Hydrogen Solutions Financial Model

Financial Model for a Hydrogen Solutions Provider

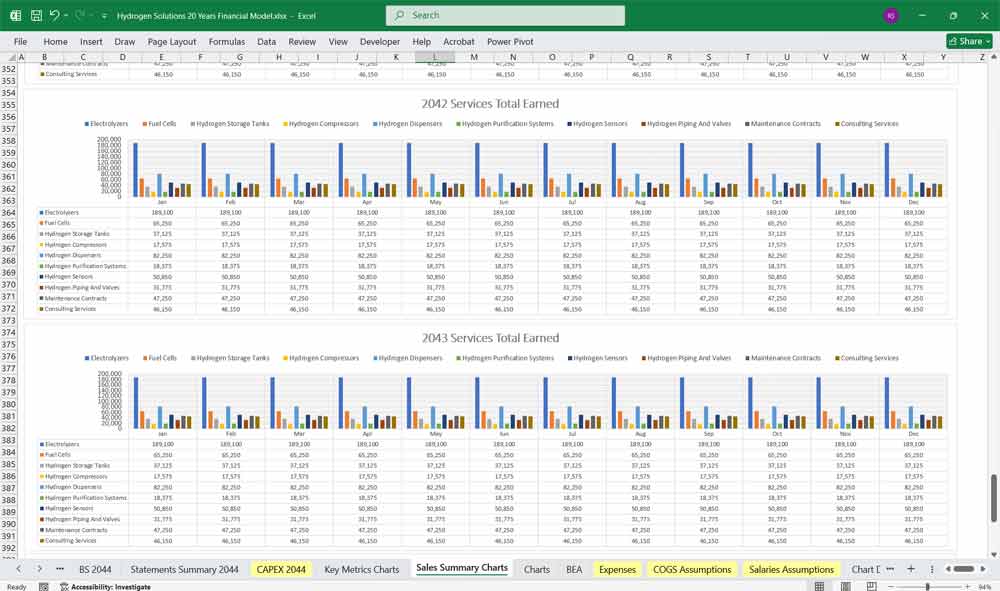

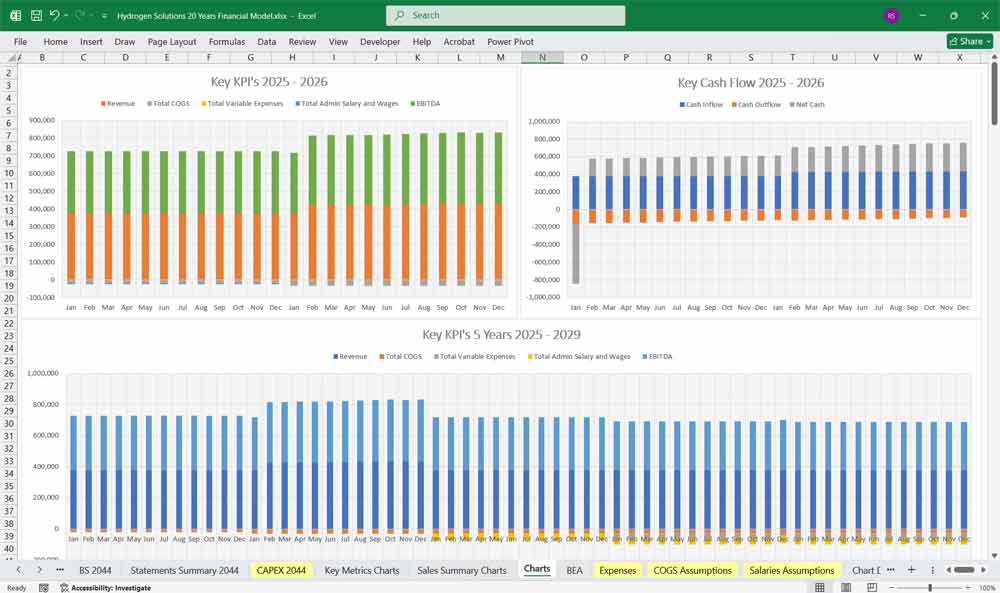

This very extensive 20 Year Hydrogen Solutions Model involves detailed revenue projections, cost structures, capital expenditures, and financing needs. This model provides a thorough understanding of the financial viability, profitability, and cash flow position of your business. Includes: 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the specified revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets.

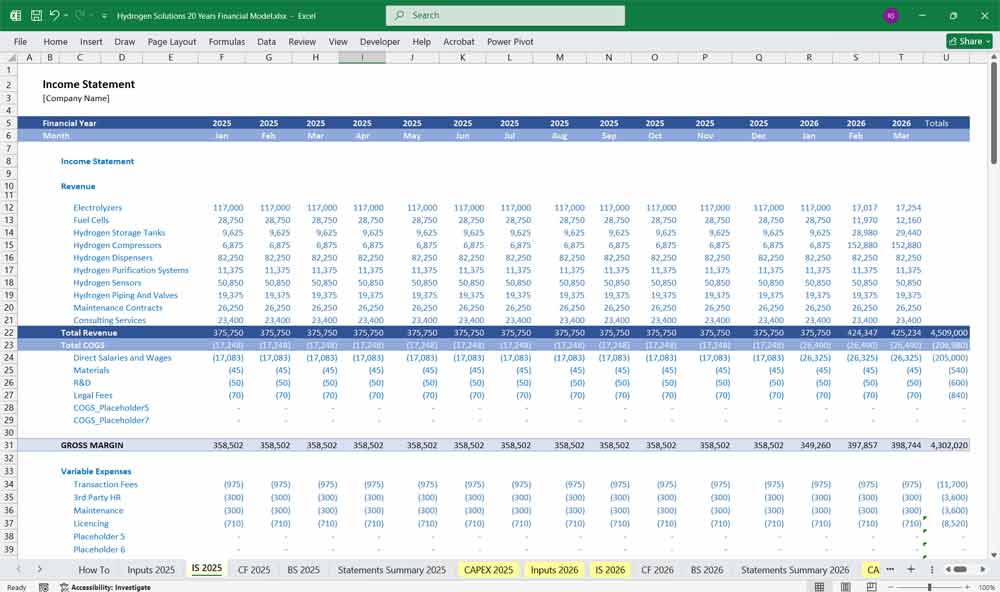

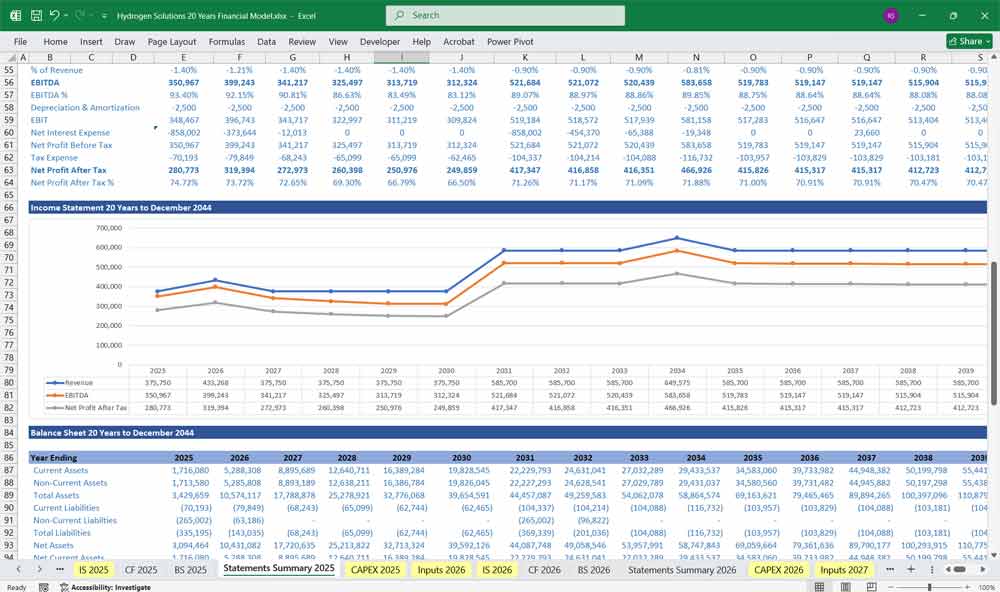

Income Statement (Profit & Loss Statement)

Key Sections:

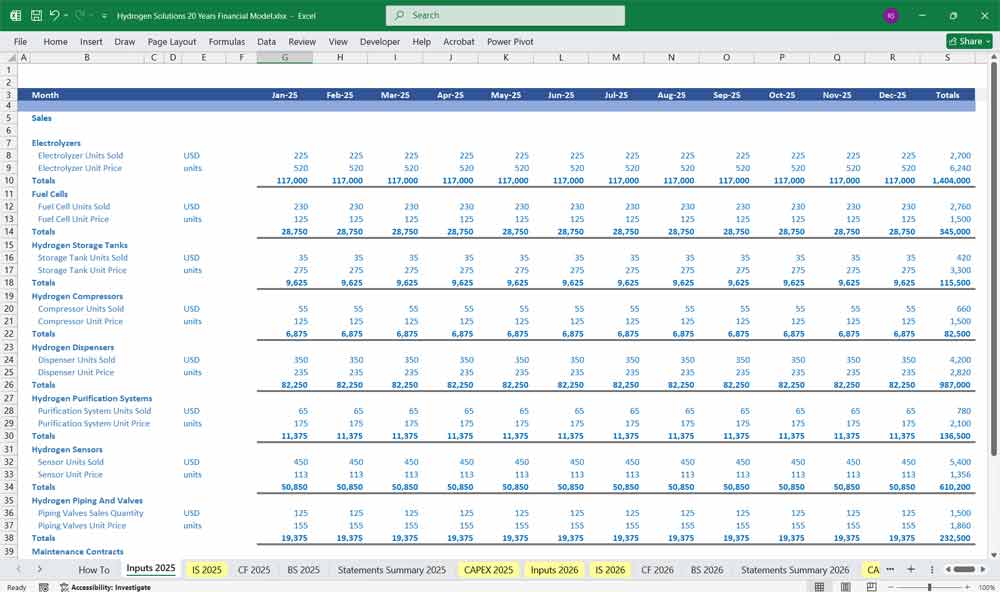

Revenue

Breakdown based on business lines:

Hydrogen Production Revenue

= Volume sold × Price per kg

→ Further segmented into industrial, mobility, and power sectors.Equipment Sales

e.g., electrolyzers, fuel cell systems, storage units.Installation & Engineering Services

Project consulting, installation, commissioning.Maintenance Contracts & Subscriptions

Annual recurring revenue (ARR) for long-term service contracts.Carbon Credit / Subsidy Income

Includes regulatory credits, green energy subsidies.

Cost of Goods Sold (COGS)

Electricity costs (major cost for electrolysis-based production).

Water supply (for electrolysis).

Raw materials (for equipment production).

Labor directly involved in production.

Transportation and storage.

Gross Profit

= Revenue – COGS

Gross Margin = Gross Profit / Revenue

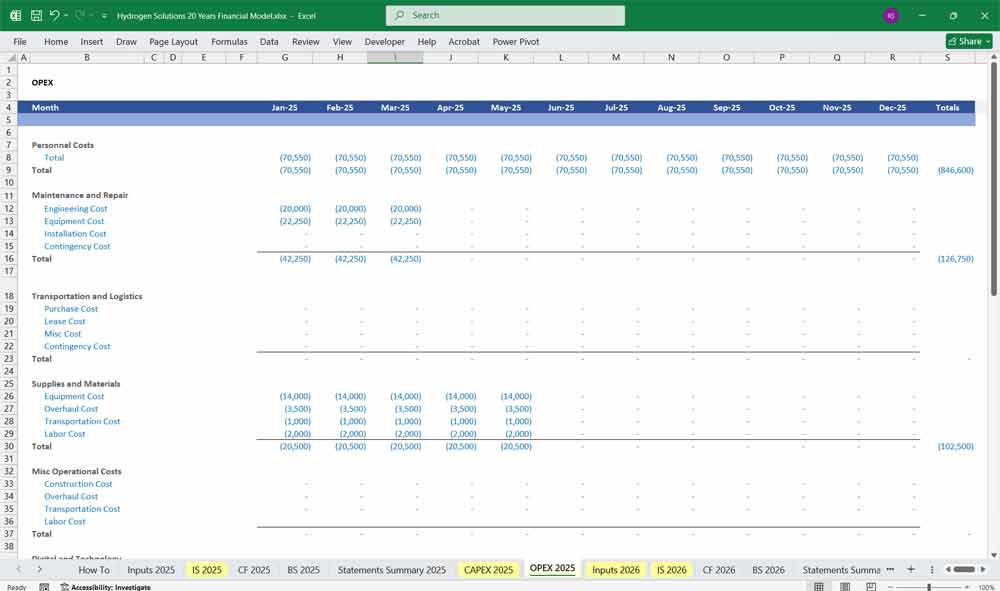

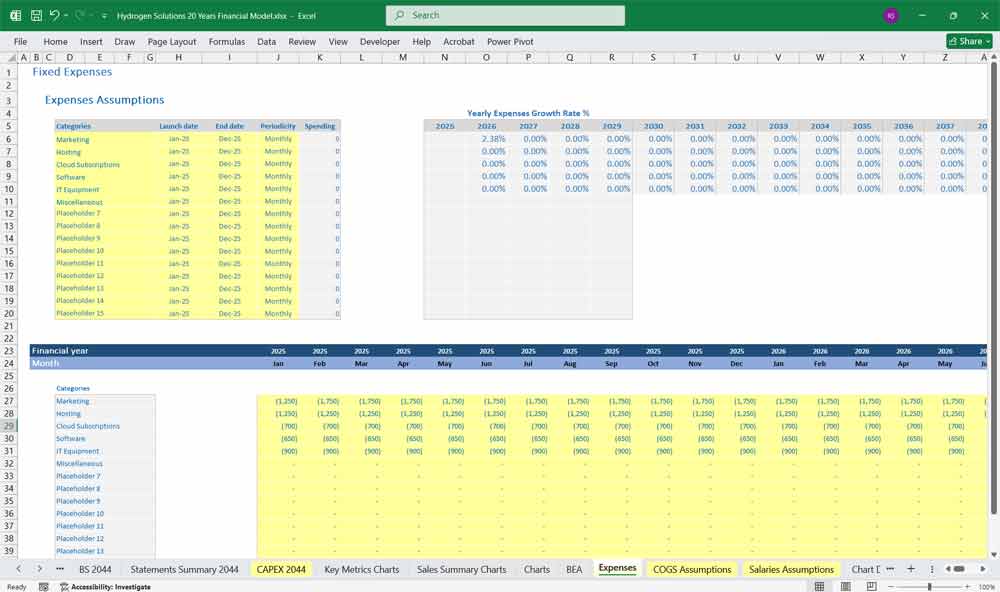

Operating Expenses

R&D: Development of fuel cell technology, efficiency improvements.

SG&A: Salaries, marketing, legal, insurance, office costs.

Sales & Business Development: Commissions, partnerships, travel.

Utilities & Facilities: For production facilities or labs.

EBITDA

= Gross Profit – Operating Expenses (excluding D&A)

Depreciation & Amortization

Based on asset schedules (electrolyzers, pipelines, intellectual property).

EBIT (Operating Income)

Interest Expense

Interest on project financing, bonds, equipment leases.

Pre-Tax Income

Income Tax Expense

Based on jurisdictional corporate tax rates.

Net Income

= EBIT – Interest – Taxes

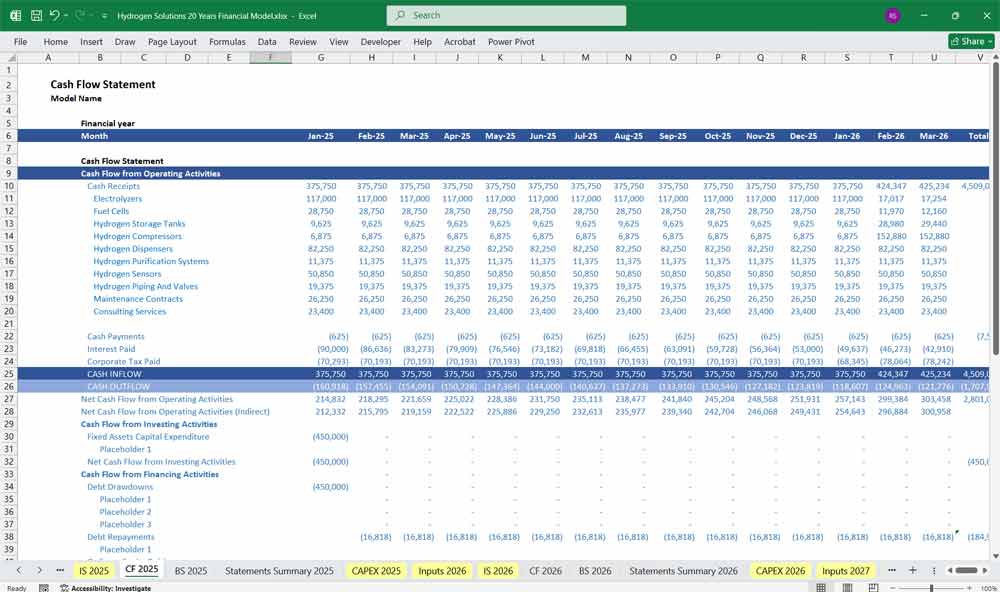

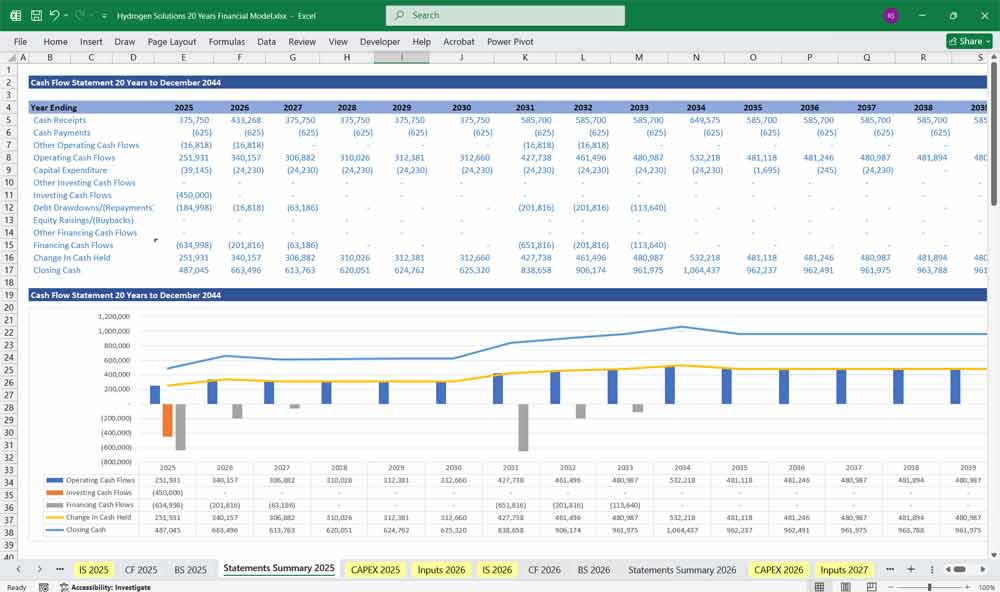

Hydrogen Solutions Provider Cash Flow Statement

Operating Activities

Net Income

Adjustments:

Depreciation/Amortization

Changes in working capital:

Accounts receivable/payable

Inventory

Prepaid expenses/accruals

Non-cash Expenses:

e.g., stock-based compensation, provisions.

Investing Activities

CapEx:

Hydrogen plants

Electrolyzer machinery

Transport fleets, pipelines

R&D Capitalization (if applicable)

Acquisitions / JV investments

Proceeds from asset sales (if any)

Financing Activities

Equity Financing

Seed, Series A–D, IPO proceeds (if startup)

Debt Financing / Repayment

Project finance debt

Green bonds

Grants / Subsidies Received

Interest & Lease Payments

Dividend Payments (if any)

Net Change in Cash

= Cash from operations + investing + financing

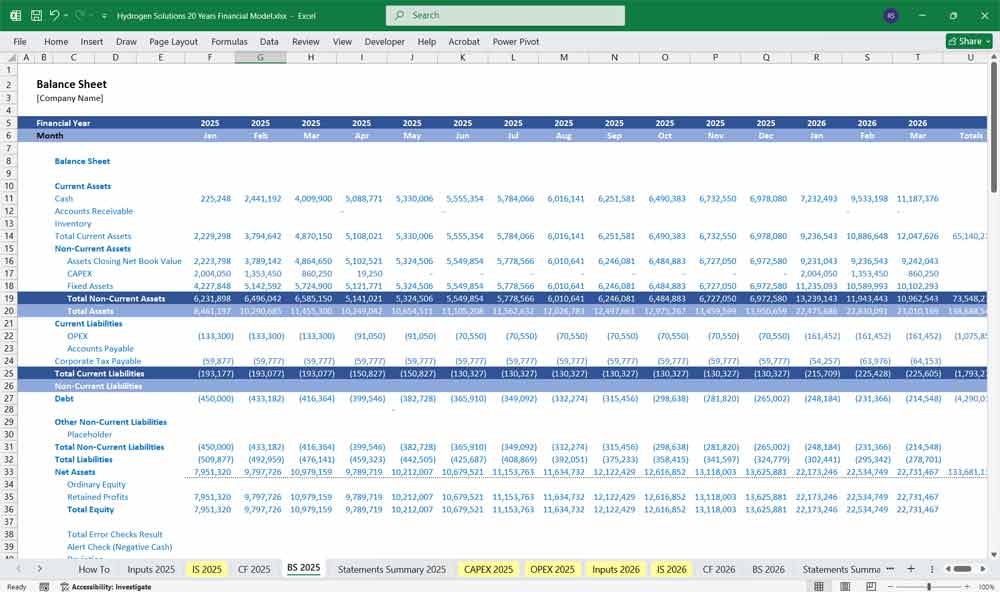

Hydrogen Solutions Provider Balance Sheet

Assets

Current Assets

Cash & Equivalents

Accounts Receivable

Inventory

Raw materials, hydrogen stored, parts

Prepaid Expenses

Carbon Credits Receivable (if monetizable)

Non-Current Assets

Property, Plant & Equipment (PP&E)

Electrolyzer facilities, tanks, vehicles, labs

Intangible Assets

Patents, licenses, software

Capitalized R&D

Investments in JVs or Hydrogen Hubs

Deferred Tax Assets

Liabilities

Current Liabilities

Accounts Payable

Accrued Expenses

Short-Term Loans / Lease Liabilities

Deferred Revenue (from prepaid maintenance/service contracts)

Non-Current Liabilities

Long-Term Debt

Lease Liabilities

Deferred Tax Liabilities

Asset Retirement Obligations

(e.g., decommissioning hydrogen plants)

Equity

Common Stock

Additional Paid-In Capital

Retained Earnings

Accumulated Other Comprehensive Income

Grants/Subsidies as Deferred Income (if treated as capital contribution)

Hydrogen Solutions: Green Hydrogen Production

Electrolysis using renewable energy (solar, wind, hydro).

Water purification systems for electrolysis.

Scalable modular electrolyzer plants.

Power purchase agreements (PPAs) with renewable producers.

Onsite vs. centralized production analysis.

Hydrogen Solutions: Hydrogen Fueling Infrastructure

Development of hydrogen refueling stations (HRS).

Partnerships with transport hubs and fleet operators.

Integration with payment and logistics systems.

Compliance with safety and storage regulations.

Mobile refueling solutions for rural or temporary sites.

Hydrogen Solutions: Industrial Hydrogen Supply

Hydrogen for ammonia and fertilizer plants.

Decarbonizing steel and cement production.

Hydrogen blending in natural gas pipelines.

Bulk delivery logistics and scheduling.

Hydrogen purity standards for industrial use.

Hydrogen Solutions: Fuel Cell Technology

PEM (Proton Exchange Membrane) fuel cells.

Fuel cells for vehicles, stationary power, and drones.

Heat and water recovery systems.

System integration and software control.

End-of-life recycling programs.

Hydrogen Solutions: Electrolyzer Manufacturing

In-house or OEM electrolyzer development.

Alkaline vs. PEM vs. SOEC technologies.

Modular designs for easy scalability.

R&D into efficiency improvements.

Global supply chain management.

Hydrogen Solutions: Transportation & Logistics

Hydrogen-powered heavy-duty trucks and buses.

Maritime hydrogen propulsion systems.

Rail and aviation hydrogen initiatives.

Cryogenic and compressed gas storage options.

Hydrogen delivery route optimization.

Hydrogen Solutions: Storage & Compression

High-pressure gaseous hydrogen storage systems.

Liquid hydrogen cryogenic tanks.

Underground and metal hydride storage.

Safety monitoring and leak detection systems.

Energy density vs. cost tradeoff evaluation.

Hydrogen Solutions: Carbon Credit Optimization

Green hydrogen certification (e.g., CertifHy).

Generating and selling carbon credits.

Tracking emissions avoided with blockchain.

Participation in emission trading schemes (ETS).

Verification by third-party auditors.

Hydrogen Solutions: Grid Integration

Hydrogen for energy storage (power-to-gas).

Electrolyzer demand response services.

Balancing grid load with hydrogen production.

Virtual power plant (VPP) participation.

Co-location with renewable energy assets.

Hydrogen Solutions: Distributed Generation

Microgrid-compatible hydrogen systems.

Containerized power units for remote areas.

Off-grid backup systems using fuel cells.

Community-scale hydrogen production.

Integration with solar + battery systems.

Hydrogen Solutions: Public Sector Partnerships

Working with government on pilot projects.

Accessing grants and green innovation funding.

Urban hydrogen strategy collaborations.

Hydrogen use in public transit fleets.

Regulatory lobbying and policy support.

Hydrogen Solutions: Maintenance & Lifecycle Management

Scheduled service contracts for equipment.

Predictive maintenance via IoT.

Asset lifecycle tracking and reporting.

Decommissioning and disposal protocols.

Spare parts inventory management.

Hydrogen Solutions: Export Opportunities

Exporting hydrogen to regions like Japan, EU.

Infrastructure for liquefied hydrogen export.

International shipping and customs compliance.

Global hydrogen certification standards.

Bilateral trade agreements and logistics.

Hydrogen Solutions: End-User Applications

Residential fuel cell units.

Hydrogen for data center backup power.

Use in remote mining and construction sites.

Agriculture (e.g., tractors, irrigation pumps).

Events and emergency power deployments.

Hydrogen Solutions: Software & Monitoring

SCADA systems for plant operations.

AI-driven optimization of hydrogen flows.

Mobile dashboards for field technicians.

Smart contracts for automated billing.

Predictive analytics for demand planning.

Hydrogen Solutions: Safety & Compliance

Hydrogen sensor and alarm systems.

Fire suppression and risk mitigation designs.

Employee H2 safety training programs.

Compliance with ISO, NFPA, OSHA standards.

Emergency response planning tools.

Hydrogen Solutions: Financing Models

Power-as-a-Service or Hydrogen-as-a-Service.

Long-term off-take agreements.

Project finance and green bonds.

Joint ventures with energy providers.

Risk-sharing agreements for early adopters.

Hydrogen Solutions: Research & Innovation

Catalyst development to reduce costs.

Hybrid hydrogen-battery systems.

AI models for real-time efficiency control.

Pilot programs for next-gen hydrogen tech.

University and think tank partnerships.

Hydrogen Solutions: Training & Education

Hydrogen certification programs.

Technical training for installers and operators.

Awareness campaigns for hydrogen safety.

Webinars and virtual plant tours.

Internship and upskilling programs.

Hydrogen Solutions: Branding & Market Development

Green hydrogen branding strategy.

B2B marketing for industrial clients.

Media campaigns highlighting sustainability.

Partnerships with eco-conscious brands.

Showcasing use cases at global expos.

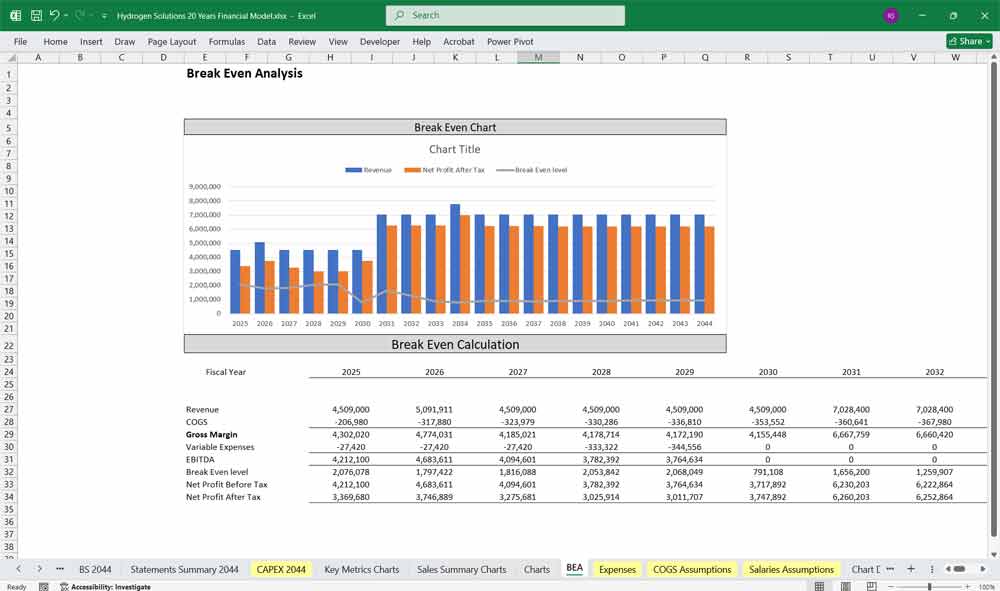

Sensitivity & Scenario Analysis On The Financial Model

Base Case, Upside Case, Downside Case:

Vary hydrogen pricing, power costs, capex inflation, regulatory support.NPV/IRR Calculations for each project / production site.

Break-even Analysis:

At what volume or hydrogen price does the firm turn profitable?

Download Link On Next Page