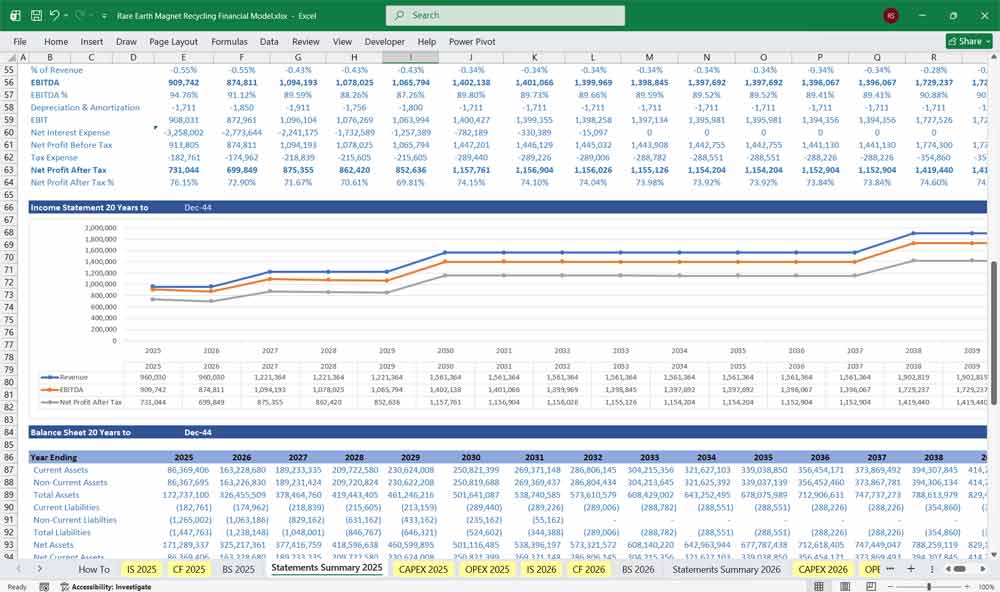

20-Year Financial Model for a Rare Earth Magnet Recycling Facility

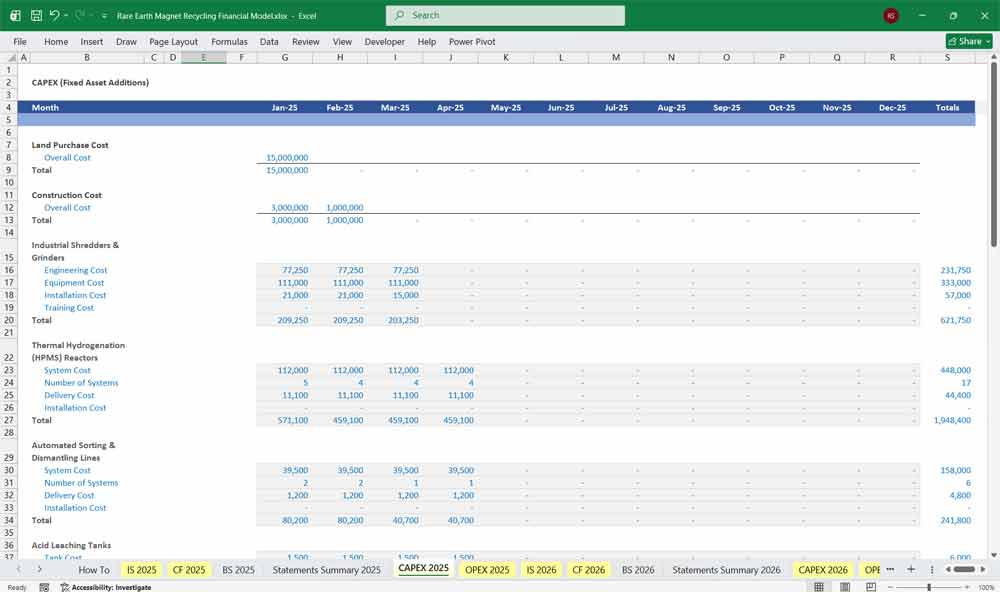

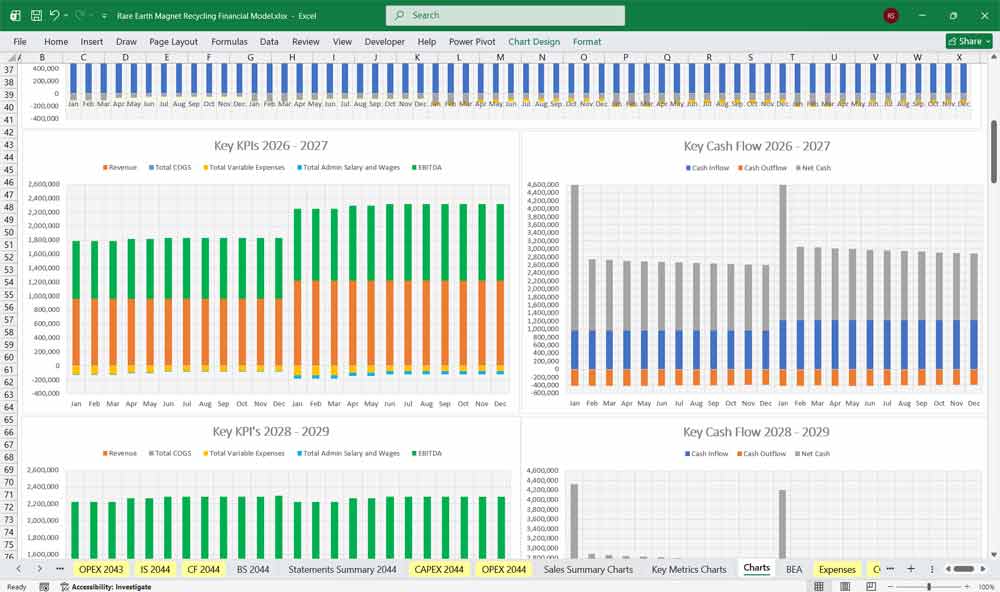

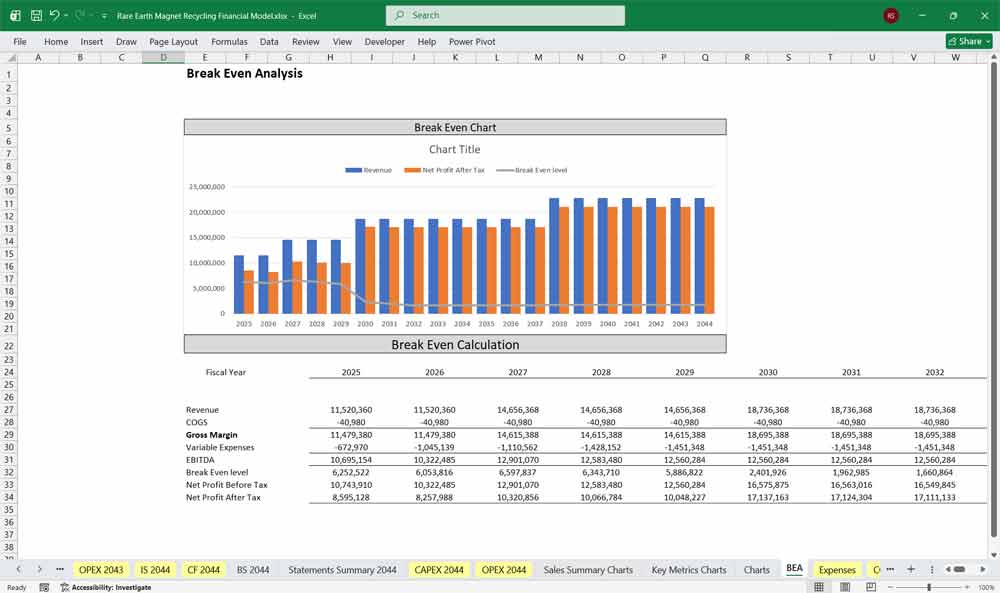

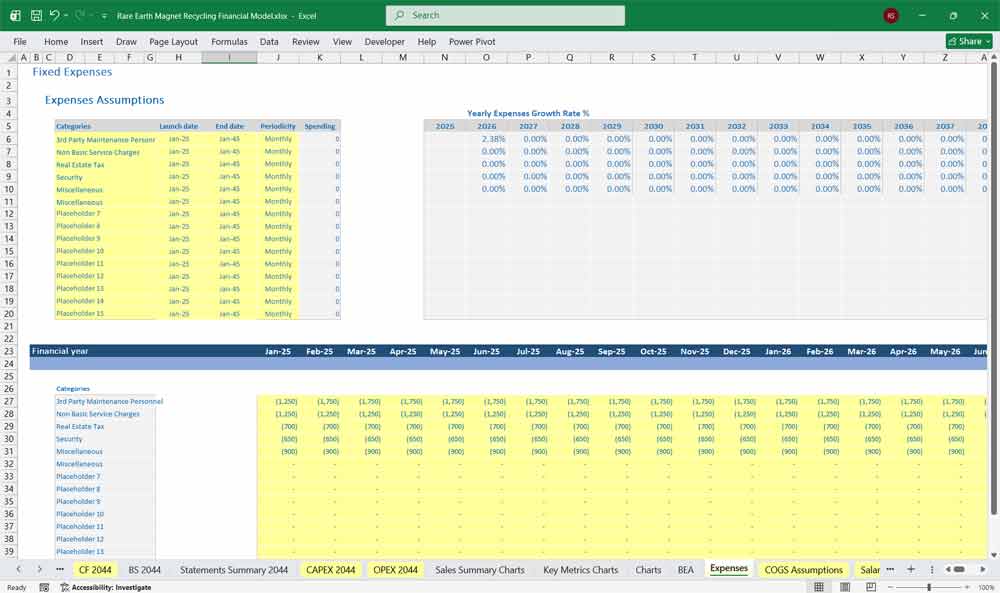

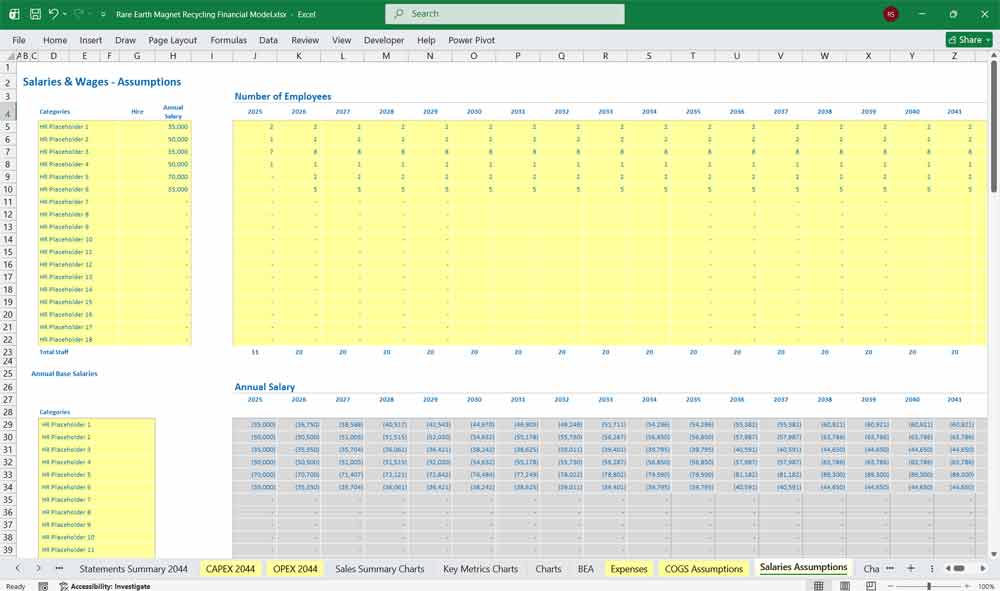

This very extensive 20 Year REM Model involves detailed revenue projections, cost structures, capital expenditures, and financing needs. This model provides a thorough understanding of the financial viability, profitability, and cash flow position of your recycling facility. Includes: 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets. Over 120 Spreadsheets in 1 Excel Workbook.

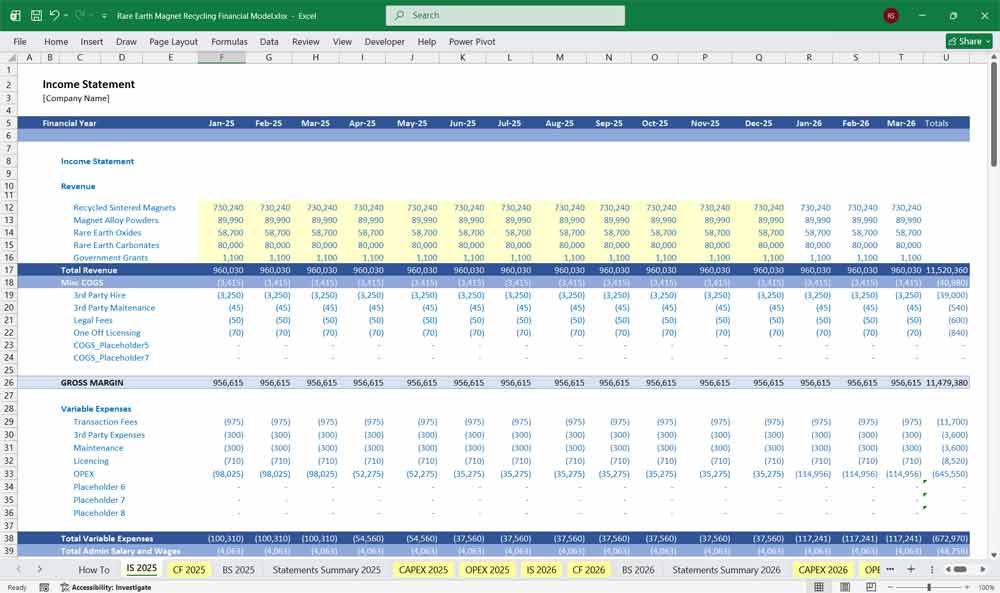

Income Statement (Profit & Loss)

The Income Statement measures operational profitability over time.

Revenue

Revenue is typically modeled bottom-up:

Recovered Nd oxide sales

Recovered Pr oxide sales

Heavy rare earths (Dy, Tb)

By-product revenue (iron, boron residues, tolling services)

Cost of Goods Sold (COGS)

Direct costs tied to production.

Key COGS Components

Feedstock procurement costs

Chemicals and reagents

Energy (electricity, gas)

Consumables (filters, membranes)

Direct labor (operators, technicians)

Waste treatment and disposal

Maintenance materials

COGS is often split into:

Variable costs (scale with throughput)

Semi-fixed costs (minimum operating levels)

Gross Profit

Margins are highly dependent on

Key Components

Feedstock cost vs recovered REE price

Process yield stability

Energy pricing

Operating Expenses (OPEX)

Indirect costs not directly tied to throughput.

OPEX Categories

Salaries (management, admin, R&D)

Site overhead

Insurance

Environmental monitoring & compliance

Corporate G&A

Digital and Technology Costs

- Material Handling System Improvement

EBITDA

A critical metric for infrastructure and recycling projects.

Used For

Debt sizing

Valuation multiples

- Cash flow analysis

Interest Expense

Project debt interest

Working capital facilities

Taxes

Corporate income tax

Loss carryforwards modeled explicitly

Investment tax credits or recycling incentives (if applicable)

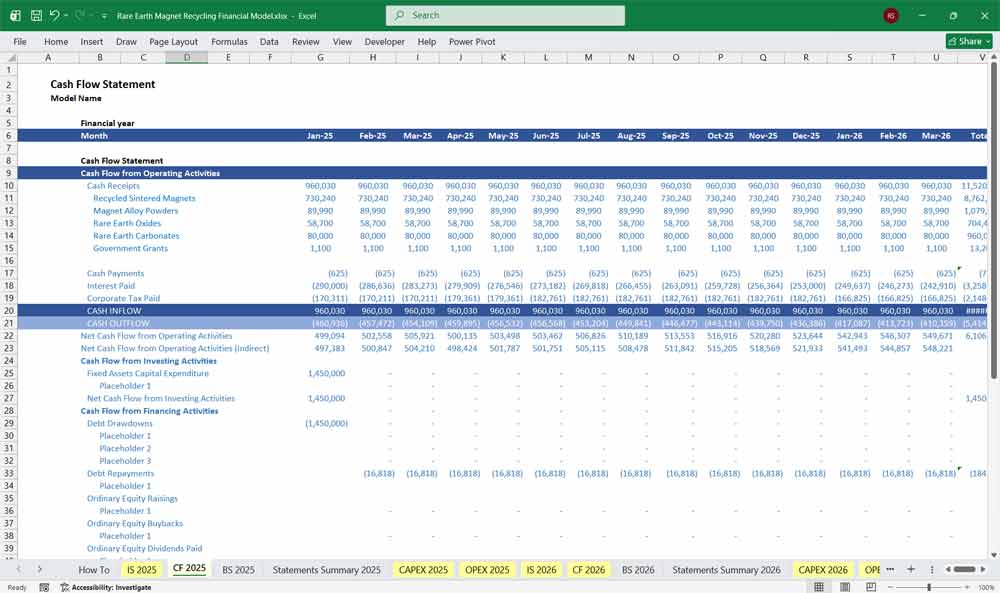

Rare Earth Magnet Recycling Cash Flow Statement

Shows cash movements, integrating operations, investment, and financing.

Cash Flow from Operating Activities

Starts from Net Income and adjusts for non-cash items.

Add-backs / Adjustments

Depreciation & amortization

Deferred taxes

Changes in working capital:

Inventory

Accounts receivable

Accounts payable

This section reflects the facility’s true cash-generating ability.

Cash Flow from Investing Activities

Captures long-term asset investments.

Key Items

Initial plant construction (CAPEX)

Replacement CAPEX

Capacity expansion

Technology upgrades

Typically front-loaded in early years.

Cash Flow from Financing Activities

Tracks how the project is funded.

Financing Sources

Equity contributions

Project debt drawdowns

Government grants or subsidies

Uses

Debt repayment (principal)

Interest payments

Dividends (if applicable)

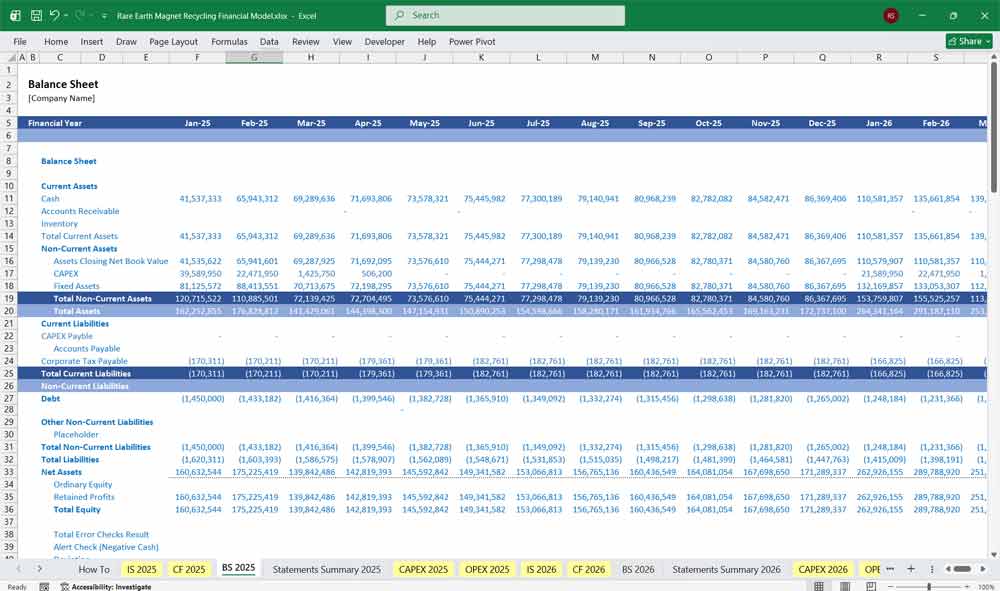

Rare Earth Magnet Recycling Balance Sheet

Snapshot of the company’s financial position at a point in time.

Assets

Current Assets

Cash & cash equivalents

Accounts receivable

Inventory:

Feedstock

Work-in-process

Finished goods

Non-Current Assets

Property, plant & equipment (net of depreciation)

Capitalized development costs

Environmental bonds or deposits

Liabilities

Current Liabilities

Accounts payable

Accrued expenses

Short-term debt

Current portion of long-term debt

Long-Term Liabilities

Project finance debt

Decommissioning or reclamation provisions

Deferred tax liabilities

Key Rare Earth Magnet Recycling Facility Considerations

High Fixed Cost Base: Equipment-heavy industry with high depreciation.

R&D Intensity: Critical for staying competitive.

Quality & Certification: Failure costs can be catastrophic (scrap, rework).

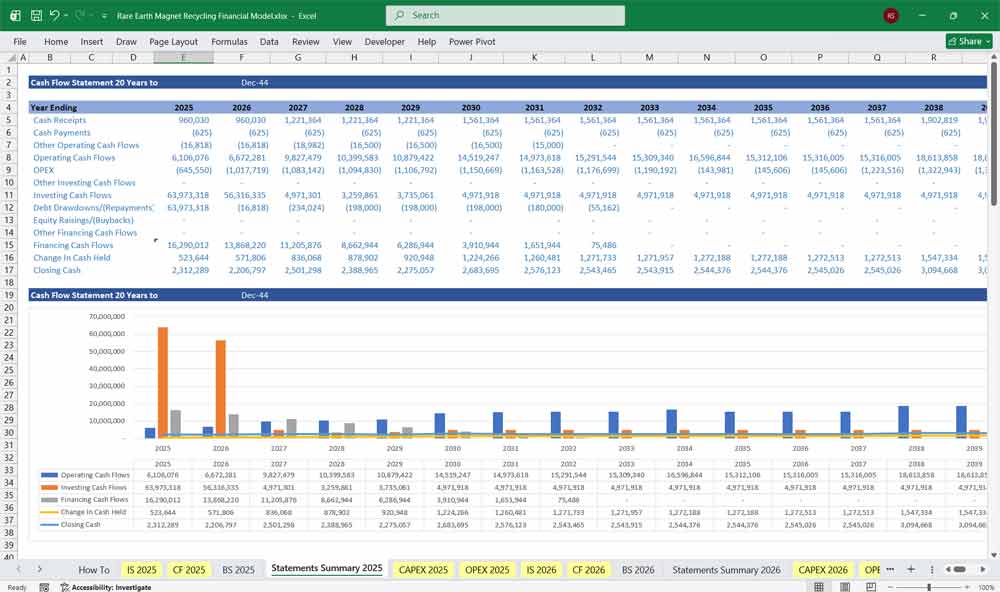

20-Year Rare Earth Magnet Recycling Financial Model Advantages

A 20-year financial model gives a REM Facility the ability to plan around long product lifecycles and extended contract horizons. Contracts can span 20 years, and equipment lifespans often exceed two decades. A long-term model ensures that capital investment decisions—like building new Thermal Hydrogenation (HPMS) Reactors and Solvent Extraction (SX) Batteries—are aligned with the revenue and cash flow timelines they are meant to serve.

Closer View Of Rare Earth Magnet Recycling Investments

A 20-year model allows management to capture the full return on R&D and innovation investments. In the composite sector, new material systems or recycling processes can take years to develop and commercialize. A 20-year horizon shows not only the upfront development costs but also the long-term payoff in reduced recycling costs, and reflects a higher market share over time.

REM Recycling 20 Year Dept Financing

A 20-year debt financing structure for a rare earth magnet recycling facility offers significant advantages by aligning long-term capital with the asset’s extended operating life. Longer tenor debt reduces annual debt service, improves cash flow stability during ramp-up years, and enhances debt service coverage ratios, making the project more resilient to commodity price volatility.

20 Years Of Rare Earth Magnet Recycling Facility Projections

Twenty-year financial and operational projections for a rare earth magnet recycling facility provide a long-term view that aligns with the asset’s durable infrastructure, evolving feedstock availability, and multi-cycle commodity dynamics. Extended projections capture full ramp-up, steady-state operations, and reinvestment cycles, improving the accuracy of cash flow forecasting, debt sizing, and lifecycle returns while demonstrating resilience across rare earth price fluctuations and policy-driven demand growth.

Final Notes on the Financial Model

This 20-Year, 3 Statement Rare Earth Magnet Recycling Financial Model in Excel focuses on balancing capital expenditures with steady revenue growth. By optimizing operational costs, and power efficiency, and maximizing high-margin services, the models ensure sustainable profitability and cash flow stability.