Elearning Company Financial Model

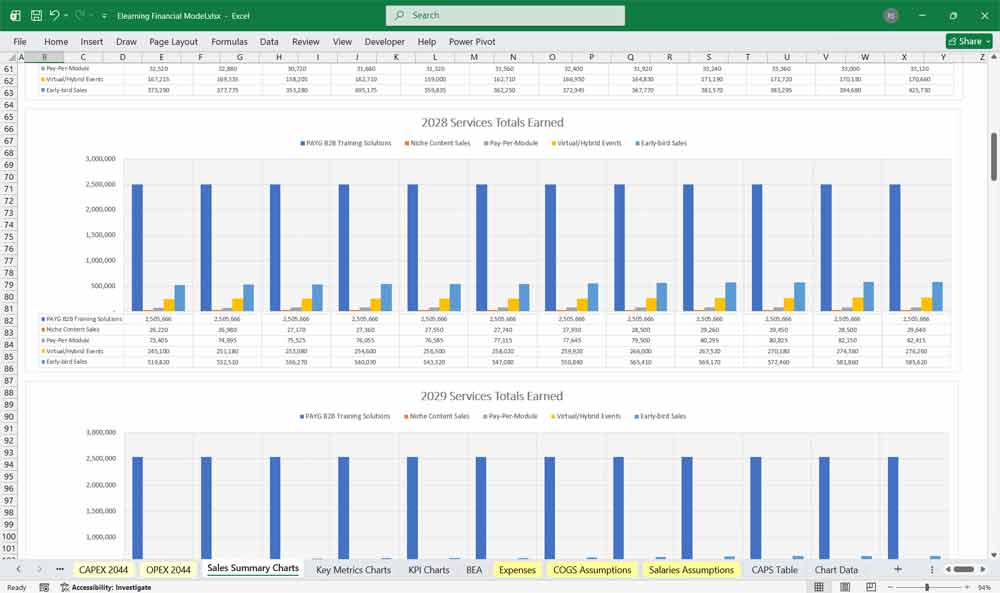

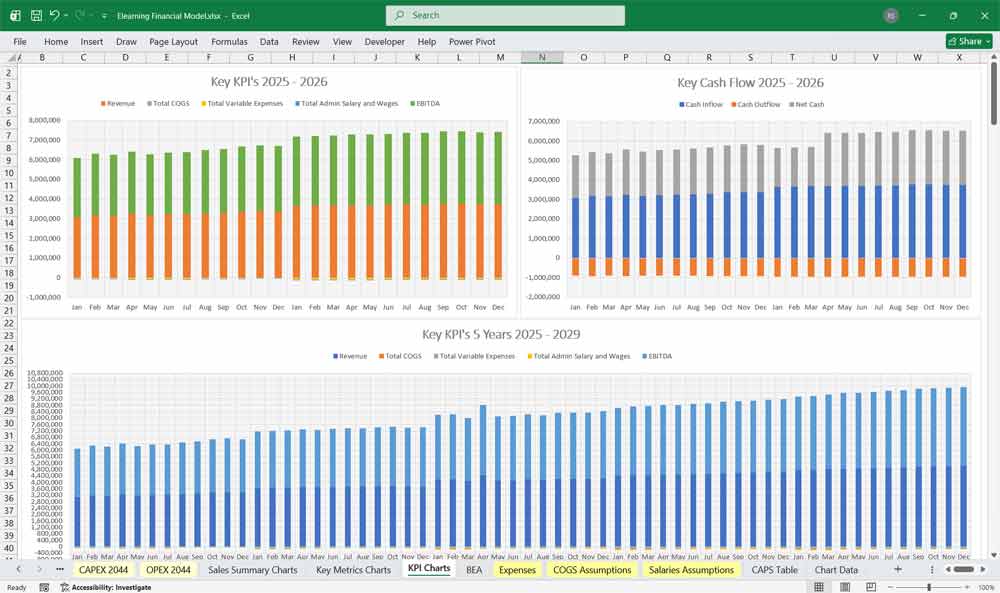

This 20-Year, 3-Statement Excel Elearning Company Financial Model includes revenue streams from 6-tier subscriptions, PAYG B2B Training Solutions, Niche Content Sales, Pay-Per-Module, Virtual/Hybrid Event sales, etc. Cost structures, and financial statements to forecast the financial health of your EdTech learning management system (LMS) business.

20-Year Financial Model for an Elearning Company

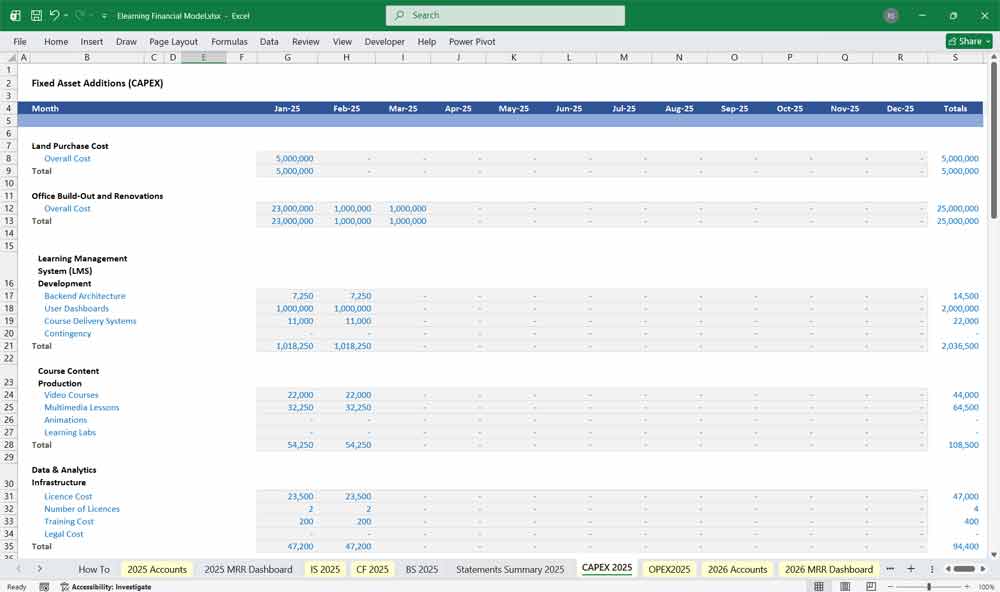

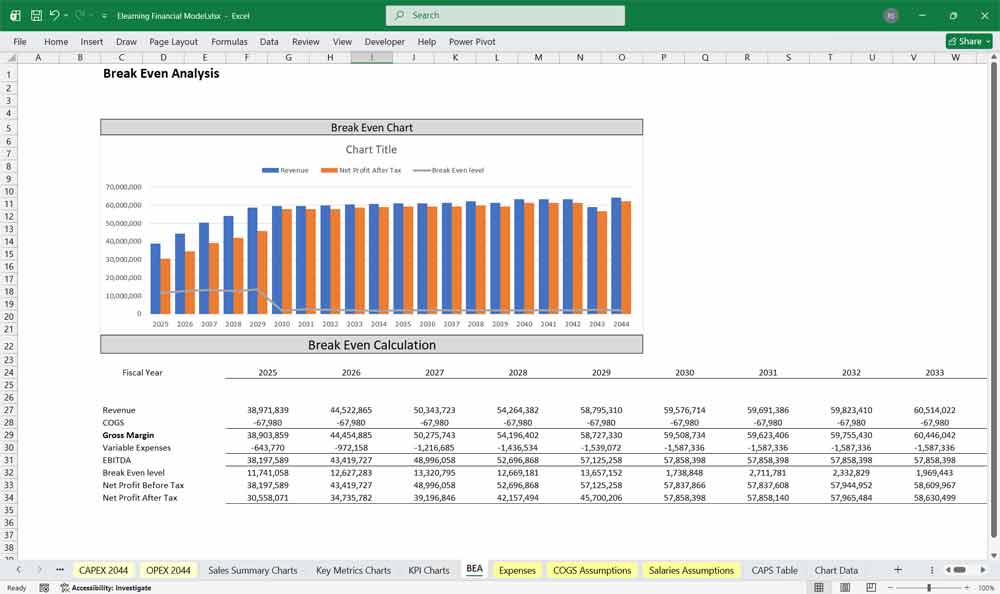

This very extensive 20 Year ELearning Edtech LMS Model involves detailed revenue projections, cost structures, capital expenditures, and financing needs. This model provides a thorough understanding of the financial viability, profitability, and cash flow position of your manufacturing company. Includes: 20x Income Statements, Cash Flow Statements, Balance Sheets, CAPEX sheets, OPEX Sheets, Statement Summary Sheets, and Revenue Forecasting Charts with the revenue streams, BEA charts, sales summary charts, employee salary tabs and expenses sheets. Over 130 Spreadsheets in 1 Excel Workbook.

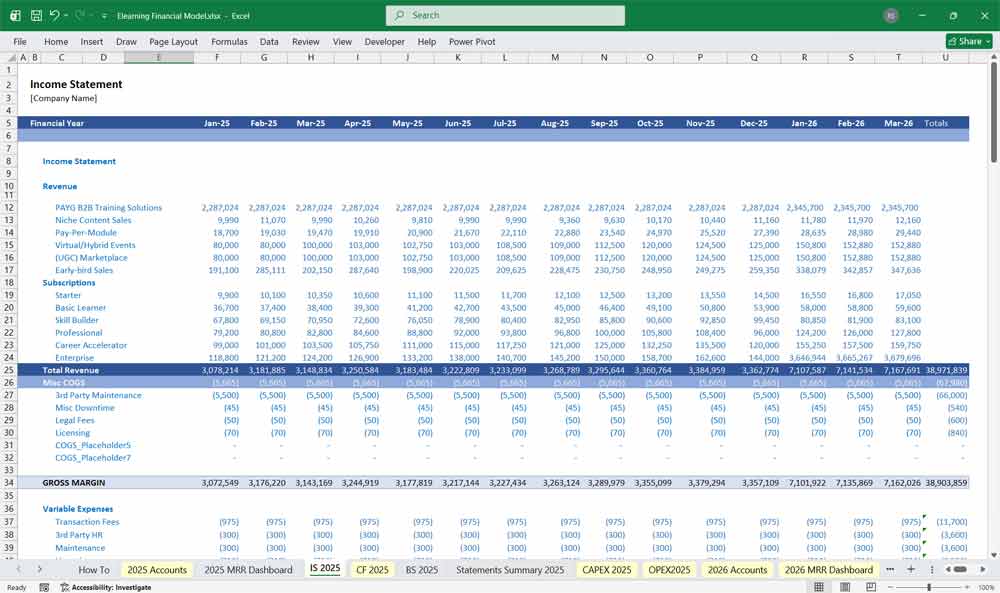

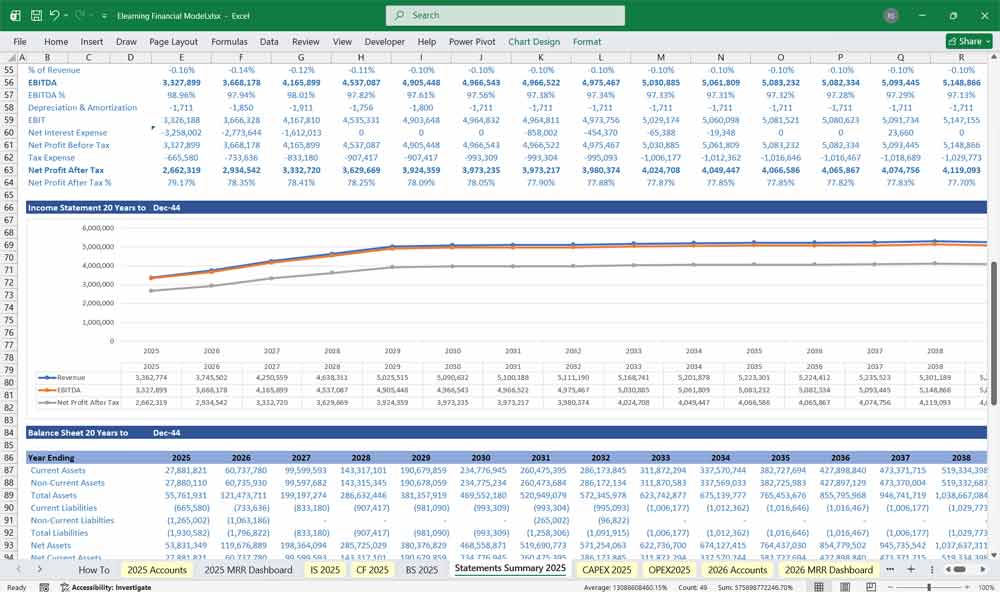

Income Statement (Profit & Loss)

The Income Statement shows profitability over time (monthly or annually).

Revenue

Segmented Revenue Streams:

Subscription revenue (by tier)

One-time course purchases

Certification & exam fees

Corporate/enterprise contracts

Mentorship & coaching fees

Key Metrics Modeled:

ARPU (Average Revenue Per User)

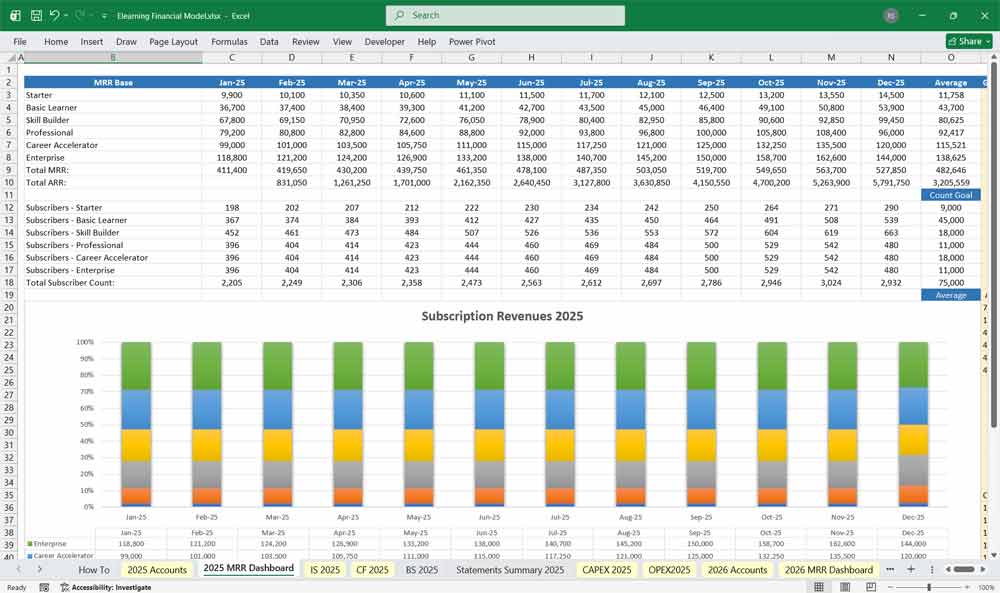

MRR / ARR

Revenue growth rate

Revenue concentration risk (B2B)

Cost of Revenue (Direct Costs)

Costs directly tied to delivering learning:

Cloud hosting & content delivery (CDNs)

Instructor royalties or revenue share

Proctoring & certification fees

Payment processing fees

Student support costs

Gross Profit = Revenue – Cost of Revenue

Gross Margin Indicators:

Scalable platforms: 65%–85%

Content-heavy / mentorship models: lower initial margins

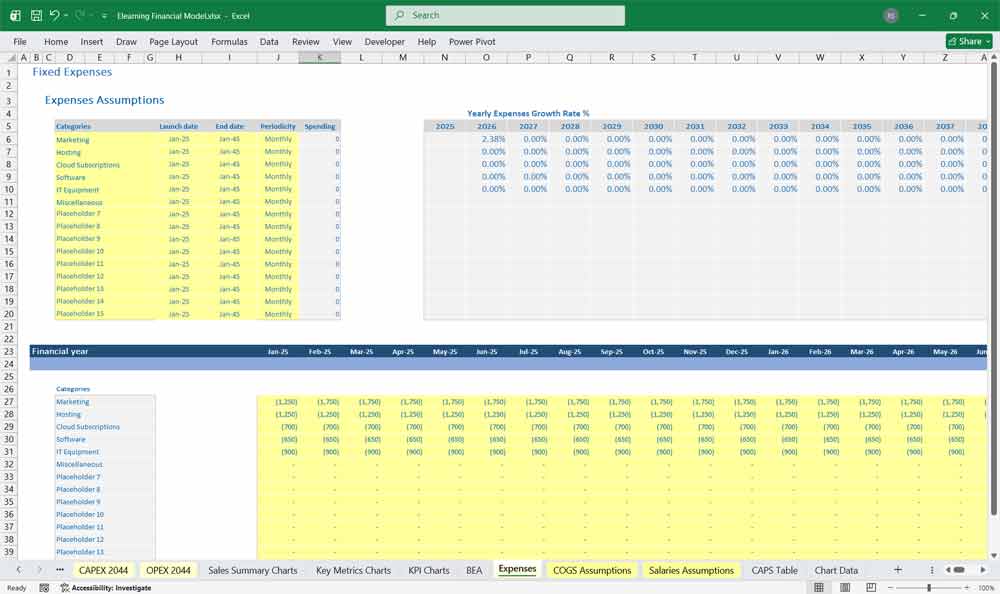

Operating Expenses (OPEX)

1. Research & Development

LMS platform development

Content creation & instructional design

AI & personalization features

2. Sales & Marketing

Paid acquisition (ads, affiliates)

Partnerships & events

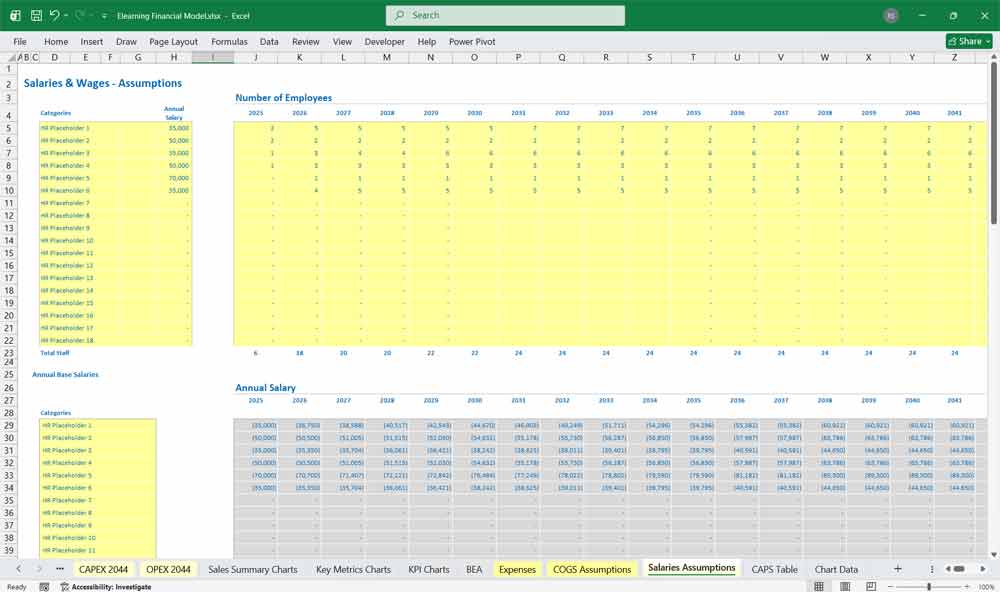

Sales team compensation (B2B)

Promotional campaigns

3. General & Administrative

Executive and finance salaries

HR, legal, accounting

Office and software subscriptions

EBITDA

Earnings before interest, taxes, depreciation & amortization

Key metric for:

Valuation benchmarking

Operational efficiency

Depreciation & Amortization

Capitalized software & platform costs

Capitalized course content

Studio equipment depreciation

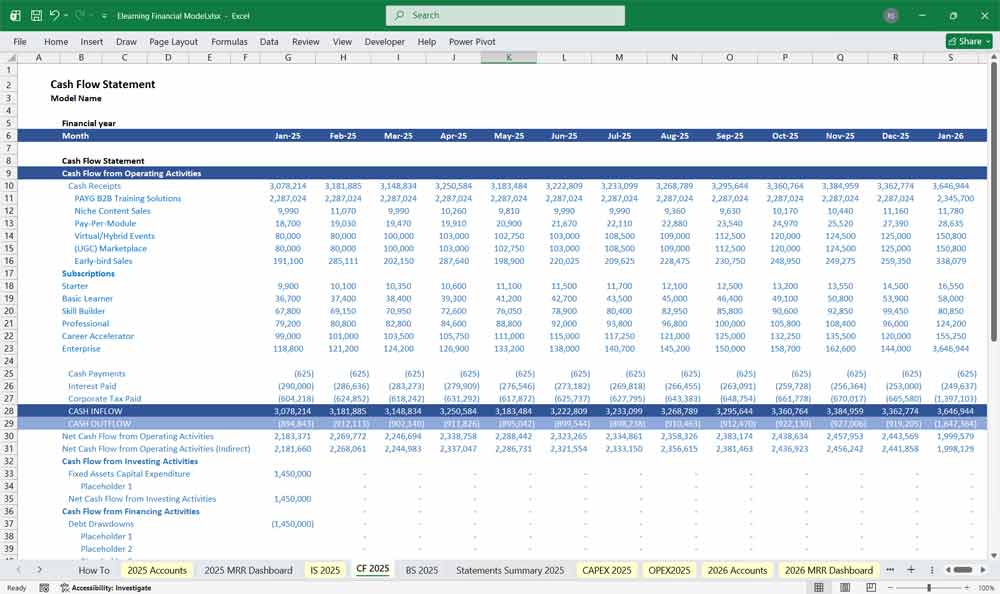

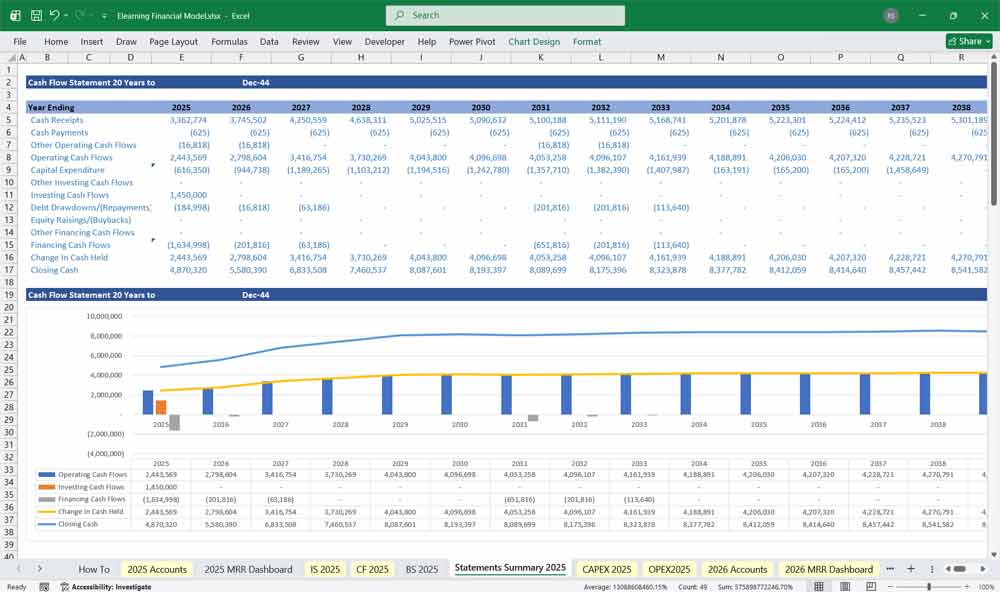

ELearning Company Cash Flow Statement

Tracks actual cash movement, critical for runway management.

Cash Flow from Operating Activities

Starts from Net Income, adjusted for:

Depreciation & amortization (non-cash)

Deferred revenue changes (subscriptions paid upfront)

Changes in working capital:

Accounts receivable (B2B contracts)

Accounts payable

Accrued expenses

Key Insight:

An eLearning company can be profitable but still cash-negative if growth and content investment are aggressive.

Cash Flow from Investing Activities

Capitalized platform development

Capitalized content creation

Studio & equipment purchases

IP acquisitions

Often negative during growth phases.

Cash Flow from Financing Activities

Equity funding rounds

Debt issuance or repayment

Convertible notes

Dividends (rare in growth stage)

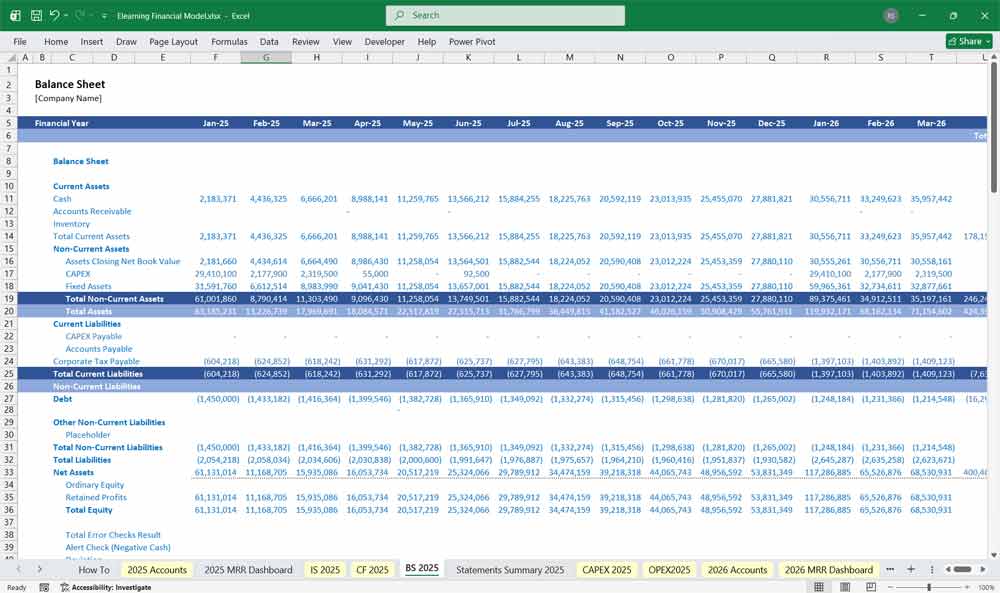

ELearning Company Balance Sheet

Snapshot of financial position at a given point in time.

Assets

Current Assets

Cash and equivalents

Accounts receivable (enterprise clients)

Prepaid expenses

Non-Current Assets

Capitalized software development

Capitalized course content (intangible assets)

Property & equipment (studio, IT equipment)

IP and trademark assets

Liabilities

Current Liabilities

Deferred (unearned) revenue from subscriptions

Accounts payable

Accrued payroll & expenses

Long-Term Liabilities

Long-term debt

Lease obligations

Deferred tax liabilities (if applicable)

Equity

Share capital

Additional paid-in capital

Retained earnings (accumulated losses or profits)

Scenario & Sensitivity Analysis For An ELearning Company

Major Fluctuations:

Pricing changes

Churn improvements

Content spending acceleration

Hiring freezes or sales expansion

B2B vs B2C mix shifts

6-tier subscription framework suggestions For An eLearning company

Tier 1: Starter (Free / Entry Tier)

Purpose: Lead generation & trial experience

Ideal For: Beginners exploring the platform

Features:

Access to introductory courses only (e.g., “Foundations” or “Essentials”)

Limited lessons per course (e.g., first 20–30%)

Community forum (read-only)

Mobile & desktop access

In-platform quizzes (no certificates)

Course previews & learning paths overview

Limits:

No downloadable resources

No completion certificates

No instructor interaction

Value Proposition:

“Try before you buy — start learning with zero risk.”

Tier 2: Basic Learner

Purpose: Entry-level paid conversion

Ideal For: Casual EdTech learners & hobbyists

Features:

Full access to all beginner-level courses

Structured learning paths

Downloadable practice materials

Course completion certificates (non-accredited)

Community forum participation

Progress tracking dashboard

Limits:

No advanced or professional courses

Instructor interaction limited to FAQs

Value Proposition:

“Build real skills with guided beginner programs.”

Tier 3: Skill Builder (Intermediate LMS)

Purpose: Core recurring revenue

Ideal For: Career switchers & serious learners

Features:

Access to beginner + intermediate courses

Hands-on projects & assignments

Skill assessments with performance scoring

Instructor Q&A via monthly live sessions

Downloadable resources & templates

Verified certificates with shareable credentials

Extras:

AI-powered learning recommendations

Resume & portfolio guidance

Value Proposition:

“Go beyond theory — practice real-world skills.”

Tier 4: Professional (Advanced)

Purpose: Career advancement tier

Ideal For: Professionals seeking advancement or specialization

Features:

All course access (beginner → advanced)

Industry-aligned capstone projects

Priority instructor support & feedback

Advanced certifications (industry-recognized or partner-endorsed)

Monthly expert workshops & masterclasses

Interview preparation resources

Extras:

Career path specialization tracks

Peer collaboration spaces

Value Proposition:

“Learn at a professional level with expert guidance.”

Tier 5: Career Accelerator / Mentorship Tier

Purpose: High-touch premium EdTech offering

Ideal For: Job seekers, freelancers, & career climbers

Features:

Everything in Professional, plus:

1-on-1 mentorship sessions

Personalized learning roadmap

Resume review & LinkedIn optimization

Mock interviews & real-world case studies

Job board & referral access

Portfolio-ready project reviews

Support Level:

Dedicated success mentor

Priority response times

Value Proposition:

“Turn learning into a job — with personal mentorship.”

Tier 6: Enterprise / Elite

Purpose: B2B & executive-level growth

Ideal For: Companies, teams, executives, or institutions

Features:

Unlimited LMS platform access for teams or individuals

Custom learning paths & private cohorts

Team analytics & reporting dashboard

Dedicated account manager

Live private workshops & trainings

White-label branding options

LMS integrations (SCORM, SSO, API)

Extras:

Custom certification programs

Workforce upskilling & compliance tracking

Value Proposition:

“Enterprise-grade learning solutions tailored to your organization.”

Strategic Notes

Each tier solves a distinct problem (exploration → skill building → career outcomes).

Pricing increases with outcome certainty, support, and personalization.

Tier 3–4 drive scale. Tier 5–6 drive profit.

Final Notes on the Financial Model

This 20 Year Elearning Company Financial Model focuses on balancing capital expenditures with steady revenue growth from varied LMS Elearning services. By optimizing operational costs, and power efficiency, and maximizing high-margin services, the models ensure sustainable profitability and cash flow stability.

Download Link On Next Page