Clothing Store Financial Model

Financial Model for a Clothing Store

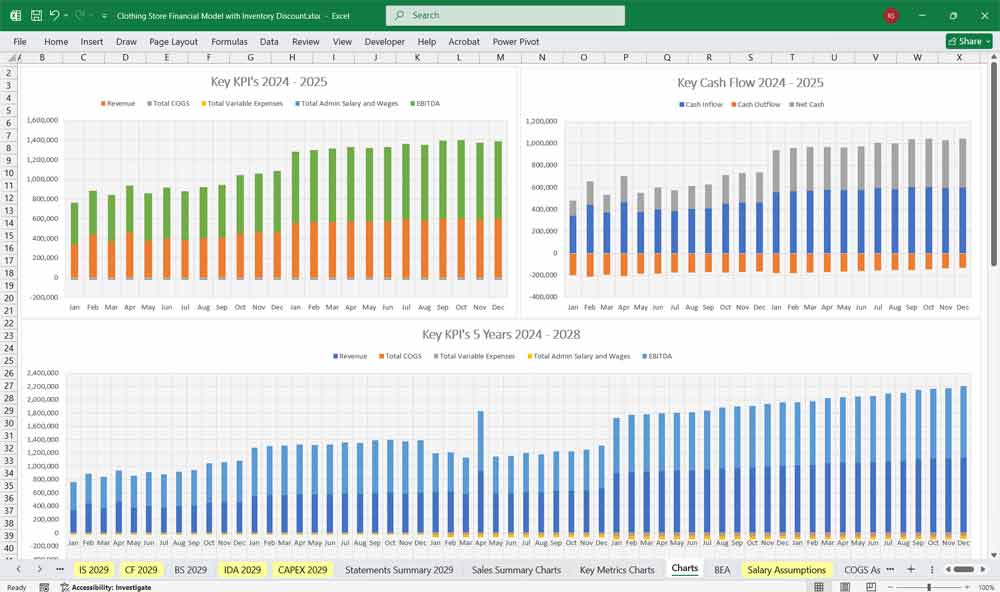

Financial model for a clothing store forecasting and tracking key financial metrics, inventory performance, and operating expenses over set monthly periods. Includes Income Statement, Cash Flow Statement, Balance Sheet, and Inventory Discount Analysis Sheets.

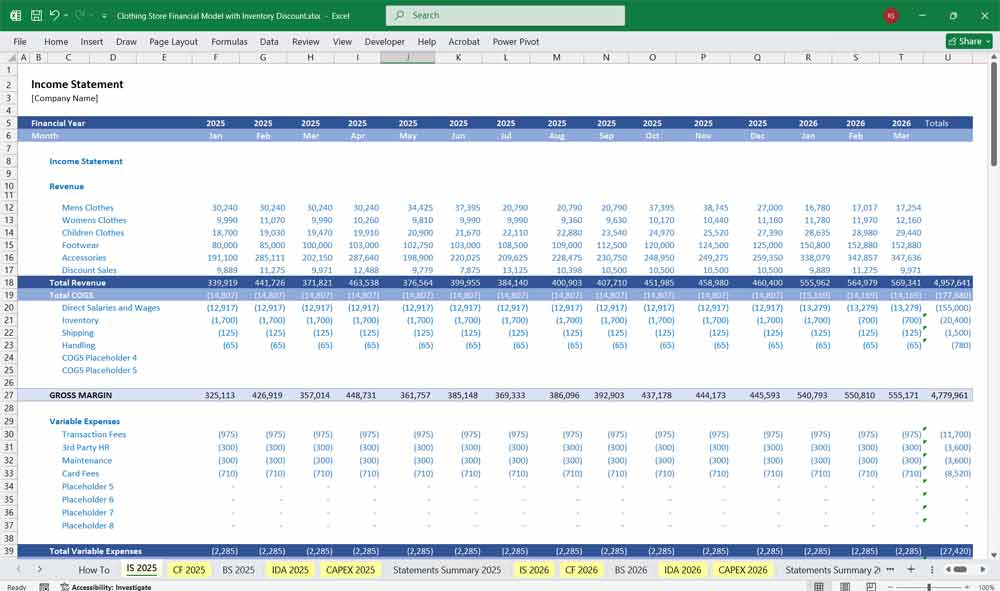

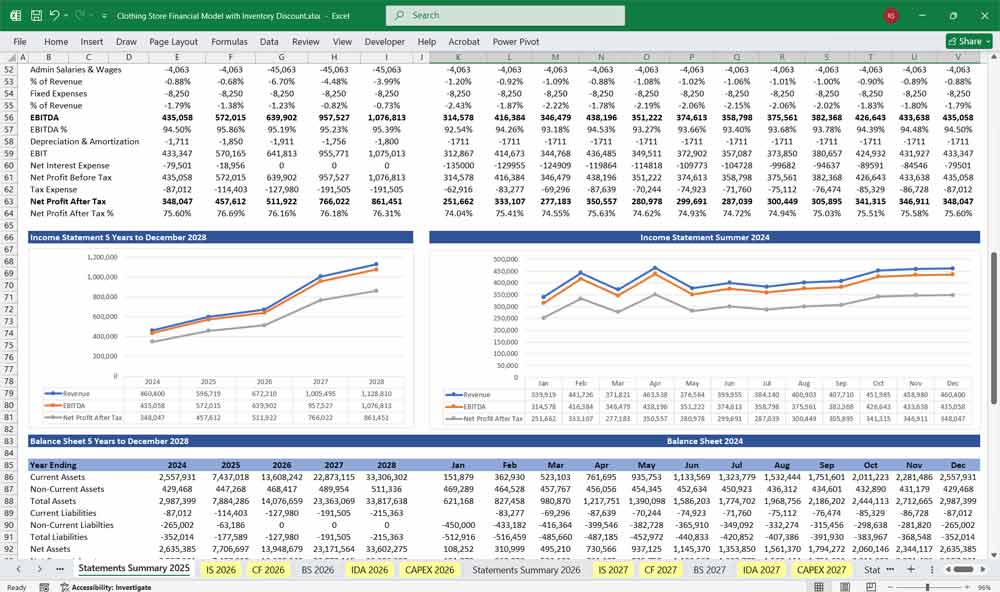

Income Statement (Profit & Loss Statement)

This statement summarizes the clothing store’s revenues, costs, and expenses over a period, showing profitability.

A. Revenue

Retail Sales Revenue

In-store sales

Online sales

Wholesale Revenue (if applicable)

Other Revenue

Tailoring services

Consignment sales

Gift card breakage

Revenue = Units Sold × Average Selling Price (ASP)

B. Cost of Goods Sold (COGS)

Opening Inventory

Purchases (including shipping and handling)

Closing Inventory

OR: Units Sold × Cost per Unit

Gross Profit = Revenue – COGS

C. Operating Expenses

Rent and Utilities

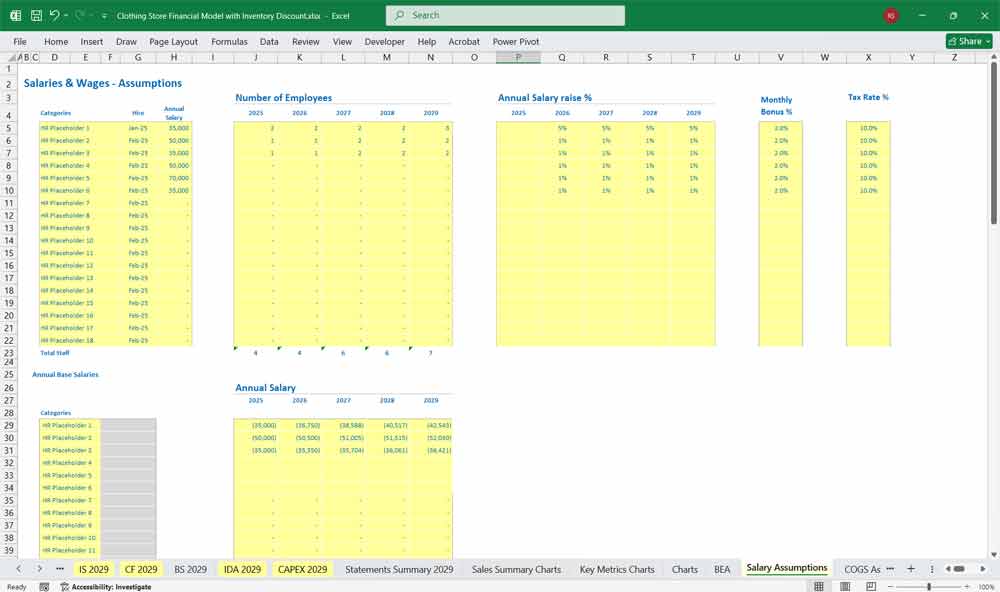

Salaries and Wages

Marketing and Advertising (social media, flyers, promotions)

Point of Sale (POS) system fees

Depreciation (for store fixtures, computers)

Supplies (bags, hangers, etc.)

Insurance

Professional Fees (accounting, legal)

Operating Profit (EBIT) = Gross Profit – Operating Expenses

D. Interest and Taxes

Interest on Loans

Taxes (based on local rates)

Net Profit = EBIT – Interest – Taxes

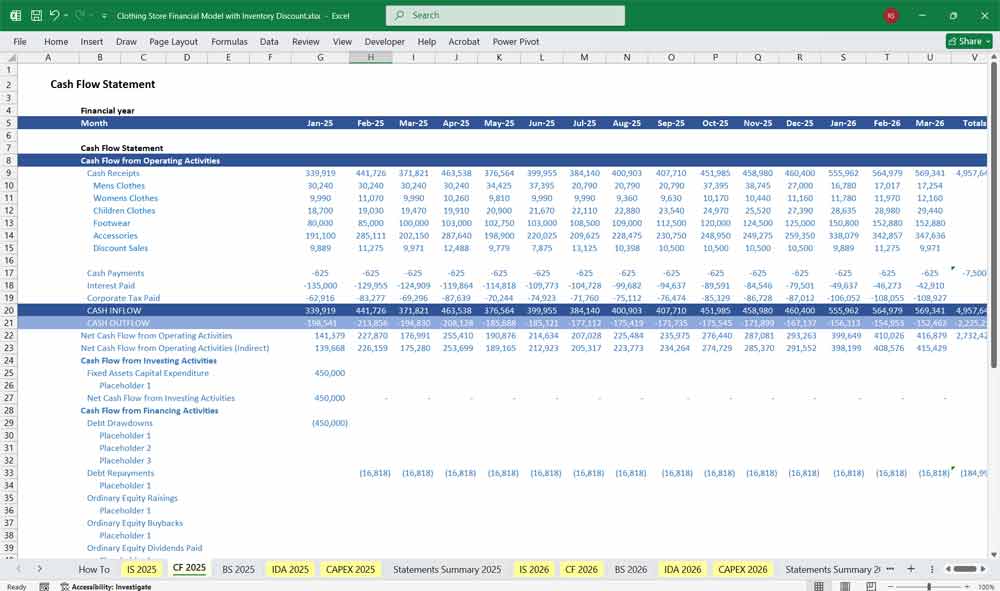

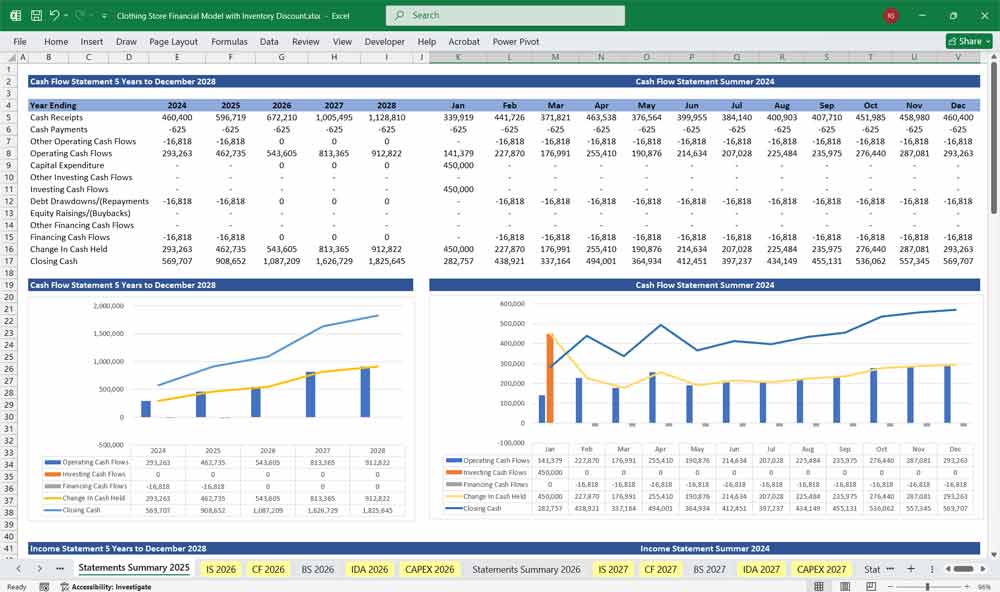

Cash Flow Statement for A Clothing Store

Tracks how much cash is coming in and going out. It’s broken down into Operating, Investing, and Financing activities.

A. Cash Flow from Operating Activities

Net Profit (from Income Statement)

Depreciation/Amortization

Increase in Accounts Receivable

Increase in Inventory

Increase in Accounts Payable

Prepaid Expenses

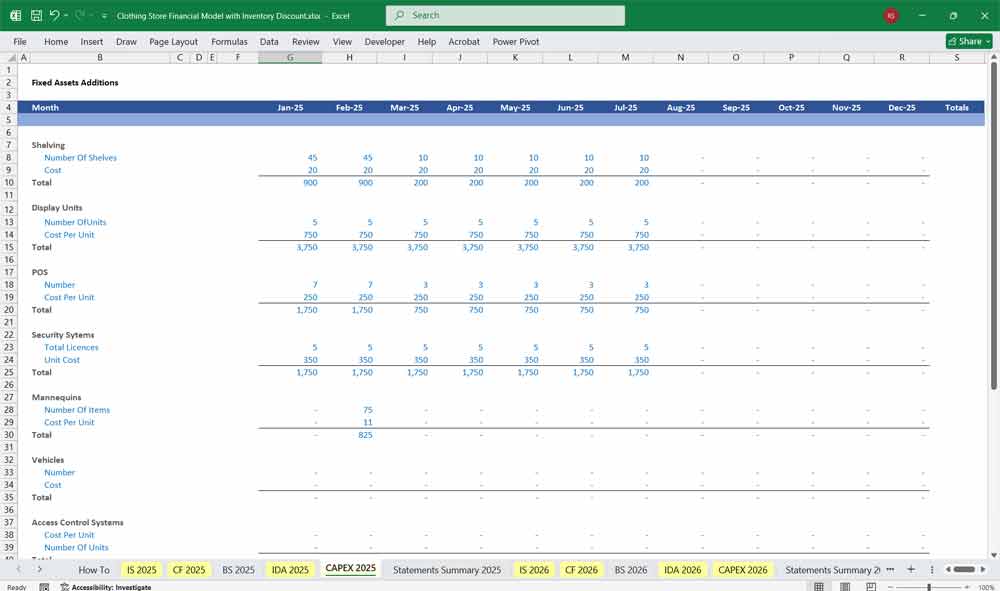

B. Cash Flow from Investing Activities

Purchase of Store Fixtures or Equipment

Purchase of Vehicles (for delivery)

Sale of Old Assets (if any)

C. Cash Flow from Financing Activities

Owner Contributions or Loans

Loan Repayments

Dividend Distributions (if applicable)

Net Change in Cash = Cash from Operating + Investing + Financing

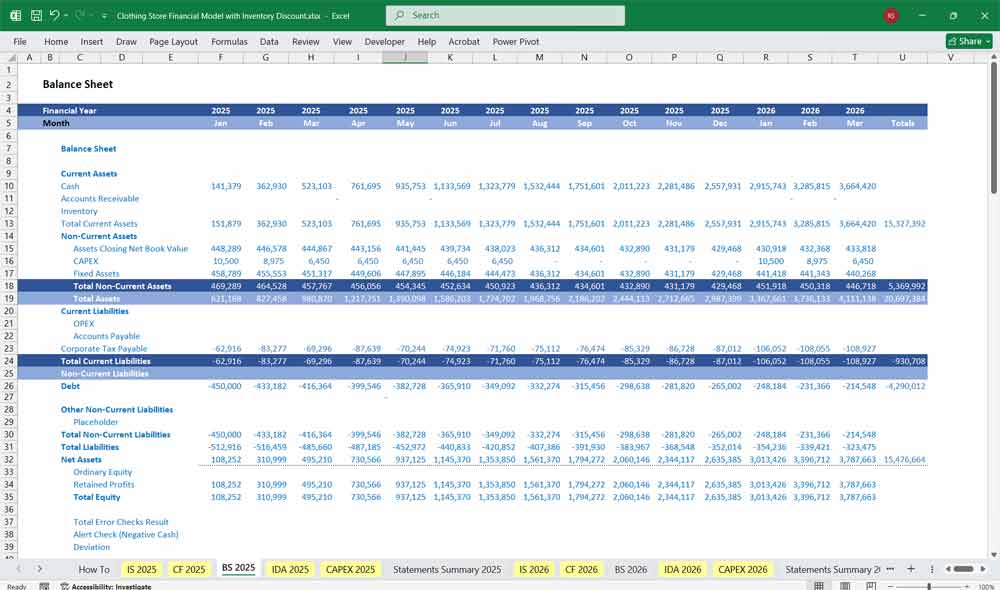

Balance Sheet For A Clothing Store

Provides a snapshot of the business’s financial position at a given date.

A. Assets

Current Assets

Cash and Cash Equivalents

Accounts Receivable

Inventory (raw and finished goods)

Prepaid Expenses

Non-Current Assets

Property, Plant, and Equipment (PP&E)

Leasehold Improvements

Accumulated Depreciation

B. Liabilities

Current Liabilities

Accounts Payable (to suppliers)

Credit Card Payables

Short-term Loans

Accrued Expenses (wages, utilities)

Long-term Liabilities

Bank Loans

Lease Liabilities

C. Equity

Owner’s Equity / Capital

Retained Earnings

Current Year Net Income

Assets = Liabilities + Equity

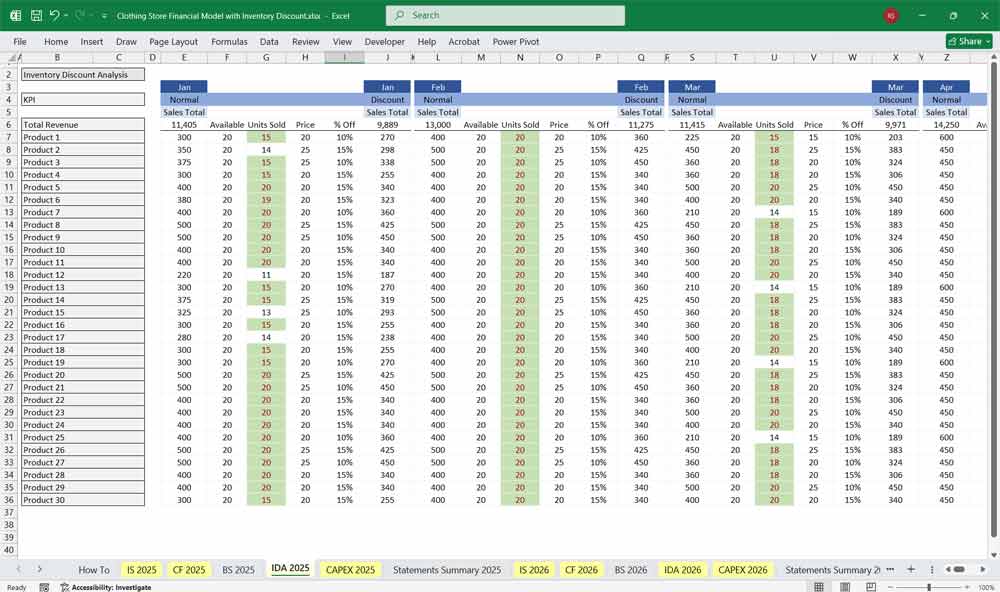

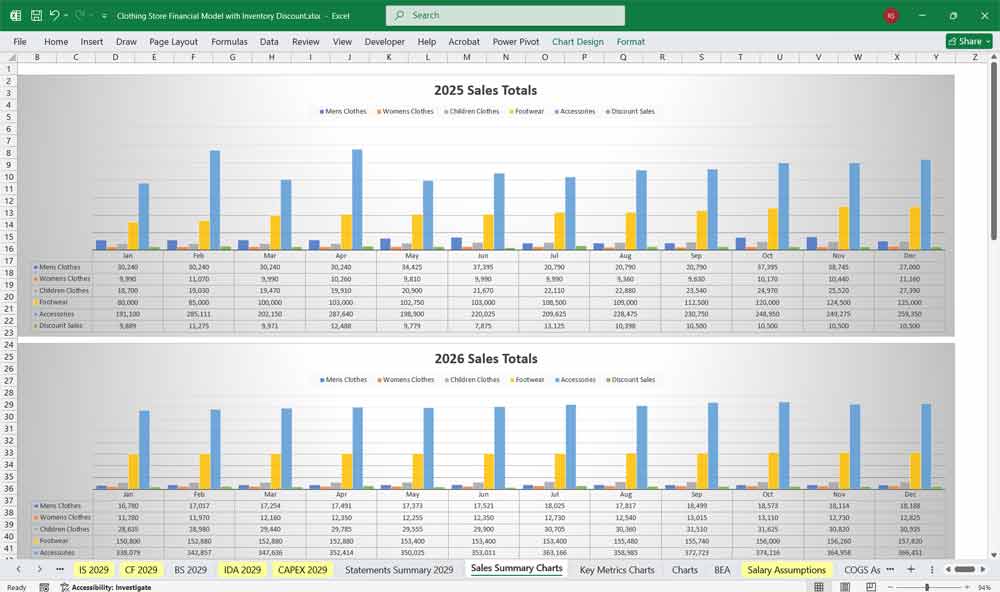

Clothing Store Financial Model With Inventory Discount Analysis Sheet

Tracks how discounting affects inventory turnover and gross margins. Useful for clearance strategies and end-of-season sales.

A. Inventory Overview

Beginning Inventory (by SKU)

Purchases (units & cost)

Sales (units & ASP)

Ending Inventory

B. Discount Tiers

Available Units

Amount Sold

Price

Percentage Off

- Sales Totals

C. Key Metrics

Sell-Through Rate = Units Sold / Total Available

Average Discount = ∑ (Units × Discount %) / Total Units

Inventory Turnover Ratio = COGS / Average Inventory

Gross Margin After Discount = ∑ (Revenue – COGS) / Revenue

D. Recommendations

Identify slow-moving SKUs

Analyze profitability of discounts

Optimize markdown timing (e.g., start clearance at 25%, not 50%)

Integration of Sheets

Interlinked pages via formulas in Excel spreadsheets:

Sales data drives revenue and COGS in the Income Statement

Cash inflows/outflows in Cash Flow Statement come from operating, investing, and financing activities

Closing balances of Cash, Inventory, and Payables feed into the Balance Sheet

Inventory Discount Analysis provides insights that influence purchasing, pricing, and discounting strategy, reflected in all other sheets.

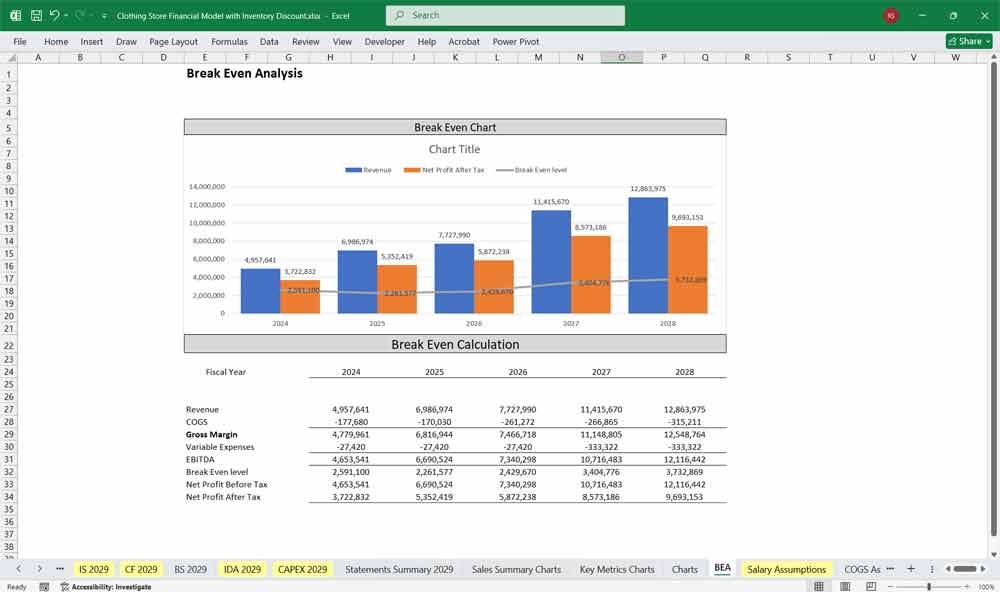

Final Notes on the Financial Model

This 5 Year Clothing Store Financial Model must focus on balancing capital expenditures with steady revenue growth from diversified services. By optimizing operational costs, power efficiency, and maximizing high-margin services the model ensures sustainable profitability and cash flow stability.

Download Link On Next Page