B2B Services Financial Model Excel Template

This 5-Year, 3-Statement B2B Services Company Finance Model in Excel includes revenue streams from Subscription to one-time set-up fees and consulting. Financial statements to forecast the financial health of your B2B Business.

Financial Model for a B2B Services Company

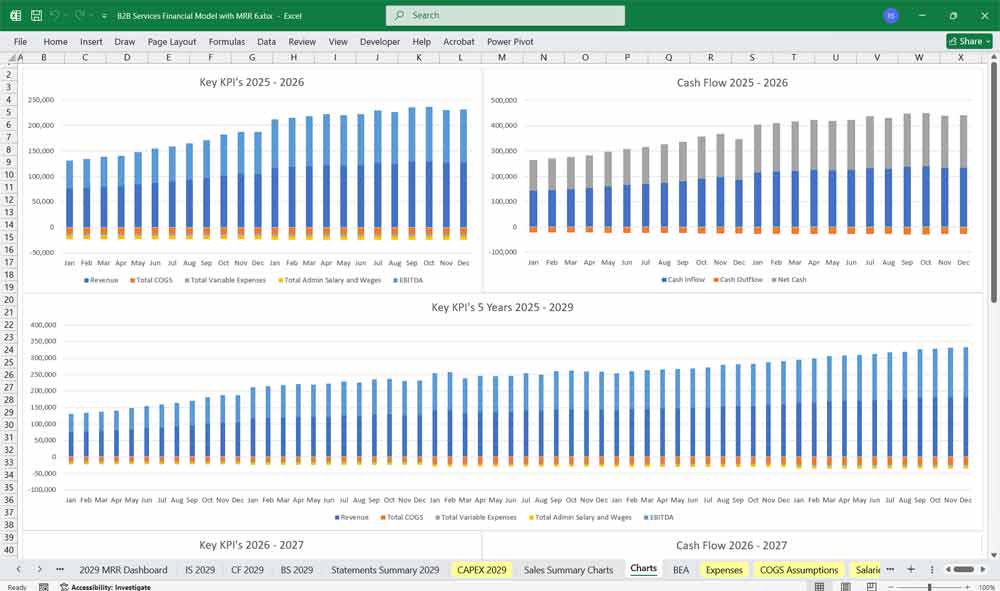

This financial model for a B2B services company includes projections for revenue, expenses, and profitability based on various revenue streams. The key financial statements in the model include:

- Income Statement (Profit & Loss)

- Cash Flow Statement

- Balance Sheet

- Subscription Model Assumptions (6-tier pricing model)

Income Statement (Profit & Loss Statement)

The income statement tracks the company’s revenue and expenses to determine net profit.

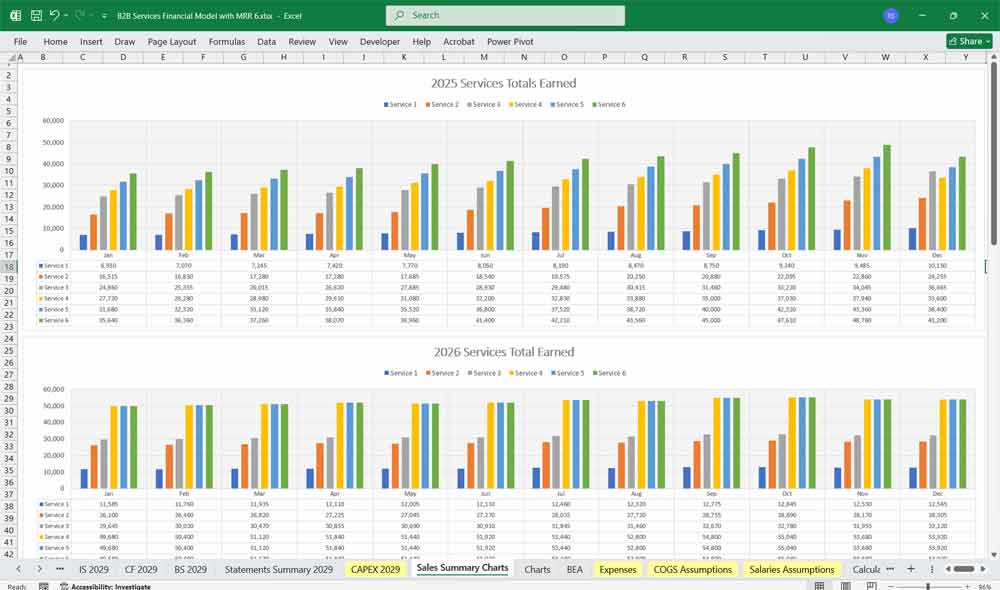

Revenue Streams

- Subscription Revenue (from the 6-tier subscription model)

- One-Time Setup Fees (for enterprise clients or onboarding costs)

- Consulting Services (if the company offers additional advisory services)

- Upsells & Add-ons (extra services like integrations, analytics, etc.)

- Affiliate or Partnership Revenue (if applicable)

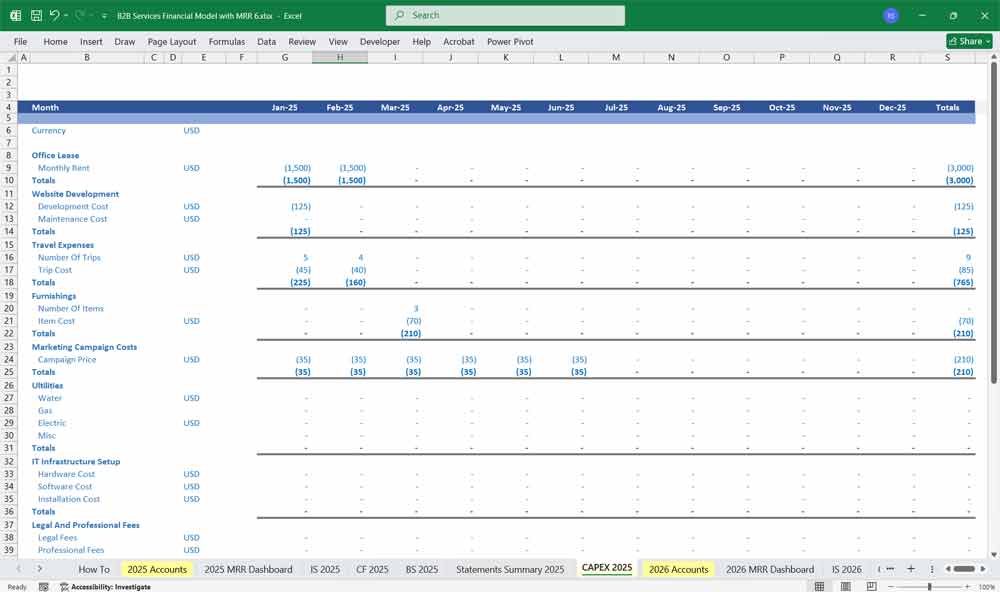

Key Expense Categories

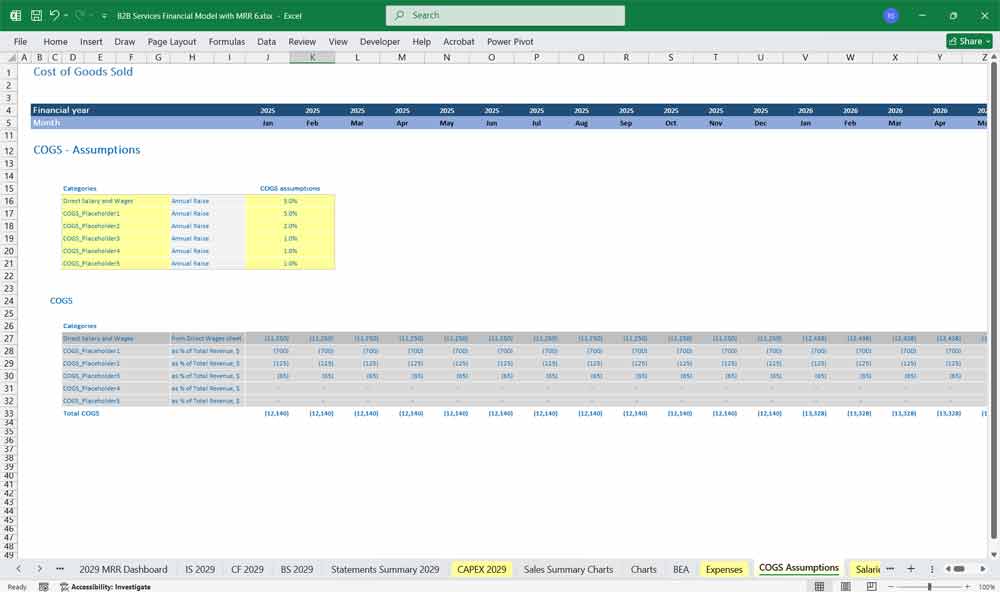

Cost of Goods Sold (COGS) / Direct Costs

- Cloud hosting fees (if SaaS-based)

- Third-party software licensing costs

- Payment processing fees

- Customer support costs directly linked to service delivery

Operating Expenses (OPEX)

- Sales & Marketing

- Digital advertising (Google Ads, LinkedIn, etc.)

- Sales team salaries & commissions

- Content marketing

- General & Administrative (G&A)

- Office rent & utilities (if applicable)

- Employee salaries (HR, finance, legal)

- Software tools for internal operations (CRM, ERP, etc.)

- Research & Development (R&D)

- Product development

- Engineering team salaries

- Feature updates & innovations

- Sales & Marketing

Depreciation & Amortization

- Equipment depreciation (if applicable)

- Software development amortization (if internally developed)

Other Income & Expenses

- Interest income (on cash reserves)

- Interest expense (on loans)

- Foreign exchange gains/losses (if operating globally)

Taxes

- Corporate income tax

- Sales tax (if applicable)

Net Profit Calculation

- Gross Profit = Revenue – COGS

- Operating Profit (EBIT) = Gross Profit – OPEX

- Net Profit = Operating Profit – Taxes – Interest

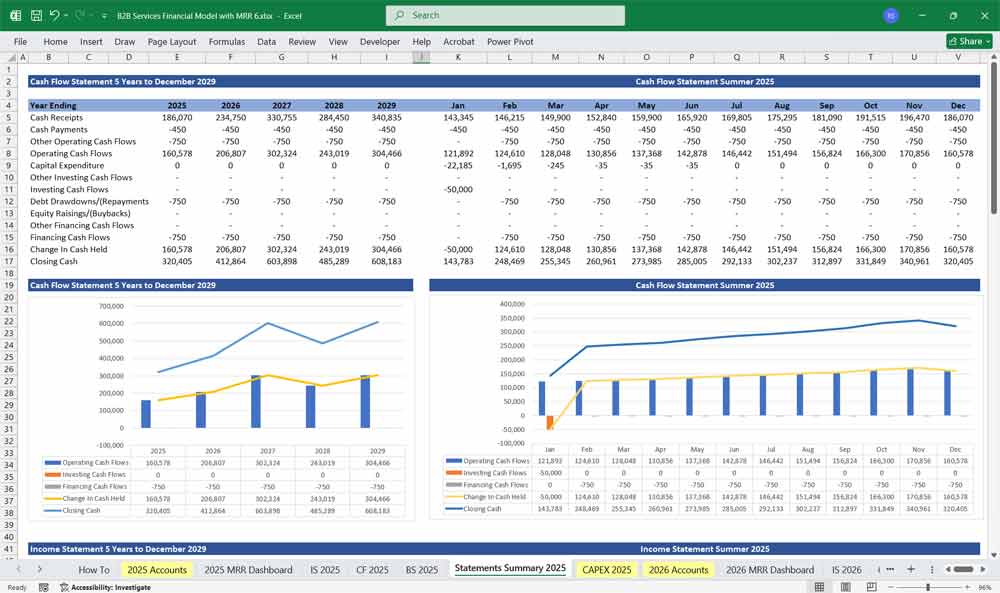

B2B Services Company Financial Model Cash Flow Statement

The cash flow statement tracks the actual movement of cash, categorized into three sections:

1. Operating Cash Flow

- Cash inflows from subscriptions & services

- Cash outflows for salaries, marketing, office expenses, etc.

- Adjustments for non-cash expenses (depreciation & amortization)

2. Investing Cash Flow

- Capital expenditures (e.g., upgrading IT infrastructure)

- Software development costs (if capitalized)

- Acquisitions of other companies or tools

3. Financing Cash Flow

- Issuance of equity (if fundraising)

- Loan repayments

- Dividend payments (if applicable)

The Net Cash Flow is the sum of these three categories, determining the company’s cash position at any given time.

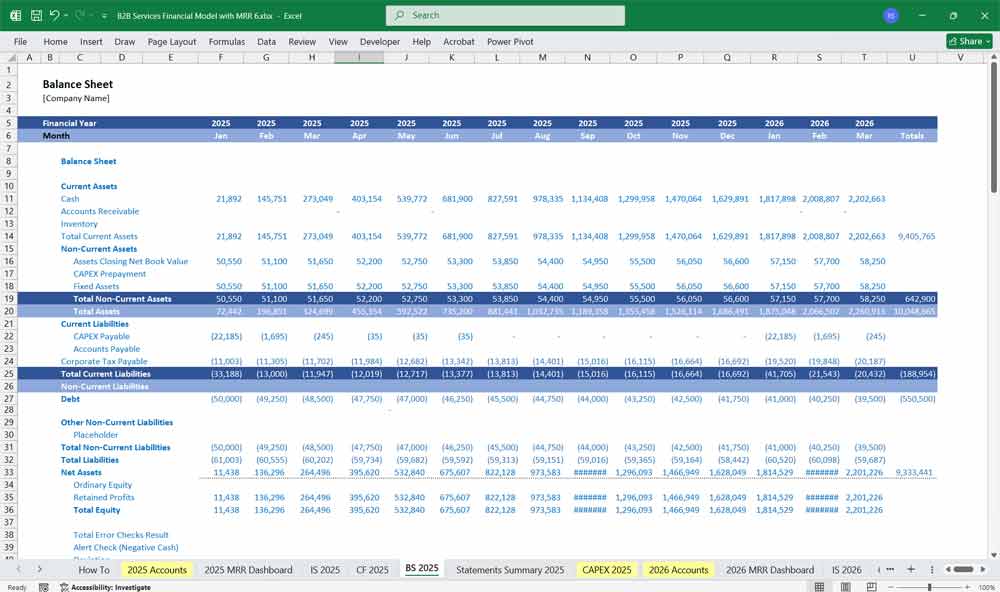

B2B Services Company Financial Model Balance Sheet

The balance sheet shows the company’s assets, liabilities, and equity.

Assets

Current Assets

- Cash & cash equivalents

- Accounts receivable (outstanding invoices)

- Prepaid expenses

Fixed Assets

- IT infrastructure & equipment

- Software development costs (if capitalized)

Intangible Assets

- Intellectual property (patents, trademarks)

- Customer database

Liabilities

Current Liabilities

- Accounts payable (vendor payments due)

- Deferred revenue (prepaid subscriptions)

- Short-term loans

Long-Term Liabilities

- Long-term debt

- Lease obligations (if applicable)

Equity

- Paid-in capital (funding from investors)

- Retained earnings (profits reinvested into the business)

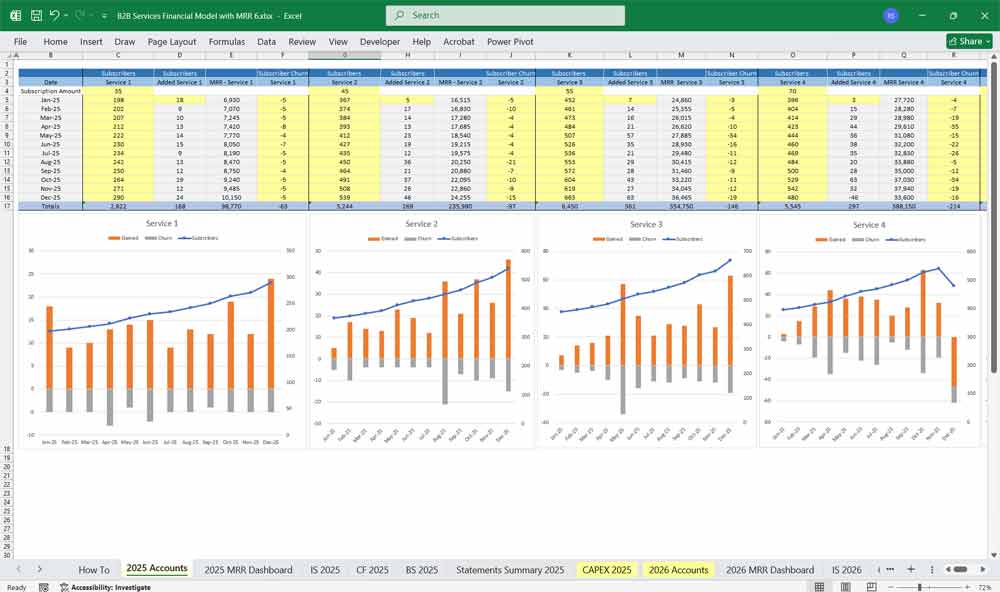

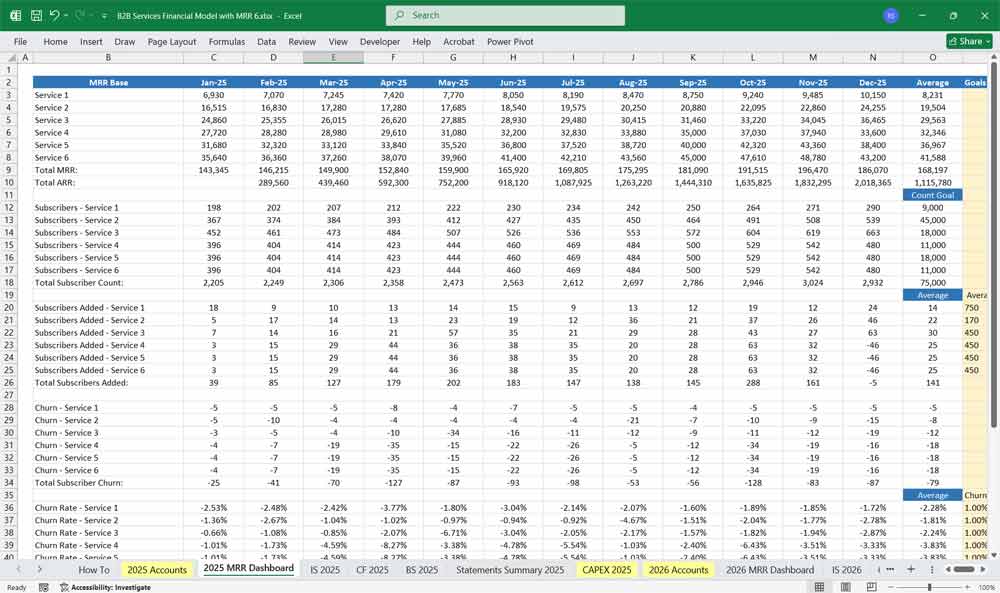

6-Tier Subscription Model for B2B Services

A tiered subscription model allows the company to cater to businesses of various sizes and needs.

Tier 1: Basic B2B Services Plan (Entry-Level)

Target Audience: Startups, small businesses, or companies testing the service.

Features:

Access to core b2b services (e.g., basic analytics, limited support).

Monthly usage limits (e.g., 100 API calls, 10 reports).

Email support with a 48-hour response time.

Basic onboarding and b2b training materials.

Pricing: Low-cost or freemium b2b model to attract new customers.

Value Proposition: Affordable entry point for businesses to evaluate the service.

Tier 2: Starter B2B Services Plan (Growing Businesses)

Target Audience: Small to medium-sized businesses (SMBs) with moderate needs.

Features:

Increased usage limits (e.g., 1,000 API calls, 50 reports).

Access to standard b2b features (e.g., advanced analytics, integrations).

Chat support with a 24-hour response time.

Monthly webinars or b2b training sessions.

Pricing: Mid-range pricing to reflect added value.

Value Proposition: Scalable solution for businesses ready to grow.

Tier 3: Professional B2B Services Plan (Established Businesses)

Target Audience: Medium-sized businesses with consistent b2b service needs.

Features:

Higher usage limits (e.g., 10,000 API calls, 200 reports).

Access to premium features (e.g., custom dashboards, automation tools).

Priority support with a 12-hour response time.

Quarterly business reviews and strategy sessions.

Pricing: Higher pricing to reflect advanced b2b features and support.

Value Proposition: Comprehensive solution for businesses with established operations.

Tier 4: Advanced B2B Services Plan (High-Growth Businesses)

Target Audience: High-growth companies or larger SMBs with complex needs.

Features:

Custom usage limits based on business requirements.

Advanced b2b features (e.g., AI-driven insights, API customization).

Dedicated account manager and 24/7 support.

Access to exclusive industry reports and benchmarks.

Pricing: Premium pricing for high-value features.

Value Proposition: Tailored solutions for businesses scaling rapidly.

Tier 5: Enterprise B2B Services Plan (Large Corporations)

Target Audience: Large enterprises with high-volume and complex b2b requirements.

Features:

Unlimited usage and full access to all b2b features.

Custom integrations and white-label solutions.

On-site training and implementation support.

SLA-backed 24/7 premium support with a dedicated team.

Pricing: Custom pricing based on volume and needs.

Value Proposition: End-to-end b2b solutions for enterprise-level operations.

Tier 6: Custom B2B Services Plan (Bespoke Solutions)

Target Audience: Businesses with unique or highly specialized needs.

Features:

Fully customized service offerings tailored to the client’s requirements.

Co-development of features or tools.

Executive-level consulting and strategic planning.

Exclusive access to beta features and early releases.

Pricing: Negotiated pricing based on scope and complexity.

Value Proposition: A partnership approach to deliver maximum value.

Key Considerations for All Tiers:

Scalability: Ensure each tier allows for easy upgrades as businesses grow.

Flexibility: Offer add-ons or b2b modular features for customization.

Customer Success: Provide resources (e.g., training, support) to ensure clients derive value.

Pricing Transparency: Clearly communicate pricing and benefits to avoid confusion.

Tier Differentiation: Highlight unique features and value at each tier to justify pricing.

Retention Strategies: Include loyalty perks, discounts, or exclusive features for long-term subscribers.

Revenue Assumptions

- Churn Rate: % of customers leaving per month

- Customer Acquisition Cost (CAC): Cost to acquire one new customer

- Lifetime Value (LTV): Expected total revenue from a customer

- Expansion Revenue: Upsells and add-ons

Key Metrics for Financial Model

- Annual Recurring Revenue (ARR)

- Monthly Recurring Revenue (MRR)

- Customer Acquisition Cost (CAC) vs. Customer Lifetime Value (LTV)

- Churn Rate (customer retention rate)

- Gross & Net Profit Margins

- Burn Rate & Cash Runway (if venture-backed)

Conclusion

This financial model gives a structured approach to analyzing a B2B services company’s financial health. The 6-tier subscription model ensures flexible pricing for different customer segments while optimizing revenue potential.

Download Link On Next Page