Monetization And Your Fintech App

Step-by-Step Guide: Monetization And Your Fintech App, Launching Raising White Label Revenue, Crowdfunding & Investment Financials and your Fintech App. Adding investment services to your app, developing it and monetising it successfully.

Four strategic App ad placement ideas

Maximize revenue for your Fintech App while maintaining a good user experience:

1. In-App Banner Ads (Non-Intrusive & Targeted)

- Where? Home screen, transaction history, or insights dashboard.

- How? Display relevant financial products (e.g., credit cards, loans, investment platforms).

- Revenue Model: CPC (Cost-Per-Click) or CPM (Cost-Per-Thousand Impressions).

- Best for: Passive ad revenue without disrupting the user experience.

2. Affiliate Offers & Partnered Financial Products

- Where? Inside “Financial Recommendations” or “Offers” section.

- How? Partner with banks, investment firms, and lenders to promote their services.

- Revenue Model: CPA (Cost-Per-Acquisition) – earn commission when users sign up.

- Best for: Promoting credit cards, robo-advisors, insurance, or high-yield savings accounts.

3. Sponsored Insights & Smart Recommendations

- Where? AI-driven insights, expense reports, or savings recommendations.

- How? Example: If a user spends a lot on travel, recommend a travel rewards credit card.

- Revenue Model: Sponsored placements or revenue-sharing from partners.

- Best for: Monetizing user behavior insights in a seamless and helpful way.

4. Premium Upgrade Prompts & Paywalled Features

- Where? Inside advanced features like credit score tracking, investment tools, or tax optimization.

- How? Offer a “Preview Feature” and show the benefits before prompting an upgrade.

- Revenue Model: Subscription-based monetization (upselling paid tiers).

- Best for: Converting free users into paying subscribers.

How White-Label Solutions Can Generate Revenue For Your Fintech App

1. Licensing Your Fintech Platform to Banks & Financial Institutions

- How it Works: Offer your app’s technology (budgeting tools, AI-driven insights, investment tracking) to banks, credit unions, or fintech startups that want a branded solution without building their own.

- Revenue Model:

- Upfront setup fee (e.g., $50K–$500K per client).

- Monthly subscription fees based on user volume (e.g., $2–$10 per user).

- Revenue sharing (percentage of transaction fees or subscriptions).

2. White-Label API Monetization for Fintech Startups & Developers

- How it Works: Provide an API that third-party apps can integrate for financial services like credit score tracking, AI-driven budgeting, or expense categorization.

- Revenue Model:

- API subscription fees (e.g., $99–$999/month depending on usage).

- Pay-per-use pricing for transactions or API calls.

3. Embedded Finance Solutions (BaaS – Banking-as-a-Service)

- How it Works: Offer white-label digital banking, lending, or investment solutions that companies can integrate into their apps.

- Examples:

- Retail companies offering branded savings accounts.

- Gig platforms providing their workers with instant payment solutions.

- Revenue Model:

- Per-user/month pricing for businesses.

- Transaction fees on deposits, withdrawals, or trades.

4. Corporate Financial Wellness Programs

- How it Works: Sell a white-labeled version of your app to HR departments & enterprises to offer employees financial wellness tools.

- Revenue Model:

- Per-employee pricing (e.g., $5–$15/month per employee).

- Enterprise license fee (bulk pricing for large organizations).

Why This Works?

✅ Creates multiple income streams beyond individual subscriptions.

✅ Establishes B2B partnerships for long-term revenue stability.

✅ Positions your fintech brand as a technology provider, not just an app.

White-label solutions for a multivendor e-commerce

White-Label Fintech Solutions for Multivendor E-Commerce

Target Clients:

- E-commerce platforms (Shopify, WooCommerce alternatives)

- Marketplaces (B2B & B2C)

- Niche sellers (fashion, electronics, dropshipping, etc.)

- Enterprise retailers

Monetization & Pricing Strategy

Here’s a multi-tiered revenue model you can implement:

Setup & Licensing Fees

- One-time setup fee: $20K – $200K (varies based on customization needs).

- Annual white-label license fee: $10K – $100K per platform.

Subscription-based SaaS Pricing

- Small Businesses: $99/month (basic features).

- Mid-Sized Marketplaces: $499/month (advanced analytics, fraud protection).

- Enterprise Clients: $2,000+/month (custom integrations, AI automation).

Revenue Share Model

- Charge 0.5% – 2% per transaction processed through the platform.

- Monetize via embedded payments, loans, BNPL (Buy Now, Pay Later) solutions.

API Monetization (for Custom Platforms)

- Per API call: $0.01–$0.10 (ideal for marketplaces integrating payments).

- Tiered Pricing:

- Starter: $199/month (up to 50K API calls).

- Pro: $999/month (up to 500K API calls).

- Enterprise: Custom pricing (unlimited API access).

Embedded Fintech Add-Ons (Extra Revenue)

- Instant Vendor Payouts: Charge $0.50–$2 per transaction for faster withdrawals.

- Escrow & Buyer Protection: Take a small commission (1%–3%) from high-value transactions.

- Vendor Credit & Microloans: Lend funds to sellers & take interest-based fees.

- FX & Cross-Border Payments: Earn from currency exchange markups.

Features to Offer in Your White-Label Fintech Solution

✅ Multi-Vendor Payment Gateway – Split payments between sellers, platform, & affiliates.

✅ Instant Payouts & BNPL – Let sellers access funds early for a small fee.

✅ AI-powered Fraud Detection – Reduce chargebacks & disputes.

✅ Automated Tax & Compliance – Sales tax & VAT calculations for global sellers.

✅ Loyalty & Cashback System – Help vendors run promotions, with your platform taking a cut.

Why This Model Works?

✅ Recurring revenue via SaaS & API pricing.

✅ Scalable earnings from transaction-based fees.

✅ Sticky ecosystem – E-commerce platforms stay locked into your financial services.

Fintech Integrations to Boost Adoption & Stickiness for Your Multivendor E-Commerce Platform

Maximising Monetization And Your Fintech App and to ensure vendors and buyers stay engaged, your white-label fintech solution should offer seamless financial services. Here are the most effective fintech integrations to drive adoption and long-term retention:

Embedded Payments & Split Transactions

Why? Multi-vendor marketplaces need a way to distribute funds efficiently between sellers, affiliates, and the platform.

✅ Instant Vendor Payouts – Let sellers withdraw earnings instantly for a small transaction fee (e.g., $1–$2 per payout).

✅ Automated Split Payments – Allow multiple vendors to receive their cut automatically (Stripe Connect, PayPal Adaptive Payments).

✅ Flexible Payment Methods – Support credit/debit cards, digital wallets (Apple Pay, Google Pay), bank transfers, crypto payments.

✅ Recurring Payments – Allow subscription-based or installment payment models for products/services.

Monetization Model:

- Charge 0.5% – 2% per transaction.

- Offer faster payout options for an extra fee.

Buy Now, Pay Later (BNPL) & Vendor Credit

Why? BNPL increases cart conversions while offering an additional revenue stream.

✅ BNPL for Customers – Partner with providers like Affirm, Klarna, Afterpay to offer installment payments.

✅ Credit Line for Vendors – Offer working capital loans to vendors based on their sales history.

✅ Deferred Payments – Allow customers to pay in installments while vendors get paid upfront.

Monetization Model:

- Take a 1%–3% cut from BNPL transactions.

- Charge interest (APR 5%–20%) on vendor credit.

AI-Powered Fraud Prevention & Chargeback Protection

Why? Reducing fraud improves vendor trust & minimizes losses.

✅ AI-based Risk Scoring – Analyze transaction patterns to flag suspicious activity.

✅ Chargeback Protection for Vendors – Offer a paid add-on where vendors get reimbursed for chargebacks.

✅ Biometric Authentication – Enable face ID, fingerprint, & OTP verification for transactions.

Monetization Model:

- Charge a premium fee ($19–$99/month per vendor) for fraud protection.

- Offer chargeback insurance (1% fee per transaction covered).

Global & Cross-Border Payment Processing

Why? If your vendors sell internationally, they need an easy way to accept and withdraw funds in multiple currencies.

✅ Multi-Currency Payments – Auto-convert currency based on buyer’s location.

✅ International Payouts – Enable vendor withdrawals in local currencies.

✅ FX Optimization – Provide competitive exchange rates for vendors withdrawing in foreign currencies.

Monetization Model:

- Earn FX markup fees (0.5%–3%) per cross-border transaction.

- Charge a flat withdrawal fee ($2–$10) for international payouts.

Automated Tax & Compliance Reporting

Why? Vendors need help calculating taxes, and your platform can monetize this service.

✅ Sales Tax & VAT Calculation – Auto-calculate tax based on customer location (Avalara, TaxJar integration).

✅ Automated Tax Filing for Vendors – Help vendors file their sales tax & VAT automatically.

✅ Custom Invoice Generation – Auto-generate compliant invoices with tax breakdowns.

Monetization Model:

- Charge $9.99–$99/month per vendor for automated tax handling.

- Offer pay-per-use tax filings ($10–$50 per filing).

Loyalty, Cashback & Rewards System

Why? Retain customers & vendors by offering financial incentives.

✅ Cashback for Shoppers – Offer buyers 1%–5% cashback on purchases to encourage repeat orders.

✅ Seller Rewards – Vendors earn perks (discounted fees, marketing credits) based on sales volume.

✅ Branded Digital Gift Cards – Allow customers to buy store credit for future purchases.

Monetization Model:

- Charge vendors 1%–3% per cashback transaction.

- Take a small commission on gift card sales.

Why These Fintech Integrations Will Boost Adoption & Retention?

✅ Vendors make more sales (BNPL, tax automation, split payments).

✅ Buyers return more often (cashback, installment payments).

✅ Your platform earns recurring revenue from fees, subscriptions & transactions.

Monetization And Your Fintech App Through Investment Services

1. Equity Crowdfunding (Startup & Business Investments)

Why? Helps businesses raise funds from retail investors while your platform earns commissions.

✅ How It Works:

- Businesses list investment opportunities on your platform.

- Investors buy equity (shares) in those businesses.

- Your platform manages transactions, compliance, and payouts.

Revenue Model:

- Success-based commission: Charge 3%–7% of funds raised from businesses.

- Transaction fees: Take 1%–2% per investor transaction.

- Premium listing fees: Charge businesses $500–$5,000 for featured placement.

- Subscription for investors: Offer premium investor tools for $19.99–$99/month.

Example: Platforms like SeedInvest, Republic, and Wefunder use this model.

2. Peer-to-Peer (P2P) Lending & Fintech Microloans

Why? Connects borrowers with lenders, allowing individuals to earn interest while your platform takes a cut.

✅ How It Works:

- Borrowers apply for small business or personal loans.

- Investors (lenders) fund these loans and earn interest.

- Your platform handles matchmaking, credit analysis, and payment processing.

Revenue Model:

- Origination Fees: Charge 1%–5% per loan issued.

- Loan Servicing Fees: Take 0.5%–2% of repayments.

- Premium Borrower Profile Fees: Charge $50–$500 for higher loan visibility.

- Investor Subscription Fees: Offer risk assessment tools for $19.99–$99/month.

Example: Platforms like LendingClub and Prosper operate this way.

3. Real Estate & Your Fintech App

Why? Enables investors to pool money for real estate deals while your platform earns commissions.

✅ How It Works:

- Real estate developers list investment opportunities.

- Investors buy fractional ownership in properties.

- Your platform manages transactions, legal agreements, and distributions.

Revenue Model:

- Commission per investment: Take 2%–5% of funds raised.

- Asset management fee: Charge investors 0.5%–2% per year on invested capital.

- Listing Fees: Developers pay $1,000–$10,000 to list a project.

- Premium investor subscription: Offer exclusive deals for $49.99–$199/month.

Example: Fundrise, CrowdStreet, and RealtyMogul use this model.

4. Tokenized Fintech (Crypto & Web3 Investments)

Why? Blockchain-based crowdfunding allows for global investor participation and instant liquidity.

✅ How It Works:

- Startups tokenize equity or assets using blockchain.

- Investors buy & trade tokens representing ownership.

- Your platform handles smart contracts and compliance.

Revenue Model:

- Transaction fees: Take 1%–3% per investment transaction.

- Token listing fees: Charge startups $5,000–$50,000 to list projects.

- Smart contract setup fees: Offer blockchain-based legal services for $10K–$100K.

- Premium investor access: Charge for early investment access at $99–$499/month.

Example: Republic Crypto, Polymath, and DAO-based funding platforms.

Why This Works?

✅ Multiple revenue streams – commissions, subscriptions, transaction fees.

✅ Strong investor demand – crowdfunding democratizes investing.

✅ Scalability – more listings = more revenue.

Monetization And Your Fintech App: Launching an Investment Service

Step 1: Define Your Business Model

First, decide which type of crowdfunding or investment service fits your fintech app.

✅ Equity Crowdfunding – Investors buy shares in startups & businesses (like Republic, Wefunder).

✅ P2P Lending & Microloans – Investors lend money directly to borrowers for interest (like LendingClub).

✅ Real Estate Crowdfunding – Investors pool funds to buy fractional property ownership (like Fundrise).

✅ Tokenized Crowdfunding (Web3 & Crypto) – Investors buy blockchain-based tokens representing equity or assets.

Key Consideration: Choose a model that aligns with your app’s existing financial services.

Step 2: Establish Legal & Compliance in Fintech Framework

Crowdfunding is highly regulated! You need to comply with financial laws.

Regulatory Compliance Checklist:

SEC & Financial Regulations: If operating in the US, register with the SEC & FINRA (or local regulators in other countries).

KYC & AML Compliance: Implement identity verification (KYC) and Anti-Money Laundering (AML) checks for investors.

Smart Contract Compliance (For Web3 Solutions): Ensure tokenized investments follow securities laws.

Pro Tip: Partner with legal fintech firms to handle compliance efficiently.

Step 3: Develop Core Fintech Crowdfunding Features

Your fintech app needs robust features to attract both investors & fundraisers.

1. Investor Fintech Dashboard

✅ Investment Portfolio Tracking

✅ Earnings & Dividends Dashboard

✅ Risk Assessment Tools

✅ Early-Access Deals for Premium Members

2. Crowdfunding Fintech Marketplace

✅ Project Listings (Startups, Loans, or Real Estate Deals)

✅ Investor Ratings & Due Diligence Reports

✅ AI-Powered Investment Recommendations

3. Fintech Payment & Transaction Processing

✅ Secure multi-payment options (cards, ACH, crypto, BNPL, wire transfers)

✅ Automated dividends & interest payouts

✅ Split Payments for multi-party funding rounds

4. Compliance & Fintech Security

✅ Integrated KYC/AML verification (ID scanning, facial recognition)

✅ AI-powered fraud detection

✅ Escrow services for secure investment handling

Step 4: Fintech Monetization Strategy – How You’ll Earn Revenue

Once the platform is live, maximize revenue using these multiple streams:

Success-Based Commission on Funds Raised

Take a % from funds raised by businesses or real estate projects.

3%–7% commission per successful funding

Example: A startup raises $500,000 → Your platform earns $25,000 (5%)

Transaction Fees on Fintech Investments

Charge a fee per investment transaction.

1%–3% per investor transaction

Example: Investor funds $10,000 → You collect $200 (2%)

Investor Subscription Model (Premium Access)

Offer premium services for a subscription fee.

$19.99–$99/month for:

✅ Exclusive early-access deals

✅ Advanced market insights

✅ AI-powered risk analysis

Listing Fees for Fintech Startups & Real Estate Developers

Charge projects to list their campaigns.

$500–$5,000 per listing for standard campaigns

$10,000+ for featured placements on the homepage

Exit & Liquidity Fees (Web3 & Tokenized Crowdfunding)

If using blockchain-based investment tokens, charge fees for trading & exits.

0.5%–2% per secondary market trade

Example Revenue Model: If your platform facilitates $10M in investments/month, you could earn:

✅ $500K–$700K from commissions

✅ $100K+ in listing fees

✅ $50K–$200K from subscriptions & premium services

Step 5: Acquire Investors & Fintech Startups (Growth Strategy)

Once your platform is ready, attract high-quality investors & fundraisers using:

✅ Content Marketing & Webinars – Educate investors on crowdfunding benefits.

✅ Strategic Partnerships – Partner with venture capital firms & startup incubators.

✅ Referral & Affiliate Programs – Reward users for bringing in new investors & startups.

✅ Influencer & Community Marketing – Leverage finance YouTubers, LinkedIn thought leaders & Reddit communities.

Why This Model Works?

✅ Recurring revenue from commissions, subscriptions & transaction fees

✅ Growing market demand for alternative investments & P2P lending

✅ Scalable business model – More projects = More revenue

Monetization And Your Fintech App: Tech Stack for Your Investment

UX Flow: How Users Navigate Your Platform

Your platform will have two primary user types:

Investors – Looking to fund projects/startups & track returns.

Fundraisers (Businesses, Startups, Real Estate Developers, etc.) – Seeking capital from investors.

Investor UX Flow (Step-by-Step)

Sign Up & KYC Verification

- Enter personal details → Upload ID → AI-powered verification (Instant KYC)

- Tech: Onfido, Jumio, Alloy for KYC/AML compliance

Browse Investment Opportunities

- Filter by industry, ROI, risk level, funding stage

- View real-time analytics & AI-driven insights

- Tech: ElasticSearch (search), D3.js (visualization), GPT-based AI assistant

Invest & Make Payments

- Choose amount → Confirm terms → Secure payment

- Tech: Stripe, Plaid (ACH), Fireblocks (crypto), PayPal

Track Portfolio & Returns

- Dashboard with earnings, dividends, payout schedule

- Tech: Chart.js, Highcharts (data visualization), AWS Lambda (automated payouts)

Withdraw & Exit Investments

- Request withdrawal → Instant payout to bank, PayPal, crypto wallet

- Tech: Wise (multi-currency payouts), Prime Trust (escrow)

Fundraiser (Fintech Business/Startup) UX Flow

Sign Up & Business Verification

- Register → Upload business docs → Auto-verification

- Tech: Alloy, Stripe Identity, KYB compliance tools

Create & Submit Fundraising Campaign

- Add pitch deck, financials, goals

- AI-driven risk assessment & investor matching

- Tech: AI-powered pitch scoring (OpenAI fine-tuned models), DocuSign (legal contracts)

Receive Funding & Track Performance

- Live investor dashboard → See raised amount & investor activity

- Tech: Websockets (real-time updates), Twilio (investor notifications)

Manage Payouts & Investor Updates

- Automated payouts (milestone-based or direct)

- Tech: Stripe Treasury, Plaid, Smart Contract (Web3 model)

Recommended Tech Stack for Development

Frontend (User Interface)

✅ React.js / Next.js (Highly scalable, fast UI)

✅ TailwindCSS / Material UI (Modern styling)

✅ Framer Motion (Smooth UI animations)

✅ Chart.js / Highcharts (Investment performance visualization)

Backend (APIs & Business Logic)

✅ Node.js (Express/NestJS) or Python (Django/FastAPI) – Scalable API handling

✅ PostgreSQL / MongoDB – Secure database for user transactions & profiles

✅ Redis – Caching for fast project listings & investor data

✅ WebSockets – Real-time notifications & investment updates

Fintech Payments & Transactions

✅ Stripe / PayPal / Plaid – ACH, card, & digital wallet payments

✅ Fireblocks / Prime Trust – Secure crypto payments & asset custody

✅ Wise / Payoneer – Cross-border payouts to fundraisers

AI & Automation

✅ OpenAI / LangChain – AI-driven investor recommendations

✅ Onfido / Jumio / Alloy – KYC & fraud detection

✅ AWS Lambda / Firebase Functions – Automated workflows (investment tracking, payouts)

Security & Compliance

✅ OAuth2 & JWT – Secure authentication

✅ SOC 2, GDPR & PCI DSS Compliance – Ensures financial & user data security

✅ Smart Contracts (for Web3 model) – Blockchain-powered investment tracking

Development Timeline & Roadmap

MVP (Minimum Viable Product) in 6 Months

✔ Month 1–2: UX/UI Design + Compliance Setup

✔ Month 3–4: Backend API Development + Payment Integrations

✔ Month 5–6: AI-powered Investor Matching + Testing & Launch

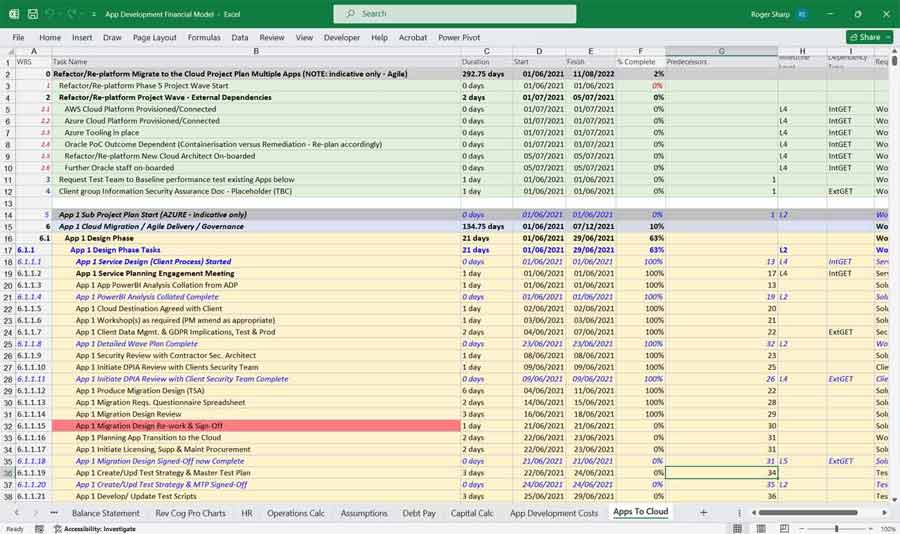

Example here