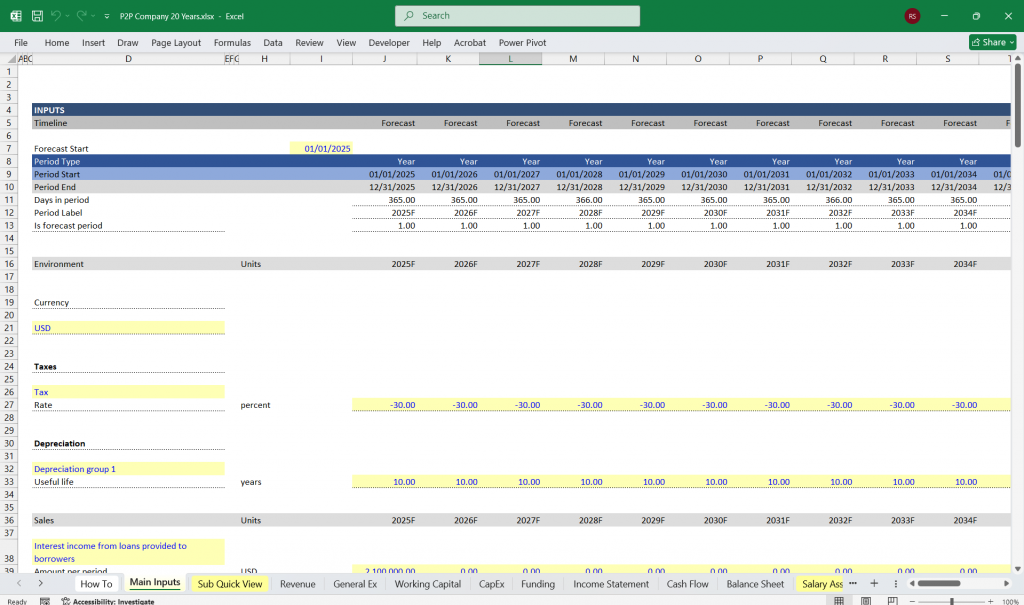

Peer to Peer Lending Financial Model

This 3-Statement Peer-to-Peer Lending Financial Model in MS Excel for a (P2P) Lending Platform includes an interconnected Income Statement, Cash Flow Statement, and Balance Sheet to provide a comprehensive financial outlook.

Income Statement (Profit & Loss Statement) For A Peer-To-Peer Loan Company

The income statement reflects the platform’s profitability over a period, capturing revenues, expenses, and net income.

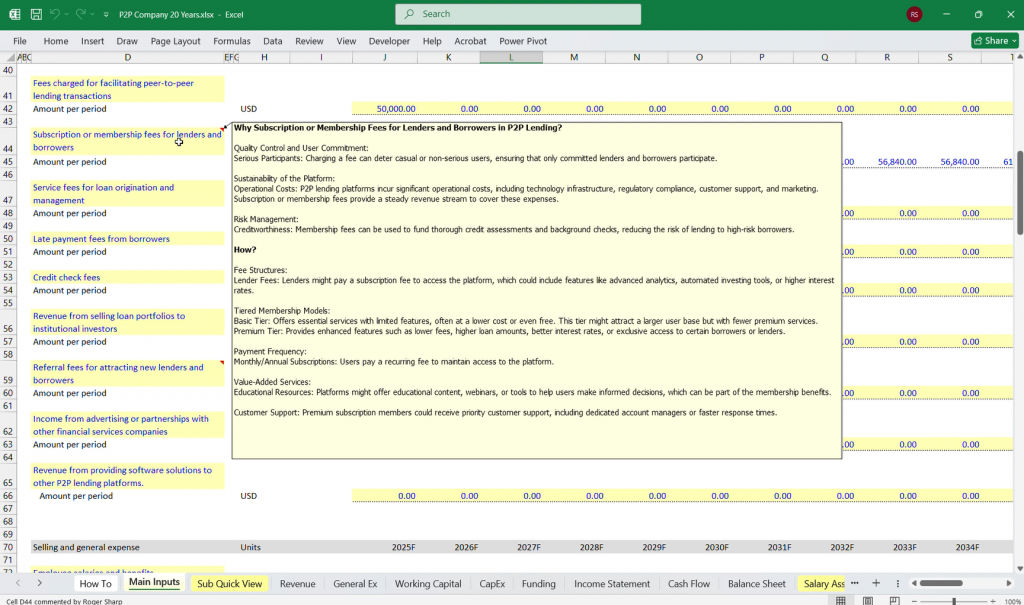

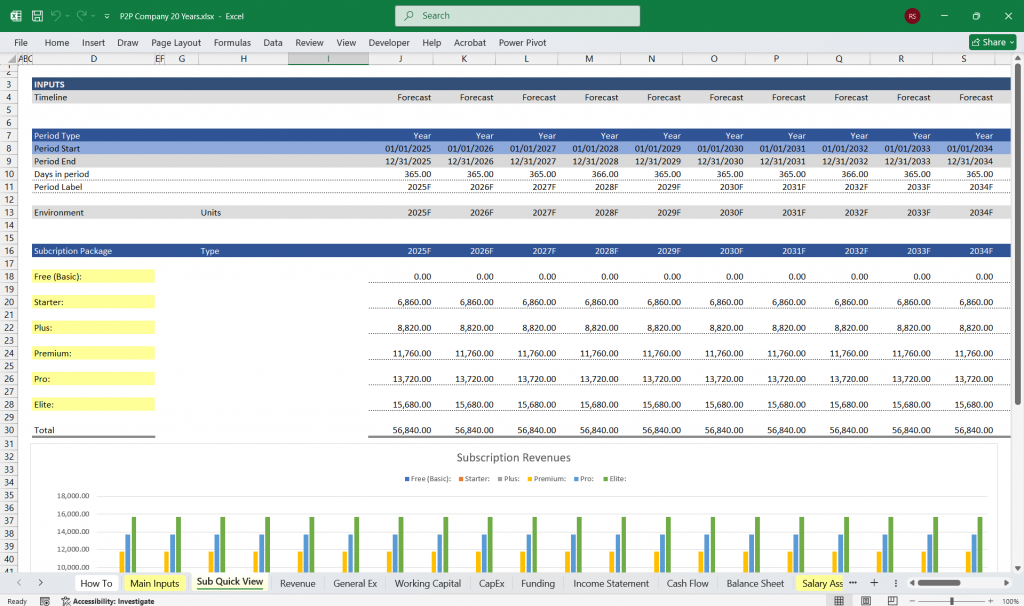

This 6-tier subscription model for a Peer-to-Peer (P2P) Lending Platform allows flexibility for different user segments, from casual investors to high-net-worth individuals and institutional lenders. Below is a structured tier system with features, pricing, and value propositions:

1. Free Tier (Basic) – “Free “Target: New users, small lenders, and casual investors

Features:

- Access to basic marketplace listings

Loan browsing & investing up to a capped amount (e.g., $1,000)

Standard credit scoring data

Basic reporting & portfolio tracking

Standard customer support

No auto-investing or secondary market access

Limited transaction history.

2. Bronze Tier – “Starter “Target: Growing investors, active lenders

Features:

- Everything in Free Tier +

Increased investment cap (e.g., $10,000)

Early access to new loan listings

Basic auto-investing tools

Advanced credit scoring metrics

Community forum access

Limited access to premium loan categories

3. Silver Tier – “Plus”Target: Mid-level investors and frequent lenders.

Features:

- Everything in Bronze Tier +

Unlimited investing (no cap)

Full auto-investing customization

Access to secondary market trading - Portfolio risk analysis & projections

Priority customer support

No API access or custom risk scoring models

4. Gold Tier – “Premium”Target: High-net-worth individuals and serious investors.

Features:

- Everything in Silver Tier +

VIP loan listings with exclusive deals

Customized credit risk scoring tools

Tax optimization & advanced reporting

Early access to platform innovations

Dedicated account manager - Limited institutional investment tools

5. Platinum Tier – “Pro”Target: Family offices, hedge funds, and large-scale lenders.

Features:

- Everything in Gold Tier +

API access for automated investing

Bulk loan purchasing options

Real-time data feeds & analytics dashboards

Direct integration with external financial tools

Customizable risk assessment models

No private lending pools or white-label solutions

6. Diamond Tier – “Elite”Target: Large-scale financial institutions, banks, and fintech firms.

Features:

- Everything in Platinum Tier +

White-label solutions for branded lending platforms

Private loan pools & syndicate investing

Full regulatory compliance support

Custom AI-driven credit scoring solutions

Dedicated data science & engineering support

24/7 dedicated account & risk management team.

Additional Monetization Add-ons (For Any Tier):

Pay-Per-Use API Calls – Charge per credit risk API query.

One-Time Loan Analysis Reports – Detailed insights on borrower risk.

Premium Customer Support Package – Instant support for lower tiers.

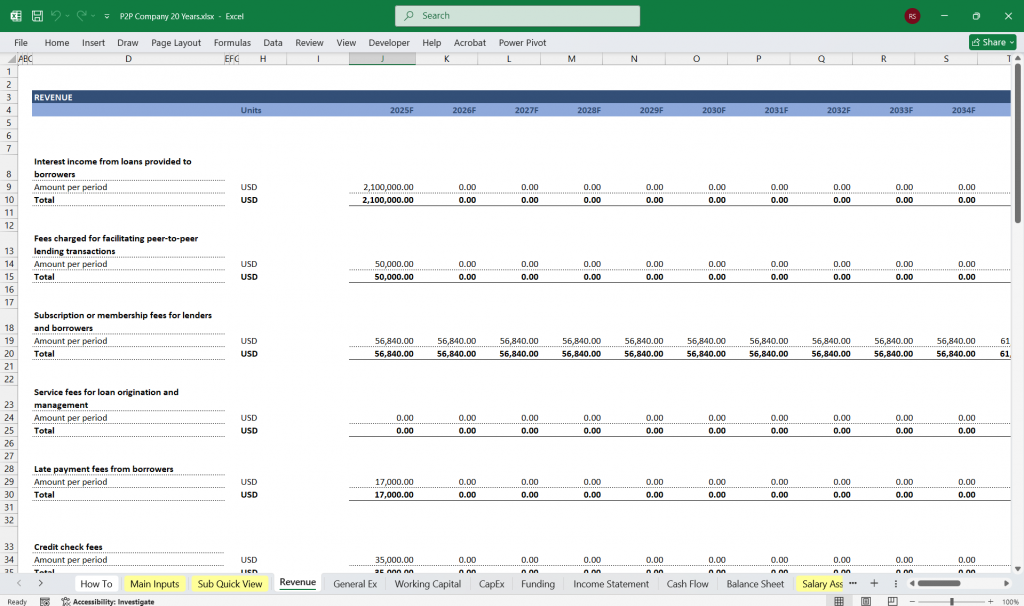

Revenue Streams For A Peer-to-Peer Loan Company

- Loan Origination Fees – Fees charged to borrowers upon successful loan issuance (e.g., 1%-5% of loan amount).

- Servicing Fees – Ongoing fees charged to investors/lenders for managing loans (e.g., 0.5%-2% of outstanding loan balance).

- Late Payment Fees – Penalties imposed on borrowers for overdue payments.

- Interest Spread – If the platform funds loans itself, it earns an interest spread between borrower rates and lender returns.

- Secondary Market Fees – If the platform allows loan resale, it earns transaction fees.

- Subscription Fees – Fees for premium services or enhanced investor tools.

- Advertising Revenue – Income from third-party ads if applicable.

Cost of Revenue (COGS/Direct Costs)

- Loan Processing Costs – Credit checks, KYC (Know Your Customer), and fraud detection.

- Transaction Costs – Payment gateway charges for fund transfers.

- Customer Support Costs – Support staff and dispute resolution.

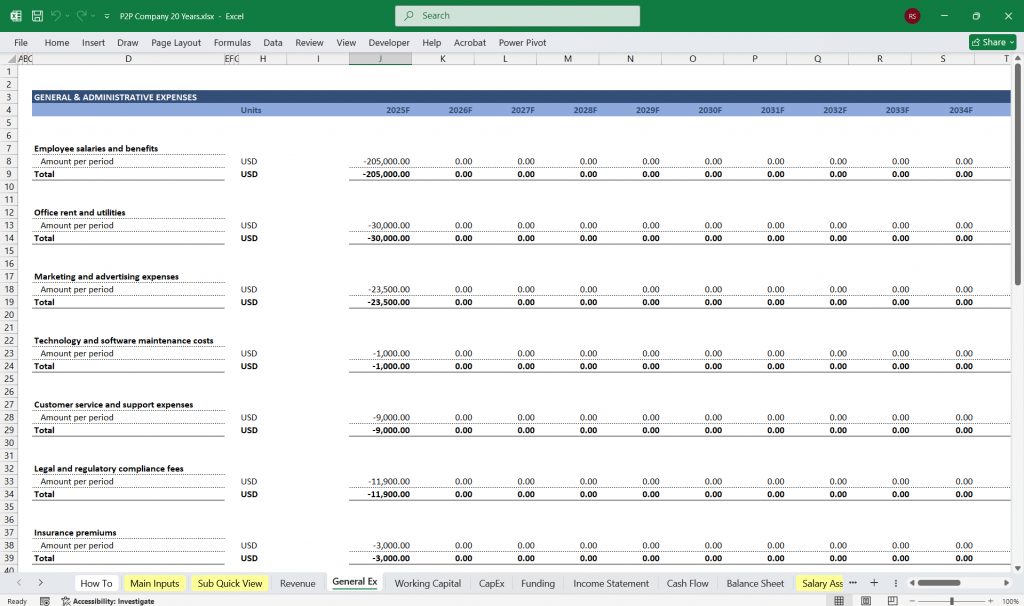

Operating Expenses

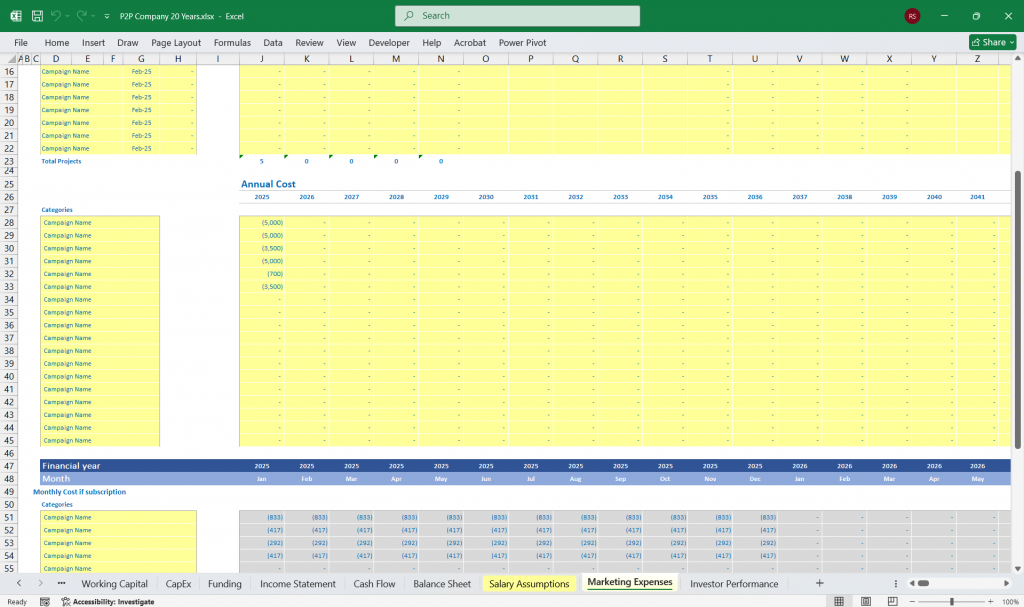

- Marketing & Customer Acquisition – Digital marketing, referral programs, and affiliate partnerships.

- Technology & Platform Development – IT infrastructure, app maintenance, and cybersecurity.

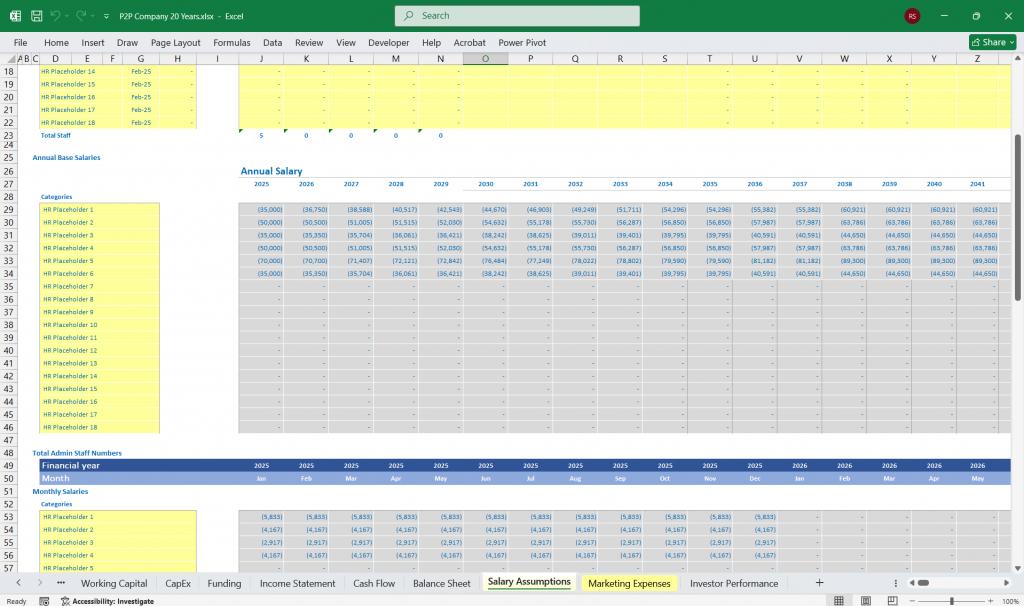

- Employee Salaries & Benefits – Operations, compliance, engineering, and finance teams.

- Regulatory & Compliance Costs – Legal fees, licenses, and audits.

- Office & Administrative Costs – Rent, utilities, and general admin expenses.

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

- EBITDA = Revenue – (COGS + Operating Expenses)

Depreciation & Amortization

- Includes amortization of software development costs and depreciation of office assets.

Operating Income (EBIT)

- EBIT = EBITDA – Depreciation & Amortization

Interest Expense & Taxes

- If the platform has borrowed funds or earns interest, it is reflected here.

- Taxes depend on jurisdiction and applicable tax rates.

Net Income

- Net Income = EBIT – Interest – Taxes

- Represents overall profitability for the period.

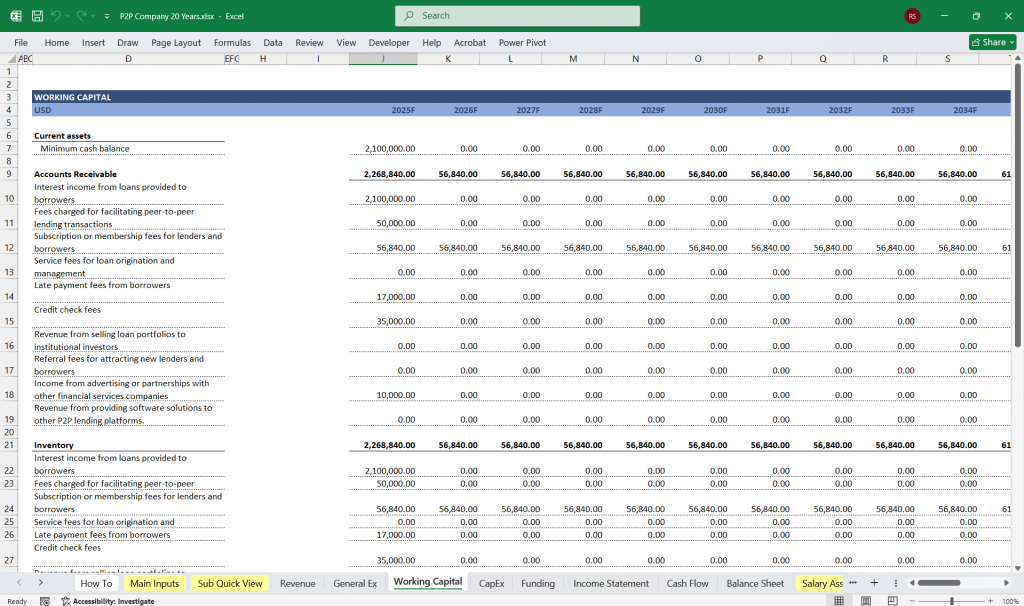

Peer-To-Peer Cash Flow Statement

Tracks cash movements to assess liquidity and operational efficiency.

Operating Cash Flow

- Net Income Adjustments – Adding back non-cash expenses like depreciation and amortization.

- Changes in Working Capital – Adjustments in receivables, payables, and accrued expenses.

- Loan Disbursements & Repayments – If the platform engages in direct lending, these appear here.

- Fees & Revenue Collections – Cash received from borrowers and lenders for platform services.

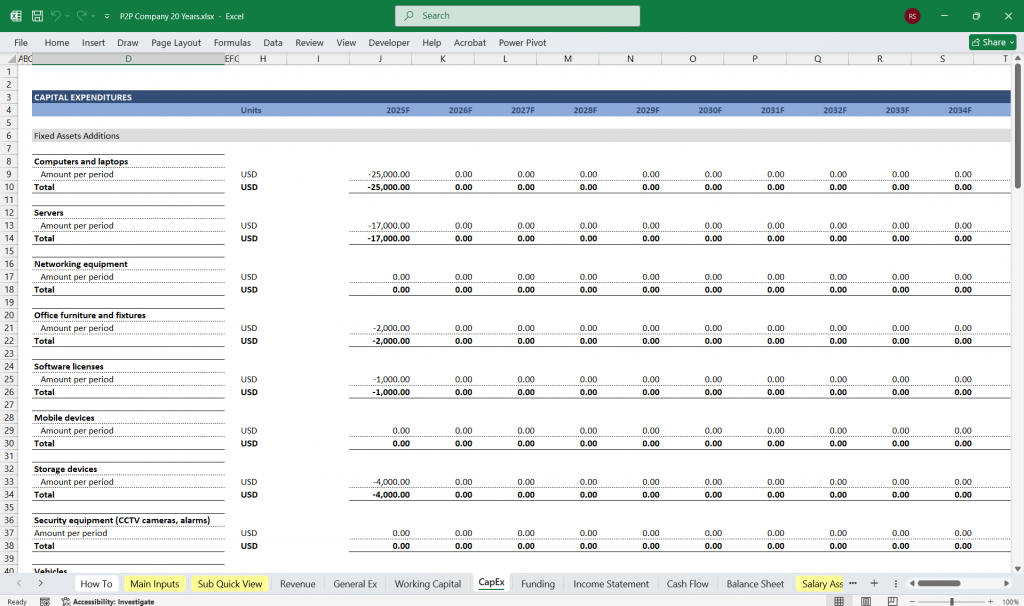

Investing Cash Flow

- Capital Expenditures (CapEx) – Spending on technology, office equipment, and software.

- Acquisitions & Investments – If the company invests in partnerships, R&D, or acquisitions.

Financing Cash Flow

- Equity Funding – Cash inflow from venture capital, private equity, or IPO.

- Debt Financing – Loans raised by the platform.

- Dividends & Buybacks – If the company distributes earnings to shareholders.

Net Change in Cash

- Summarizes total cash inflows and outflows.

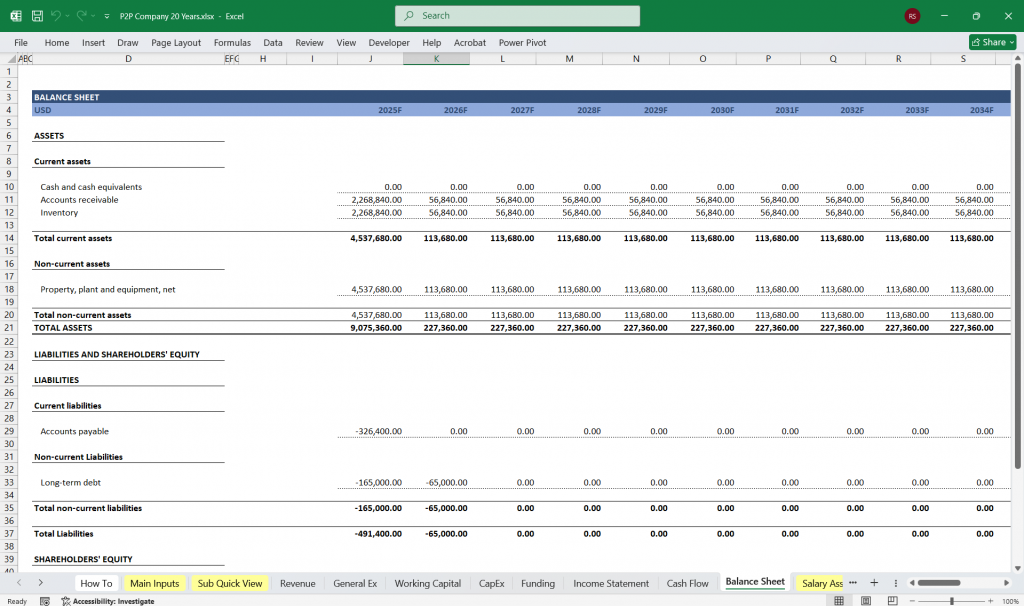

Peer-To-Peer Balance Sheet

Reflects the company’s Per-to-Peer Lending financial position at a point in time.

AssetsCurrent Assets

- Cash & Equivalents – Cash reserves from operations and funding.

- Accounts Receivable – Outstanding fees due from lenders or borrowers.

- Loan Receivables – If the platform lends directly, outstanding loan balances.

Non-Current Assets

- Technology & Software – Capitalized development costs.

- Office & Equipment – Hardware, office space, and infrastructure.

- Investments – Strategic investments in other companies or projects.

LiabilitiesCurrent Liabilities

- Accounts Payable – Unpaid expenses and vendor obligations.

- Deferred Revenue – Fees collected for services not yet delivered.

- Borrowings (Short-Term) – Any short-term debt obligations.

Non-Current Liabilities

- Long-Term Debt – Any loans or financing raised by the company.

- Investor Liabilities – If managing funds on behalf of lenders, recorded as liabilities.

Equity

- Common Stock & Retained Earnings – Represents ownership capital and cumulative profits.

- Additional Paid-in Capital – Funds raised above the par value of issued stock.

Interconnectivity of the 3 Statements For A Peer-to-Peer Loan Company

- Net Income from the Income Statement flows into Operating Cash Flow (Cash Flow Statement) and Retained Earnings (Balance Sheet).

- Depreciation & Amortization from the Income Statement are added back into the Cash Flow Statement but reduce the Asset Value (Balance Sheet) over time.

- Loan Disbursements & Repayments affect Cash Flow and are reflected as Loan Receivables or Liabilities in the Balance Sheet.

- Equity & Debt Financing in the Cash Flow Statement affects the Liabilities & Equity sections of the Balance Sheet.

Conclusion For The Financial Model

This 3-statement Peer-to-Peer Lending Financial Model platform provides insights into revenue generation, cost management, cash flows, and financial health. Key considerations include:

- Scalability of fee-based revenue models

- Credit risk exposure if lending directly

- Regulatory compliance costs

- Customer acquisition efficiency (CAC vs. LTV)

Download Available Immediately After Payment