Petrochemical Engineering Financial Model

Financial Model for a Petrochemical Engineering Company

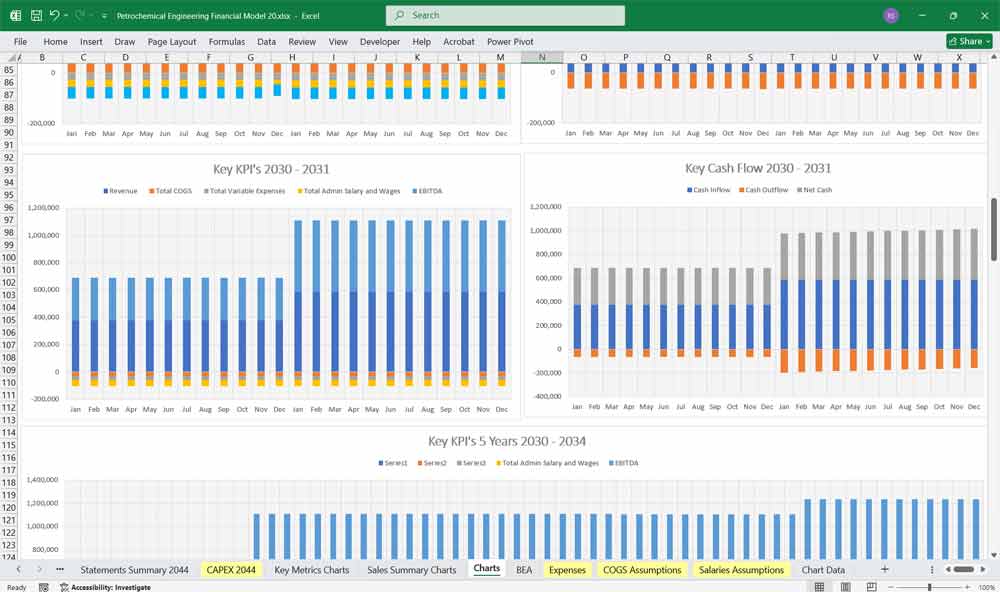

This very extensive 20 Year Petrochemical Engineering Company Model involves detailed revenue projections, cost structures, capital expenditures, and financing needs. This model provides a thorough understanding of the financial viability, profitability, and cash flow position of your business. Includes: 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the specified revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets. 140 Spreadsheets in 1 Excel Workbook giving a calculation of profitability for your Petrochemical Engineering Company.

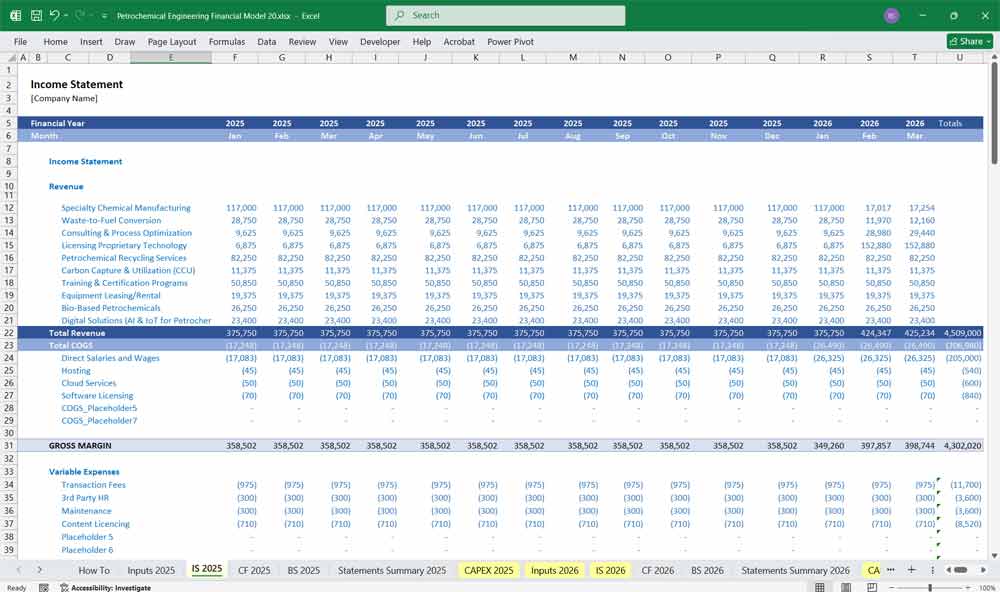

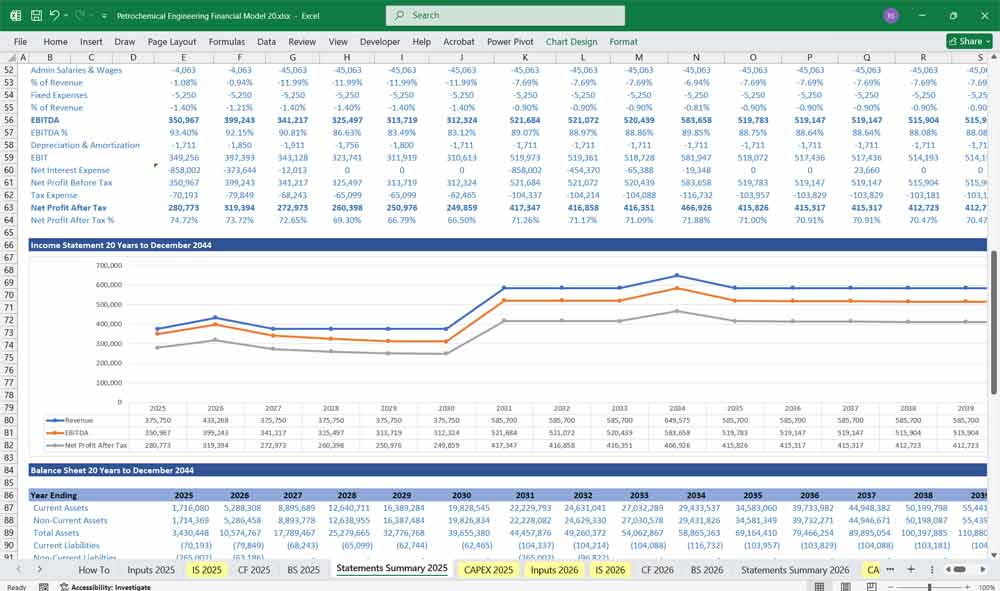

Income Statement (Profit & Loss Statement)

A. Revenue

Product Sales Revenue

Ethylene, Propylene, Polyethylene, Methanol, etc.

Based on volume (metric tons) × average selling price (ASP)

Engineering/Service Contracts

Lump sum or milestone-based payments

By-product and Waste Sales

Trading Revenue (if any)

B. Cost of Goods Sold (COGS)

Raw Material Costs

Naphtha, Natural Gas, Crude Oil fractions

Utilities

Steam, electricity, water usage

Labor (Production Only)

Maintenance and Repairs

Depreciation (Production-related assets)

→ Gross Profit = Revenue – COGS

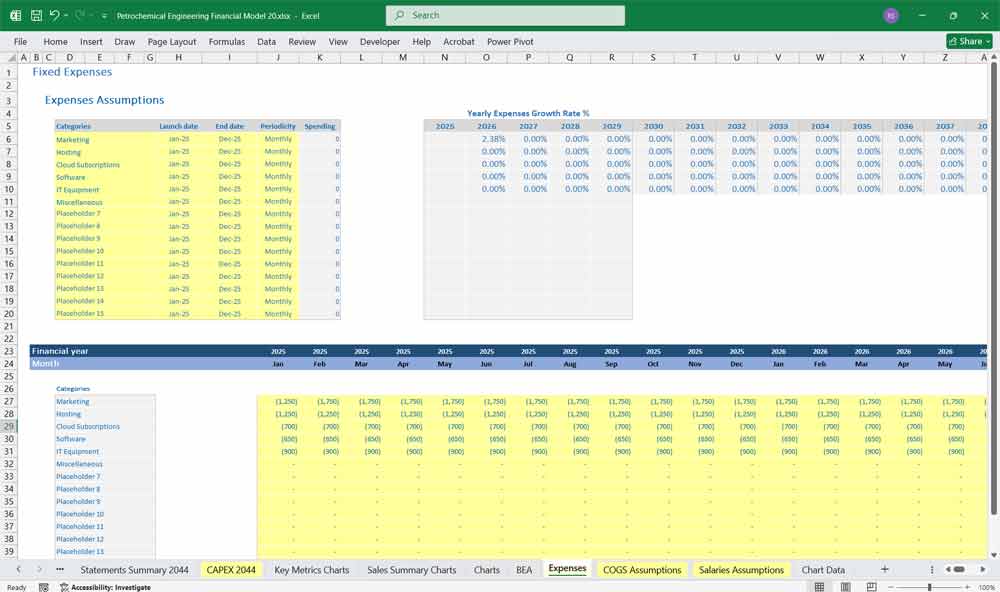

C. Operating Expenses (OPEX)

Selling, General & Administrative (SG&A)

Marketing, management salaries, legal, insurance

R&D Costs

Process innovation and catalyst development

Other Operating Expenses

Travel, audit, environmental compliance

Depreciation & Amortization (non-production)

→ EBITDA = Gross Profit – Operating Expenses (excl. D&A)

→ EBIT = EBITDA – Depreciation & Amortization

D. Other Income/Expenses

Interest Income / Expense

Exchange Rate Gains/Losses

Gains/Losses on Asset Sales

E. Taxes

Effective tax rate based on jurisdiction and incentives

F. Net Income

→ Net Income = EBIT – Interest – Taxes

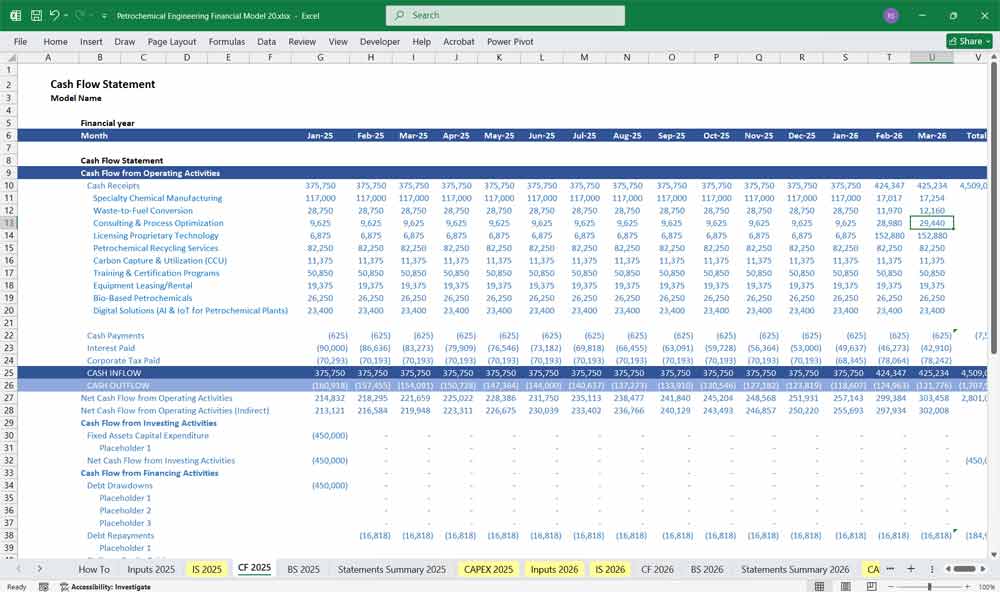

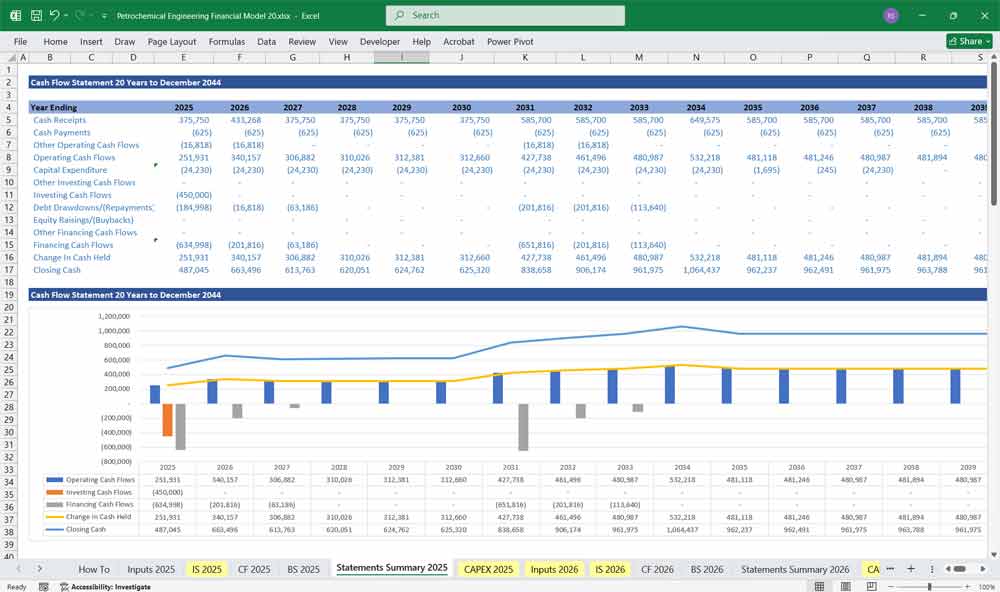

Petrochemical Engineering Company Cash Flow Statement

Organized into three major categories:

A. Cash Flow from Operating Activities

Net Income

Adjustments for Non-Cash Items

Depreciation & Amortization

Provision for environmental liabilities

Changes in Working Capital

Accounts Receivable

Inventory (raw materials, WIP, finished goods)

Accounts Payable

Prepaid Expenses and Accrued Liabilities

Deferred Taxes

→ Net Cash from Operating Activities

B. Cash Flow from Investing Activities

Capital Expenditures (CapEx)

Plant expansions

Equipment upgrades

Storage tanks and pipelines

Asset Sales

Sale of old equipment or non-core assets

Investments in JVs or New Projects

Intangible Asset Investments

Licenses, patents, technical know-how

→ Net Cash from Investing Activities

C. Cash Flow from Financing Activities

Debt Issuance / Repayment

Equity Issuance / Buybacks

Dividend Payments

Interest Paid

Lease Payments (if not part of OpEx)

→ Net Cash from Financing Activities

D. Net Cash Flow

= Operating + Investing + Financing Activities

E. Beginning and Ending Cash Balances

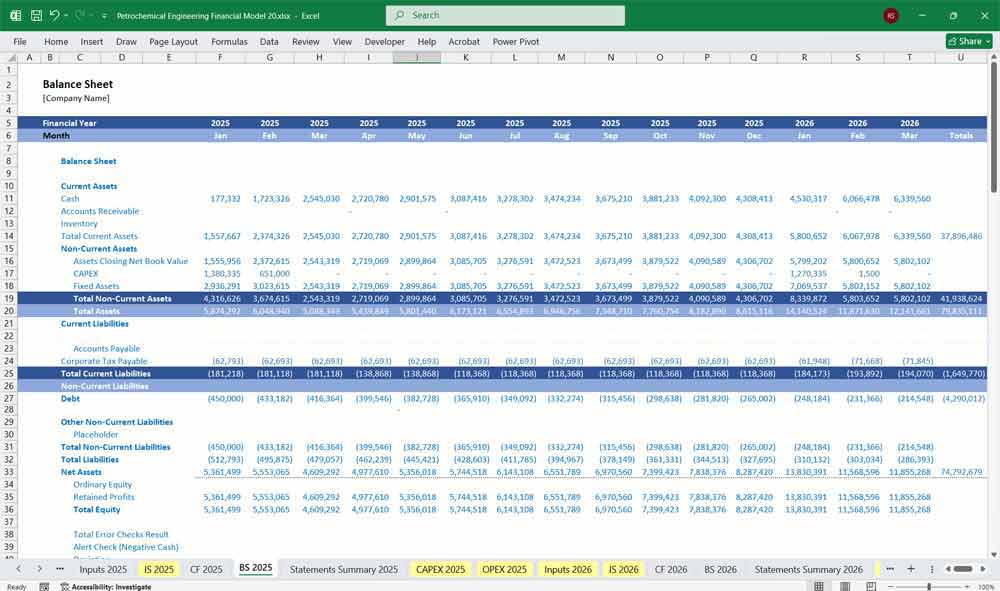

Petrochemical Engineering Company Balance Sheet

A snapshot of the company’s financial position.

A. Assets

1. Current Assets

Cash and Equivalents

Accounts Receivable

Inventory

Raw materials

Work-in-progress (WIP)

Finished goods

Prepaid Expenses

Other Short-Term Assets

2. Non-Current Assets

Property, Plant & Equipment (PP&E)

Petrochemical plants

Pipelines

Machinery & vehicles

Accumulated Depreciation

Capital Work in Progress (CWIP)

Intangible Assets

Licenses, patents, software

Long-term Investments

Deferred Tax Assets (if any)

B. Liabilities

1. Current Liabilities

Accounts Payable

Accrued Expenses

Short-Term Debt

Taxes Payable

Current Portion of Long-Term Debt

2. Non-Current Liabilities

Long-Term Debt

Lease Liabilities

Pension Liabilities

Decommissioning/Environmental Provisions

Deferred Tax Liabilities

C. Equity

Share Capital

Additional Paid-In Capital

Retained Earnings

Revaluation Reserves (if any)

Non-controlling Interest (in case of subsidiaries)

→ Assets = Liabilities + Equity

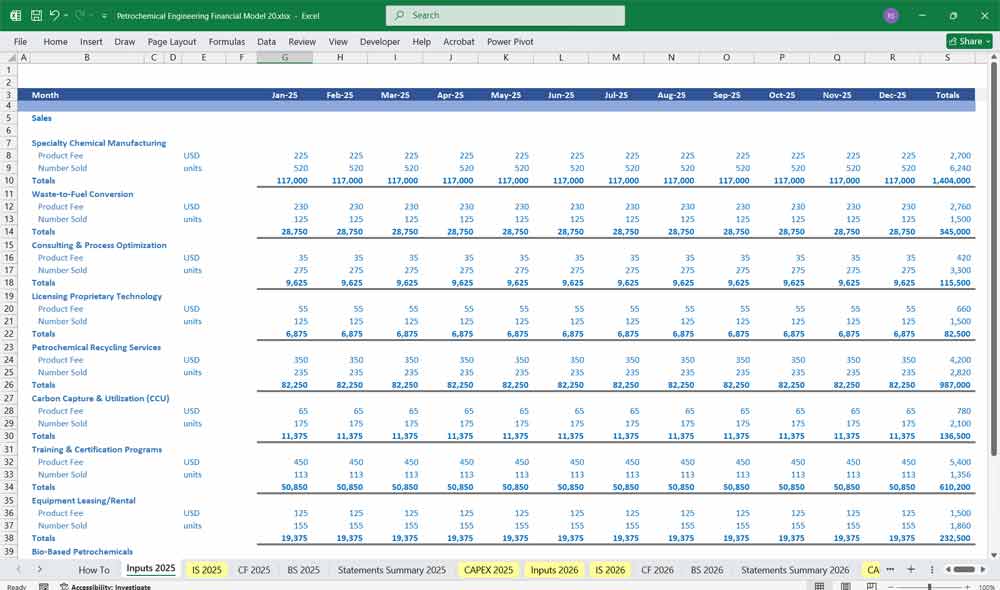

Supporting Schedules (optional but recommended)

Revenue Schedule: Volume × Price per product line

COGS Schedule: Linked to input prices and volumes

CapEx Schedule: Linked to project timelines

Debt Schedule: Opening balance, additions, repayments, interest

Depreciation Schedule: Asset classes and useful lives

Working Capital Schedule: DSO, DPO, Inventory Turnover

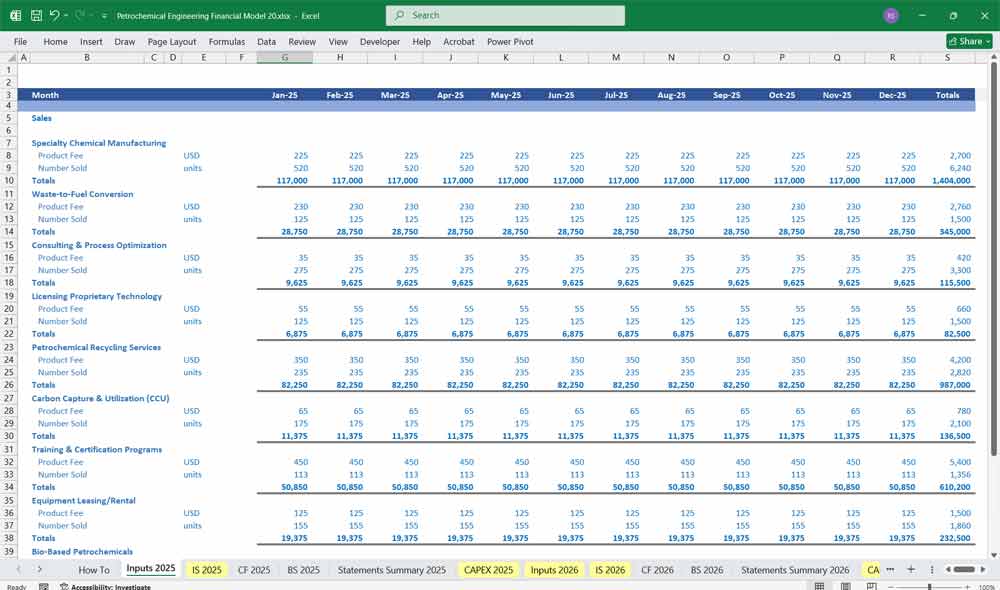

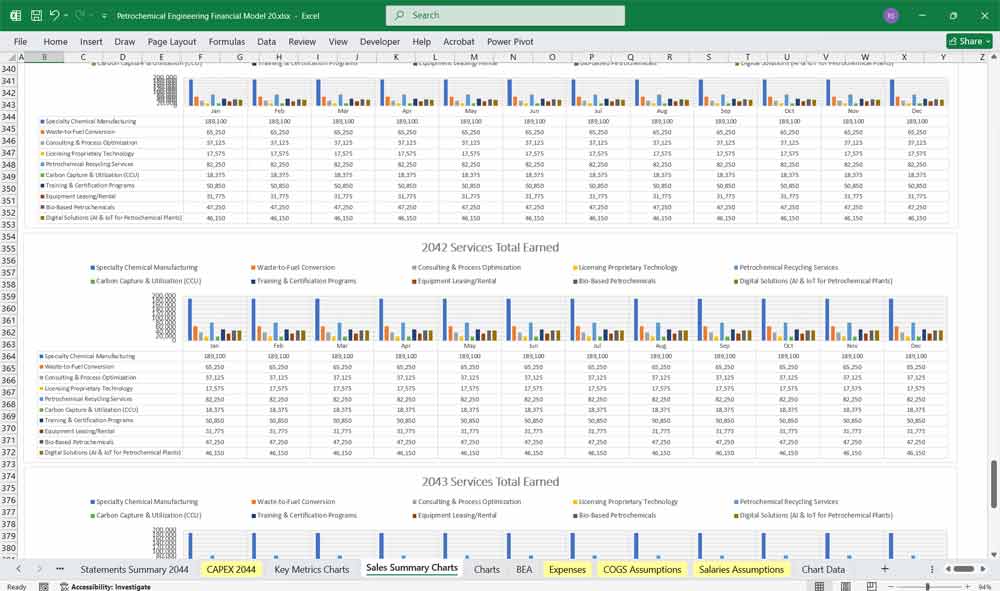

Example Revenues For A Petrochemical Manufacturing Company

1. Specialty Chemical Manufacturing

Produce high-value specialty chemicals (e.g., catalysts, additives, lubricants) for niche markets like pharmaceuticals, electronics, or renewable energy.

2. Waste-to-Fuel Conversion

Develop processes to convert petrochemical waste, plastics, or biomass into synthetic fuels (e.g., pyrolysis oil, biodiesel) and sell to refineries or energy companies.

3. Consulting & Process Optimization

Offer expert consulting services to refineries and chemical plants to improve efficiency, reduce emissions, and optimize production processes.

4. Licensing Proprietary Technology

Develop and license proprietary refining/petrochemical technologies (e.g., advanced catalysts, carbon capture systems) to other companies.

5. Petrochemical Recycling Services

Establish a business unit focused on recycling plastic waste into reusable petrochemical feedstocks (circular economy model).

6. Carbon Capture & Utilization (CCU)

Partner with energy firms to capture CO₂ emissions and convert them into useful products (e.g., methanol, polymers).

7. Training & Certification Programs

Offer specialized training courses, workshops, or certifications for petrochemical engineers and plant operators.

8. Petrochemical Equipment Leasing/Rental

Lease out specialized equipment (e.g., reactors, distillation columns, analyzers) to smaller firms that can’t afford full ownership.

9. Bio-Based Petrochemicals

Invest in R&D for bio-based alternatives (e.g., bio-plastics, green solvents) to cater to sustainability-focused industries.

10. Digital Solutions (AI & IoT for Petrochemical Plants)

Develop AI-driven predictive maintenance software, process automation tools, or IoT sensors for real-time plant monitoring.

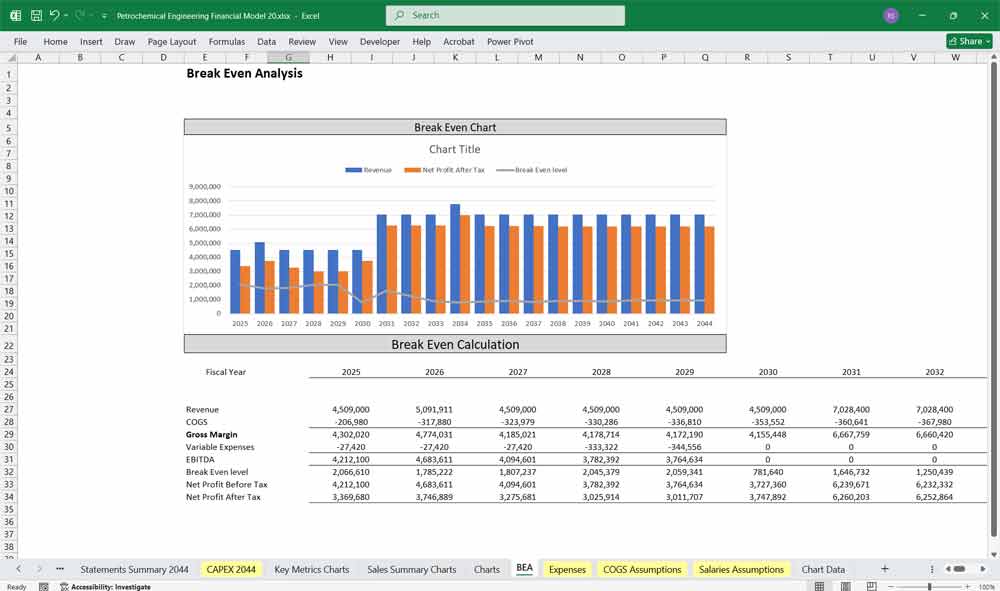

Sensitivity & Scenario Analysis On The Financial Model

Key Ratios and KPIs

Gross Margin, EBITDA Margin, Net Margin

Return on Equity (ROE), Return on Assets (ROA)

Debt/Equity, Interest Coverage

Cash Conversion Cycle

Capacity Utilization

Break-even Price per Metric Ton

Scenario and Sensitivity Analysis

Feedstock cost variation

Product price volatility

Project delay impacts

FX fluctuation scenarios

Regulatory change impact

Download Link On Next Page