Heavy Equipment Manufacturer Financial Model

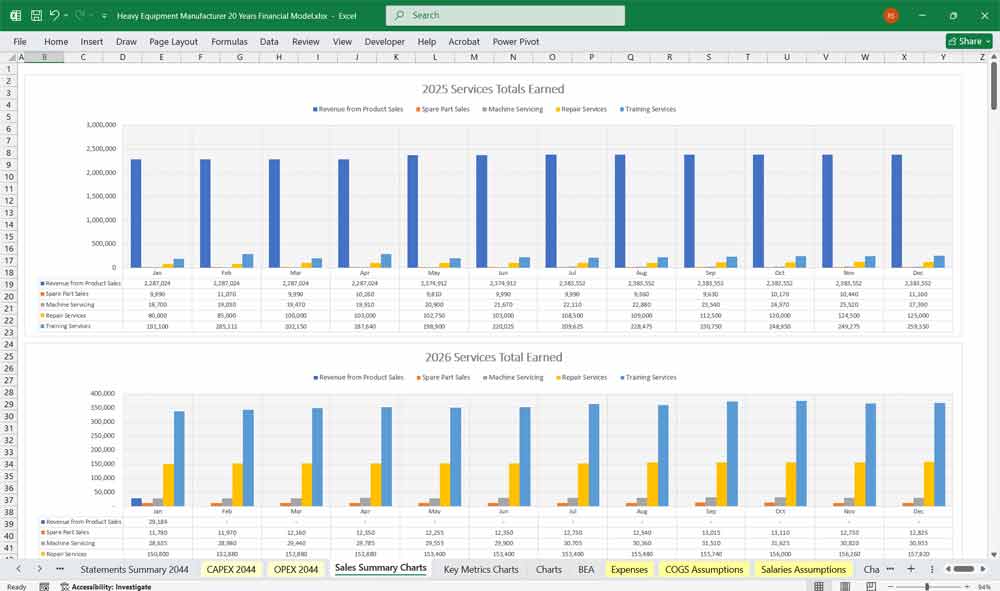

This 20-Year, 3-Statement 80 Product Line Excel Heavy Equipment Manufacturer Financial Model includes revenue streams from Product Sales, Spare Part Sales, Machine Servicing and Repair Services. Cost structures, Discounted Cash Flow (DCF) with Terminal Value, Sensitivity Analysis, WACC, and financial statements to forecast the financial health of your Heavy Equipment Manufacturing.

20-year Financial Model for a Heavy Equipment Manufacturer

This very extensive 20 Year Heavy Equipment Manufacturer Model involves detailed revenue projections, cost structures, capital expenditures, and financing breakdowns. This model provides a thorough understanding of the financial viability, profitability, and cash flow position of the equipment manufacturing. Including: 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the specified revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets. This model also takes into account “Equipment as a Service” (EaaS) with a 6-Tier Subscription, as many heavy machine manufacturers are allowing their customers to access machinery for a monthly or annual fee, rather than making a large upfront purchase.

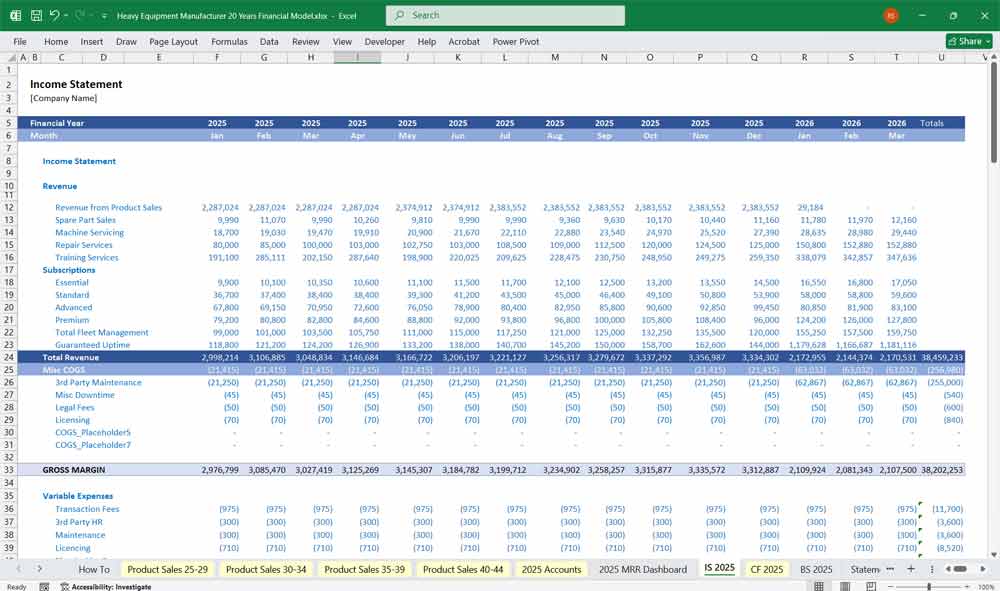

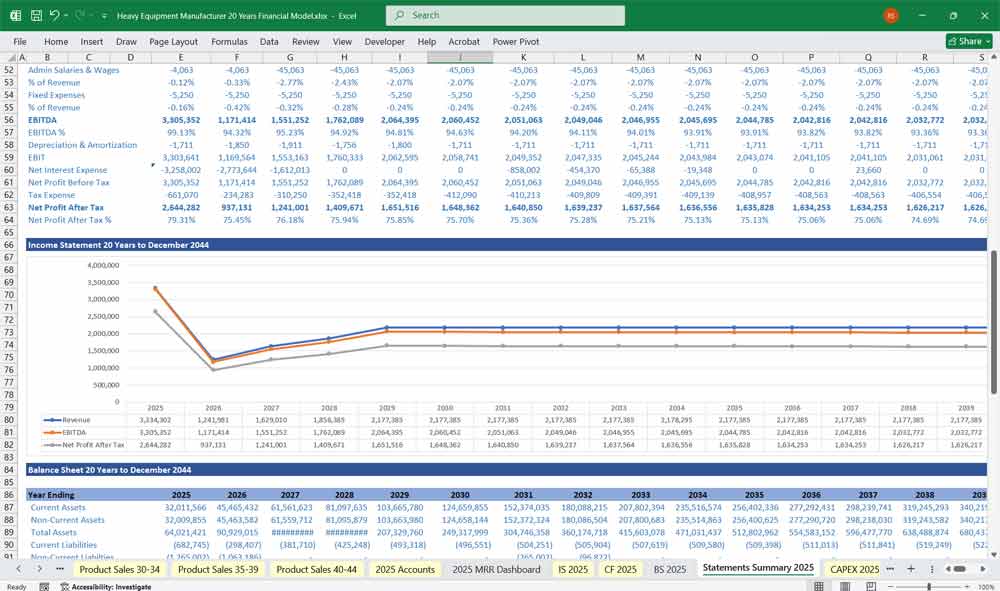

Income Statement (Profit & Loss Statement)

The Income Statement outlines the revenues, costs, and profitability of the Equipment Manufacturer.

Editable Revenue Streams

You might generate revenue from:

Heavy Equipment Sales (Primary Revenue)

Spare Parts Sales

Machine Servicing & Maintenance Contracts

Repair Services (On-site & Workshop)

Training Services (Operator & Technician Training)

Revenue Breakdown by Product Line (80 Lines)

Each product line (e.g., Excavators, Bulldozers, Cranes) will have:

Unit Sales Volume (Annual)

Average Selling Price (ASP)

Revenue = Unit Sales × ASP

Spare Parts Attach Rate (% of equipment sales)

Service Contract Penetration Rate (% of equipment under service agreements)

Revenue

Product Sales Revenue

New Equipment Sales

Used/Refurbished Equipment Sales

Spare Parts Revenue

Service & Repair Revenue

Scheduled Maintenance

Emergency Repairs

Training Revenue

Operator Certification Programs

Technical Training Workshops

B. Cost of Goods Sold (COGS)

Direct Manufacturing Costs

Raw Materials (Steel, Electronics, Hydraulics)

Labor (Assembly Line Workers)

Factory Overhead (Utilities, Depreciation)

Spare Parts COGS

Service & Repair COGS

Technician Labor

Replacement Parts

Training COGS

Instructor Costs

Training Material Costs

C. Gross Profit

Gross Profit = Total Revenue – COGS

Gross Margin % = (Gross Profit / Revenue) × 100

D. Operating Expenses (OPEX)

Sales & Marketing

Trade Shows, Advertising, Sales Commissions

Research & Development (R&D)

New Product Development

Engineering Costs

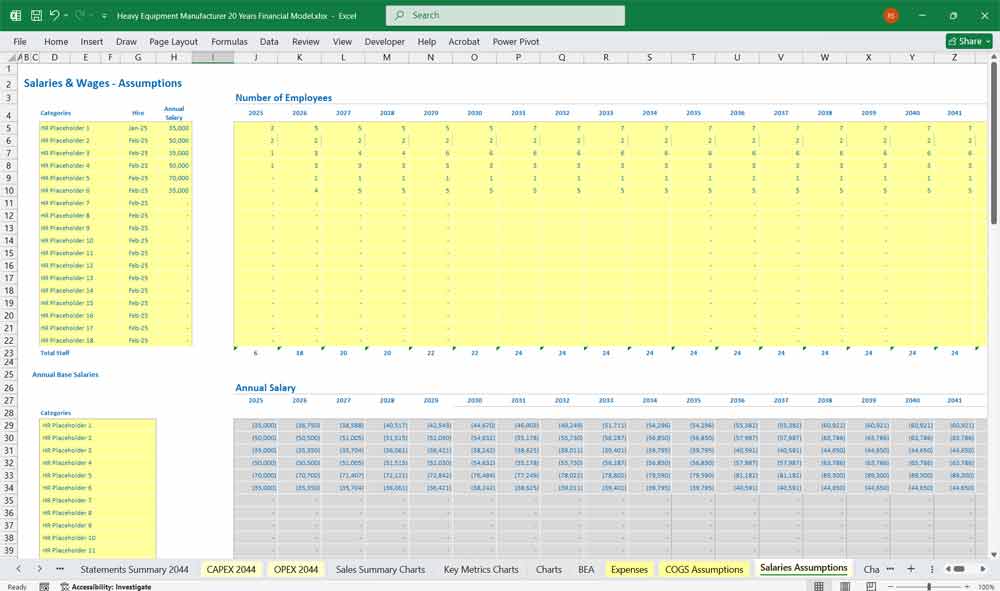

General & Administrative (G&A)

Salaries (Management, HR, Finance)

Office Rent, IT, Legal Fees

Warranty & Post-Sales Support

Warranty Claims

Customer Service

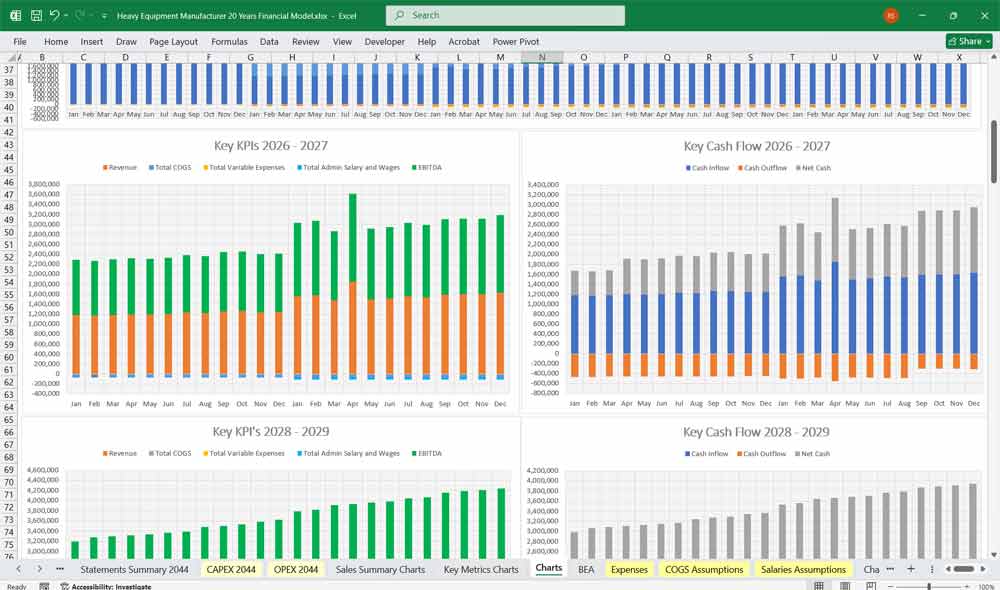

E. EBITDA & Net Profit

EBITDA = Gross Profit – OPEX

Depreciation & Amortization (Factory Equipment, Software)

Interest Expense (Loans, Leases)

Taxes (Corporate Income Tax)

Net Profit = EBITDA – Depreciation – Interest – Taxes

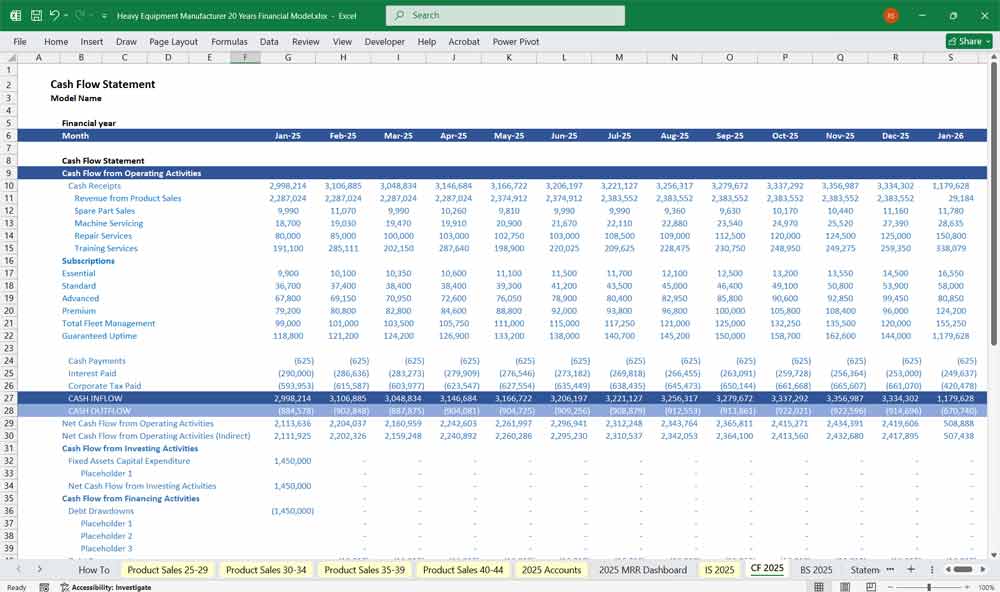

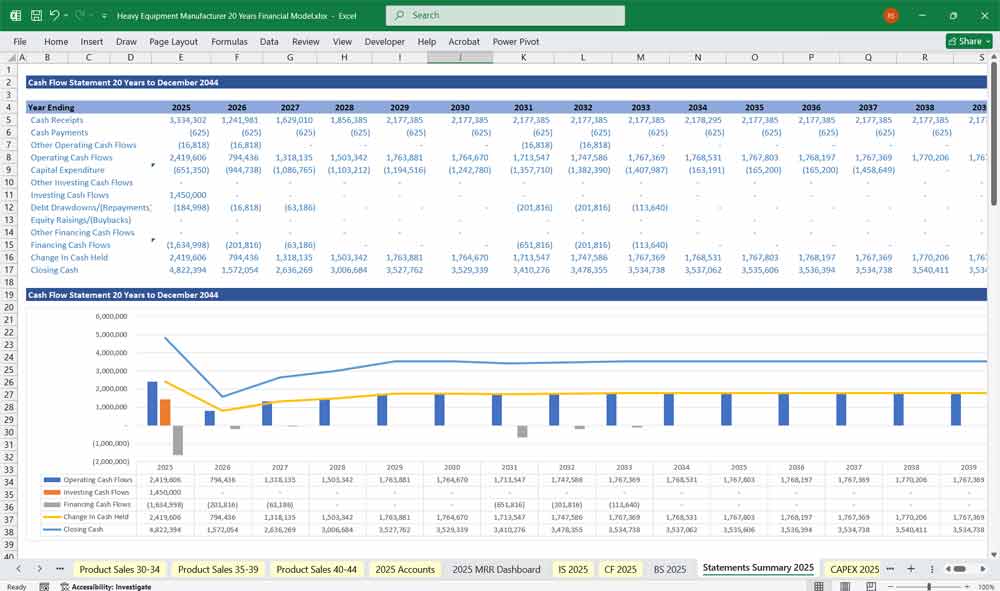

Heavy Equipment Manufacturer Cash Flow Statement

A. Operating Cash Flow

Cash from Sales (Equipment, Parts, Services)

Cash Paid to Suppliers (Raw Materials, Spare Parts)

Salaries & Wages

Tax Payments

B. Investing Cash Flow

Capital Expenditures (CapEx)

Machinery Purchases

Facility Expansion

R&D Investments

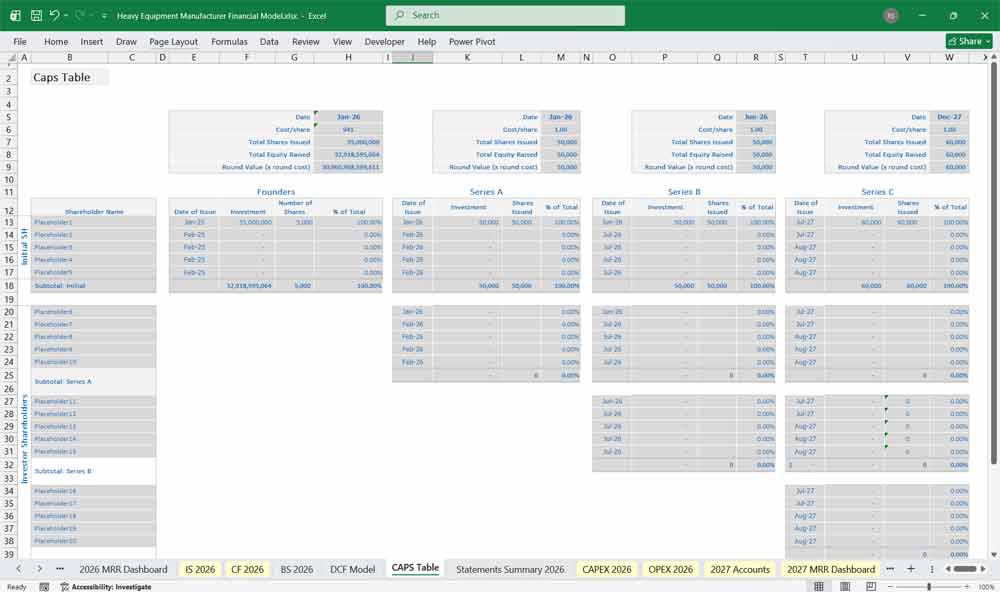

C. Financing Cash Flow

Debt Financing (Loans, Bonds)

Equity Financing (Investments, Share Issuance)

Dividend Payments

Net Cash Flow = Operating + Investing + Financing

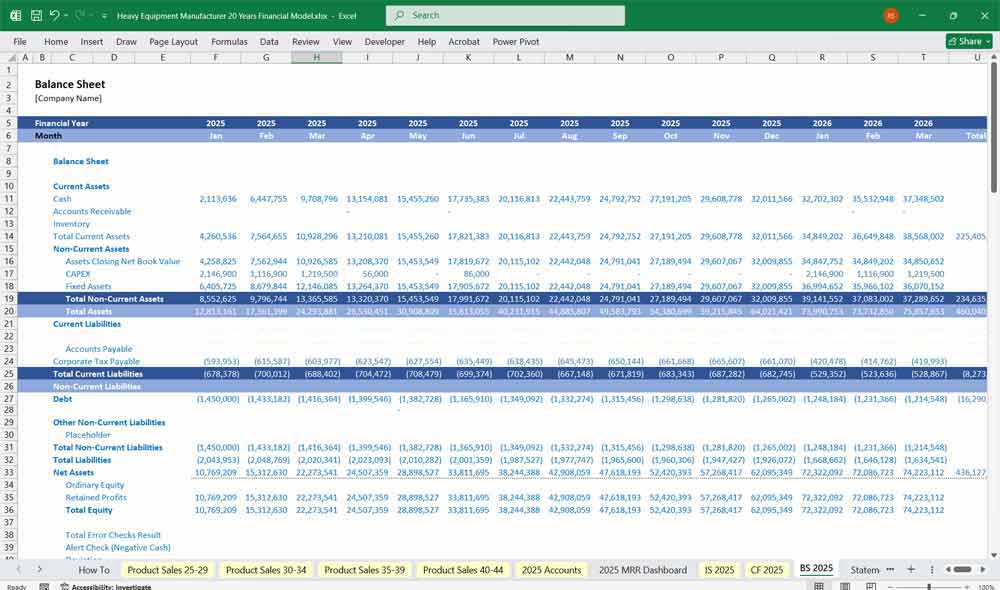

Heavy Equipment Manufacturer Balance Sheet

A. Assets

Current Assets

Cash & Equivalents

Accounts Receivable (Customer Payments Due)

Inventory (Finished Goods, Work-in-Progress, Raw Materials)

Non-Current Assets

Property, Plant & Equipment (PP&E)

Intangible Assets (Patents, Software)

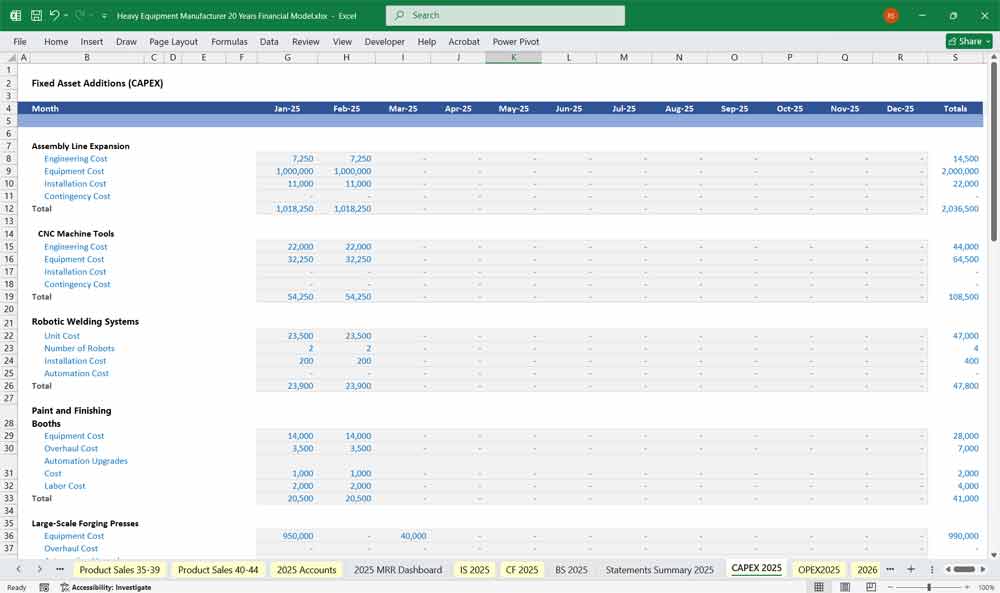

B. CAPEX

Fixed Asset Additions

Assembly Line Expansion

CNC Machine Tools

Robotic Welding Systems

- New Paint and Finishing Booths

- Large-Scale Forging Presses

- Foundry Modernization

C. OPEX

OPEX Liabilities

Personnel Costs

Maintenance and Repair

Transportation and Logistics

- Supplies and Materials

D. Liabilities

Current Liabilities

Accounts Payable (Suppliers)

Short-Term Debt

Warranty Reserves

Long-Term Liabilities

Bank Loans

Lease Obligations

E. Shareholders’ Equity

Common Stock

Retained Earnings

Balance Sheet Equation: Assets = Liabilities + Equity

Key Financial Metrics for a Heavy Equipment Manufacturer with Up To 80 Product Lines Allow You To:

Heavy Equipment Manufacturer – Product Innovation Strategy

Launch eco-friendly diesel-electric hybrid machines

Incorporate AI for predictive maintenance

Introduce modular equipment designs

Develop noise-reducing technologies

Partner with R&D labs for material innovations

Heavy Equipment Manufacturer – Revenue Diversification

Expand into spare parts and consumables

Offer subscription-based maintenance services

Introduce training-as-a-service for operators

Monetize data analytics from smart equipment

License proprietary technology to OEMs

Heavy Equipment Manufacturer – Aftermarket Services (This Can Be Part Of A Subscription Revenue Service)

Offer maintenance contracts

Launch mobile servicing units

Enable on-site diagnostics with handheld tools

Develop a customer portal for service history

Bundle service with extended warranty plans

Heavy Equipment Manufacturer – Training & Certification Programs

Launch operator training academies

Create virtual simulators for new equipment

Certify mechanics through online modules

Partner with trade schools

Offer re-certification every 2 years

Heavy Equipment Manufacturer – CapEx Planning

Budget for new assembly lines

Invest in automation equipment

Prioritize high-yield R&D projects

Build warehousing capacity near key markets

Model NPV of all major capital projects

Heavy Equipment Manufacturer – Data Analytics & Reporting (Also Part Of A Subscription Tier)

Analyze machine usage trends remotely

Forecast part failures using AI models

Track KPI dashboards in real time

Monitor factory OEE (Overall Equipment Effectiveness)

Segment customer retention by region and sector

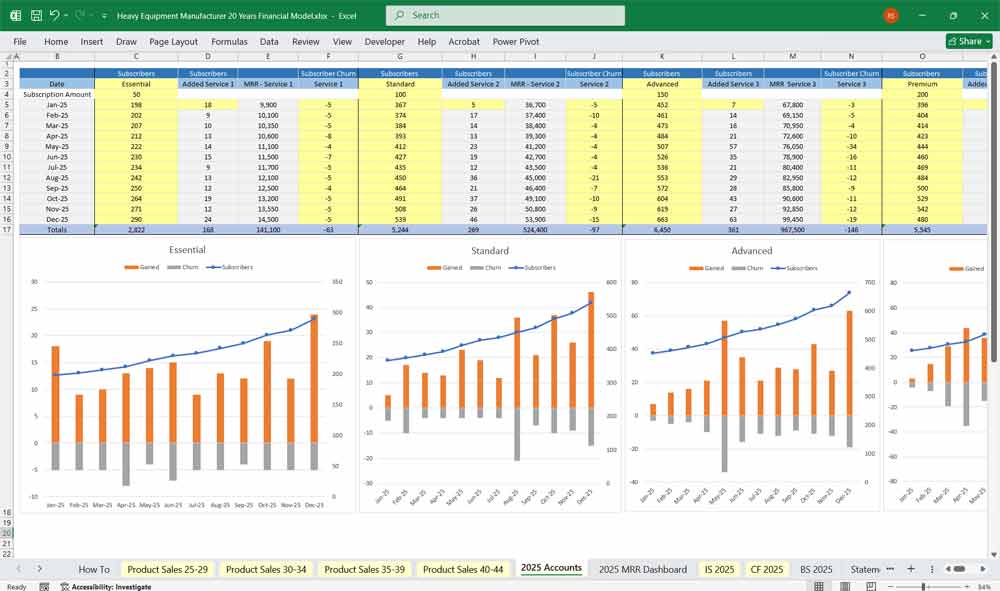

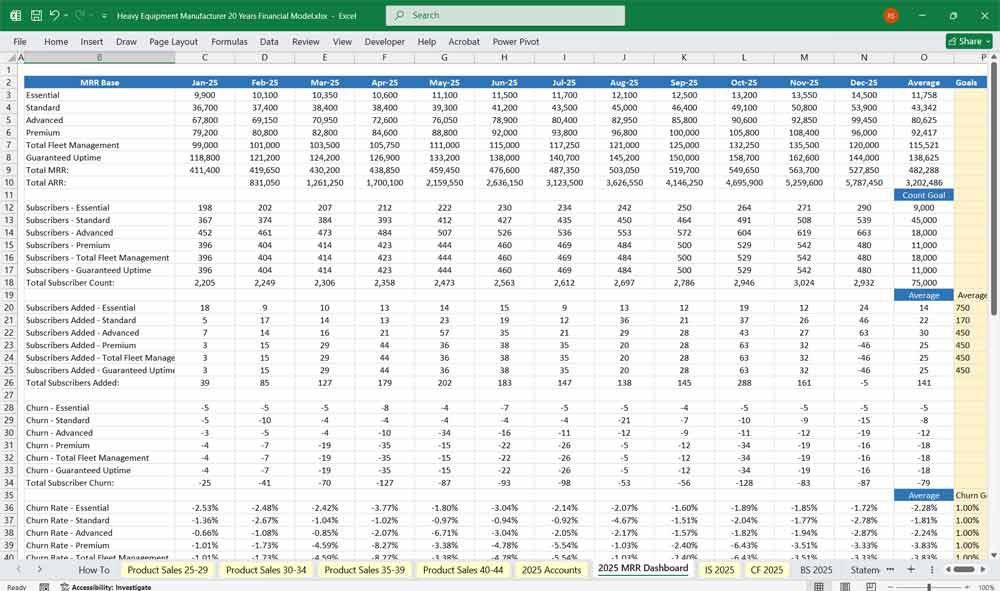

Six-tier subscription service for a heavy Equipment manufacturer “Equipment as a Service” (EaaS)

Tier 1: “Essential Heavy Equipment”

This basic tier would likely be included with the purchase of a new machine or available for a low monthly fee. It would provide customers with access to a digital parts catalog and a basic service manual. Think of it as a foundational resource for the owner-operator. 🛠️

Tier 2: “Standard Heavy Equipment“

Building on the Essential tier, this level introduces scheduled maintenance reminders and diagnostic code lookup. It helps the customer stay on top of routine service, preventing potential issues before they become major problems.

Tier 3: “Advanced Heavy Equipment”

This is where preventive maintenance becomes a key feature. Subscribers would get access to predictive analytics based on machine usage data. The system could alert them to potential component failures (e.g., a bearing showing early signs of wear) before they happen. This tier would also include remote monitoring, allowing the manufacturer to access machine data for troubleshooting.

Tier 4: “Premium Heavy Equipment”

The Premium tier adds significant value by including on-site technical support and a loaner machine program. If a critical piece of equipment breaks down, a technician would be dispatched, and the customer could get a temporary replacement to minimize downtime. It is a comprehensive solution designed to keep operations running smoothly.

Tier 5: “Total Heavy Equipment Fleet Management”

This tier is geared towards customers with multiple machines. It includes everything from the previous tiers, plus data analytics that provide insights into fleet performance, fuel consumption, and operator efficiency. The manufacturer would offer consulting services to help the customer optimize their entire operation.

Tier 6: “Heavy Equipment Guaranteed Uptime”

This top-tier subscription is a commitment from the manufacturer. It includes all the features of the other tiers and guarantees a certain level of machine uptime (e.g., 98%). If the machine falls below the agreed-upon uptime, the manufacturer would provide financial compensation or other remedies. This is a complete risk-management solution.

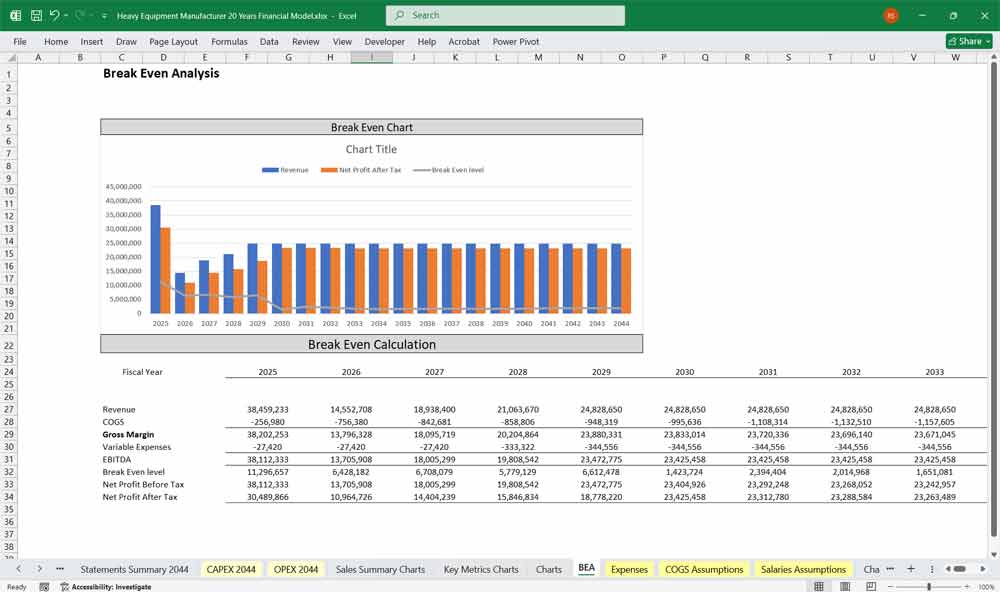

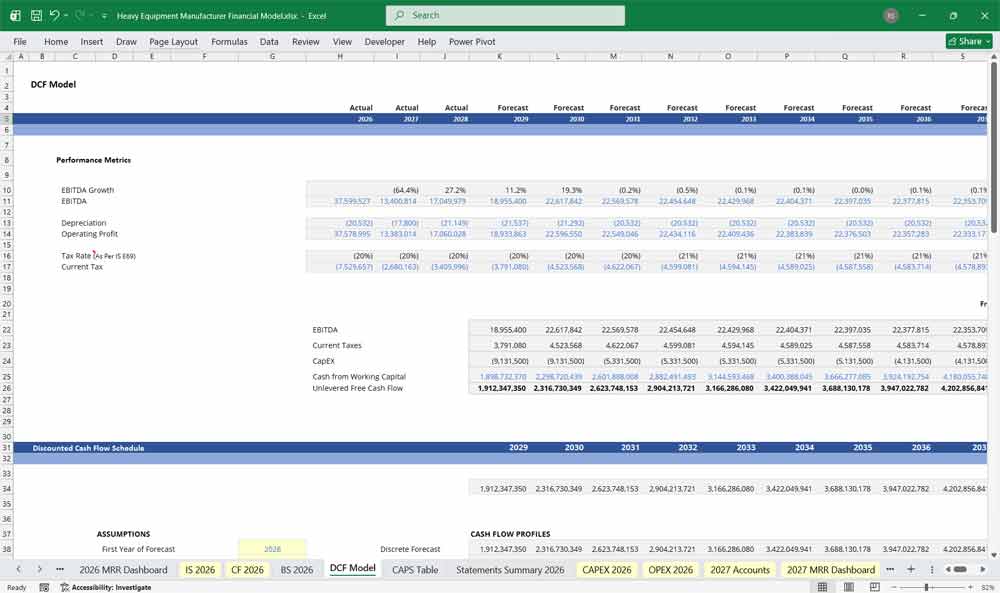

Valuing a heavy equipment manufacturer With A Discounted Cash Flow (DCF)

DCF: Valuing the Cycle and the “Aftermarket Tail”

This 20-year Discounted Cash Flow (DCF) analysis for a heavy equipment manufacturer captures the rhythmic “replacement cycles” of global fleets in mining, construction, and agriculture. The model balances the high-margin, highly cyclical sales of new “heavy iron” against a remarkably stable aftermarket tail—the recurring revenue from parts and services that often carries the business through economic downturns. Because these manufacturers are currently pivoting toward autonomous and electric machinery, the DCF must meticulously model the R&D-heavy transition phase, ensuring the terminal value reflects a company that has successfully traded diesel engines for next-generation propulsion and software-as-a-service (SaaS) integration.

WACC: Pricing Industrial Volatility and Captive Finance

The Weighted Average Cost of Capital (WACC) for a heavy equipment manufacturer typically reflects a “high-beta” risk profile, as its fortunes are tightly tethered to global GDP and commodity prices. A unique factor in this calculation is the presence of captive finance arms; these subsidiaries allow the manufacturer to carry significant debt to fund customer purchases, which can lower the overall WACC but introduce “credit risk” to the balance sheet. The discount rate must price in the double-edged sword of interest rates: a rise increases the company’s cost of capital while simultaneously dampening customer demand by making equipment leases more expensive. This hurdle rate ensures that the multi-decade cash flows are appropriately “punished” for the inherent volatility of the heavy machinery sector.

Sensitivity Analysis: Stress-Testing Steel and Order Backlogs

For a heavy equipment manufacturer, Sensitivity Analysis is the primary tool for measuring operating leverage—the way a small change in sales volume triggers a massive swing in profit. Analysts use sensitivity tables to see how a 10% spike in specialized steel prices or a shift in global labor costs impacts the “unit margin” of a bulldozer or excavator. Perhaps most critically in a 20-year model, the analysis stress-tests “backlog conversion” rates, identifying how sensitive the valuation is to customers cancelling orders during a sudden cyclical slump. By testing the impact of fluctuating exchange rates on global sales, the sensitivity analysis reveals the manufacturer’s resilience to a “strong dollar” or a prolonged downturn in the mining and infrastructure sectors.

Final Notes on the Financial Model

This 20 Year Heavy Equipment Manufacturer Financial Model focuses on balancing capital expenditures with steady revenue growth from diversified 80 product line sales and subscription-based services. By optimizing OPEX and CAPEX and maximizing high-margin services like heavy machinery sales and servicing offerings, the model ensures sustainable profitability and cash flow stability.

Download Link On Next Page