Health Insurance Company Financial Model

This Health Insurance Company Financial Model in MS Excel is a financial planning tool designed to help business owners, investors, and financial analysts evaluate the financial feasibility and profitability of your health insurance company over 5 years.

Financial model for a health insurance company

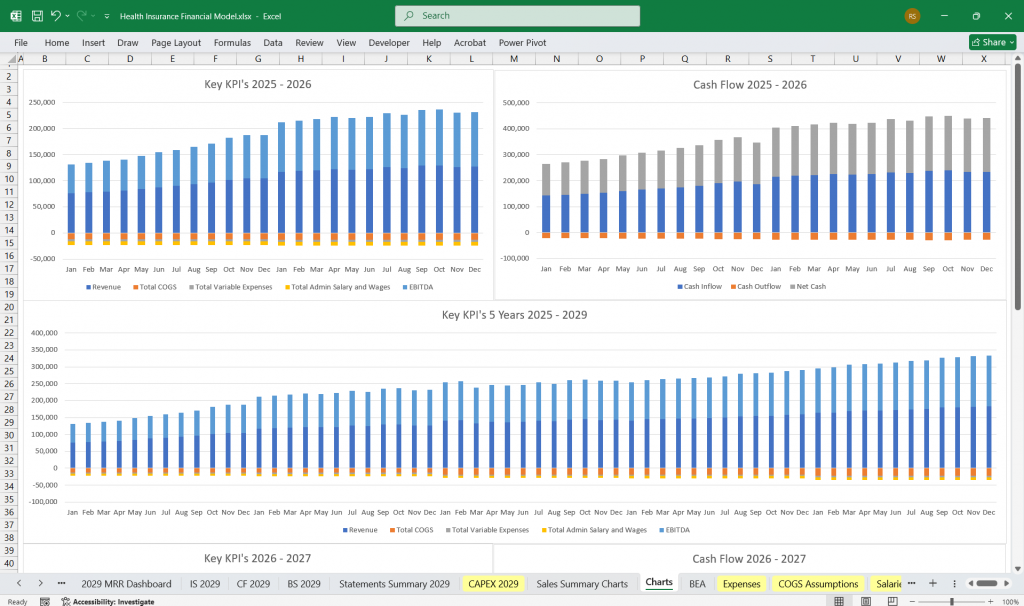

A comprehensive tool used to project your company’s financial performance over a specific period. It typically includes detailed projections for the Income Statement, Cash Flow Statement, and Balance Sheet.

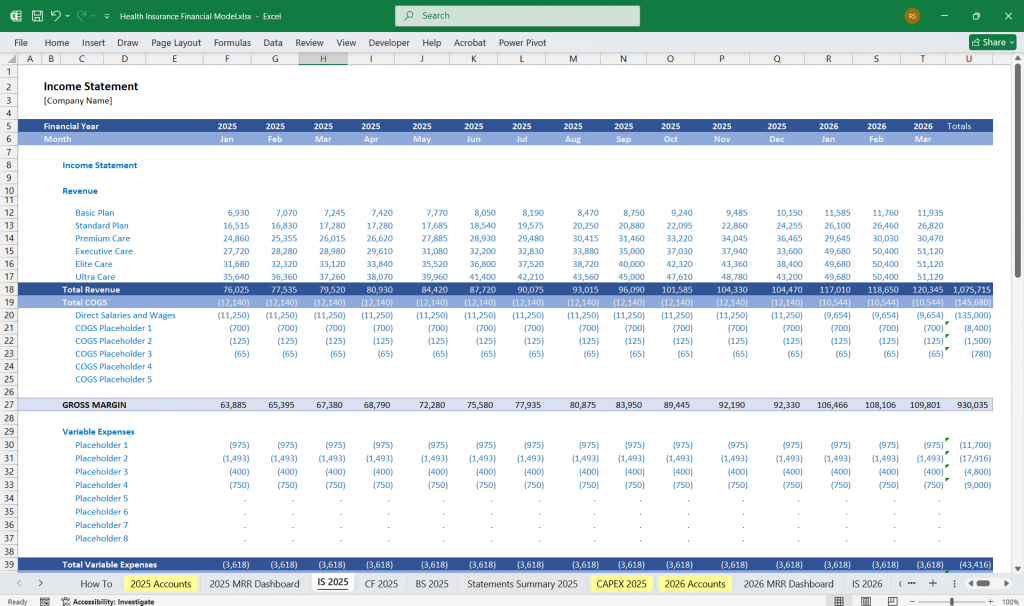

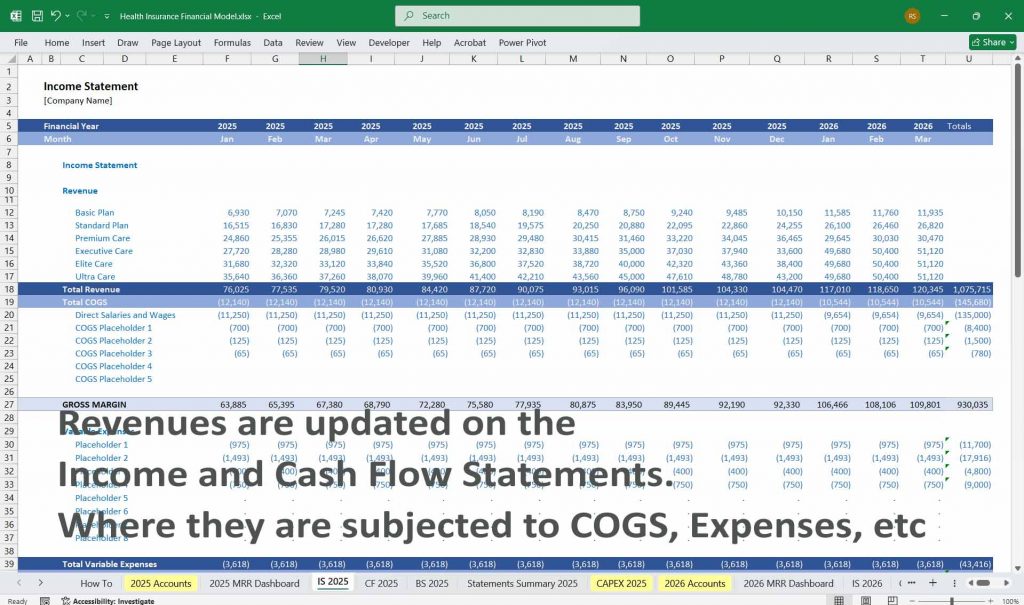

Health Insurance Income Statement

The Income Statement, also known as the Profit and Loss Statement, provides a summary of the company’s revenues, expenses, and profits over a specific period. For a health insurance company, the Income Statement would include the following key components:

Revenue:

Premiums Earned: This is the primary revenue source for a health insurance company. It represents the amount of premiums received from policyholders, adjusted for the portion of the premium that pertains to the current accounting period.

Investment Income: Health insurance companies often invest premiums received from policyholders. Investment income includes interest, dividends, and capital gains from these investments.

Other Income: This may include fees for services, such as administrative fees, or income from other ancillary services.

Expenses:

Claims Incurred: This represents the total amount of claims paid to policyholders during the period, including both medical and administrative claims.

Acquisition Costs: These are the costs associated with acquiring new policyholders, including commissions paid to agents and brokers, marketing expenses, and underwriting costs.

Administrative Expenses: These include general and administrative costs such as salaries, rent, utilities, and other overhead expenses.

Reserve Adjustments: Health insurance companies are required to maintain reserves to cover future claims. Adjustments to these reserves (either increases or decreases) are reflected in the Income Statement.

Depreciation and Amortization: This includes the depreciation of fixed assets and the amortization of intangible assets.

Net Income:

Pre-Tax Income: This is the income before taxes, calculated as total revenue minus total expenses.

Income Tax Expense: This represents the taxes owed on the pre-tax income.

Net Income: This is the final profit after all expenses, including taxes, have been deducted from total revenue.

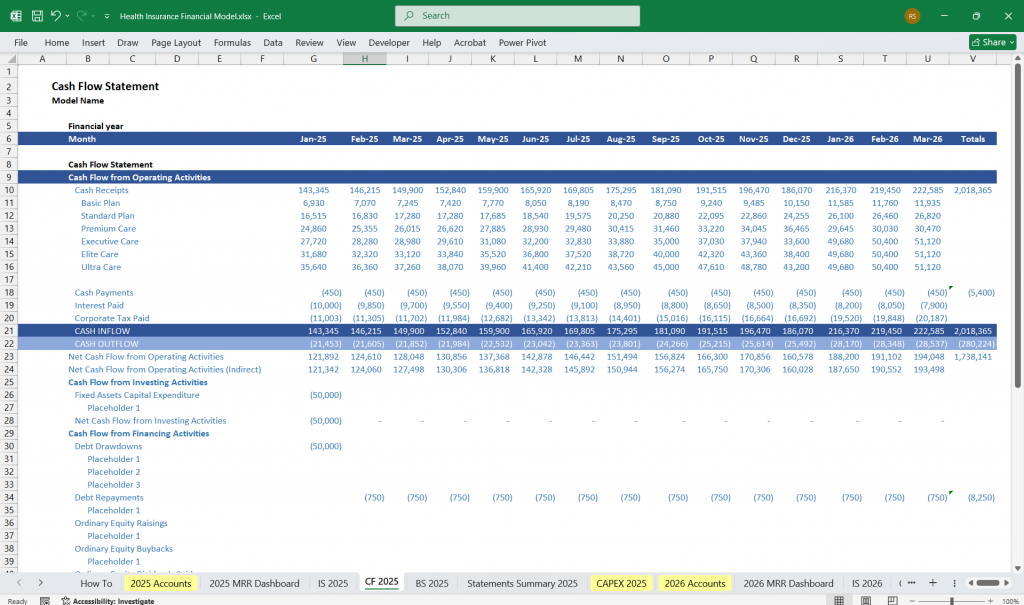

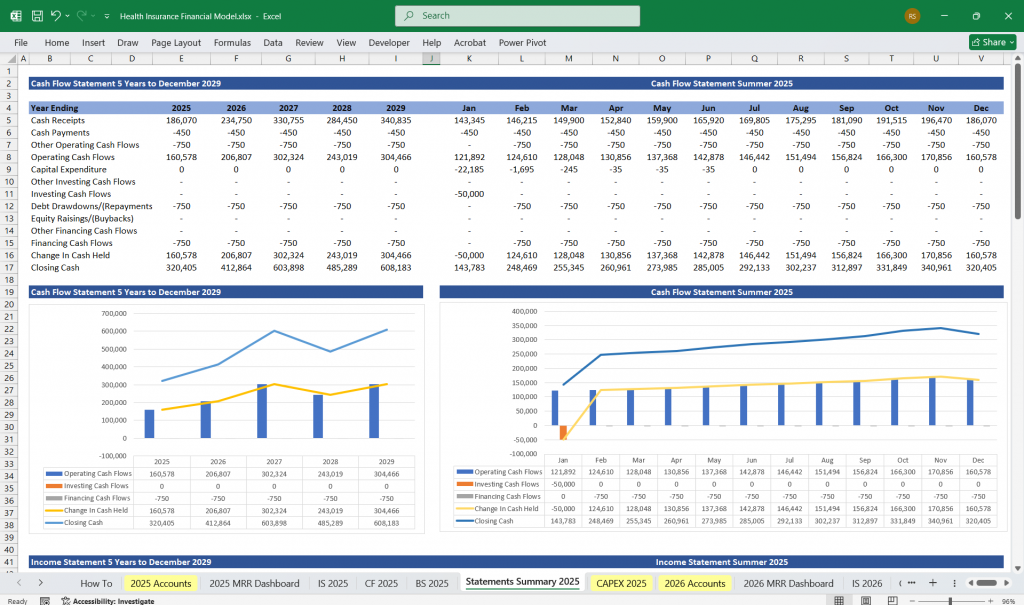

Health Insurance Cash Company Flow Statement

The Cash Flow Statement provides a detailed overview of the company’s cash inflows and outflows over a specific period. It is divided into three main sections:

Operating Activities:

Cash Received from Premiums: This includes cash received from policyholders for premiums.

Cash Paid for Claims: This represents the cash outflows for claims paid to policyholders.

Cash Paid for Operating Expenses: This includes cash outflows for administrative expenses, acquisition costs, and other operating expenses.

Net Cash Provided by Operating Activities: This is the net cash flow from the company’s core business operations.

Investing Activities:

Cash Received from Investments: This includes cash received from the sale of investments, interest, and dividends.

Cash Paid for Investments: This represents cash outflows for the purchase of new investments.

Net Cash Provided by (Used in) Investing Activities: This is the net cash flow from the company’s investment activities.

Financing Activities:

Cash Received from Issuing Debt or Equity: This includes cash inflows from issuing new debt or equity.

Cash Paid for Debt Repayment or Dividends: This represents cash outflows for repaying debt or paying dividends to shareholders.

Net Cash Provided by (Used in) Financing Activities: This is the net cash flow from the company’s financing activities.

Net Increase (Decrease) in Cash:

This is the sum of net cash flows from operating, investing, and financing activities, representing the overall change in the company’s cash position during the period.

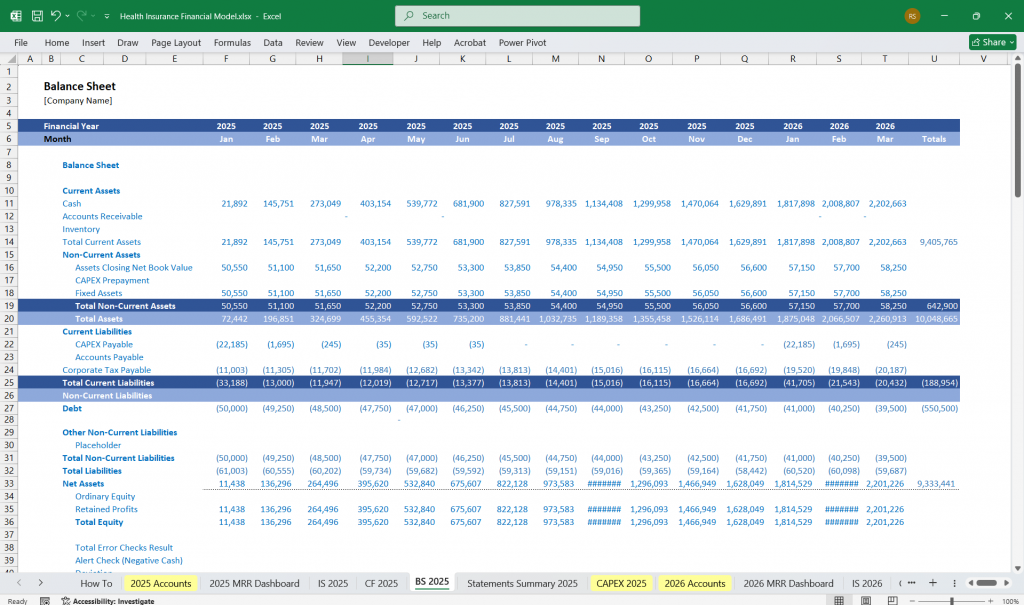

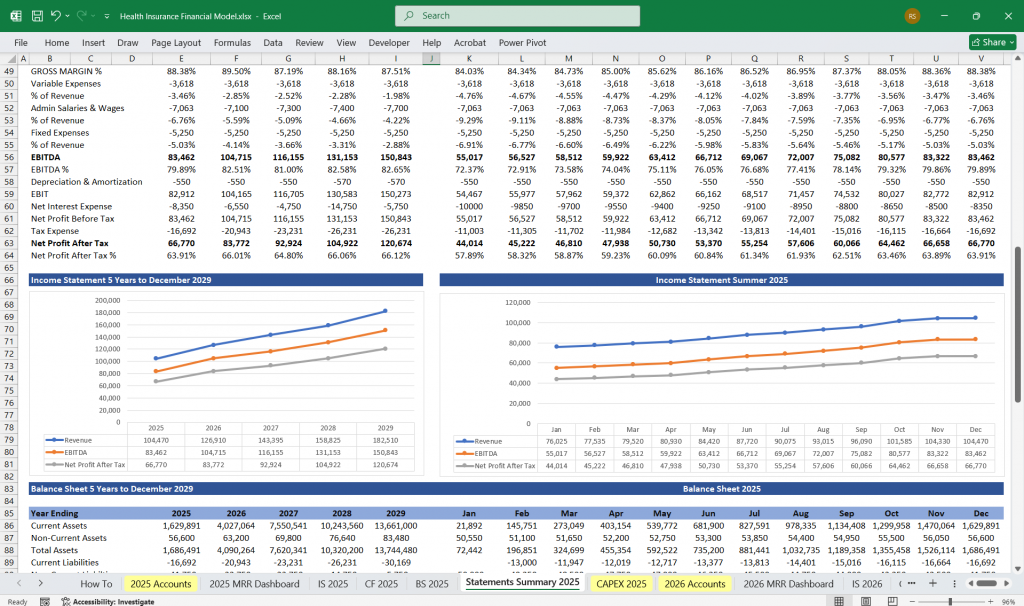

Health Insurance Company Balance Sheet

The Balance Sheet provides a snapshot of the company’s financial position at a specific point in time, showing its assets, liabilities, and equity.

Assets:

Current Assets:

Cash and Cash Equivalents: This includes cash on hand and short-term investments that can be easily converted to cash.

Premiums Receivable: This represents premiums that have been billed but not yet received from policyholders.

Investments: This includes short-term investments that are expected to be liquidated within one year.

Non-Current Assets:

Long-Term Investments: This includes investments that are not expected to be liquidated within one year.

Property and Equipment: This represents the company’s fixed assets, such as buildings and equipment, net of depreciation.

Intangible Assets: This includes assets such as software, patents, and goodwill.

Liabilities:

Current Liabilities:

Claims Payable: This represents claims that have been incurred but not yet paid.

Unearned Premiums: This represents premiums received in advance for coverage that has not yet been provided.

Accounts Payable: This includes amounts owed to suppliers and other creditors.

Non-Current Liabilities:

Long-Term Debt: This represents long-term borrowings that are not due within one year.

Reserves for Future Claims: This includes reserves set aside to cover future claims and other liabilities.

Equity:

Common Stock: This represents the par value of the company’s common stock.

Additional Paid-In Capital: This includes the amount paid by shareholders in excess of the par value of the stock.

Retained Earnings: This represents the cumulative net income retained in the company after dividends have been paid.

Accumulated Other Comprehensive Income: This includes unrealized gains and losses on investments and other items that are not included in net income.

Health Insurance Company Key Financial Metrics and Ratios:

In addition to the financial statements, the financial model may also include key metrics and ratios that are important for analyzing the performance of a health insurance company, such as:

Loss Ratio: Claims Incurred / Premiums Earned

Expense Ratio: Administrative Expenses / Premiums Earned

Combined Ratio: Loss Ratio + Expense Ratio

Return on Equity (ROE): Net Income / Shareholder’s Equity

Debt-to-Equity Ratio: Total Liabilities / Shareholder’s Equity

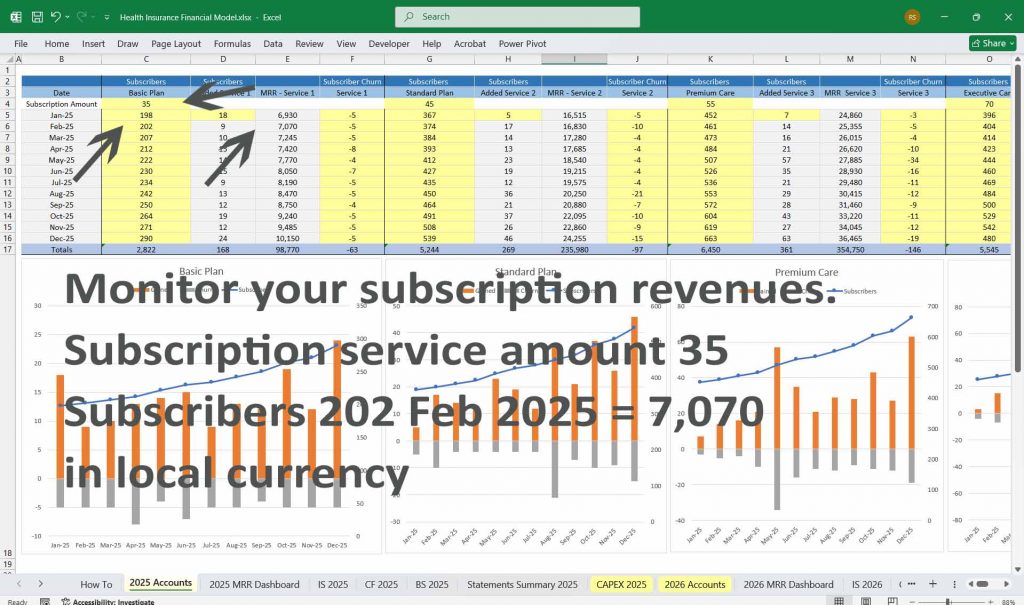

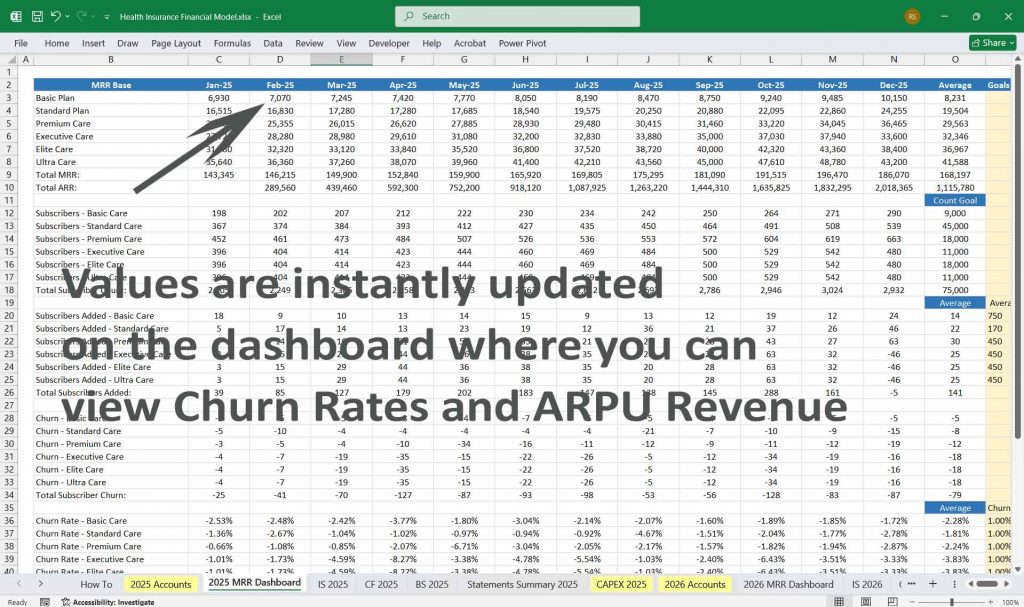

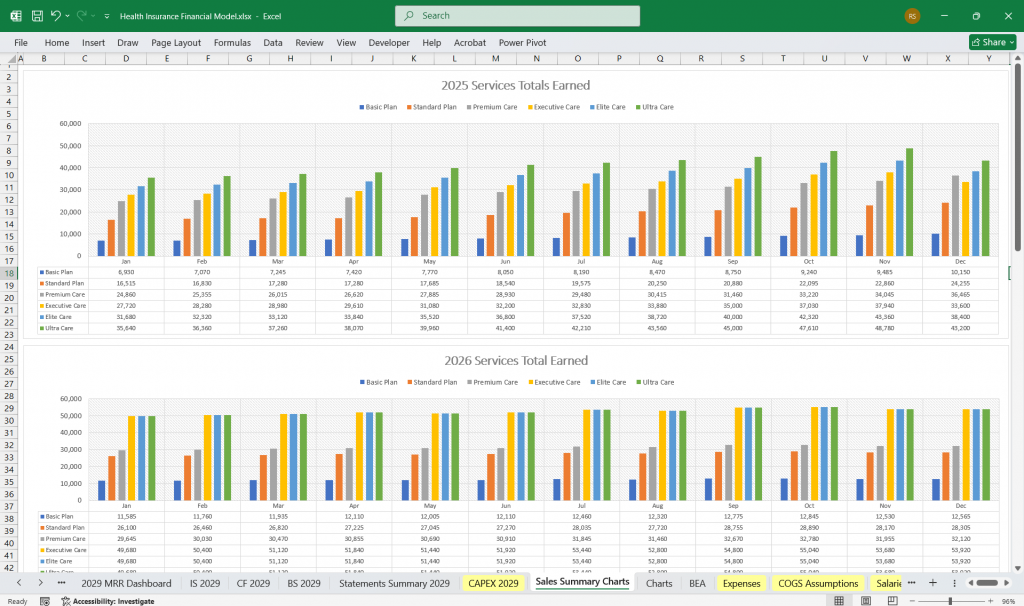

6-tier subscription model

Idea for a health insurance company subscription model, with each tier increasing in benefits and coverage.

Basic Health Insurance Care Plan (Tier 1) – Essential Coverage

- Monthly Premium: Lowest

- Coverage: Limited

- Inclusions:

- Annual wellness check-ups

- Generic prescription drugs (limited coverage)

- Emergency room (ER) visits (copay required)

- Preventive screenings (e.g., cholesterol, blood pressure)

- Limited telemedicine access

- Exclusions:

- Specialist visits require full out-of-pocket payment

- No dental or vision coverage

Standard Health Insurance Care Plan (Tier 2) – Enhanced Basics

- Monthly Premium: Low

- Coverage: Moderate

- Inclusions:

- Everything in Basic Care

- Limited specialist visits (e.g., cardiologist, dermatologist)

- Lower ER visit copay

- Partial dental and vision coverage (routine check-ups only)

- Increased telemedicine access

- Mental health counseling (limited sessions)

- Exclusions:

- No maternity care

- No alternative therapies (e.g., chiropractic, acupuncture)

Premium Health Insurance Care Plan (Tier 3) – Comprehensive Coverage

- Monthly Premium: Medium

- Coverage: Broad

- Inclusions:

- Everything in Standard Care

- Full specialist visits with lower copays

- Maternity and prenatal care (basic coverage)

- Expanded dental and vision (e.g., eyeglasses, fillings)

- Alternative therapies (e.g., acupuncture, chiropractic care)

- Mental health therapy (higher session limits)

- Prescription drug coverage (including some brand names)

- Exclusions:

- No international coverage

- No elective surgeries

Executive Health Insurance Care Plan (Tier 4) – Extensive Benefits

- Monthly Premium: High

- Coverage: Extensive

- Inclusions:

- Everything in Premium Care

- Maternity and prenatal care (full coverage)

- Lower deductibles and copays

- Specialist visits with no referral needed

- Full prescription drug coverage (brand & generic)

- Alternative therapies (extended coverage)

- Advanced diagnostic tests (MRI, CT scans)

- Out-of-network coverage (higher reimbursement)

- Exclusions:

- No international medical travel coverage

Elite Health Insurance Care Plan (Tier 5) – VIP Treatment

- Monthly Premium: Higher

- Coverage: Almost Full

- Inclusions:

- Everything in Executive Care

- Private hospital rooms

- Concierge medical services

- Full mental health and wellness support (therapy, stress management)

- International travel emergency medical coverage

- Fertility treatments (partial coverage)

- Cosmetic procedures (limited)

- No out-of-network restrictions

- Exclusions:

- Limited coverage for luxury or elective procedures

Ultra Health Insurance Care Plan (Tier 6) – Ultimate Coverage

- Monthly Premium: Highest

- Coverage: Maximum

- Inclusions:

- Everything in Elite Care

- Zero deductibles and copays

- Unlimited specialist visits and alternative treatments

- Full fertility treatments

- 100% international medical coverage (including medical evacuation)

- Full cosmetic procedures

- Anti-aging treatments (experimental included)

- Holistic and wellness retreats coverage

- Personalized healthcare concierge with at-home doctor visits

This model ensures affordability at lower tiers while offering luxury and exclusivity at the highest levels.

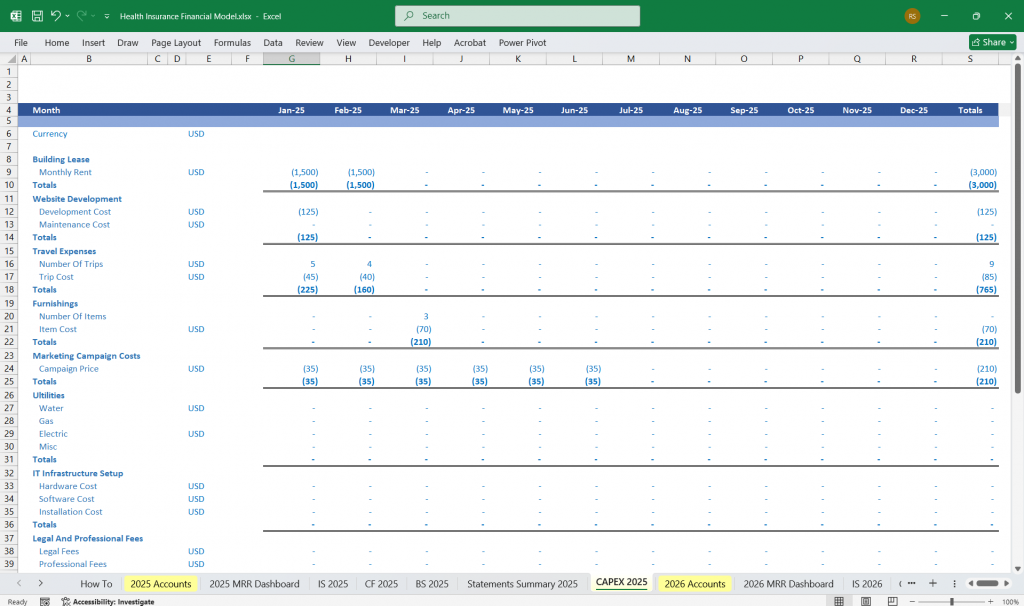

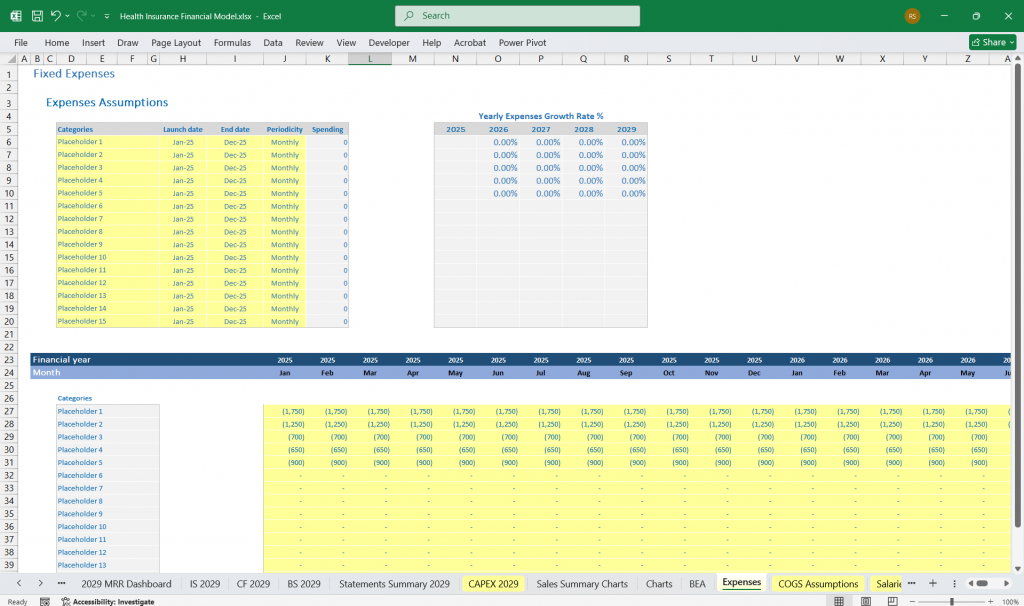

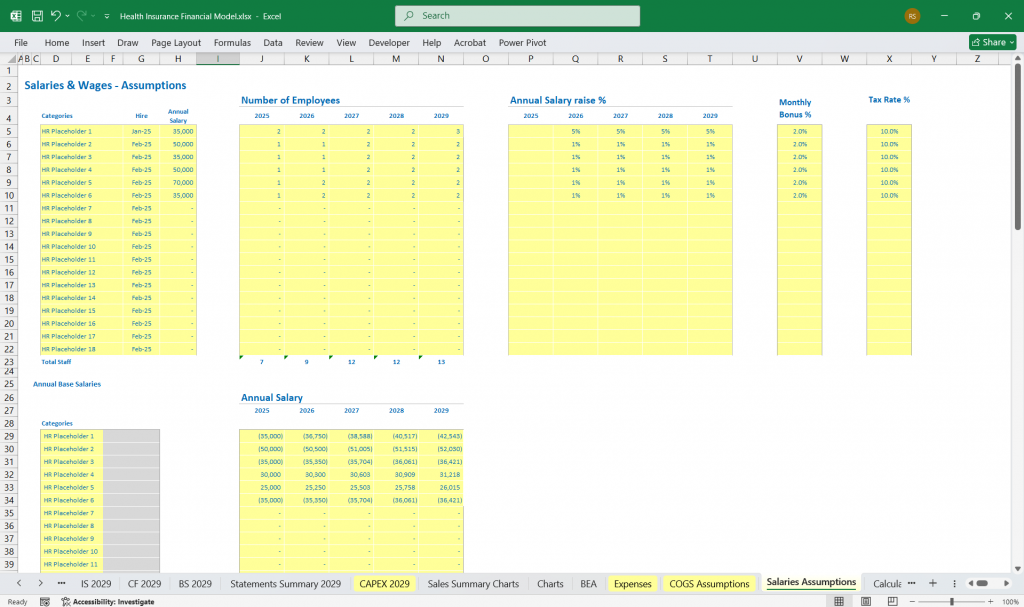

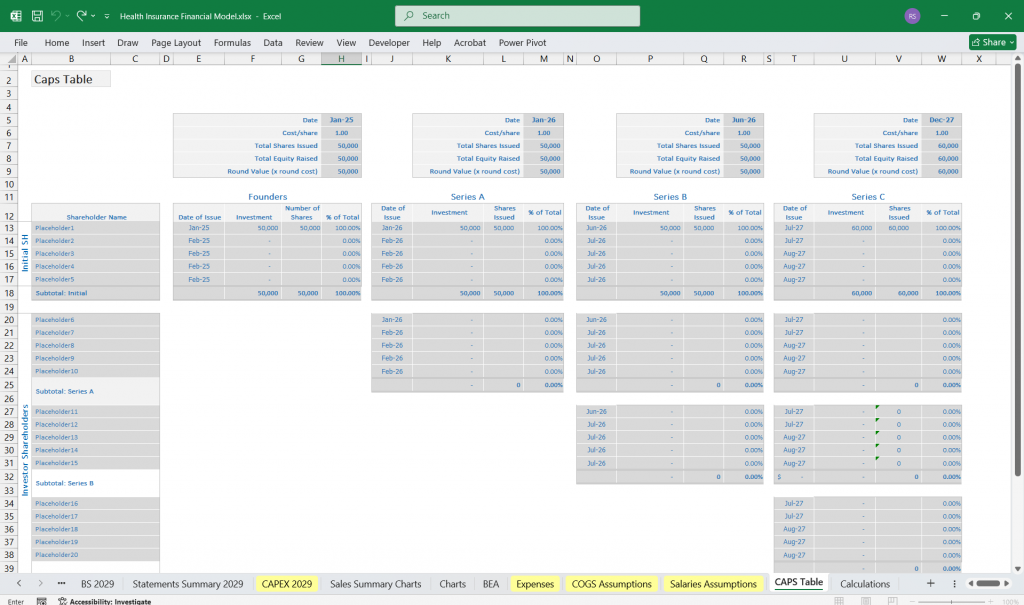

Assumptions and Drivers For The Financial Model:

This financial model also includes a set of assumptions and drivers that underpin the projections, such as:

Premium Growth Rate: The expected growth rate in premiums.

Claims Inflation Rate: The expected rate of increase in claims costs.

Investment Return Rate: The expected return on the company’s investment portfolio.

Policyholder Retention Rate: The percentage of policyholders expected to renew their policies.

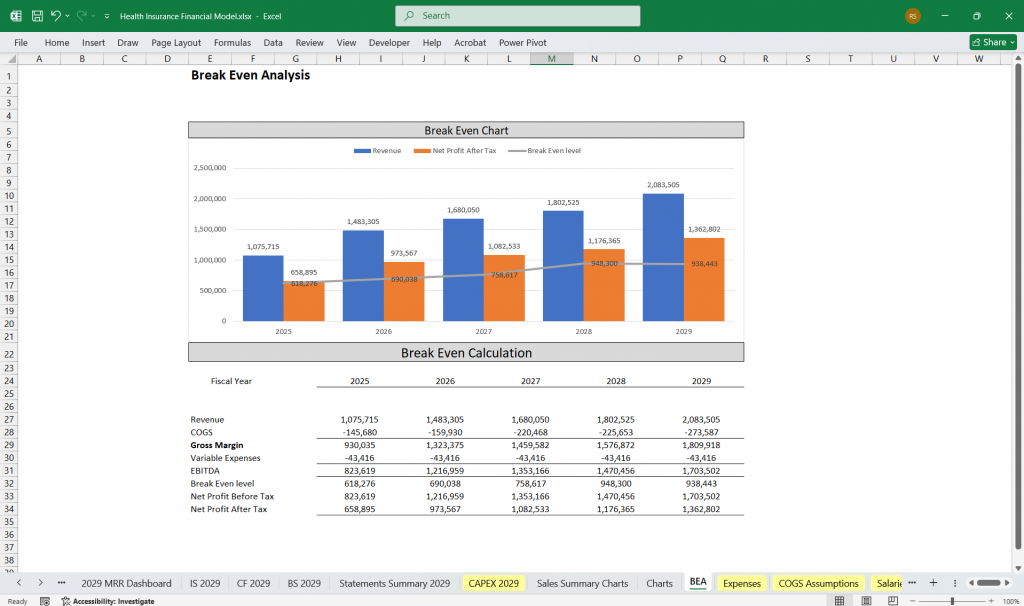

Conclusion:

This financial model for a health insurance company provides a detailed and dynamic view of the company’s financial performance and position. It is an essential tool for management, investors, and other stakeholders to make informed decisions about the company’s strategy, operations, and financial health.

Download Link On Next Page