Bitcoin Mining Financial Model

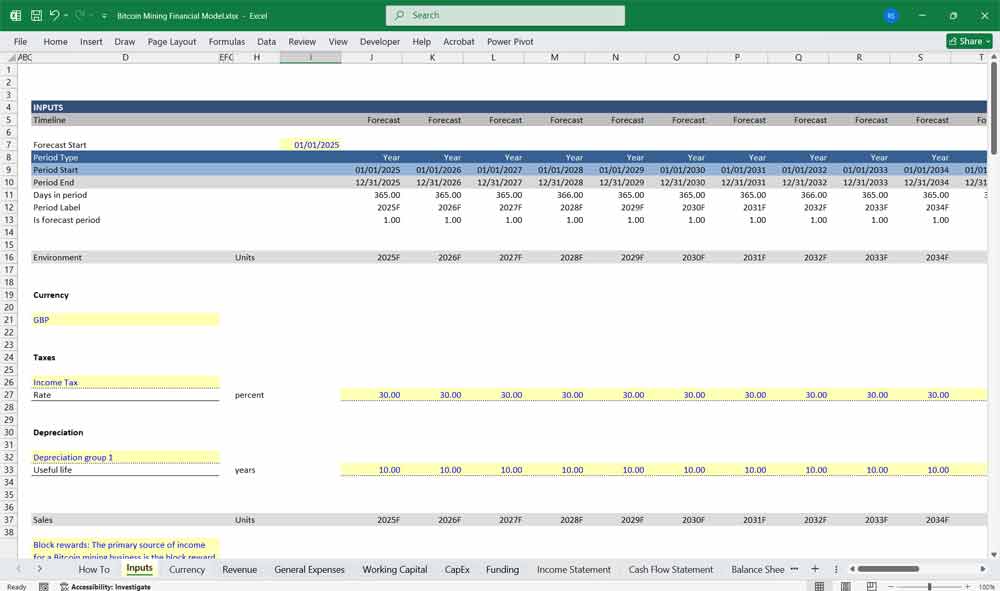

This 20-Year, 3-Statement Bitcoin Mining Financial Model in MS Excel includes revenue streams from transaction fees, block rewards, etc. Financial statements to forecast the financial health of your Crypto mining.

Financial Model for Bitcoin Mining

Financial model for a cryptocurrency mining operation. Key components include revenue generation, costs, and capital expenditures. Below is a detailed description of a financial model for crypto mining, including sections for the Income Statement, Cash Flow Statement, and Balance Sheet

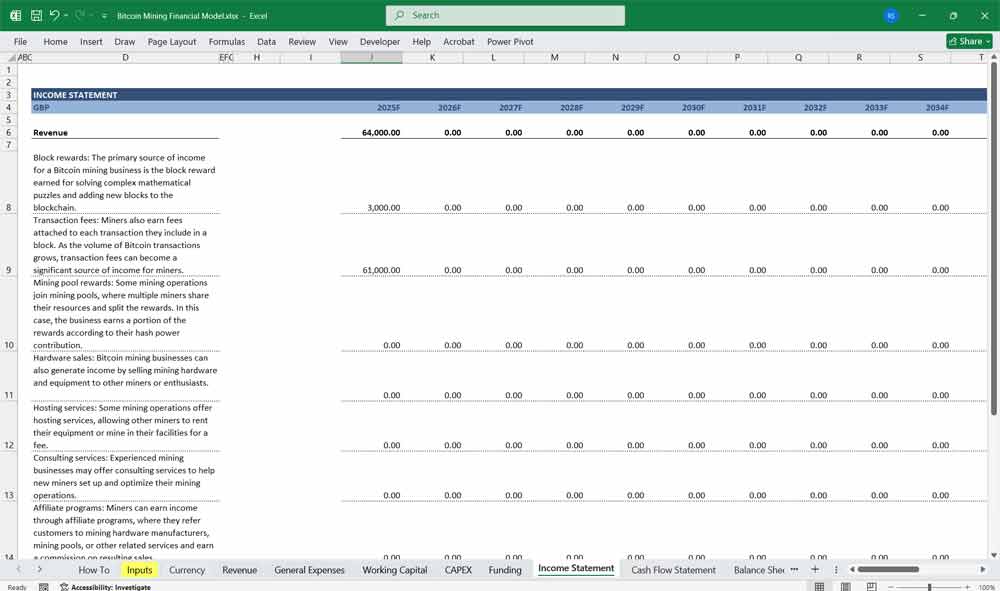

Income Statement

The Income Statement reflects the profitability of the mining operation over a specific period. It includes revenues, costs, and expenses.

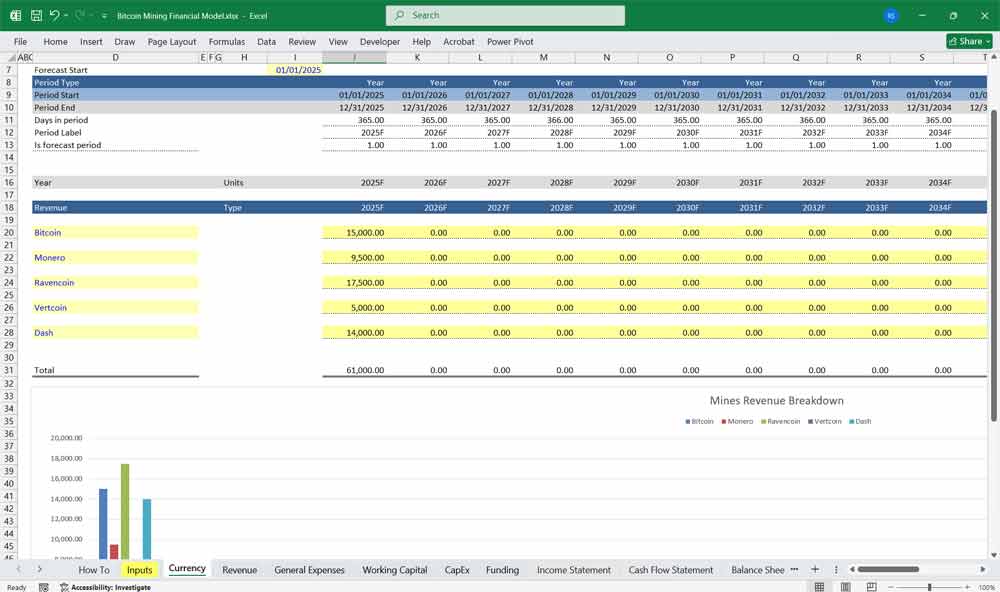

Revenue

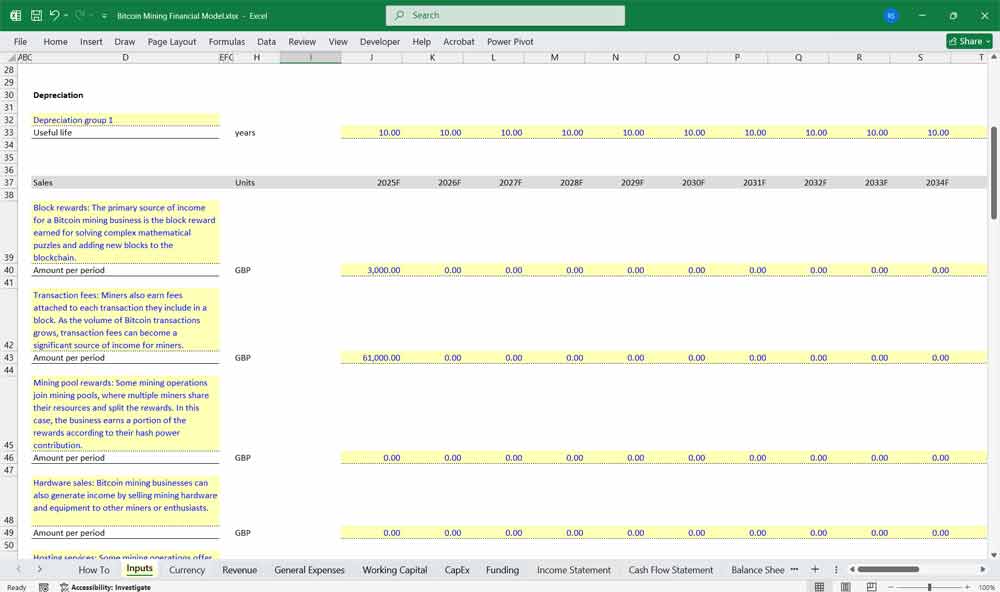

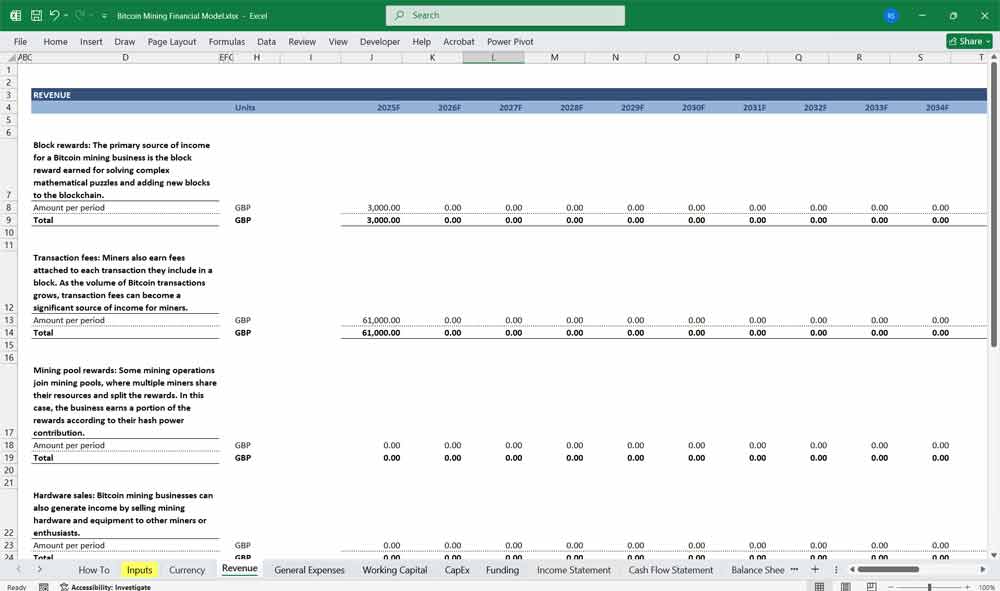

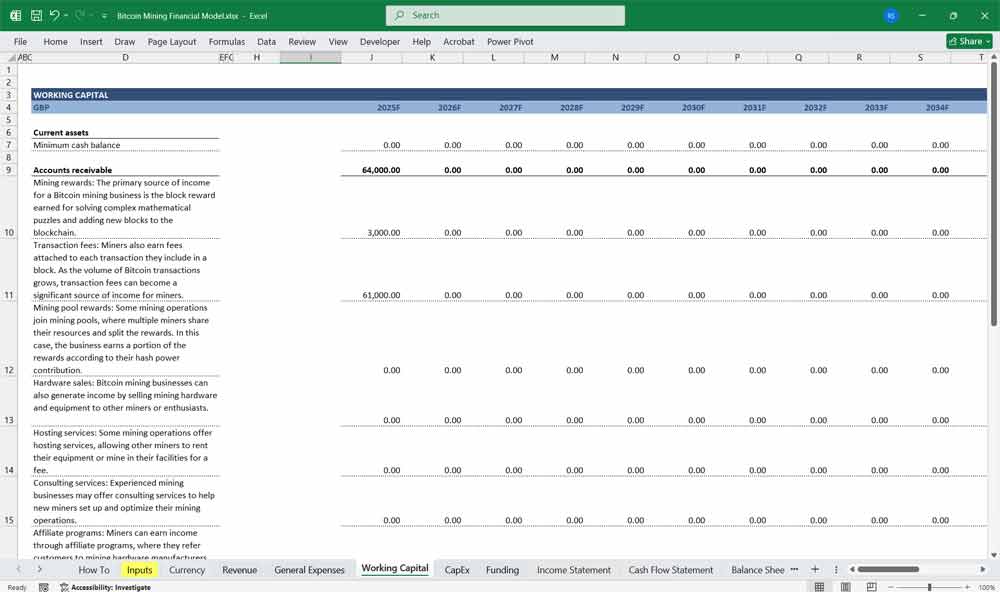

Block rewards: The primary source of income for a Bitcoin mining business is the block reward earned for solving complex mathematical puzzles and adding new blocks to the blockchain,

- Transaction fees: Miners also earn fees attached to each transaction they include in a block. As the volume of Bitcoin transactions grows, transaction fees can become a significant source of income for miners.

Mining pool rewards: Some mining operations join mining pools, where multiple miners share their resources and split the rewards. In this case, the business earns a portion of the rewards according to their hash power contribution.

Consulting services: Experienced miners may offer consulting services to help new miners set up and optimize their mining operations.

- Hosting services: Some mining operations offer hosting services, allowing other miners to rent their equipment or mine in their facilities for a fee.

- Affiliate programs: Miners can earn income through affiliate programs, where they refer customers to mining hardware manufacturers, mining pools, or other related services and earn a commission on resulting sales.

Currently, setup for 5 currencies, seen in the “Currency” tab below, all fully editable. Or more can easily be added.

Cost of Goods Sold (COGS)

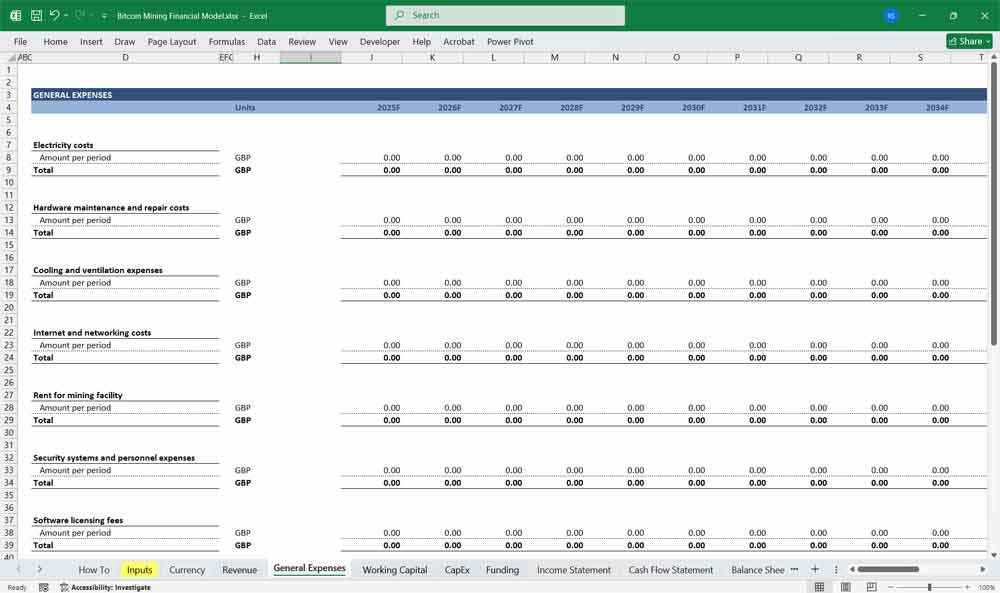

Electricity Costs: Calculated based on the power draw of the mining hardware (e.g., ASICs) and the cost of electricity (e.g., $0.05/kWh).

Cooling and Maintenance: Costs associated with maintaining the mining farm, including cooling systems and repairs.

Hosting Fees: If the mining farm is hosted by a third party, hosting fees may apply.

Operating Expenses

Labor Costs: Salaries for technicians and administrative staff.

Software and Licensing: Costs for mining software and licenses.

Depreciation: Depreciation of mining hardware (ASICs) over their useful life (e.g., 2-3 years).

Net Income

Gross Profit: Revenue minus COGS.

Operating Income: Gross profit minus operating expenses.

Net Income: Operating income minus taxes and interest.

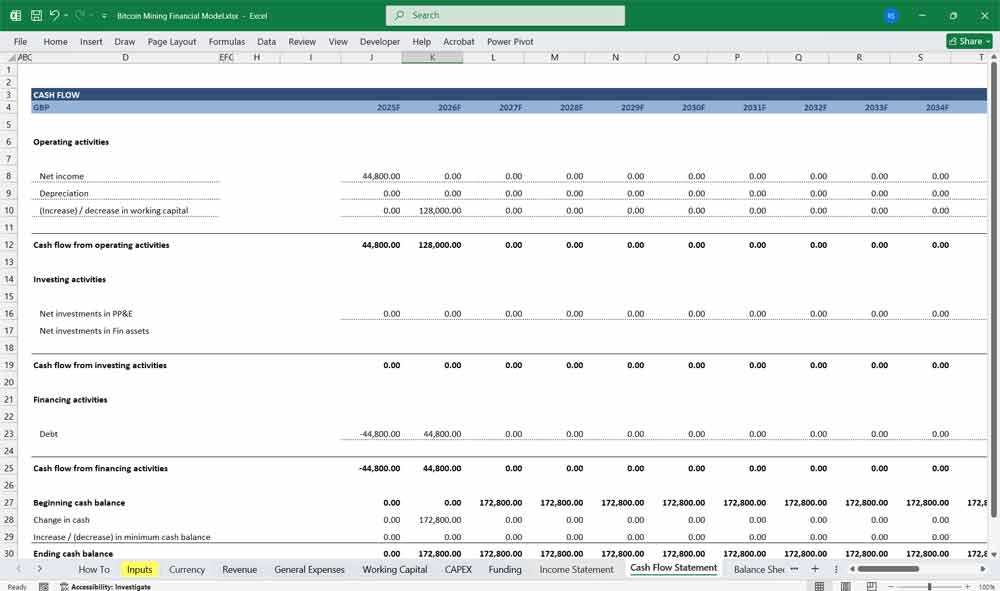

Bitcoin Mining Financial Model Cash Flow Statement

The Cash Flow Statement tracks the inflows and outflows of cash, ensuring the mining operation remains liquid.

Cash Flow from Operating Activities

Revenue from Mining: Money received from block rewards and transaction fees.

Electricity Payments: Cash paid for electricity.

Maintenance and Hosting: Money paid for cooling, maintenance, and hosting.

Labor Payments: Cost for employees.

Cash Flow from Investing Activities

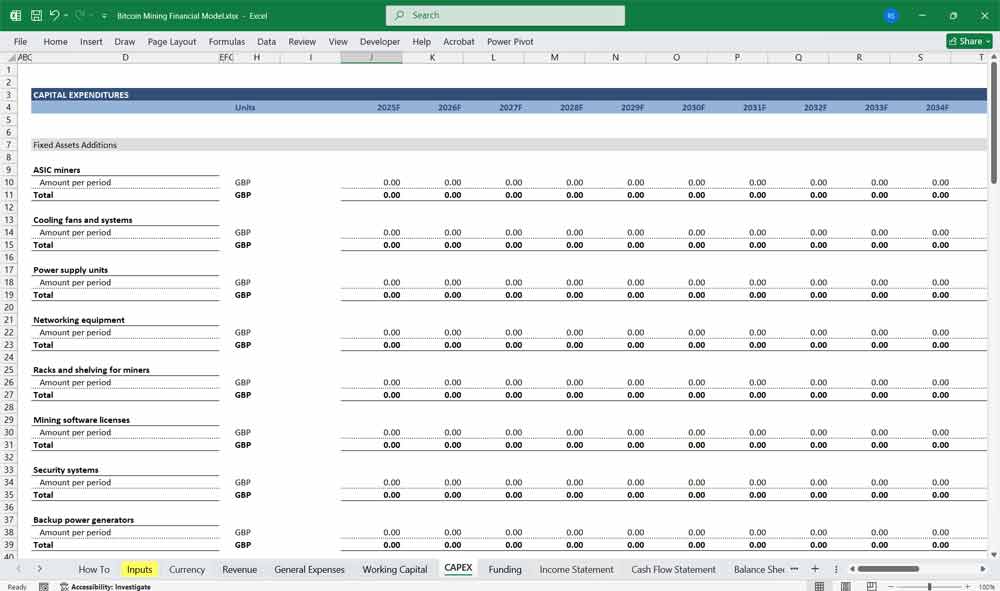

Capital Expenditures (CapEx): Cash spent on purchasing new mining hardware (ASICs) or expanding the mining farm.

Infrastructure Costs: Costs for setting up or upgrading the mining facility (e.g., cooling systems, racks).

Cash Flow from Financing Activities

Debt Repayments: Cash used to repay loans or financing.

Equity Issuance: Revenue received from issuing equity (if applicable).

Dividends: Cash paid to shareholders (if applicable).

Net Cash Flow

Net Change in Cash: Sum of cash flows from operating, investing, and financing activities.

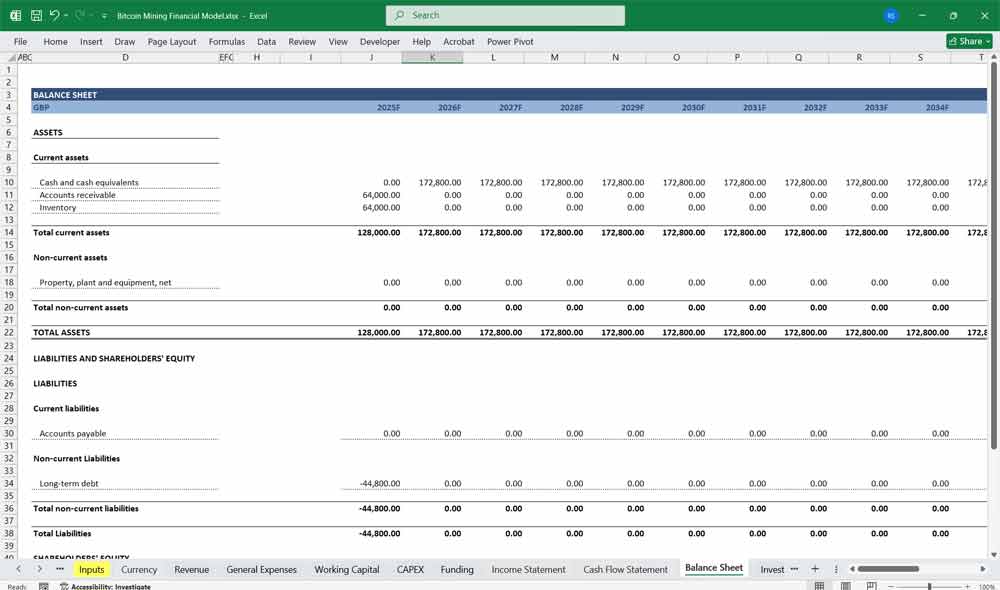

Bitcoin Mining Financial Model Balance Sheet

The Balance Sheet provides a snapshot of the mining operation’s financial position at a specific point in time.

Assets

Current Assets:

Cash and Cash Equivalents: Liquid assets available for operations.

Cryptocurrency Holdings: Value of mined but unsold cryptocurrency.

Non-Current Assets:

Mining Hardware (ASICs): Net book value of mining equipment after depreciation.

Infrastructure: Value of the mining farm and associated infrastructure.

Liabilities

Current Liabilities:

Accounts Payable: Unpaid electricity bills, maintenance costs, etc.

Short-Term Debt: Loans due within a year.

Non-Current Liabilities:

Long-Term Debt: Loans with a maturity of more than one year.

Equity

Retained Earnings: Cumulative net income retained in the business.

Shareholder Equity: Equity issued to investors.

Specific Considerations for Miners

Hashing and Hashrate

Hashing: The process of solving complex mathematical problems to validate transactions and secure the blockchain.

Hashrate: The computational power of the mining hardware, measured in hashes per second (e.g., TH/s, PH/s). Higher hashrate increases the probability of earning block rewards.

ASIC (Application-Specific Integrated Circuit)

Specialized hardware designed for mining specific cryptocurrencies. ASICs are more efficient than GPUs or CPUs but have a limited lifespan due to technological obsolescence.

Bitcoin Hashprice

Bitcoin Hashprice refers to the expected revenue a miner earns per unit of computational power (terahash per second, or TH/s) over a given period, typically measured in dollars per TH/s per day. It reflects mining profitability by combining factors like Bitcoin’s price, block rewards, transaction fees, and network difficulty. When hashprice is high, mining is more lucrative, attracting more participants; when low, less efficient miners may shut down. Hashprice is a key metric for miners to assess operational viability and optimize their strategies in response to fluctuating market conditions and network dynamics.

Bitcoin Mempool

The Bitcoin mempool (memory pool) is a temporary storage area where unconfirmed transactions wait to be included in a block by miners. When a transaction is broadcast to the network, it enters the mempool until a miner selects it for validation and adds it to the blockchain. The size of the mempool fluctuates based on network congestion—when demand is high, fees rise as users compete for block space, while during low activity, the mempool clears faster. Miners typically prioritize transactions with higher fees, meaning those with lower fees may experience delays. Monitoring the mempool helps users estimate appropriate transaction fees and predict confirmation times.

Bitcoin Power Draw

Bitcoin power draw refers to the massive amount of electricity consumed by the Bitcoin network to sustain its proof-of-work (PoW) mining operations. Miners use specialized hardware (ASICs) to solve complex cryptographic puzzles, requiring immense computational power. The network’s total energy consumption rivals that of some small countries, raising concerns about environmental impact. However, proponents argue that Bitcoin mining increasingly uses renewable energy and stranded power, while critics highlight its carbon footprint. Power draw fluctuates with Bitcoin’s price, mining difficulty, and energy costs—when profitability drops, inefficient miners shut down, reducing consumption. The debate over Bitcoin’s energy use remains a key topic in discussions about its sustainability.

Bitcoin Mining Pool

A Bitcoin mining pool is a collective group of miners who combine their computational resources to increase their chances of successfully mining a block and earning rewards. Since solo mining is highly competitive and often unprofitable for small-scale miners, pools allow participants to work together and share rewards proportionally based on their contributed hash power. The pool operator coordinates the effort, distributes tasks, and ensures fair payouts, typically charging a small fee for the service. Popular mining pools like Foundry USA, Antpool, and F2Pool control significant portions of Bitcoin’s total hash rate, raising occasional concerns about network decentralization. By joining a pool, miners achieve more consistent earnings, though they sacrifice some independence in the process.

Bitcoin Mining Farm

A Bitcoin mining farm is a large-scale facility housing hundreds or thousands of specialized mining rigs (ASICs) designed to solve cryptographic puzzles and secure the Bitcoin network. These farms require massive amounts of electricity, advanced cooling systems, and optimized infrastructure to operate efficiently. Located in regions with cheap power—such as hydro-rich areas or places with excess energy—mining farms aim to maximize profitability by reducing operational costs. Some farms also use renewable energy to address environmental concerns. By pooling significant hash power, these industrial operations dominate Bitcoin mining, though they face challenges like hardware obsolescence, regulatory scrutiny, and fluctuating Bitcoin prices. Their scale makes them critical to the network’s security but also sparks debates over-centralization.

Bitcoin Halving

Bitcoin halving is a pre-programmed event that occurs every 210,000 blocks (roughly every four years), reducing the block reward miners receive by 50%. Designed to control Bitcoin’s supply, halvings ensure a finite total of 21 million coins, making Bitcoin deflationary. The first halving in 2012 cut rewards from 50 to 25 BTC, the second in 2016 to 12.5 BTC, and the most recent in 2020 to 6.25 BTC. The next halving, expected in 2024, will drop rewards to 3.125 BTC. Historically, halvings have triggered bull runs due to reduced new supply and increased scarcity, though their long-term impact on price remains debated. This mechanism underscores Bitcoin’s predictable, transparent monetary policy.

Example Assumptions for the Model

Hashrate: 100 TH/s.

Electricity Cost: $0.05/kWh.

ASIC Power Draw: 3,250 W per unit.

Hashprice: $0.10/TH/s/day.

Mining Pool Fee: 2% of revenue.

Halving: Occurs every 4 years.

Conclusion For The Financial Model

A bitcoin mining financial model must account for the unique dynamics of the industry, including fluctuating crypto hashprice, halving events, and the rapid obsolescence of mining hardware. By carefully projecting revenues, costs, and cash flows, miners can assess profitability and make informed decisions about scaling or upgrading their operations.

Download Available Immediately After Payment